Chuck Callan is a Senior Vice President of Regulatory Affairs and Mike Donowitz is a Vice President Regulatory Affairs at Broadridge Financial Solutions. This post is based on their Broadridge memorandum.

Highlights from the 2023 Proxy Season

Shareholder support overall is at its lowest level in five years. Support is lower for management proposals and for shareholder proposals alike. We believe this is due—at least in part—both to a decline in market valuations (support for directors and Say-on-Pay proposals generally tracks stock price movements) and a general decrease in support for ESG proposals because many companies have taken steps to be more proactive and transparent.

Specifically, the data shows that:

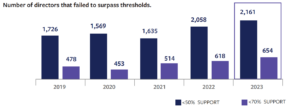

- Expectations of directors are increasing. 654 directors failed to attain majority support, the greatest number in five years.

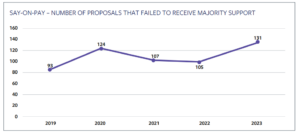

- Support has declined for Say-on-Pay. 131 Say-on-Pay proposals failed to receive majority support. The average level of support (at 86.3%) was the lowest in five years.

- More shareholder proposals and less support. While there were more shareholder proposals (588) than at any time over the past five years, shareholder support for them fell to 24.6% on average (a 10 percentage point drop from last season).

- The climate has cooled for ESG. Support for environmental and social proposals decreased to 25.5%, on average, from 30% the prior season and was the lowest in five years. And support for corporate political spending proposals decreased by 11 percentage points to 27.1%, on average, from 38% the prior season (the lowest in five years).

- More retail investors are finding their voice. Retail share ownership is at its highest level in five years. As a group, retail investors held 31.5% of the shares in the 2023 proxy season (up from 29.6%, five years ago) while institutions held the balance (at 68.5%). Voting participation by retail shareholders inched up to 29.6% of the shares they hold from 29.4% last year.

There continues to be a gap in voting sentiment between retail investors as a group and institutional investors. For example, when it comes to environmental and social proposals, retail investors cast 16% of their votes in favor, while by contrast, institutions cast 25.5% of their votes in favor. Institutional support has declined markedly during the past three seasons, but is still greater than retail support.

What to Expect in 2024

VIRTUAL SHAREHOLDER MEETINGS (VSMs)

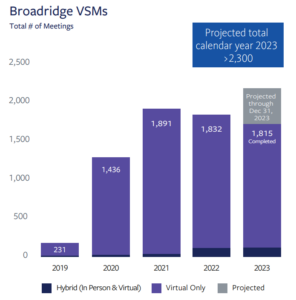

The number of virtual-only meetings in 2023 was close to the all-time high at the height of the pandemic and few companies will return to an in-person only meeting format. Companies and shareholders are realizing the benefits of online meetings as the technology continues to advance.

CLIMATE AND CYBERSECURITY DISCLOSURES

New SEC rules begin to require public companies to disclose material cyber security incidents in 2024, through a form 8K, along with information on their cyber security risk management and governance practices in their annual 10K.

The SEC is expected to adopt final climate disclosure rules for public companies in the fall of 2023. As proposed, there is a phased-in approach for different sized companies over the next few years.

IMPACT OF UNIVERSAL PROXY

Some industry stakeholders had expected the SEC’s 2022 Universal Proxy rules to dramatically increase the number of proxy contests. Thus far, the rules seem to have little impact on the number of opposition solicitations that actually go to a distribution. The number of contests was within a typical range over the past three years.[1]

PASS-THROUGH VOTING

Pass-through voting is the practice of providing retail investors in institutional accounts with a voice on how asset managers should vote their proxies. We are seeing greater adoption of pass-through voting by fund companies through a variety of technologies and approaches.[2]

Five-Year Trends

DIRECTOR ELECTIONS

Expectations of directors are increasing. Fewer directors stood for election this past season (23,829) than in 2022 season, but more failed to attain majority support (654) than at any time in the last five years. On average, institutional investors cast 31.4% of their votes against directors while retail shareholders cast 26.3% of their votes against directors. Moreover, 2,161 directors failed to surpass the 70% support threshold that is closely watched by some governance advocates and proxy advisors. The decline in director support may be due in part to shareholder displeasure with lower or flat market valuations at some firms as well as new voting policies from proxy advisory firms.

SAY-ON-PAY

Support has declined for Say-on-Pay. 131 Say-on-Pay proposals failed to receive majority support. Average support for Say-on-Pay proposals this past season was 86.3%, the lowest in five years. A closer look at the data shows that low support for Say-on-Pay correlates to low support for corporate directors. That is, 31.5% of issuers who failed to achieve at least 50% favorability on their Say-on-Pay proposals also had at least one director fail to achieve majority support.

SHAREHOLDER PROPOSALS

More shareholder proposals and less support. The number of shareholder proposals submitted for a vote increased significantly to 588 this season from 510 last season and shareholder support fell to 24.6% from 34.4% in 2022. Institutional investor support declined to 25.7% this past season from 36.2% in 2022, and retail support declined from 20% in 2022 to 17.6% in 2023, the lowest levels in five years. There continues to be a significant voting divergence among these segments of investors.

ENVIRONMENTAL AND SOCIAL PROPOSALS

The climate has cooled for ESG. The number of environmental and social proposals decreased to 137 this season, from 142 the prior season. [3] Overall, support decreased to 25.5% of the votes, on average, this season from 30.3% the prior season the lowest in five years. This was due largely to a decline in institutional support and persistently low levels of retail support generally.

POLITICAL SPENDING PROPOSALS

Overall shareholder support for corporate political spending proposals decreased by 11 percentage points to 27.1%, on average, this past season from 38.3% the prior season. Institutional investors cooled to these proposals at most firms.

SHARE OWNERSHIP

More individual investors are entering the market. As a group, retail ownership grew from 30.6% to 31.5% of the “beneficial” shares we processed, the highest percentage in the last five years. This is due in part to the continuing growth of managed accounts.

SHAREHOLDER VOTING

More retail investors are finding their voice. As a group, retail investors voted 29.6% of the shares they owned in 2023, a slight uptick from the prior year. However, voting participation by institutional investors was at its lowest level in five years. This was primarily driven by a decline in voting by smaller institutional investors (at small and microcap companies).

1Some proxy contests settle after materials are distributed and before a meeting occurs. Excludes non-U.S. issuer meetings.(go back)

2https://www.broadridge.com/_assets/pdf/broadridge-pass-through-voting.pdf(go back)

3Environmental proposal types include, but are not limited to reports on climate policies, greenhouse emissions, and deforestation. Social proposal types include, but are not limited to reports on human and civil rights audits, employee rights, and privacy and information.(go back)

Print

Print