Subodh Mishra is Global Head of Communications at Institutional Shareholder Services (ISS) Inc. This post is based on an ISS Corporate Solutions memorandum by Sandra Herrera Lopez, Ph.D., Vice President, ESG Content & Data Analytics, & Veronica Nikitas, Senior Associate, Compensation & Governance Advisory at ISS Corporate Solutions.

K E Y T AK E A W AY S

- Shareholder proposals calling for an independent board chair rose by 113% in the Russell 3000 in the first half of 2023 to the highest level in the past 10 years.

- Despite this spike in the number of proposals, average shareholder support levels have remained steady over the last 10 years at 29% to 35%.

- Activist investor John Chevedden was responsible for more than half of the proposals that went to a

- One in four S&P 500 companies chaired by a non-independent director received a shareholder proposal calling for change.

- Combined Chair and CEO roles are on the decline and they now are present at less than half of the companies across all U.S. indices.

INT R O D U CT I O N

The first half of 2023 saw a significant increase in the number of shareholder proposals calling for an independent board chair that went to a vote. Support levels for such proposals increased slightly, contrasting with a decline in support for shareholder proposals that went to a vote overall.

Looking at independent chair proposals over the last 10 years, we found that they receive significant investor support but almost never gain a majority. Further, we found a correlation between the trends for combined chair-CEO roles and the correlation with shareholder proposals calling for independent chairs.

IND E P E ND E N T CH A IR O R S T R O NG CH A IR – CE O LE AD E R?

The supporters of separate chair and CEO roles argue that the separation increases the board’s independence and leads to better monitoring and oversight. By contrast, supporters of a unified chair and CEO say the combination creates clear lines of authority that allow management to respond more efficiently and sends a clear signal to stakeholders about who is accountable.

Possible rationales for companies to separate the combined CEO-chair roles can be internal – such as succession, crisis management, potential conflicts of interests, growing workloads – or external – such as shareholder or regulatory pressure, crisis events (pandemic, war, natural disasters) and economic conditions.

Proxy advisory firms and large institutional investors take a case-by-case approach to supporting independent chair shareholder proposals. One major factor influencing the recommendations or voting behavior is the effectiveness of the board and whether there are governance concerns.

PROXY ADVISOR POLICIES

Institutional Shareholder Services (ISS)

ISS’ current policy generally recommends voting in support of independent chair proposals, taking into consideration the following five factors: (i) the scope and rationale of the proposal; (ii) the company’s current board leadership structure; (iii) the company’s governance structure and practices; (iv) the company’s performance; and (v) any other relevant factors that may be applicable.[1]

Several additional factors may increase the likelihood of a supportive vote recommendation from ISS: (i) a majority non-independent board and/or the presence of non-independent directors on key board committees;

(ii) a weak or poorly-defined lead independent director role that fails to serve as an appropriate counterbalance; (iii) the presence of a non-independent chair in addition to the CEO, a recent recombination of the role of CEO and chair, and/or departure from a structure with an independent chair; (iv) evidence that the board has failed to oversee and address material risks facing the company; (v) a material governance failure, particularly if the board has failed to adequately respond to shareholder concerns or if the board has materially diminished shareholder rights; or (vi) evidence that the board had failed to intervene when management’s interests were contrary to shareholders’ interests.

Glass Lewis

Glass Lewis’ current policy generally recommends supporting proposals to separate the roles of chair and CEO whenever the question is posed in a proxy (typically in the form of a shareholder proposal), viewing the separated roles as being in the long-term best interests of the company and its shareholders. [2]

Further, Glass Lewis may also recommend voting against the governance committee chair if a company doesn’t have an independent chair or an independent lead director.

LARGE INSTITUTIONAL SHAREHOLDER VOTING POLICIES

Larger institutional investors, such as BlackRock, Vanguard, and State Street, have varying policies on independent chair shareholder proposals. [3] Many of these institutional investors defer to the board to select the most appropriate leadership structure for the company. However, they may support a proposal for an independent chair if concerns emerge about the board’s independence or effectiveness. Larger institutional investors are more likely to support the proposals at S&P 500 companies that have not appointed a lead independent director.

INCR E A S E D INT E R E S T A N D CO NS IS T E NT S U P P O R T

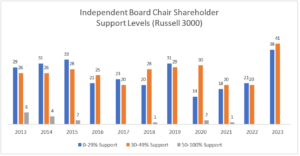

During the first half of the 2023 proxy season, 79 shareholder proposals calling for independent board chairs reached a vote at Russell 3000 companies. This represents a 113% increase year over year and the highest absolute number in the past 10 years. John Chevedden has been the largest proponent of independent chair proposals in the first half of 2023, submitting 41 of the 79 proposals that went to a vote, up from 7 in 2022.

Despite this spike in the overall number of proposals, average shareholder support levels have only slightly increased. Since 2013, the median support levels have remained between 28% and 35%.

Source (all charts and tables): ISS Corporate Solutions, data as of July 18, 2023

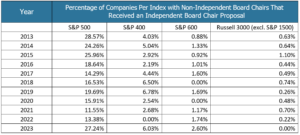

To understand the interest in independent board chairs, we analyzed the proportion of independent chair proposals compared to the total number of companies with non-independent board chairs. Most notably, one in every four S&P 500 companies chaired by a non-independent director received a shareholder proposal aiming for a change.

No independent chair proposals were approved in the first half of 2023. The last time an independent chair proposal passed was in 2021, with 51.63% support. During the past 10 years, 15 proposals have passed out of 593 that went to a vote across the Russell 3000. However, over the last 10 years, this type of proposal continued to send a strong signal to boards by receiving a substantial minority level of support, with 54% of all independent chair proposals that have been voted on receiving more than 30% support.

CH A IR – C E O ROLE S : 2 0 1 3 – 2023

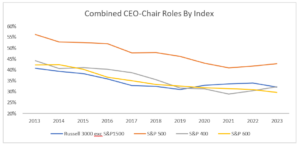

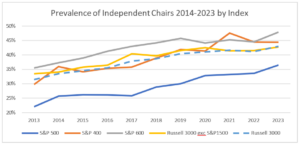

There is a general trend toward separating the CEO and the chair roles. The number of combined CEO-chair roles has decreased across all indices since 2013, and these combined roles now make up less than half of chair roles across all indices.

Historically, companies in the S&P 500 have had more combined CEO-chair roles than the rest of the Russell 3000. Those companies have received the largest share of independent chair shareholder proposals. Combined CEO-chair roles in the S&P 500 have decreased by 13% over the last 10 years, the most significant decrease across the indices.

Moreover, the number of independent chair roles has increased across all indices, demonstrating a push for not only separate CEO-chair roles but also truly independent oversight of the board.

CO NCL U S IO N

Overall, independent chairs are becoming more common, a trend supported by a significant number of investors over the last 10 years.

Independent chairs following a CEO-chair role separation are more prevalent among smaller companies, even though they are far less likely to get called on split the roles. This suggests that the shareholder proposals are not the key driver in separating the roles. There are other drivers, some likely internal – such as succession or crisis management – and other external – such as shareholder or regulatory pressure.

Prominent issuers, especially in S&P 500 that maintain the combined role, should consider the possibility of receiving this kind of shareholder proposal given investor expectations. The volume of independent chair proposals may continue to increase in coming years, and many proposals are expected to receive strong (30%+ support). Companies may consider the regular process of (1) reviewing their corporate governance practices,

(2) monitoring potential governance and oversight weaknesses, and (3) establishing robust corporate governance practices that offer appropriate checks. Adoption of these practices may help provide balance and protection of shareholder rights, which in turn can help win investor trust and confidence in the board leadership.

Print

Print