Mary Ann Deignan is Head of Capital Markets Advisory, and Rich Thomas and Kathryn Night are Managing Directors in the Capital Markets Advisory group at Lazard. This post is based on a Lazard memorandum by Ms. Deignan, Mr. Thomas, Ms. Night, Leah Friedman and Pavan Surabhi. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian A. Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); Dancing with Activists by Lucian A. Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here); and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System (discussed on the Forum here) by Frankl and Kushner Leo E. Strine, Jr.

A review of five-and-a-half years of shareholder activism campaign data reveals important (but often overlooked) observations about this increasingly popular investment approach, used broadly by hedge funds and other investors to influence how U.S. corporations are managed. Specifically, since 2018, the market has reacted positively to new activist situations, with attractive short-term share price outperformance, but relatively few activists have been able to sustain market-beating performance throughout the first year following a campaign launch. In other words, not all activists are the alpha generators that they are made to seem, and the majority do not deliver on their campaign promises of outperformance beyond an immediate “pop.”

Our empirical review included campaigns waged between 2018 and H1 2023 at U.S. companies with market capitalizations greater than $500 million at the time of campaign announcement. We measured total shareholder return (TSR) versus the S&P 500 over one week and one year as proxies for short term and long-term excess return generation. We split the activists into different groups, and then compared performance across institutions with different investing or behavioral profiles. The groups are: Leading Activist Hedge Funds, Other Activist Hedge Funds, ESG-Focused Activists, Long Only Institutions and Episodic Activists (i.e., individuals, private equity funds, family offices).

Short Term Performance

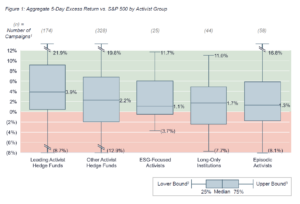

Figure 1 reveals that all activist fund groups generated median 5 day outperformance, despite each group having some meaningful short term underperformers. The Leading Activist Hedge Funds group realized the best short term performance, measured across medians and the 25th through 75th percentiles. Other activist groups delivered less attractive performance across their target universes, but the majority of targets also beat the market in the 5 day period.

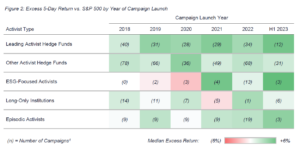

Figure 2 shows that the market has consistently rewarded the Leading and Other Activist Hedge Fund targets with market beating median returns, but has been more discriminating with other groups’ activist behavior, until recently. The small number of campaigns from ESG Focused Activists in 2019 and 2020 underperformed the market and Long Only Institutions and Episodic Activists saw mixed results from 2018 to 2021. Since 2022, all activist groups have generated median 5 day returns exceeding the S&P 500. In general, Figure 2 upholds the popular image of activists: in the very short run, they generate excess returns, on average.

Long Term Performance

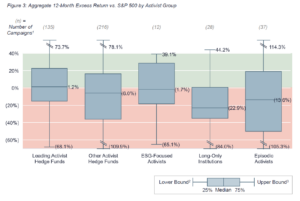

The empirical validity of the narrative around the alpha generating power of activism changes when evaluating 12 month data, though, highlighting the challenges of activism as a driver of sustainable outperformance versus the market. Figure 3 reveals that after 12 months, all activist groups generated wider distributions of excess returns, but only the Leading Activist Hedge Fund group saw median outperformance relative to the market.

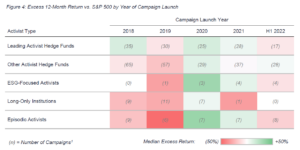

Figure 4 further exhibits the challenges of generating sustainable market beating returns with activist strategies, as no group consistently outperforms the market over the first 12 months of a campaign. Leading Activist Hedge Funds again have the best track record, with median outperformance in 2018, 2020 and 2021. Vintage year 2019 was challenging for all groups, likely reflecting the negative selection of laggards and event stocks that were the frequent targets of shareholder activism in the volatile markets of early 2020. Moreover, despite the robust levels of activism activity in 2022, the strategy did not pay off for investors in the subsequent 12 month period.

Key Takeaways

The returns activists generate for their own funds benefit from their ability to accumulate positions discreetly, hedge risk, and mix and match exposure through common stock and derivatives. The overall results for the companies targeted are more nuanced, though, with short term positive excess returns often fading to mixed or negative results over a one year horizon. Only a small group of leading activists can generate positive excess returns over a one year window. The conclusion is that activists are certainly not always right, and management teams and boards should be confident challenging the notion that activism is always good for the public shareholder.

Endnotes

1Number of campaigns waged against U.S. companies since 2018 for which 5 day returns are available.(go back)

2Lower bound represents the greater of the minimum value or Quartile 1 1.5 * (Quartile 3 Quartile 1).(go back)

3Upper bound represents the lesser of the maximum value or Quartile 3 + 1.5 * (Quartile 3 Quartile 1).(go back)

Print

Print