Ryan Colucci is a Principal at Compensation Advisory Partners. This post is based on his CAP memorandum. Related research from the Program on Corporate Governance includes The Growth of Executive Pay by Lucian Bebchuk, and Yaniv Grinstein; Paying for Long-Term Performance (discussed on the Forum here) by Lucian Bebchuk, and Jesse Fried; The CEO Pay Slice (discussed on the Forum here) by Lucian Bebchuk, Martijn Cremers, and Urs Peyer; and Golden Parachutes and the Wealth of Shareholders (discussed on the Forum here) by Lucian Bebchuk, Alma Cohen, and Charles C.Y. Wang.

This post investigates compensation actions for CEOs and CFOs at S&P 1500

companies that have fiscal year ends between 9/30 and 11/30. The sample consists of

fifty cross-industry companies with median revenue of $4.6 billion and median market

capitalization of $7.0 billion.

Highlights

Base Salary: Approximately 80% of CEOs and CFOs received salary increases

- Of those who received an increase, the median increase was 4.4% and 5.5% for CEOs and CFOs, respectively

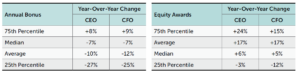

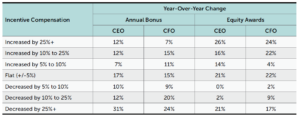

Annual Bonus: Bonuses declined compared to the prior year for just over half of CEOs and CFOs

- Bonuses decreased by 10%, on average, for CEOs while CFOs had an average decrease of 12%

Equity Awards: Grant date fair value of equity awards increased by 17%, on average, for both CEOs and CFOs

- 56% of CEOs and 50% of CFOs received increased equity awards and approximately 20% of both CEOs and CFOs received similar (+/-5%) award amounts compared to the prior year

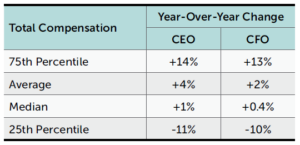

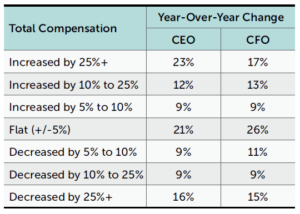

Total Compensation: Total compensation increased modestly, on average, for both CEOs (+4%) and CFOs (+2%)

- Significant year-over-year changes (+/-25% or more) in total compensation were seen for approximately 40% of CEOs and 33% of CFOs

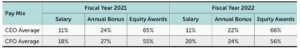

Pay Mix: On average, equity awards comprised two-thirds of CEOs total compensation and 56% of total compensation for CFOs

- Pay mix was generally consistent with the prior year although lower bonus payouts shifted the percentage of variable pay (i.e., incentive compensation) slightly lower for CFOs

Detailed Results

Salary

While the majority of CEOs and CFOs received salary increases, salary increases for CFOs were generally larger. The typical range of salary increases for CEOs was 3.4% to 7.4% whereas their CFO counterparts ranged from 3.6% to 9.1%.

Incentive Compensation

Annual bonuses generally decreased while equity awards saw double digit increases, on average, compared to the prior year. The average decrease in bonus payout for CEOs was 10% while the average size increase in equity grants was +17%. CFOs had the same increase of 17% on equity grants and bonus payouts were down slightly more than CEOs at -12%, on average.

CEOs generally saw more dramatic swings in incentive compensation when compared to CFOs with a higher percentage of CEOs experiencing increases or decreases of 25% or more. Approximately one-fifth of companies kept their equity awards for CEOs and CFOs consistent with the prior years’ grants.

Total Compensation

While total compensation increased moderately, on average, for both CEOs (+4%) and CFOs (+2%) there were many significant fluctuations for individuals. 40% of CEOs experienced a change in total compensation that was greater than 25% of their prior year total pay and this was also the case for one-third of CFOs. Total compensation remained substantially similar (+/-5%) compared to the prior year for only 21% of CEOs and 26% of CFOs.

Pay Mix

Pay mix was generally consistent with the prior year as equity awards continue to make up the majority of total compensation for both CEOs and CFOs. Incentive compensation, which is variable in nature, makes up a larger percentage of total compensation for CEOs when compared to CFOs.

Looking Ahead

As calendar year end companies file their proxy statements for fiscal year 2022, we can expect to see many of the same trends that are gleaned from this early batch of filings though there will certainly be variation by industry and/or company size. Higher salary increases, relative to historic norms, and lower bonus payouts, compared to the prior year, will both very likely be consistent themes.

Print

Print