Sally Wagner Partin and Sharon R. Flanagan are Partners and Hannah M. Brown is an Associate at Sidley Austin LLP. This post is based on their Sidley Austin memorandum. Related research from the Program on Corporate Governance includes Are M&A Contract Clauses Value Relevant to Target and Bidder Shareholders? (discussed on the Forum here) by John C. Coates, IV, Darius Palia, and Ge Wu; and The New Look of Deal Protection (discussed on the Forum here) by Fernan Restrepo, and Guhan Subramanian.

In recent months, the life sciences industry has seen the reemergence of contingent value rights, or CVRs, in public company acquisitions as a way to bridge a valuation gap between buyers and sellers. Recent public deals with CVRs include AstraZeneca’s acquisition of CinCor Pharma completed in February 2023, French biopharmaceutical company Ipsen’s acquisition of Albireo Pharma completed in March 2023, and announcements in April 2023 of the pending acquisition by Assertio Holdings of Spectrum Pharmaceuticals and the pending acquisition by Shin Nippon Biomedical Laboratories of Satsuma Pharmaceuticals. Even in deals that ultimately do not include CVRs, they are frequently being discussed behind the scenes by buyers and sellers as a way to address a lack of alignment on valuation.

Executive Summary

- This study addresses CVRs, the public M&A analog to the earnout used in private deals, which can be price-driven (e.g., providing CVR holders a payment if the average market price of the issuer’s equity security is less than a preset target price) or event-driven (e.g., providing CVR holders a payment if certain regulatory milestones are achieved).

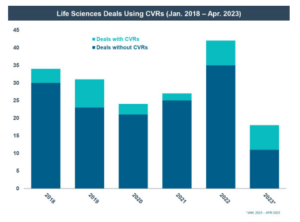

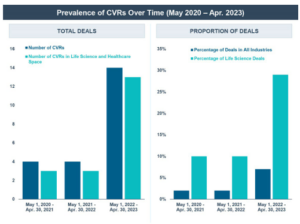

- CVRs are more common in life sciences transactions than in other industries. Of the 1,119 public deals announced across all industries from January 1, 2018 through April 30, 2023, only 37 (or 3%) included CVRs; however, of those deals, 84% were in the life sciences industry. [1]

- CVRs have been gaining popularity in recent years, particularly in the life sciences industry. From May 1, 2022 through April 30, 2023, approximately 29% of the announced life sciences industry M&A deals included the use of a CVR, as compared to 17% in the period from January 1, 2018 through April 30, 2023 and 10% in the period from January 1, 2013 through December 31, 2017.

- The use of CVRs is also much more concentrated in relatively smaller public M&A transactions in the life sciences industry, with CVRs used in approximately 45% of all public life sciences M&A deals announced from January 1, 2018 through April 30, 2023, where the transaction had less than a $500 million equity value.

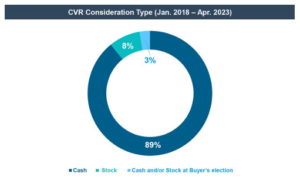

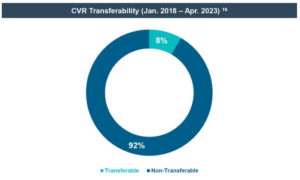

- The life sciences industry has also shown some standardization in the terms of CVRs—the strong majority of life sciences deals provided for event-driven, non-transferable, and cash-settled CVRs. From 2018 through April 30, 2023, of the 31 life sciences deals using CVRs, only one provided for CVR stock consideration and one provided for CVR consideration to be paid in cash and/or stock at the buyer’s election, and only one deal provided for transferable CVRs. [2]

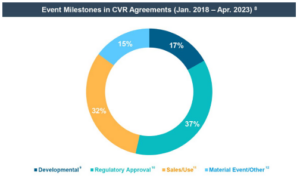

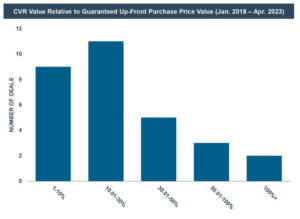

- All of the life sciences CVRs were event-driven (and none was price-driven) and the strong majority of life sciences CVRs provide for regulatory approval milestones or sales milestones. CVR agreements also generally provide for fewer milestones that are less complex in nature as compared to private company deals utilizing milestones. • Based on the study sample, the median potential value of a CVR, as compared to the guaranteed value a shareholder will receive in a deal, is approximately 18%. [3]

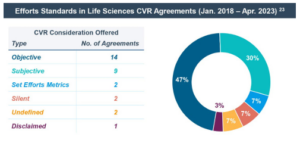

- Of the 31 CVRs in the life sciences industry included in the study sample, 30% included a subjective standard of required efforts (i.e., the efforts that the buyer expends on its own internally developed programs) and 47% an objective standard (i.e., the efforts that a reasonable company would expend on a similar program). Other CVR agreements were silent, had another standard or even specifically disclaimed that the buyer would have to use any specified efforts to achieve the milestone. [4]

Background

CVRs, the public company analog to the earnout, were first introduced in the late 1980s and are still used today to provide additional value to public company shareholders in a transaction. CVRs can help bridge the valuation gaps in public M&A transactions, which can be especially significant in times of economic uncertainty. Despite their complexity, CVRs retain their appeal because they can be structured and customized to meet the circumstances of a particular transaction, providing a flexible tool that can offer a solution to a host of unknowns and risks associated with the future performance of a target company. While these valuation issues can occur for deals in any industry, CVRs may be more attractive in life sciences transactions because target companies already face high beta outcomes that depend on uncertain future events like clinical trial results, regulatory approvals, and successful product commercialization. Furthermore, sellers in the private life sciences industry are already accustomed to partial payment in “bio bucks”—where earnouts, or milestones, are common practice. [5] While CVRs in public deals are less common than earnouts in private deals, largely due to the complexity of CVRs, they remain a potentially valuable tool under the right circumstances.

Recent uses of CVRs in public deals have been concentrated and growing in the life sciences industry. Of the 1,119 public deals announced across all industries from January 1, 2018 through April 30, 2023, only 37 (or approximately 3%) included CVRs; however, of those deals approximately 84% were in the life sciences industry. By contrast, in the five-year period from January 1, 2013 through December 31, 2017, there were only 25 deals that included CVRs (or approximately 2% of all announced public deals), 72% of which were in the life sciences industry.

CVRs are more common in public company life sciences transactions than one might expect—they were included in approximately 17% of the 176 public M&A deals in the life sciences industry announced from January 1, 2018 through April 30, 2023. Over the last three years in particular, the use of CVRs has greatly increased, including the use of CVRs in 29% of all announced life sciences M&A deals in the last year.

The use of CVRs is also much more concentrated in relatively smaller public M&A transactions in the life sciences industry, with CVRs used in approximately 45% of all public life sciences M&A deals announced from January 1, 2018 through April 30, 2023, where the transaction had less than a $500 million equity value. A possible reason for this concentration of CVRs in transactions with a lower equity value may be that the valuation of those sellers is particularly tied to uncertain future events such as clinical trial results, regulatory approvals, and successful commercialization.

[6]Fundamentals of CVRs

CVR Agreements

CVRs are typically incorporated into standalone agreements attached as an exhibit to the merger agreement, unlike private company earnouts that are generally included in the acquisition agreement itself. The CVR agreement is entered into between the buyer and a rights agent who acts as the representative of the CVR holders and oversees their rights under the CVR agreement.

CVR agreements for public deals also generally provide for fewer milestones that are less complex in nature when compared to private company deals, with the majority of the examined CVR agreements providing for only one or two milestones.

Price-Protection and Event-Driven CVRs

CVRs are typically structured in one of two ways:

- Price-Protection CVRs: CVRs can be used as a form of price-protection to provide target company shareholders some downside protection when a portion of the merger consideration will be paid in a buyer’s public company stock. Price-protection CVRs are used to guarantee that a certain stock value is paid even if the buyer’s stock fails to perform to specified levels post-closing, and are typically settled in cash or additional shares of buyer stock. While the price-protection CVR gained significant recognition in a few notable public takeover contests in the early 1990s, only one of the publicly-announced M&A transactions since 2018 provided for a traditional price-protection CVR and it was not a life sciences transaction.

- Event-Driven CVRs: Alternatively, and as more commonly used today, CVRs can be structured as payments owed upon the achievement of certain milestones or the occurrence of specific triggering events after closing (i.e., “event-driven” CVRs). Similar to private company earnouts, event-driven CVRs are bespoke for each transaction and have significant variation between deals. A CVR may have only one milestone (for example, based on a regulatory development or future product sales) or may provide for multiple milestones paid incrementally upon the achievement of each milestone, or paid in a single payment only if all milestones have been achieved. Event-driven CVRs can also be used as a form of risk-shifting when the value of a target is reliant upon certain positive future events, such as the resolution of pending disputes against the target. [7]

CVRs May Be Settled in Cash, Stock, or a Mix

CVRs can be paid out either in cash, buyer stock, or a mix of both. Typically, the form of consideration is fixed at the signing of the merger agreement, but the CVR agreement may also provide that a buyer or a CVR holder may elect the form of payment as between cash and stock or a mix at the time the rights become due. From 2018 through April 30, 2023, almost all public deals announced involving CVRs provided CVR consideration exclusively in cash.

Valuation of CVRs

The average potential value of a CVR, as compared to the guaranteed value a shareholder will receive in a deal, was approximately 50% and the median potential value of a CVR, as compared to the guaranteed value a shareholder will receive in a deal, was approximately 18%. [13] The general trend was for the maximum payout available under the CVR agreement to represent a range between 1-30% of the value guaranteed to a shareholder in cash or stock—however, some high-value outliers exist which greatly affected the average potential payout. For example, one CVR provided that if the maximum payout was made, approximately 200% of potential additional value could be achieved under the CVR when compared to the guaranteed upfront merger consideration. Similarly, another transaction provided for CVR payments of over 600% of the upfront merger consideration. Excluding these two outlier transactions, the average maximum payout available under the CVR agreements represented approximately 24% of the upfront value guaranteed to a shareholder in cash or stock and the median maximum payout remained approximately 18%.

CVRs as Tradable Securities Requiring Registration

As buyers consider whether to include a CVR in an M&A transaction, they frequently consider that one of the downsides of CVRs is that they may impose regulatory requirements upon the buyer. If a CVR is considered a “security” under U.S. federal securities laws, this may require registration of the CVRs under the U.S. Securities Act of 1933, and require registration and lead to reporting obligations for the buyer under the U.S. Securities Exchange Act of 1934.

The SEC has provided a five-factor test for determining if a CVR is a contractual right, rather than a security. [14] Under this test, the SEC will typically conclude the CVR is not a security if all of the following five factors are met:

- The rights are an integral part of the consideration to be received in the merger;

- The holders of the rights have no rights common to shareholders such as voting and dividend rights;

- The rights bear no stated rate of interest;

- The rights are not assignable or transferable except by operation of law; and

- The rights are not represented by any form of certificate or instrument. [15]

The SEC places particular emphasis on whether a CVR is transferable. If a CVR is not transferable, it is generally able to be structured such that it will not be considered a “security.”

[16]These reporting obligations can be of particular concern to non-U.S. or private buyers that may not otherwise be required to comply with U.S. federal securities law reporting obligations.

Former shareholders of a seller generally prefer CVRs that are transferable and registered on a stock exchange so that the holders are able to achieve liquidity by selling the CVR instead of holding the CVR for the entire milestone period. [17] However, the majority of recent deals involving CVRs have been structured to provide that the CVRs are non-transferable, likely to avoid SEC registration requirements (and, to the extent applicable, the requirements of the stock exchanges) along with the costs and expenses of registration, listing, and continued compliance. [18] Another reason buyers may avoid registering CVRs with the SEC is because hedge funds and other market participants often become the holders of a significant percentage of registered CVRs and may even hedge their CVR exposure with the buyer’s stock, resulting in unnatural trading activity in a buyer’s stock and undesired consolidation of holdings in CVRs and buyer’s stock.

Given the concerns of buyers about SEC registration, recent agreements with CVRs have provided only for limited “permitted transfers” that are not considered to convert these CVRs from contractual rights into securities from an SEC perspective. These limited permitted transfers are generally transfers of CVRs (a) upon death of a holder by will or intestacy; (b) pursuant to court order; (c) by operation of law (including by consolidation or merger) or without consideration in connection with dissolution, liquidation or termination of any corporate entity; or (d) in the case of CVRs held in book entry or other similar nominee form, from a nominee to a beneficial owner.

CVR Terms in Life Sciences Transactions

CVRs Typically Event-Driven, Cash-Settled and Non-Transferable

The life sciences industry has shown some standardization in the terms of CVRs—the strong majority of life sciences deals provided for event-driven, non-transferable, and cash-settled CVRs. From 2018 through April 30, 2023, of the 31 life sciences deals using CVRs, only one provided for CVR stock consideration, one provided for CVR consideration to be paid in cash and/or stock at the buyer’s election, and one deal provided for transferable CVRs, the remainder were all cash-settled and non-transferable. [19]

Post-Closing Efforts to Achieve the CVR Events

CVR agreements are sophisticated documents that require structuring complex variables—this can present numerous issues both in the negotiation, and later, the implementation of these rights. When CVRs are event-driven, sellers and buyers will focus during negotiations on what efforts, if any, the buyer must expend post-closing to achieve the milestone that is the subject of the CVR. A seller may be concerned that a buyer will not devote sufficient resources for the acquired program post-closing or may prioritize an internal program over the acquired program, resulting in the nonachievement of the milestone. A buyer will be focused on maintaining autonomy over a company that it now owns and having the freedom to make decisions in the future without regard to the existence of these contingent payments. For example, a buyer may need the freedom to continue to pursue internal programs after the acquisition, even if those internal programs are potentially competitive with the acquired program. [20]

A buyer’s efforts to achieve the milestones are typically found within the definition of “Commercially Reasonable Efforts” or “Diligent Efforts.” The efforts that the buyer commits to expend may be articulated as a subjective standard (i.e., the efforts that the buyer expends on its own internally developed programs) or an objective standard (i.e., the efforts that a reasonable company would expend on a similar program). Some CVR agreements specifically disclaim that the buyer will have to use any specified efforts to achieve the milestone. [21]

The majority of the CVR agreements in the life sciences industry from 2018 through April 30, 2023, specifically limited a buyer from taking into account the obligations to make milestone payments in its consideration of required efforts. However, one agreement made clear in its definition of “Commercially Reasonable Efforts” that the obligation to make milestone payments under the agreement could be taken into account. [22]

As an alternative to general defined efforts provisions, a CVR agreement may instead provide for specific funding requirements or a set sales strategy to be used to reach the milestones. In one examined transaction, the CVR agreement provided for three independent milestones, relating to the achievement of a clinical recommendation, regulatory approval, and net sales targets. In that CVR agreement, the buyer agreed to expend not less than a specified amount towards the achievement of the clinical recommendation milestones and the regulatory approval milestone, while specifically reserving sole and absolute discretion over the development, marketing, commercialization, and sales of the product tied to the net sales milestone.

[23]As with any earnout negotiation, sellers will be looking for contractual commitments by buyers, and buyers will seek discretion as to required efforts to allow flexibility in making future business decisions. Sellers may attempt to seek further assurances as to the efforts buyer will use to achieve a milestone by specifically restricting acts in bad faith made for the purpose of avoiding the achievement of a milestone or of making a milestone payment. While Delaware law provides that the implied covenants of good faith and fair dealing attach to every contract unless specifically disclaimed, a seller may seek to include an explicit prohibition against bad faith acts. Specific prohibitions against bad faith actions taken by buyers were found in approximately 23% of the CVR agreements in the life sciences industry included in the 2018-2023 CVRs. [24]

Audit rights for the CVR holders and reporting obligations of the buyer are also common in CVR agreements.

Duration

CVR agreements provide for varying durations —spanning only months to years based on the defined milestones, with the strong majority of the CVR agreements having a specified time period for performance (i.e., a date by which the milestones must be achieved) or expiration date (i.e., a date upon which the milestones will expire if some or all of the milestones have not been achieve by that date). Some CVR agreements also include payments for early achievement of milestones before a specified date.

Post-Closing Assignment by the Buyer

Standard CVR agreements in life sciences transactions will provide for the assignability of the CVR agreement, and in cases where the milestones are tied to the development, regulatory approvals, or sales of a specific product, the assignability of that CVR product. Generally, the buyer may assign the CVR agreement so long as the assignee agrees in writing to be bound by the terms of the original CVR agreement—however, the buyer will often remain liable for performance by any assignee. A minority of CVR agreements allow the buyer to assign without ongoing obligations or liability if the assignee meets certain pre-established criteria, such as holding certain net assets or being a significant company in the buyer’s industry. [25]

Other Considerations

Litigation Risks

As with earnouts in private M&A transactions, CVRs create a real risk of post-closing litigation. Common disputes involve claims that the buyer failed to meet the efforts standards specified in the CVR agreement, leading to missed milestones and non-payment. Disputes are very common in milestones in private M&A, and in public M&A, the larger number of former shareholders of a public company target who may hold CVRs amplifies this risk.

Accounting Considerations

Another complexity that may dissuade buyers (and, in particular, public company buyers who have their own public financial disclosure requirements) from using CVRs, is that, as with all contingent consideration, buyers also will need to consider the accounting treatment of these contingent payments.

Accounting Standards Codification 805 is the primary accounting standard governing the accounting for business combinations under US GAAP and provides guidance on a wide range of accounting issues related to business combinations, including recognizing and measuring contingent consideration. Under ASC 805, a buyer typically must establish a liability account on its balance sheet for the outstanding CVRs that is marked to market on a quarterly basis.

Conclusion

In today’s M&A landscape, it’s increasingly common for buyers and sellers to have divergent views on the value of a target company—this divergence is amplified in the life sciences space because success in this industry is often dependent on the outcome of future events, making it difficult to accurately predict the value of a company over the long term. The use of CVRs in life sciences M&A transactions can provide a valuable mechanism for bridging these valuation gaps by tying future payments to specific events, such as developmental, regulatory, or commercial milestones. However, implementing a CVR agreement is a complex process that requires careful consideration of a variety of factors, including the appropriate milestones and metrics, other key terms of the CVR, and the potential risks and rewards for both buyers and sellers.

Endnotes

1This article examines all announced public transactions from January 1, 2018 through April 30, 2023, providing CVRs as a specific form of consideration according to DealPoint Data (the “2018-2023 CVRs”). For purposes of determining transactions in the life sciences and healthcare industry, transactions were sorted by DealPoint Data’s “healthcare” industry sector, which includes pharmaceuticals, medical devices and equipment, and healthcare services, among others. This article refers to those transactions as “life science” and “healthcare” industry transactions interchangeably. Percentages calculated have been rounded to the nearest whole number, which rounding results in certain statistics not summing to 100%. All data cited is from the entire 2018-2023 CVRs data set unless otherwise indicated.(go back)

2Based on review of the 2018-2023 CVRs, excluding one transaction that was withdrawn before the CVR agreement was made publicly available.(go back)

3Based on review of the 2018-2023 CVRs, assuming all milestones are met so as to lead to the maximum payout possible without any discount for risk or time value of money and valuing a buyer’s stock at the time of signing based on the value of the buyer’s shares as defined in the merger agreement. Excluded from this analysis were seven transactions with uncertain CVR values (e.g., CVRs entitling holders to proceeds from pending litigation or settlement of litigation, percentages of futures net sales of certain products, or providing for price protection).(go back)

4Based on review of the 2018-2023 CVRs (limited to event-driven CVRs), excluding one transaction that was withdrawn before the CVR agreement was made publicly available.(go back)

5According to SRS Acquiom’s 2021 Life Sciences M&A Study, earnouts are included in 87% of biotech/pharmaceuticals transactions, 78% of medical device transactions, and 64% of diagnostics and research technologies transactions.(go back)

6Based on review of the 2018-2023 CVRs sorted by DealPoint Data’s listed equity value.(go back)

7For example, one transaction provided for CVRs to be paid in the event “a certain ongoing dispute” between the seller and “certain unrelated third-parties has not been resolved, and the proceeds, if any, from the resolution of the dispute have not been paid out” to the seller’s shareholders prior to the completion of the merger.(go back)

8Based on review of the 2018-2023 CVRs (limited to event-driven CVRs), excluding one transaction that was withdrawn before the CVR agreement was made publicly available. Certain CVR agreements use more than one event milestone type. CVR agreements using multiple milestones of the same type were only counted once.(go back)

9Developmental milestones, only seen in life sciences transactions, included, for example, regulatory submissions, including investigational new drug applications or new drug applications, and successful initiation or results of clinical trials.(go back)

10Regulatory approval milestones, only seen in life sciences transactions, included, for example, approval by the U.S. Food and Drug Administration, the European Medicines Agency, or other international regulatory authorities of a drug or device.(go back)

11Sales milestones included, for example, first sale and net sales milestones. Use milestones, only seen in life sciences transactions, included, for example, milestones based on the numbers of issued prescriptions or treatment visits.(go back)

12Material event/other milestones, mainly seen in non-life sciences transactions, included milestones dependent on events such as the result of litigation or disputes, restarting of certain operations, duty deposit refunds, the sale or licensing proceeds of a future sale by buyer of the target or a license of the target’s technology with a third party, and achievement of targeted share trading prices.(go back)

13Based on review of the 2018-2023 CVRs, assuming all milestones are met so as to lead to the maximum payout possible without any discount for risk or time value of money and valuing a buyer’s stock at the time of signing based on the value of the buyer’s shares as defined in the merger agreement. Excluded from this analysis were seven transactions with uncertain CVR values (e.g., CVRs entitling holders to proceeds from pending litigation or settlement of litigation, percentages of futures net sales of certain products, or providing for price protection).(go back)

14See Minnesota Mining and Manufacturing Co., SEC No-Action Letter, 1988 WL 234978 (Oct. 13, 1988).(go back)

15These are the five factors most commonly considered by the SEC when determining whether a CVR is a security, but some no action letters have also included additional factors in support of a CVR being a contractual right and not a security.(go back)

16Based on review of the 2018-2023 CVRs, excluding one transaction that was withdrawn before the CVR agreement was made publicly available.(go back)

17The listing of CVRs is governed by Nasdaq Listing Rule 5730 and by NYSE Listed Company Manual Section 703.18.(go back)

18Based on review of the 2018-2023 CVRs, excluding one transaction that was withdrawn before the CVR agreement was made publicly available.(go back)

19Based on review of the 2018-2023 CVRs, excluding one transaction that was withdrawn before the CVR agreement was made publicly available.(go back)

20One CVR agreement included, for example, “For clarity, the application of Commercially Reasonable Efforts will not necessarily require Parent to disadvantage any particular currently available competing products or products currently under development by Parent or any of its Affiliates or which may in the future enter development by Parent or any of its Affiliates.”(go back)

21One CVR agreement included, for example, “Notwithstanding anything in this Agreement to the contrary, in no event shall Purchaser or any of its Affiliates be required to undertake any level of efforts, or employ any level of resources, to develop any product or achieve the Milestone.”(go back)

22The CVR agreement provided that “‘Commercially Reasonable Efforts’ means, with respect to a particular task or obligation, a level of efforts that is consistent with the general practice followed by Parent . . . taking into account . . . the profitability of the Relevant Products (including pricing and reimbursement status achieved or expected to be achieved and including, in respect of a CVR Product, the obligation to make Milestone Payments under this Agreement . . .”(go back)

23Based on review of the 2018-2023 CVRs (limited to event-driven CVRs), excluding one transaction that was withdrawn before the CVR agreement was made publicly available.(go back)

24Based on review of the 2018-2023 CVRs (limited to event-driven CVRs), excluding one transaction that was withdrawn before the CVR agreement was made publicly available.(go back)

25 For example, one CVR agreement permitted the buyer to be released from liability if the assignee was one of the top thirty pharmaceutical companies, determined on worldwide annual revenue, or a pharmaceutical or biotechnology company with a regulatory and scientific infrastructure comparable to that of buyer. Another allowed for the buyer to be released from liability if the assignee held net assets of at least $350,000,000.(go back)

Print

Print