Lindsey Stewart is Director of Investment Stewardship Research at Morningstar, Inc. This post is based on his Morningstar memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita; Companies Should Maximize Shareholder Welfare Not Market Value (discussed on the Forum here) by Oliver Hart and Luigi Zingales; Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee (discussed on the Forum here) by Robert H. Sitkoff and Max M. Schanzenbach; and Exit vs. Voice (discussed on the Forum here) by Eleonora Broccardo, Oliver Hart, and Luigi Zingales.

Key Takeaways

The Volume of Shareholder Resolutions Keeps Rising

- The number of shareholder resolutions proposed at U.S. companies grew by 18% in the 2023 proxy year to a total of 616, from 522 in 2022.

- This followed an already strong increase of 16% in 2022, following the SEC’s decision to broaden the definition of permissible shareholder resolutions addressing “significant social policy issues.“

- The recent increase included many resolutions on environmental and social (E&S) topics that asset managers rejected as “prescriptive” or “redundant.”

Lower Support for E&S Resolutions in 2023

- The number of resolutions on environmental and social topics increased by 23% in 2023 to 337, from 273 in 2022.

- There was a sharp fall in shareholder support for E&S resolutions to an average of 20% in the 2023 proxy year, from 30% in 2022.

- Among the Big Three index firms, BlackRock and Vanguard sharply reduced their support for key resolutions in 2023. State Street’s support increased.

The Population of Key Shareholder Resolutions Halves

- The number of key E&S resolutions (proposals supported by at least 40% of a company’s independent shareholders) almost halved in 2023 to 53, from 102 last year.

- Social issues continue to represent over 70% of key resolutions. Proposals on political activity and on workplace fairness and safety dominated in 2023, as in previous years. Climate change and technology ethics issues also featured.

Shareholder Resolutions in 2023

The volume of environmental and social topics increased again in 2023. Support levels fell as prescriptive resolutions represented a greater share of the total.

Continued Growth in the Volume of Shareholder Resolutions in 2023

The end of June marked the end of another proxy year, and fresh data reveals key trends on how shareholders are responding to the growing volume of resolutions addressing ESG themes in 2023.

Growth in the volume of shareholder resolutions proposed at U.S. companies accelerated in the 2023 proxy year. There was an 18% increase in the number of shareholder resolutions to a total of 616.

This followed an already strong increase of 16% in 2022, from 449 to 522, following the SEC’s decision in November 2021 to broaden the definition of permissible shareholder resolutions addressing “significant social policy issues.“

Environmental and Social Resolutions: Higher Volumes, Lower Support in 2023

The 2022 proxy year marked the first year that the majority of shareholder resolutions addressed environmental and social (E&S) themes, rather than governance themes. This trend continued in 2023.

The 337 E&S resolutions in the 2023 proxy year represented 54% of the total, compared with 52% in 2022. The number of E&S resolutions increased by 23% in the 2023 proxy year, from 273 the previous year.

Amid the higher volumes of E&S shareholder proposals in the last two proxy years, there has been an increase in the number of resolutions that asset managers see as overly prescriptive.

The higher share of these resolutions in 2023 compared with previous years has prompted a dramatic fall in shareholder support levels. Average shareholder support dropped a full 10 percentage points from 30% in the 2022 proxy year to 20% in 2023.

Analyzing Key Shareholder Resolutions

Social issues dominated again. Shareholders requested greater transparency on corporate political activity and on fairness and safety in the workplace.

The Population of Key Shareholder Resolutions Halved in 2023

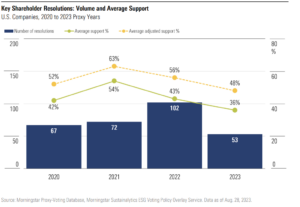

Each year, we analyze the volume and support for key shareholder resolutions—the proposals that are well supported by independent shareholders of U.S. companies. By Morningstar’s definition, key resolutions are supported by at least 40% of a company’s independent shareholders. For that reason, the decline in adjusted support [1] for key resolutions in the 2023 proxy year is less steep, having fallen to 48% from 56% in 2022. (Respectively, 36% and 43% on an unadjusted basis including insider shareholders’ votes.)

The number of such resolutions has almost halved to 53 in 2023 from 102 the previous year. Key resolutions consistently represented over 35% of all E&S resolutions in the 2020 to 2022 proxy years. However, this figure dropped to just 16% in 2023. Further, the number of resolutions supported by an outright majority of shareholders fell to just nine in the 2023 proxy year from 40 in 2022. (If we exclude proposals that were unopposed by companies’ boards, the figures are seven and 32, respectively.)

Social Issues Continue to Dominate

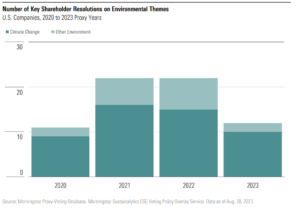

Social issues have consistently represented over 70% of key resolutions since 2020. The 2023 proxy year is no exception. Overall, 37 of the 53 key resolutions in 2023 address social themes. This is just over half the number of social key resolutions (76) in 2022, reflecting the broader trend. Similarly, the number of environmental key resolutions fell from 22 in the 2022 proxy year to 12 in 2023, the lowest count since 2020. Four resolutions in the 2023 proxy year addressed a mix of social and governance themes. All four addressed board diversity.

An important factor in the decline in the number of key resolutions is that many proposals that asset managers could potentially have supported were not actually voted. The Interfaith Center on Corporate Responsibility— a coalition of frequent filers of ESG proposals—reported [2]

in August that 122 proposals were withdrawn in 2023 after the company and the proponent agreed on a path forward. Out of these proposals, 40 addressed racial equity and diversity, equity, and inclusion topics, and 37 targeted climate change issues.

Shareholder Support: Environment’s Lead Over Social Narrows in 2023

Support for environment-related key resolutions has been consistently ahead of social resolutions over the last four proxy years, albeit by a small and narrowing margin.

In the 2020 and 2021 proxy years, resolutions on environment themes gained around 4 percentage points more support from independent shareholders than social resolutions. This fell to 3 percentage points in 2022 and just 1 percentage point in 2023. A full list of key resolutions and support levels can be found in Appendix 2.

Environment: Volume of Key Resolutions Addressing Issues Other Than Climate Thins Out

The number of environment-related key resolutions fell back toward 2020 levels in the 2023 proxy year, with incoming regulation set to fill many of the reporting and governance gaps on climate that were previously filled by shareholder resolutions.

There were 10 resolutions in the 2023 proxy year targeting climate change and greenhouse gas emissions issues, down from 15 in 2022.

One proposal at Coterra Energy requesting disclosures on methane emissions gained outright majority support. A resolution at Berkshire Hathaway requesting a report on climate risk management at the company gained the support of a majority of the company’s independent shareholders for a third year running.

This year, there were only two resolutions addressing other environment-related topics such as plastic use and water management risks, down from seven in 2022.

Social: Political Activity and Workplace-Related Disclosures Remain Center Stage

In each of the last four years, resolutions related to political influence and activity and to workplace equity topics have comprised over 60% of all key resolutions. In 2023, these two topics represented 26 (70%) of the 37 resolutions on social topics (13 for each topic).

Resolutions on political activity typically asked for disclosure on political spending or lobbying activities by companies. However, requests for disclosure on congruence of political spending with corporate values represented a new theme in 2023. Two such resolutions gained over 40% independent shareholder support. The 13 key resolutions on workplace equity themes covered a broad range of topics besides just DEI reporting, including freedom of association, gender and racial pay gap reporting, workplace safety, and mandatory arbitration.

The swell of 16 key resolutions requesting civil rights and racial equity audits in the 2022 proxy year shrank to just three in 2023. Many companies were responsive to previous requests. As a result, some proposals were withdrawn and there was lower support for those that went to a vote.

Asset Manager Voting Trends

Voting records for the Big Three index firms—BlackRock, State Street, and Vanguard—show diverging trends amid the overall decline in support.

Big Three Support for Key Resolutions Diverges Further

The Big Three index firms control around one fifth of the independent shareholder vote at the largest U.S. public companies. So, they have a big influence over which proposals, and how many, become key resolutions. Out of the 294 key resolutions in the last four proxy years, 222 (75%) were supported by at least one Big Three firm.

Voting decisions by the two largest firms, Vanguard and BlackRock, reflected the broader trend in support for shareholder resolutions. Both have sharply reduced their support for such proposals: BlackRock supported less than 7% of E&S shareholder resolutions in the 2023 proxy year; Vanguard supported just 2%. BlackRock supported 38% of key resolutions in the 2023 proxy year, down from 50% in 2022. Vanguard supported only 8% of key resolutions in 2023, down from 23% in 2022.

State Street bucked the wider trend by increasing its backing for key shareholder resolutions. The firm supported 66% of key resolutions in 2023, up from 59% in 2022. This means that there is even wider divergence between the three firms’ voting patterns than we observed earlier this year.

Common Themes in Well-Supported Resolutions

As in 2022, well-supported shareholder resolutions in the 2023 proxy year focused on requests for reporting and disclosure on material issues that is not already provided or promised by the company. Requests for reporting on climate risk management and political activity were more likely than other topics to be supported, particularly where the company has not responded to previous engagement by asset managers. Two key examples are the resolutions on climate risk management at Berkshire Hathaway and on lobbying disclosures at Charter Communications. Both resolutions have appeared on those two companies’ proxy cards for three years in a row. BlackRock, State Street, and Vanguard voted “For” these resolutions each time. Here are some excerpts from the managers’ voting rationales on these resolutions.

| Berkshire Hathaway 2023

Item 4: Report on Climate Risk Management – 51% adjusted support Request for disclosure aligned with the Taskforce on Climate-related Financial Disclosure (TCFD) recommendations, addressing how the Company manages physical and transitional climate-related risks and opportunities at parent level, and for subsidiaries materially impacted by climate change and the energy transition. |

BlackRock, 2023: “The company does not meet our aspirations for disclosing a plan for how their business model will be compatible with a low-carbon economy.” (Link)

BlackRock, 2021: “On our assessment, the shareholder proposal is reasonable and not unduly constraining to management, and therefore our support may help accelerate action on climate-related business risks by the company.” (Link)

Vanguard, 2023: “Determined the proposal addressed material risk(s), a gap in oversight or disclosure, and supported long-term investment returns. Proposal not determined to be overly prescriptive.” (Link)

| Charter Communications Item

5: Lobbying Activities Report – 47% adjusted support Request for disclosure on governance and board oversight of various forms of lobbying activity (direct and indirect lobbying, and “grassroots” communications), and disclosure of lobbying related payments. |

Vanguard, 2023: “We believe that the company’s reporting did not sufficiently detail the board’s oversight of corporate political activities. We observed that the company’s existing disclosures lagged those of its peers in terms of transparency into governance processes, oversight policies, and trade association memberships. The lack of adequate disclosures of the company’s approach to and oversight of political activities limits investors’ ability to assess associated risks.” (Link)

BlackRock, 2021: “While Charter publicly provides some information related to lobbying activities, including its Code of Conduct, it does not disclose a comprehensive lobbying policy or oversight structure, nor does it disclose its federal or state lobbying expenditures on its website. Furthermore, the company does not disclose its memberships in, or payments to, trade associations and other tax-exempt entities, nor the amount used towards lobbying.” (Link)

“Prescriptive” and “Redundant” Resolutions: What Do Asset Managers Mean?

The Big Three have been unequivocal in their opinions on most of the 2023 slate of E&S shareholder proposals. As in 2022, many were described as “overly prescriptive,” but in 2023, managers also complained about proposals they saw as “redundant.” Here are some excerpts from the three firms’ recent reports on voting. (Our emphasis.)

BlackRock, August 2023: “Because so many proposals were over-reaching, lacking economic merit, or simply redundant, they were unlikely to help promote long-term shareholder value and received less support from shareholders, including BlackRock, than in years past… In our assessment, there was an uptick in the number of such shareholder proposals that were overly prescriptive or unduly constraining on management decision-making. The number of single-issue proposals where the request made did not have economic merit also increased. Importantly, many proposals failed to recognize that companies had already substantively met their request.” (Link)

Vanguard, August 2023: “In some cases, we identified that although a proposal raised a material risk at the company in question, the board had already demonstrated appropriate oversight of the risk and evidenced its oversight through robust disclosure or had practices in place that substantially fulfilled the proposal’s request. In those cases, the funds did not support the proposals, because boards demonstrated that the risks were overseen and disclosed to the market. The funds also did not support proposals that went beyond disclosure and encroached upon company strategy and operations. We continue to believe that the strategies and tactics for maximizing a company’s and its shareholders’ long-term investment return should be decided by its board and management team.” (Link)

State Street, May 2023: “While shareholder proposals can be effective at raising awareness on certain issues… proposals are non-binding in most markets and often too prescriptive.” (Link)

Examples: 67 E&S shareholder resolutions filed at S&P 100 companies in the 2023 proxy year gained more than 30% adjusted support, of which 26 were opposed by all the Big Three firms. Of those 26 resolutions, listed below, three were described by at least one of the three firms as “prescriptive” or “unduly constraining on the company.” (These are marked with * on the list.) The other 23 were said to request issues already being addressed by management. Three proposals, highlighted, are key resolutions.

ENVIRONMENT

- Greenhouse Gas Emissions Reduction: Raytheon

- Report on Effects of Reduced Plastics Demand: Dow

SOCIAL AND MULTIPLE THEMES

- Abortion Law-Related Privacy Measures: Meta

- Access to Medicine: Johnson & Johnson, Merck & Co (Vaccines, Patents*), Pfizer

- Animal Welfare: McDonald’s*

- Anti-Harassment and Discrimination Efforts: IBM

- DEI Policies and Pay Equity: Amazon, Apple, Eli Lilly

- Indigenous Rights Policies: Citigroup

- Lobbying Activities: AbbVie, Alphabet, Boeing, Eli Lilly, FedEx, Goldman Sachs, Mastercard, McDonald’s*

- Political Spending: FedEx, Home Depot, JPMorgan, Walt Disney

1Adjusted support is the number of votes cast “For” a shareholder resolution as a percentage of the total votes cast, excluding votes cast by insider shareholders such as company founders, executives, and strategic investors.(go back)

2Catalyzing Corporate Change In 2023, Interfaith Center on Corporate Responsibility, August 2023. (go back)

Print

Print