Julie Daum is Leader, North American Boards Practice, at Spencer Stuart, and Kira Ciccarelli is a Lead Research Specialist at the Diligent Institute. This post is based on a report by Ms. Daum, Ms. Ciccarelli, Jason Baumgarten, and Dottie Schindlinger. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) and Will Corporations Deliver Value to All Stakeholders? (discussed on the Forum here) both by Lucian A. Bebchuk and Roberto Tallarita; Stakeholder Capitalism in the Time of COVID (discussed on the Forum here) by Lucian Bebchuk, Kobi Kastiel, Roberto Tallarita; and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock (discussed on the Forum here) by Leo E. Strine, Jr.

Is ESG still a priority or is it losing momentum?

In the last year, we’ve seen watershed moments in the world of ESG. In Europe, there has been added pressure on companies to tighten and enhance their approach to sustainability more broadly, without relying on the blanket term “ESG.” Meanwhile, in the United States, high-profile and divisive backlash has made some companies and leaders fearful to even use the term ESG. This begs the question: is ESG still a priority, has it lost momentum in the boardroom or does it just depend on where you are in the world?

In 2022, our inaugural survey and report set out to understand how boards were structuring oversight of ESG and how companies were pivoting to address these issues. In light of how rapidly the financial and ESG climate has changed over the last year and with new insights from a much larger, more global sample of board members, this updated edition aims to shed additional light on the following:

- Organizational approach: How are directors and companies thinking about, managing and overseeing ESG issues, and how has this changed in the last year? What are the biggest obstacles?

- Boardroom action: How often do boards discuss and evaluate progress on ESG goals? What actions are boards taking in light of current or upcoming regulatory changes, and where do they need better insight?

- Strategy & future state: Where are environmental and social metrics incorporated? What are the benefits? How could things change in the next few years?

- Oversight structures: Where does ESG oversight sit within the board? On committees? How are these structures changing?

- Regional distinctions: Are there differences by geography?

Methodology

Diligent Institute and Spencer Stuart surveyed 992 board members from April 13 to May 3, 2023, spanning public/listed, pre-IPO and other private companies across industries. [1] U.S.-based companies account for a little less than half of the respondents (44%); about one-third (34%) represent companies based in the European Union or the U.K. (hereafter referred to as “Europe”); and the remainder represent companies based elsewhere across the globe. A full demographic breakdown can be found in the Appendix.

This post contains global analysis as well as regional breakdowns comparing responses from U.S.-based company directors and Europe-based company directors. Additionally, this report contains insights from Diligent Compensation and Governance Intel [2] and the Diligent Institute Corporate Sentiment Tracker [3] to further contextualize the survey results. For each chart, totals may not sum to 100% due to rounding.

Key Findings

ESG still top of mind for corporate leaders

To contextualize our survey findings, we wanted to learn more about how corporate leaders (C-suite level or higher) are speaking about ESG issues publicly and globally using Diligent Institute’s Corporate Sentiment Tracker.

Looking back a year ago to spring 2022, the Sentiment Tracker recorded 4,394 articles in which corporate leaders from 302 companies spoke about the term “ESG” in the month of May. Over this one-year period, the lowest count was recorded in December 2022, when the ESG article count was 3,624 from 183 companies.

In March 2023, the number of ESG articles peaked strongly, with a count of 5,624 ESG-related articles from 324 companies.

Which specific ESG-related topic areas are being discussed the most frequently? The Tracker categorizes topics based on the World Economic Forum’s International Business Council (IBC) ESG metrics outlined in their whitepaper: “Measuring Stakeholder Capitalism: Towards Common Metrics and Consistent Reporting of Sustainable Value Creation.” The topics include related terms grouped together for better analysis.

In the last year, the top ESG-related topics discussed by corporate leaders in the news are economic risk, emerging technology risk (as it relates to risk oversight and ethical considerations) and renewable energy.

Some of the terms driving discussions of economic risk include “inflation,” “recession,” “higher costs” and “cost of living.” For example, the Corporate Sentiment Tracker recorded and analyzed nearly 13,000 stories about inflation in the last year from 1,000 companies.

Meanwhile, emerging technology risk became the biggest driver of ESG-related articles beginning in February 2023, and this has continued throughout the year to date due to ethical and business considerations around AI.

Risk vs. reward: How are companies approaching ESG issues?

Do companies think of ESG in terms of risk or opportunity?

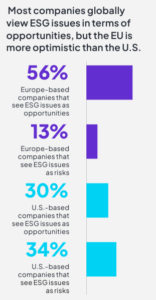

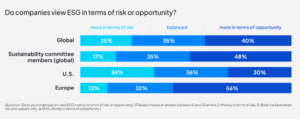

We asked respondents whether their companies view ESG issues mostly in terms of risk or opportunity on a 10-point scale, with 0 being mostly in terms of risk and 10 being mostly in terms of opportunity. Across the board, 5 is the most frequently selected single answer, with 35% of directors saying their companies take a balanced view of ESG in terms of both risk and opportunity. Forty percent of respondents globally selected answers in the 6–10 range, indicating that they view ESG more in terms of opportunity.

European directors are far more likely to focus on opportunity compared to their U.S. counterparts (with 56% selecting 6–10 responses compared to 30%). Conversely, U.S. directors are more likely to indicate that their organizations view ESG issues in terms of risk compared with their European counterparts (34% compared to 13%).

When we look at U.S. respondents who are members of sustainability/ESG committees, the results are similar to those of Europe: about 48% say that their organizations view ESG more in terms of opportunity.

Are companies leading with high ambition on ESG?

We asked our respondents to best characterize their organization’s approach and ambition on ESG issues. Globally, the most popular response is that our respondents’ organizations have effective leadership and high ambition across both environmental and social issues.

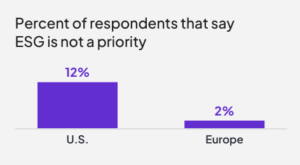

In the U.S., 25% of directors choose this option, a vastly smaller percentage than the 50% of directors who do in Europe. More U.S. directors indicate that they are keeping up with expectations and disclosures at 36%. U.S. directors are also slightly more likely to prioritize the social side of ESG than the environmental, or to indicate that ESG is not a priority.

European directors, meanwhile, are more likely to indicate a prioritization of environmental issues, while only 2% indicate that ESG is slowing down because of other priorities or that ESG issues are not a priority.

What are the biggest obstacles companies are facing with ESG?

What are the biggest obstacles to ESG strategy integration, according to directors? A little more than a quarter (27%) globally say that there are no obstacles. However, the biggest obstacles cited by others are: 1) lack of clarity around what ESG means for the company and 2) competing business or strategic interests, both at 22%.

On the other hand, few respondents cite public backlash (2%), lack of desire to pursue ESG initiatives (2%) or ESG not being a priority (7%) as major concerns.

In Europe, only 2% of our respondents say that ESG is not a priority, while this number is 12% among U.S. respondents. Respondents who indicated that ESG is not a priority were more likely to say their organization views ESG in terms of risk versus opportunity. They averaged 3 on our 10-point risk-to-opportunity scale (versus the balanced global average of 5.4)

Adapting to local markets

Are companies adapting their ESG strategies to local markets? Globally, directors are split: 37% try to strike a balance — maintaining core features of their ESG metrics across markets while adapting to local specifics — while 35% adopt the same strategy across markets.

U.S. directors are more likely than Europeans to indicate that they are still figuring this out. In Europe, directors are more likely to indicate that their companies adopt the same strategy across markets.

Looking at market capitalization, smaller companies are more likely to still be figuring out how to adapt their ESG strategy to local markets, if at all, compared to their larger counterparts. Companies with less than 1.9 billion USD in market cap are also more evenly spread between options, whereas larger companies (with 2 billion USD or larger market cap) have largely coalesced around either adopting the same strategy consistently across markets or striking a balance.

Questions for your board and management team

- How does our organization view ESG issues — in terms of risk or opportunity?

- Are we facing obstacles when it comes to ESG integration? What are those obstacles and how can we overcome them?

- What does our ESG profile look like internationally? Do we need to re-evaluate how we execute our strategy outside of where we’re headquartered?

Navigating ESG in the boardroom

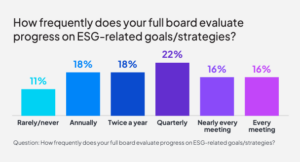

How often do boards evaluate progress on ESG goals?

Globally, the spread is fairly even — from rarely or never to at every meeting — indicating that there is no “one-size-fitsall” approach. In the U.S., directors are more likely to indicate discussing progress twice a year or annually, while more European directors chose quarterly, at nearly every meeting or at every meeting. The bottom line: European boards seem, on average, to be discussing progress on ESG goals more frequently, which suggests a higher level of engagement on these issues.

Discussing ESG issues in board meetings

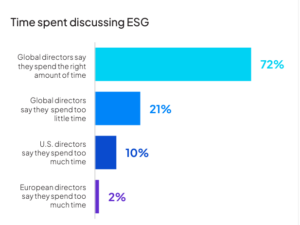

Do directors think they spend the right amount of time discussing ESG in the boardroom? The answer was largely yes, at 72%. This trend holds true for both U.S. and European directors, according to our results.

In Europe, a smaller percentage of directors indicate that their board spends “too much time” on this issue compared to the U.S., at 2% compared to 10%.

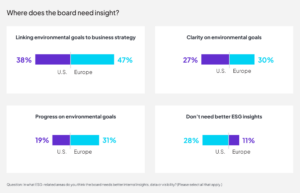

Board action around ESG regulation

How are boards responding to recent ESG legislation and regulation, and how are they preparing for more to come? In general, directors are focusing on disclosures. More than half (60%) are taking extra care to ensure that the company’s ESG strategy is adequately reflected in annual reports and filings, or that they are enhancing the company’s current ESG disclosures (53%). Additionally, 38% are looking to install ESG-monitoring solutions at the board level.

In terms of upskilling the board:

- 29% are engaging in educational programs.

- 24% are bringing in external consultants.

- 10% are looking to appoint new directors with ESG backgrounds.

In the U.S., fewer boards are taking action in response to legislation compared to boards of companies in Europe, where the Corporate Sustainability Reporting Directive (CSRD) has already begun its rollout. Whatever type of action was listed in our survey, a higher percentage of European directors indicate that they are doing it. While 14% of U.S. directors say they aren’t taking any action, only 2% of European directors say the same. And while U.S. directors were more likely to report that their companies view ESG in terms of risk, they were less likely than European directors to say their boards are conducting scenario planning around ESG risks (12% compared to 33%).

How many current directors have sustainability backgrounds?

Globally, 10% of respondents say their boards are looking to appoint new directors with ESG expertise, yet finding current directors with a professional background in sustainability is rare. Currently, less than one percent (0.8%) of 110,000 directors across 7,226 public companies globally have a professional background in sustainability, according to data from Diligent Compensation and Governance Intel.

Given growing scrutiny in this area, boards may have to make sure they have access  to the expertise they need to properly oversee ESG given their organization’s particular context — location, industry, size — and what issues are most material based on that context.

to the expertise they need to properly oversee ESG given their organization’s particular context — location, industry, size — and what issues are most material based on that context.

In our board work at Spencer Stuart, we find that recruiting CEOs, CFOs and other leaders to boards who have been effective leaders in businesses that have made real progress in capturing opportunities for sustainability or addressing risk effectively can be equally or more effective than recruiting a functional expert. Boards can also consult climate scientists and experts, engage in director education on these issues or bring in directors who have overseen company transformations in ESG-related areas. The question each board may need to answer is, do you need an ESG expert on the board, or is raising the level of ESG fluency across the whole board sufficient?

Questions for your board and management team

- How do current, upcoming and proposed ESG regulatory changes impact your organization, including the board specifically? What can the board be doing to upskill or otherwise prepare?

- How can you avoid “ESG burnout” — among the board, management and the company at large?

- What solutions could your organization be using to get better, more focused insights on material ESG issues across the organization?

How are boards connecting ESG to corporate strategy?

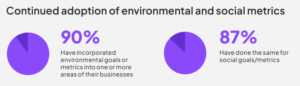

Incorporating environmental metrics or goals

Globally, companies are incorporating environmental and social metrics/goals into many different areas of the business. On the environmental side, nearly two-thirds (63%) of respondents report working on carbon footprint reduction efforts, including making new decisions around their company’s physical locations and business travel policies. Half of respondents are now incorporating environmental metrics into facilities/operations decisions.

Meanwhile, only 38% are incorporating environmental metrics into supply chain strategy, and only 33% consider environmental metrics in evaluations of third-party vendors.

Across the board, European companies seem to be integrating environmental metrics into more areas of the business compared to the U.S. In our survey, 18% of U.S. respondents say they are not incorporating environmental metrics into any of the areas listed. By comparison, nearly 90% of European respondents said their companies are incorporating environmental metrics into their carbon footprint reduction plans (compared to 47% in the U.S.), and more than half are incorporating these metrics into supply chain strategy, facilities/operations decisions, third-party vendor evaluations and into their companies’ strategic plans more broadly.

Incorporating social metrics or goals

Many respondents report incorporating social metrics in the areas of employee and executive training, evaluation and compensation, and in director training and evaluation. However, only 30% of respondents globally say they incorporate social metrics when evaluating and choosing vendors.

This finding holds partly true across the U.S. and Europe, with both regions incorporating social metrics into the areas of employee and executive training, evaluation and compensation, and director training and evaluation at similar rates. However, European directors report higher rates of social metric inclusion in other areas compared to the U.S. Meanwhile, 18% of U.S. directors report no inclusion of social metrics, compared with only 6% of European respondents.

ESG and stock performance

Given that many companies are incorporating environmental and social goals across the business, do public company directors believe that this process has led to better performance of their stock? Globally, nearly half of public company directors answer no. In the U.S., the majority of directors reject the idea that ESG metrics lead to improved stock price (61%), while European directors are more split on the issue.

For those who answer “no,” nearly half indicate that investors care more about a company’s financial metrics than its ESG results. Another 27% say a combination of all the options listed are at play — including that ESG metrics are different across jurisdictions and companies, and that investors are unsure how to value a company based on ESG metrics.

ESG and security valuation

Relatedly, ESG metrics are not yet used as a direct input in conventional security valuation models. Do directors think ESG metrics should be included in securities valuation? Globally, more than half (57%) say yes. In the U.S., this percentage is only 42%, compared to 73% in Europe. This could indicate a desire on the part of European directors for investors to recognize and reward progress on ESG goals.

Where do directors see their companies’ ESG efforts headed?

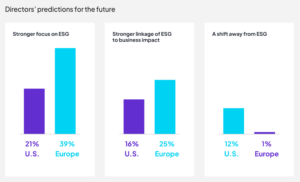

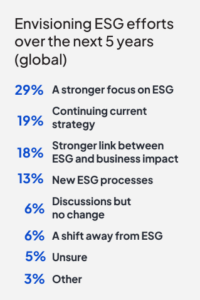

Globally, 29% of surveyed directors predict a stronger focus on ESG objectives in the next five years. Another 19% predict a continuation of current efforts around ESG, and a similar number (18%) predict a stronger linkage between ESG and business impact. This could indicate a willingness on the part of many boards to go full steam ahead on ESG, and a belief that these issues are not going away from the board agenda anytime soon, but that they will remain integrated with company strategy and become more concrete over time.

issues are not going away from the board agenda anytime soon, but that they will remain integrated with company strategy and become more concrete over time.

In Europe, a higher percentage predict a stronger focus on ESG compared to the U.S., at 39% compared to 21%. Meanwhile, 32% of U.S. directors predict either a continuation of their current strategy and goals or a shift away from ESG to focus on other business

priorities, compared with just 13% of European directors. In fact, less than 1% of European directors predict a shift away from ESG in the coming years.

Questions for your board and management team

- Do you have a good understanding of how the organization’s ESG goals align with the broader strategy, mission, values and purpose? Can you clearly articulate that connection to shareholders and other stakeholders?

- Does the board have a clear understanding of the organization’s ESG trajectory? Are those goals realistic?

ESG board oversight structures

How is ESG oversight evolving in boardrooms?

We were also keen to learn more about whether board oversight structures around ESG had been changed in the last year. About a third of our respondents say yes (30%) with the remaining two-thirds (65%) saying no. In the U.S., these numbers are 23% and 71%, respectively. Meanwhile, in Europe, far more boards have changed their oversight structures in the last year, at 41%.

The most common way in which boards have changed their oversight  structures in the last year is increased discussion about ESG in the boardroom (29%). About 27% of our respondents globally indicate that their board created a new committee or subcommittee to oversee one or more ESG issues, while 19% report formalizing ESG oversight in governing documents, including committee charters.

structures in the last year is increased discussion about ESG in the boardroom (29%). About 27% of our respondents globally indicate that their board created a new committee or subcommittee to oversee one or more ESG issues, while 19% report formalizing ESG oversight in governing documents, including committee charters.

In Europe, directors are again far more likely to have created a new committee and to have increased ESG discussion compared with the U.S. Meanwhile, the U.S. is more likely to have formalized ESG oversight in governing documents and to have kept ESG oversight within traditional board committees — either by renaming an existing committee to better oversee one or more ESG issues or by moving oversight responsibilities from one committee to another.

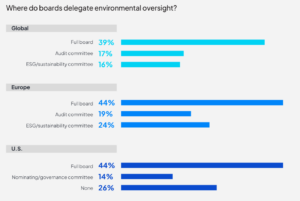

Who takes responsibility for broad ESG oversight?

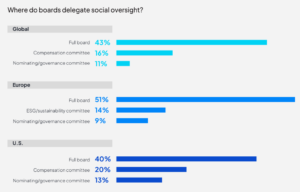

The oversight of ESG is now firmly falling on the shoulders of the full board, according to nearly half our survey respondents (49%). This trend holds for the U.S. and Europe, at 45% and 55%, respectively. Only 18% of our global sample give ESG oversight responsibility to an ESG/sustainability committee. Even fewer (15%) relegate ESG oversight to the nominating/governance committee.

There are some regional differences worth noting. European boards are more likely to assign oversight responsibility to an ESG/sustainability committee compared to U.S. boards, at 31% versus 8%. U.S. boards are more likely to give oversight responsibility to the nominating/governance committee, at 27% compared with 3% in Europe.

How many companies globally have ESG-related committees?

According to data from Diligent Compensation and Governance Intel, as of May 2023, 46% of the companies in our global sample of about 6,500 public companies have at least one ESG-related board committee. This includes ESG committees, sustainability committees, DE&I committees and any other committee relating to a specific ESG issue area.

Why aren’t more boards dedicating ESG oversight to an ESG or sustainability committee, if they have one? One answer may be that while the ESG/sustainability committee (or other committees) deals with specialized issues and tracks progress on ESG goals, the full board still has final or predominant oversight. Also, some boards divvy up ESG responsibilities to existing board committees, preferring not to create additional committees.

Who oversees social issues at the board level?

For social issues, oversight is a bit more spread out among the committees beyond the majority of boards who delegate social oversight to the full board. In the U.S., oversight of various social issues falls to the nominating/governance committee, compensation committee and audit committee, if not the full board. For Europe, the full board is again in first place by a wider margin, with the ESG/sustainability committee being used for social oversight more so than in the U.S.

Who oversees governance issues related to ESG at the board level?

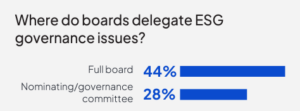

For governance issues related to ESG, the full board is once again the most common choice for oversight globally, in the U.S. and in Europe, followed by the nominating/governance committee.

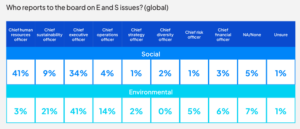

Who reports to the board on environmental and

social issues?

For environmental issues, responsibilities seem more distributed across a broader set of C-suite stakeholders — with a wider variety reporting up to the board outside the chief executive officer, including the chief financial officer, chief operating officer, chief sustainability officer and chief risk officer. For social issues, reporting responsibilities fall broadly on the CEO or chief human resources officer.

In Europe, the chief sustainability officer is more likely to report to the board for both environmental and social issues compared to the U.S.

In Europe, the chief sustainability officer is more likely to report to the board for both environmental and social issues compared to the U.S.

C-suite ESG responsibility — it takes a village

It is clear that organizations often use a primary member of the C-suite to report to the board on ESG issues. In our work at Spencer Stuart, however, we’re seeing more and more collaboration required across the whole C-suite on these issues given the related complexities and intersections with other areas — finance, risk, etc. This is an area to keep an eye on as the picture continues to evolve.

A recent Spencer Stuart survey of chief sustainability officers found that while they interact with the board much less frequently than do other parts of the business, the ease of interaction with the board is on a par with that of other parts of the business.

Download the complete report here.

Endnotes

1Please note that these responses may or may not be from 992 unique companies. We did not ask respondents to list the name of the company they based their answers on.(go back)

2Diligent Compensation and Governance Intel is a Diligent proprietary database containing information from public company filings.(go back)

3The Corporate Sentiment Tracker is an AI-powered tool that analyzes what topics corporate leaders are speaking about in the news (English-language sources only). The Corporate Sentiment Tracker is powered by Manzama, a Diligent brand.(go back)

Print

Print