Merel Spierings is a Researcher for the ESG Center at The Conference Board. This post is based on her Conference Board memorandum, in partnership with ESG analytics firm ESGAUGE and in collaboration with Russell Reynolds Associates and Rutgers Center for Corporate Law and Governance.

Introduction

Something rather unexpected happened in the 2022 proxy season. Amid a growing focus on environmental, social & governance (ESG) issues, [1] and following a 2021 proxy season with record support for shareholder proposals on environmental and social (E&S) topics,[2] average support for E&S shareholder proposals declined compared with 2021. At the same time, opposition to directors and negative votes on say-on-pay proposals increased.

This signals a trend that is expected to continue into 2023: more friction between companies and investors in traditional areas of corporate governance and executive compensation than in E&S areas. Investors will continue to use their votes on director elections and say-on-pay to express their concerns about governance and problematic pay packages, but will likely seek common ground on many E&S issues.

Although this dynamic provides an opportunity for companies, as investors are truly open to hearing companies’ side of the story on E&S issues, companies are not off the hook. In fact, the 2023 proxy season promises to be, yet again, more challenging than previous years, with even more shareholder proposals, lower support for directors and say-on-pay proposals, and increased Big “A” activism, which aims to change corporate strategy.

Insights for What’s Ahead

- The 2023 proxy season is bound to be even more challenging than previous years for the following reasons:

- The overall volume of shareholder proposals will likely continue to rise as a result of 1) the SEC having narrowed grounds for excluding proposals from the company’s proxy statement; 2) new proponents who—drawn by the success of shareholder proposals in previous years—are submitting more proposals and new variations of proposals; and 3) proponents continuing to pursue a variety of agendas in submitting shareholder proposals, including getting press attention and making an ideological point, as opposed to seeking change at a company.

- There will be an increase in “anti-ESG” proposals, which are often more complicated to deal with as the proponents may offer resolutions that are similar to “pro-ESG” proposals but involve different rationales, motivations, and consequences if they are approved.

- Asset managers have adopted policies that will lead to more votes against directors on, among other things, governance practices and problematic compensation packages.

- Investors’ diminishing tolerance for adjustments, discretion, and special grants in executive compensation is expected to result in lower levels of support for company say-on-pay proposals.

- Big “A” shareholder activism is likely to rise, due in part to the current economic environment and the implementation of the universal proxy.

- Climate-related proposals are likely to continue to be a dominant theme in 2023, but we expect a growing number of proposals on certain other environmental and social topics. Look for growing levels of shareholder proposals on issues such as biodiversity, plastic pollution, and deforestation. On social topics, expect to see shareholder proposals focusing on corporate political spending through third-party groups[3] and on workers’ rights (particularly at companies where there is a perceived disconnect between the company’s commitments and actions on freedom of association).

- Declining average support for shareholder proposals on E&S topics is not a sign of ESG backlash but does reflect factors that could well continue into 2023, including 1) the nature of the proposals, especially those that are of lower quality, less relevant to the company’s business, or reflect overreach by the proponent; 2) the rationale offered by the proponent, including those that are notably “anti-ESG” even if the resolution language mirrors pro-ESG proposals; 3) the nature of the recipient, such as companies that already have strong ESG records; and 4) investors seeking common ground with companies on E&S issues, as they are trying to separate the wheat from the chaff in a growing number of shareholder proposals and steer a steady course amid growing scrutiny and multiple conflicting pressures. [4]

- Companies should consider including more practical details in opposition to shareholder proposals in their proxy statements. Major institutional investors recognize that the growing number of shareholder proposals includes an increase in those where the costs and risks of implementation (including unintended consequences) outweigh the benefits. Companies should not be shy about explaining, in clear, specific, and concrete terms, why implementation is not feasible or is inadvisable (e.g., it would result in the release of sensitive information or significant expense). Investors also welcome companies mentioning the proponent’s name in the proxy and describing what the negotiation process looked like.

- Having recent and relevant industry experience on the board may be a company’s best defense in contested director elections. While some activist campaigns feature dissident candidates with strong ESG credentials, the vast majority of actual or threatened proxy fights will feature opposing candidates with strong industry experience. In explaining why they have the right board composition, companies will want to focus not just on filling in a skills matrix, but on explaining how directors add value, including through their experience in the company’s industry or in adjacent industries.

- While the SEC’s recently adopted pay versus performance disclosure rule might get more attention from investors than the CEO pay-ratio rule, complying with the rule (rather than going above and beyond in disclosures) will likely suffice this year. Major institutional investors already have established their own methods for evaluating companies’ compensation plans, so the new SEC rule is unlikely to add much to their analysis. Accordingly, unless there are any particular points that companies feel truly compelled to address (such as anomalies in pay vs. performance charts), companies can remain in compliance mode.

- The increase in client-directed voting may shift more influence back to proxy advisors. Institutional investors that are expanding the opportunity for certain clients to participate in voting decisions will likely have the unintended consequence of amplifying proxy advisors’ voices, as clients are typically presented with proxy advisors’ voting policies.

- Companies should be prepared to deal with ESG backlash during this proxy season. While not altering their policies, companies are now considering making fewer public pronouncements on social issues, focusing more on actions and internal communications, and tying their stands on social issues more closely to business strategy.[5] Shareholder proposals, however, may force companies to take a public stand that can serve as fodder for anti-ESG activists. By clearly focusing on why the company’s position on an ESG issue is “good for business”—and by sticking to that theme—companies may avoid being pulled into unnecessarily distracting debates.

All of the data presented in this report, unless otherwise noted, are for the full Russell 3000.

Expectations for the 2023 Proxy Season

Management Proposals

Director elections

What the data say:

- Average support for directors in the Russell 3000 continued to decline, from 95 percent in 2021 to 94 percent in 2022. And as in prior years, directors at the smallest companies received the lowest average levels of support (90 percent versus 95 percent for directors at the largest companies). In fact, almost half of the directors who failed to receive majority support were serving on the board of smaller companies, with revenues under $1 billion.

What the experts say:

- Support for director elections will continue to decline in 2023 as investors are no longer relying on shareholder proposals to address core governance issues. Indeed, companies whose governance practices are out of alignment with investor expectations (e.g., those with classified boards and dual class shares, with insufficient director independence, with ineffective board and board committee-level oversight of ESG, without board diversity, or with overboarded directors) should be prepared to see a decline in support for incumbent directors. These negative votes will likely be concentrated on members of committees that are (or should be) responsible for the subject matter.

- Companies should expect increasing opposition to directors based on executive compensation. For some investors, dissatisfaction with a company’s pay plan was one of the main reasons to vote against boards last year. Investors are also scrutinizing companies’ lack of responsiveness to a previous low say-on-pay vote, which will have a direct impact on director elections as well.

Say-on-pay

What the data say:

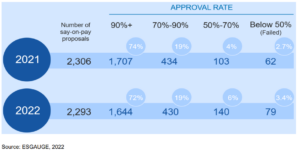

- Average support for company say-on-pay proposals in the Russell 3000 declined further in 2022, dipping below the 90 percent threshold to 89 percent. Last year, fewer companies (both in absolute and relative terms) received at least 90 percent support. A rising number of companies received under 70 percent for votes (the threshold below which proxy advisors and investors alike begin to scrutinize companies’ responsiveness to shareholder concerns). And more companies failed to receive majority support altogether.

What the experts say:

- The number of companies receiving a negative say-on-pay vote will likely further increase, especially at companies that are not providing sufficient context and detail on executive compensation decisions. Moreover, investors’ tolerance for adjustments to programs (e.g., because of the impact of the strong dollar and inflation) is diminishing—making them more likely to vote against say-on-pay proposals.

- A major theme for some investors is the “resilience” of executive compensation programs. Making compensation resilient to exogenous conditions and unexpected market outcomes helps to avoid the need for adjustments, the exercise of discretion, and special grants. Keeping compensation performance based while still providing a reasonable payout in this volatile economic environment is a central challenge to which there is no easy answer. Theoretically, a compensation committee could structure annual bonus and long-term incentive plans that have goals that vary depending on different underlying economic scenarios, but this could be quite complex to structure and explain.

Shareholder Proposals

What the data say:

Overall

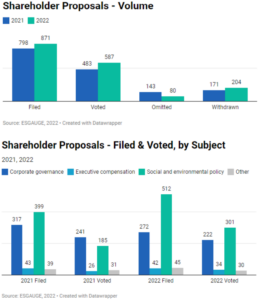

- Driven by a sharp rise in E&S proposals, the volume of shareholder proposals increased significantly in 2022. Governance proposals were, yet again, most likely to come to a vote, with 82 percent of such proposals being voted on. E&S proposals saw high withdrawal levels, with 34 percent of such proposals being withdrawn. At the same time, compared with 2021, E&S proposals were less likely to be omitted— a result of the SEC’s November 2021 Staff Legal Bulletin.

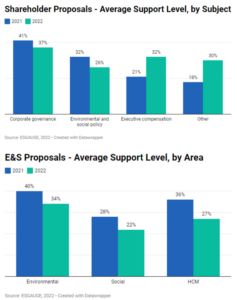

- Average support for shareholder proposals dropped to 31 percent in 2022 from 35 percent in 2021—a direct result of a decline in support for both governance and E&S proposals. In fact, average support in all E&S areas (environmental, social, and human capital management) declined compared with 2021.

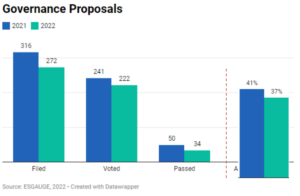

Governance proposals

- The total number of filed and voted governance proposals declined in 2022, but while average support for these proposals decreased as well, it was still higher than the average support for E&S proposals. While fewer governance proposals received majority support compared with 2021, more of such proposals passed compared with E&S proposals (15 percent versus 11 percent).

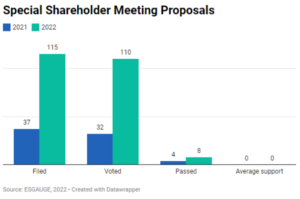

- The number of proposals on special shareholder meetings increased dramatically in 2022, from 37 such proposals filed in 2021 to 115 proposals in 2022, and with almost all proposals (96 percent) coming to a vote. Moreover, average support grew from 34 percent to 37 percent, and eight proposals passed in 2022 compared with four in 2021.

Corporate Governance Proposals 2022

Environmental proposals

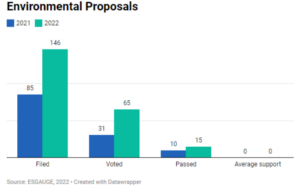

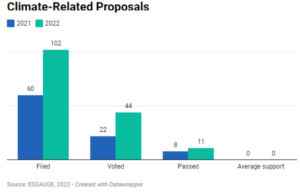

- The number of environmental proposals filed and voted on increased sharply in 2022. However, while more proposals passed compared with 2021 as a result of more proposals coming to a vote, average support for environmental proposals declined. The increase in environmental proposals was driven by climate-related proposals, which dominated the 2022 proxy season in terms of volume. Yet, average support for climate-related proposals declined.

Environmental & Social Proposals 2022

- The most successful environmental topic in terms of average support last year was plastic pollution (52 percent). And although average support went down slightly compared with 2021, when it received 53 percent, it was the only E&S topic receiving average majority support in 2022, compared with five topics in 2021 (plastic pollution, environmental reporting, climate-related lobbying, EEO-1 data disclosure, and employee arbitrage).

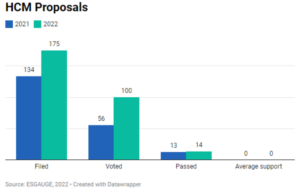

Human capital management (HCM) proposals

- The number of HCM proposals grew substantially in 2022, and more of such proposals came to a vote, both in absolute and relative terms. But relatively fewer HCM proposals passed (14 percent versus 23 percent in 2021)—and average support declined

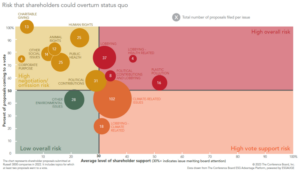

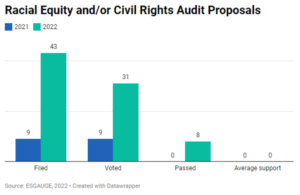

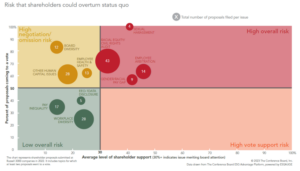

- Proposals on racial equity and civil rights audits gained traction in 2022. The number of such proposals filed and voted increased significantly compared with 2021—when the proposal was first introduced—with eight proposals receiving majority support. These proposals now appear in the “red zone” of the heat map, indicating that they were both likely to go to a vote (72 percent) and received significant shareholder support (33 percent).

Human Capital Management Proposals 2022

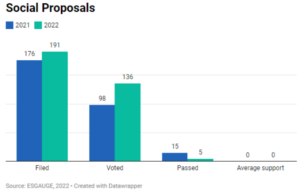

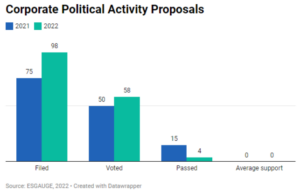

Social proposals

- The number of social proposals grew in 2022 and compared with the other E&S areas (environmental and HCM), these proposals came to a vote most frequently, both in absolute and relative terms. Yet, both the number of proposals that passed as well as average support declined.

- Shareholders’ focus on corporate political activity continued, with an increase in volume of such proposals in 2022—but like other E&S shareholder proposals, support for such proposals declined compared with 2021. As was the case in 2021, proposals on traditional lobbying were most likely to come to a vote (76 percent). New in 2022 was the proposal on health-related lobbying; the three proposals that went to a vote reached an average support of 42 percent, the third-highest level of average support for any E&S proposal—only behind plastic pollution and employee arbitration policy proposals.

What the experts say:

- The volume of shareholder proposals is not abating, and may, yet again, rise in 2023 for several reasons:

- The SEC is no longer playing much of a gatekeeping role. The November 2021 Staff Legal Bulletin has made it harder for companies to exclude proposals from the company’s proxy statement on the grounds of ordinary business, and the proposed amendments to Rule 14a-8 with respect to substantial implementation, duplication, and resubmission (expected to be finalized in October) will continue to narrow the grounds for exclusion.

- The success of shareholder proposals in recent years has drawn new proponents who are not only submitting more proposals but also new variations of proposals.

- Proponents are not only targeting large companies, but increasingly focusing on (the much larger pool of) mid-size and smaller companies as well.

- Proponents will continue to submit proposals, not for effectuating change at the company related to the proposal, but for other reasons—including gaining public attention (and related fundraising) for themselves or for a cause, or initiating a conversation with the company that has little if anything to do with the proposal.

- Support level for E&S shareholder proposals may remain below 2021 levels. After supporting a record number of shareholder proposals in 2021 (especially on E&S topics), institutional investors tapped the brakes last year, resulting in a decline in average support for shareholder proposals in 2022. They were particularly reluctant to support proposals that were of lower quality, less or not relevant to the company’s business, and those that reflected over-reach by the proponent. They also considered the rationale for the proposal, including those that were notably antiESG, even if the resolved language mirrored pro-ESG proposals. This fundamental dynamic is likely to continue in 2023, even as some proponents learned lessons in 2022 and are submitting better-phrased proposals for 2023.

- Companies should not be shy about discussing problems with proposals in the proxy statement. Investors are willing to vote against shareholder proposals if the company can argue why implementation is not feasible (e.g., because of a cost/benefit mismatch, unintended consequences, or release of sensitive information). Investors prefer companies to be assertive and disclose this information in the proxy statement rather than wait for engagement. To accommodate this, executives will want to (i) engage internal subject matter experts early on to get a full picture of the administrative burden of compliance with the proposal; (ii) accelerate the process of collecting this information so it can be included in the proxy; and (iii) explain the company’s opposition to the shareholder proposal in “real-world terms” rather than a ramped-up version of the no-action letter. Companies should also not hesitate to mention the proponent’s name in the proxy statement (which is something that investors are still sensitive to) and describe what the negotiation process looked like (e.g., were they willing to speak with you?).

- As noted earlier, companies should brace for an increase in shareholder proposals from anti-ESG groups, which are getting more complicated to deal with for several reasons: these proponents are increasingly using new tactics— mirroring those from mainstream proponents—making it harder for investors to spot such proposals and identify their true intent. Anti-ESG groups may also look for multiple opportunities during the submission, negotiation, and voting process to make headlines, without any real expectation of the company changing its practices.

- Although companies may choose to implement shareholder proposals that receive majority support, they will still want to keep a cost-benefit analysis in mind when doing so. For example, companies have invested substantial resources in producing reports on racial equity audits, only to find that the resulting report received little if any reaction, including from the proponent and major investors who supported a shareholder proposal on the topic.

Other Topics and Trends

As companies prepare for the 2023 proxy season, they should be mindful of various additional topics and trends, including:

Big “A” shareholder activism and the impact of the universal proxy

- 2023 will be a big year for shareholder activism despite (or perhaps due to) the economic environment. Indeed, low stock prices are creating a target-rich environment and activists, who are looking for short-term gains, are focusing on (i) speeding up strategic and capital allocation changes; (ii) more urgency in executing business plans; and (iii) changing out boards and management that are underperforming. In 2021, it was difficult to predict activists’ tactics because so many were new to the game and they did not have established playbooks. Now, it is even harder to predict tactics as they are borrowing playbooks from each other.[6]

- In explaining why they have the right board composition, companies should focus on how individuals and the board as a whole add value, including experience in the company’s industry or in adjacent industries. The universal proxy will likely result in more contested director elections in 2023. (In fact, the first contest that went to a vote using a universal proxy since the SEC’s new rule went into effect last fall resulted in a board seat for the activist investor.) And while some activist campaigns may focus on ESG issues and feature dissident candidates with strong environmental credentials, the vast majority of actual or threatened proxy fights will feature opposing candidates with strong industry experience, making it pivotal for companies to explain to investors why they have the right board that consists of directors with recent and relevant industry experience.[7]

- The universal proxy makes it more important for companies to get their directors in front of investors—especially those who are new and relatively unknown. While many incumbent directors are former C-suite executives, newer— more diverse and/or junior—directors are increasingly tapped from a level below the C-suite. As such, investors may not know them nor understand what value they can bring. Since this information is hard to convey through the skills matrix in the proxy statement, companies will want to give their new directors direct exposure through other avenues, such as shareholder engagement.

- Companies that are updating their bylaws in light of the universal proxy should expect scrutiny. A wave of companies recently amended (or are considering amending) their bylaws in light of the universal proxy rule, requiring shareholders that want to nominate directors to the board to make additional disclosures that some investors deem too difficult and costly (e.g., disclosures about nominees as well as shareholder proponents and persons with whom the proponent is collaborating or from whom the proponent is receiving funding). However, companies should tread carefully as proxy advisors, investors, and others are still formulating their positions regarding such amendments. Moreover, bylaw amendments (such as those recently adopted by Masimo Corporation in light of a potential proxy fight with activist fund Politan Capital Management) may give rise to litigation risk as well as reputational harm.

ESG backlash

- Despite being subjected to ESG backlash and increased regulatory scrutiny, institutional investors are not backing away from ESG. They are, however, devoting resources to scrutinizing environmental and social shareholder proposals.

- Companies need to ensure they have a consistent way to respond to ESG skepticism and backlash should it occur. According to a recent Conference Board survey of CEOs and C-suite executives around the globe, neither an economic slowdown, nor an ESG backlash, will impact ESG spending at most US firms this year.[8] But companies will want to have a playbook in place for addressing ESG backlash, just as they should in deciding whether and how to respond to social issues.[9]

- Companies can manage backlash through their public profile. While not altering their policies, companies can consider making fewer public pronouncements, focusing more on actions and internal communications, and tying their efforts more closely to business strategy.[10]

By taking these actions, companies can not only prepare themselves for the upcoming proxy season, but also better position themselves to navigate the ever-challenging ESG landscape.

About This Report

In December 2022, The Conference Board ESG Center held invitation-only focus group sessions with executives from the investor community representing over 20 trillion dollars in assets under management (December 2) and in-house governance professionals (December 13) to review shareholder voting trends from the 2022 proxy season and discuss what they portend for 2023.

This report provides prospects for the 2023 proxy season, based on a review of management and shareholder proposals at Russell 3000 companies for (full years) 2021 and 2022, as well as insights and perspectives from corporate governance thought leaders on what they think is likely to happen in 2023.[11] It complements a series of comprehensive retrospective reports on the 2022 proxy season that The Conference Board published last year.

Endnotes

1Paul Washington, ESG Essentials: Who’s Driving the Focus on ESG?, The Conference Board, July 2022.(go back)

2Merel Spierings and Paul Washington, 2022 Proxy Season Preview and Shareholder Voting Trends, The Conference Board, February 2022.(go back)

3The Center for Political Accountability’s new proposal (the “Model Code Resolution”) calls on companies to “adopt a policy requiring that any trade association, social welfare organization, or organization organized and operated primarily to engage in political activities that seeks financial support from the company agree to report to the company, at least annually, the organization’s expenditures for political activities, including the amount spent and the recipient, and that each such report be posted on company’s website.”(go back)

4ESG Funds: Is Green the Color of Money?, CEO Perspectives podcast, The Conference Board, August 2022.(go back)

5Chuck Mitchell et al., C-Suite Outlook 2023: On the Edge: Driving Growth and Mitigating Risk Amid Extreme Volatility, The Conference Board, January 2023.(go back)

6Shareholder Activism, Governance Watch Webcast, The Conference Board, September 2022.(go back)

7Merel Spierings and Paul Washington, The Roles of the Board in the Era of ESG and Stakeholder Capitalism (Overview and Key Insights), The Conference Board, February 2023.(go back)

8C-Suite Outlook 2023: On the Edge.(go back)

9Merel Spierings and Paul Washington, Choosing Wisely: How Companies Can Make Decisions and a Difference on Social Issues, The Conference Board, June 2021.(go back)

10C-Suite Outlook 2023: On the Edge.(go back)

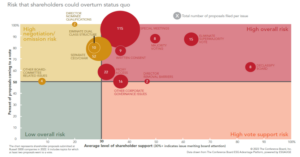

11Our insights on the proxy season are accompanied by graphics that map the ESG-related shareholder proposals from 2022 against these three dimensions: number of proposals filed per issue; percent of proposals coming to a vote; and average level of shareholder support. These “heat maps” illustrate which topics have caused most tension between companies and investors last year.(go back)

Print

Print