Cary Martin Shelby is a Professor of Law at Washington and Lee University School of Law. This post is based on her recent paper, forthcoming in the Northwestern University Law Review.

News of colossal bank failures have threatened economic stability once again. In March 2023, Silicon Valley Bank (“SVB”) failed after a myriad of factors facilitated a large-scale bank run of its underlying deposits. While SVB’s failure does not seem to have risen to the level of a systemic disruption, it has certainly called into question the Financial Stability Oversight Council’s (“FSOC”) ability to continually effectuate its mission to identify and assess emerging threats to U.S. financial stability. FSOC is comprised of the chairpersons of major U.S. regulators. It was created by Congress shortly following the financial crisis of 2007-09 (the “Great Recession”) to protect against the ever-expanding categories of activities and institutions that could generate and transmit systemic risk. Such risk generally encompasses “the risk of a breakdown of an entire system rather than simply the failure of individual parts.” Even still, a recent report found that FSOC failed to act within their regulatory power to subject SVB to additional oversight despite its knowledge that the bank held excessive levels of uninsured deposits.

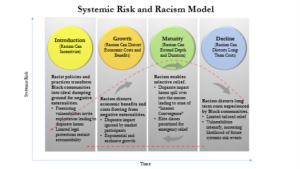

I have recently authored an article entitled Racism and Systemic Risk (forthcoming in Northwestern University Law Review), which urges FSOC to recognize yet an additional threat to financial stability that has repeatedly aggravated notable systemic risk disruptions—the insidious virus of racism. Scholars have previously insisted that the private sector acknowledge its contribution to systemic racism, which encompasses deeply entrenched inequities that are intertwined within institutional structures. This article extends these analyses by demonstrating the interconnectedness between racism and systemic risk that has consistently floated past the radar of regulators. It does so through my novel “Systemic Risk and Racism Model” provided below, which examines how racism has exacerbated recent systemic risk disruptions across every stage of their life cycle continuums. The Great Recession as well as climate change, provide quintessential case studies of recent disruptions to filter through this model, particularly since FSOC has officially recognized climate change as a threat to financial stability in 2021. While this post focuses on the Great Recession, my full article provides a robust analysis of how climate change could similarly be filtered through this model.

Introduction. Within the Introduction phase, I argue that racist policies and practices can incentivize systemic risk by transforming Black communities and other vulnerable areas into ideal dumping grounds for the negative externalities produced by the private sector. As a threshold matter, I first assess the breadth of disparate harms that emanated from underlying markets that partly fueled the systemic disruption in question. With respect to the Great Recession, subprime mortgages accounted for 50% of total home loans within predominantly Black neighborhoods while accounting for a mere 9% in White communities during the period leading up to the crisis. I then assess how preexisting vulnerabilities from a legal and economic standpoint lead to exploitation of this magnitude. Redlining and restrictive racial covenants made Black communities ideal targets for subprime mortgages during the initial stages of the Great Recession. Practices of this nature relegated Black homeowners to segregated areas with lower real estate values while deepening the racial wealth gap. Subprime mortgages likely presented a seemingly golden opportunity for securing the “American” dream of homeownership for countless Black individuals, many of whom were ultimately preyed upon by predatory lending practices. Assessing the extent to which the law further incentivizes these disparate impacts, by scrutinizing accountability loopholes, is the final step within this analysis. The Great Recession revealed that many institutions that engaged in predatory lending practices were simply “too big to jail” while any resulting settlements prevented direct admissions of wrongdoing by implicated institutions.

Growth. Since these disparate harms can freely exist with minimal legal interventions in terms of prevention, the financial sector can further commodify these harms for additional streams of profit. Within the Growth phase of this model however, I contend that intricate layers of embedded racism can lead to “blind spots” where market participants magnify the economic benefits flowing from these additional markets while underestimating resulting costs. During the period leading to the Great Recession, subprime mortgages were repackaged into complex financial instruments and sold to elite counterparties on a global level. Targeted communities were generally unable to participate in these markets under federal securities laws where access is limited based on wealth and other factors. Since market participants fueling this growth are not experiencing disparate harms to the same degree, they are more likely to underestimate the ways in which repackaging such harms into complex financial instruments can affect the broader economy.

Maturity. When the systemic risk disruption reaches its Maturity phase, the disparate harms experienced by Black people and other vulnerable communities spill over into the masses. This article therefore argues that Professor Derrick Bell’s “interest convergence theory” firmly takes root within this Maturity phase since this spillover effect is a necessary condition for meaningful regulatory intervention. Racism however can extend the depth and duration of this Maturity phase given the tendency of lawmakers to grant relief tilted in favor of elite groups. A rich volume of research concluded that Black communities and other underrepresented groups suffered the most from the ill-effects of the Great Recession. During 2005 to 2009, the median net worth for Black households dropped by 53%, while it dropped by 17 % for White households. While many prominent financial institutions benefited from a series of bailout programs implemented by the federal government, direct relief to affected homeowners and other individuals was severely limited.

Decline. As the systemic risk event reaches its last Decline phase, racism can cause lawmakers to underestimate the long-term costs accruing to vulnerable communities. In further dissecting this claim, this article gathers evidence demonstrating that Black communities disproportionately suffered long-term harms connected to the Great Recession. Although wealth levels within White households showed early signs of recovery, Black households continued to face significant declines. One study found that “in 2031 median wealth of a typical Black family will be $98,000 lower than it would have been without the Great Recession.” Regulatory interventions have had a limited impact in addressing these long-term harms. The vulnerabilities of underrepresented communities are therefore expanded during this Decline phase, enhancing their allure as dumping grounds for future negative externalities produced by the private sector. Cycles of this scale can therefore repeat themselves into perpetuity within seemingly unrelated corners of the economy as further discussed in the full article.

A formal recognition by FSOC of racism as a threat to financial stability could significantly disrupt these deeply troubling cycles. This article utilizes FSOC’s recent recognition of climate change as a threat to financial stability as a blueprint in this regard. A comparable designation for racism could serve as a tool in formalizing data collection and coordination across regulatory agencies, as well as expertise building within every corner of the financial markets. An FSOC designation could further spur investors, asset managers, stakeholders, and NGOs to advocate for meaningful reform, while stimulating integral and more inclusive rulemaking from applicable regulatory agencies. Despite FSOC’s purported shortcomings in recent years, holding the council accountable to its mission is crucial in safeguarding financial stability going forward.

Print

Print