Subodh Mishra is Global Head of Communications at Institutional Shareholder Services, Inc. This post is based on an ISS Corporate Solutions publication by Trey Poore, Associate Director at ISS Corporate Solutions. Related research from the Program on Corporate Governance includes Social Responsibility Resolutions (discussed on the Forum here) by Scott Hirst.

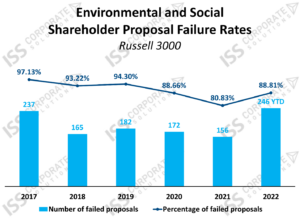

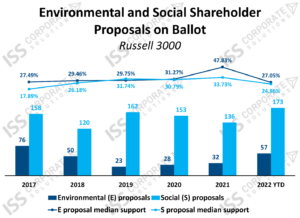

Despite a steady decrease in the portion of environmental and social proposals receiving less than majority support from 2017 through 2021, 2022 bucked the trend likely due to some institutional investors viewing them as overly prescriptive as explained here, for example, by BlackRock.

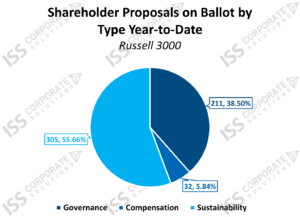

Environmental and social remains a hot topic among shareholder proposals accounting for 55 percent of all such resolutions in 2022.

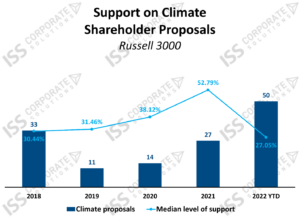

Climate-related proposals experienced a significant increase in volume this year, nearly doubling over the count of those voted in 2021. Although the number of climate proposals increased, median shareholder support for these proposals fell to the lowest level over the last five years.

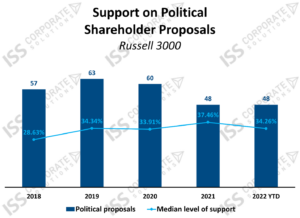

Shareholder support for political proposals (defined as those covering political contribution disclosures, political lobbying disclosures, and political activities and action) has remained fairly consistent since 2019, while proposal volume has fallen off since the high-water mark in 2019.

This year, social proposals outnumbered environmental proposals by a factor of more than three, although there were more environmental proposals this year than any year since 2017. Median support for both types of proposals ranged between 24 and just over 27 percent, compared with larger deviations in 2017 and 2021.

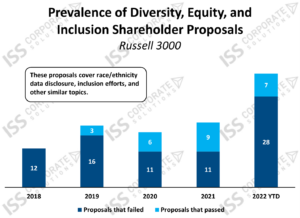

This year saw a material increase in the number of proposals related to diversity, equity, and inclusion, with 35 proposals in 2022 versus 20 last year. Moreover, shareholders supported fewer of these proposals, both in number and as an overall percentage.

Print

Print