Heidi Welsh is the Executive Director at the Sustainable Investments Institute. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita; How Much Do Investors Care about Social Responsibility? (discussed on the Forum here) by Scott Hirst, Kobi Kastiel, and Tamar Kricheli-Katz; and Social Responsibility Resolutions (discussed on the Forum here) by Scott Hirst.

While much recent public controversy about sustainable investment focuses on climate change and fossil fuel companies, almost all shareholder proposals from organizations opposed to ESG investment considerations instead are about social policy. While “regular” ESG proposals generally offer ideas for how to address various corporate policies—voicing different ideas for new policies, actions or disclosures—the anti-ESG proponents ask companies to stop doing things. Theirs is a “just say no” campaign.

Generally speaking, the anti-ESG proponents seek to roll back the clock to a mid-20th century world where businesses operated with little consideration of their social and environmental impacts. The needle has moved, however; investors with trillions of AUM now routinely examine corporate impacts on society and the natural world. The cutting-edge debate is not about if there are impacts, but rather about the nature of systemic economic risk from climate change, human capital management and other issues. Proponents with anti-ESG ideas have gained little recent traction with investors at large in proxy season, even though like-minded politicians have had some success in passing state laws eschewing ESG considerations in the investment process.

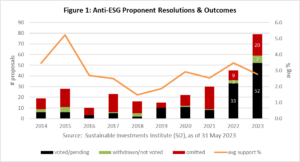

More proposals, meager support: The volume of proposals from “anti-ESG” proponents has more than doubled in the last three years, growing to 79 and up from 30 just three years ago. Only eight such proposals went to votes in 2021 but more than four dozen are on track for votes in 2023. Support levels have not budged significantly, with 36 votes as of May 31 earning average support of 2.8 percent—half what is needed to qualify for resubmission in the first year. Average support has dropped from last year’s already meager 3.5 percent. (Figure 1.)

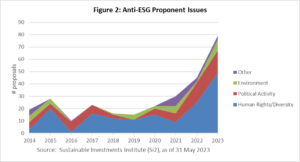

Main themes: The most popular proposals for anti-ESG proponents question the wisdom of encouraging racial and ethnic diversity on boards and in the workplace, suggesting that diversity, equity and inclusion (DEI) programs and anti-racism initiatives discriminate against conservative white people. Two-thirds of the 2023 proposals are about these diversity matters, up from the decadal average of 55 percent. About a quarter concern corporate political involvement. Only a little more than 10 percent are about the environment. All contend that a liberal agenda from investors and companies will damage the economy and American culture, asserting that ESG matters have no bearing on the bottom line. (Figure 2 shows issues over the last decade

SEC trends, little negotiation—Over the last 10 years, about 18 percent of anti-ESG proposals omissions occurred because of procedural flaws, although 58 percent of omissions were were blocked on ordinary business grounds, with another 17 percent occurred because SEC staff found the resolutions they were moot. There is little visibility about any engagement between these proponents and companies—which also stands in sharp contrast to the “pro-ESG” resolutions. In 2023, seven of 20 omissions to date have occurred because of procedural mistakes and the SEC staff found 11 were ordinary business.

Copy-cats—A few anti-ESG proponents have copied verbatim the resolved clauses of their ideological opponents, or use language in resolved clauses that makes the resolutions appear to support sustainability objectives. Supporting statements in these proposals commonly cite right-wing opinion pieces and argue against the resolved clauses’ purported goal. Corporate governance advisors to companies have started to advise companies to name the proponents in proxy statements as a result.

China—A whisper of bipartisanship might exist with resolutions about doing business in China, where the left and right agree that authoritarianism is deeply problematic, as is persecution of the Uyghur people. This year, a dozen proposals have questioned corporate ties to Communist China, but support for such proposals remains low. Three 2023 China proposals earned about 7 percent—at Boeing, IBM and Walt Disney—but all the others received less than 5 percent support. Last year, a similar proposal at 3M earned 12 percent but only 4.5 percent at Verizon Communications.

Proponents

The National Center for Public Policy Research (NCPPR) think tank in Washington, D.C., is the main player, although its principals and like-minded supporters also file on their own. NCPPR calls itself “the nation’s preeminent free-market” shareholder activist group, via its Free Enterprise Project. Its representatives also attend annual meetings without filing proposals to make statements about corporate policy; these regularly make their way into social media channels. Since 2020, NCPPR has published the Investor Value Voter Guide, with its own spin on the resolutions presented in the annual Proxy Preview, a collaborative forecast authored by Si2 and, Proxy Impact and published by the As You Sow Foundation. The NCPPR guide says it helps “Christian and conservative investors vote their shareholder proxies in a manner consistent with their values.” Thus far, NCPPR has filed at least 42 proposals in 2023.

The National Legal and Policy Center (NLPC) also files shareholder proposals, via its Corporate Integrity Project, as part of its mission to combat “practices that undermine the free enterprise system, including corporate giving to groups hostile to a free economy.” It has filed at least 18 proposals in 2023, including nine of the 12 proposals questioning ties to China.

A few individuals also file. One is Steven J. Milloy, a former lobbyist for the tobacco industry who maintains a website that denies climate science; his proposals question the benefits of corporate action to protect the environment—such as those he submitted a few years ago on a letterhead proclaiming the need to “Burn More Coal.” Milloy sits on the board of the Heartland Institute, a nonprofit think tank that incubates right-wing policy ideas.

New entrants in 2023 include:

- Inspire Investing supports clients interested in “biblical investing.” It offers Christian financial advisors who “help you glorify God in your financial life,” is the “world’s largest faith-based ETF provider and offers an online screener with nearly 40,000 tickers for companies or funds, including eight of its own. It names “abortion travel” as a “trending issue,” giving negative ratings to eight public companies. Inspire filed and withdrew a proposal at M&T Bank about the risks of anti-discrimination policies but withdrew after an SEC challenge.

- David Bahnsen leads The Bahnsen Group, which manages $4 billion in assets, and sits on the advisory board of the National Review, founded by William F. Buckley in 1955 to promote conservative ideas. Bahnsen also sits on the advisory board of the Viewpoint Diversity Index, a project of the Alliance Defending Freedom. ADF works to bolster right-wing causes and has been a key player in pressing for like-minded judges who increasingly dominate the American judiciary, including the U.S. Supreme Court. Bahnsen has filed at least seven proposals in 2023, several invoking concerns about the fiduciary duty to focus only on financial returns for shareholders, with the presumption that any ESG issues are immaterial. His proposal at JPMorgan Chase on the risks of anti-discrimination policies earned 2.3 percent.

- The American Conservative Values ETF, based in the Washington, D.C., suburbs, launched in October 2020 and claims net asset of $37.9 million as of March 2023. It asserts that “politically active companies negatively impact their shareholder returns, as well as support issues and causes that conflict with conservative political ideals, beliefs and values.” It lists 34 companies it deems too liberal to hold and offers a fact sheet about its approach. It is advised by Ridgeline Research LLC, a Washington, D.C.-based investment advisor “focused on creating innovative investment strategies and products” with “experiential ETFs that provide both purposeful and financial returns, supporting multiple affinity groups.” Ridgeline’s research director, Don Irvine, formerly worked at Accuracy in Media, a conservative Washington policy shop now headed by Adam Guilette. Guilette founded the Florida chapter of the Koch family political advocacy group Americans for Prosperity and also was a vice president of the far-right activist group Project Veritas that promotes conspiracy theories through misinformation.

- William Hild is executive director of Consumers’ Research, a Washington, D.C.-based non-profit organization that maintains a webpage tracking anti-ESG legislation. Its Consumers First Initiative, launched in May 2021, says it “has exposed numerous companies that have chosen to put woke politics above consumer interests.” Hild filed a resolution this year at ExxonMobil questioning the motives of one of its board members and asked for detailed information on all board members’ activities, but it was omitted on ordinary business grounds.

Human Rights & Diversity

China: The NLPC last year earned notable support for one of its resolutions about ties to China, with two proposals that said business in China holds undisclosed risks. It earned 12.2 percent at 3M and a more usual 4.5 percent at Verizon Communications. NLPC and others proposed the same thing this year and asked each to

report annually to shareholders on the nature and extent to which corporate operations depend on, and are vulnerable to, Communist China, which is a serial human rights violator, a geopolitical threat, and an adversary to the United States. The report should exclude confidential business information but provide shareholders with a sense of the Company’s reliance on activities conducted within, and under control of, the Communist Chinese government.

Outcomes—As noted above, support for these reports from investors at large is tepid, with votes three votes noted above of about 7 percent and five more below 5 percent: around 4 percent at Apple, Intel, Merck and Starbucks and 2 percent at International Paper.

Racial justice audit risks: Inspired by requests to conduct racial justice audits which have earned substantial support including eight majorities in 2022, NCPPR filed mirror-image proposals asking about the risks of anti-racism assessments and programs. The proposal last year received an average of 3 percent support at 10 companies, but NCPPR and others persisted this year. With slight variations, the resolution asked for (emphasis added):

an audit analyzing the Company’s impacts on civil rights and non-discrimination, and the impacts of those issues on the Company’s business. The audit may, in the Board’s discretion, be conducted by an independent and unbiased third party with input from civil rights organizations, public-interest litigation groups, employees and other stakeholders — of a wide spectrum of viewpoints and perspectives. A report on the audit, prepared at reasonable cost and omitting confidential or proprietary information, should be publicly disclosed on the Company’s website.

The only difference from other anti-racism proposals is the phrase highlighted above. NCPPR believes that DEI programs are discriminatory and create harmful controversy. Several of the recipients of this proposal are conducting civil rights audit and have a history of commitments to civil and human rights. In response to the proposals, companies have described related oversight and management as important to effective human capital management.

Outcomes—At least 10 votes will occur and all but one have earned 2 percent or less, with one exception at UPS (5.6 percent).

Last year, a request to Home Depot that it conduct a racial justice audit earned nearly 63 percent support and the company agreed to conduct the exercise. Irked, NCPPR this year simply asked the company “to rescind the 2022 Racial Equity Audit proposal and reject any racially discriminatory practices at the company.” It said the audit “may jeopardize Home Depot’s value by elevating divisive identity politics above its commitment to excellence, while also raising serious legal and commercial risks.” It further contended that these audits “promote claims about ‘white supremacy’” that many stakeholders “don’t accept.” The action is “far beyond the Company’s fiduciary remit” and could interfere with profit-maximizing decisions, it asserted. Investors demurred and gave the 2023 proposal only 0.9 percent support.

Anti-discrimination policies: Five companies—Capital One Financial, Charles Schwab, JPMorgan Chase, Mastercard and PayPal—will see votes this year about claims that their DEI programs are discriminatory, based on findings from the Viewpoint Diversity Index discussed above. The proposal seeks a report “evaluating how [the company] oversees risks related to discrimination against individuals based on their race, color, religion (including religious views), sex, national origin, or political views, and whether such discrimination may impact individuals’ exercise of their constitutionally protected civil rights.” Proponents asserted corporate diversity policies restrict free speech rights and threaten American freedoms.

Outcomes—The highest 2023 vote on this issue to date was 2.3 percent at JPMorgan Chase; other two votes were 1 percent or less. The SEC staff disagreed that the resolutions were ordinary business.

Liberal bias: Three additional proposals have called for examination of a purportedly biased approach to the news media, EEO policies and digital content management:

- Media bias—At AT&T, a resolution proposed “a report on the potential risks and consequences to the Company associated with the prioritization of non-pecuniary factors when it comes to establishing, rejecting, or failing to continue network relationships on its DirecTV platform.” The proposal took issue with the company’s decision not to renew DirecTV’s contract with One America News (OAN), a conservative news outlet. It contended OAN was a solid revenue source and that left-wing groups “such as Greenpeace, GLADD, Media Matters, and the NAACP” were responsible for ending the contract, saying the decision showed “viewpoint discrimination” that hurts the bottom line for AT&T investors overall. SEC staff agreed with the company’s assertion this was ordinary business.

A similar proposal argues that Alphabet suppresses the views of people with conservative political views and disfavors Republicans, suppressing free speech and interfering with elections on behalf of Democrats. The company refutes these allegations in the proxy statement and says its policies to prevent “manipulation and abuse” of its platforms are extensive, through a “thoughtful and tailored approach.”

- EEO—At Kroger and Tesla, NCPPR proposed a report from each “detailing the potential risks associated with omitting ‘viewpoint’ and ‘ideology’ from [the] written equal employment opportunity (EEO) policy.” The resolution argued each firm was hostile to conservatives and said Kroger had taken “blatant leftwing actions” with the result that “individuals with conservative viewpoints may face discrimination.” Cited evidence was that Kroger removed merchandise with political slogans and then worked to advance “a leftwing social agenda” by publishing a guide to support LGBTQ employees. Its current approach invites employee dissent and litigation, a material risk according to NCPPR. The Kroger proposal was omitted and the Tesla version filed too late, so neither will see a vote.

- Censorship—At Amazon.com, Meta Platforms, Pinterest and Verizon Communications, a proposal alleges the companies collude with the U.S. government, echoing earlier concerns from human rights advocates about regimes abroad. It seeks a semi-annual report on company

policy in responding to requests to remove or take down content from its platforms by the Executive Office of the President, Members of Congress, or any other agency, entity or subcontractor on behalf of the United States Government.

This report shall also include an itemized listing of such “takedown” requests, including the name and title of the official making the request; the nature and scope of the request; the date of the request; the Company’s action or inaction to the request; and a reason or rationale for the Company’s response, or lack thereof.

The proposal contends that the Biden administration inappropriately asked companies to remove misinformation, mentioning COVID-19 vaccine denial and Russian propaganda. It suggests that each company “cooperates with government officials engaged in unconstitutional censorship” and could be sued, claiming this is a material risk.

The Meta vote has yet to occur as of this writing but the resolution earned 1.6 percent at Amazon.com, 0.3 percent at Pinterest and 2.7 percent at Verizon.

Gun control: Proponents used two different approaches to defend personal gun ownership, all at financial companies that lodged SEC challenges:

- At JPMorgan Chase, Mastercard and Wells Fargo, the proposal was similar to the censorship resolution noted above but made claims of biased account closures, asking for a semi-annual report

that specifies the Company’s policy in responding to requests to close, or in issuing warnings of imminent closure about, customer accounts by any agency or entity operating under the authority of the executive branch of the United States Government. [at Mastercard: or by any representative of a government of any individual state within the U.S.]

This report shall also include an itemized listing of such requests, including the name and title of the government official making the request; the nature and scope of the request; the date of the request; the outcome of the request; and a reason or rationale for the Company’s response, or lack thereof.

The resolution is new and outside the resolved clause critiqued the Biden administration’s efforts to combat firearms and precious metals fraud, which the proponent said are unconstitutional constraints on free speech. However, it was omitted on ordinary business grounds or withdrawn after a challenge on those grounds and will not see a vote.

- At American Express, the proposal’s focus on gun sales was more direct. It asked the board to evaluate and report “describing if and how the Company intends to reduce the risk associated with tracking, collecting, or sharing information regarding the processing of payments involving its cards and/or electronic payment system services for the sale and purchase of firearms.”

Companies have begun to use a new merchant code for firearms sales that the International Standards Organization adopted in response to gun control advocates who include some institutional investors. The New York City Comptroller withdrew a proposal this year at American Express after it confirmed compliance with the new industry standard. However, NCPPR suggested the company’s use of the new code violates the Second Amendment right to bear arms—and that information collected may be shared with law enforcement and could be used to surveil and harass gun owners. In the end, SEC staff agreed the proposal concerned ordinary business, after the company argued it was about specific products and services and would micromanage.

Political Influence

Business partnerships: A new proposal questions whether business partnerships are consistent with fiduciary duty. It asked Alphabet, Bank of America, Boeing, Johnson & Johnson, Marriott International, Merck, MetLife and Pfizer (with a few slight variations) for

a report, at reasonable expense, analyzing the congruency between voluntary partnerships with organizations that facilitate collaboration between businesses, governments and NGOs for social and political ends and the Company’s fiduciary duty to shareholders.

The resolution takes issue with company ties to the World Economic Forum, the Council on Foreign Relations and/or the Business Roundtable and contends the companies are hiding such connections. These organization have “agendas…antithetical with the Company’s fiduciary duty” because they aim to serve many stakeholders, not only shareholders, according to the proponents. At Bank of America, for instance, it said the World Economic Forum “openly advocates for transhumanism, abolishing private property, eating bugs, social credit systems, ‘The Great Reset,’ and host of other blatantly Orwellian objectives.” Such aims are part of an “anti-human, anti-freedom agenda.”

A variation at MetLife wanted the report to be about “risks created by Company business practices that prioritize non-pecuniary factors when it comes to establishing, rejecting, or failing to continue business relationships.” In the resolution’s body, it noted with disapproval the company’s decision not to offer a bulk discount to NRA members, the exclusion of firearms makers from investment portfolios and excluding from portfolios coal companies and oil sands extractors.

Outcomes—The proposal was omitted on ordinary business grounds at J&J and MetLife and on procedural grounds at Bank of America and Pfizer (and also withdrawn at Boeing after a procedural error). It is still pending as of this writing at Alphabet and earned less than 2 percent at Marriott International and Merck (neither lodged a no-action request).

Charitable giving: A persistent concern from anti-ESG proponents is how charitable giving from companies may pose risks given the involvement of recipients in controversial activities. Three proposals voiced these concerns this year. One earned 7.4 percent at Walt Disney; the proponent was Thomas Strobhar, who in previous years has voiced opposition to abortion and funding for Planned Parenthood. He asked the company to “consider listing on the Company website any recipient of $10,000 or more of direct contributions, excluding employee matching gifts.” The same proposal is pending at Kroger but was omitted on ground it was moot at Merck, where it asked for disclosure of contributions of $5,000 or more and information about “the material limitations, if any, placed on the restrictions, and/or the monitoring of the contributions and its uses, if any, that the Company undertakes.”

Public policy advocacy: David Bahnsen wanted McDonald’s, PepsiCo and Walmart to report annually,

listing and analyzing policy endorsements made in recent years. The report should include public endorsements, including press statements released by the company and signing of public statements associated with activist groups and statements of threat or warning against particular states in response to policy proposals.

The report should analyze whether the policies advocated can rigorously be established to be of pecuniary benefit to the company and describe possible risks to the company arising from such statements, endorsements, or warnings.

The proposal was similar to one Vident Advisory withdrew in 2022 at Target, which also argued companies should carefully scrutinize their public policy involvement given the contentious nature of the political arena. The company apparently engaged with the proponent, who in the withdrawal letter thanked Target for “getting to understand our point of view.

Outcomes—The proposal was omitted on ordinary business grounds at McDonald’s and Walmart and withdrawn after being filed too late at PepsiCo. The companies argued the proposals were about public relations.

Board advocacy oversight committee: NCPPR earned 1.7 percent for its proposal at Starbucks that asked for a new board committee “to oversee and review the impact of the company’s policy positions and advocacy on matters relating to the company’s ongoing growth and sustainability.” Outside the resolved clause the proposal blames “woke policies” for store closures.

Business justification: The American Conservative Values ETF earned 0.8 percent at Berkshire Hathaway and 1.7 percent at Home Depot for a proposal that asked for a policy that the companies

avoid supporting or taking a public position on any controversial social or political issues (collectively “political speech”), without having previously, comprehensively and without bias justified by action on the basis of underlying business strategy, exigencies, and priorities.

Board member political activity: Resurrecting an idea that surfaced 10 years ago about former Al Gore’s board seat at Apple back in 2012, Consumer’s Research executive director Will Hird asked Exxon Mobil to

report to shareholders annually regarding all interviews, speeches, writings or other significant communications relating to ExxonMobil given by members of the Board of Directors to the media or public. The report should include all information necessary for shareholders to monitor and review director communications to the public, including date and transcript, and omit any confidential business information.

The proposal criticizes board member Jeffrey Ubben, a philanthropist and social investment venture capitalist, for his views on climate change. Hild’s organization, Consumer’s Research, is active in the effort to discredit consideration of ESG issues in the capital markets. But in the end, SEC staff agreed the proposal was an ordinary business issue.

Environmental Issues

As noted above, climate change remains low on the explicit agenda of anti-ESG proponents in proxy season. As of the end of May, nine proposals have addressed climate change, with four from Steven Milloy, four more from NCPPR and one from David Bahnsen.

Cost-benefit: Steven Milloy and NCPPR reprised proposals from years past to ask for a report on the feasibility of achieving net-zero greenhouse gas emissions, while expressing doubt about climate change. The proposal asked Alliant Energy, PepsiCo and Southern to “report annually to shareholders, omitting any confidential business information, about the company’s actual progress toward, and ongoing feasibility of [the company’s] announced goal of reaching ‘net-zero carbon dioxide (CO2) emissions by 2050.’” At General Electric, it was more specific, seeking

an audited report evaluating the material factors relevant to decisions about whether a 2050 net-zero carbon goal, or other similar decarbonization goals, is appropriate, including factors that mitigate against the adoptions of such goals. These factors might reasonably include technological feasibility (or its absence), the economic consequences of adoption, the possibility that the climate models that underlie such goals are incorrect, the possibility that failure to adopt such goals in other countries will render adoption by General Electric meaningless, the possibility that U.S. governments will not mandate such decarbonization, unending adoption-favoring “stranded asset” assumptions, and relevant considerations….

The proposal argued that investors need the reports because net-zero carbon goals are unattainable and any corporate plan for net zero is “pure fantasy” at best, which will hurt shareholders.

Outcomes—The resolution was omitted on mootness grounds at Alliant and earned less than 2 percent at GE and PepsiCo. Milloy failed to present the resolution at Southern so no vote was recorded.

Decarbonization risk committee: David Bahnsen and NCPPR filed another proposal in similar mien at Chevron, Duke Energy and First Energy, asking each for a new board committee to evaluate and report on what they deem “pie in the sky” climate goals whose pursuit will hurt shareholders. The proposal said each company should evaluate its

strategic vision and responses to calls for [company] decarbonization on activist-established deadlines. The charter should require the committee to engage in formal review and oversight of corporate strategy, above and beyond matters of legal compliance, to assess the company’s responses to demands for such decarbonization schedules, including the potential impacts on the Company from flaws in activists’ climate models, the possibility that the U.S. will not force decarbonization according to such schedules, thus obviating “stranded asset” calculations, the possibility that other countries will not adopt similar targets, thus making Company efforts meaningless, concerns about technological or economic infeasibility, and other relevant considerations.

Outcomes—Chevron investors vote on the proposition on May 31 but those at the other two companies voted less than 3 percent of their shares in favor.

No carbon reduction: Milloy responded to a 2021 resolution about Scope 3 emissions goals from Follow This, which earned 60 percent support, with a new proposal that is going to a vote at Chevron. He argues the 2021 proposal was politically motivated and that its implementation will hurt the company and its investors. His proposal asks Chevron now to “rescind the 2021 proposal and thereby reject the policy embedded in it that insists the Company substantially reduce consumer use of its products.”

Sustainability

Neither of two proposals NCPPR filed about setting up a more generalized board committee saw a vote because it failed to prove its stock ownership, at Levi Strauss and Warner Brothers Discovery. The proposal asked for a committee “to oversee and review the impact of the Company’s policy positions, advocacy, and charitable giving on social and political matters, and the effect of those actions on the Company’s financial sustainability.” Outside the resolved clause, NCPPR claimed that corporate support for civil rights organizations contributes to crime, undermines the police, hurts the economy and supports “civilizations-destroying developments that now beset the company.”

Health

A final proposal at Eli Lilly from NCPPR took its inspiration from corporate responses to the Dobbs v. Jackson Women’s Health Supreme Court decision that removed federal protections for abortion rights in June 2022. The proposal claims that the company’s public statements in support of abortion rights undercut its diversity policy and respect for those who oppose abortion. It called for a report

detailing the known and reasonably foreseeable risks and costs to the Company caused by opposing or otherwise altering Company policy in response to enacted or proposed state policies regulating abortion, and detailing any strategies beyond litigation and legal compliance that the Company may deploy to minimize or mitigate these risks.”

The SEC disagreed with Lilly’s no-action challenge that it was ordinary business since it is about workforce management and also would micromanage. But investors gave the proposal just 1.9 percent support.

Print

Print