Lindsey Stewart is Director of Investment Stewardship Research at Morningstar, Inc. This post is based on his Morningstar memorandum. Related research from the Program on Corporate Governance includes Corporate Political Speech: Who Decides? (discussed on the Forum here) by Lucian Bebchuk and Robert J. Jackson Jr.; The Untenable Case for Keeping Investors in the Dark (discussed on the Forum here) by Lucian Bebchuk, Robert J. Jackson Jr., James David Nelson, and Roberto Tallarita; The Politics of CEOs (discussed on the Forum here) by Alma Cohen, Moshe Hazan, Roberto Tallarita, and David Weiss.

Executive Summary

Sustainable investing has become an increasingly political matter in the United States. In light of this, there is a much greater need for asset managers to scrutinize corporate lobbying practices and political spending as part of their role as stewards of investors’ capital.

There is broad recognition of this need with regard to climate change and companies’ net-zero strategy. As a recent study by the London School of Economics highlights: “There is growing scrutiny of the alignment of corporate lobbying practices with the statements companies make on how they will act on climate change.” But there is a need for greater transparency on corporate political activity across a range of environmental and social issues, so that investors can make informed decisions on how to allocate their capital. This places a responsibility on asset managers to ensure that companies’ lobbying practices align with their statements on sustainability.

A steady stream of shareholder resolutions at U.S. companies requesting greater transparency on lobbying and political activity over recent years illustrates the level of interest in this topic. In this paper, we take a closer look at all U.S. shareholder resolutions on lobbying and political activity over the last three proxy years, assessing how the top 10 U.S. asset managers are voting on this topic generally and with respect to climate matters.

Investors’ Increasing Focus on Lobbying Alignment

Sustainable investing has become an increasingly political matter in the United States. In light of this, there is a much greater need for asset managers to scrutinize corporate lobbying practices and political spending as part of their role as stewards of investors’ capital.

This is especially true regarding climate action, which remains high on the list of priorities for both governments and the finance sector, following the United Nations COP27 conference in November last year. As countries worldwide reaffirmed their commitment to limiting global temperature rise to 1.5 degrees Celsius above preindustrial levels, attention is increasing on how companies are ensuring their lobbying and political activity is well-aligned with their net-zero goals.

This was highlighted in a report by the U.N. High-Level Expert Group on net zero, Integrity Matters, published just before COP27. In a section specifically focusing on Aligning Lobbying and Advocacy, it encouraged “non-state actors” (that is, businesses and local governments) to “align their external policy and engagement efforts, including membership in trade associations, to the goal of reducing global emissions,” emphasizing that “this means lobbying for positive climate action and not lobbying against it.”

A recent analysis by the London School of Economics’ Grantham Research Institute on Climate Change and the Environment highlights growing investor interest in this topic. It states:

“There is growing scrutiny of the alignment of corporate lobbying practices with the statements companies make on how they will act on climate change. Many large investors are increasingly concerned about the potential financial impacts on their investments of policy that fails to ensure a sufficiently rapid reduction in greenhouse gas emissions, and that exposes their investment portfolios to significant physical climate-related work.”

Looking at shareholder resolutions in the United States over the last three proxy years [1], it is clear that lobbying and political activity, both generally and with respect to climate, have featured as a prominent recurring theme. Our recent research paper on key shareholder resolutions [2] in the U.S. indicates that, over the last three proxy years, 45% of key resolutions on social themes addressed the topic of political influence and activity (that is, 77 of 170 resolutions). In this paper, we take a closer look at all U.S. shareholder resolutions on lobbying and political activity over the last three proxy years, assessing how the top 10 U.S. asset managers are voting on this topic generally and with respect to climate matters.

Shareholder Resolutions on Lobbying and Political Activity

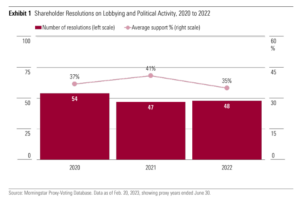

According to Morningstar’s proxy-voting database, there were 149 shareholder resolutions addressing U.S. companies’ lobbying and political activity in the last three proxy years—54 in 2020, 47 in 2021, and 48 in 2022 (see Exhibit 1). Resolutions on this topic generally request greater transparency on lobbying activities and political spending and are usually quite well-supported. Company management is generally expected to respond to shareholder resolutions that gain 30% support, and average support for shareholder resolutions on lobbying and political activity tends to exceed this threshold. On average, these resolutions gained 38% of the shareholder vote, peaking at 41% in the 2021 proxy year. Average support fell slightly in 2022 to 35%, in line with a general trend of lower support for shareholder resolutions seen by some managers as highly prescriptive or duplicative of ongoing efforts by companies. Appendix 1 contains a full list of the 149 resolutions.

The shareholder resolutions on lobbying and political activity are usually similarly worded from company to company, and they generally request disclosure on whether a company’s lobbying is “consistent with its expressed goals and interests” across a range of social issues, with reporting on policies governing lobbying and political activity, payments made for this purpose, and how the board exercises its oversight in this matter.

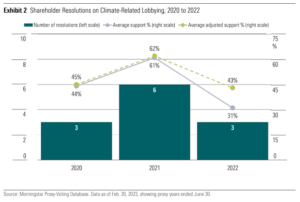

Twelve of the 149 resolutions on lobbying and political activity focused specifically on climate-related lobbying (see Exhibit 2). These enjoyed a higher level of shareholder support at 49% on average over the three years, peaking at 61% in 2021. Support fell to 31% in 2022, reflecting the pullback in support for “prescriptive” resolutions, but this equates to 43% on an adjusted basis counting only the votes of independent shareholders.

These 12 resolutions request disclosure of how the company’s lobbying activities (either directly or through trade associations) align with the Paris Agreement’s goal of limiting global temperature rise and how the company is managing the risks of potential misalignment.

Asset Manager Votes on Lobbying and Political Activity

We reviewed the voting record of the top 10 U.S. asset managers (by value of fund assets in open-end and exchange-traded funds) on the 149 lobbying and political activity resolutions. As at Dec. 31, 2022, the top 10 managers are Vanguard, BlackRock, Fidelity Investments, Capital Group, State Street Global Advisors, T. Rowe Price, Invesco, JPMorgan Asset Management, Dimensional Fund Advisors, and Franklin Templeton Investments. [3] We examine each manager’s record in detail in Appendix 2.

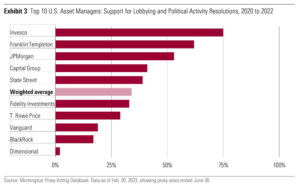

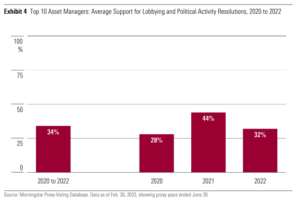

Overall, the top 10 U.S. managers cast 34% of their fund votes in support of resolutions on lobbying and political activity over the last three proxy years (see Exhibits 3 and 4). This is slightly lower than the 38% overall shareholder support for these resolutions mentioned earlier. The average for the top 10 is pulled downward by the lower level of support for these resolutions by the top two managers: Vanguard and BlackRock.

Vanguard and BlackRock accounted for more than one third of the 32,000 votes in Morningstar’s database on lobbying and political activity over the last three proxy years. Both managers cast less than 20% of their votes in support of these resolutions over the period. According to Vanguard’s public disclosures, proposals it supported address “material risk(s) and an oversight or disclosure gap, [are] not overly prescriptive, and [are] determined to be in the best long-term interest of shareholders.” Where Vanguard voted against such proposals, the firm noted that the company in question “has already taken sufficient actions, made sufficient progress, and/or has related actions pending to address [the proponent’s] request.” [4]

Similarly, where BlackRock has voted in support of these resolutions, the firm’s rationale is often that the firm “believes it is in the best interests of shareholders to have access to greater disclosure on this issue.” When the firm votes against such proposals, it often states that “the company already provides sufficient disclosure and/or reporting regarding this issue, or is already enhancing its relevant disclosures,” or that the “proposal is not in shareholders’ best interests.”

Other managers held different views on this, however. Fidelity, State Street, and Capital Group cast at least one third of their fund votes “For” lobbying and political activity resolutions. JPMorgan, Franklin Templeton, and Invesco did so for more than half their fund votes on these proposals. Invesco tops the ranking with 75% overall support. Dimensional’s overall support for these resolutions stood at only 2%. Support by the top 10 U.S. asset managers for lobbying and political activity resolutions peaked at 44% in the 2021 proxy year before falling to 32% in 2022, reflecting the broader trend.

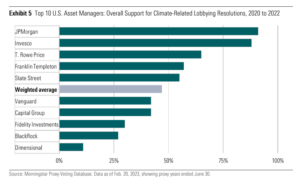

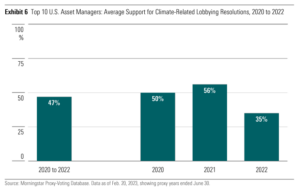

The top 10 U.S. asset managers showed considerably stronger support for climate-related lobbying resolutions compared with those on lobbying and political activity more broadly. The 10 firms cast 47% of their fund votes in support of the 12 resolutions on climate-related lobbying in the last three proxy years (see Exhibits 5 and 6). JPMorgan and Invesco both cast more than 80% of their fund votes in favor of the 12 climate-related lobbying resolutions, while T. Rowe Price, Franklin Templeton, and State Street all showed greater than 50% overall support for these proposals.

The top 10 U.S. managers cast more than half of their votes “For” the nine climate-related lobbying resolutions in the 2020 and 2021 proxy-voting years. However, their support fell to 35% for the three such resolutions in the 2022 proxy year amid a pushback on highly prescriptive proposals. In particular, BlackRock—who supported none of those resolutions in 2022—called out proposals “directing climate lobbying activities, policy positions or political spending.” [5]

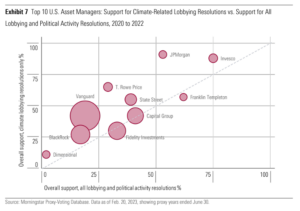

Exhibit 7 plots percentage overall support for climate-related resolutions for each asset manager against their support for lobbying and political activity resolutions over the last three years. All except two firms are above the dashed line, indicating that their support for climate-related lobbying proposals was higher than for lobbying and political activity proposals more generally. The two exceptions—Fidelity and Franklin Templeton—showed only slightly lower support for climate-lobbying proposals.

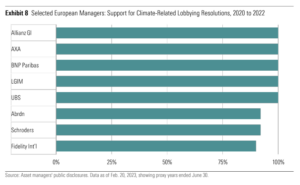

Notably, the top 10 U.S. managers’ support for the 12 resolutions on climate-related lobbying is considerably lower than that of their European peers. We selected eight large European asset managers who publicly disclose their voting decisions and analyzed their votes on these 12 resolutions: Abrdn, Allianz Global Investors, AXA Investment Managers, BNP Paribas Asset Management, Fidelity International, Legal & General Investment Management, Schroders, and UBS Asset Management.

On average, these eight managers showed over 90% support for climate-related lobbying proposals, with five managers supporting all 12 such resolutions (see Exhibit 8). Where votes against were cast (for example, Abrdn’s vote against the proposal at Honeywell International in 2022, and Schroders’ vote against the proposal at United Airlines in 2020), the managers’ rationale was that the company had made sufficient progress on its climate-related lobbying disclosures.

Download the full report here.

Endnotes

1 A proxy year represents the 12 months to June 30, as most shareholder meetings take place in the first half of the calendar year.(go back)

2Morningstar defines key shareholder resolutions as those that are supported by at least 40% of a company’s independent shareholders.(go back)

3See our research paper Proxy-Voting Insights, 2022 in Review (P. 11-12) for a full analysis of the top 10 U.S. asset managers.(go back)

4Key votes, Vanguard Investment Stewardship Insights, June 2022.(go back)

52022 Climate-Related Shareholder Proposals More Prescriptive Than 2021, BlackRock Investment Stewardship, May 2022.(go back)

Print

Print