Chris Goolgasian is Director of Climate Research and Cheryl Duckworth is Head of Sustainable Investment at Wellington Management. This post is based on their Wellington memorandum.

Key findings

Climate Awareness & Interest

Investment Considerations

Product Preferences

Challenges

Methodology

Coalition Greenwich conducted its fifth market study with institutional investors examining their preferences, perspectives, and future plans for employing ESG.

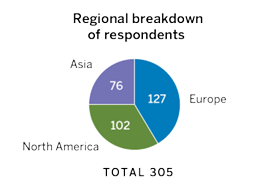

Results are based on 305 telephone interviews with key investment decision makers at large institutional investors across North America, Europe, and APAC.

Interviews took place from June through August of 2022.

Climate awareness & interest

Most asset owners are somewhat informed about climate investing, and many consider it a priority for their firm.

Takeaway

Asset managers may want to strengthen their educational efforts around key climate themes/

Survey questions

- How informed are you on climate change investing?

- What is your organization’s approach to climate change?

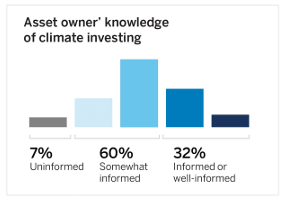

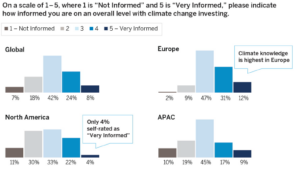

By and large, asset owners are “somewhat informed” about climate investing

Survey Question

While nearly three-quarters of asset owners say they have some understanding of the subject, relatively few feel “very informed.”

Climate knowledge is highest in Europe and lowest among asset owners in North America.

Interest in climate investing is high

Survey Question

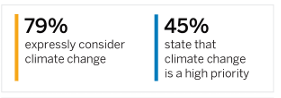

45% of asset owners consider climate change a high priority

- A majority of European owners see climate as a priority.

- Outside North America, asset owners focus more on transition risks than physical risks.

- 41% of North American owners currently do not consider climate investing.

- Nearly half of asset owners in APAC want to learn more about climate change.

Investment Considerations

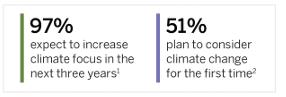

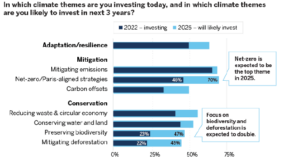

The focus on all climate themes is expected to grow in the next three years. The focus on net-zero/Paris-aligned investment strategies may increase to 70%. Focus on climate adaptation and mitigation, as well as biodiversity-related themes, themes may also rise.

Takeaway

Asset managers may want to help clients understand and evaluate ke climate-related opportunities and risks.

Survey questions

- In which climate themes are you investing today, and which are you likely to invest in over the next three years?

- What percentage of your portfolio integrates climate considerations, and how might that change in the next three years?

Asset owners expect to increase their focus on all climate themes over the next three years

Survey Questions

Respondents expect to increase their investments in all climate themes, including net-zero/Paris-aligned approaches.

While mitigation, adaptation, net-zero, waste reduction, and conservation are top themes, asset owners also plan to focus more on biodiversity and deforestation.

Across the board, asset owners expect more climate integration…

Survey Question

The number of owners who currently allocate at least 50% of their portfolio to climate investing will grow from 24% to 39%.

The number of owners who currently have less than 10% of their portfolios invested in climate change is expected to fall from 34% to 15% in three years.

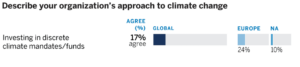

Nearly one quarter of European owners have some allocation to climate-specific funds.

…yet, most lack exposure to climate-specific mandates

Survey Question

Just 17% overall are currently investing in dedicated climate funds or mandates.

This could indicate that asset owners need a clearer roadmap from providers.

Product preferences

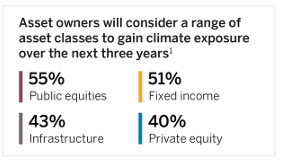

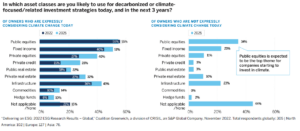

While 39% of firms investing in climate change do not invest in discrete/ dedicated climate strategies today, in three years, 19% expect to invest at least 20% of their portfolio in climate-specific approaches across a range of asset classes and vehicle types.

Takeaway

Expanding climate-related product offerings may serve clients well.

Survey Questions

- In which asset class segments do you invest in climate-focused strategies today?

- How might your investments in climate-focused strategies change in the next three years?

Asset owners plan to explore a wide range of dedicated solutions to increase climate exposure

Survey Question

Challenges

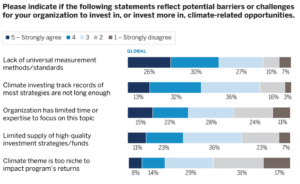

Across all regions, a lack of universal standards, limited track records, and a lack of expertise present challenges to investing in climate-related approaches.

Takeaway

Key performance indicators or other metrics that quantify climate risk, opportunities, and outcomes could be game changers.

Survey questions

- Please select the potential barriers or challenges for your organization to invest in climate-related opportunities.

- Please indicate how important it is for managers to offer the following climate capabilities.

Asset owners cite several barriers to investing in climate approaches

Survey Question

A lack of standards, limited track records, and a dearth of expertise present challenges. Asset owners also cite a lack of high-quality investment strategies that meet their needs.

This suggests the growing importance of increasing climate offerings that incorporate key performance indicators and relevant metrics that help quantify climate risk, opportunities, and outcomes.

Perceived challenges to climate investing vary by region

Survey Question

The survey revealed some nuances in barriers to the adoption of climate investing by global region. Compared to North America and Europe, more asset owners in APAC perceive greater potential challenges to climate investing.

This might suggest that providers should offer more targeted approaches to their APAC clients.

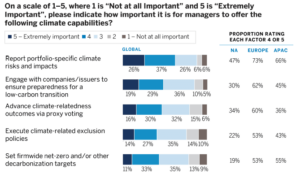

Asset owners value transparency and stewardship around climate change

Survey Question

Reporting on portfolio-specific climate risks, company engagement, and proxy voting are valued capabilities, especially in Europe. More than half of half of owners in APAC cite managers’ net-zero or other firmwide decarbonization efforts as important.

Conclusion & Resources

This survey revealed that asset owners, by and large, want more information, are interested in

climate solutions, and would consider increasing their allocations to climate investments. There is a clear appetite for climate-dedicated approaches across a range of asset classes and investment vehicles.

Download the full report here.

Endnotes

1Excludes current asset owners not expressly considering climate change.(go back)

2Excludes asset owners currently considering climate change(go back)

Print

Print