Lindsey Stewart is Director of Investment Stewardship Research at Morningstar, Inc. This post is based on his Morningstar memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita; Does Enlightened Shareholder Value add Value (discussed on the Forum here) and Stakeholder Capitalism in the Time of COVID (discussed on the Forum here) both by Lucian A. Bebchuk, Kobi Kastiel and Roberto Tallarita; and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy – A Reply to Professor Rock (discussed on the Forum here) by Leo E. Strine, Jr.

Executive Summary

The newly formed International Sustainability Standards Board issued two draft climate and sustainability reporting standards, which closed for public comment at the end of July. The ISSB aims to set a “global baseline,” internationally consistent minimum sustainability reporting standards for companies. In this paper, we examine the comment letters from 20 large asset managers responding to the ISSB. Such analysis can help investors better understand the underlying thinking driving managers’ approaches to environmental, social, and governance issues.

Morningstar also sent a response to the ISSB. We strongly believe that as asset owners and asset managers invest globally, they need some international convergence to be able to report meaningful aggregated information to end-users. On the whole, asset managers firmly agree with this but their responses in key areas addressed by the draft standards—particularly materiality, greenhouse gas emissions disclosures, and international alignment—suggest that this goal will be difficult to achieve without major changes in approach by either the ISSB or other standard-setters globally.

Key Takeaways

- Six of the 20 managers state their agreement with the ISSB’s focus on enterprise value, including Capital Group, Dimensional, Legal & General, Wellington, UBS, and Vanguard. This is seen by some as being aligned with a “single materiality” approach.

- Eight others—mostly based in Europe, and including Allianz, Amundi, BNP Paribas, DWS, and Schroders—encourage the ISSB to consider a double materiality approach, incorporating companies’ impacts on the environment and wider society, in line with the European Commission’s proposals.

- Five U.S.-based managers—BlackRock, Invesco, Northern Trust, State Street, and T. Rowe Price— advise that a more flexible approach accommodating local regulatory practices is needed.

- The majority of the 20 managers agree with the ISSB’s proposal that Scope 1 and 2 greenhouse gas emissions (that is, direct emissions and those related to electricity use) should be mandatory for all companies. Dimensional disagrees, believing such disclosures should be mandatory only if material.

- Eight of the 20 respondents—including BNP Paribas, Capital Group, Legal & General, and Wellington—agree with the ISSB that Scope 3 emissions disclosures (that is, other indirect emissions) should also be mandatory.

Introduction

At Morningstar, we evaluate asset managers’ active ownership—also called investment stewardship— as part of our overall assessment of their ESG Commitment Level. Public policy advocacy activity— alongside proxy voting and direct engagement with companies—is one of the key elements of an asset manager’s active ownership approach. Analyzing asset managers’ public comments on key regulatory and standard-setting projects helps us better understand the ethos underlying asset managers’ approaches to ESG.

Recently, there have been several important opportunities to engage in public policy advocacy on corporate disclosures about climate change. In June 2022, the SEC closed the comment period for its proposed rule, The Enhancement and Standardization of Climate-Related Disclosures for Investors. We analyzed the responses of the top 10 U.S. asset managers in a research paper in July. We found that a broad base of support for consistent, investor-relevant climate disclosures was somewhat complicated by significant reservations in some areas, notably the definition of materiality and the scope of disclosures about mandatory greenhouse gas emissions.

Around the end of July, public comment periods on two other major consultations on climate and sustainability disclosures also ended.

The first consultation is for the Exposure Drafts IFRS S1 General Requirements for Disclosure of Sustainability-Related Financial Information and IFRS S2 Climate-Related Disclosures. These two draft reporting standards were issued by the newly formed International Sustainability Standards Board of the IFRS Foundation, which sets accounting standards that are either mandatory or permitted in most major capital markets outside the U.S. The ISSB aims to set a “global baseline” (that is, an internationally consistent minimum standard of required disclosure) for sustainability reporting by companies to investors, which would also help companies meet the requirements of national regulators. In this paper, we examine the comment letters responding to IFRS S1 and IFRS S2 from 20 large asset managers based in the U.S and Europe. [1]

The second consultation was on 13 draft European Sustainability Reporting Standards, issued by the European Financial Reporting Advisory Group and backed by the European Commission. The draft ESRS are intended to be the key sustainability reporting framework for companies in Europe1. Although the EFRAG consultation is outside the scope of this paper, important differences between the draft ESRS and the ISSB’s draft standards are mentioned frequently in comment letters to the ISSB.

Evaluating Comments by 20 Asset Managers to the ISSB

The investing world is placing more emphasis on sustainability and climate matters as a key input in assessing investee companies’ performance and valuation, so establishing common standards for disclosing sustainability information has become critically important.

Getting companies to report under globally consistent climate- and sustainability-related standards would help investors make better-informed decisions about risks and opportunities. This is why the ISSB is keen to set a global baseline for sustainability reporting by companies for investors to use.

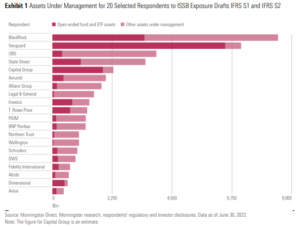

To assess asset managers’ views on how the ISSB should go about implementing a global baseline for sustainability reporting, we selected comment letters sent by 20 respondents. All these responses are from asset managers or from diversified financial services groups with a large asset-management segment. They are: Abrdn, Allianz Group, Amundi, Aviva, BlackRock, BNP Paribas, Capital Group, Dimensional, DWS, Fidelity International, Invesco, Legal & General, Northern Trust, PGIM, Schroders, State Street, T. Rowe Price, UBS, Vanguard, and Wellington. As shown on the chart below, the 20 respondents represent over USD 40 trillion of assets under management invested in all regions of the globe, of which over USD 17 trillion is in open-ended and exchange-traded funds. Ten of these respondents are based in the United States and 10 are in Europe. All 20 are signatories to the Principles for Responsible Investment, and all except two (PGIM and Dimensional) are signatories to the Net Zero Asset Managers Initiative.

In light of this, the responses by these 20 organizations should give a representative view of how large asset managers integrating ESG into their general investment decision-making processes perceive the ISSB’s draft climate and sustainability standards. Such analysis helps us better understand the ethos underlying asset managers’ approaches to ESG and helps us refine our ESG Commitment Level ratings, which investors can use in their manager selection processes.

In the following sections, we have summarized the broad points of view expressed by the 20 respondents. (See Appendix 2 for further details and links to the respondents’ original comment letters.)

In our opinion, these responses indicate that there is very broad support for the ISSB to establish a “global baseline” for investor-focused climate and sustainability reporting; however, significant differences in opinion among the respondents on the definition of materiality, required emissions disclosures, and the level of alignment with parallel regulatory initiatives in Europe and the U.S. highlight some major challenges to achieving that global baseline.

Overall Need for Consistent Disclosures

The ISSB’s Proposals

“The proposals set out the overall requirements for disclosing sustainability-related financial information in order to provide primary users with a complete set of sustainability-related financial disclosures… The prototype and the Exposure Draft include the recommendations by the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD) and components of the frameworks and standards of international sustainability bodies… To identify sustainability-related risks and opportunities and to disclose information about them, entities are directed to consider sources that include the disclosure topics in the industry-based Sustainability Accounting Standards Board (SASB) Standards [and] the International Sustainability Standards Board’s (ISSB) non-mandatory guidance (such as the CDSB Framework application guidance for water- and biodiversity-related disclosures).” [2]

Asset Managers’ Views

Broad Support for the ISSB’s Efforts to Implement a Global Baseline

All 20 respondents

Although there are many differences in opinion on the detail of IFRS S1 and IFRS S2, the 20 respondents we analyzed all recognize the need for globally consistent disclosures on climate and sustainability standards. Every comment letter we reviewed mentioned that they either “support,” “welcome,” “applaud,” or “agree that there is a need for” the ISSB’s efforts in this regard.

Here are some representative quotes from a few respondents:

“BlackRock strongly supports the International Sustainability Standards Board’s (“ISSB”) objective of providing a global baseline of sustainability-related disclosure standards. As an asset manager investing on behalf of diverse clients with a range of long-term financial objectives, we weigh a variety of investment factors, risks, and opportunities, including those related to sustainability.” – BlackRock

“We are supportive of efforts to drive greater international consistency in sustainability reporting, and we believe these efforts will improve the effective functioning of the capital markets. We welcome the formation of the International Sustainability Standards Board (ISSB) and support the “building blocks” approach, which provides a baseline founded on existing frameworks and standards.” – Vanguard

“We consider that the Exposure Drafts represent an important step forward towards delivering consistent and comparable disclosures needed for the genuine assessment of an issuer’s sustainability credentials.” – Fidelity International

A few respondents note that the ISSB’s efforts are especially important given the existing degree of fragmentation in nationally mandated reporting requirements for sustainability information, something they hope the exposure drafts will address. One of them puts it like this:

“Despite the growing importance of sustainability disclosures, the existing fragmentation of the reporting landscape creates difficulties and uncertainties in collecting and publishing comprehensive and comparable sustainability data. The variety of sustainability standards, frameworks, and definitions together with numerous different indicators and metrics create further challenges for companies to focus their efforts on strategic and meaningful disclosures. That is why we support the mandate of the IFRS cross-jurisdictional working group to align global sustainability reporting requirements.” – DWS

Morningstar’s View

“We welcome the progress made by ISSB and believe the standard is on the right track. A base level of standardized, consistent and comprehensive sustainability information is a critical minimum requirement for investors to be fully informed in their investment decision-making and necessary to provide guidance to issuers/corporates. We particularly support the fact the standard follows the TCFD structure/ definitions and the reference to existing standards such SASB.” [3]

Definition of Materiality

The ISSB’s Proposals

“Proposals in the Exposure Draft would require an entity to disclose material information about all of the significant sustainability-related risks and opportunities to which it is exposed. The assessment of materiality shall be made in the context of the information necessary for users of general purpose financial reporting to assess enterprise value… Enterprise value reflects expectations of the amount, timing and uncertainty of future cash flows over the short, medium and long term and the value of those cash flows in the light of the entity’s risk profile, and its access to finance and cost of capital. Information that is essential for assessing the enterprise value of an entity includes information in an entity’s financial statements and sustainability-related financial information.” [4]

“Sustainability-related financial information is material if omitting, misstating or obscuring that information could reasonably be expected to influence decisions that the primary users of general purpose financial reporting make on the basis of that reporting… Material sustainability-related financial information provides insights into factors that could reasonably be expected to influence primary users’ assessments of an entity’s enterprise value.” [5]

Asset Managers’ Views

In contrast to the respondents’ broad agreement on the overall need for consistent sustainability disclosures, their opinions diverge on key details of the ISSB’s proposals. This is particularly true regarding the definition of materiality, which is important because this definition determines what is considered sufficiently important to investors to be required to be reported by companies.

We can divide the responses into three groups. Respondents who comment on materiality generally either:

- agree with the ISSB’s proposal for a materiality approach that focuses on enterprise value (often referred to as “financial materiality” or “single materiality”);

- prefer a flexible approach that uses a materiality definition that is aligned with the relevant local jurisdiction’s own definition; or

- advocate for a “double materiality” approach that recognizes environmental and social impacts alongside financial ones (as proposed in the European Commission’s draft ESRS).

There are also calls for greater clarity on the intention behind using the words “material” vs. “significant” in the draft ISSB standards.

Agrees With the Proposed Enterprise-Value Focused Approach

Capital Group, Dimensional, Legal & General, UBS, Vanguard, Wellington

Five respondents clearly came out in support of the ISSB’s proposed enterprise-value focused approach. Three of these respondents are U.S.-based asset managers, reflecting the financial materiality approach required by U.S. reporting regulations (which was also a key area of focus in asset managers’ responses to the SEC’s proposed climate rule, discussed in our July paper). Respondents embracing this view emphasize the perceived cost-benefit balance of this approach, and its ability to capture the “dynamic nature” of materiality over time.

“The ISSB focuses on disclosure of sustainability-related financial information that is necessary for investors to assess enterprise value and clearly states that an entity need not provide a specific disclosure if the information is not material. We strongly agree with this approach. Because the costs of disclosing specific climate-related information may outweigh the benefits to a company’s investors, we believe that financial materiality is the right lens through which a company should determine what climate-related information to disclose.” – Dimensional

“We believe the proposed definition and application of materiality will capture the breadth of sustainability related risks and opportunities relevant to the enterprise value of a specific entity, including over time. Implicit in this definition is the requirement that companies assess the sustainability risks and opportunities which they believe to be most material to enterprise value on at least an annual basis, which we support, given the dynamic nature of materiality.” – Capital Group

Comment letters in this group from respondents in Europe add a caveat to their responses, noting the need for clarity over how companies assess enterprise value and mindful of the dynamic nature of materiality and the need to consider ESG issues beyond climate.

“We are supportive of the focus on a materiality based on users’ assessment of enterprise value. However, it is important when assessing materiality that there is clarity over the expectations of how a firm must assess its enterprise value. An assessment of enterprise value must be beyond a point-in-time ‘financial materiality’ as applied to financial statements.” – Legal & General

“We also support the goal to go beyond climate and address E, S, and G topics in their entirety with a focus on risks and opportunities that are material to understanding enterprise value.” – UBS

Prefers a Flexible Approach Aligned to Local Requirements

BlackRock, Invesco, Northern Trust, State Street, T. Rowe Price

Five U.S.-based asset managers call for a more flexible approach aligned to local regulatory requirements. This stance appears to respond to the difference in approaches to materiality taken by various regulators; particularly the SEC, which focuses on financial materiality, and the European Commission, which has opted for double materiality.

Comments from two of these respondents summarize the issue well:

“We believe the ISSB should revise its approach to defining materiality such that it aligns with accounting and policy frameworks that do not apply IFRS accounting standards, for example, in the United States. We agree with industry recommendations to adopt a more flexible approach that would enable companies to apply the same materiality standard as they do for financial reporting today, or to remove the reference to “enterprise value” and instead utilize the definition provided by [the accounting standard] IAS 1.” – State Street

“While we continue to strongly support the clear focus of the ISSB on financial materiality in assessing enterprise value, we recognize that clients and regulators in some jurisdictions, most notably in Europe, are requiring the disclosure by corporations and their asset managers on the wider impacts they have on the environment and the societies they operate in, i.e., double materiality. This underscores the importance for interoperability of the ISSB standards to serve as building blocks upon which different jurisdictional reporting standards can be layered upon.” – Northern Trust

Advocates for a Double Materiality Approach

Abrdn, Allianz, Amundi, Aviva, DWS, Fidelity International, PGIM, Schroders

Several respondents, mostly based in Europe, express considerable reservations about the single materiality approach proposed by the ISSB and advise that a change of approach is needed. Two such respondents put it this way:

“We urge the ISSB to commit to an acceleration of efforts to incorporate impact materiality into the standards through intensive engagement with EFRAG to devise a workable double materiality concept. This is a significant opportunity to address the fragmentation of reporting standards and develop a truly comprehensive ‘gold standard’ for sustainability reporting. Without this the needs of both investors and other stakeholders will not be met.” – DWS

“Our point of attention is that, while ISSB does require the disclosure of the impacts on people, planet and the economy, the requirement is narrowed only if this information is needed by ‘primary users’ to assess the implications of sustainability-related risks and opportunities on an entity’s enterprise value. Broadly diversified global companies may be able to create significant harm that never crosses the threshold of financial materiality. Investors carry all of these impacts. Without a full inventory of impacts, we cannot assess which are the most significant, where they are coming from, etc. Without this information, we cannot hope to reverse the systemic risk of nature loss, climate change or even child labor. This also means that we cannot hope to mitigate the most significant financial risks to our clients.” – BNP Paribas

Some are less critical of the single materiality approach but indicate that there would be benefits to investors in using a double materiality approach, particularly as this would align with the proposed European regulations.

“The definition of materiality used is reflective of that used in traditional financial reporting, but this is difficult to apply to a sustainability reporting context. We would welcome further guidance on how materiality should be applied, not least in order to ensure consistency and comparability of reporting. We also believe a consistent definition of materiality should be applied across the standard setting bodies and we specifically note the concept of ‘double materiality’ in CSRD, which aims to reflect decision-useful information that extends beyond information affecting enterprise value solely.” – Schroders

Not all respondents in this group want an immediate change in approach. One suggests a more “gradualist” approach:

“We believe that a gradualist approach is appropriate to encourage broad adoption, but that over time the ISSB should consider how its approach should evolve to the principle of double materiality, which will be necessary to meet the needs of investors seeking to align to broader international objectives such as the UN Sustainable Development Goals.” – Fidelity International

One respondent requests further clarity from the ISSB on how to address “endogenous and exogenous” risks:

”When determining significant risks and opportunities, entities should consider endogenous risks and well as exogenous risks that impact enterprise value and consider the impact of risks and opportunities over a long-term horizon, consistent with the obligations of the company to shareholders and stakeholders over the long-term. We believe that this is the intention of the ISSB’s proposals, but ensuring this is clear will be important to ensure that the disclosure standard achieves the ISSB’s ambition to make meaningful change.” – Aviva

Clarifying “Material” vs. “Significant”

Aviva, DWS, Schroders, State Street, Wellington

A few respondents mention the ISSB’s use of the terms “material” and “significant” in the draft standards when referring to sustainability risks and opportunities, which they believe adds complexity. They feel that more precise definitions—or removing “significant” from the standard—would help clarify matters for investors.

Morningstar’s View

“While we believe that ISSB should initially focus on financial materiality, we also recognize that it does not respond to all the needs of investors. Investors are increasingly interested in sustainability issues which affect a broad range of stakeholders as these are the most likely to in turn affect enterprise value. There is a diversified pool of investors who seek to allocate capital to create measurable environmental and social impacts. Impact investors in particular may want to know the sustainability impact of a firm alongside financial materiality. Further, there is a growing retail investment market where individuals are being more inclined to think of ESG investing as a way to invest according to their personal values, rather than from a risk perspective.”

“The focus on double materiality is also being driven by regulation. In 2023, asset managers in the EU will have to report on Principal Adverse Impacts indicators at the entity level. The EU SFDR also demands that a financial product seeking a sustainable investment does not harm significantly other sustainable objectives.”

“In the short-term and in the context of this first sustainability standard, ISSB should at least acknowledge the dynamic nature of materiality: sustainability risks that a company assesses not to be material can change in response to stakeholder pressure, consumer and investor expectations, regulation and technological progress. We would also suggest that companies provide a clear rationale supporting their materiality judgment supporting disclosure on top of mandatory SASB-inspired quantitative disclosure.” [6]

Mandatory Greenhouse Gas Emissions Disclosures

The ISSB’s Proposals

“The proposed Standard would require a company to disclose its absolute gross Scope 1, Scope 2 and Scope 3 GHG emissions, in metric tonnes of CO2 equivalent, and the intensity of those emissions. The company would be required to calculate these emissions using the GHG Protocol. A consolidated group would be required to disclose GHG emissions by associates and joint ventures separately from those by the consolidated group. The requirement to disclose Scope 3 emissions reflects the importance of providing information related to a company’s value chain.” [7]

Asset Managers’ Views

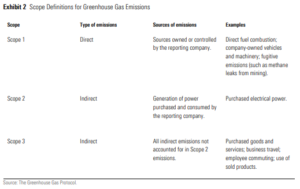

Under the Greenhouse Gas Protocol, greenhouse gas emissions are assigned to Scope 1, 2, or 3 depending on whether they:

- are directly emitted by the reported company (Scope 1); or

- represent the company’s share of indirect emissions that occur in its value chain (Scope 2 or 3).

Proposals to mandate disclosure of Scope 3 greenhouse gas emissions often divides opinion. Some view the provision of these disclosures as premature because reliable measurement methodologies for Scope 3 emissions (which necessarily overlap with the Scope 1 and Scope 2 emissions of other reporters, raising the risk of double counting) are still being developed.

Reflecting this, there are a range of views on greenhouse gas emissions disclosures among the 20 respondents that can also be broadly divided into three groups. Respondents who comment on the matter prefer either:

- disclosures of Scope 1, 2, and 3 emissions by all reporting companies;

- disclosures of Scope 1 and 2 emissions by all reporting companies, with Scope 3 disclosed only in certain circumstances or phased in over time; or

- disclosures of emissions under any scope only by companies that deem such information material.

Prefers Mandatory Disclosures for Scope 1, 2, and 3

Abrdn, Aviva, BNP Paribas, Capital Group, Fidelity International, Legal & General, Northern Trust, Wellington

Several of the respondents in our selection who have commented at length about the scope of greenhouse gas emissions disclosures agree with the ISSB’s proposal requiring disclosures about Scope 1, 2, and 3 emissions. These respondents are a mixture of firms based in Europe and the U.S.

Respondents in this group believe that disclosure across all three scopes is necessary for investors to obtain a complete picture of climate-related risks and opportunities and that methodologies for disclosing Scope 3 emissions in particular will improve rapidly.

Key comments from firms in this group include the following:

“Scope 1 and Scope 2 emissions alone will not provide a complete picture for investors to assess a company’s transition risk… Disclosure of both overall categories of Scope 3 emissions— upstream and downstream—with context and specificity from companies about the most significant Scope 3 sources, is necessary for investors to develop a full picture of transition risk exposure and to evaluate investment risks and opportunities.” – Wellington

“Without disclosure of Scope 3 emissions, we will not be able to assess the credibility and progress towards net zero of our investee companies and will therefore also not enable investors to fully understand the transition risks a company is exposed to through its value chain.” – Legal & General

“We are strongly in support of the requirement to disclose Scope 3 emissions which goes beyond the strong encouragement of TCFD’s recommendations. While we note that data and methodological challenges still exist, they are rapidly improving and preparers should be given a long runway to implement the new disclosure regime.” – Northern Trust

Prefers Mandatory Disclosures for Scope 1 and 2, Limited or Deferred Disclosures for Scope 3

BlackRock, DWS, Invesco, PGIM, State Street, T. Rowe Price, Vanguard

These respondents agree with mandatory disclosures for Scope 1 and 2 emissions but believe that methodologies for disclosing Scope 3 emissions are not sufficiently mature to require mandatory disclosure by all companies at this time. This group is dominated by some of the largest U.S.-based asset managers.

Some of these firms suggest that Scope 3 disclosures should be required only where material; others suggest that such disclosures should be deferred until more robust measurement methods are available.

Key comments from firms in this group include the following:

“The ISSB should not mandate full Scope 3 GHG disclosure at this time. Many aspects of the calculation and attribution of GHG emissions disclosures are still in early stages of development, but there continues to be significant practical challenges preventing full disclosure of Scope 3.” – State Street

“There are a number of areas that are complex for issuers to comply with due to lack of clear methodologies. This includes: Scope 3 GHG emissions… These elements could be framed as more advanced disclosures that apply to only the largest companies and/or subject to a phase-in approach to allow more time for companies to build up towards these more advanced disclosures.” – Invesco

“Given methodological complexity for Scope 3 emissions and the lack of direct control by companies over the requisite data, our investors believe the usefulness of this disclosure varies significantly right now across industries and Scope 3 emissions categories. We encourage regulators to adopt a disclosure framework that accounts for this significant variation. Under this framework, companies would disclose emissions estimates for any of the fifteen Scope 3 categories that are material to them. If none of the fifteen categories are material, or if companies are not yet capable of estimating their Scope 3 emissions, they would have the option of explaining why that is the case.” – BlackRock

“We recommend that the ISSB apply a lead time for requiring Scope 3 GHG data disclosure, once a protocol and accounting methodology have been agreed on and tested broadly, rather than proposing industry-based disclosure requirements for financed and facilitated emissions now.” – T. Rowe Price

Prefers Mandatory Disclosures Only if Deemed Material by the Company

Dimensional

Dimensional has taken a very different view from the other respondents on the scope of emissions disclosures. Dimensional’s response to the SEC’s proposed climate rule is attached to their comment letter to the ISSB. It states:

“We strongly believe that only companies that have identified climate change as a material risk to their business should be required to disclose specific climate-related information… In our view, if a company has not identified climate change as a material risk to its business, the costs of requiring that company to disclose specific climate-related information will outweigh benefits to shareholders.”

Additionally, Dimensional’s response to the ISSB adds further detail regarding Scope 3 emissions.

“We also encourage the ISSB to reconsider whether requiring disclosure of Scope 3 emissions is appropriate, even when material. Companies in most industries are not able to estimate their Scope 3 emissions with reasonable reliability at this time. Estimates of Scope 3 emissions may vary substantially because of differences in the assumptions made and methodology employed. Such data is of limited use to investors.”

Morningstar’s View

“We recognize that certain data points are now needed by investors regardless of sectorial financial material assessment. We therefore agree that Scope 1 and Scope 2 GHG emissions should be disclosed by all preparers. For Scope 3, we would argue that disclosure be required by companies which cite specific scope 3 emissions-reduction targets and for companies whose emissions are material according to the SASB standards… In the medium term, the ISSB should create standards that encompass sustainability impacts beyond Scope 1-3 emissions, setting out a roadmap, including timelines, for this next stage of work.” [8]

International Alignment

Comments by the ISSB and Its Supporters

“Rarely do governments, policymakers and the private sector align behind a common cause. However, all agree on the importance of high-quality, globally comparable sustainability information for the capital markets. These proposals define what information to disclose, and where and how to disclose it.”— Emmanuel Faber, Chair of the ISSB [9]

“IOSCO [the global association of securities regulators] welcomes the publication of the ISSB’s two proposed IFRS Sustainability Disclosure Standards. We will review the proposals, with the objective to endorse them for use by our member jurisdictions. Endorsement by IOSCO can pave the way for adoption of the Standards around the world, delivering much-needed consistency and comparability in sustainability-related information to the capital markets.”—Ashley Alder, Chairman of the IOSCO Board [10]

“By building on the TCFD’s framework, the ISSB’s climate proposals will create further consistency, comparability and reliability across climate disclosure so investors can make more informed financial decisions.”—Mary Schapiro, Head of the TCFD Secretariat [11]

Asset Managers’ Views

On this topic, respondents’ views also differ. There is a large group of respondents who support the draft standards’ alignment with TCFD and SASB. A smaller group believes greater collaboration with local regulators and international standard-setters is needed.

Support for Current Alignment with TCFD and SASB Frameworks

Abrdn, BlackRock, Aviva, Dimensional, Capital Group, DWS, Fidelity International, Legal & General, Northern Trust, PGIM, State Street, Vanguard, Wellington

There is broad support among the 20 respondents for the ISSB’s efforts to align its draft standards with the existing frameworks set by TCFD and SASB.

Key comments from this group of respondents include the following:

“We applaud the ISSB for basing the Exposure Drafts on the SASB Standards and the Taskforce on Climate-related Financial Disclosure (TCFD), two frameworks which have been extensively tested over the last years by institutional investors and public companies globally, and which have a successful track record.” – Capital Group

“As an investment adviser, we rely on portfolio companies’ public disclosures to help us make investment decisions on behalf of our clients and the retail investors who have entrusted us with their savings, and we support the ISSB’s efforts to build upon the well-established work of Task Force on Climate-related Financial Disclosures (the “TCFD”) to create a globally harmonized framework for sustainability reporting standards.” – Dimensional

“ISSB’s incorporation of existing global standards, such as the GHG protocol and Task Force on Climate-Related Financial Disclosures (TCFD) into these standards will significantly encourage international adoption of the Exposure Drafts.” – Fidelity International

However, even amid this broad support some respondents express reservations about the way the ISSB intends to implement the draft standards.

“We also agree with the overall approach to leverage the SASB standards for the industry- specific approach to Climate-related disclosures. However, the ISSB standards should recognize the flexibility that is incorporated into the TCFD and SASB. For example, the proposal would require companies to disclose information relevant to the cross-industry metric categories, including its absolute gross Scope 3 GHG emissions generated during the reporting period, despite there being significant challenges with reporting on Scope 3 GHG emissions in light of data and methodological constraints.” – State Street

“We generally welcome the ISSB’s stated commitment to maintaining an industry-based standard-setting approach and to evolving and enhancing SASB’s existing industry-based standards over time. However, we are concerned that proposing an umbrella of disclosure expectations that are meant to be applied across all the ISSB’s standards may overlook environmental, social, and governance factors specific to a sector or industry, such as asset management. Our view is that the adoption of a highly topical approach to sustainability (e.g., water, biodiversity, or even social issues) might inadvertently obfuscate issues that are germane to the financial sector.” – T. Rowe Price

Greater Collaboration With Local Regulators and International Standard-Setters Needed

Amundi, Allianz, Capital Group, DWS, Invesco, Schroders, UBS

There are some calls for the ISSB to go further in collaborating with other regulators and reporting framework owners in Europe and the U.S. to ensure greater interoperability with relevant national reporting requirements. These respondents frequently mention European regulators and the SEC, and they are conscious of the diverging approaches to materiality being taken on either side of the Atlantic.

Key comments from this group of respondents include the following:

“We see a risk that there will be a significant gap between the ISSB’s global baseline and the EU’s ambition given the fact that the EU does not limit its materiality perspective to what is material for investors to assess enterprise value, but requires to fully embrace the inside-out view… The ISSB and EFRAG should urgently develop a collaboration model that enables global alignment and connect EFRAG’s work with the ISSB’s agenda. Allianz Group is happy to support this effort. This rationale of course also applies for other jurisdictions and/or their standard setting bodies (e.g., the US and the US Securities and Exchange Commission).” – Allianz

“We would strongly encourage the ISSB to continue working with leading national regulators in other markets – including the US Securities and Exchange Commission and the European Commission – to ensure interoperability with other emerging standards such as the SEC’s draft disclosure rules on climate change reporting and EFRAG’s upcoming exposure consultation on European Sustainability Reporting Standards.” – Capital Group

“We encourage the ISSB to co-operate further with other standard setters to agree a globally consistent framework wherever possible. Such an approach would allow bodies like the SEC and EU regulators to support the work of the Board without sacrificing the nature or timeliness of their independent actions. It could also reduce the cost and complexity of compliance for companies with a global footprint that are currently preparing for the introduction of multiple and varying new reporting regulations at the same time. This would be subject to addressing aspects of the existing draft that we believe would add to the cost and complexity for companies.” – Schroders

Morningstar’s View

“Asset owners and asset managers invest globally. They absolutely need some international convergence to be able to report meaningful aggregated information to end-users. We therefore fully support a global approach to the development of sustainability disclosure standards and are supportive of the ISSB as the global body to issue these standards. The goal should be a base level of standardized, consistent and comprehensive sustainability information as a critical minimum requirement for investors to be fully informed in their investment decision-making and necessary to provide guidance to issuers/corporates. The standard should strike the right balance between firm-specific information and standardized information. We believe the TCFD framework allow issuers to tailor qualitative information while SASB metrics will ensure a global baseline for quantitative information. We note the many initiatives reporting initiatives already underway and encourages that the ISSB work closely with these initiatives with a view towards simplifying reporting and controlling costs.” [12]

The complete memorandum is available for download here.

Endnotes

1Morningstar’s response to the draft ESRS can be found on EFRAG’s website.(go back)

2IFRS Foundation, March 2022: Exposure Draft IFRS S1 General Requirements for Disclosure of Sustainability-Related Financial Information p. 6-7.(go back)

3Morningstar, July 2022: Response to ISSB draft sustainability disclosure standards IFRS S1 and IFRS S2 p. 1.(go back)

4IFRS Foundation, March 2022: Exposure Draft IFRS S1 General Requirements for Disclosure of Sustainability-Related Financial Information p. 9-10.(go back)

5IFRS Foundation, March 2022: Exposure Draft IFRS S1 General Requirements for Disclosure of Sustainability-Related Financial Information 33-34.(go back)

6Morningstar, July 2022: Response to ISSB draft sustainability disclosure standards IFRS S1 and IFRS S2 p. 2.(go back)

7IFRS Foundation, March 2022: Exposure Draft—Snapshot IFRS S1 and IFRS S2 p. 10(go back)

8Morningstar, July 2022: Response to ISSB draft sustainability disclosure standards IFRS S1 and IFRS S2 p. 2(go back)

9“ISSB delivers proposals that create comprehensive global baseline of sustainability disclosures,” 31 March 2022; ifrs.org.(go back)

10“ISSB delivers proposals that create comprehensive global baseline of sustainability disclosures,” 31 March 2022; ifrs.org.(go back)

11Id.(go back)

12Morningstar, July 2022: Response to ISSB draft sustainability disclosure standards IFRS S1 and IFRS S2 p. 10(go back)

Print

Print