Jonathan Bailey is a Managing Director and Head of ESG Investing, and Savannah Irving is an Associate at Neuberger Berman LLC. This post is based on their Neuberger Berman memorandum.

In recent years a variety of market disrupting events have underscored the importance of active ownership and the analysis of material environmental, social and governance (ESG) factors in fundamental credit research as well as investment decision-making. In our view, asset managers who leverage their relationships with issuers are best positioned to manage these ESG risks and take advantage of ESG opportunities. As highlighted in our prior ESG engagement reports, Neuberger Berman views direct issuer engagement as a critical tool to mitigate portfolio risks while generating long-term sustainable returns.

During the past year our established relationships with issuers in developed and emerging markets enabled us to have meaningful engagements with a number of management teams. We engaged on key ESG issues such as climate change, community relations and human capital management. While these ESG issues present varying challenges and complexities, both transparency and accountability are key determinants of the success of our engagements with corporate credit issuers. We encourage issuer alignment with external frameworks such as the United Nations Sustainable Development Goals (UN SDGs), the Task Force on Climate-Related Financial Disclosures (TCFD) and the SASB Standards to improve the transparency of issuers’ credit profiles. We also assess the capability of management teams to set and successfully execute sustainability targets, as evidenced in the emerging practice of linking ESG Key Performance Indicators (KPIs) to executive variable compensation with a focus on enhancing accountability.

At Neuberger Berman, we believe the transition toward strong ESG performance is incremental, and our engagement provides guidance and support to issuers in improving their sustainability metrics, including issuers who are early in their ESG integration processes. In our view, working with companies that need the most guidance and support will not only help deliver on the financial objectives of our clients, but also their desire to make a long-term positive impact in the real world. Moreover, when properly deployed, the capital provided by our clients and others have the potential to help companies make this transition over time, both operationally through new products, services and technologies, as well as financially by reducing their ESG risks, thereby strengthening their overall credit profiles.

Rather than take a hard line of exclusion or divestment, we employ a “work-in-progress” approach to our engagements, where we look for the appropriate level of disclosure and goal-setting to increase our confidence in a company’s future. Where lacking or limited in scope, we challenge companies to reduce their risk profiles by setting clear objectives and holding them accountable through our engagement process. We keep our analysis and engagement in-house, leaning heavily on our credit analysts in the process given their intimate knowledge of issuers and sectors.

We believe Neuberger Berman’s proprietary ESG scoring system and focused engagement efforts can lead us to identify material credit risk factors which influence an issuer’s long-term cost of capital. We believe we have the platform to drive positive long-term outcomes for our stakeholders through active engagement due to our established relationships with corporate issuers, along with our deep understanding of ESG risks and opportunities amidst an evolving landscape.

| DIRECT ENGAGEMENT IS CORE TO NEUBERGER BERMAN’S FUNDAMENTAL RESEARCH PROCESS AND IS AN INTEGRAL RESOURCE TO SEEK TO MITIGATE PORTFOLIO RISKS AND IDENTIFY OPPORTUNITIES. |

Prioritizing Our Engagement Efforts

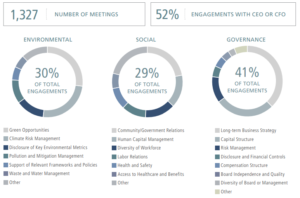

During 2022, Neuberger Berman continued its commitment to active and direct dialogue with corporate management. Our corporate fixed income research teams hosted 1,327 meetings during this period, over half of which were with CEOs or CFOs. We prioritize direct engagement with issuers as evidenced by our limited reliance on letter-writing or email campaigns, which represented only 6% of our engagements during the period.

In comparing engagement data to the prior year, engagements relating to environmental topics comprised 30% of our engagements versus 27% in 2021, and were focused on topics such as green opportunities and climate risk management. An increasing portion of our governance related engagements were focused on compensation structure, as well as financial disclosure and controls, highlighting the importance of these practices on corporate credit profiles. Our proportion of social engagement topics in 2022 remained relatively consistent compared to 2021. Community and government relations continued to be primary topics of discussion. Human capital management was an increasing area of focus, reflecting the tight labor market and its impact on company operations.

ENGAGEMENT AT A GLANCE [1]

Engagement Areas in Focus

1- NET-ZERO AND CLIMATE TRANSITION

We believe asset managers have a key role to play in mitigating climate change and the risks it presents to society, businesses and the global economy by directing capital to support climate solutions. As a part of the Net Zero Asset Managers initiative, Neuberger Berman actively engages with issuers on strategies and objectives to support the goal of achieving net-zero greenhouse gas emissions by 2050 or sooner, in line with global efforts to limit global warming to 1.5 degrees Celsius.

Priorities of our engagement on climate change:

- Encourage issuers to disclose historical emissions records in alignment with the Task Force on Climate-Related Financial Disclosures guidelines and establish science-based reduction targets certified by a credible third party such as the Science Based Targets initiative (SBTi).

- Understand the credibility and ambition of issuer climate transition plans and their emission management and reduction strategies.

- Integrate material climate risks and opportunities into our investment thesis for issuers with outsized exposure to energy transition risks while tracking management responsiveness and progress toward goals.

Climate Transition engagement in practice:

As issuers seek to shift to a low carbon future, market participants will continue to reprice financial assets correspondingly. Energy intensive companies face heightened threats from climate change, as the energy transition may result in increased carbon costs and regulatory requirements. We regularly engage with companies to encourage establishment and disclosure of short-, medium- and long-term carbon emissions reduction targets, as well as KPIs to incentivize progress for ESG commitments.

As an example, we engaged with a U.S. credit issuer that has a large regulated electric utility and a leading non-regulated renewable generation business. Through quarterly discussions with senior management, we encouraged the issuer to further reduce their carbon emissions and enhance their carbon reduction targets. Management responded by reinforcing their commitment to improving the company’s environmental footprint and ultimately setting a goal to eliminate all scope 1 and 2 emissions by 2045. The company’s leading position in wind and solar renewable development at both its utility and non-regulated generation business should improve the likelihood that its targets are met. Engaging with issuers on climate change and encouraging management teams to develop credible climate transition plans can help mitigate long-term credit risks such as stranded assets and costs related to compliance with emerging legal and regulatory guidelines.

| WE BELIEVE CLIMATE CHANGE POSES A SYSTEMIC RISK TO MANY COMPANIES. WE ACTIVELY ENGAGE WITH ISSUERS TO ADDRESS THE SHORT- AND LONG-TERM IMPACT OF CLIMATE TRANSITION ON THEIR BUSINESS MODEL AND OPERATIONS. |

2- HUMAN CAPITAL MANAGEMENT

We view human capital management as a critical component of long-term business success to retain skilled labor in competitive markets through varying economic conditions. Topics related to human capital are among the most significant risks and opportunities for companies, and we value transparency on workforce composition and human capital policies, practices and outcomes.

The COVID-19 pandemic heightened pressure on supply chains and labor management. As the labor market tightened, companies continued to face labor shortages and challenges in attracting new employees. Through our human capital management engagement efforts, we noticed varying levels of progress for incentive programs and talent management; including adjustments to benefit packages to enhance retention, revamped recruitment efforts to attract labor, and professional development and training opportunities to develop internal talent pipelines.

Priorities of our engagement on human capital management:

- Develop strong human capital management programs, including compensation initiatives, diversity initiatives and recruitment efforts.

- Encourage reevaluation of labor standards, benefits packages and working conditions to attract and retain labor.

- Encourage companies to disclose KPIs to assess workplace culture and enable proper monitoring.

Human capital management engagement in practice:

We engaged with a technology solutions provider on its recruiting practices and its equity, inclusion and diversity progress. We encouraged the company to publish its Equal Employment Opportunity (EEO-1) diversity data to enhance transparency and assist in benchmarking and goal setting as we believe equitable, inclusive and diverse workforces contribute to a company’s long-term success. The EEO-1 report consists of demographic workforce data including race, ethnicity, sex and job categories. It is collected by the U.S. Equal Employment Opportunity Commission and is mandatory disclosure for companies that have more than 100 employees. Given companies must collect and report this data to the U.S. government, it is not a significant additional time or resource burden for the issuer to incorporate publishing of this data into their ESG disclosure practices. Following our engagements, the company published its EEO-1 diversity data in its 2021 ESG report as well as in a standalone EEO-1 data report. Publishing this data allows us to monitor progress on workforce and board diversity, and we continue to meet with this company to obtain details on equity and inclusion initiatives and talent development programs.

| WE BELIEVE STRONG POLICIES RELATED TO HUMAN CAPITAL MANAGEMENT AND IMPROVING EQUITY, INCLUSION AND DIVERSITY ARE VITAL TO ADVANCING WORKFORCE OPPORTUNITIES AND REDUCING POTENTIAL LEGAL LIABILITIES AND REPUTATIONAL RISKS. |

3- COMPENSATION STRUCTURE

Governance is core to our analysis of issuers and is a material factor assessed in our investment process. We incorporate analysis of management into our proprietary Governance scorecard, which assesses governance quality across various factors for every corporate credit issuer for our portfolio companies. For example, we consider how companies incorporate factors such as capital allocation and cash flow management into corporate decision making and management compensation. We believe it is important for issuers to integrate ESG targets throughout their operations, and we encourage them to incorporate performance of these metrics into long-term variable compensation structures to strengthen the alignment between management’s business incentives and its ambitious ESG targets.

Priorities of our engagement on compensation structure:

- Understand how an issuer’s operations and capital allocation are tied to management compensation.

- Engage with issuers to encourage management to set compensation incentives which are tied to ESG goals and KPIs.

- Identify which issuers have incorporated these principles into their management structure, and how this correlates with their performance on ESG goals.

Compensation structure engagement in practice:

We engaged with an American chemical company to advocate that executive compensation be tied to the company’s ESG goals. Previously, long-term management compensation was limited to financial KPIs such as operating ROIC, cash flow from operations and stock appreciation rankings relative to peers. A focus on financial metrics alone could lead to the risk of concessions on ESG performance, such as by introducing cost-cutting initiatives that could compromise safety, or underinvesting in infrastructure upgrades and retrofits that would reduce emissions. In October 2021, the issuer announced plans to incorporate ESG metrics into the long-term variable compensation plan for the leadership team. We were encouraged by the issuer’s response as it reflects their commitment to ESG performance and sustainability initiatives, which can impact long-term business operations.

| ASSESSMENT OF COMPANY GOVERNANCE PRACTICES IS A KEY PART OF NEUBERGER BERMAN’S RESEARCH PROCESS. WE BELIEVE THE INCLUSION OF SUSTAINABILITY METRICS IN EXECUTIVE COMPENSATION CAN BETTER ENCOURAGE MANAGEMENT TO PRIORITIZE STRONG PERFORMANCE ON ESG TARGETS. |

Engagement Partnerships

NON-INVESTMENT GRADE CREDIT TEAM HOSTS 3RD ANNUAL ROUNDTABLE OF HIGH YIELD AND LEVERAGED LOAN ISSUERS

Expanding interest in ESG suggests that issuers are likely to be called upon for more disclosure, communication and progress in the coming years, making it crucial to effectively navigate these areas. To help with this process, Neuberger Berman’s Non-Investment Grade Credit team, in conjunction with the firm’s ESG Investing team, conducted its third annual roundtable discussion in May 2022 to highlight key industry trends, explain our approach to ESG, and provide insights on managing the major shifts ahead. We provide some essential takeaways

ENGAGEMENT: DO NOT LET PERFECTION BE THE ENEMY OF GOOD

The use of ESG factors is crucial to credit underwriting at Neuberger Berman, helping us seek to avoid exposure to defaults over time and to heighten the potential for income. We develop ESG risk profiles for the corporate credit issuers we invest in.

The SASB standards, the Task Force on Climate-Related Financial Disclosures (TCFD), and the Science Based Targets initiative (SBTi) are three voluntary frameworks we have found particularly helpful in aligning issuers with disclosure requirements and emissions reduction targets in line with the Paris climate agreement. With near- and long-term goals in mind, we apply targets and look for progress reports to clarify how capital is deployed and ensure that companies are on track, be it relating to reducing carbon footprint, diversity initiatives or other ESG issues. In turn, many companies look to us for guidance on best practices.

REGULATORY MOMENTUM

There has been a general push toward greater mandatory and standardized disclosure of environmental and social data. In the U.S., the Securities and Exchange Commission (SEC) has proposed rules that would require issuers to fortify disclosure of climate-related data, most prominently in Scope 1 (direct) and Scope 2 (purchased electricity, steam, heating and cooling), but also for those with material Scope 3 emissions (indirect emissions in the value chain).[2] The SEC is also looking to require companies that have made commitments to net-zero or other climate goals to provide detail on how those goals are being achieved. The rules would increase the alignment of the U.S. with Europe’s Corporate Sustainability Reporting Directive (CSRD), which will require all large companies[3] to publish regular reports on their environmental and social activities. More generally, we would note efforts to standardize global disclosure through the newly established International Sustainability Standards Board (ISSB), drawing from the TCFD and SASB standards. Global momentum is also evident in the efforts of previously lagging regions and countries such as Japan and Southeast Asia, which are taking positive steps on improving disclosure

MOVING TOWARD NET-ZERO

Emissions reduction has become a key focus of many investors looking for holdings to actively contribute to the net-zero pathway. This is a long-term journey—30 years for much of the developed world, and perhaps 40 or 50 years for China and India. Some sectors are simply awaiting technology and innovation to curb impact; for example, aviation and cement manufacture. However, the path for other sectors, such as autos and energy, are clearer, and the question is more about the pace of change instead of how change will be achieved. For us as investors, therefore, it is important to understand how companies’ capital allocation will guide them in the right direction. This may be a function of periodic benchmarking, but it also may be appropriate to introduce these steps into long-term compensation, aligned with tangible metrics. As part of our process, we have created a Net-Zero Alignment Indicator to quantify where issuers stand on their journey, which helps us feel confident in the components of our overall portfolios

MERITS OF ‘GREEN’ DEBT

Innovation will play an essential role in the climate evolution in company operations, but also likely in their financial approaches. A topic we are frequently asked about is the merits of bonds that are labeled as “green” or “ESG,” with provisions tied to achieving goals in climate and overall sustainability. In our view, such bonds can be beneficial to an issuer’s entire capital structure, helping to enhance transparency and clarify goals, practices and policies. As such, we encourage companies to incorporate those elements in their issuance. Characteristics we assess include the transparency around eligible projects and the use of issuance proceeds. We also look to ensure that the capital raise is additive to the company’s strategy, that there is accountability, and that key performance indicators can be measured and tracked over time. However, crucially, we conduct the same research on a green bond that we would on any other issuance. There are no special allowances for the category, which means that bonds we seek to invest in should not only be fundamentally sound, but should also meet stringent requirements for the potentially beneficial green labeling.

LOOKING AHEAD

As we look to the future, we expect continued momentum on ESG integration. Although in early stages, some clients, particularly in Europe, are looking to expand risk assessments beyond greenhouse gases to broader environmental impact, such as biodiversity. More concretely, the physical risk of climate change is becoming a key focus of analysis: the degree to which property, plant and equipment are being adapted to limit the impacts of extreme weather events. In the social realm, shareholders are increasingly looking for progress on equity, inclusion and diversity, while on governance, some regions are seeking to catch up on practices already adopted by more advanced peers globally.

Through initiatives such as our annual roundtable, we aim to assist the adoption of best practices and clarify what we are looking for from our investee companies while fulfilling our commitment to lead on ESG efforts.

| AS INVESTORS, WE RECOGNIZE THE IMPORTANT ROLE WE HOLD TO INFLUENCE AND SUPPORT POSITIVE CORPORATE DECISIONMAKING |

PRI Workshop – Credit Risks and Ratings Initiative: Focus on Chemical Sector

OVERVIEW

As part of the PRI’s ESG in credit risk and ratings initiative, the PRI hosted sector-focused workshops to facilitate discussion between credit analysts and borrowers. The workshops were attended by investors, rating agencies, and company representatives such as sustainability managers and investor relations managers. This PRI initiative is supported by 169 investors and 24 credit rating agencies.

ENGAGEMENT SCOPE AND PROGRESS

Members of our fixed income research team participated in multiple sector workshops hosted by the PRI. During the discussions, we shared our views on material ESG factors, disclosure best practices and explained how ESG factors are incorporated into our investment process. We emphasized the need for consistent comparable ESG reporting. We also discussed the importance of setting measurable targets, transparency and accountability around how targets are structured, including within executive compensation.

OUTLOOK AND OUTCOMES

The workshops enabled open discussion and knowledge sharing between various stakeholders, in addition to providing the opportunity to engage with multiple stakeholders at once. For example, during the discussions we were pleased to learn that two portfolio companies had recently introduced sustainability targets as additional parameters for their executive variable compensation. We incorporated the information gained into our one-on-one engagements with issuers to strengthen our engagement objectives and interactions with senior management. Our participation in this forum contributed to refining our engagement approach towards chemicals companies, which in turn enabled multiple successful engagements with issuers in the Chemicals sector.

| ISSUER PROGRESS

Following our participation in the PRI sector workshop we continued to engage with an issuer in the chemicals sector on carbon emissions reduction and linkage of compensation to ESG metrics. OVERVIEW The issuer is a German specialty chemicals company specializing in manufacturing specialty additives, which include coating, polyurethane and lubricants, nutrition and care products. ENGAGEMENT SCOPE AND PROCESS

OUTLOOK AND OUTCOMES

|

Spotlight on Climate Transition Efforts

Our Commitment to Net-Zero

In November 2021, Neuberger Berman became a signatory to the Net Zero Asset Managers Initiative, which has the goal of achieving net-zero emissions consistent with the Paris Agreement. We are committed to investing aligned with achieving net-zero emissions by 2050 or sooner. We believe that asset managers have a key role to play in mitigating climate change and the risks it presents to businesses and the global economy. Incorporating material climate factors into our investment process aligns with our long-term philosophy of seeking to maximize risk-adjusted returns for our clients.

CONTINUED INNOVATIONS TO SUPPORT THE CLIMATE TRANSITION: DEVELOPMENT OF A NET-ZERO ALIGNMENT INDICATOR

As net-zero commitments accelerate, we recognize it is difficult to compare two companies, even in the same sector. This has prompted us to design a proprietary Net-Zero Alignment indicator to help us assess net-zero transition plans for companies. The framework goes beyond assessing backward-looking company emissions data by seeking to capture real-time insights and incorporate expertise from our research analysts to generate a forward-looking view on each company’s alignment with net-zero.

To quantify the alignment status of a company, our starting point is the Institutional Investors Group on Climate Change (IIGCC) net-zero implementation framework. We use a variety of third-party data metrics to measure each of the hurdles the framework recommends such as: Transition Pathway Initiative (TPI), CDP (formerly Carbon Disclosure Project), Science Based Targets initiative (SBTi), and Climate Action 100+. These resources, combined with our analysts’ expertise, allow us to formalize our assessment of the company’s net-zero alignment.

NET-ZERO ALIGNMENT INDICATOR INFORMS ENGAGEMENT ACTION

Carbon-intensive energy companies face heightened threats from climate change, as the energy transition may result in stranded fixed assets and significant financial costs if not properly managed. As such, we regularly engage with companies to communicate our belief that it is critical for issuers to provide robust environmental disclosures and both short- and long-term emission reduction targets.

In our ongoing active engagement strategies, we encourage issuers to set specific, measurable ESG targets and to publicly report their progress within a specified time frame.

Furthermore, we have partnered with the following climate-focused initiatives and networks to support the global goal of net-zero emissions by 2050:

- Transition Pathway Initiative (“TPI”) – Research funding partner[4]

- Ceres – Member

- CDP (formerly “Carbon Disclosure Project”) – Investor Member and Signatory; Signatory to Science Based Targets Campaign

- Task Force on Climate-Related Financial Disclosures (“TCFD”) – Supporter

- Climate Action 100+ – Signatory and member

- Institutional Investors Group on Climate Change (“IIGCC”) – Member

- Net Zero Asset Managers Initiative – Signatory

| OUR NET-ZERO ALIGNMENT INDICATOR SUPPORTS OUR DIRECT ENGAGEMENT STRATEGY WITH COMPANIES TO SET GOALS FOR TRANSITIONING BUSINESS MODELS TO ACHIEVE NETZERO EMISSIONS. |

Net-Zero Engagement in Action

Net-Zero Engagement in Action Net-Zero Commitment Bolstered by Renewable Power Generation Targets

BACKGROUND

Neuberger Berman engaged with Algonquin Power & Utilities Corp., a diversified utility issuer that has a portfolio of renewable energy and sustainable infrastructure assets across North America. The company’s interests include renewable energy facilities, thermal energy facilities, and water distribution and wastewater facilities.

OBJECTIVE

We engaged with the issuer to implement more aggressive emissions reduction targets aligned with the SBTi.

ENGAGEMENT SCOPE AND PROCESS

The diligence process involved regular discussions with the issuer’s senior management including the CEO, CFO, and the investor relations team over multiple years. Given the company’s long-term renewables strategy and responsiveness to our engagement, we pushed them to expedite the retirement of coal-fired plants and transition recently acquired carbon-emitting assets.

OUTLOOK AND OUTCOMES

The company announced a net-zero emissions target by 2050. Additionally, the company set a public goal to achieve 75% renewable generation by 2023. In 2020, renewables accounted for approximately 50% of the company’s generation mix.

The issuer’s renewable generation goals position them well against the potential 80% clean energy generation by 2030 target being considered at the U.S. federal level. We view this as an example of a company successfully managing transition risk.

Beyond ESG Risks and Opportunities

Amplifying Corporate Contribution to the UN SDGs

The 17 Sustainable Development Goals (UN SDGs) created by the United Nations are a set of financial, economic and political changes that must be achieved to improve our environment and society. The United Nations estimates the required annual investment to achieve the UN SDGs in the developed and developing world is between $5 trillion and $7 trillion. Global bond markets have a significant role to play in funding the achievement of the UN SDGs.

As a result of our partnership with a client to develop an engagement-focused strategy to support progress toward the UN SDGs, we launched the Global High Yield SDG Engagement strategy in 2022. Within this strategy our research teams and ESG Investing team collaborate and establish engagement objectives aimed at amplifying each issuer’s contribution to the UN SDGs. In our goal-setting with issuers, we assign UN SDG-linked goals that fit with the issuer’s business model as we believe objectives aligned with a company’s operations will deliver the most impact. The goals we assign are ambitious and are intended to be challenging for each issuer to achieve. We also attach Key Performance Indicators (KPIs) to every engagement objective to measure company progress toward the goal.

Our research teams engage with portfolio issuers on these diversified set of UN SDGaligned objectives. Notably, our engagement efforts extend to both public and privately owned issuers, which we believe capture engagement opportunities not traditionally covered by market participants. We closely monitor our engagement activity for progress toward these objectives by assigning specific indicators that measure and track issuer responses.

| THE GLOBAL HIGH YIELD SDG ENGAGEMENT STRATEGY LEVERAGES AND EXPANDS THE ROBUST ENGAGEMENT PROCESS ESTABLISHED BY OUR FIXED INCOME TEAMS. |

BROAD RANGE OF ENGAGEMENTS: GLOBAL HIGH YIELD SDG ENGAGEMENT STRATEGY

We engage on a diversified set of objectives which aim to achieve incremental contributions to specific UN Sustainable Development Goals (UN SDGs).[5]

SDG-Aligned Engagement on Energy Efficiency Disclosure

BACKGROUND

Neuberger Berman engaged with Starwood Property Trust, a large commercial mortgage REIT and commercial mortgage special servicer.

OBJECTIVE

We utilized our long-term relationship with management to encourage the issuer to enhance its energy efficiency disclosure related to its real estate portfolio in-line with recommendations of SASB and TCFD and to set a public goal to increase the energy efficiency of its properties.

ENGAGEMENT SCOPE AND PROCESS

We believe environmental considerations are material to the overall credit profile of an issuer that owns, manages, and finances real estate property. We engaged with senior management, including the CEO, CFO, COO and Investor Relations team over a period of multiple years. The company was highly receptive and committed to improving their disclosures.

OUTLOOK AND OUTCOMES

Since our engagement efforts began, the issuer launched SASB and TCFD indices on their website, highlighting the company’s climate-related considerations and incorporation of ESG factors in asset management and credit analysis. Additionally, the company’s recent disclosures included the energy management metrics we requested in our engagements. We believe that the issuer will remain focused on the environmental footprint of its assets and will continue to integrate environmental considerations into its business practices. We continue to engage the issuer on tenant engagement efforts and enhancing the coverage and reporting of energy data tracked.

| Sustainable Development Goal 7:

Ensure access to affordable, reliable, sustainable and modern energy for all 7.3: By 2030, double the global rate of improvement in energy efficiency |

| Sustainable Development Goal 12:

Ensure sustainable consumption and production patterns 12.6: Encourage companies, especially large and transnational companies, to adopt sustainable practices and to integrate sustainability information into their reporting cycle |

“We are fortunate to have been able to engage with the Neuberger Berman team as we have developed Starwood Property Trust’s ESG program and have found our two-way dialogue to be extremely valuable. As we progress on our ESG journey we look forward to our continued partnership.”

– Zach Tanenbaum,

Managing Director,

Head of Investor Strategy & Co-Chair ESG Committee, Starwood Property Trust

SDG-Aligned Emerging Markets Engagement on Access to Finance

BACKGROUND

Shriram Transport is a non-bank financial institution focused on pre-owned commercial vehicle-backed loans in India. The issuer offers affordable financing solutions to micro, small and medium enterprises (MSME), in particular first-time vehicle buyers and small road transport operators. The financing provided by Shriram empowers many drivers to become truck owners typically within two to three years, supporting poverty alleviation in the rural regions of the country by creating steady income generating opportunities for drivers. The company’s business model and performance are supported by their social efforts to increase access to finance to the local population, so this is a material issue to the company.

OBJECTIVE

In our view, Shriram has demonstrated a strong and proven track record over decades in aligning with social causes and profitability through its ability to price loans and manage credit costs efficiently. Given the social impact the company has already demonstrated, we engaged with the company to broaden the application of its social finance framework. Additionally, we encouraged the company to enhance its current environmental disclosure and establish environmental goals.

ENGAGEMENT SCOPE AND PROCESS

We engaged with Shriram in relation to the company’s social finance framework, SDG aligned goals, general ESG strategy and governance topics. Our due diligence process consisted of eight conversations with senior management including the CEO, CFO, and corporate finance team.

OUTLOOK AND OUTCOMES

- Since we started following Shriram’s ESG developments in 2020, we believe the company has demonstrated a high level of consistency in supporting the financing needs of socially and economically underserved populations of society.

- In demonstration of ESG improvement at the company, MSCI upgraded Shriram’s ESG rating from BB in January 2020 to A in April 2022.

- We expect Shriram to gradually expand its social finance framework, which is likely to positively impact both social inclusion and funding costs.

- We look forward to increased disclosure on social and environmental topics at the firm level with more quantifiable indicators as the company continues to deepen its ESG commitments. We continue to engage with Shriram on its current environmental framework and future environmental goal development for the company and the sector.

| Sustainable Development Goal 8:

Promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all 8.3: Promote development-oriented policies that support productive activities, decent job creation, entrepreneurship, creativity and innovation, and encourage the formalization and growth of micro-, small- and medium-sized enterprises, including through access to financial services |

| Sustainable Development Goal 10:

Reduce inequality within and among countries 10.2: By 2030, empower and promote the social, economic and political inclusion of all, irrespective of age, sex, disability, race, ethnicity, origin, religion or economic or other status |

Reflections from a Fixed Income Perspective

THE ROLE OF FIXED INCOME INVESTORS

The engagement statistics we share in this report highlight that fixed income investors continue to play a pivotal role in influencing corporate decision-making related to ESG efforts. As part of our active engagement strategy, we encourage issuers to set specific, measurable ESG targets and to publicly report their progress within a specified timeframe to ensure accountability. Our engagement meetings provide opportunities to both educate issuers on best-in-class standards related to ESG performance, as well as share our views on the most material ESG factors affecting industries and issuers.

DIRECT ENGAGEMENT IS CRITICAL

We prioritize consistent engagement over time in a one-on-one setting as this develops our long-term trusted relationships with issuers. Specifically, access to senior management allows us to achieve the most meaningful impact from our engagement meetings.

TANGIBLE GOALS ENCOURAGED BY SPECIFIC KPIS

Clearly communicated ESG objectives related to an issuer’s business operations, along with associated key performance indicators allow us to track company progress toward intended outcomes. Our specific goals and progress tracking mechanisms are aimed to hold issuers accountable for their actions toward improved ESG performance.

| WE BELIEVE OUR RESEARCH-DRIVEN ENGAGEMENT STRATEGY COMBINED WITH THE DEPTH OF OUR LONGTERM MANAGEMENT TEAM RELATIONSHIPS POSITION US STRONGLY TO ADVISE ON CHANGES TO CORPORATE BEHAVIOR AND DRIVE REAL-WORLD IMPACT. |

Conclusion

The expertise of our research analysts and portfolio managers along with the scale and reach of our fixed income platform allows Neuberger Berman to be well positioned to actively engage with issuers, sponsors, and capital market participants on ESG topics. The environmental and social crises resulting from global events in 2022 along with evolving material risk factors underscore our view that ESG integration and active engagement are important drivers of identifying material credit risks, which can impact the cost of an issuer’s capital. Complemented by the rigor of our fundamental credit research, our established engagement framework and trusted relationships with management teams encourage meaningful ESG engagements with the issuers. Across emerging and developed markets, we continue to grow our ESG capabilities with an aim to enhance our analysis of material risk factors and anticipate key changes affecting industries. In the upcoming years, we look forward to expanding our engagement efforts to further enhance issuers’ credit profiles.

More generally, the physical risk of climate change is becoming a key focus of analysis. Although in early stages, there is growing interest to expand risk assessments beyond greenhouse gases to broader environmental impact, such as biodiversity. In the social realm, stakeholders are increasingly looking for progress on equity, inclusion and diversity while governance also remains a core focus. Many of Neuberger Berman’s fixed income stakeholders continue to value our engagement efforts as a tool to address risks and pursue opportunities related to ESG.

Endnotes

1Source: Neuberger Berman. Data as of July 1, 2021 – June 30, 2022.(go back)

2Proposed Rule: The Enhancement and Standardization of Climate-Related Disclosures for Investors, available at: Proposed rule: The Enhancement and Standardization of Climate-Related Disclosures for Investors (sec.gov)(go back)

3Source: European Commission. EU rules on non-financial reporting currently apply to large public-interest companies with more than 500 employees. This covers approximately 11,700 large companies and groups across the EU, including listed companies, banks, insurance companies and other companies designated by national authorities as public-interest entities.(go back)

4Research Funding Partners play an important role by enabling the research behind the TPI’s publications and their free availability. Further information can be found here: https://www.transitionpathwayinitiative.org/research-funding-partners(go back)

5Source: Neuberger Berman. We assign engagement objectives aligned with UN SDGs 1-15 to corporate issuers. UN SDG 16 is a focus point for portfolios that own sovereign debt. Neuberger Berman supports UN SDG 17 through its own field-building activities rather than engaging with issuers. Please note this strategy may only be offered for sale or sold in jurisdictions in which or to persons to which such an offer or sale is permitted. Please see the end of this material for the list of risk considerations.(go back)

Print

Print