Melissa Sawyer, Lauren Boehmke, and Marc Treviño are Partners at Sullivan & Cromwell LLP. This post is based on a Sullivan & Cromwell memorandum by Ms. Sawyer, Ms. Boehmke, Mr. Treviño, Susan M. Lindsay, June Hu, and H. Rodgin Cohen.

Hot Topics for Boards and Committees

Board Agenda Topics

Addressing the Use of Artificial Intelligence

Many boards are seeking a general understanding of AI, how their companies and peers are using it, and potential risks and concerns arising from the use of AI, including any cybersecurity, privacy and other liability issues, as well as employee and ethical implications. Although there is not one correct approach for overseeing AI risks, boards of companies that rely on AI for material products, services or operations (or relevant committee members) may want to consider receiving training on AI and associated risks, as well as management reports on the company’s use of AI.

Assessing the Business Impact of Macro Trends

As political, social, economic, climate and health conditions continue to fluctuate, challenging some companies’ ability to manage risks, some boards are asking management to sensitize the assumptions underlying the company’s strategic plan to take account of different potential scenarios. Some boards will also receive periodic updates from outside advisors on conditions in the various markets in which the company operates, with a particular focus on China.

Preparing for Heightened Antitrust Scrutiny

With antitrust scrutiny intensifying in the U.S. and internationally, some boards are obtaining briefings on the competitive landscape, potential regulatory risks and opportunities, and the increased time and cost required to engage in M&A transactions.

Audit/Risk Committee Agenda Topics [1]

Understanding Cybersecurity/AI Risks

Overseeing cybersecurity risks is likely to continue to be a focus area for audit and risk committees (especially with the recent release of the SEC’s final cybersecurity risk governance rules), while the growing use of AI may require committees to take additional steps to better understand use-cases and potential risks.

Proposed NOCLAR Amendments

Audit committees should understand the potential implications of the PCAOB’s proposed amendments to its auditing standards related to the auditor’s responsibility for identifying, assessing and communicating a company’s noncompliance with laws and regulations (“NOCLAR”), including its impact on the company’s existing internal processes for monitoring legal and regulatory compliance.

Controls and Procedures for Sustainability Disclosures

In light of the agenda‑ed October release of the SEC’s final climate disclosure rules (which will likely require detailed information and third-party attestation of GHG emissions metrics and may require the inclusion of climate-related information in audited financial statements) and the adoption of international sustainability reporting standards and frameworks that may be applicable to certain U.S. companies, audit committees may need to establish and oversee disclosure controls and procedures for climate and other sustainability disclosures.

Reviewing Responsibility for Risk Oversight

As corporate risk profiles continue to evolve to reflect rapidly changing technological, regulatory, political, social, climate, health and economic conditions, among other things, audit committees, which are often responsible for overseeing the key risks facing the company in addition to their financial reporting-related responsibilities, and boards may want to consider whether the oversight of certain risks should be delegated to another committee or a stand‑alone risk committee.

Compensation Committee Agenda Topics

Evaluating the Incorporation of ESG Metrics into Executive Compensation

Compensation committees may want to evaluate the appropriateness of incorporating environmental or social metrics into their executive compensation plans and, if appropriate, the weight and achievability of such metrics. A June 2023 study by Meridian Compensation Partners (available here) found that approximately 73% of S&P 500 companies link a portion of incentive compensation to the achievement of ESG metrics (most commonly, social metrics such as workforce diversity and inclusion and employee health and safety and engagement). However, the increasing polarization of ESG issues, challenges to achieving existing plan targets and, more recently, the Harvard decision may be causing some compensation committees to reevaluate the use of ESG metrics in their executive compensation plans.

Preparing for Clawback Rules

Compensation committees will want to work with management to ensure that the company has adopted a policy that complies with the new NYSE and Nasdaq rules imposing a deadline of December 1, 2023 for listed companies to adopt policies mandating the clawback of excess incentive-based compensation of current or former executive officers during the three fiscal years preceding a required accounting restatement.

Advance Planning for Potential Non-Compete Ban

Compensation committees may want to consider preparing for the potential adoption of the FTC’s proposed ban on non-compete agreements between employers and employees (which will apply both prospectively and retroactively) by, among other things, directing management to take an inventory of existing non-compete agreements and other restrictive agreements. Attention should also be paid to any applicable state law restrictions on non-competes. For example, the New York Legislature recently adopted legislation that, if signed into law by the Governor, will effectively ban non-compete agreements with employees or contractors and create a private right of action for covered individuals to sue employers for violations of the law, with potential remedies including injunctive relief, liquidated damages up to $10,000 and payment of lost compensation, damages and reasonable attorneys’ fees.

Nominating and Governance Committee Agenda Topics

Updating Advance Notice Bylaws

In light of the universal proxy rules, nominating and governance committees may want to consider whether (i) any updates to their advance notice bylaws are desirable and appropriate in order to ensure the board will have sufficient time and information to evaluate proposed nominees and/or (ii) whether any recently adopted or prospective changes could attract investor scrutiny for being outside the norm of current market practices, taking into account recent shareholder litigation challenges to advance notice requirements and the submission of “fair election” Rule 14a-8 proposals that seek to require shareholder approval for certain amendments to a company’s advance notice bylaws (although such challenges and proposals have generally been unsuccessful to date).

Scrutinizing Outside Directorships

With director overboarding a recurring investor concern and the Department of Justice and FTC increasingly scrutinizing interlocking directorates for potential Clayton Act issues, nominating and governance committees should review the outside board memberships and other employment affiliations of their directors to ensure such service aligns with the current overboarding expectations of their top investors and also does not raise potential Clayton Act or conflict of interest issues.

Adopting Officer Exculpation

As Delaware companies continue to adopt officer exculpation provisions in their certificates of incorporation with significant shareholder support following the August 2022 amendments to the Delaware General Corporation Law, nominating and governance committees should consider whether to seek shareholder approval of an exculpation provision in the coming year, taking into account the company’s rationale for adopting the provision, the practices of their peers and potential quorum and/or any potential investor concerns. Dual-class companies, however, may want to wait to seek approval of such a provision until the resolution of the lawsuits against Fox Corp. and Snap Inc. regarding whether shareholders with unequal voting rights need to be provided with a separate class vote on such provisions. These lawsuits were dismissed by the Delaware Court of Chancery on March 29, 2023 after the Court held that no separate class vote was required because the exculpation provisions did not affect the “powers, preferences or special rights” of the applicable class, but appeals are currently pending. Companies that decide to include an officer exculpation proposal in their next proxy statement also should be aware that they may need to factor additional time into their typical proxy timelines since the inclusion of an exculpation proposal will require the filing of a preliminary proxy statement.

Governance Developments

Companies are facing an ESG political “culture war” on multiple fronts

| Takeaway |

| The board may want to consider the process for making business decisions that involve ESG matters (including for determining whether to speak or act on a specific issue). A record of having considered this process can be helpful in the event of any legal challenge and also can clarify the board’s expectations of management with respect to making such decisions, as well as management’s need to act without consultation in many situations. |

ESG issues are becoming increasingly polarized:

- State Laws – A number of states have enacted or proposed various laws with opposing ESG-related goals. The majority of recent state-level lawmaking has sought to prohibit or restrict the consideration of ESG factors by state entities when investing public funds (e.g., Arkansas, Florida and Kentucky) and/or by financial institutions or other private sector companies that provide services to the state (e.g., the so-called “anti-boycott” laws enacted in Kentucky, Texas and West Virginia) or in the state (e.g., Florida’s HB 3). In contrast, some state legislatures (e.g., New York, California and Connecticut) are proposing laws and policies that encourage or require the consideration of ESG factors by companies in the private sector. Some stakeholders have begun to challenge these state-level ESG laws. For example, SIFMA recently filed a complaint (available here) challenging a new Missouri law requiring financial firms and professionals to obtain customer consents before providing them with advice that incorporates social or other non-financial objectives on federal preemption and First Amendment grounds.

- Political Actors – Members of the U.S. Congress, state attorneys general and governors have taken a range of actions against companies, institutional investors and proxy advisors on the basis of their ESG-related commitments, products, engagements and policies, including sending public letters and civil investigative demands.

- Shareholder Proposals – Shareholders submitted a record number of Rule 14a-8 proposals on ESG issues during the 2023 proxy season, including as a result of a 65% year-over-year increase in the number of proposals submitted by so-called “anti-ESG” proponents. [2] However, as shown in the table below, average support for proposals on both sides of the ESG debate decreased as proponents struggled to gain support (particularly anti-ESG proponents, whose proposals received less than 3% support on average) due, in part, to the intensifying polarization of these issues and the more prescriptive nature of the submitted proposals. See Part 1 of our 2023 Proxy Season Review Memo (available here) for an analysis of the significant trends and developments in Rule 14a-8 proposals during the 2023 proxy season.

| AVERAGE VOTES CAST IN FAVOR OF PROPOSALS | ||||||

| Proponent Type | Environmental | Social | Governance | |||

| H1 2023 | H1 2022 | H1 2023 | H1 2022 | H1 2023 | H1 2022 | |

| All | 21% | 35% | 18% | 26% | 29% | 35% |

| Anti-ESG | 2% | 2% | 3% | 8% | 15% | 18% |

| All Other | 23% | 35% | 22% | 29% | 30% | 36% |

- Shareholder Activism – There are some indications that activists may also be having difficulty gaining traction for public ESG-focused campaigns in the current environment. For example, anti-ESG proponents have generally not engaged in proxy contests, although they are increasingly engaging in other types of activism, such as letter-writing campaigns and filing lawsuits. Moreover, Engine No.1, an investment firm that previously launched the first successful U.S. proxy contest focused primarily on environmental and social demands, recently announced it had sold its sustainability-focused ETF business and is planning on shifting its activist approach to private investments instead of public proxy fights.

- ESG Investment Funds – The past few years have seen a rise and fall in ESG-focused investment funds on all sides of the spectrum, with Morningstar finding that sustainable funds in the U.S. experienced a net outflow of over $5.2 billion in Q1 2023 (according to a report available here) while net inflows into U.S. funds designed as an alternative to responsible investment funds fell to $183 million during Q1 2023 after peaking at $377 million in Q3 2022 (according to a report available here).

- Public Stakeholders – Customers, employees and other stakeholders have also launched boycotts, social media campaigns, walkouts and other demonstrations in response to corporate ESG action (or inactions), such as conducting marketing campaigns that may be seen as taking a stance on an ESG-related issue.

Even the term “ESG” itself has become inflammatory for some stakeholders, resulting in some companies changing references to ESG to more neutral terms, such as “sustainability.”

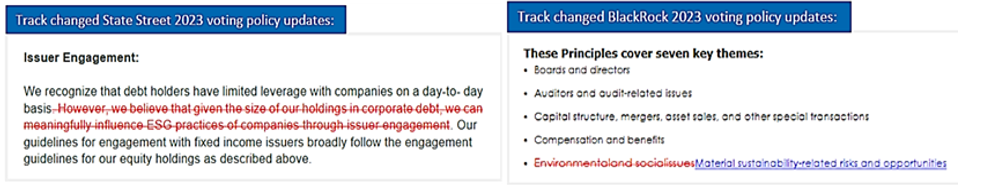

In response to these developments, some institutional investors have updated their voting policies to deemphasize ESG as a stand-alone priority and instead emphasize risk stewardship and the link between a company’s “values” and long-term shareholder value. ISS and Glass Lewis also recently released “governance-only” thematic voting policies, which generally follow management’s recommendations on environmental and social issues.

As a result of the ESG political “culture war,” many companies are struggling to determine how to address increasingly divisive issues, if at all. However, the Delaware Court of Chancery’s recent decision in Simeone v. The Walt Disney Company (June 27, 2023) should provide some comfort to directors of Delaware companies navigating these issues. In that case, the Court, as part of its decision to reject a shareholder’s books and records demand following Disney’s decision to oppose Florida’s Parental Rights in Education Act, confirmed that a company’s decision to publicly speak (or not to speak) on public policy issues is an ordinary business decision entitled to the protection of the business judgment rule, regardless of the ultimate impact of that decision. The Court emphasized that the board bears the ultimate responsibility for corporate strategy. Plaintiffs did not appeal this decision. See S&C’s memo (available here) for more information on this case.

Another recent case further signals a general judicial deference to corporate policies and strategies related to ESG issues. On August 11, 2023, the U.S. District Court for the Eastern District of Washington granted Starbucks Corp.’s motion to dismiss a complaint filed by the National Center for Public Policy Research alleging that Starbucks’ policies seeking to increase the racial diversity among its employees, suppliers and vendors violated various federal and state laws. Although the case was dismissed on procedural grounds and the written decision is still pending, at the hearing the Court expressed skepticism about judicial second guessing of corporate public policy decisions.

The risk of liability for directors continues to evolve

|

Takeaway |

| Boards should oversee a reasonable process to identify the “central compliance risks” facing the company and check that meeting minutes provide a sufficient level of detail when oversight and monitoring of such risks is discussed (including the nature of the discussions and any follow-up actions that were implemented). |

The last few years have seen a proliferation of Delaware cases emphasizing Caremark duties, which require directors, in order to satisfy their fiduciary duty of loyalty, to (a) make a good faith effort to establish board-level reporting or information systems with respect to “central compliance risks” and (b) monitor those systems, including by addressing “red flags” that arise. Although prior cases limited this duty to mission-critical risks (e.g., food safety for an ice cream company or airplane safety for an airplane manufacturer), recent cases have begun to suggest that the scope of a board’s Caremark duties may evolve as corporate risk profiles continue to change.

For example, recent Caremark cases have emphasized that boards of companies in regulated industries have a Caremark responsibility to oversee regulatory compliance issues. Additionally, in its second decision in connection with In re McDonald’s Corp. S’holder Derivative Litig. (March 1, 2023), the Delaware Court of Chancery held that ESG issues, such as sexual harassment within the workplace, can form the basis of a Caremark claim. Additionally, in Ontario Provincial Council of Carpenters’ Pension Tr. Fund v. Walton (April 12, 2023), which involved Caremark claims brought against Walmart’s officers and directors in connection with the company’s role in the national opioid epidemic, the Delaware Court of Chancery outlined certain situations in which a risk could qualify as a “central compliance risk,” such as if the company:

- has an enterprise risk management system and has identified the risk as central;

- has a mission statement or set of policies that describe the issue as a priority; or

- has touted the importance of, and its proficiency in, the particular area.

Beyond these situations, the Walton Court held that the business judgment rule will generally protect the judgment of officers and directors regarding what risks need to be monitored, provided that they have used a rational process to identify the risks facing the company and made good faith decisions about the level of monitoring resources, if any, to assign to each risk.

For risks covered by Caremark duties, these cases also highlight the importance of maintaining appropriate records demonstrating the board’s active oversight of such risks. For example, the Walton Court cautioned that the production of heavily redacted meeting minutes that merely identify the topics that were discussed at a board meeting (without any substantive detail as to the nature of those discussions) may result in the Court needing to infer, at the pleading stage, that the substance of those minutes support the plaintiff’s claims (e.g., that the board was informed of, but failed to address, red flags).

Director qualifications are in the spotlight

|

Takeaway |

| Boards should regularly review their directors’ individual and collective skillsets as well as their outside board service and employment affiliations in light of the then-current policies of the company’s key institutional investors and proxy advisors and consider adopting their own overboarding policy if they do not already have one. |

Shareholders, proxy advisors and other stakeholders have heightened their focus on director skills and qualifications in order to ensure that boards have the necessary tools to exercise effective oversight in light of changing market conditions, regulatory requirements, risk profiles and stakeholder expectations, among other things.

During the 2023 proxy season, this focus led to increasingly personal attacks on individual directors based on personal characteristics such as their skills, backgrounds and tenures during proxy contests. Under the new universal proxy regime (which now allows shareholders to mix-and-match between nominees from both the activist’s and the company’s slate), activists began focusing more on comparing the perceived “weakest” company nominees with its own nominees in order to garner support, including by using the format of the universal proxy cards to single out the company nominees they opposed (as demonstrated by Land & Buildings Investment Management, LLC’s proxy card from its proxy contest against Apartment Investment and Management Company (shown below)).

Land & Buildings Proxy Card from AIMCO Proxy Contest

To highlight the qualifications of their directors, more companies are publishing director skills matrices that identify the key areas of expertise (and corresponding qualifications) they believe are necessary for effective board oversight and how their current directors, individually and collectively, fulfill these capabilities. Appropriately identifying, fulfilling and disclosing director skills may become even more important following the SEC’s agenda-ed October release of its final climate disclosure rules and proposed human capital rules, which may include disclosure requirements that highlight the role of individual directors in the governance of such issues.

Outside board service and employment affiliations of directors have also become top concerns for investors and other stakeholders who want evidence that directors not only have the qualifications but also the time to oversee the company. Institutional investor overboarding limits have become stricter in the last few years. For example, Wellington revised its overboarding policy to provide that it will now count service as a board chair or audit committee chair as two seats when determining whether a director is overboarded. In contrast to this trend, however, State Street recently adopted a new policy providing that, beginning in 2024, it will no longer prescribe its own overboarding limits but will instead vote against nominating and governance committee chairs at S&P 500 companies that have not adopted and publicly disclosed their own overboarding policies.

| 2023 TOTAL PUBLIC COMPANY OVERBOARDING LIMITS | |||||

| ISS | Glass Lewis | BlackRock | Vanguard | State Street | |

| Non-Executive Director | 5 | 5 | 4 | 4 | 4 |

| Active CEO | 3 | 2 | 2 | 2 | 2 |

| Other Active NEO | N/A | 2 | 2 | 2 | 2 |

| Executive Chair | N/A | 3 | 2 | N/A | N/A |

| Non-Executive Chair/LID | N/A | N/A | N/A | N/A | 3 |

The Harvard decision has operational implications for the private sector

|

Takeaway |

| Boards and management should prepare for the possibility that the Harvard decision will be applied in the private sector in the future, potentially resulting in challenges to certain company diversity programs and initiatives, such as diversity-related targets and aspirational goals related to employees, directors, suppliers and/or venders (and litigation on this topic may take a long time to play out). |

On June 29, 2023, the U.S. Supreme Court issued its decision in Students for Fair Admissions, Inc. v. President and Fellows of Harvard College in which it held that it is unconstitutional for colleges and universities to consider race as a factor in the admissions process under Title VI of the Civil Rights Act of 1964 (the “1964 Act”), which prohibits discrimination based on race, color or national origin under any program or activity receiving federal financial assistance. This decision does not directly impact private corporations (which are already prohibited from engaging in discriminatory employment practices on the basis of race, color, religion, sex, or national origin under Title VII of the 1964 Act), which means there is no legal requirement for companies to change any of their existing diversity, equity and inclusion (“DE&I”) policies as a result of this decision. However, in the wake of this decision, it is likely that companies will face an increase in challenges to corporate diversity programs and initiatives under Title VII.

For example, on July 18, 2023, Strive Asset Management sent a letter to McDonald’s Corp. (available here) expressing “concern” that the company’s decision to set and adhere to race- and/or gender-based targets for its board, management, employees, suppliers and vendors creates “serious legal and commercial risks” under the Harvard decision and could result in lawsuits as well as regulatory investigations. As a result, Strive’s letter demands that McDonald’s, among other things:

- rescind its DE&I policies in full, including all representation goals and executive compensation packages tied to such goals;

- make clear to its employees that any discrimination (including for the purposes of advancing diversity targets) will lead to disciplinary action up to and including termination; and

- commit to making all director, employment and supplier decisions based on merit.

More recently, on August 2, 2023, the American Alliance for Equal Rights — an organization led by the same individual who founded the plaintiff organization in the Harvard case — filed a complaint (available here) against Fearless Fund (an early-stage venture capital firm that focuses on providing funding to female founders of color), accusing it of violating Section 1981 of the Civil Rights Act of 1866’s prohibition on racial discrimination in private contracts by offering a grant program that only Black women who own small businesses can participate in.

Activism Developments

More companies are facing multi-activist “swarms”

|

Takeaway |

| Providing clear and consistent messaging about the company’s strategy and business to shareholders and activists can be key when dealing with a single campaign or a swarm with multiple different objectives. |

Large-cap companies are increasingly being targeted by multiple activists at the same time (referred to as a “swarm”). According to data from Lazard (available here), 13% of all companies targeted by an activist campaign during Q1 2023 were subjected to multiple new campaigns that were launched within the same quarter.

Swarms will intensify the challenges posed by an activist campaign as the target company will need to engage simultaneously with different funds that have varying time horizons and potentially competing objectives.

M&A continues to be a focus of activists

|

Takeaway |

| Companies considering potential M&A transactions (including potentially in response to an M&A-related activist demand) should take into account the heightened risk of scrutiny from both regulators and activists and how such scrutiny could impact deal timing and certainty. |

The number of M&A-related campaigns fluctuates with market conditions but consistently remains high. During the first half of this year, nearly half (48%) of all global activist campaigns included M&A-related demands (particularly, sell the company or a division of the company, as well as opposing announced deals), despite slower M&A and financing markets, according to data from Barclays (available here). However, the increasingly intensifying scrutiny of M&A transactions from antitrust and foreign investment regulators, which can negatively impact deal timing, costs and certainty, may complicate the ability of companies to respond to such campaigns.

Moreover, corporate responses to antitrust concerns can themselves draw the attention of activists. For example, on March 13, 2023, Carl Icahn launched a proxy contest against Illumina, Inc. for three board seats as a result of Illumina’s decision to close its acquisition of GRAIL, Inc. despite the launch of investigations and opposition from U.S. and E.U. antitrust regulators. Icahn was ultimately partially successful after shareholders voted to oust Illumina’s board chair and replace him with one of Icahn’s nominees at the company’s annual meeting in May. Illumina’s CEO also resigned shortly thereafter.

Activists are pushing back on advance notice bylaws

|

Takeaway |

| Nominating and governance committees should periodically review the company’s advance notice bylaws against market practices, shareholder views and recent Delaware cases to ensure they continue to contain clear and reasonable requirements. |

Delaware courts have repeatedly reiterated that they will enforce reasonable and unambiguous advance notice requirements that were adopted on a clear day and without evidence that the board’s actions were unreasonable or inequitable. Following the implementation of the universal proxy rules last year, over 200 S&P 500 companies updated their advance notice bylaws to impose additional procedural and information requirements for shareholders seeking to submit director nominations. However, after a few companies subsequently sought to use these new requirements to prevent or invalidate an activist’s nomination, some activists responded by filing lawsuits arguing that the changes themselves, or how they were applied to the activist’s specific nomination, were unreasonable. Examples of these lawsuits include:

- Politan Capital Management LP’s complaint (available here) against Masimo Corp. in which it alleged, among other things, that Masimo’s board breached its fiduciary duties by adopting unreasonable information requirements that precluded investment funds such as itself from being able to nominate candidates (e.g., requiring disclosure of the identity and certain investment holdings of limited partners as well as any future plans to submit nominations/proposals). Although this case was expected to provide guidance on the parameters of what constitutes a “reasonable” requirement, Masimo repealed its advance notice bylaw changes before the Court ruled on their validity.

- Driver Management Company LLC’s complaint (available here) against First Foundation Inc. alleging that First Foundation’s board breached its fiduciary duties by, among other things, manipulating its advance notice requirement by waiting 11 days to provide the required form questionnaire, not notifying Driver of deficiencies in its notice after the deadline closed and not giving Driver an opportunity to cure the deficiencies. However, this complaint was later withdrawn after First Foundation agreed to allow Driver’s nominee to be considered for election at its annual meeting.

Board-approved advance notice bylaw amendments are also being challenged by Rule 14a-8 shareholder proponents through the submission of “fair election” proposals that seek to require companies to obtain shareholder approval before adopting bylaw requirements affecting director nominations by shareholders (such as the imposition of new disclosure requirements for nominees). These proposals have had limited success thus far, with almost half being withdrawn following engagement with the company and none of the proposals that went to a vote passing. See Part 1 of our 2023 Proxy Season Review Memo (available here) for more details.

Universal proxies may increase activist success rates

|

Takeaway |

| Advance preparation remains key for defending against potential activist campaigns. Boards and management should continue to regularly review and, if needed, refresh their company’s structural defenses, potential vulnerabilities and business strategy and publicly and privately communicate with their shareholders to understand their concerns. |

Although the universal proxy rules do not appear to have significantly impacted the number of proxy contests launched so far this year, they do appear to be impacting activist success rates. More activist campaigns have settled this year, potentially due, in part, to incumbent directors being more willing to step off boards voluntarily in order to avoid being the subject of personal attacks (as discussed above).

Additionally, activists have also achieved significantly higher rates of partial success in the campaigns that did go to a vote. According to data from Barclays (available here), activists won at least one seat in 80% of the U.S. proxy contests that went to a vote (compared to 33% in H1 2022). This supports the conclusion that the ability of shareholders to “mix-and-match” nominees from both the activist’s and the company’s slate under the universal proxy rules may be making it easier for activists to gain at least one board seat, but harder for them to gain control.

However, these trends are based on only a small number of campaigns and may continue to evolve in future proxy seasons. Moreover, as institutional investors continue to take steps to provide more of their clients with the ability to choose how the fund votes their underlying shares (known as “voting choice” programs), institutional support in proxy contests may become even less predictable.

Endnotes

1Some public companies may delegate responsibility for these agenda topics to other committees or the full board based on regulatory requirements and other considerations.(go back)

2In this publication, we refer to an entity or individual as an “anti-ESG” proponent if the official website of the proponent states that the entity or individual is boycotting, criticizing or otherwise asking companies to reconsider what the proponent describes as an “ESG” or “woke/liberal” agenda.(go back)

Print

Print