Shaun J. Mathew and Daniel E. Wolf are Partners at Kirkland & Ellis LLP. This post is based on a Kirkland & Ellis memorandum by Mr. Mathew, Mr. Wolf, Edward J. Lee, and Evan Johnson. Related research from the Program on Corporate Governance includes Universal Proxies (discussed on the Forum here) by Scott Hirst.

The much-anticipated first proxy season under the SEC’s new universal proxy rules is now largely in the books. Looking back, did the new regime mark a paradigm shift in how proxy fights are conducted? Or was this truly a technical change with limited effects on corporate and activist behavior? While the answer was always likely to be somewhere in between, we took a closer look at this inaugural season to determine how companies, activists, institutional investors and proxy advisors adapted to the new regime and how strategy, tactics and outcomes did – and did not – change.

Key Takeaways

- Activity levels: Activism levels remained high, but fewer campaigns resulted in proxy fights while more settled

- Target size: Activism campaigns targeted companies of all sizes, but the vast majority of proxy fights occurred at smaller companies

- Number of nominees: Activists did not nominate more candidates per slate

- Proxy fight costs: While universal proxy theoretically lowered the cost of entry for an activist, proxy fight costs did not come down and there was no surge in bare-bones campaigns

- Proxy advisor recommendations: While ISS and Glass Lewis continue to require that activists make a case for change, they are placing greater emphasis on individual director qualifications

- Litigation: In a highly litigious proxy season, companies challenged the validity of activist nominations at unprecedented levels

- Success level: Universal proxy may be increasing the odds of at least some activist success, but it has not opened the floodgates

Methodology

In addition to drawing upon our experiences advising companies in responding to activism, we took a deep dive into the data. This involved analyzing all of the activist campaigns taking place at US-listed companies (excluding closed-end funds and BDCs) during the 2023 proxy season (which we define as the period starting when the new rules took effect on September 1, 2022 through June 16, 2023) and comparing against prior periods. Unless otherwise noted, we define proxy fights as activism campaigns where the activist filed a proxy statement for an election contest with competing slates of nominees at an annual meeting. In addition to examining data from relevant databases, we reviewed each proxy statement and each ISS and Glass Lewis report published in connection with contested director elections during this period.

Key Findings

Activism levels remained high, but fewer campaigns resulted in proxy fights while more settled.

The advent of universal proxy did not lead to more activism during the 2023 proxy season. In fact, activists initiated over 300 “high impact” (as classified by FactSet) activism campaigns, almost exactly on par with the level of activity in 2022 and consistent with activity levels over the last decade. However, the number of campaigns that escalated into a proxy fight dropped by nearly 20% relative to 2022, while the number of publicly disclosed settlements increased by nearly 20%.

What drove these shifts? While the data does not paint a clear picture and the sample size is admittedly small, the rise in settlements could be attributed to a number of factors. Notably, we saw universal proxy crystallize for boards the heightened risk that individual directors perceived to have certain weaknesses would be uniquely vulnerable under the new rules – this increased the willingness of some directors to step off the board or decline to be re-nominated, whether as part of a proactive board refresh or a negotiated resolution with an activist. In other cases, the increased propensity to avoid a fight may simply have resulted from a case of first-year jitters by both companies and activists who were uncertain about expected voting dynamics under the new regime. Finally (and wholly unrelated to universal proxy), the more challenging macroeconomic environment during the 2023 proxy season left activists with fewer (and less certain) short-term transactional “event” opportunities to push for in a fight, making quick settlements potentially more appealing to activists.

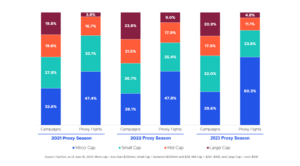

Activists targeted companies of all sizes, but most proxy fights took place at smaller companies. Headlines naturally focus on campaigns by high profile activist hedge funds at blue-chip companies, and over the last several years activists have increasingly taken larger dollar positions in large- and mega-cap companies. However, the frequency of “high impact” activism campaigns has been fairly evenly distributed across the market cap spectrum, while the vast majority of proxy fights have historically taken place at smaller companies. This phenomenon was super-charged in 2023, with 84% of proxy fights occurring at sub-$2B market cap companies, up from 73% in 2022. The median market cap of companies involved in a proxy fight also dropped by almost half during the 2023 season, falling to $362M from $706M in 2022.

While the data does not offer a clear universal-proxy-related explanation, several factors generally explain the likelihood of more fights occurring at smaller companies. For example, larger companies are more likely to have the necessary resources to evaluate and address their potential vulnerabilities and probable activist demands on a clear day, and they more often engage in proactive board refreshment – each of which gives them more leverage and flexibility to negotiate a palatable offramp when an activist emerges. On the flipside, activists targeting smaller companies with potentially greater vulnerability are more likely to decline a settlement and push for a broader win through a proxy fight. In addition, newer activist funds (which continue to launch each year) tend to focus on smaller companies as they typically have less capital to deploy. These upstart funds also tend to be more contentious and willing to go “all the way” to a vote because the added publicity can bolster both their reputation and fundraising prospects.

Activists did not nominate more candidates per slate.

Activists have long sought to improve their posture in early negotiations by proposing more nominees than they would likely run in a fight, knowing they can always pare down their slate if a proxy fight ensues. Given the increased ability of shareholders to mix and match among candidates using universal proxy, many speculated that activists seeking this added leverage would have less incentive to limit the size of their slates under universal proxy. However, while we have seen activists more regularly submit nominations with alternate candidates in addition to their preferred slates, we have largely seen activists refrain from over-nominating during private negotiations. This may be in part because this tactic risks backlash from boards, which may damage an activist’s chances of reaching a swift negotiated resolution.

At the proxy fight stage, the average number of director nominees that activists disclosed in their proxy statements did not increase during the 2023 proxy season – in fact, the number remained effectively flat at approximately three nominees per slate. In our experience, activists generally have resisted disclosing an oversized nominee slate in their proxy statements to avoid losing credibility with institutional investors and proxy advisors (who are acutely focused on the appropriate degree of board change that is warranted). Notably, nearly half of companies facing a proxy fight (47%) had a classified board, which also placed a natural limit on the maximum number of nominees an activist could nominate (this was up modestly from 44% in 2022).

While universal proxy theoretically lowered the cost of entry for an activist, proxy fight costs did not come down and there was no surge in bare-bones campaigns.

In its adopting release, the SEC calculated that an activist could run a bare-bones campaign for under $10,000 by relying on internet delivery of proxy materials (“notice and access”) to satisfy the minimum 67% solicitation requirement under the new rules. Because a company facing a proxy fight would always be expected to incur the significant expense of delivering physical proxy cards to its shareholders, the fact that the universal proxy rules require the company proxy card to include the activist’s nominees presents an opportunity for the activist to free-ride off the company’s solicitation efforts. Such a bare minimum approach was never likely to result in an activist successfully electing directors at an annual meeting and was unlikely to be used by large, sophisticated activist funds. However, the lower cost of entry created the potential for a subset of activists to employ this approach to increase their settlement leverage (e.g., smaller, less-resourced hedge funds or groups that have historically submitted 14a-8 proposals who may be concerned more with publicity for a single-issue non-economic cause than electoral success).

While there were a few examples of activists attempting to take a bare-bones approach (and at least one situation where such an activist prevailed), this did not become a widespread phenomenon. In fact, for the 2023 proxy season, the average estimated cost of conducting a proxy fight disclosed by activists increased from $1.2M for the 2022 season to $2.7M, while the median stayed roughly the same (~$1M).

While ISS and Glass Lewis continue to require that activists make a case for change, they are placing greater emphasis on individual director qualifications.

Prior to universal proxy, ISS and Glass Lewis each evaluated proxy contests under a two-step analytical framework that generally required an activist to first demonstrate a compelling case for change at the company before considering whether to support any activist candidates. Despite their assertions to the contrary, many speculated that the proxy advisors might use the ability to mix and match on the universal proxy card as an excuse to drop the first prong and simply turn their focus to evaluating candidates head-to-head. Based on our review of the ISS and Glass Lewis reports published during the 2023 proxy season, this has generally not transpired. Instead, ISS and Glass Lewis continue to require a case for change before recommending in favor of activist nominees, and continue to impose an even higher standard on activists seeking to replace a CEO or a majority of a board. However, the reports reveal that each proxy advisor has offered clients more commentary on individual director vulnerability than before. They have also provided occasional quasi-endorsements where – without explicitly recommending a vote for the activist nominee – they highlight the qualifications of an activist nominee for those clients who may be more inclined to pick and choose nominees regardless of whether the proxy advisor believed board change is warranted.

With respect to trends in the recommendations themselves, during the 2023 proxy season ISS supported activists less often than last year (44% in 2023 vs. 57% in 2022), whereas Glass Lewis supported activists more frequently (53% in 2023 vs. 40% in 2022). Based on our review of the reports and the relatively small sample size, we do not draw any meaningful conclusions from these year-over-year shifts.

In a highly litigious proxy season, companies challenged the validity of activist nominations at unprecedented levels.

During the 2022 proxy season, three companies declared that an activist’s nomination notice had material defects, and all three nomination notices were eventually disqualified (including some with existential implications, such as Lee Enterprises’ successful defense against Alden’s hostile takeover bid). During the 2023 proxy season, there have already been 12 such instances, with four ultimately disqualified (including in the first attempted proxy fight conducted under the universal proxy rules at AIM ImmunoTech). In contrast to the challenges last year, several lawsuits filed over the validity of activist nominations during the 2023 proxy season have been settled, with the company agreeing to permit the activist’s nominees to stand for election. Multiple factors could be driving the significant increase in challenges to activist nominations, including the more widespread adoption of modernized advance notice bylaws, boards more carefully enforcing compliance with their advance notice bylaws, and less experienced activists submitting nominations with consequential omissions or misrepresentations.

Beyond the uptick in challenges to nomination notices this year, activists also initiated several lawsuits seeking to challenge board actions taken during a proxy fight (e.g., adoption of an advance notice bylaw provision that the activist perceived to be unusually aggressive). Most of these cases were dropped, as several companies ultimately decided to reverse course on the challenged actions after litigation commenced.

Universal proxy may be increasing the odds of some activist success, but it did not open the floodgates.

Consistent with expectations, we observed that the ability to mix and match candidates from the company and activist slate under universal proxy may have made it somewhat easier for activists to win at least one board seat, but may also have made it harder for activists to win board control or elect all nominees on a large minority slate. While the sample size is small, shareholders have elected at least one activist nominee in 67% of proxy fights that went to a vote since the universal proxy rules were adopted, up from 40% of proxy fights that went the distance last proxy season. In addition, the frequency of “clean sweeps” by either the company or the activist (which would be expected to occur more frequently in the prior “all or nothing” regime) dropped relative to last year (87% in 2022 vs. 67% in 2023, including one situation this year where the activist nominees ultimately ran unopposed).

The more things change, the more they stay the same

The results of the first season under universal proxy suggest that the formula for success in engaging with activists and winning proxy contests has not fundamentally changed. Companies that engage in thoughtful crisis preparedness, including by anticipating the most likely attack vectors in a proxy fight, proactively addressing their vulnerabilities (particularly as they relate to board composition), and executing on a clearly articulated strategy focused on maximizing shareholder value, will be best positioned to most effectively engage with an activist, counter any case for change and ultimately achieve success through negotiation or at the ballot box.

Print

Print