Dorothy Flynn is President of Corporate Issuer Solutions and Chuck Callan is Senior Vice President of Regulatory Affairs at Broadridge Financial Solutions. This post is based on their NACD publication.

Choppy market valuations, more engaged shareholders, and new regulations will create new challenges for corporate governance in the upcoming proxy season. Companies and boards should anticipate pressure from stakeholders regarding director elections and say on pay, high numbers of shareholder proposals on environmental and social matters, and added disclosure in proxy statements.

Broadridge’s analysis shows that in 2022 the most directors over the past five years failed to attain majority support, there was a decline in shareholder support for say on pay, and there were more shareholder proposals than at any time over the preceding five years. Directors and management should expect the following factors to weigh on the upcoming 2023 proxy season:

1. Investment Democratization: An influx of new investors is expanding the shareholder base, and they are communicating among themselves. Many of them will be engaged on proxy matters. Others will come off the sidelines because new technologies are making it easier for their voices to be heard.

2. Advancing Environmental, Social, and Governance (ESG) Issues: Investors are demanding more information and action, and many companies are proactively providing it, not just in proxy statements but throughout the year.

3. Changes in Say on Pay and Clawbacks: “Pay vs. Performance” rules as well as pending stock exchange rules on clawbacks are adding to the disclosures that companies and boards need to make on executive compensation. These rules provide another opportunity to demonstrate alignment between management and shareholders.

4. Uncertainty about Board Leadership: Market downturns can presage a decline in shareholder support, and new US Securities and Exchange (SEC) rules for universal proxy make it easier for some activists to add their nominees to company ballots.

5. Pass-Through Voting: Some of the largest fund companies are passing votes to their underlying investors while others are taking retail shareholder “sentiment” into account in voting decisions. Nevertheless, guidelines from proxy advisers will continue to sway large numbers of votes.

INVESTMENT DEMOCRATIZATION

Broadridge’s analysis shows that, as a group, retail shareholders owned 31 percent of the “streetname” shares of the “average” company in 2022, up from 30 percent in 2021. And in some cases, they are joining forces in chat rooms to act on proxy matters. Some companies and boards are going to where their investors are to provide information and monitor sentiment. Such information can include business strategies, product innovations, and efforts to improve diversity or reduce the company’s carbon footprint. Retail investors differ from institutional investors in important ways—traditionally, they have been more supportive of director recommendations; when not supportive, many vote with their feet, unlike passive institutional investors who must own shares in an index.

From 2016 through 2020, approximately 70 percent of retail shares each year were not voted. [1] Some companies, governance experts, dissidents, and others are of the mind that engaging retail owners to vote ensures that all voices are heard on important proxy matters. By reaching out to their retail shareholders, issuers can communicate more about themselves and learn more about their shareowners.

Companies and boards have a range of tools and strategies to engage with all shareholders, not just the largest institutional investors and proxy advisers. They can leverage digital platforms to communicate, for example, with investors who own more than a certain number of shares. These platforms include “investor mailboxes” that are integrated into brokerage firms’ client-facing websites. Some companies are also providing investors with executive summaries of proxy statements to facilitate voting interest and participation.

Many companies will see greater importance in engaging with the growing ranks of retail shareholders due to new rules and the ease of using new technologies. SEC rules for universal proxy ballots require companies to put dissident nominees on their ballots when opposition solicitors meet requirements for notification and solicitation, and pass-through voting technologies will begin to factor retail sentiment into the votes of fund managers.

ADVANCING ESG

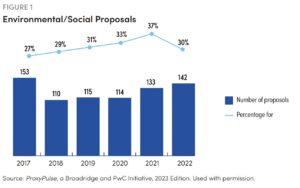

Our analysis shows that the number of ESG-related shareholder proposals in 2022 increased by 25 percent over 2021, driven by record numbers of environmental and social proposals. While governance proposals (such as voting rights issues) represent a plurality of all ESG proposals, the number of environmental and social proposals increased to 142 in 2022 from 133 in 2021 and comprised over half of all ESG proposals.

As the number of environmental and social proposals grew in 2022, there was a marked decline in shareholder support for some of these measures. Overall, average support for environmental and social proposals decreased to 30 percent on average this proxy season from 37 percent the prior season.

Some observers have suggested that the expanding reach of these proposals might have cooled support among proxy advisors and large institutions, leading to a year-over-year decline in support.[2]

Companies and boards should expect shareholders and regulators to make new demands in the future. Stepped up climate reporting disclosures are on the docket for future rulemaking at the SEC. Some companies are proactively providing their shareholders and the investing public with additional decision-useful information on ESG. While many large companies are now releasing annual sustainability reports, going forward, the trend will be toward greater disclosure on targets and metrics.

CHANGES IN SAY ON PAY AND CLAWBACKS

Support levels for say-on-pay votes fell to 86 percent on average in 2022—the lowest in five years. Looking ahead, new disclosure requirements on executive compensation will add a new variable to corporate say-on-pay votes in 2023.

In August 2022, the SEC adopted new “Pay Versus Performance” rules requiring companies to disclose the relationship between executive compensation and financial performance on proxies and in information statements. These rules are in effect for the 2023 proxy season. They require companies to provide new details on the compensation paid to the CEO and other named executive officers, to expand upon information about the performance measures used to determine executive compensation, and to provide greater explanation of the relationship between financial performance and executive compensation.

It’s unclear how these changes will impact shareholder support for say-on-pay proposals. Many companies have begun to gather the required five years of historical data on pay versus performance, including detailed breakdowns of awarded compensation in terms of cash, benefits, stock, and deferred compensation. Some companies and boards are preparing to respond to shareholder questions by readying simple and compelling explanations of their compensation strategies, structures, and payouts.

UNCERTAINTY ABOUT BOARD LEADERSHIP

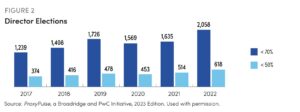

There has generally been a direct correlation between declining market valuations and declining levels of support for directors and say-on-pay proposals. Broadridge’s analysis shows that in the 2022 proxy season, a record number of directors (618) failed to attain majority support, an increase of 104 from the prior year when market valuations were higher. Our analysis also shows that large numbers of directors failed to surpass the 70 percent support threshold that is closely watched by proxy advisers and some governance advocates. That could trigger recommendations to vote against these directors, as well as chairs of the nominating or compensation committees in some cases, this coming season.

In 2023, companies must comply with the SEC’s universal proxy rules for contested solicitations by putting dissident director nominees on company ballots when those dissidents solicit at least twothirds of the votable shares. The rules, which went into effect in August 2022, make it easier for proxy voters to pick and choose directors from an expanded slate.

The rules may also cause some companies and boards to engage earlier and more often with their shareholders—institutional and retail alike—to make sure they have the information they need on how the company is handling challenging economic conditions, human capital management, climate disclosures, and the like. In many cases, that will also mean shoring up descriptions of board nominees and explanations of why they are nominated.

PASS-THROUGH VOTING

Some of the largest fund companies are looking to pass votes to their underlying investors; others are taking retail sentiment into account in voting decisions. Legislators are also getting involved. In May 2022, several US senators introduced the INvestor Democracy is EXpected Act, or the INDEX Act, which would require certain fund companies to vote proxies in accordance with the wishes and instructions of their underlying fund investors.

New technologies are making it easier for asset managers to implement pass-through voting without the need for new regulations. In 2022, BlackRock began providing their investor accounts with voting choice options. Schwab announced in October that it will use a new proxy polling solution to gather additional input on their investors’ voting preferences on key proxy issues.

These changes could ultimately amplify the voices of retail investors and get more of them engaged in corporate governance.

BOARD OVERSIGHT QUESTIONS |

| The 2023 proxy season has the potential to raise the stakes on corporate governance due to economic pressure on company share prices, new rules governing the proxy process, and technology innovations that are expanding participation in corporate governance. To ensure their companies are prepared, boards and directors should be asking the following questions:

1. Are we prepared for the new rules and disclosures on pay versus performance and (in 2023) clawbacks? 2. How will we respond if investors use the universal proxy rules to put director candidates on the slate? 3. What additional information and metrics are our shareholders asking for regarding ESG reporting? 4. Are we prepared to effectively educate our newer retail shareholders as well as our base of long-term retail shareholders? 5. Are we effectively monitoring and using social media for investor relations’ purposes (beyond marketing and customer service)? |

Endnotes

1NACD, 2021 Governance Outlook: Projections on Emerging Board Matters (Arlington, VA: NACD, 2020), p. 17.(go back)

2Sustainable Governance Partners, “The 2022 Proxy Season: Forces Collide,” posted on sgpgovernance.com on July 28, 2022(go back)

Print

Print