Ronald O. Mueller, Elizabeth A. Ising and Thomas J. Kim are Partners at Gibson, Dunn & Crutcher LLP. This post is based on a Gibson Dunn memorandum by Mr. Mueller, Ms. Ising, Mr. KIm, Lori Zyskowski, Julia Lapitskaya and Geoffrey Walter.

This post provides an overview of shareholder proposals submitted to public companies during the 2023 proxy season, [1] including statistics and notable decisions from the staff (the “Staff”) of the Securities and Exchange Commission (the “SEC”) on no-action requests. [2]

I. Summary of Top Shareholder Proposal Takeaways From the 2023 Proxy Season

As discussed in further detail below, based on the results of the 2023 proxy season, there are several key takeaways to consider for the coming year:

- Shareholder proposal submissions rose yet again. For the third year in a row, the number of proposals submitted increased. In 2023, the number of proposals increased by 2% to 889— the highest number of shareholder proposal submissions since 2016.

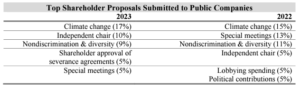

- The number of executive compensation proposals significantly increased, along with a continued increase in environmental and social proposals. Executive compensation proposals increased notably, up 108% from 2022, with the increase largely attributable to proposals seeking shareholder approval of certain executive severance agreements. The number of both environmental and social proposals also increased, up 11% and 3% respectively, compared to 2022 and 68% and 24% respectively, compared to 2021. In contrast, governance proposals declined 14%, and civic engagement proposals declined 6%. The five most popular proposal topics in 2023, representing 43% of all shareholder proposal submissions, were (i) climate change, (ii) independent chair, (iii) nondiscrimination and diversity-related, (iv) shareholder approval of certain severance agreements, and (v) special meetings. Of the five most popular topics in 2023, all but one (shareholder approval of certain severance agreements replacing lobbying spending and political contributions) were also in the top five in 2022.

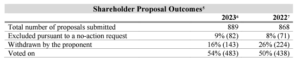

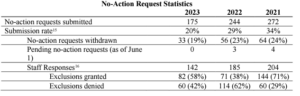

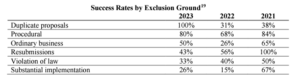

- While the number of no-action requests dropped significantly, the percentage of proposals excluded pursuant to a no-action request rebounded from 2022’s historic low. Only 175 no-action requests were submitted to the Staff in 2023, representing a submission rate of 20%, down from a submission rate of 29% in 2022 and 34% in 2021. The overall success rate for no-action requests, after plummeting to only 38% in 2022, rebounded to 58% in 2023, but was still well below the 71% success rate in 2021, and marked the second lowest success rate since 2012. Success rates in 2023 improved for duplicate proposals (100% in 2023, up from 31% in 2022), procedural (80% in 2023, up from 68% in 2022), ordinary business (50% in 2023, up from 26% in 2022), and substantial implementation grounds (26% in 2023, up from with 15% in 2022), while success rates declined for resubmissions (43% in 2023, compared with 56% in 2022) and violation of law (33% in 2023, compared with 40% in 2022).

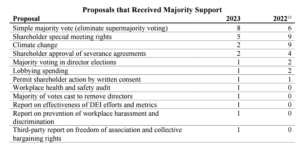

- The number of proposals voted on increased yet again, but overall voting support decreased significantly, and less than 3% of proposals submitted received majority support. In 2023, over 54% of all proposals submitted were voted on, compared with 50% of submitted proposals voted on in 2022. Despite this increase, average support for all shareholder proposals plummeted to 23.3% in 2023, down from 30.4% in 2022. The decrease in average support was primarily driven by decreased support for both social and environmental proposals, with support for social (non-environmental) proposals decreasing to 17.2% in 2023 from 23.2% in 2022 and support for environmental proposals decreasing to 21.3% in 2023 from 33.8% in 2022. And in line with lower support overall, only 25 shareholder proposals received majority support in 2023, down from 55 in 2022.

- More change is in store for the shareholder proposal process, as the SEC considers further amendments to Rule 14a-8, Congress homes in on reform of Rule 14a-8, and stakeholders challenge the SEC’s role in the process. In July 2022, the SEC proposed amendments to Rule 14a-8 that, if adopted, would make it significantly more challenging for companies to exclude shareholder proposals on substantial implementation, duplication, and resubmission grounds. The SEC targeted approval of these amendments by October 2023, which means the 2024 proxy season could see further changes in how companies approach no-action requests. Additionally, the Financial Services Committee of the U.S. House of Representatives recently formed a Republican ESG Working Group, which has identified reforming the Rule 14a-8 no-action request process as a key priority of the Working Group’s focus on reforming the proxy voting system for retail investors. And, as discussed below, legal action by two stakeholder groups, the National Center for Public Policy Research and the National Association of Manufacturers, could disrupt the shareholder proposal process altogether.

- Proponents’ use of exempt solicitations grows again, and now others are joining the game. Exempt solicitation filings continued to proliferate, with the number of filings reaching a record high again this year and increasing almost 22% over last year and 64% compared to 2021. As in prior years, the vast majority of exempt solicitations filed in 2023 were filed by shareholder proponents on a voluntary basis—i.e., outside of the intended scope of the SEC’s rules—in order to draw attention and publicity to pending shareholder proposals. Interestingly, third parties have begun intervening in the shareholder proposal process by using exempt solicitation filings to provide their views on shareholder proposals submitted by unaffiliated shareholder proponents.

II. Overview of Shareholder Proposal Outcomes

A. Overview of Shareholder Proposals Submitted

According to the available data, shareholders submitted 889 shareholder proposals during the 2023 proxy season, up 2% from 868 in 2022—marking the third consecutive year of increased submissions and the highest number of shareholder proposal submissions since 2016. The table below shows key year-over-year submission trends across five broad categories [3] of shareholder proposals in 2023—governance, social, environmental, civic engagement, and executive compensation. As in 2022, social and environmental proposals combined represented over 50% of all proposals submitted (55% in 2023, up from 53% in 2022), with social proposals representing 33% of all proposals submitted. This was followed by governance proposals (24%), environmental proposals (21%), civic engagement proposals (11%), executive compensation proposals (8%), and other proposals (2%).

[4]The table below shows that four of the five most common proposal topics during the 2023 proxy season were the same as those in the 2022 proxy season, with proposals requesting boards seek shareholder approval of certain severance agreements joining the top five in 2023 and lobbying spending and political contributions proposals leaving the top five. A significant decrease in the number of special meeting proposals drove down the concentration of the top five proposal topics, which collectively represented 45% of all shareholder proposals submitted in 2023, down from 49% in 2022.

B. Overview of Shareholder Proposal Outcomes

As shown in the table below, the 2023 proxy season saw both new and continued trends in proposal outcomes that emerged in the 2022 proxy season: (i) the percentage of proposals voted on increased moderately from 2022 (54% in 2023 compared to 50% in 2022), but overall support declined by over seven percentage points (23.3% in 2023 compared to 30.4% in 2022); (ii) the percentage of proposals excluded through a no-action request increased slightly in 2023 (9% in 2023 compared to 8% in 2022); and (iii) the percentage of proposals withdrawn decreased significantly to 16% in 2023 compared to 26% in 2022.

Social and environmental proposals both continued to see decreased withdrawal rates in 2023, with 20% of social proposals withdrawn (compared to 30% in 2022) and 32% of environmental proposals withdrawn (compared to 51% in 2022). These significant drops in withdrawal rates may reflect, among other factors, the impact of Staff Legal Bulletin No. 14L (Nov. 3, 2021) (“SLB 14L”) on the viability of no-action requests in 2022, leading shareholders to demand more robust commitments from companies in exchange for withdrawal. The percentage of withdrawn governance proposals (4%) dropped (down from 9% in 2022, but almost level with 5% in 2021), reflecting the fact that certain individuals, who are the main proponents of many governance proposals, generally are disinclined to withdraw their proposals, even when a company has substantially implemented the request.

Voting results. Shareholder proposals voted on during the 2023 proxy season averaged support of 23.3%, down significantly from 30.4% in 2022. Notably, looking at just environmental proposals, average support decreased significantly to 21.3%, compared to 33.3% support in 2022. Consistent with the trend we saw in 2022 and as discussed below, the lower support for climate change proposals appears to be driven by an increase in more prescriptive proposals which have received lower support from institutional investors. Similarly, support for social (non-environmental) proposals decreased to 17.2% in 2023 from 23.2% in 2022, likely for the same reason. Average support for governance proposals decreased to 31.1% from 36.7% in 2022. Of particular note, 62 of the 483 proposals that were voted on during the 2023 proxy season received less than 5% shareholder support, the lowest resubmission threshold under Rule 14a-8(i)(12)—up from 47 proposals that received less than 5% support in 2022 and consistent with the overall decline in shareholder support.

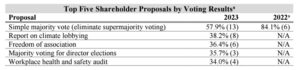

Four of the top five shareholder proposals by average shareholder support in 2023 were different from those reported in 2022. As in prior years, corporate governance proposals received generally high levels of support. The table below shows the five shareholder proposal topics voted on at least three times that received the highest average support in 2023.

Majority-supported proposals. As of June 1, 2023, only 25 proposals (less than 3% of the 889 proposals submitted) received majority support, as compared with 55 proposals (or 6% of the 868 proposals submitted in 2022) that had received majority support as of June 1, 2022. Notably, after several consecutive years of growth in the number of majority-supported climate change proposals, only two climate change proposals received majority support in 2023, including one proposal that the company supported. This is in contrast to nine majority supported climate change proposals in each of 2022 and 2021, and four in 2020. Despite the sharp decline in majority-supported proposals in 2023, there were a few noteworthy proposals that received majority support, including a proposal requesting the commission of a third-party assessment of the company’s commitment to freedom of association and collective bargaining rights [10] and two human capital management proposals—the first requesting a report on the effectiveness of the company’s diversity, equity and inclusion (“DEI”) efforts and metrics [11] and the second requesting a report on the company’s efforts to prevent workplace harassment and discrimination. [12]

Governance proposals accounted for 64% of proposals that received majority support in 2023 (compared with 38% in 2022). While governance proposals have consistently ranked among the highest number of majority-supported proposals, the steep decline in the number of climate related shareholder proposals receiving majority support resulted in a much narrower range of majority-supported proposals than in recent years. Environmental and social proposals together represented 24% of majority-supported proposals, while 8% of majority-supported proposals related to executive compensation, each of which related to requesting that boards seek shareholder approval of certain severance agreements. As of June 1, 2023, only one civic engagement proposal received majority support. The table below shows the proposals that received majority support.

[13]III. Shareholder Proposal No-Action Requests

A. Overview of No-Action Requests

Submission and withdrawal rates. The number of shareholder proposals challenged in noaction requests submitted to the Staff during the 2023 proxy season again decreased significantly, down 28% compared to 2022 and down 35% compared to 2021, likely reflecting lower success rates in 2022. [14]

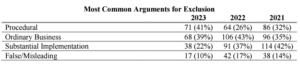

Most common arguments. The below table, reflecting the number of no-action requests that contained each type of argument, reveals a change in the most-argued grounds for exclusion from ordinary business in 2022 to procedural in 2023. As in recent years, ordinary business and substantial implementation continued to be the most argued substantive grounds for exclusion.

Success rates. This year, the Staff granted approximately 58% of no-action requests, a significant increase over the 38% success rate in 2022, though still significantly below the 71% success rate in 2021 and the 70% success rate in 2020. Consistent with 2022, the Staff most often granted no-action requests based on procedural (representing 48% of successful requests), ordinary business (representing 34% of successful requests), and substantial implementation (representing 9% of successful requests) grounds. Notably, no-action requests based on these three grounds together accounted for over 90% of successful requests in 2023 compared to 77% of successful requests in 2022, evidencing a narrower concentration of the grounds on which successful requests were granted. While the success rate for substantial implementation arguments for environmental proposals increased to 20% (up from 6% in 2022), only one such request was actually successful, [17] and the increase is instead attributable to there being a smaller number of total requests for exclusion on substantial implementation grounds. No social proposals were successfully excluded on substantial implementation grounds, a continuation of the downward trend noted in 2022, where 3% of social proposals were successfully excluded on substantial implementation grounds. Meanwhile, the high success rate for proposals seeking exclusion on duplicate proposal grounds was driven by the overall decrease in no-action requests seeking exclusion on this basis—in 2023 only eight no-action requests sought exclusion on duplicate proposal grounds, [18] down from 23 in 2022.

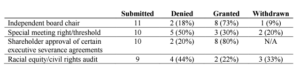

[19]Top proposals challenged. This year, the most common proposals for which companies submitted no-action requests (on both procedural and substantive grounds) were those requesting a policy requiring an independent board chair, amendments to the company’s governing documents to expand and/or lower the threshold for special meetings, a policy requiring the board to seek shareholder approval of certain executive severance arrangements, and audits related to racial equity or civil rights issues.

The no-action requests related to independent board chair proposals made the following arguments: procedural (7), duplicate proposal (2), vague or false/misleading (1), substantial implementation (1), and resubmission (1). The successful requests were granted on the following grounds: procedural (4), duplicate proposal (2), substantial implementation (1), and resubmission (1).

The no-action requests related to special meeting proposals made the following arguments: procedural (6), vague or false/misleading (3), violation of law (2), absence of power/authority (1), and substantial implementation (1). Two of the successful requests were granted on procedural grounds, and one was granted on substantial implementation grounds. The no-action requests related to shareholder approval of certain executive severance agreements made the following arguments: procedural (8), ordinary business (1), and substantial implementation (1). Seven of the successful requests were granted on procedural grounds, and one was granted on ordinary business grounds. The no-action requests related to racial equity and civil rights audits made the following arguments: procedural (6), resubmission (2), and substantial implementation (1). The two successful requests were both granted on procedural grounds.

B. Key No-Action Request Developments

There were a number of noteworthy procedural and substantive developments in no-action decisions this year.

1. Success Rates Rose, but Submissions Declined

This season saw a rebound in the success rates of no-action requests, with the Staff granting relief to approximately 58% of no-action requests, a significant increase over the 38% success rate in 2022, but still well below the 71% success rate in 2021. This rise in success rates can be attributed in part to a decline in overall no-action requests submitted (175 in 2023, compared to 244 in 2022), with companies being more reluctant to challenge proposals given last year’s low success rate. This decrease in submissions was driven in part by a marked decrease in submission of no-action requests related to environmental (21 in 2023, compared to 38 in 2022) and social (61 in 2023, compared to 92 in 2022) proposals.

The overall decline in submissions was also driven in part by companies declining to submit noaction requests arguing for exclusion on substantive bases that appear to be increasingly disfavored by the Staff. For example, during this season no proposals were successfully excluded under three key substantive bases—Rule 14a-8(i)(1), which permits the exclusion of proposals that are improper under state law; Rule 14a-8(i)(3), which permits exclusion if the proposal or supporting statement is false or misleading or otherwise in violation of proxy roles; and Rule 14a-8(i)(6), which permits the exclusion of proposals where the company would lack the power or authority to implement the proposal. Similarly, there were only three no-action requests submitted this season that argued for exclusion under the economic relevance exclusion in Rule 14a-8(i)(5) and none were successful. The Staff under Chair Clayton sought to revitalize the economic relevance exclusion in 2017 through the issuance of Staff Legal Bulletin No. 14I (Nov. 1, 2017), but that guidance was subsequently rescinded by SLB 14L. Finally, the number of no-action requests arguing for exclusion on the basis of substantial implementation under Rule 14a-8(i)(10) dropped dramatically in 2023 (only 38 in 2023, compared to 91 in 2022). While the success rate for substantial implementation rebounded modestly from 2022 (26% in 2023, compared to 15% in 2022), it continued to be well below recent years.

2. Continued Implications of SLB 14L on No-Action Requests

As discussed in our 2022 client alert, [20] in November 2021, the Staff issued SLB 14L, [21] which rescinded certain Staff guidance and reversed prior no-action decisions, upending the Staff’s recent approach to the application of the economic relevance exclusion in Rule 14a-8(i)(5) and the ordinary business and micromanagement exclusions in Rule 14a-8(i)(7). SLB 14L rejected a more recent company-specific approach to significance and expressed the Staff’s current view that the analytical focus should be on whether the proposal raises issues with a broad societal impact such that they transcend the company’s ordinary business and whether the proposal raises issues of broad social or ethical concern when interpreting economic relevance. Moreover, SLB 14L rejected the Staff’s long-standing position requiring a sufficient nexus between a proposal and the social concern raised in the proposal. [22] SLB 14L also changed the Staff’s approach on assessing micromanagement, focusing on the granularity sought by a proposal and the extent to which a proposal limits company or board discretion rather than the prior focus on whether a proposal included requests for specific detail, timeframes, or targets.

The position taken by the Staff in SLB 14L appears to have led to an overall decline during the 2022 and 2023 seasons in the number of no-action requests arguing ordinary business grounds under Rule 14a-8(i)(5) and Rule 14a-8(i)(7). For the second year in a row, no proposals were excluded during the 2023 season under Rule 14a-8(i)(5). The 2023 season saw a continued decline in the number of no-action requests arguing ordinary business grounds under Rule 14a8(i)(7), likely due to SLB 14L. In total, 58 no-action requests, or 6.5% of all proposals, challenged proposals on ordinary business grounds in 2023 (excluding those making only a micromanagement argument), with a success rate of 45%. By comparison, 95 no-action requests, or 11% of all proposals, challenged proposals on ordinary business grounds in 2022 (excluding those making only a micromanagement argument), with a success rate of 26%, and 87 no-action requests challenged proposals on ordinary business grounds in 2021, with a success rate of 64%. This drastic change in success rates for ordinary business arguments between 2021 and 2022 was likely the result of the Staff’s abandonment of the traditional company-specific approach to significance. Instead, under SLB 14L, the Staff is focused on whether a proposal raises issues with a broad societal impact, without regard to any connection between those issues and a company’s business operations. Moreover, the Staff has demonstrated increased willingness to recognize more topics as transcending ordinary business.

The number of shareholder proposals excluded on ordinary business grounds rebounded from the historically low success rate in 2022. Notably, the increase in success rates appears to be attributable in part to the fact that some proponents, apparently emboldened by their success in 2022 and the Staff’s unwillingness to grant exclusion on the grounds of ordinary business, submitted proposals that addressed matters that have traditionally been viewed as clearly relating to ordinary business. It remains to be seen whether the Staff has recalibrated its evaluation of ordinary business arguments and whether proponents will return to submitting only those types of proposals that the Staff has refused to exclude since SLB 14L.

3. Resurrection of Micromanagement

SLB 14L impacted the Staff’s approach on assessing micromanagement during the 2022 season: companies submitted 45 no-action requests arguing for exclusion on micromanagement grounds, and the Staff only granted two of those requests on that basis, representing a success rate of 8%. In contrast, the 2023 season saw a significant increase in the success of no-action requests on micromanagement grounds, with companies submitting 41 no-action requests arguing for exclusion on micromanagement grounds as at least one basis for exclusion, and the Staff granting eight of those requests on that basis, representing a success rate of 31%. [23] The rise in the success rate of micromanagement arguments is partially attributable to the fact that proponents are increasingly drafting more prescriptive proposals. Successfully excluded proposals spanned different categories of proposals, including those related to GHG emissions and climate change, death benefits for senior executives, corporate charitable contributions and pilot participation in a program to mitigate risks of forced labor in a company’s supply chain.

4. Effects of 14a-8 Amendments on No-Action Requests

As discussed in our 2022 client alert, in September 2020, the SEC adopted amendments (the “Amended Rules”) to key aspects of the SEC’s shareholder proposal rule. The 2023 proxy season was only the second season following the application of the Amended Rules.

Among other changes, the Amended Rules increased the resubmission thresholds in Rule 14a-8(i)(12), which permits exclusion of a proposal if a similar proposal was last included in the proxy materials within the preceding three years and if the last time it was included it received: less than 5% support, if proposed once within the last five years (increased from 3%); less than 15% support, if proposed twice within the last five years (increased from 6%); or less than 25% support, if proposed three or more times within the last five years (increased from 10%). During the 2023 proxy season, only three proposals were successfully excluded under Rule 14a-8(i)(12) for failure to receive a sufficient level of support, [24] compared to five such successful exclusions in 2022 and one such successful exclusion in 2021. Notably, however, none of the three proposals excluded under Rule 14a-8(i)(12) in 2023 would have been excluded under the lower resubmission thresholds of the prior rules.

The Amended Rules also require each proponent to affirmatively state that the proponent is available to meet with the company, either in person or via teleconference, between 10 and 30 calendar days after the submission of the shareholder proposal, and each proponent must provide the company with contact information, as well as specific business days and times that the proponent is available to meet with the company to discuss the proposal. In eight instances this season, compared to three instances in 2022, the Staff concurred with the exclusion of proposals where proponents did not provide such a statement of engagement availability. Notably, in two instances, as discussed below, the Staff also noted that the “[p]roponent has not provided sufficient proof of email delivery,” and in one instance, the Staff noted that the proponent had not demonstrated, “solely by providing its asset manager’s contact information, that it is ‘apparent and self-evident’ that the asset manager has authority to engage with the [c]ompany for purposes of Rule 14a-8(b)(1)(iii).” [25]

5. Noteworthy Procedural Challenges

This season saw the Staff address numerous procedural challenges. Notable challenges include:

- Sufficient proof of email delivery must be provided. As noted above, in two instances this season, companies challenged proposals under Rule 14a-8(f) where a proponent’s representative did not provide a statement of engagement availability, as required under Rule 14a-8(b)(1)(iii). [26] In both instances, the company timely notified the representative of the deficiency, but received no response curing the defect. Immediately after the submission of both no-action requests, the representative sent to each company and the Staff photographs of emails that were purportedly timely sent, without forwarding the purported emails. The Staff granted exclusion in both instances, noting that the “[p]roponent has not provided sufficient proof of email delivery” and referencing SLB 14L, which provides that “[i]f a shareholder uses email to respond to a company’s deficiency notice, the burden is on the shareholder or representative to use an appropriate email address (e.g., an email address provided by the company, or the email address of the counsel who sent the deficiency notice), and we encourage them to seek confirmation of receipt.”

- Procedural exclusion may be granted in unique instances, despite deficient company notices. In one instance this season, [27] the Staff granted the exclusion of a proposal under Rule 14a-8(f) where the proponent failed to establish the requisite eligibility to submit the proposal as required under Rule 14a-8(b)(1)(i), while at the same time criticizing the company’s deficiency notice notifying the proponent of the defect. The proposal, which was received by the company via FedEx, only contained the P.O. box address of the proponent’s trust and no other contact information. The company mailed a timely deficiency notice to the proponent at the P.O. box address provided and received no response curing the deficiency. Following the submission of the no-action request seeking exclusion, the proponent alerted both the company and the Staff that he had not included other contact information in his submission materials for security purposes and did not regularly check the P.O. box address included in the materials, and, as a result, missed the deficiency notice sent by the company. The Staff granted exclusion of the proposal, noting that although “the [c]ompany’s Rule 14a-8(f) notice was deficient in numerous respects, the [c]ompany did notify the [p]roponent of the problem – using the only method of contact that the [p]roponent provided.” The Staff found that because the proponent did not check the singular method of contact provided until after the deadline for responding to the deficiency notice, the proponent’s failure to remedy the defect “could not have been caused by the inaccuracy and incompleteness of the deficiency notice.”

- Manner of deficiency notice delivery matters. In one instance this season, the Staff indicated in its response to the company’s no-action request that it was unable to concur with exclusion of a proposal because the Staff claimed it was unable to determine if the proponent had timely received the company’s deficiency notice because of the manner in which the company sent the deficiency notice. The deficiency notice was sent via overnight delivery to the proponent at a multi-unit complex, no signature was obtained upon delivery, and the company did not send a copy by email to the proponent.

- Specificity in the wording of deficiency notices. In one instance this season, while the Staff found that a proponent’s submission was deficient under Rule 14a-8(b)(1)(iii) because it did not contain the proponent’s contact information, the Staff denied relief and criticized the company’s deficiency notice, stating that “rather than focusing on the defect, the [c]ompany’s deficiency notice asserted that the Rule 14a-8(b)(1)(iii) statement already provided was wholly inadequate because it came from the [p]roponent’s representative instead of from the [p]roponent.” The Staff also noted that a proponent’s representative may send this information on behalf of a proponent.

6. Third Party Attempts to Intervene in No-Action Request Process

While stakeholder activism has historically focused on the submission of shareholder proposals, the past several years have demonstrated the increasing politicization of the shareholder proposal process. And the 2023 proxy season marked a notable development in the evolution of stakeholder activism in this process—in at least one instance this season, a third party sought to intervene in the consideration by the Staff of a pending no-action request. The third party, which had no known relationship to the shareholder proponent that submitted the proposal, sent the Staff a response to the no-action request arguing against exclusion of the proposal. In its response to the third party’s letter, the company argued that allowing third parties to intervene in the no-action process is inconsistent with Rule 14a-8, would increase the administrative burdens on companies and shareholder proponents as well as place additional pressure on the Staff’s resources, would encourage submissions by a multitude of third parties whose interests may not be aligned with those of shareholders (or even the shareholder proponent), and would inappropriately turn the no-action request process into a forum for public policy debates. The Staff ultimately concurred with the exclusion of the proposal for reasons unrelated to the attempted third-party intervention and did not include the third party’s correspondence in the file posted on the SEC website with the company’s no-action request.

IV. Key Shareholder Proposal Topics During the 2023 Proxy Season

A. Human Capital and Social Proposals

Proposals focused on nondiscrimination and diversity constituted the largest subcategory (representing 26%) of social proposals submitted in 2023. These proposals were largely focused on racial equity and civil rights, DEI efforts, and gender and racial pay equity. While many social proposals in 2023 were tied to race and equality issues, proposals focused on reproductive rights and human rights assessments gained momentum. The 2023 proxy season also saw a significant rise in social proposals directly challenging the traditional ESG consensus. These ESG-skeptic social proposals included proposals requesting that companies, among other things, roll back plans to undertake a racial equity audit, conduct a cost/benefit analysis of DEI programs, conduct a racial equity and “return to merit” audit, and report on risks of supporting reproductive rights.

1. Racial Equity/Civil Rights Audit and Nondiscrimination Proposals

In 2023, there were 55 shareholder proposals that addressed issues of racial equity and civil rights, including workplace discrimination, audits of workplace practices and policies, and related topics, compared to 51 similar proposals submitted in 2022 and 38 in 2021.

The most frequent type of these proposals were 32 proposals calling for a racial equity or civil rights audit analyzing each company’s impacts on the “civil rights of company stakeholders” or “civil rights, diversity, equity, and inclusion.” Similar to prior years, these proposals often included the required or optional use of a third party to conduct the audit, with input to be solicited from employees, customers, civil rights organizations, and other stakeholders. These proposals were primarily submitted by the Service Employees International Union, with other filers including the New York State Comptroller (on behalf of the New York State Common Retirement Fund), Trillium Asset Management, and As You Sow. Fourteen of these proposals went to a vote, with ISS generally recommending votes “against” the proposal and average support of 22.4%, down from 21 such proposals that went to a vote in 2022, with average support of 45.3%. Four companies unsuccessfully sought to exclude a racial equity/civil rights audit proposal, arguing for exclusion on ordinary business, resubmission, substantial implementation, violation of law, vagueness or false/misleading, or procedural grounds.

The remaining 23 proposals related to workplace nondiscrimination, including requests to report on the prevention of workplace harassment and discrimination, eliminating discrimination through inclusive hiring, and requests to commission a non-discrimination audit analyzing the impacts of the company’s DEI policies on “civil rights, non-discrimination, and return to merit.” Of these, 13 proposals, including each of the “return to merit” proposals, were ESG-skeptic proposals submitted by the National Center for Public Policy Research (“NCPPR”) and The Bahnsen Family Trust, with supporting statements that focused on concerns about discrimination against “non-diverse” employees or discrimination based on religious and political views. Five companies sought to exclude workplace nondiscrimination proposals, three of which were successful on procedural grounds. [28] The 12 proposals that went to a vote averaged 10.3% support, with ESG-skeptic social proposals garnering an average of only 1.5% support.\

2. Diversity, Equity, and Inclusion Efforts and Metrics

The number of proposals requesting disclosure of DEI data or metrics or reporting on the effectiveness of DEI efforts or programs remained relatively flat, with 35 such proposals submitted in 2023 and 34 submitted in 2022, up from 21 comparable proposals submitted in 2021. Of these, 25 proposals were withdrawn or otherwise not included in the proxy statement and five went to a vote with average support of 29.3%. One proposal received majority support, with 57.3% of votes cast in favor, at Expeditors International of Washington, Inc. Three companies sought exclusion of DEI proposals via no-action request, two of which were withdrawn and one of which was unsuccessful. As in 2022 and 2021, As You Sow was the main driver behind these proposals, submitting or co-filing 27 DEI proposals, 21 of which were withdrawn. Other filers included the New York State Comptroller on behalf of the New York State Common Retirement Fund (submitting two proposals), Amalgamated Bank (submitting three proposals co-filed by As You Sow), and Myra Young (submitting four proposals, three of which were co-filed by As You Sow).

3. Gender/Racial Pay Gap

The number of shareholder proposals calling for a report on the size of a company’s gender and racial pay gap and policies and goals to reduce that gap increased during the 2023 proxy season. In 2023, shareholders submitted 16 proposals (up from nine proposals submitted in 2022), including two resubmissions to companies that received pay gap proposals last year. Six gender/racial pay gap proposals were submitted by Arjuna Capital and 10 were submitted by James McRitchie and/or Myra Young. Average support for these proposals decreased in 2023 as compared to 2022: the nine proposals voted on in 2023 received average support of 31.7% (with none receiving majority support), a significant decrease from average support of 42.6% for the five proposals voted on in 2022 (with two receiving majority support). Six proposals were not included in the company’s proxy statement, with one proposal withdrawn after the company agreed to disclose quantitative median and statistically adjusted pay gaps. Each of these proposals targeted unadjusted pay gaps. In addition, where the company did not already provide adjusted wage gap information for comparable jobs (i.e., what women and ethnic minorities are paid compared to their most directly comparable male and nonminority peers, adjusted for seniority, geography, and other factors), the proposals requested that the company also provide adjusted pay gap disclosure.

4. Reproductive Rights

In the wake of the overturn of Roe v. Wade, a focus area for the 2023 proxy season involved shareholder proposals requesting a report on the effect of reproductive healthcare legislation, including risks from state policies imposing restrictions on reproductive rights (including impacts on employee hiring, retention, and productivity) or on risks related to fulfilling information requests for enforcement of laws criminalizing abortion access. One ESG-skeptic proposal was submitted, requesting a report on risks and costs associated with opposing or altering company policy in response to state policies regulating abortion, with the supporting statement focusing on concerns that the company took a “pro-abortion stance” by opposing prolife legislation and offering employees health coverage for travel costs. The number of reproductive rights proposals increased this season, with 22 such proposals submitted in 2023, up from four comparable proposals submitted in 2022, including three resubmissions to companies that received these proposals last year. The main proponents were Arjuna Capital, Tara Health Foundation, and Change Finance P.B.C. Five companies sought to exclude these proposals, arguing for exclusion on ordinary business, micromanagement, and/or procedural grounds, but three requests were unsuccessful and the remaining two requests were withdrawn. Average support for these proposals decreased in 2023 as compared to 2022: the 11 proposals voted on in 2023 received average support of 10.8% (with none receiving majority support), a significant decrease from average support of 22.3% for the two proposals voted on in 2022.

5. Human Rights

The number of shareholder proposals relating to human rights, including those calling for a report on or an impact assessment of risks of doing business in countries with significant human rights concerns or for an assessment of the human rights impacts of certain products or operations, increased during the 2023 proxy season. In 2023, shareholders submitted 37 human rights proposals (up from 16 proposals submitted in 2022), including seven to companies that received human rights proposals last year. Fourteen of these proposals were ESG-skeptic proposals submitted primarily by the National Legal and Policy Center (“NLPC”) and NCPPR, generally requesting reports on the risk of the company’s operations in China. The 24 human rights proposals voted on received average support of 12.3% overall, with the proposals focused on operations in China receiving average support of 4.9% and the remainder receiving average support of 19.6%. Five companies sought to exclude these proposals via no-action requests, but only one was successful on resubmission grounds; two that argued for exclusion on ordinary business, micromanagement, and vagueness or false/misleading grounds were unsuccessful, and the remaining two were withdrawn.

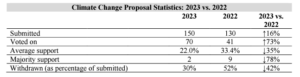

B. Continued Focus on Climate Change and Environmental Proposals

As was the case in 2022, climate change-related proposals were the largest group of environmental shareholder proposals in 2023 by a large margin, representing 80% of all environmental proposals (and 17% of all proposals) submitted. There were 150 climate changerelated proposals submitted in 2023, up from 130 proposals submitted in 2022 and 83 proposals submitted in 2021. This season also saw an increase in the number of environmental and climate change proposals excluded via no-action requests, with 13 excluded during the 2023 season (five were excluded on procedural grounds, one was excluded on substantial implementation grounds, and seven were excluded on ordinary business or micromanagement grounds), and five were excluded during the 2022 season (four were excluded on procedural grounds and one was excluded on substantial implementation grounds). Consistent with the overall rise in the success of ordinary business arguments more generally (as described in Part III above), the rise in environmental and climate change proposals excluded via no-action request can be at least partially attributed to the fact that some proponents have drafted more prescriptive proposals. In 2023, three environmental proposals were excluded as relating to the company’s ordinary business matters, all of which requested that healthcare companies serve plant-based food options in their hospitals, [29] and four climate change proposals were excluded on micromanagement grounds, two seeking detailed information on asset retirement obligations [30] and two seeking implementation of specific accounting methods. [31]

Climate change proposals took various forms, including requesting adoption of GHG emissions reduction targets (usually in alignment with net zero scenarios), disclosure of climate transition plans, disclosures regarding climate-related lobbying, changes to investments in and underwriting policies relating to fossil fuel production projects, and disclosures of risks related to climate change. Of these, the most common were proposals focusing on GHG emissions reductions targets and climate transition plans. Other popular climate change proposals included 17 proposals related to climate lobbying aligned with the Paris Agreement, nine proposals that requested the company phase out underwriting and lending for new fossil fuel exploration and development projects, and six proposals related to stranded carbon assets and asset retirement obligations due to energy companies’ decommissioning of refineries. As with social proposals, there was also a rise in climate change proposals from the ESG-skeptic perspective, including proposals calling for a board committee to analyze risks of committing to decarbonization, reports on the feasibility of achieving the company’s net zero targets, and requests to “rescind” a prior shareholder proposal requesting adoption of Scope 3 emissions reduction targets.

Continuing the trend from 2022, while the number of climate change proposals submitted and voted on increased significantly in 2023 compared to prior years, the average support for these proposals, the number receiving majority support and the withdrawal rates of these proposals are all at their lowest rates in at least three years. Similarly, ISS support for climate change proposals in 2023 decreased significantly, with ISS recommending votes “for” 47% of climate change proposals, down from 61% in 2022. This dramatic shift is likely largely due to the rise of more prescriptive proposals that went to a vote. As opposed to proposals seeking disclosure of company policies and practices related to climate change, these proposals related to specific business decisions that the company should undertake. For example, proposals focused on barring financial and insurance companies from underwriting or lending for new fossil fuel development received average support of 7.2%. By contrast, less prescriptive proposals seeking disclosure of companies’ climate transition plans received average support of 26.9%.

1. Climate Transition Plans

There were 37 shareholder proposals submitted that related to issuing a climate transition report disclosing the company’s GHG emissions reduction targets as well as policies, strategies, and progress made toward achieving those targets. These proposals usually called for long-term GHG emissions targets that cover Scopes 1, 2, and 3 emissions and that are in alignment with a 1.5 degree Celsius net zero scenario and the Science Based Targets initiative, including by asking companies to expand established emissions targets that do not meet these requirements. The supporting statements of these proposals frequently referenced concerns that disclosure of emissions reduction targets is not enough to address climate risk or provide sufficient accountability for achieving those targets and that investors would benefit from increased disclosure regarding the company’s strategies to achieve those targets, including relevant timelines and metrics against which to measure progress. Five climate transition plan proposals focused on the impact of the company’s climate transition strategy on relevant stakeholders under the International Labour Organization’s “just transition” guidelines. Four climate transition proposals targeted financial institutions and called for transition plans to align the company’s financing activities with its GHG emissions reduction targets, citing each company’s membership in the Net Zero Banking Alliance. The primary proponents of these proposals were As You Sow (submitting 19 proposals), Green Century Capital Management (submitting five proposals), and Mercy Investment Services (submitting three proposals). Most of these proposals (a total of 25) were withdrawn or otherwise not included in the company’s proxy statement, with 12 going to a vote, of which nine were voted on as of June 1, 2023, receiving average support of 28.7%.

2. Continued Focus on GHG Emissions

There were 52 proposals submitted related to measuring GHG emissions or adoption of GHG emissions reduction targets, typically in alignment with the Paris Agreement and often timebound and covering all three scopes of emissions. Two of these proposals requested that the company recalculate its GHG emissions baseline to exclude emissions from material divestitures, both of which went to a vote (one after an unsuccessful no-action request arguing for exclusion on multiple proposals grounds), receiving average support of 18.4%. Two GHG emissions proposals were submitted by ESG-skeptic shareholder proponents, with one calling for the company to “rescind” a shareholder proposal to reduce Scope 3 GHG emissions that received majority support in 2021 and another requesting a report on the company’s progress toward and feasibility of achieving net zero emissions by 2025 with a supporting statement that focused on obstacles to achieving net zero and expressed concerns that the company’s net zero targets equate to “a false and misleading promise.” Six companies sought to exclude GHG emissions proposals via no-action request, arguing for exclusion on ordinary business, micromanagement, multiple proposals, and substantial implementation grounds. Two requests were successful, one on procedural grounds and one that involved a proposal that requested that the company “measure and disclose scope 3 GHG emissions from its full value chain” and defined that to include scope 3 emissions of certain customers. The company argued that the proposal sought to micromanage the company by dictating the methodology and scope of activities included in the company’s Scope 3 emissions reporting, thus limiting management’s discretion in this regard. [32] A majority of the emissions-focused proposals (28) were voted on, receiving average support of 24.8%.

3. Other Environmental Proposals

Other popular environmental proposals (not related to climate change) predominantly focused on plastic pollution and sustainable packaging (totaling 14 of the 38 non-climate environmental proposals submitted in 2023), deforestation in supply chains (eight proposals), and other sustainability practices. Five non-climate environmental proposals were excluded via no-action requests: two on procedural grounds, and three on ordinary business grounds (which, as described above, all related to serving plant-based food options in the company’s hospitals). Of the remaining proposals, 17 were withdrawn or otherwise not included in the company’s proxy statement and 11 were voted on (and averaged 17.3% support). Of the 11 proposals voted on so far, six related to plastic use, plastic pollution, or sustainable packaging materials; one related to environmental and health impacts of the company’s operations; one related to deforestation; one related to supply chain water risks; one related to impacts of oil spills; and one related to plant based milk pricing. None of the proposals received majority support, and the highest level of support received were proposals relating to the use of plastics, which received between 25.3% and 36.9% support.

C. A New Governance Topic: Advance Notice Bylaws

A new focus area for the 2023 proxy season involved 28 shareholder proposals requesting that the company amend its bylaws to require shareholder approval for certain advance notice bylaw amendments, including timing of nominations, disclosure requirements for director nominees, and disclosure of nominating shareholders’ affiliates. These proposals were in response to the adoption of changes made by companies to the advance notice provisions in their bylaws following the SEC’s adoption of new universal proxy card rules in November 2021, which became effective in August 2022. [33] In support of these proposals, shareholder proponents expressed concern that certain bylaw amendments would make it burdensome for shareholders to nominate directors. All 28 of these proposals were submitted by John Chevedden’s associates, primarily James McRitchie. Five no-action requests were submitted on this topic, and all were withdrawn. Nine of these proposals were withdrawn or otherwise not included in the company’s proxy statement, and the remaining 19 went to a vote, with those voted on so far garnering average shareholder support of 13.8%. ISS recommended votes “against” all 11 advance notice bylaws proposals that received a recommendation as of June 1, 2023

D. The Return of Independent Board Chair Proposals

Although submissions focusing on governance topics were generally down this season, there was a significant increase in the number of proposals related to policies of separating the roles of chair of the board and CEO, which was the most frequent corporate governance proposal topic in 2023. There were 85 independent board chair proposals submitted this season, up from 50 proposals in 2022. Of the 85 independent board chair proposals submitted, at least 70 were submitted by John Chevedden and/or his associates, including Kenneth Steiner and Myra Young, and nine were submitted by the NLPC, which has historically not focused on the submission of proposals related to governance topics. Six proposals [34] were excluded via no-action requests, two on procedural grounds, [35] two on duplication grounds, [36] one on substantial implementation grounds, [37] and one on resubmission grounds. [38] The remaining 79 proposals were or will be voted on at company annual meetings, compared with only 40 proposals voted on in 2022. The 72 independent board chair proposals voted on so far this year received average shareholder support of 29.8%, in line with 2022 results, with no proposals receiving majority support. Notably, the proposals submitted by the NLPC received average shareholder support of 21.2%, compared to average shareholder support of 30.9% for the remaining proposals.

E. Increase in Proposals Focused on Shareholder Approval of Severance Agreements

Overall, the number of executive compensation shareholder proposals received by companies more than doubled this season. In 2023, 75 proposals focused on executive compensation were submitted, up from 36 proposals in 2022. This increase was largely attributable to the marked increase in proposals seeking shareholder approval of certain executive severance agreements, the most common executive compensation proposal received by companies.

Forty-seven proposals requesting boards seek shareholder approval of severance agreements were submitted in 2023, up markedly from 16 such proposals in 2022. These proposals typically requested that boards seek shareholder approval of any senior manager’s new or renewed pay package that provided for severance or termination payments with an estimated value exceeding a certain multiple (usually 2.99x) of the executive’s base salary and bonus. At least 43 of these 47 proposals were submitted by John Chevedden and/or his associates. Nine companies sought to exclude these proposals via no-action requests, seven of which were successful on procedural grounds. [39] The two remaining companies were denied relief, one arguing for exclusion on procedural grounds and one on substantial implementation grounds. Proposals seeking shareholder approval of severance agreements that went to a vote received average shareholder support of 23.8%, with two proposals receiving majority shareholder support. At numerous companies, voting results were significantly affected by whether companies already had in place or, in response to the proposal, adopted policies addressing key aspects of the proposal.

F. Overall Decline in Civic Engagement Proposals but Congruency Proposals on the Rise

This season saw a decrease in the submission of proposals focusing on civic engagement, with the number of proposals addressing lobbying policies and practices disclosure, political contributions disclosure, and charitable contributions disclosure all declining (a total of 97 civic engagement proposals were submitted in 2023, compared to 106 in 2022). However, proposals focused on the alignment or congruency of a company’s political contributions or lobbying expenditures with the company’s publicly stated values saw an increase this season, with 21 such proposals submitted in 2023, compared to 14 such proposals in 2022.

Many of the new types of civic engagement shareholder proposals this season were ESG-skeptic proposals focused on the company’s political speech or affiliations with certain entities. For example, NCPPR submitted six proposals requesting a report on the congruency of the company’s partnerships with globalist organizations, expressing concerns about the company’s affiliation with particular organizations (such as the World Economic Forum, Council on Foreign Relations, and Business Roundtable) that support stakeholder theory and that have agendas the proponent believes are incongruent with the company’s fiduciary duty to shareholders. Three of these proposals went to a vote with the two voted on so far averaging support of 1.3%, and the remaining proposals were either excluded via no-action requests on procedural grounds or withdrawn. Other new proposals included three proposals submitted by The Bahnsen Family Trust relating to the company’s involvement in “non-core” political issues (two of which were excluded via no-action request on ordinary business grounds and the other was withdrawn) and two proposals submitted by Ridgeline Research’s American Conservative Values ETF requesting that companies encourage senior management to commit to avoiding political speech (both went to a vote with average support of 1.3%).

Overall, civic engagement proposals received average shareholder support of 22.9% in 2023. Thirty-four proposals focused on lobbying were submitted in 2023, compared with 46 proposals in 2022, with the 17 proposals that were voted on receiving average shareholder support of 32.9%, consistent with 33.1% support in 2022. Thirty proposals focused on political spending were submitted in 2023, compared with 36 proposals submitted in 2022, with the 12 proposals voted on receiving average shareholder support of about 20.6% (compared to 26.9% in 2022). Proposals focused on charitable contributions saw the biggest decrease in 2023, with three proposals submitted, compared with 13 in 2022, with the one that went to a vote receiving 7.4% shareholder support (compared to an average of 4.1% in 2022). Twenty-one proposals focused on congruency of political spending or lobbying with company values were submitted in 2023, compared with 14 in 2022, with the 13 voted on receiving average shareholder support of 19.1% (compared to 37.8% in 2022).

Download the complete report here.

Endnotes

1Data on No-Action Requests: For purposes of reporting statistics regarding no-action requests, references to the 2023 proxy season refer to the period between October 1, 2022 and June 1, 2023. Data regarding no-action letter requests and responses was derived from the information available on the SEC’s website.

Data on Shareholder Proposals: Unless otherwise noted, all data on shareholder proposals submitted, withdrawn, and voted on (including proponent data) is derived from Institutional Shareholder Services (“ISS”) publications and the ISS shareholder proposals and voting analytics databases, with only limited additional research and supplementation from additional sources, and generally includes proposals submitted and reported in these databases for the calendar year from January 1 through June 1, 2023, for annual meetings of shareholders at Russell 3000 companies held on or before June 1, 2023. Consistent with last year, the data for proposals withdrawn and voted on includes information reported in these databases for annual meetings of shareholders held through June 1, 2023. References in this alert to proposals “submitted” include shareholder proposals publicly disclosed or evidenced as having been delivered to a company, including those that have been voted on, excluded pursuant to a no-action request, or reported as having been withdrawn by the proponent, and do not include proposals that may have been delivered to a company and subsequently withdrawn without any public disclosure. All shareholder proposal data should be considered approximate. Voting results are reported on a votes-cast basis calculated under Rule 14a-8 (votes for or against) and without regard to whether the company’s voting standards take into account the impact of abstentions.

Where statistics are provided for 2022, the data is for a comparable period in 2022.(go back)

2Gibson, Dunn & Crutcher LLP assisted companies in submitting the shareholder proposal no-action requests discussed in this alert that are marked with an asterisk (*).(go back)

3In recent years, as shareholder proposals increasingly touch on multiple topics that may overlap, the categorization of the specific subject matter of shareholder proposals has become increasingly challenging. Where a shareholder proposal addresses multiple topics, we have categorized the proposal based on what appears to be primary focus of the proposal. We categorize shareholder proposals based on subject matter as follows:

Governance proposals include proposals addressing: (i) independent board chairman; (ii) shareholder special meeting rights; (iii) proxy access; (iv) majority voting for director elections; (v) board declassification; (vi) shareholder written consent; (vii) elimination/reduction of supermajority voting; (viii) director term limits; (ix) stock ownership guidelines; and (x) shareholder approval of bylaw amendments.

Social proposals cover a wide range of issues and include proposals relating to: (i) discrimination and other diversity-related issues (including board diversity and racial equity audits); (ii) employment, employee compensation or workplace issues (including gender/ethnicity pay gap); (iii) board committees on social and environmental issues; (iv) social and environmental qualifications for director nominees; (v) disclosure of board matrices including director nominees’ ideological perspectives; (vi) societal concerns, such as human rights, animal welfare, and reproductive health; and (vii) employment or workplace policies, including the use of concealment clauses, mandatory arbitration, and other employment-related contractual obligations.

Environmental proposals include proposals addressing: (i) climate change (including climate change reporting, climate lobbying, greenhouse gas emissions goals, and climate change risks); (ii) climate transition planning; (iii) plastics, recycling, or sustainable packaging; (iv) renewable energy; (v) environmental impact reports; and (vi) sustainability reporting.

Civic engagement proposals include proposals addressing: (i) political contributions disclosure; (ii) lobbying policies and practices disclosure; and (iii) charitable contributions disclosure.

Executive compensation proposals include proposals addressing: (i) severance and change of control payments; (ii) performance metrics, including the incorporation of sustainability-related goals; (iii) compensation clawback policies; (iv) equity award vesting; (v) executive compensation disclosure; (vi) limitations on executive compensation; and (vii) CEO compensation determinations.(go back)

4Data in this column refers to the percentage increase or decrease in shareholder proposals submitted in 2023 as compared to the number of such proposals submitted in 2022.(go back)

5Excludes proposals that, for other reasons, were reported in the ISS database as having been submitted but that were not in the proxy or were not voted on, including, for example, due to a proposal being withdrawn but not publicized as such or the failure of the proponent to present the proposal at the meeting. As a result, in each year, percentages may not add up to 100%.(go back)

6As of June 1, 2023, ISS reported that 118 proposals (representing 13% of the proposals submitted during the 2023 proxy season) remained pending.(go back)

7As of June 1, 2022, ISS reported that 108 proposals (representing 12% of the proposals submitted during the 2022 proxy season) remained pending.(go back)

8The numbers in the parentheticals indicate the number of times these proposals were voted on.(go back)

9In 2022, the five shareholder proposals voted on at least three times that received the highest average support included board declassification, eliminate/reduce supermajority voting, submit severance agreement to shareholder vote, report on civil rights/racial equity audit, and majority voting for director elections.(go back)

10See Starbucks Corporation’s proxy statement at 81, available here.(go back)

11See Expeditors International of Washington, Inc’s proxy statement at 40, available here.(go back)

12See Wells Fargo & Company’s proxy statement at 115, available here.(go back)

13Indicates the number of similar proposals that received majority support in 2022.(go back)

14Gibson Dunn remains a market leader for handling shareholder proposals and no-action requests during proxy season, having filed approximately 20% of all shareholder proposal no-action requests each proxy season for several years.(go back)

15Submission rates are calculated by dividing the number of no-action requests submitted to the Staff by the total number of proposals reported to have been submitted to companies.(go back)

16Percentages of exclusions granted and denied are calculated by dividing the number of exclusions granted and the number denied, each by the number of Staff responses.(go back)

17Alliant Energy Corp. (avail. Mar. 30, 2023).(go back)

18Of the eight no-action requests that sought exclusion on duplicate proposal grounds, four no-action requests were granted on the basis of duplicate proposals, one no-action request was withdrawn and three no-action requests were granted on alternative grounds without the Staff issuing a decision on the duplicate proposal argument.(go back)

19Success rates are calculated by dividing the number of no-action requests granted on a particular ground by the total number of no-action requests granted or denied on that ground, excluding no-action requests that are withdrawn or granted on an alternative ground.(go back)

22See SLB 14H (Oct. 22, 2015) at n.32 (“Whether the significant policy exception applies depends, in part, on the connection between the significant policy issue and the company’s business operations.”) citing SLB 14E (Oct. 27, 2009) (stating that a proposal generally will not be excludable “as long as a sufficient nexus exists between the nature of the proposal and the company”)).(go back)

23As noted above, success rates are calculated by dividing the number of no-action requests granted on a particular ground by the total number of no-action requests granted or denied on that ground.(go back)

24Chevron Corp. (Unitarian Universalist Association) (avail. Apr. 4, 2023)* (concurring with exclusion under Rule 14a-8(i)(12)(ii) where the similar proposal last received 12.38% of the votes cast, less than the 15% required); CVS Health Corp. (Steiner) (avail. Mar. 28, 2023) (concurring with exclusion under Rule 14a8(i)(12)(iii) where the similar proposal last received 21.53% of the votes cast, less than the 25% required); PNC Financial Services Group, Inc. (avail. Feb. 28, 2023) (concurring with exclusion under Rule 14a-8(i)(12)(iii) where the similar proposal last received 7.69% of the votes cast, less than the 15% required).(go back)

25Chevron Corp. (Meyer Memorial Trust (S)) (avail. Apr. 4, 2023)*(go back)

26 Textron Inc. (avail. Jan. 23, 2023)*; The Allstate Corp. (avail. Jan. 23, 2023).(go back)

27Yum! Brands, Inc. (avail. Mar. 31, 2023).(go back)

28CVS Health Corp. (Baker) (avail. Mar. 28, 2023); The Coca-Cola Co. (avail. Feb. 21, 2023); Deere & Co. (avail. Dec. 5, 2022).(go back)

29UnitedHealth Group Inc. (avail. Mar. 16, 2023); Elevance Health, Inc. (Beyond Investing LLC) (avail. Mar. 6, 2023)*; HCA Healthcare, Inc. (Beyond Investing LLC) (avail. Mar. 6, 2023).(go back)

30Phillips 66 (avail. Mar. 20, 2023)*; Valero Energy Corp. (avail. Mar. 20, 2023).(go back)

31 Amazon.com, Inc. (avail. Apr. 7, 2023, recon. denied Apr. 20, 2023)* (seeking measurement and disclosure of specific activities encompassed in the company’s Scope 3 GHG emissions reporting); Chubb Limited (Green Century Equity Fund) (avail. Mar. 27, 2023) (seeking the phase out of underwriting risks associated with new fossil fuel exploration and development projects as a method for aligning the company’s activities with limiting global temperature rise to 1.5 degrees Celsius).(go back)

32Amazon.com, Inc. (avail. Apr. 7, 2023, recon. denied Apr. 20, 2023)*.(go back)

33For a detailed discussion of the SEC’s universal proxy rules, see SEC Adopts Rules Mandating Use of Universal Proxy Card, Gibson Dunn (Nov. 18, 2021), available here.(go back)

34In one additional instance, the Staff concurred with exclusion of an independent chair proposal on procedural grounds, but the proposal was still included in the company’s proxy statement and voted on. See Laboratory Corp. of America Holdings (Chevedden) (avail. Mar. 22, 2023).(go back)

35The Allstate Corp. (avail. Jan. 23, 2023); Textron Inc. (avail. Jan. 23, 2023)*.(go back)

36PepsiCo, Inc. (avail. Mar. 7, 2023)*; Bank of America Corp. (Steiner) (avail. Jan. 23, 2023)*.(go back)

37Anavex Life Sciences Corp. (avail. May 2, 2023).(go back)

38CVS Health Corp. (Steiner) (avail. Mar. 28, 2023).(go back)

39Rite Aid Corp. (avail. Apr. 12, 2023); AMC Networks Inc. (avail. Apr. 4, 2023); JetBlue Airways Corp. (avail. Jan. 19, 2023); Kohls Corp. (avail. Jan. 12, 2023); The Walt Disney Co. (avail. Dec. 5, 2022); Visa Inc. (avail. Nov. 8, 2022)*; Walgreens Boots Alliance, Inc. (Chevedden) (avail. Nov. 8, 2022)*.(go back)

Print

Print