Leah Malone is a Partner and Emily B. Holland is Counsel at Simpson Thacher and Bartlett LLP. This post is based on a Simpson Thacher & Bartlett LLP memorandum by Ms. Malone, Ms. Holland, Martin Bell, Stephen Blake, Karen Hsu Kelley and Alicia Washington. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita; Does Enlightened Shareholder Value add Value (discussed on the Forum here) and Stakeholder Capitalism in the Time of COVID (discussed on the Forum here) both by Lucian Bebchuk, Kobi Kastiel, Roberto Tallarita; Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock (discussed on the Forum here) by Leo E. Strine, Jr.; and Corporate Purpose and Corporate Competition (discussed on the Forum here) by Mark J. Roe.

The backlash against ESG in the United States has been unmistakable in 2023. More than one-third of states have passed anti-ESG laws in 2023, most ESG-related shareholder proposals failed to garner majority support, new lawsuits have been filed challenging companies’ ESG-related activities and decisions, and some companies seem to be distancing themselves from the term “ESG” itself. [1] But despite a heavy stream of opinion pieces, the business case for incorporating non-financial metrics into an evaluation of a company’s risk and opportunity profile (the very crux of ESG efforts) remains clear.

Instead, companies’ on-the-ground approaches to their ESG strategies are evolving in response to recent events. With proxy season complete, the Supreme Court term wrapped, Congress in recess and most state legislatures adjourned, we take stock of the current state of ESG for U.S. companies.

Proxy Season: A Drop in Support for E&S Shareholder Proposals

While shareholders can use engagement tools throughout the year to express their priorities and concerns, the casting of votes during proxy season is when shareholder views have the most acute impact. In recent years, proxy season has catalyzed the focus on ESG issues as many institutional investors made oversight and management of those issues both an engagement priority and a component of their voting policies. In response, public companies have been propelled to make changes. In large numbers, they have increased their voluntary reporting on ESG issues, [2] implemented and amended ESG-related policies, [3] set ESG-related goals and targets (including verified science-based targets), [4] and appointed executives to oversee sustainability efforts. [5]

Support for shareholder proposals has undoubtedly been an important part of this activity. For example, in 2021 a record 36 shareholder proposals relating to environmental and social (“E&S”) issues received majority support. [6] The most successful of these proposals related to issues involving the disclosure of workforce diversity (EEO-1) data, or reports on climate change transition plans, greenhouse gas emissions or targets. Since that time, a growing number of companies have begun disclosing this type of data. [7]

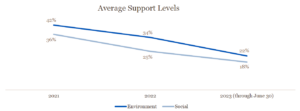

But trends in shareholder proposals have shifted significantly since then. While E&S issues in particular (as opposed to governance-related issues) continue to attract a growing number of proposals, support for these measures declined demonstrably in 2023. Support for environmental proposals in particular fell steeply from 42% in 2021 to just 22% in 2023. Just two of these proposals received majority support, compared to nine in each of 2022 and 2021.

Source: Diligent, 2023 Proxy Season Review available here.

Source: Diligent, 2023 Proxy Season Review available here.

On its surface, these figures indicate a drop in shareholder support for E&S issues. But the numbers also reflect shifts in the types of proposals being submitted, their proponents and voting patterns, and the broader investor sentiment.

- Increased diversity of proposals and proponents. Proponents of prior years’ shareholder proposals relating to E&S issues tended to be fairly uniform in their desire for companies to make additional ESG-related disclosure, or to take steps to preserve social safeguards or advance environmental protection. Since 2021, a growing number of “anti-ESG” proponents have submitted proposals asking companies to pull back on these efforts. That trend has intensified in 2023. [8] These proposals received very low levels of support, contributing to lower average figures.

- More specific, bespoke and prescriptive proposals. As E&S issues advance, many shareholder proposals have moved from general requests for additional reporting to more prescriptive limitations. For example, in 2021 a number of proposals passed at companies including United Airlines and Phillips 66 seeking disclosure of climate-related lobbying efforts. [9] In 2023, environmental-focused proposals were more likely to seek specific emissions targets [10] or the issuance of detailed climate transition [11] reports. Such prescriptive approaches were less likely to garner broad shareholder support.

- Refined voting guidelines. As companies are advancing their practices in many E&S areas, proxy advisors and large institutional investors are refining their voting guidance. For example, proxy advisor ISS recommended votes in favor of just 29% of the proposals for racial and civil equity audits during the 2023 proxy season (compared to 70% in 2022), noting in its revised voting guidelines that its recommendations would take a company’s existing workforce disclosures and diversity, equity and inclusion (“DEI”) practices into account. As companies disclose more information, set targets and make commitments, many shareholders recognize that undertaking additional steps laid out in a shareholder proposal may not be cost-effective to mitigate the risk posed.

A potential looming change to proxy season dynamics may also arrive in the form of voting choice programs. Several large institutional investors have rolled out or are piloting programs designed to pass voting decisions along to their customers, typically through the customer’s selection of a voting policy. Although these programs currently account for a small percentage of those investors’ securities, a substantial increase in their application could make proxy season outcomes and trends less predictable, and could lead to the decline of concentrated voting power.

While this year’s results certainly indicate a shift in how ESG factors into proxy season, it’s also important to note that many large institutional shareholders continue to reiterate their focus on creating and supporting long-term sustainable business practices, as well as strong support for companies’ ESG-related disclosure. Companies, having spent years building ESG and sustainability teams, and enhancing disclosures and setting targets, also largely remain focused on the continued development of and support for these programs.

DEI: A Supreme Court Ruling Sets off Early Reactions

In recent years, companies have significantly expanded their DEI initiatives [12] in response to societal movements like #MeToo, social unrest in the wake of the killing of George Floyd, and stakeholder concern about the role corporations play in perpetuating bias and social inequality. But recent developments, including the Supreme Court’s holding in Students for Fair Admissions, Inc. v. President and Fellows of Harvard College and Students for Fair Admissions v. University of North Carolina et al. (“SFFA”) that the use of race in college admissions processes violates the Equal Protection Clause and Title VI of the Civil Rights Act of 1964 (“Civil Rights Act”), have put these initiatives under a microscope. [13] Debate about the ruling’s implications began almost immediately.

- On the day of the Supreme Court’s ruling, Charlotte Burrows, the Chairperson of the Equal Employment Opportunity Commission (“EEOC”), issued a press release emphasizing that the decision does not implicate employer DEI programs, and stated that “[i]t remains lawful for employers to implement diversity, equity, inclusion, and accessibility programs that seek to ensure workers of all backgrounds are afforded equal opportunity in the workplace.” [14]

- On July 13, 2023, Attorneys General from 13 states, relying on the SFFA decision, sent a letter to Fortune 100 CEOs, threatening “serious legal consequences” for the use of race-based preferences in employment and contracting practices. [15] The group emphasized the Court’s statement that “[e]liminating racial discrimination means eliminating all of it,” implying that this language in the Court’s opinion could be used to challenge various private-sector diversity policies, including through legal actions filed by certain Attorneys General who have enforcement authority under their respective states’ anti-discrimination laws. [16] In response, six days later, Attorneys General from 20 states and the District of Columbia sent these same CEOs a letter to explain that corporate DEI programs are legal and serve legitimate business purposes, and reiterating support for companies that build and maintain DEI programs in the face of widespread criticism from state and federal legislators. [17]

- That same week, a federal district court in Tennessee extended the SFFA ruling and held in Ultima Servs. Corp. v. United States Dep’t. of Agriculture (“Ultima”) that certain racial preferences in government contracting violate the Equal Protection Clause of the Constitution. [18] Ultima, like SFFA, does not directly impact private-sector companies, because it did not address the legality of private entities using racial preferences in procurement decisions. Future courts, however, may apply Ultima’s logic in cases that challenge private companies’ efforts to diversify their suppliers.

- On August 2, 2023, American Alliance for Equal Rights, the same group that backed the SFFA litigation, filed a lawsuit in federal court in Atlanta, challenging a Black-owned venture capital fund focused on funding businesses owned by women of color, a possible forerunner to attacks against corporate DEI programs. [19]

As of now, there is no indication that well-formulated corporate DEI programs focusing on a more egalitarian workplace are unlawful. But there is also no question that the combination of growing anti-ESG political sentiment (discussed further below), with a new line of legal reasoning to rely on, will lead to further scrutiny of these programs. Rather than abandon DEI efforts, which have formed an important part of many workplaces, companies are wise to undergo a holistic assessment of all relevant programs and goals that are in place. A careful review will ensure that policies comply with the law, that disclosure or discussion of programs is specific and accurate, and that programs are well-defined to achieve a company’s relevant goals.

Simpson Thacher recently formed a multidisciplinary team focused on Equity and Civil Rights Reviews to provide comprehensive and concrete guidance to help companies mitigate legal, reputational and business risks associated with DEI issues.

State-Level Lawmaking: A Significant Focus of Anti-ESG Efforts

The first eight months of 2023 have been witness to considerable state-level legislative and regulatory efforts taking aim at the role of ESG in investing and business decisions. Over 150 anti-ESG bills and resolutions were introduced in 37 states since January 2023, and laws targeting a broad scope of entities including financial institutions and insurance companies, among others, passed and have started to come into effect. [20] State executives also continue to take aim at industry leaders promoting ESG through high-profile legal challenges and other campaigns. [21]

But while the anti-ESG trend is undoubtedly shifting the legal landscape in the United States, it is not yet taking over the country. The vast majority of anti-ESG bills and resolutions introduced since January 2023 failed to pass. [22] Laws in some states were significantly revised or pulled back entirely—in some cases at the urging of industry groups, chambers of commerce, financial institution trade associations and even state pension executives citing high costs to retirees and taxpayers. [23] And when comparing the financial impact of these laws, which in many cases relate to the investment of state pension assets, we note that the total state pension assets controlled by states that have taken “pro-ESG” action exceeds that of states that have taken “anti-ESG” action by 25%. [24]

Meanwhile, movement also continues in the form of pro-ESG state legislation, most notably California’s proposed bill SB 253, [25] which would place even more stringent disclosure requirements on companies than the SEC’s forthcoming climate disclosure rules (discussed below). Other states continue to consider bills that would require state entities to consider non-financial factors (including ESG factors) in investment decisions; prohibit the investment of public funds in various ESG-disfavored industries; place diversity requirements on the boards of publicly held domestic and foreign corporations; or require corporations to participate in climate surveys or engage in climate risk and GHG emissions reporting.

Individually and collectively, the states are undoubtedly playing a key role in defining the future of the ESG-related regulatory environment in the United States. Widely divergent approaches yield a complicated landscape, particularly for banks that manage public funds, insurance companies, and for asset managers and investment managers of state pension funds—the chief targets of such measures. The full impact of anti- (and pro-) ESG legislation has yet to be felt, and will depend to some extent on the prescriptiveness of the legislation, which varies significantly among states. The robustness of potential enforcement, and the effect that a presidential election year will have—given recent polls indicating that the anti-ESG argument is not resonating well with the American public—remains to be seen. [26] Practically speaking, we expect to see more anti-ESG and pro-ESG bills proposed in the 2024 legislative session and the scope and nature of such measures to continue to evolve.

Federal Legislative/Rulemaking Activity: A Slower Pace of Change

Federal lawmakers have also been active on ESG matters. A group of Republican legislators deemed July “ESG month,” with the House Financial Services Committee holding a series of hearings on various anti-ESG matters. [27] Following the hearings, the committee advanced a series of bills aimed at limiting the SEC’s rulemaking authority and studying the potential impact of European rulemaking, such as the CSRD and CSDDD (discussed below), and revising the proxy voting and shareholder proposal processes. [28] Earlier in 2023, Rep. Chip Roy (R-TX) also introduced legislation seeking to limit the role of ESG factors in investment decisions, akin to some of the state laws passed earlier this year. The “No ESG at TSP” Act seeks to prevent the Thrift Savings Plan, a 401(k)-type plan available to federal employees, from offering any investment fund options that make decisions based on ESG criteria. [29]

But while the flurry of recent anti-ESG legislative activity has attracted attention, it is important to view it within the context of broader recent federal activity in related areas. In particular, the August 2022 passage of the Inflation Reduction Act infused significant investment into ESG-related initiatives, with a particular focus on clean energy. [30] Earlier this year, the Department of Labor also passed a final rule permitting the use of ESG factors in corporate retirement plans. [31] As discussed in our previous client alert, the rule later became the subject of President Biden’s first veto when Congress passed a resolution that would have nullified the rulemaking. From an enforcement perspective, the SEC’s ESG and Climate Task Force has also brought and settled several ESG-related claims against companies in the past 12 months, as discussed further in this article.

The SEC has also continued to work through new ESG-related disclosure rules. The Commission recently finalized cybersecurity risk management disclosure rules, [32] requiring companies to make timely disclosure of cybersecurity incidents and to offer more robust information about risk oversight and management. While the SEC has not yet finalized the significant (and much commented-on) climate disclosure rules proposed last March, [33] they remain on the Commission’s agenda, and indications are that they will reach finalization. [34] The SEC’s agenda also includes finalization of proposed rules requiring additional information from investment funds regarding their ESG investment practices, [35] and changes to the “Names” Rule to ensure that ESG investing strategies are appropriately disclosed. [36] Proposals for new rules relating to corporate board diversity and human capital management also remain on the SEC’s short-term reg-flex agenda. [37] Other agency activity includes the Federal Trade Commission’s current undertaking to update its “Green Guides” on the use of environmental claims for which it solicited public comment earlier this year. [38]

Global Regulatory Activity: Launching Significant New Disclosure Regimes

While the U.S. state and federal ESG rulemaking efforts have been marked by political discord, since 2021, we have witnessed approximately 40 other jurisdictions around the globe embark on ESG-related rulemaking. Europe, in particular, continues to drive efforts to increase the volume and types of sustainability-related information that companies are required to provide, and last month progress on one of the cornerstones of new EU regulation, the Corporate Sustainability Reporting Directive (“CSRD”), [39] took a significant step forward with the adoption of the European Sustainability Reporting Standards (“ESRS”). [40]

CSRD will require in-scope companies—principally those based in or operating in the EU above certain size thresholds, but also including U.S. and other non-EU companies with securities admitted to trading on an EU regulated market—to produce annual disclosures in line with a detailed set of sustainability standards relating to matters including environmental protection, social responsibility and treatment of employees, respect for human rights, anti-corruption and bribery, and corporate board diversity.

The ESRS adopted by the Commission, when compared against previous versions, are likely to result in companies making less extensive disclosures from a sustainability impact perspective on the basis that such disclosures are only required where a business assesses its impacts as being material on a particular sustainability matter. But the requirements of CSRD, which will be phased in over several years beginning in 2024, nonetheless represent a sea change for corporate sustainability reporting efforts, not least because of the “double materiality” perspective the CSRD applies. Under this standard, companies are required to consider how external environmental and social factors affect their businesses and the impacts of their operations and value chains on people and the environment. Ultimately, what is to be regarded as material is left to companies to determine, but such conclusions will be subject to an audit standard, and in respect of climate change, detailed reasons must be provided as to why an issue is not material.

Further, countries influenced by the “EU effect” may continue to look to the sustainability reporting frameworks built on by the ESRS (e.g., GRI, TCFD) when developing or refining their own ESG-related reporting regimes.

A second substantial new set of rules with global impact coming out of the EU is the Corporate Sustainability Due Diligence Directive (“CSDDD”). [41] The proposed directive would impose far-reaching due diligence and related obligations in respect of environmental and human rights risks and impacts across corporate supply (and potentially value) chains on companies based in or operating in the EU. It is currently subject to negotiations among the European Commission, Parliament and Council and approaching a decisive phase. Like the CSRD, the law is broad in scope, likely to affect an estimated 17,000 EU and third country companies directly, [42] with many more likely to be affected indirectly as a result of their positions in corporate supply/value chains. While there are differences between the initial negotiation positions of the European institutions with respect to certain specific provisions (including as to scope), it is generally understood that there is sufficient political will that the CSDDD should be adopted such that final rules are expected to be agreed to prior to the European elections in June 2024.

Litigation and Enforcement: New Litigants, Familiar Arguments

Litigation relating to ESG is as broad as the term ESG itself, spanning health and safety, human rights, environmental/sustainable claims, privacy, workplace harassment and other issues. For the past several years, much of the ESG-related litigation has focused on the concept of “greenwashing” or “social washing”—complaints that companies are making false or misleading claims about their environmental or social benefits or practices, presumably to appeal to or assuage consumer desires for eco- and human-friendly products. But lately a different flavor of “anti-ESG” litigation is also making headlines.

In contrast to greenwashing suits brought by individuals looking to hold companies accountable for their ESG-related statements, a new crop of claims look to hold companies to account for their ESG-related practices. In Wong et al. v. New York City Employees’ Retirement System et al., [43] plaintiffs allege that three New York City pension funds breached their fiduciary duty by inappropriately divesting from fossil fuels. In Spence v. American Airlines, Inc. et al., the leading plaintiff claims that the defendants, the American Airlines 401(k) plan committee and administrators, breached their fiduciary duty by: (i) offering ESG funds as an investment option in their 401(k) plans, and (ii) offering non-ESG funds that are managed by investment companies that pursue nonfinancial ESG initiatives. [44] The defendants in both cases have filed motions to dismiss, and the courts’ decisions may impact whether these cases are the first in a long line of similar arguments. Neither of these cases presents novel legal theories or arguments.

DEI-related developments (discussed further above) are also spurring new litigation. Within the past week, a right-wing non-profit organization has filed complaints against both Kellogg’s and Target for their DEI efforts. [45] The EEOC complaint letter alleges that race-based programs that Kellogg’s has implemented violate Title VII of the Civil Rights Act, while the federal securities lawsuit against Target takes a different approach, relying on Section 10(b) and Rule 10b-5 misrepresentation and Section 14(a) proxy disclosure theories. According to the plaintiff, Target aggressively embraced ESG and DEI mandates without properly considering its risks, leading to a drop in shareholder value.

Similar lawsuits have not fared well in the U.S. court system. On August 11, 2023, a Washington federal judge dismissed with prejudice a stockholder’s suit against Starbucks and dozens of its officers, directors and employees, alleging that the company’s diversity policies to ensure that Black people, Indigenous people and people of color make up at least 30% of its corporate workforce by 2025, and hold at least 40% of retail and manufacturing jobs by 2025, violate Title VII of the Civil Rights Act and amount to a breach of fiduciary duty. [46] And in a June 27, 2023 opinion, Vice Chancellor Will of the Delaware Chancery Court rejected a demand by a stockholder of The Walt Disney Company to inspect corporate books and records relating to the Company’s decision to express public opposition to Florida’s House Bill 1557, “Parental Rights in Education” bill, also known as the “Don’t Say Gay” bill, which prohibits teachers from discussing topics related to sexual orientation and gender identity from kindergarten through third grade.

The Court found that that the stockholder’s articulated purpose for the demand was “pretextual,” and that the stockholder had already received necessary documents, and had not sufficiently alleged potential wrongdoing by the board. [47]

Meanwhile, close to 150 lawsuits relating to environmental justice, greenwashing and social washing were filed during 2022 and the first quarter of 2023. [48] The SEC is also holding issuers accountable for ESG-related statements and products by identifying ESG-related misconduct, such as material misstatements related to climate risks. While actions from the SEC’s Climate and ESG Task Force (the “Task Force”) have been fairly modest thus far, as discussed in our prior memo, there have been a few notable exceptions including the $55.9 million settlement ordered against Vale S.A. for its allegedly false and misleading disclosures related to employee safety and environmental contamination.

Most recently, we note the groundbreaking decision issued on August 14 by a Montana federal court in a case brought by young environmental activists, arguing that state agencies are violating their right under the state constitution to a clean and healthful environment. [49] Historically U.S. courts have been unwilling to recognize a right to a stable climate as a fundamental right or liberty under state or federal constitutions, and U.S. lawmakers have not taken steps to enshrine such a right in federal law. In this case, the judge sided with the plaintiffs in determining that the state’s policy for evaluating requests for fossil fuel permits, which prevents state agencies from evaluating the impact of greenhouse gas emissions, violated the state’s constitutional protections.

Setting aside this new (and likely limited) argument, by and large, the legal theories articulated in these lawsuits are not novel. At their heart, many ESG-related claims come down to real or alleged corporate governance failures and application by the courts of fundamental principles of accountability, transparency, sound practices, appropriate controls and risk management. While ESG may seem like a hot topic inviting litigation across a variety of viewpoints, the underlying arguments and principles are usually familiar ones.

Conclusion

Rarely does the country or globe move in lockstep, and it’s certainly the case that ESG-related practices, laws, rules and theories across countries and continents are not in sync. A patchwork of varying legislative and regulatory actions call for localized responses and present challenges for many companies with a global footprint. Longer-term approaches to risk assessment and management call for new methodologies and more specialized approaches. And while “ESG” isn’t going anywhere just yet, companies are wise to consider a “GES” formation, putting a primary focus on the governance practices supporting companies’ strategy deployment, risk assessments, commitments and decision-making.

Endnotes

1See Factset, Lowest Number of S&P 500 Companies Citing ‘ESG’ on Earnings Calls since Q2 2020 (June 12, 2023), available here; Daniela Sirtori-Cortina and Bloomberg, McDonald’s is removing ‘ESG’ from parts of its website amid a conservative backlash against ‘woke capitalism,’ Reuters (Aug. 11, 2023) available here.(go back)

2The Center for Audit Quality, The Rise in S&P 500 ESG Reporting (July 11, 2023) available here.(go back)

3UNPRI, Are corporate boards responding to successful shareholder ESG proposals? (March 1, 2023) available here.(go back)

4The Science-Base Targets Initiative reports increasing numbers of companies setting verified SBTi targets through its progress report and target dashboard.(go back)

5Federica Urso, Number of company sustainability officers triples in 2021 – study, Reuters (May 4, 2022), available here.(go back)

6Morningstar, The 2021 Proxy Voting Season in 7 Charts, (Aug. 5, 2021) available here.(go back)

7Just Capital, Companies Disclosing the Gold Standard of Workforce Diversity Data – the EEO-1 Report or Similar Intersectional Data – More Than Tripled between 2021 and 2022, available here; Sustainalytics, Carbon Emissions Data for Investors: Closing the Reporting Gap and Future-Proofing Estimations, (Feb. 8, 2023) available here.(go back)

8Sustainable Investments Institute, Anti-ESG Shareholder Proposals in 2023 (June 1, 2023) available here.(go back)

9United Airlines Holdings, Inc., Definitive Proxy Statement (Form DEF 14A), Proposal 8 (April 15, 2021) available here; Phillips 66 Company, Definitive Proxy Statement (Form DEF 14A), Proposal 6 (March 31, 2021) available here.(go back)

10See, e.g. Martin Marietta Materials, Inc., Definitive Proxy Statement (Form DEF 14A), Proposal 5 (April 13, 2023), available here (requesting the company to issue near, medium and long-term science-based GHG emissions reduction targets and summarize plans to achieve the targets).(go back)

11See, e.g. Valero Energy Corp., Definitive Proxy Statement (Form DEF 14A), Proposal No. 5 (March 22, 2023) available here (requesting the company to issue an annual report on its climate transition plan and progress, including near, medium and long-term GHG emissions reduction targets.(go back)

12McKinsey Institute for Black Economic Mobility, Corporate Commitments to Racial Justice: An Update (Feb. 21, 2023), available here.(go back)

13Students for Fair Admissions, Inc. v. President and Fellows of Harv. Coll., Nos. 20-1199 and 21-707, 143 S. Ct. 2141 (2023) (Roberts, C.J.) [Decided with Students for Fair Admissions, Inc. v. University of North Carolina, No. 21-707 (2023)](go back)

14U.S. Equal Employment Opportunity Commission, “Statement from EEOC Chair Charlotte A. Burrows on Supreme Court Ruling on College Affirmative Action Programs,” Press Release (June 29, 2023) available here.(go back)

15Kris Kobach, et al., Letter to Fortune 100 Companies (July 13, 2023), available here. The signatories represented Kansas, Tennessee, Alabama, Arkansas, Indiana, Nebraska, Iowa, South Carolina, Kentucky, West Virginia, Mississippi, Missouri and Montana.(go back)

16On July 17, 2023, Sen. Tom Cotton (R-AR) also sent letters to 51 law firms warning them of the implication of the advice they provide to clients regarding DEI programs, as well as operating DEI programs on behalf of the firm. The text of the letter is available here.(go back)

17Aaron Ford, et al., Letter to Fortune 100 CEOs (July 19, 2023), available here. The signatories represented Nevada, Arizona, California, Colorado, Connecticut, Delaware, District of Columbia, Hawaii, Illinois, Maine, Maryland, Massachusetts, Michigan, Minnesota, New Jersey, New Mexico, New York, Oregon, Rhode Island, Vermont and Washington.(go back)

18Ultima Servs. Corp. v. U.S. Dep’t. of Agric., No. 2:20-CV-00041 (E.D. Tenn.), Mem. Op. and Order dated July 19, 2023, available here.(go back)

19American Alliance for Equal Rights v. Fearless Fund Management, LLC, et al., No. 23-CV-03424 (N.D. Ga.), Compl. dated Aug. 2, 2023, available here.(go back)

20See our prior memo for a discussion of state-level bills currently in force and under consideration, as well as our memo on Florida’s HB3 introducing restrictions on a wide range of state and local entities and their investment fiduciaries, financial institutions and businesses, and our memo on Texas’s law aimed at prohibiting insurers from considering ESG factors in rate-setting.(go back)

21See Mark Brnovich, et al., Letter to Asset Manager (Aug. 4, 2022), available here (noting that decarbonization efforts may constitute a violation of the Sherman Antitrust Act and various state laws) and response Letter to Sherrod Brown, et al., (Nov. 21, 2022), available here; see also Press Release, Office of the Attorney General of Texas, Paxton Launches Investigation Into Six Major Banks for Collusion-In-Lending Practices That Potentially Violate Consumer Protection Laws (Oct. 19, 2022), available here (seeking information relating to the banks’ participation in global climate change initiatives such as the Net-Zero Banking Alliance based on purported antitrust and consumer-protection concerns); see also Austin Knudsen, et al., Letter to Asset Manager (Mar. 30, 2023), available here (warning of antitrust concerns associated with participation in Climate Action 100+ and the Net Zero Asset Managers Initiative); see also Sean Reyes, et al., Letter to Members of the Net-Zero Insurance Alliance (May 15, 2023), available here (claiming that initiatives espoused by the alliance could violate state and federal antitrust laws); see also Austin Knudsen, et al., Letter to Directors (July 6, 2023), available here (requesting information on their role in investigating conflicts of interest and meeting fiduciary duties).(go back)

22Citing a June 22 report from Pleiades Strategy, a climate risk consulting firm, S&P Global reported that as of the date of the report, 83 out of 165 anti-ESG bills and resolutions introduced in 37 states between January and June 2023 had failed to become law while 19 bills became law and six resolutions passed. Pleiades Strategy, 2023 Statehouse Report: Right-Wing Attacks on the Freedom to Invest Responsibly Falter in Legislatures (July 23, 2023).(go back)

23See e.g., Daniel Garrett and Ivan Ivanov, Gas, Guns, and Governments: Financial Costs of Anti-ESG Policies, U. Penn. (May 30, 2022), available here; The Sunrise Project, ESG Boycott Legislation in States: Municipal Bond Market Impacts, (Jan. 12, 2023, available here; and Debra Kahn, Want to go anti-ESG? It’ll cost you, Politico (March 17, 2023), available here.(go back)

24Based on our research of FY 2022 data from the National Association of State Retirement Administrators, the total AUM of state pension funds in states that have taken pro-ESG measures is $3,079,294,717 and states that have taken anti-ESG measures $2,327,797,683.(go back)

25See SB-253 Climate Corporate Data Accountability Act, S. Res. 253, 2023 Leg., Reg. Sess. (Ca. 2023), available here.(go back)

26Jonathan Weisman, Are G.O.P. Voters Tiring of the War on ‘Wokeness’?, The New York Times, (Aug. 6, 2023) available here.(go back)

27Ben Werschkul, July is ‘ESG month’ for GOP leaders who want to limit do-good investing, Yahoo Finance, (July 2, 2023) available here.(go back)

28See Guiding Uniform and Responsible Disclosure Requirements and Information Limits Act, H.R. 4790, 118th Cong. (2023) available here; see also Protecting Americans’ Retirement Savings from Politics Act, H.R. 4767, 118th Cong. (2023) available here; see also H.R. 4655, 118th Cong. (2023) available here.(go back)

29See No ESG at TSP Act, H.R. 3612, 118th Cong. (2023) available here.(go back)

30Inflation Reduction Act of 2022, Pub. L. No. 117-169, 136 Stat. 1818; Clean energy investment is extending its lead over fossil fuels, boosted by energy security strengths, IFA (May 25, 2023), available here.(go back)

3129 C.F.R. § 2550.404a-1.(go back)

32“Cybersecurity Risk Management, Strategy, Governance, and Incident Disclosure,” SEC Release Nos. 33-11216; 34-97989 (July 26, 2023), available here.(go back)

33“The Enhancement and Standardization of Climate-Related Disclosures for Investors,” SEC Release Nos. 33-11042, 34-94478 (Mar. 21, 2022), available here.(go back)

34Seventy-seven House Democrats recently wrote a letter to SEC Chair Gary Gensler urging finalization. Casten, Sean, et al., Letter to The Honorable Gary Gensler (Aug. 7, 2023), available here.(go back)

35“Enhanced Disclosures by Certain Investment Advisers and Investment Companies about Environmental, Social, and Governance Investment Practices,” SEC Release No. 33-11068 (May 25, 2022), available here.(go back)

36“Investment Company Names,” SEC Release No. 33-11067, 34-94981 (May 25, 2022), available here.(go back)

37See SEC, Agency Rule List—Spring 2023 (accessed Aug. 14, 2023), available here.(go back)

3888 Fed. Reg. 7656 (Feb. 6, 2023), available here.(go back)

39Directive (EU) 2022/2464 of the European Parliament and the Council of 14 December 2022 amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, as regards corporate sustainability reporting, OJ L 322, 16.12.2022, pp. 15-80, available here.(go back)

40European Commission, “Annex 1 to the Commission Delegated Regulation (EU) supplementing Directive 2013/34/EU of the European Parliament and of the Council as regards sustainability reporting standards,” (July 31, 2023), available here. The ESRS are currently subject to approval by the European Parliament and European Council. If approved, they will come into force in December 2023, just in time for the first round of CSRD reporting.(go back)

41European Commission, Proposal for a Directive of the European Parliament of the Council on Corporate Sustainability Due Diligence and amending Directive (EU) 2019/1937, COM(2022) 71 final, available here.(go back)

42“Corporate sustainability due diligence, European Commission, available here.(go back)

43Wong v. NYCERS et al., No. 652297/2023 (N.Y. Sup., N.Y. Cty.).(go back)

44Complaint, Spence v. American Airlines, No. 4:23-cv-00552 (N.D. Tex. June 2, 2023).(go back)

45Craig v. Target Corporation, No. 2:23-cv-00599 (M.D. Fl.).(go back)

46National Center for Public Policy Research v. Howard Schultz et al., No. 22-cv-00267 (E.D. Wash.).(go back)

47Simeone v. Walt Disney Co., C. A. 2022-1120-LWW, 2023 Del. Ch. LEXIS 154 (Del. Ch. Jun. 27, 2023).(go back)

48Bloomberg Law, “2023 Litigation Statistics Series: ESG Litigation” (July 6, 2023) available here.(go back)

49Findings of Fact, Conclusions of Law, and Order, Held v. State of Montana, et al., No. CDV-2020-307 (Mont. 1st Dist. Ct. Aug. 14, 2023).(go back)

Print

Print