Lindsey Stewart is Director of Investment Stewardship Research at Morningstar, Inc. This post is based on a Morningstar memorandum by Mr. Stewart and Hortense Bioy. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita; For Whom Corporate Leaders Bargain (discussed on the Forum here) and Stakeholder Capitalism in the Time of COVID (discussed on the Forum here), both by Lucian Bebchuk, Kobi Kastiel, and Roberto Tallarita; and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock (discussed on the Forum here) by Leo E. Strine, Jr.

Executive Summary

Public policy advocacy is an important part of an asset manager’s active ownership strategy. Asset managers recently had a key opportunity to influence U.S. climate policy as the SEC invited comments on its proposed rule for corporate disclosures of climate-related information. Climate-related risks have increasingly become important for many companies within various industries and, as such, disclosures in this area are financially material and a key aspect of investor decision-making—a point emphasized in Morningstar’s own response to the SEC. Asset managers that have committed to addressing the climate crisis should be keen to engage with regulators like the SEC in setting guidelines for corporate disclosures on climate change, and they largely have been.

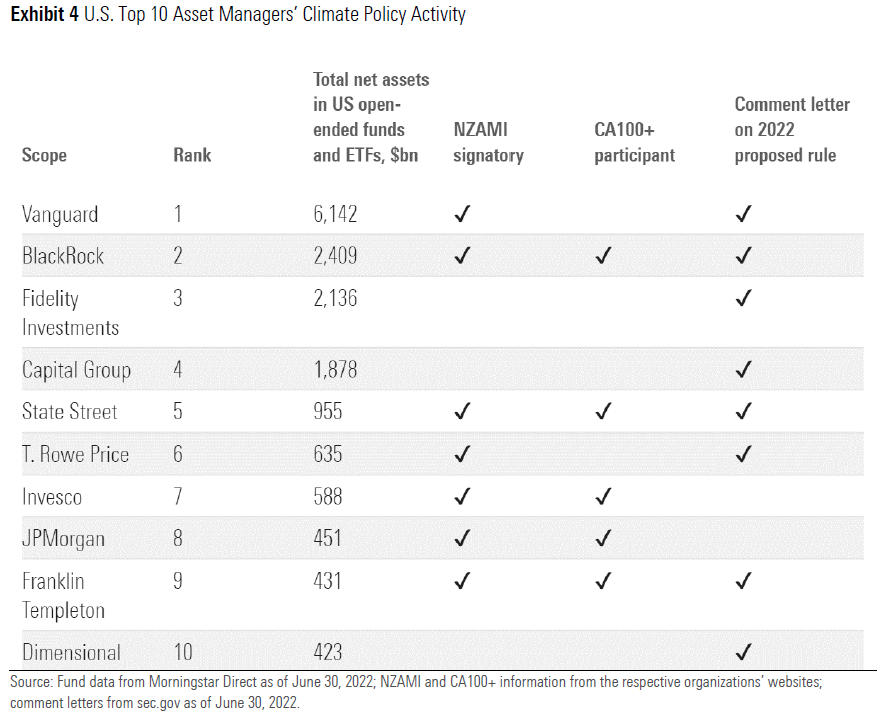

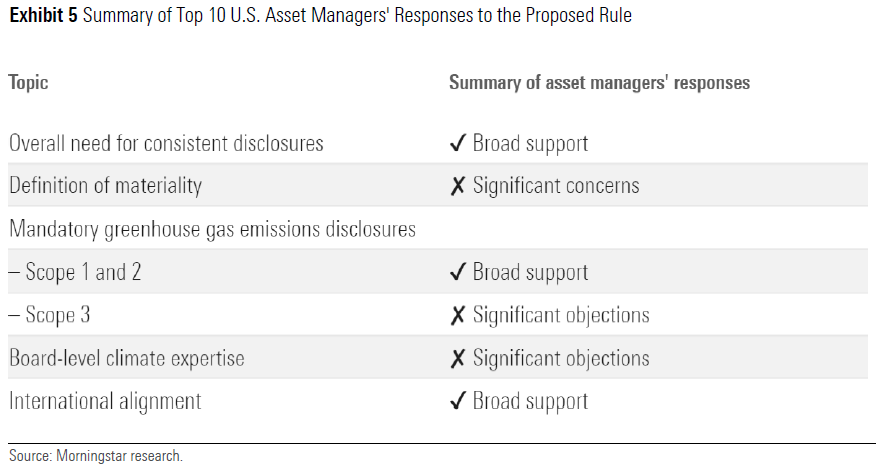

In this post, we analyze the responses of the 10 largest U.S. asset managers, including Vanguard, BlackRock, Fidelity Investments, Capital Group, State Street Global Advisors, T. Rowe Price, Invesco, JPMorgan, Dimensional, and Franklin Templeton. As our research shows, almost all of these 10 managers have engaged directly with the SEC on the proposed rule. They are generally supportive of the SEC’s efforts to mandate consistent disclosure from companies on climate risks, but they also have significant concerns in several important areas.

Key Takeaways

- Eight out of the top 10 U.S. asset managers have responded to the SEC’s March 2022 call for comment on its proposed rule. The two exceptions are Invesco and JPMorgan.

- Seven of the eight respondents favor mandatory climate change disclosures by all public companies. One manager, Dimensional, supports the disclosures only for public companies exposed to material climate risk.

- All eight respondents agree on the need for mandatory disclosures of direct greenhouse gas emissions (Scope 1) and indirect greenhouse gas emissions from purchased electricity (Scope 2), where these are material.

- Only one manager, Capital Group, favors mandatory disclosures of other indirect greenhouse gas emissions (Scope 3) at this time. The others are opposed to making such disclosures mandatory, citing a lack of maturity in measurement methods and an absence of materiality for many companies.

- Most respondents’ support for the proposals is contingent on how materiality is defined. This is a key area of concern for most managers, who believe the SEC should clarify the definition in the proposals.

- All respondents believe the SEC’s actions on climate disclosure should align with internationally accepted standards, particularly the Taskforce for Climate-Related Disclosures, and the emerging International Sustainability Standards Board.

Active Ownership and Public Policy Advocacy Introduction

Active ownership is “the use of influence by institutional investors to maximize overall long-term value including the value of common economic, social and environmental assets, on which returns and clients’ and beneficiaries’ interests depend.” [1]

At Morningstar, we evaluate asset managers’ active ownership—also called investment stewardship—as part of our overall assessment of their ESG Commitment Level. Public policy advocacy activity—alongside proxy voting and direct engagement with companies—is one of the key elements of an asset manager’s active ownership approach.

Recently, asset managers were given an important opportunity to engage in public policy advocacy regarding corporate disclosures about climate change. In March 2022, the SEC issued its proposed rule, The Enhancement and Standardization of Climate-Related Disclosures for Investors, which remained open for public comment until June 17, 2022.

The SEC’s actions in this area will set the tone for how U.S. companies—and by extension, the asset managers who invest in them—will report on how they are responding to the climate crisis.

Climate Change: A Key Stewardship Theme

Much of the momentum behind the global investment stewardship movement comes from rising public concern and a growing sense of political urgency about the climate crisis. Furthermore, since the 2015 Paris Agreement on climate change, active ownership is viewed as an indispensable tool in shaping corporate behavior toward the global goal of net-zero carbon emissions by 2050.

Asset managers have committed to taking action on achieving net zero, and many have joined industry initiatives such as Climate Action 100+ and the Net Zero Asset Managers Initiative, which seek to encourage investee companies—particularly, the largest greenhouse gas emitters—to:

- implement a strong governance framework on climate change;

- take action to reduce greenhouse gas emissions across the value chain; and

- provide enhanced corporate disclosure.

Robust disclosures from companies on greenhouse gas emissions and climate strategy are needed for asset managers to make climate-conscious investment decisions and to report to investors in their funds. So, it is reasonable to expect asset managers that have committed to addressing the climate crisis to engage with regulators like the SEC in setting guidelines for corporate disclosures on climate change.

The comment period for the SEC’s request for information is now closed and submitted comment letters are available to read on the SEC’s website. You can read Morningstar’s comment letter here. We researched responses to the SEC’s request by the top 10 asset managers in the United States by total assets in open-ended funds and exchange-traded funds.

Vanguard, BlackRock, Fidelity, State Street, Capital Group, and T. Rowe Price—who comprise the top six—all responded to the proposed rule. Dimensional and Franklin Templeton—nine and 10, respectively—also responded, but at the time of writing no comment letter could be found for Invesco or JPMorgan.

The SEC’s Proposed Rule

An Important Topic for Investors

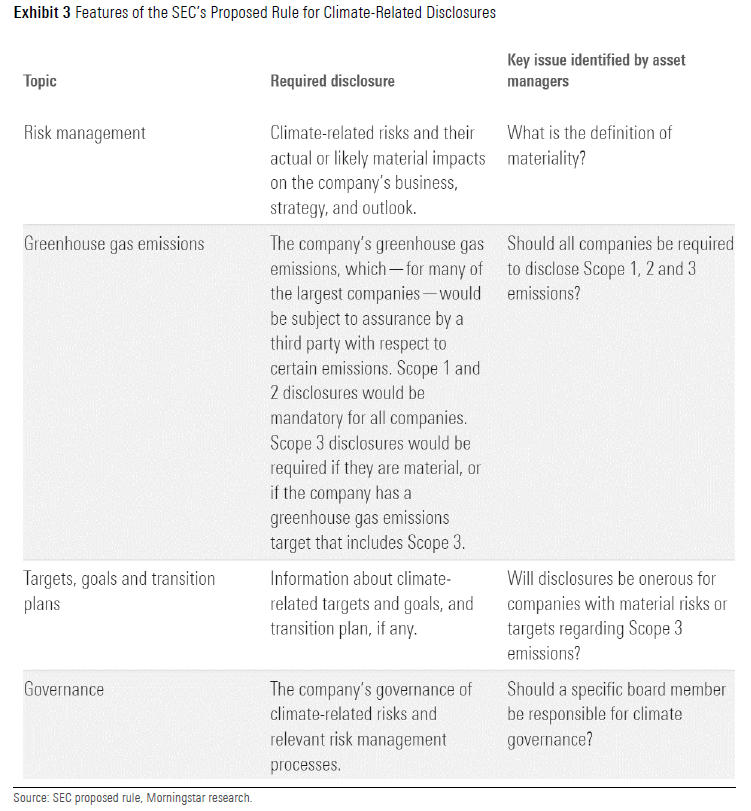

The SEC’s proposed rule aims to enhance and standardize disclosure of climate-related risks and opportunities by public companies.

We view this rule as timely and necessary. Climate-related risks have increasingly become important for many companies within various industries and, as such, disclosures in this area are frequently financially material and a key aspect of investor decision-making. The SEC puts it like this:

“We also believe that enhanced climate disclosure requirements could increase confidence in the capital markets and help promote efficient valuation of securities and capital formation by requiring more consistent, comparable, and reliable disclosure about climate-related risks, including how those risks are likely to impact a registrant’s business operations and financial performance.” [2]

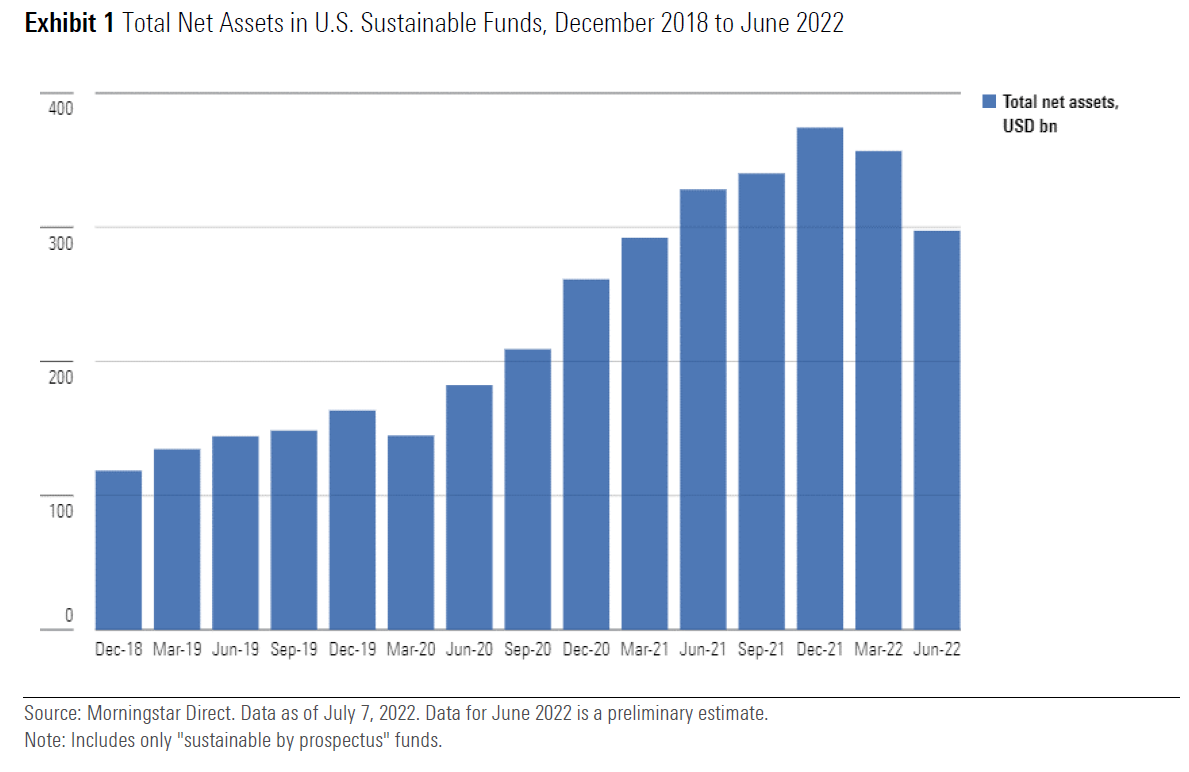

Additionally, although the year-to-date market decline and rotation into value equities has taken a toll on sustainable portfolios in 2022, the amount invested in U.S. sustainable funds has increased by an average 30% a year on a compound annual basis since the end of 2018 (see Exhibit 1 above). Around $300 billion of assets is currently invested in funds defined in their prospectus as sustainable, and with increasing focus on climate change mitigation and adaptation by the investment community, this number is set to continue growing strongly. In order to give investors the information they need to manage climate-related risks, companies first need to have a robust and consistent regulatory framework under which they can disclose relevant information on greenhouse gas emissions and climate-related corporate governance. This makes the SEC’s proposals in this area all the more important.

What Is the SEC Proposing?

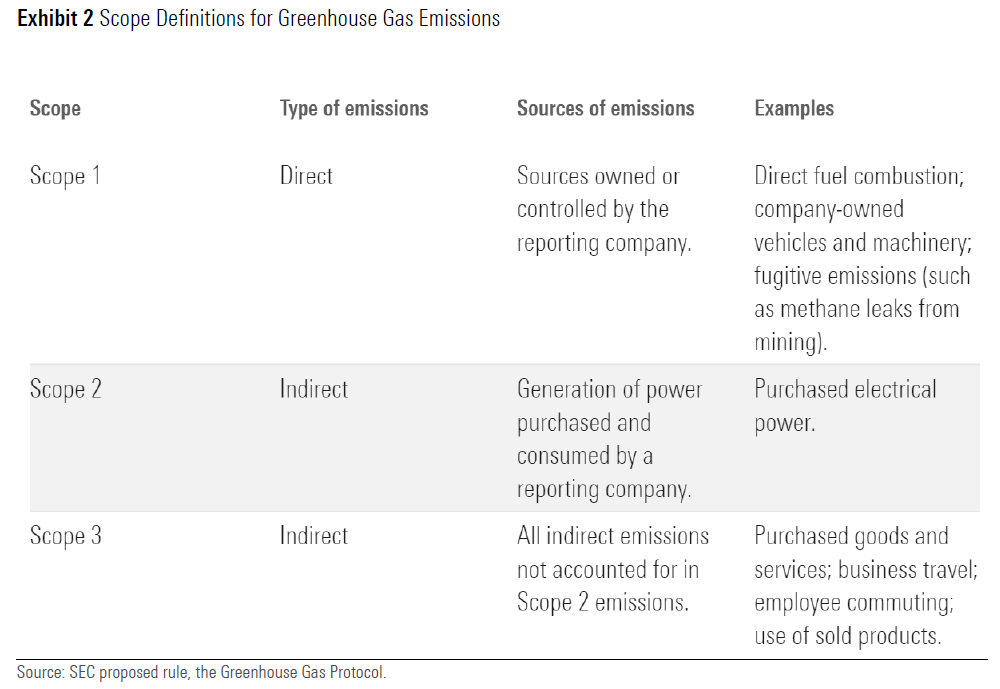

The SEC’s proposed climate-related disclosures are similar to those in existing frameworks—notably the Task Force on Climate-Related Financial Disclosures and the Greenhouse Gas Protocol—which are already used by many companies globally to report climate-related information. This is an important factor in helping ensure much-needed global consistency in such disclosures, which would allow investment decision-makers to compare like-with-like when companies across the globe report climate-related information. Under the Greenhouse Gas Protocol, greenhouse gas emissions are assigned to Scope 1, 2, or 3 depending on whether they:

- are directly emitted by the reported company (Scope 1); or

- represent the company’s share of indirect emissions that occur in its value chain (Scope 2 or 3).

The SEC’s proposed rule would require U.S. companies and foreign private issuers to include certain climate-related information in their reporting, including the following areas.

Analyzing the Top 10 Managers’ Comment Letters

We selected the top 10 U.S. asset managers (by total net assets in U.S. open-ended funds and exchange-traded funds) to analyze their responses to the SEC’s proposals. Out of the top 10 U.S. asset managers—who represent over USD 17 trillion of fund assets—nine submitted at least one comment letter to the SEC on its proposed climate disclosure rule issued in March 2022, or its request for input on climate change disclosures issued in March 2021.

- Eight are signatories to the Net Zero Asset Managers initiative.

- Six participate in the Climate Action 100+ initiative for corporate engagement on climate change.

- All 10 are PRI signatories.

The Investment Company Institute—an association of U.S. asset managers, including all of the top 10, representing close to $30 trillion in investment assets in the United States—also submitted a comment letter to the SEC.

Overall Need for Consistent Disclosures The SEC’s Proposal

“We are proposing to require registrants to provide certain climate-related information in their registration statements and annual reports, including certain information about climate-related financial risks and climate-related financial metrics in their financial statements. The disclosure of this information would provide consistent, comparable, and reliable—and therefore decision-useful—information to investors to enable them to make informed judgments about the impact of climate-related risks on current and potential investments.” [3]

Asset Managers’ Views

Broad support

Eight of the top 10 asset managers submitted their views on the overall need for consistent climate-related disclosures in response the proposed rule published in March 2022: Vanguard, BlackRock, Fidelity, State Street, Capital Group, T. Rowe Price, Dimensional, and Franklin Templeton. Additionally, one of the top 10—Invesco—responded only to the SEC’s request for public input in March 2021. Six of the asset managers responded to both of the SEC’s requests for comment (see Appendix 2 of the complete publication, available here).

All these respondents agree with the SEC that consistent, comparable, and reliable information on climate-related financial risks and financial metrics are important to allow investors to make informed investment decisions. The comments below by three respondents are broadly representative of the overall consensus.

“Fund managers desire access to comparable, consistent, and comprehensive information on how companies are affected by, or are seeking to respond to, climate change. Therefore, it is critical for the Commission to implement more uniform reporting standards for companies for the benefit of investors, efficient allocation of capital, and enhanced capital formation.”—ICI

“Because we firmly believe that climate risk is investment risk, we also write to express our strong support for the Commission’s goal of implementing a framework for public issuers to provide investors with more comparable and consistent climate-related disclosures.”—BlackRock

“The broad adoption of meaningful climate disclosures would also preserve and create shareholder value by providing investors with the consistent climate data they need to (1) evaluate whether issuers are aware of, and adapting to, these rapidly evolving business and regulatory risks and (2) gain a more informed understanding of the climate risk management process at portfolio companies.”—Vanguard

A few managers highlight their perception of the need for climate-related disclosures to be “grounded in the well-understood concept of materiality”—Dimensional and Fidelity are particularly vocal about this matter, which is reflected in their comments on the definition of materiality and the proposed requirements for greenhouse gas emissions disclosures, examined in the following sections of this post.

Morningstar’s View

Morningstar appreciates the Commission’s intention to enhance and standardize disclosure of climate-related risks and opportunities by public companies. Morningstar supports the Commission’s Proposed Rule because we recognize that it will add depth and standardization to today’s voluntary reporting, as mandated reporting on climate-related information will provide comprehensive, consistent, and comparable information, which supports informed investor decisions.

Definition of Materiality

The SEC’s Proposal

“The proposed rules would require a registrant to disclose whether any climate-related risk is reasonably likely to have a material impact on a registrant, including its business or consolidated financial statements, which may manifest over the short, medium, and long term.” [4]

Asset Managers’ Views

Significant concerns

The definition of “material” is an area of significant concern in the comment letters we have analyzed, and one that the SEC will need to address when drafting its final rule. Materiality is a central point of discussion in international consultations on the future of climate and sustainability reporting standards, so it is not surprising to see it emerge as a key issue here.

Respondents to the SEC note that the proposed climate rule appears to deviate from the materiality definition long established by the U.S. Supreme Court. [5] As summarized in BlackRock’s response to the SEC:

“A fact is material “if there is a substantial likelihood that a reasonable shareholder would consider it important” in making an investment decision or if it “would have been viewed by the reasonable investor as having significantly altered the ‘total mix’ of information made available” to the shareholder.”

A majority of the top 10 asset managers, and the ICI, agree that aspects of the proposed rule deviate from the Supreme Court’s definition of materiality, with potential unintended negative consequences. The ICI’s comment letter—supported by several of the asset managers—puts it this way:

“By requiring companies to disclose in SEC filings information that the SEC believes to be ‘decision-useful’ without regard to whether the information is material to the company, the Commission would undermine the important protections provided by the traditional materiality standard… A departure from this standard will expose companies to unnecessary litigation risk.”

Much of this concern relates to proposals to require Scope 3 emissions disclosures for some companies, which is covered in detail below. But there are also broader concerns that the proposed rule requires companies to make certain climate-related disclosures regardless of materiality. T. Rowe Price’s comment letter says:

“To require disclosure of immaterial information will be detrimental to investors, making it difficult for them to determine exactly what information, of the wealth of data presented, is in fact useful, relevant, and comparable across registrants.”

Morningstar’s View

Climate risks have increasingly become material for many companies within various industries and, as such, disclosures in this area are financially material and a key aspect of investor decision-making. The Commission should provide guidance on materiality for industry standards for firms to reference.

Mandatory Greenhouse Gas Emissions Disclosures

The SEC’s Proposal

“The proposed rules would require a registrant to disclose its total Scope 1 emissions separately from its total Scope 2 emissions after calculating them from all sources that are included in the registrant’s organizational and operational boundaries. A registrant would also be required to disclose separately its total Scope 3 emissions for the fiscal year if those emissions are material, or if it has set a greenhouse gas emissions reduction target or goal that includes its Scope 3 emissions. For each of its Scopes 1, 2, and 3 emissions, the proposed rules would require a registrant to disclose the emissions both disaggregated by each constituent greenhouse gas… and in the aggregate.” [6]

Asset Managers’ Views

Scope 1 and 2: Broad support

Most of the 10 asset managers’ comment letters mention their support for mandatory disclosure of Scope 1 and 2 greenhouse gas emissions by companies. The ICI’s letter well reflects the majority view when it states:

“Doing so would make more consistent, comparable, and reliable data available for fund managers to use in making investment decisions.”

Additionally, disclosures of Scope 1 and 2 emissions are now commonplace for companies that do report climate-related information. Fidelity’s comment letter puts it this way:

“We believe that Scope 1 and 2 emissions data are now table stakes and part of investors’ fundamental expectations of companies.”

Amid this broad support for the proposal, there are two dissenting opinions. T. Rowe Price mentions:

“We support the SEC’s proposal to include Scope 1 and Scope 2 greenhouse gas (GHG) emissions disclosures utilizing the approach set forth in the GHG Protocol, yet we oppose disaggregation by constituent GHG. We recommend instead that registrants be required to provide CO2-equivalent information for Scopes 1 and 2.”

T. Rowe Price does not believe that the cost and effort of obtaining disaggregated data is justified either by the quality of the data that would be obtained or its usefulness to investors.

Dimensional’s objection is broader than this—they do not support the idea that greenhouse gas emissions disclosures should become mandatory information in regulatory filings for all public companies. Their letter states:

“We strongly believe that only companies that have identified climate change as a material risk to their business should be required to disclose specific climate-related information… In our view, if a company has not identified climate change as a material risk to its business, the costs of requiring that company to disclose specific climate-related information will outweigh benefits to shareholders.”

One additional point of concern for several managers is the timing of reporting and whether such mandatory disclosures would be “filed” or “furnished” with the SEC. [7] Some are concerned that requiring companies to provide greenhouse gas emissions reporting in the 10-K annual report filed with the SEC could prove impractical and expose companies to additional risk of litigation. BlackRock says:

” Given the methodological and estimation challenges issuers face today in collecting Scope 1 and 2 data on a timely basis, we are of the view that it is impracticable to require this information to be disclosed in SEC filings on the annual report timeline, even if material, although that may change over time as these challenges abate.”

A potential solution suggested by the ICI and several asset managers is that companies would furnish a separate climate report with the SEC 120 days after the fiscal year-end, rather than including this information in a filing.

Scope 3: Significant concerns

The proposal to mandate disclosure of Scope 3 greenhouse gas emissions receives the strongest opposition from the top 10 asset managers. Such disclosures are widely seen as premature because reliable measurement methodologies for Scope 3 emissions (which necessarily overlap with the Scope 1 and Scope 2 emissions of other reporters, raising the risk of double counting) are still being developed. The ICI’s comment letter reflects the views of most of the top 10 asset managers when it states:

“A large majority of our members believe that the Commission should not require companies to report Scope 3 emissions at this time, because of significant data gaps and the absence of agreed-upon methodologies to measure Scope 3 emissions. These deficiencies seriously undermine the ability of most companies to report consistent, comparable, and verifiably reliable data.”

Several managers mention their willingness to accept mandatory disclosures in time once measurement methodologies have improved and companies are routinely reporting Scope 1 and 2 greenhouse gas emissions—a necessary input for Scope 3 calculations. Several managers also favor the disclosure of Scope 3 emissions data on a “targeted and flexible” basis where such information is material and can be reasonably estimated.

Capital Group’s response to the SEC stands out, as it takes a more positive line on Scope 3 disclosures than the rest of the group, supporting mandatory Scope 3 disclosures for larger companies.

“Scope 1 and Scope 2 GHG emissions data alone provide an incomplete (and potentially inaccurate) picture of a company’s overall carbon footprint and its ability to create and sustain long-term value through shifting consumer demands or changes in energy policy. Scope 3 GHG emissions data is thus a necessary supplement to Scope 1 and Scope 2 GHG emissions data, and we support making this disclosure mandatory for larger companies.”

Morningstar’s View

We agree with the Commission that Scope 1 and Scope 2 greenhouse gas emissions should be disclosed by all registrants. We further agree with the Commission’s Proposal to require that Scope 3 emissions only be disclosed by registrants with a Scope 3 emissions-reduction target, or by companies for which those emissions are material.

Board-Level Climate Expertise

The SEC’s Proposal

“The proposed rules would require a registrant to disclose a number of board governance items, as applicable. The first item would require a registrant to identify any board members or board committees responsible for the oversight of climate-related risks. The responsible board committee might be an existing committee, such as the audit committee or risk committee, or a separate committee established to focus on climate-related risks. The next proposed item would require disclosure of whether any member of a registrant’s board of directors has expertise in climate-related risks, with disclosure required in sufficient detail to fully describe the nature of the expertise.” [8]

Asset Managers’ Views

Significant concerns

Both the ICI and several asset managers who comment on this oppose the proposed disclosure regarding climate expertise at board level. T. Rowe Price’s comment letter reflects the overall consensus:

“Although we support the requirement for enhanced transparency around climate risk governance, we recommend eliminating the requirement that registrants identify if a board member has climate-related expertise and the process and frequency of board-level discussions. Single-issue expertise is not a quality that we have traditionally sought in board members, preferring instead well-rounded candidates who are able to contribute in multiple ways to a company’s governance.”

Respondents cite several reasons for their opposition to this:

“We believe that robust board oversight with respect to climate requires a whole-of-the-board approach, and the identification of “specialist” directors is not conducive to a holistic undertaking by the board.” —BlackRock

“This requirement goes beyond TCFD recommendations, is duplicative of existing disclosure requirements… and also fails to recognize the supervisory nature of the board’s role.”—Capital Group

“This [requirement] could imply that boards without directors with such specific expertise are deficient, which we believe is inaccurate.”—State Street

“There is no justification for singling out climate-related risks for requiring such a heightened level of board disclosure concerning their member’s qualifications and oversight responsibilities.”—Fidelity

“The proposed approach may cause companies to create larger, and possibly less cohesive, boards to the detriment of the company’s investors.”—ICI

Morningstar’s View

We agree with the Commission that disclosures regarding board and management oversight of climate-related risks should be mandated. Additionally, disclosure of board and management oversight of climate-related opportunities should be mandated. We would also like the Commission to mandate disclosure of how executive remuneration within existing discussion and analysis of incentive pay arrangements in companies’ annual proxy statements reflect climate-related goals, including emissions targets.

International Alignment

The SEC’s Proposal

“Our proposed climate-related disclosure framework is modeled in part on the TCFD’s recommendations. A goal of the proposed rules is to elicit climate-related disclosures that are consistent, comparable, and reliable while also attempting to limit the compliance burden associated with these disclosures.” [9]

Asset Managers’ Views

Broad support

The top 10 asset managers who responded unanimously agree that alignment with the TCFD framework—”the leading global standard for material climate-related disclosures,” according to Capital Group—is the right way forward.

This is because TCFD-aligned climate-related disclosures are mandatory, or on the path to becoming so, in several capital market jurisdictions. Additionally, major asset managers have been encouraging companies globally to report in line with TCFD guidelines for over two years—BlackRock CEO Larry Fink’s 2020 letter to company CEOs [10] was a key catalyst in this regard.

T. Rowe Price explains the rationale well, saying:

“Consistency across jurisdictions and within each regulatory regime is critical for global asset managers, who need comparable sustainability and climate-related disclosures in every country in which they invest.”

At the same time as the SEC’s request for comments on its proposed rule for climate-related disclosures, the new International Sustainability Standards Board—part of the IFRS Foundation, which sets reporting standards for companies in most jurisdictions outside the U.S.—also published its draft standard on the same topic. [11]

Several asset managers emphasize the importance of ensuring that the SEC’s and ISSB’s final proposals remain aligned to facilitate the global consistency that aids investment decision-making. Some managers also called on the SEC to allow foreign private issuers to report under global standards such as those published by the ISSB.

As Fidelity’s comment letter notes:

“We applaud the SEC for recognizing the current efforts of global sustainability standards and strongly support the reliance on global standards, such as the ISSB, for reporting by foreign private issuers. This will achieve the SEC’s goal of providing investors with useful information while mitigating the potential burden on issuers to disclose on regionally nuanced standards. We believe permitting reliance on global sustainability standards will enhance disclosure by promoting consistency and comparability for investors.”

Consultations on climate and sustainability standards in Europe are currently being conducted by the ISSB and EFRAG—the European Commission’s advisory body for financial reporting standards. Given managers’ responses to the SEC on climate-related disclosures, we would expect to see them provide similar responses to the ISSB and EFRAG to help deliver the global consistency that is important to investors. We will review managers’ comments to the ISSB and EFRAG after those consultations have closed.

Morningstar’s View

We support the Commission’s use of TCFD terminology and definitions. We encourage alignment with TCFD-based terminology and definitions as much as possible to maximize comparability, integration, and understanding of the new climate disclosures because the framework proposed by the TCFD has gained traction globally.

The complete publication, including footnotes, is available here.

Endnotes

1Principles for Responsible Investment website(go back)

2SEC proposed rule The Enhancement and Standardization of Climate-Related Disclosures for Investors, p.23.(go back)

3SEC proposed rule The Enhancement and Standardization of Climate-Related Disclosures for Investors, p.7.(go back)

4SEC proposed rule The Enhancement and Standardization of Climate-Related Disclosures for Investors, p.63.(go back)

5TSC Industries, Inc. v. Northway, Inc., 426 U.S. 438 (1976).(go back)

6SEC proposed rule The Enhancement and Standardization of Climate-Related Disclosures for Investors, p.151.(go back)

7This is a legal technicality—all disclosures are registered with the SEC in the same way. However, what is important for the purpose of this analysis is that companies can benefit from certain liability protections regarding information that is “furnished” rather than “filed.”(go back)

8SEC proposed rule The Enhancement and Standardization of Climate-Related Disclosures for Investors, p.94.(go back)

9SEC proposed rule The Enhancement and Standardization of Climate-Related Disclosures for Investors, p.41.(go back)

10A Fundamental Reshaping of Finance, January 2020.(go back)

11Exposure Draft IFRS S2 Climate-related Disclosures.(go back)

Print

Print