Linda Barham, Nicole Salama, and Esmerelda Popo are consultants at Russell Reynolds Associates. This post is based on an RRA memorandum by Ms. Barham, Ms. Salama, Ms. Popo, and Catherine Schroeder.

Over the past decade, the public company CFO remit has rapidly evolved beyond the traditional financial scope to include operational and strategic responsibilities. To stay abreast and develop your finance talent as the role continues to evolve, understanding tomorrow’s CFO is paramount.

To better understand the current state of the role and hiring implications, Russell Reynolds Associates recently analyzed the backgrounds, career paths, and tenures of S&P 500 CFOs (N = 500). [1] Based on our findings, we identify three important trends in how CFO appointments have evolved over the years, as the war for talent continues.

- High turnover leads to an extremely active market

- Recent strides have been made in promoting women CFOs

- The S&P 500 landscape is shifting towards strategically-oriented CFOs

Finally, we also review key considerations for CEOs, Boards, and CFOs as they continue to hire and develop their finance talent.

1. An active CFO market has companies forgoing traditional requirements

Over half of S&P 500 CFOs were hired into their role within the past three years. This high churn rate is the result of many factors, including a frothy IPO market in 2021 that significantly increased the number of public company CFO opportunities, as well as overall strong equity performance that allowed some to retire earlier. [2] While recent market slowdowns have slightly cooled the war for talent, increasing retirement rates and the ongoing search for talent from historically unrepresented minority groups, point to a CFO market that is far from stagnant [3] (To read more about CFO turnover in 2022, see our latest research.)

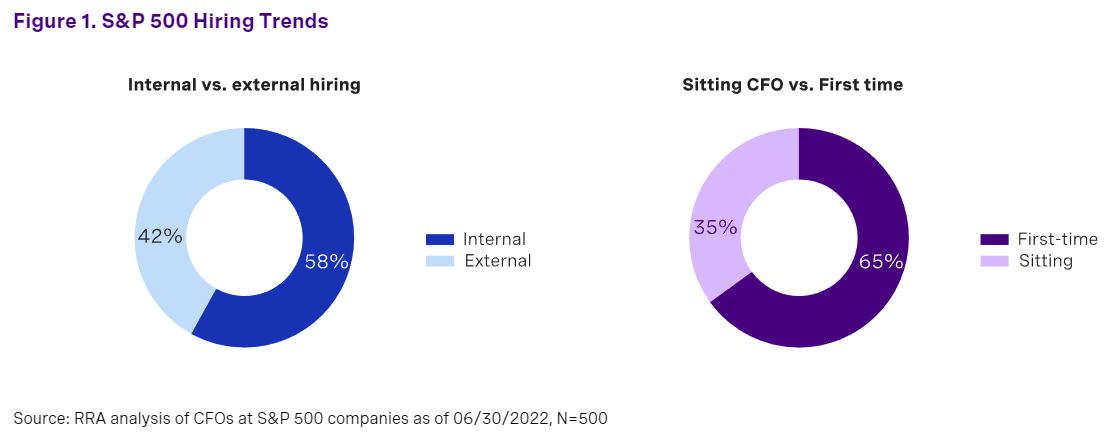

Recent turnover [4] led many organizations to develop internal CFO talent, resulting in the majority of CFOs being first-time in role. The average role tenure decreased from 5.6 years in 2020 to 4.2 in 2022 (Figure 1).

Tight talent markets have led to a significant increase in first-time CFOs, leaving many considering whether previous CFO experience is necessary.

2. External women hires in finance remains a challenge

Increased focus on gender diversity combined with high CFO turnover has created more opportunities for women. The majority of current women CFOs were promoted into their role within the past three years, with 36% of women CFOs joining within the past year, compared to 22% of men CFOs. These recent strides bring the total percentage of women CFOs on the S&P 500 to 16%.

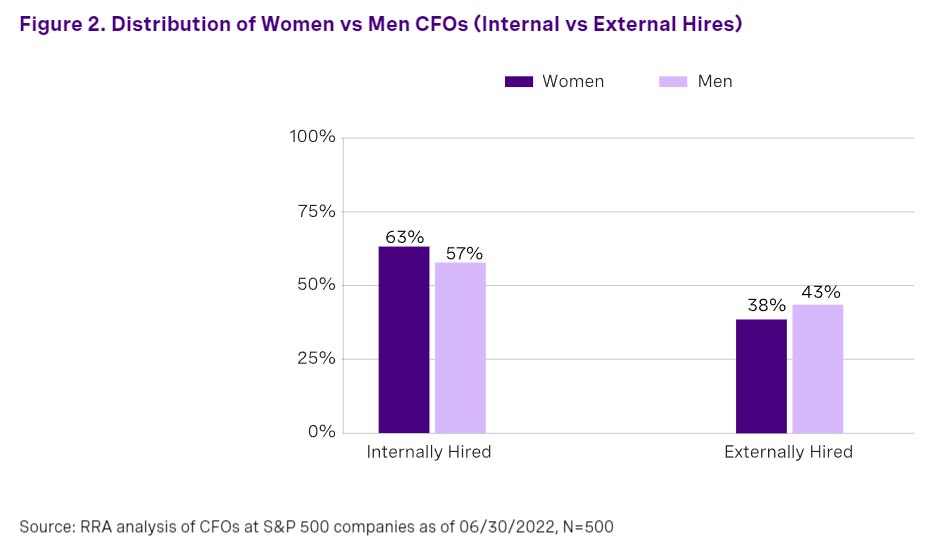

There is not a significant gap between women and men who are in their first CFO role. However, more women are being promoted internally, showcasing how succession planning can pay off for increasing gender diversity (Figure 2.)

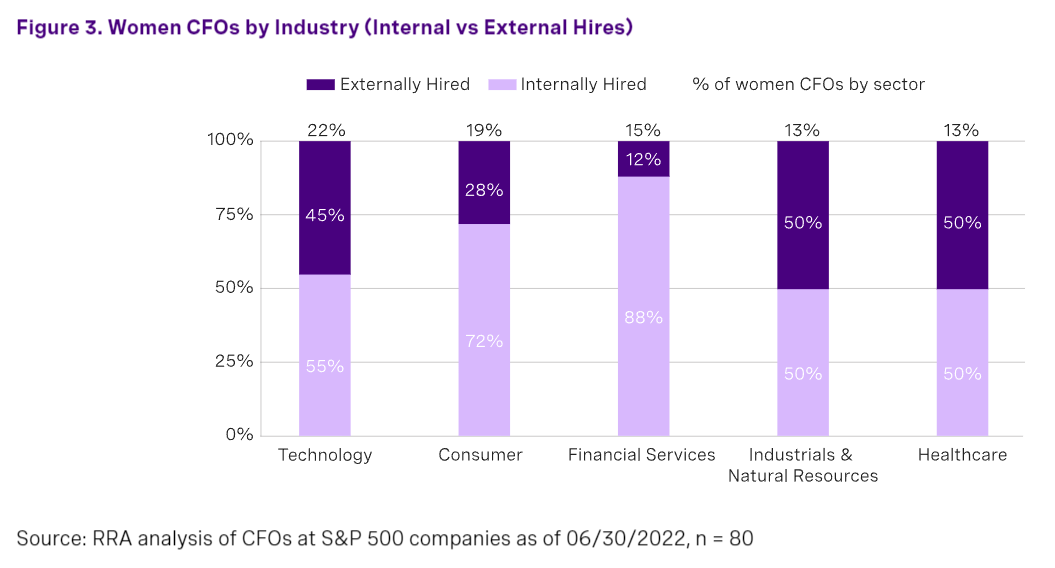

Lessons can still be learned from leading industries and companies that are promoting and developing women in finance. Certain industries have greater CFO gender diversity than others (Figure 3.) The technology industry leads the way with almost 2x more women in the role than the Healthcare and Industrial & Natural Resources (INR) industries. Those leading the way in addressing gender parity are investing in succession planning, as exhibited by increased internal promotions.

3. Current state CFO DNA prioritizes operations versus accounting

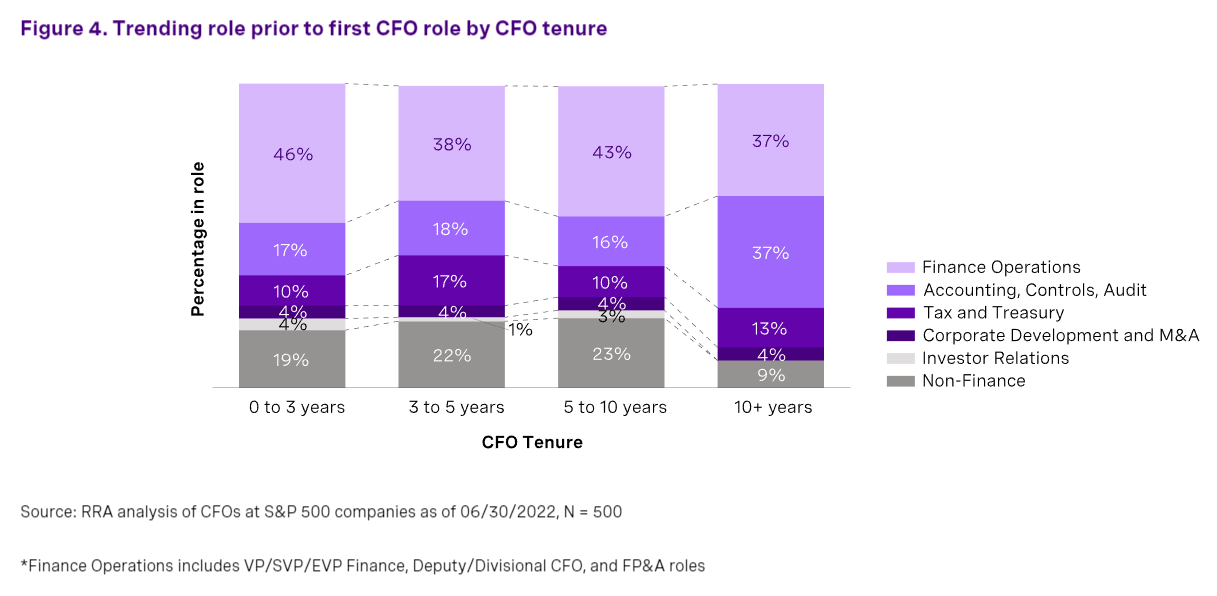

As organizations fight to retain CFO talent and look to the CFO as a potential CEO successor, the CFO mandate is broadening, [5] requiring CFOs to have business acumen and a strategic and operations orientation. In the last 10 years, there’s been a dramatic shift away from accounting, controls, and audit backgrounds to those who are more operational and strategic, usually from a finance operations or divisional CFO archetype (Figure 4.)

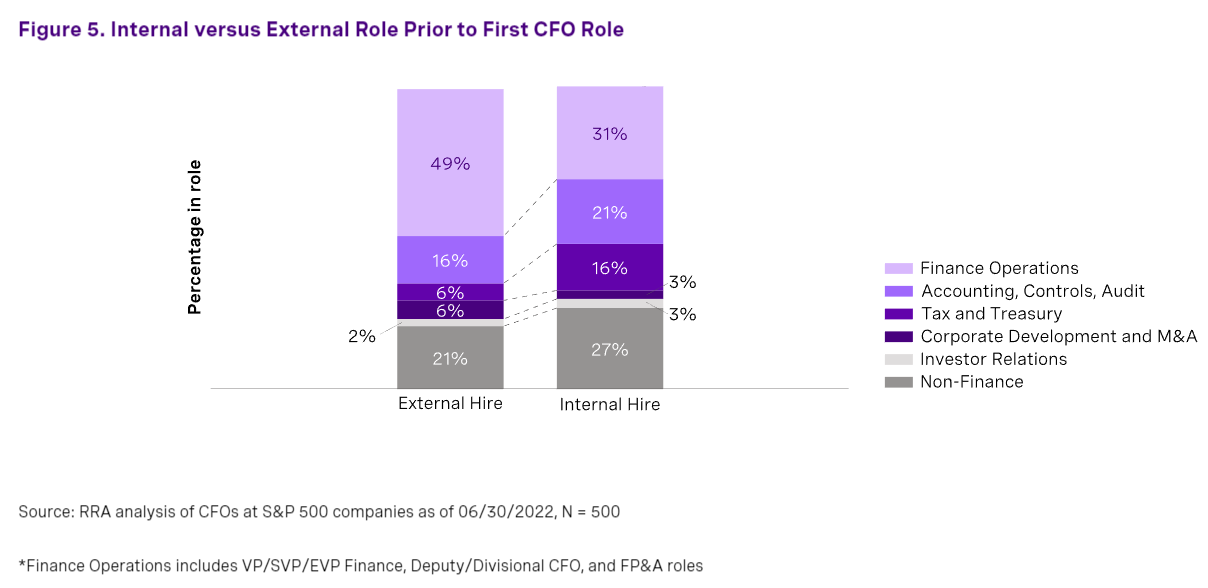

Those recruiting externally have the opportunity to engage with a broader range of experiences and tend to focus more on this operational archetype (Figure 5.), while those looking internally are more open to candidates from traditional finance backgrounds, such as accounting and treasury. One explanation for the difference in archetypes is the availability of operational finance roles within the organization. Larger-scale organizations likely have this talent pool to recruit from, whereas smaller-scale organizations are less likely to include roles like division CFO.

An unprecedented CFO market requires unique solutions

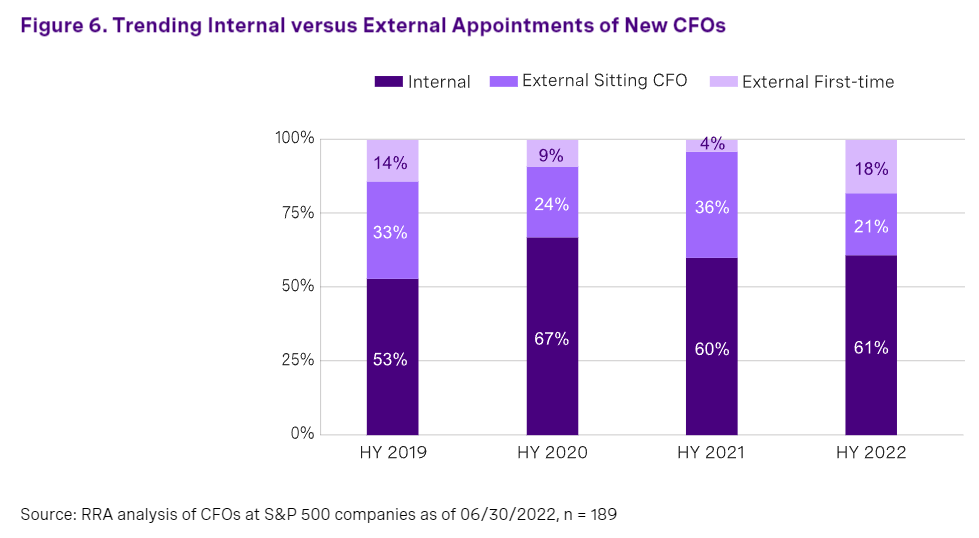

- In a tight market, consider being open-minded when it comes to prior CFO experience. The majority of CFOs are promoted internally and companies without adequate bench strength need to consider whether previous CFO experience is necessary. Companies are already taking this approach—within the first half of 2022, of newly appointed CFOs, 79% are in the role for the first time (Figure 6.). This is a record number and indicative of an extremely active CFO market and robust succession planning.

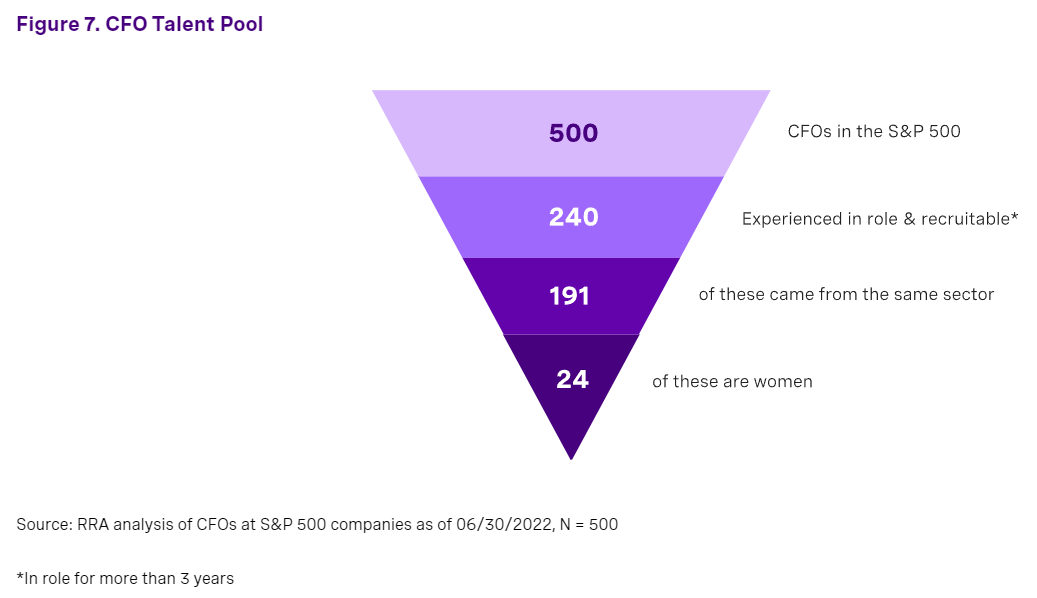

- Internal development is key for increasing women representation in finance. Take note from other industry leaders and develop women in finance. With many women being first-time in the role, the number of experienced women CFOs is limited (Figure 7.) By developing internally, companies can avoid over-fishing in a limited talent pool.

- Operational CFOs are the new accounting CFOs. With increasing importance being placed on operational and strategic experience amongst CFOs, ensure finance operations and business acumen are key competencies—whether looking externally or developing your finance team internally. Think both long-term and mid-term to imbed these competencies:

- Mid-term solution: Consider the placement of these roles within the finance organizational structure. Often division CFO or vice president of finance roles aren’t viewed at the same seniority as roles such as Chief Accounting Officer. Evaluate your organizational structure and ensure they are appropriately senior.

- Long-term solution: Create more junior early career opportunities for traditional finance backgrounds (accounting, audit, tax, and treasury) in FP&A, division CFO, and vice president of finance roles. If there isn’t company scale to embed these roles early on, rebrand operational and strategic roles as coveted developmental tours, so there is the opportunity to hold a vice president of finance, division CFO, or division CEO role before becoming CFO.

In an active market, reconsider what experiences are truly necessary for tomorrow’s CFO, especially when looking externally.

Endnotes

1RRA analysis of CFOs at S&P 500 companies as of 06/30/2022(go back)

2RRA ‘2021: The year of CFO turnover and strides in gender diversity’, 2021(go back)

3RRA ‘CFO Turnover in 2022 Slows, But Don’t Expect it to Stay’, 2022(go back)

4Id.(go back)

5Wall Street Journal, ‘Companies Broaden CFOs’ Responsibilities to Retain Them In Strong Job Market’, 2022(go back)

Print

Print