Melissa Sawyer and Marc Treviño are Partners, and June Hu is an Associate at Sullivan & Cromwell LLP. This post is based on a Sullivan & Cromwell memorandum by Ms. Sawyer, Mr. Treviño, Ms. Hu, H. Rodgin Cohen, and Lauren Boehmke.

A. OVERVIEW OF SHAREHOLDER PROPOSALS

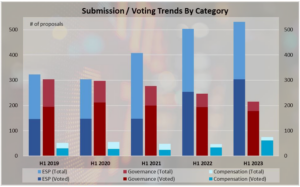

The number of Rule 14a-8 proposals submitted to S&P Composite 1500 companies reached over 800 for the first time in the core proxy season. Compared, however, to the more substantial year-over-year increases in 2022 (9%) and 2021 (12%), the year-over-year [1] increase in the total number of submissions was more modest in H1 2023 (3%). Voted shareholder proposals increased by 13% (543 vs. 481 H1 2022), reflecting recent changes in the SEC’s stance on no-action relief (further discussed in Section H) and a decrease in settlement rate. [2]

Consistent with 2022, proposals on environmental and social/political (“ESP”) topics remained the focus of the proxy season, representing 65% of total submissions (vs. 63% in H1 2022). Notably, the number of voted environmental proposals increased by 57% year over year, and 26% more individual companies— including several companies that did not receive any ESP proposals during the past five years—had at least one ESP proposal reach a vote. The polarization in the dialog on these topics, which is intensifying on the broader national stage, also is reflected in Rule 14a-8 proposals this year. In H1 2023, so-called “anti-ESG” proponents submitted 89 proposals, up 65% from H1 2022 and 256% from 2021. [3]

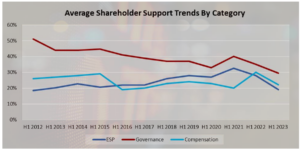

The increase in proposals has been accompanied by record low shareholder support and pass rates. [4] In particular, after enjoying a steady decade-long rise before dropping for the first time last year, average support for ESP proposals further decreased (to 19% vs. 28% in H1 2022 after a record high of 32% in H1 2021). Only 5% of overall and 2% of ESP proposals that went to a vote passed (vs. 12% and 14% in H1 2022). Nonetheless, frequent ESP proponents, such as As You Sow, have indicated that they will not be influenced by the low shareholder support this year and intend to resubmit proposals at companies where votes exceeded the resubmission threshold under Rule 14a-8. [5]

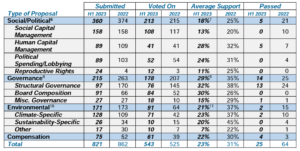

The following table summarizes the Rule 14a-8 shareholder proposals submitted in H1 2023 and full-year 2022, the number voted on, average support rate and the rate at which proposals passed:

B. WHO MAKES SHAREHOLDER PROPOSALS

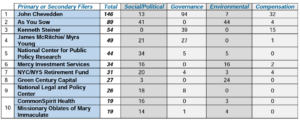

Proposals from a handful of proponents once again accounted for the majority of H1 2023 submissions (see table below). Historically, proposals by frequent proponents have been weighted toward governance. Consistent with the increased representation of social/political proposals over the past three years, this year for the first time social/political proposals submitted by the top 10 proponents outnumbered governance proposals. Some companies received criticism for not including the names of proponents in proxy statements and making it more difficult for other investors to engage with the proponent or understand the proponent’s main policy objectives. The Council of Institutional Investors, for example, approved a policy this proxy season urging companies to include this disclosure and has discussed the potential for a rulemaking change with the SEC (current SEC rules only require companies to provide the proponent’s name to shareholders upon request).

“Anti-ESG” Proponents. The main change in proponent profiles this year was an increase in proposals from “anti-ESG” proponents. For the first time, an “anti-ESG” proponent is represented in the top five proponents and proposals from these proponents accounted for over 10% of overall submissions.

The National Center for Public Policy Research (“NCPPR”), which has been a frequent proponent for many years, and the National Legal and Policy Center (“NLPC”), which became a frequent proponent in 2022, continued to lead in submissions among this group. A significant number of new proponents also were represented in the broader proponent population, including groups like Consumer’s Research and investment entities such as the American Conservative Values ETF. Consistent with 2022, “anti-ESG” proponents remained focused on social/political proposals (73% of their submissions). Most of the remaining proposals were independent chair governance proposals submitted in order to check the decision-making of a purported “rogue CEO” who is motivated by “flawed, personal human opinions.” [12]

Proposals from “anti-ESG” proponents in H1 2023 also diverged in terms of approach. In some cases, these proponents followed the approach we observed in 2022, submitting proposals—such as civil rights audit proposals—that were facially similar to “pro-ESG” proposals. In other cases, however, the proponents highlighted their viewpoints in their resolutions and supporting statements, demanding disclosure on the costs and risks of ESG initiatives (such as support for reproductive health access, decarbonization goals or participation in “globalist organizations” such as the World Economic Forum or Business Roundtable), as well as the rescission of recently adopted ESG measures (such as racial equity audits or Scope 3 reduction targets). Many of these proposals use similar language and focus on similar themes (i.e., materiality, antitrust and the threat to national security posed by limiting the energy industry’s access to capital) as the House Financial Services Committee’s Republican ESG Working Group, which was formed in February 2023 “to combat the threat posed to our free markets by far-left environmental, social, and governance proposals.” [13]

Settlements between companies and “anti-ESG” proponents rarely occurred this year, with 71% of proposals from “anti-ESG” proponents going to a vote and 21% being excluded through the SEC’s no action process. Shareholder support averaged 5% overall and 2% for ESP proposals. No proposals passed. Despite these low results, several “anti-ESG” proponents have signaled that they will continue to submit proposals in the coming years.

Social investment entities. Social investors, including ESG funds and other asset management or advisory institutions with a mandate to make “socially responsible” investments, continued to be the main proponents of ESP proposals. Submissions from As You Sow and Green Century Capital accounted for 40% of all environmental proposals and 12% of all social proposals. Although there was a decline in the number of proposals submitted by the frequent social investor proponents compared to 2022, a larger group of such entities, including new proponents, submitted proposals in H1 2023.

With these proponents in particular, the submission data in this publication does not capture the high level of private engagement between these entities and companies, especially in the 2023 proxy season. For example, As You Sow self-reported that it engaged with 209 companies this proxy season and resolved half of these engagements without needing to formally submit a shareholder proposal. As You Sow also self-reported that it withdrew half of submitted proposals after further engagement with companies. In some cases, especially on climate-related issues, the proponent withdrew (either before or after submitting a shareholder proposal) after learning that the company had a plan deemed sufficiently concrete for accomplishing the measures proposed by the proponent, but warned the company that it would (re)submit a proposal in the future if the planned actions did not occur. In other cases, the proponent decided to withdraw (either before or after submitting a shareholder proposal) because there were company-specific reasons for why a proposed course of action was likely to be inappropriate for the company or unpopular with the broader shareholder base (e.g., strategic or financial issues that were more demanding on management’s time and the company’s resources).

Individuals. John Chevedden, Kenneth Steiner, James McRitchie and Myra Young, individually and as co-filers with other organizations and individuals, submitted 249 proposals, or 30% of all submissions this year. These individuals remained focused on governance issues, with governance proposals comprising 64% of their total submissions. Around 14% of their proposals focused on social issues, largely political spending and lobbying. For the first time, this group also submitted a meaningful number of compensation proposals, almost all of which demanded the submission of certain severance arrangements to a shareholder vote. Several of these severance proposals received relatively high support in 2023, and we expect that this group will submit an increased volume in the 2024 season.

Public Pension Funds. Public pension funds and related entities continued to be among the most prolific proponents on social issues, but the number of proposals they submitted continued to decline year over year. We expect this trend to continue as state and local government scrutiny continues to increase with respect to public pension fiduciaries’ use of ESG-related factors in investment and voting decisions, with at least 20 states having already adopted laws, regulations or policies prohibiting or restricting the use of such factors by pension funds as of July 2023. Consistent with 2022, the New York City and State retirement funds once again submitted the largest number of proposals among public pension funds. In addition to a continued focus on racial equity audits and political spending disclosures, these proponents also sought reports on the prevention of harassment and discrimination in the workplace.

Religious Organizations. Religious organizations submitted at least 80 proposals this year, an increase from the 73 proposals submitted in H1 2022. Many of these organizations were affiliated with the faithbased investor coalition, the Interfaith Center on Corporate Responsibility (ICCR), and they often co-filed proposals. These proponents focused on social topics such as access to food, drugs and healthcare, human rights issues (e.g., use of child labor), political spending and political congruency. These organizations continued to be somewhat willing to negotiate; a third of H1 2023 proposals from these organizations were withdrawn.

Unions. Even though no individual union ranked in the top 10 proponents this year, these organizations (particularly the Service Employees International Union) continued to submit and/or support a meaningful number of proposals this year, primarily proposals on racial equity audits and political spending disclosure. In terms of environmental proposals, the International Brotherhood of Teamsters submitted a handful of “just transition” proposals, which focus on the impact on workers and other stakeholders in different regions and industries who are likely to be left behind in the transition to a low-carbon economy. Consistent with prior years, these organizations rarely settled with companies unless a company agreed to meet their full set of demands.

C. TARGETS OF SHAREHOLDER PROPOSALS

This year, shareholders were asked to vote on Rule 14-8 proposals at 263 individual companies (vs. 233 companies in H1 2022). Once again, many companies also received multiple Rule 14a-8 submissions, with 44 companies receiving five or more proposals (vs. 46 companies in H1 2022) and 10 companies receiving 10 or more proposals (vs. nine companies in H1 2022). ESP shareholder proposals went to a vote at 145 companies (26% more than the number of companies in H1 2022).

Traditionally, large-cap companies have received the vast majority of shareholder proposals and account for almost all Rule 14a-8 proposals that shareholders vote on. [14] This remained the case in H1 2023, with almost 90% of the proposals that reached a vote being at S&P 500 companies. The following graphs show the number of proposals voted on at large-cap companies compared to small- and mid-cap companies. Large-cap companies received a significantly higher number of proposals even though there are twice as many mid- and small-cap companies. A lower percentage (62%) of shareholder proposals went to a vote at small- and mid-cap companies than at large-cap companies (67%), but the voted proposals at small- and mid-cap companies received higher support on average (27% of votes cast) than at large-cap companies (22% of votes cast). “Anti-ESG” proponents submitted all their H1 2023 proposals to companies in the S&P 500. Not counting proposals from “anti-ESG” proponents, shareholder support for proposals at large-cap companies averaged 25% of votes cast.

Download the complete report here.

Endnotes

1Unless otherwise noted, in the tables throughout this publication, we present H1 2023 and full year 2022 data for completeness. However, in the discussion, we generally assess year-over-year changes by comparing H1 2023 and H1 2022 data for consistency.(go back)

2In this publication, we generally refer to proposals withdrawn by the proponent (typically after settlement) and proposals which are not presented by the proponent at the shareholder meeting as “withdrawn” proposals.(go back)

3In this publication, we refer to an entity or individual as an “anti-ESG” proponent if the official website of the proponent states that the entity or individual is boycotting, criticizing or otherwise asking companies to reconsider what the proponent describes as an “ESG” or “woke/liberal” agenda.(go back)

4In this publication, we refer to a proposal as “passing” if it received a majority of votes cast, regardless of whether this is the threshold for shareholder action under state law or the company’s organizational documents.(go back)

5Rule 14a-8(i)(12) currently allows a company to exclude a proposal that addresses “substantially the same subject matter” as a proposal voted on in the previous three years if the most recent vote was less than 5% of votes cast (or 15% if previously voted twice, or 25% if previously voted three or more times). See Section H for more information on proposed amendments to Rule 14a-8(i)(12).(go back)

6Social capital management (“SCM”) proposals relate to corporate impact on stakeholders other than employees and shareholders, and in H1 2023 included 75 proposals on civil rights, human rights and racial justice as well as proposals relating to animal welfare and access to medical products. Human capital management (“HCM”) proposals relate to workforce issues, and in H1 2023 included 54 proposals on workforce diversity, equity and inclusion (“DEI”) and 35 proposals on non-DEI topics such as collective bargaining and freedom of association, paid sick leave policy, and workplace health and safety audits. Even though almost all the reproductive rights proposals could have been included as SCM and/or HCM proposals, we tracked them as a separate category in H1 2023.(go back)

7Social/political proposals submitted by so-called “anti-ESG” proponents received an average of 3% of votes cast (vs. 8% in H1 2022). Not counting these proposals, shareholder support for social/political proposals averaged 22% of votes cast (vs. 29% in H1 2022).(go back)

8Structural governance proposals relate to companies’ defensive profile as outlined in corporate governance documents, and in H1 2023 included 40 special meeting proposals (down from 108 in 2022) and 21 “fair election” proposals that demanded shareholder approval of advance notice bylaw amendments. Board composition proposals in H1 2023 included 84 independent chair proposals. Miscellaneous governance proposals in H1 2023 included proposals requesting a tax transparency report, independent review of the audit committee and company-specific proposals. (go back)

9Governance proposals submitted by “anti-ESG” proponents received an average of 15% of votes cast (vs. 18% in H1 2022). Not counting these proposals, shareholder support for governance proposals averaged 30% of votes cast (vs. 36% in H1 2022).(go back)

10Climate-specific proposals in H1 2023 included 42 related to emissions targets/goals, 31 related to climate transition plans, 17 related to financing activities and 16 related to climate-related political congruency. Sustainability-specific proposals in H1 2023 covered a range of topics from plastic use to deforestation. Other environmental proposals in H1 2023 included seven board oversight proposals, two environmental justice proposals, two general reporting proposals and company-specific proposals (see Section F).(go back)

11Environmental proposals submitted by “anti-ESG” proponents received an average 2% of votes cast (same as H1 2022). Not counting these proposals, shareholder support for environmental proposals averaged 23% of votes cast (vs. 35% in H1 2022).(go back)

12See, e.g., the exempt solicitation notice filed by NLPC at Bank of America, available at https://www.sec.gov/Archives/edgar/data/70858/000109690623000637/nlpc_px14a6g.htm.(go back)

[13]House Financial Services Committee, McHenry Announces Financial Services Committee Republican ESG Working Group (Feb. 3, 2023), available at https://financialservices.house.gov/news/documentsingle.aspx?DocumentID=408533.[/ref]

[14]In this publication, we refer to S&P 500 companies as “large-cap”, the next largest S&P 400 companies as “midcap”, and the next largest S&P 600 companies as “small-cap”.[/ref]

Print

Print