More from: Lara Shalov Mehraban, Ranah Esmaili, Sidley Austin

Lara Shalov Mehraban and Ranah Esmaili are Partners at Sidley Austin LLP. This post is based on a Sidley memorandum by Ms. Esmaili, Ms. Mehraban, Stephen Cohen, Barry Rashkover, and Ashley DePalma.

On November 15, 2022, the U.S. Securities and Exchange Commission (SEC) released its enforcement results for the 2022 fiscal year (October 1, 2021 – September 30, 2022).

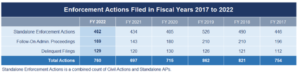

The SEC reported that it brought a total of 462 standalone actions, a 6.5% increase over 2021. The total enforcement actions also increased 9% from the prior year for a total of 760. These numbers are still down substantially from pre-Covid years.

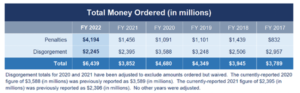

Most notably, the SEC touted a record-breaking year in monetary recoveries ordered due to a huge increase in penalties. Money ordered in SEC actions totaled over $6.4 billion in civil penalties, disgorgement, and prejudgment interest — the most on record in SEC history and almost $2.6 billion more than was collected in 2021. Of that, civil penalties comprised $4.194 billion, also the highest on record and nearly double the amount collected in disgorgement, which decreased to $2.245 billion in 2022.

Nonetheless, Enforcement Division Director Gurbir S. Grewal cautioned: “[W]e don’t expect to break these records and set new ones each year because we expect behaviors to change. We expect compliance.” Consistent with that message, the SEC reported “robust” enforcement through resolutions it noted were designed to deter future violations. For example, the SEC highlighted actions against 16 broker-dealers and one investment adviser in connection with off-channel recordkeeping violations resulting in $1.235 billion in cumulative penalties as well as admissions of wrongdoing and remedial undertakings by each firm.[1] Firms can look to these undertakings in considering potential enhancements to their compliance programs around communications and recordkeeping. Other examples include obtaining the largest-ever penalty from an audit firm[2] as well as more than $1 billion in combined penalties, disgorgement, and prejudgment interest from an investment adviser in connection with an alleged “massive” fraudulent scheme that concealed “immense” downside risks of a complex options trading strategy.[3]

The SEC also emphasized the benefits of cooperation, noting that it did not impose civil penalties, or agreed to substantially limit penalties, in a number of actions where companies self-reported, cooperated meaningfully with the staff’s investigation, or undertook remedial measures.

Looking at the categories of enforcement actions shows the Enforcement Division’s continued focus on traditional priority areas. The SEC brought nearly a quarter of its enforcement actions in matters involving investment advisers and investment companies, a total of 174 in 2022. This represented a 9.4% increase from the prior year and reflected a continued trend of heightened focus in this area. The SEC also brought 132 actions involving broker-dealers, a 20% increase, and 43 insider trading actions, a 54% increase. Actions involving public finance abuse also increased from 12 in 2021 to 20 total actions brought this year. On the other hand, actions involving securities offerings decreased almost 25%, although, at 113 actions, they still represent a significant portion of total actions brought in 2022. The six Foreign Corrupt Practice Act (FCPA) actions remains well below the number of actions brought in the 2017–20 time period. The number of market manipulation and nationally recognized statistical ratings organization actions remained generally consistent with prior years.

The division touted several first-of-its-kind actions, including an action against a crypto lending platform for violating registration requirements of the Investment Company Act of 1940, charges against a registered investment adviser stemming from the adviser’s involvement with special-purpose acquisition companies, and the SEC’s first action enforcing Regulation Best Interest, which requires broker-dealers to act in the best interest of their retail customers when recommending any securities transaction or investment strategy involving securities. In addition, the division highlighted several actions involving environmental, social, and governance issues, which we expect will receive continued scrutiny in 2023. Actions in the cryptoasset securities space are also likely to continue in 2023, as the division reported doubling the number of staff in its Crypto Assets and Cyber Unit, and there are significant disruptions in the digital asset marketplace.

Finally, the division reported more than 12,300 whistleblower tips in 2022, which is a small increase from last year’s record high and shows a sustaining trend in increased whistleblower reporting. The SEC also issued approximately $229 million in 103 whistleblower awards in 2022, making it the SEC’s second-highest year in terms of dollar amount and number of awards.

The full SEC Division of Enforcement 2022 report is available here.

Print

Print