Ira T. Kay is a Managing Partner, Mike Kesner is a Partner, and Ed Sim is a Consultant at Pay Governance LLC. This post is based on their Pay Governance memorandum. Related research from the Program on Corporate Governance includes Pay without Performance: The Unfulfilled Promise of Executive Compensation (discussed on the Forum here) by Lucian Bebchuk and Jesse M. Fried.

Does the SEC’s new Pay Versus Performance (PVP) disclosure provide an effective means to evaluate the alignment of pay and performance?

Key Takeaways

Based on our analysis, there are several key takeaways that shareholders and companies may find of interest, including:

- CAP is more fit for purpose than SCT compensation disclosure for evaluating pay for performance.

- A relative rank analysis against a company’s peer group or industry-specific index provides the most useful evaluation of the relationship between CAP and company performance.

- The number of situations where a company’s compensation percentile rank significantly exceeds its TSR percentile rank drops dramatically when actual performance is considered when calculating compensation.

- Significant differentials in relative TSR and CAP rank may help identify competitive deficits/surpluses in total pay opportunities, competitive discrepancies with incentive design features, potential issues with performance metric rigor or alignment with shareholder value, etc.

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank) required that companies disclose the relationship of PVP and granted the SEC wide discretion in promulgating the required disclosure. At the time, Congress acknowledged that the current disclosure rules, which included the Compensation, Discussion, and Analysis (CD&A) and Summary Compensation Table (SCT), did not provide shareholders with a sufficient understanding of the relationship of compensation and performance. While the CD&A and SCT provided better visibility to the rationale for — and components of — compensation, they did not illustrate the relationship between the pay decisions made in the reporting year with the subsequent performance of the organization.

The introduction of the PVP disclosure provides a more multidimensional view of pay relative to performance as it incorporates the impact of stock price and performance on equity awards in measuring compensation. At this point in the 2023 proxy season, thousands of companies have filed their proxy statements and spent countless hours preparing the new PVP disclosure, and many are now asking the question, “Does the SEC’s new PVP disclosure provide an effective means to evaluate the alignment of pay and performance?”

Based on Pay Governance’s analysis of 188 S&P 500 company PVP disclosures, the answer is Yes.

Various organizations and articles have utilized the newly required PVP disclosures in different ways, but many concluded that compensation actually paid (CAP) and total shareholder return (TSR) are aligned.

While this was nearly a foregone conclusion given the large emphasis on stock-based compensation for executives, it should reassure shareholders that their strong support for Say on Pay over the last 13 years was well founded. In that sense, one could argue that the PVP disclosures were successful, and we certainly agree that CAP is much better than Summary Compensation Table Total Compensation (SCT compensation) when evaluating the alignment of pay and performance. What remains to be seen is whether and how Compensation Committees, shareholders, and proxy advisory firms incorporate the PVP disclosures when evaluating pay and performance.

Establishing the Approach: Using PVP and Company Performance to Determine Level of Pay and Performance Alignment

Prior to the introduction of the PVP disclosure requirement, SCT compensation has been the primary measure of compensation used by many investors, academics, the media, and, importantly, proxy advisory firms to evaluate the alignment of pay and performance, in part because the data was most readily available. However, SCT compensation is based on the Grant Date Fair Value of equity awards which means equity awards are not adjusted for changes in stock price and/or actual performance. This is in contrast with an outcomes-based valuation of equity awards, such as CAP, which reflects the change in value of equity awards until the vest date. As a result, SCT compensation is not ideal for evaluating the relationship of pay and performance, as it provides a view into the accounting value of equity awards but not the actual performance-adjusted value of those awards, which is critically important when measuring pay for performance.

Based on our analysis, CAP is better for alignment evaluation purposes than SCT compensation to facilitate a meaningful evaluation of the alignment of pay with performance if a comparison of the relative amount of a company’s CAP is compared to its relative performance against an appropriate peer set.

While CAP amounts may be distorted (e.g., by the inclusion of equity awards granted prior to the performance period, use of the Black-Scholes value of stock options rather than the in-the-money value of such awards, and exclusion of cash long-term incentive plans until the year the award is earned, among others), they reflect the actual or best estimate of the value of equity at the time of disclosure versus the accounting value of equity at the time of grant. Further, the use of relative percentile comparisons against a peer index or peer group can remove some of the noise in these data.

To demonstrate how to analyze pay and performance using the PVP disclosures, the following approach was utilized:

- Compared a company’s percentile ranking of cumulative CAP and cumulative TSR against companies in their 2digit GICS® Sector.

- Included only companies with revenue between the 25th and 75th percentiles to eliminate the potential effect of exceptionally large or small companies in the analysis.

- Used cumulative figures over a 3- and eventually 5-year period to minimize the impact of outliers, transitions, and other CAP anomalies.

Assessing the relative positioning of CAP and performance using percentile rankings against a relevant peer or industry group demonstrates if a particular company’s pay and performance alignment is commensurate, better, or worse than peers. This type of relative analysis is consistent with how Pay Governance typically evaluates Realizable Pay and performance alignment for our clients. For additional valid methodologies for evaluating and confirming the alignment of pay and performance, see our Viewpoints, Demonstrating Pay and Performance Alignment: A Comparison of Compensation Actually Paid and Realizable Pay and What Shareholders Can Learn from the SEC’s New Pay Versus Performance Disclosure, which compare, respectively, changes in CAP to changes in TSR and key differences between CAP and Realizable Pay.

Analysis

SCT Compensation

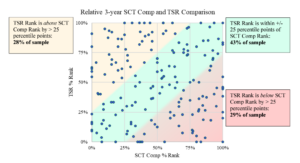

Figure 1 below is based on 188 S&P 500 companies and plots each one based on their difference in percentile ranking of 3-year cumulative TSR and 3-year cumulative SCT compensation. The three-shaded areas represent companies where relative TSR performance and SCT compensation percentile ranking are within 25 percentile points (green zone), TSR percentile ranking exceeds SCT compensation ranking by > 25 percentile points (yellow zone), and TSR percentile ranking is below SCT compensation ranking by > 25 percentile points (red zone).

- As shown, only 43% of the companies have a TSR rank that is within +/- 25 percentile points of the SCT compensation rank (green zone), which suggests a minority of companies have aligned pay and performance.

- The remaining 57% of the companies fall in the yellow or red zones, where the TSR rank either exceeds or is lower than the SCT compensation rank by > 25 percentile points, signaling a possible disconnect between pay and performance.

- The correlation between TSR rank and SCT compensation rank is low (0.08). This is a strong indication that using SCT compensation for evaluating pay for performance has limited utility.

Figure 1: Relative 3-year Cumulative SCT compensation versus 3-year Cumulative TSR (N=188 S&P 500 Companies) [1]

When the same analysis is performed using CAP rather than SCT compensation, the alignment of pay and performance improves dramatically as observed in prior Viewpoints and as shown in Figure 2 below.

- The percentage of companies in the green zone increases from 43% to 66%. This model significantly reduces the number of “false negatives” by 43 companies, as SCT compensation is not aligned to stock price changes, but CAP is clearly aligned.

- Correlation between TSR rank and CAP rank is high (0.54).

Figure 2: Relative 3-year Cumulative CAP versus 3-year Cumulative TSR (N = 188 S&P 500 Companies)

Figure 3 below focuses on the change in pay for performance alignment for the 28 companies in the Industrials sector using SCT compensation and CAP.

- The chart on the left (3a) shows the comparison of SCT compensation and TSR; the distribution is random, and correlation is low as observed in Figure 1.

- The chart in the middle (3b) shows how compensation percentile changes when using CAP instead of SCT compensation; arrows show the directional shift in SCT compensation rank to CAP rank.

- The circled observation at the top of the middle chart highlights an Industrials Sector company in the sample with the highest relative TSR and SCT compensation at the 44th percentile, suggesting a misalignment of pay and performance. When CAP is used, the percentile ranking of TSR and CAP are both at the 100th percentile (highest performer provided the highest compensation), thus squarely in the green zone.

- The circled observation at the bottom of the middle chart highlights an Industrials Sector company in the sample with the lowest relative TSR and SCT compensation at the 56th percentile (red zone). When CAP is used, the percentile ranking for CAP is reduced to the 22nd percentile, which is far more aligned with the company’s TSR rank and is squarely in the green zone.

- The chart on the right (3c) shows the strong alignment of CAP and TSR among the Industrials Sector companies.

- Overall, when using CAP instead of SCT compensation, 7 of the 28 observations (25%) move from outside the green zone (+/- 25 percentile points) to inside the green zone, while only 1 moves from inside the green zone to outside.

- The total percentage of Industrials Sector companies in the green zone is 68% compared to 46% if using SCT.

- 5 of the 28 observations (18%) do not change, meaning compensation percentile rank using SCT compensation and CAP are the same.

Figure 3: Illustrative Industry Sector Analysis of Relative 3-year Cumulative SCT compensation/CAP versus 3-year Cumulative TSR (N = 28 S&P 500 Companies in the Industrials Sector)

Table 1 below shows the distribution of compensation and TSR rank by Sector within the three zones of alignment: yellow zone where TSR rank exceeds compensation rank by > 25 percentile points, green zone where TSR rank is within +/- 25 percentile points of compensation rank, and red zone where TSR is below compensation rank by > 25 percentile points.

The percentage of companies identified in the red zone, where TSR is less than compensation rank by > 25 percentile points, decreases for all Sectors except Communication Services, which is likely due to the small sample size of seven companies.

A key takeaway of Table 1 for investors and others is the number of situations where a company’s compensation percentile rank significantly exceeds its TSR percentile rank (red zone) drops dramatically when actual performance is considered in calculating compensation.

Table 1: Industry Sector Analysis of Relative TSR and CAP/SCT compensation Alignment

Conclusion, Implications and Considerations

A relative analysis of cumulative CAP and TSR against a company’s peer group or industry sector can provide a more meaningful evaluation of pay and performance than comparing SCT compensation and TSR (or other industry specific performance measures).

- For companies in the yellow zone, where TSR rank exceeds CAP rank by > 25 percentile points, it may signal:

- Pay opportunities/targets are low relative to peers • Performance targets are more difficult than peers

- Incentive plans are less leveraged than peers

- TSR is performing better than incentive plan metrics

Companies in the yellow zone may want to further investigate the apparent pay for performance disconnect to ensure the company is not at a competitive disadvantage in retaining executive talent.

For companies in the red zone, where CAP exceeds TSR rank by > 25 percentile points, there may be several explanations, including:

- Pay opportunities/targets may be high relative to peers

- Pay mix may place less emphasis on equity incentives relative to peers

- Performance targets may be less rigorous than peers

- Incentive plans may be more leveraged than peers

- Actual performance against incentive plan metrics/incentive goals is not translating to share price performance

Companies in the red zone may also want to further investigate the apparent disconnect to ensure the company’s pay levels and incentive plan design are appropriately rewarding their executive talent.

Endnotes

1This study includes data provided to us by ESGAUGE of 389 S&P 500 companies that filed PVP disclosures as of May 31, 2023. The sample was divided into 11 industry sectors, which were further refined by removing companies with revenues in the bottom and top quartiles within each sector. Results of the full sample were consistent with the data utilized by the presented figures and tables.(go back)

Print

Print