J.T. Ho is a Partner, Robert Bee is Practice Support Counsel, and Hayden Goudy is Director of Environmental, Social and Governance and Corporate Governance, at Orrick, Herrington & Sutcliffe LLP. This post is based on an Orrick memorandum by Mr. Ho, Mr. Bee, Mr. Goudy, Crystal Milo, and Carolyn Frantz.

More pay equity-related proposals see significant levels of shareholder support.

Pay equity, a significant focus for investors and activists, saw increased shareholder proposal activity in the first half of 2023. We are aware of 16 companies receiving shareholder proposals requesting the disclosure of unadjusted gender and racial pay gap data, with 10 going to a vote. While still a low absolute number, this is nearly double the number of proposals received in each of 2021 and 2022.

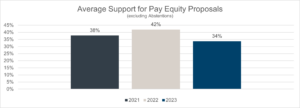

Support for these proposals is significant.

Shareholder support for pay equity proposals has been significant in the first half of 2023 compared to other ESG proposals and will likely impact offseason engagement for a number of companies. On average, these pay equity proposals received support from 34% of shareholders, compared to an overall average of 25% for ESG-related shareholder proposals generally in 2023. [1] Support in that range also can be impactful from an institutional shareholder perspective. For example, Glass Lewis expects to see shareholder engagement and some initial level of responsiveness from a subject company when a shareholder proposal receives at least 20% support; ISS looks for a subject company to clearly disclose its response and explain the board’s rationale for responsive actions taken in the following year’s proxy statement if a shareholder proposal receives support from a substantial minority of shares cast. As a result, even if a company successfully defeats a pay equity proposal at the annual meeting, the topic is likely to remain on the investor relations team’s agenda for at least the following year.

Despite challenges to diversity initiatives, including the ongoing anti-ESG backlash and the recent Supreme Court case regarding educational affirmative action, activist and investor interest in pay equity does not appear to be significantly waning.

How can companies decrease their risks from such proposals?

We looked at which companies have received pay equity proposals and assessed investor voting patterns on such proposals since 2021.

In the first half of 2023, 16 companies, all in the S&P 500, received pay equity proposals from two proponent groups: Arjuna Capital and representatives from CorpGov.net (James McRitchie, John Chevedden, and Myra K. Young). [2] In contrast to 2017, when activists were generally targeting companies in the financial sector for these proposals, in the past

three years, activists targeted 28 large-cap companies in 16 different industries—ranging from diversified retail to food and beverage. The risks related to pay equity proposals appear to depend on company disclosure practices rather than industry.

From 2021 through the first half of 2023, only three companies had pay equity proposals receive more than majority support. In each case, we believe shareholders that voted in favor of the proposal did so due to the company’s lack of, or unwillingness to commit to providing, disclosure about pay gap data and/or a commitment to pay equity. Specifically:

- In 2022, a pay equity proposal passed with 59% approval at a media and publishing company that did not disclose that they conducted, or planned to conduct, a pay equity analysis, despite the company’s disclosed commitment to pay equity.

- In 2022, a pay equity proposal passed with 56% approval at a specialty retailer company that did not disclose a commitment to pay equity and did not disclose that they conducted, or planned to conduct, a pay equity analysis.

- In 2023, a pay equity proposal passed with 52% approval at a food and drug retailing company that did not disclose a commitment to pay equity, despite the company disclosing that it conducted an annual pay equity analysis, the results of which were not disclosed.

These results were in clear contrast with other companies in 2023 that had relevant proposals and had already disclosed commitments to pay equity and adjusted pay equity data. Each of the proposals at these other companies received less than 36% shareholder support.

Our research suggests that there are several key indicators of interest to investors [3] and proxy advisors in evaluating a pay equity proposal. First, ISS has indicated that it will consider whether a company has been the subject of recent controversy, litigation, or regulatory actions related to gender, race, or ethnicity when evaluating whether to support a pay equity proposal. [4] Although not appearing in its voting guidelines, ISS has also indicated in certain reports a preference for unadjusted pay gap disclosure, citing that such disclosure will lead companies to address pay disparities. Companies most often disclose an adjusted pay gap, which compares the pay of men and women or workers across different racial groups who do similar or equivalent work by accounting for differences in relevant factors such as the role, work experience, location, education levels, and management responsibilities. Shareholder proponents, on the other hand, driven by concerns that adjusted pay gap data does not accurately reflect potential gender or racial disparities across an organization, are often seeking unadjusted pay gap data. ISS also considers the existence of diversity goals in making its recommendations.

Glass Lewis has stated they will consider supporting well-crafted shareholder resolutions requesting more disclosure on the issue of gender pay equity in instances where the company has not adequately addressed the issue and there is some evidence to suggest that such inattention could present a risk to the company’s operations and/or shareholders. [5] In contrast to ISS, reports indicate that Glass Lewis does not have a strong preference for the use of unadjusted pay gap information, citing its impact on company morale.

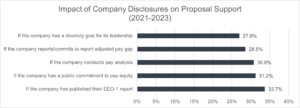

In addition, an empirical analysis reveals that the following factors appear correlated with pay equity proposal votes:

- If the Company has diversity goals specifically related to diversity at the management level;

- If the Company reports or commits to reporting adjusted pay gap data; [6]

- If the Company conducts a pay equity analysis;

- If the Company has a public commitment to pay equity; and

- If the Company has published their EEO-1 report.

We performed an analysis of the impact of each of these types of disclosure on the amount of support a pay equity proposal received. Where a company had more than one factor disclosed, each is reflected separately in the chart below.

Interestingly, having a diversity goal for leadership seems to have a stronger impact on the success of pay equity proposals than actions directly related to pay equity. This could be just a data anomaly since all companies with a diversity goal for its leadership in our sample also disclosed or committed to disclosing adjusted pay gap information. However, this trend could also be attributed to shareholders voting based on their perception of the overall quality of disclosed diversity, equity, and inclusion initiatives, rather than pay equity issues themselves.

Takeaway:

Our data suggests that companies proactively providing diversity-related disclosure in line with investor expectations, such as diversity goals and metrics pertaining to workforce recruitment, retention, promotions, compensation, and also adjusted pay gap data, are more likely to perform better on pay equity shareholder proposals. Nevertheless, given the current anti-ESG sentiment focus on diversity programs, [7] companies considering adopting these initiatives should collaborate with counsel to develop compliant programs and corresponding disclosures.

Endnotes

1According to data published in May 2023 by ISS. U.S. Shareholder Proposals Jump to a New Record in 2023.(go back)

2For a summary of recent pay equity proposals and corporate performance on pay equity, see the Racial and Gender Pay Scorecard, 6th Edition, published by Arjuna Capital.(go back)

3For a representative example of the investor position, refer to this 2022 Vanguard Investment Stewardship Insights report.(go back)

4ISS 2023 Proxy Voting Guidelines for the United States.(go back)

5Glass Lewis 2023 Policy Guidelines for ESG Initiatives.(go back)

6In our analysis, no company disclosed unadjusted pay gap data.(go back)

7Consider, for example, a recent letter from 13 state attorneys general to Fortune 100 CEOs citing concerns with “explicit racial quotas and preferences in hiring, recruiting, retention, promotion, and advancement” in employment practices.(go back)

Print

Print