Robert Bartlett is the W. A. Franke Professor of Law and Business and faculty co-director of the Arthur and Toni Rembe Rock Center for Corporate Governance at Stanford Law School. This post is based on his recent paper.

In 2003, a group of approximately two dozen lawyers specializing in venture capital (VC) finance embarked on a mission to standardize the financing documents utilized by VC firms for investments in US-based startups. The primary objective was to mitigate the transaction costs associated with memorializing the non-binding term sheet negotiated between a company and a VC investor. While a term sheet typically outlines the standard economic and governance terms (e.g., valuation, type of liquidation preference, the number of investor- and founder-appointed directors), translating these core “deal” terms into definitive financing documents often entailed further negotiation. This additional negotiation occurred as both investor and company counsel sought to converge on the precise contractual language that would legally govern the investment. The standardization project aimed to curtail this latter form of negotiation by establishing a standard “template” for each of the five documents used in US VC finance. Since December 2003, the National Venture Capital Association (NVCA) has hosted these templates on its website, leading to their colloquial reference as the “NVCA financing documents.”

In a forthcoming chapter written for The Research Handbook on the Structure of Private Equity and Venture Capital (B. Broughman and E. de Fontenay, eds.), I investigate the extent to which this standardization project has succeeded over the past two decades. To do so, I turn to a dataset of nearly 5,000 charters negotiated by VC investors and startup companies between 2004 and 2022 in connection with a company’s VC financing. While most contracts utilized in VC finance are not publicly available, a defining feature of a company’s charter is that it is both publicly-available and plays a pivotal role in VC financial contracting. In particular, a VC financing will require a startup to amend its charter to authorize a new class of securities that will be sold to investors (typically convertible preferred stock). Moreover, because the charter must define the rights, preferences and restrictions that apply to these securities, negotiation of the charter constitutes one of the most important facets of a VC financing transaction. For this reason, central to the NVCA financing documents is the NVCA model charter.

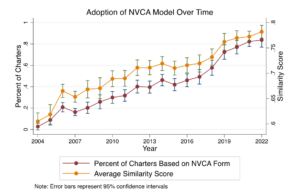

All charters within my sample represent the charter used for a company’s “Series A” round of financing, which is conventionally viewed as the initial financing between a startup company and its VC investors. Using two different natural language processing methods, I find a striking increase in the adoption rate of the NVCA model form during the sample period, along with a concomitant increase in the overall similarity of Series A charters between 2004 and 2022. As shown in the following figure, for sample charters filed in 2022, nearly 85% appear to be based on the NVCA model, up from just 3% of 2004 charters. Adoption of the Delaware-oriented charter has also been accompanied by the growing dominance of Delaware incorporation, with Delaware charters growing from 54% of sample charters in 2004 to 100% in 2022.

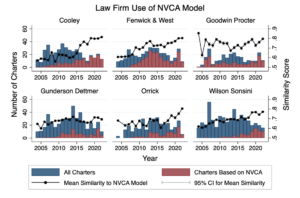

By using the document footers affixed to most charters, I additionally examine the law firm associated with each charter to explore a possible channel for these trends. Specifically, legal services related to U.S. startups are highly concentrated among a select group of specialist firms, effectively placing the success or failure of the standardization project in the hands of roughly a half dozen firms. Consistent with this claim, analysis of the charters’ footers reveals what appears to be firm-wide adoption of the NVCA forms by most of the most active firms in the industry.

Finally, the chapter examines the extent to which VC financial contracts have continued to evolve notwithstanding the success of the NVCA standardization project. Of particular interest are changes since 2004 in the early- and late-stage financing environments that greatly enhanced the leverage of founders, as well as changing expectations around when and how founders and investors can exit their startup investments. These developments prompted three contractual innovations around a startup’s capital structure not reflected in the NVCA model documents. First, consistent with the growing use of dual class common stock capital structures at a company’s initial public offering (IPO), some companies implemented dual class common stock structures at the pre-IPO stage to solidify founders’ control positions relative to their venture capital investors. Second, some companies also issued to founders a form of “founder preferred stock” to facilitate secondary sales by founders in the future. Lastly, given the abundance of early-stage capital, startups increasingly issued a variety of “seed” and “pre-seed” securities that would have to be incorporated into the company’s capital structure at the time of its Series A financing.

Across these three innovations, empirical analysis of the sample charters reveals that only the third appears in a meaningful number of charters. In particular, while dual class common stock and founder preferred stock increasingly appear in sample charters during the first half of the sample period, their annual incidence is never more 5% and 8%, respectively, with incident rates generally declining after 2016 particularly with regard to dual class common stock. In contrast, whereas no Series A charters filed in 2004 had “series seed” preferred stock, this security is present in nearly 65% of sample charters filed in 2022. Likewise, while roughly 12% of 2004 charters had some form of “shadow” Series A preferred stock—which is typically used to account for seed-stage convertible securities—approximately 60% of 2022 charters authorized such a security.

These findings reveal a dramatic increase in the complexity of a startup’s capital structure by the time of its Series A financing. Indeed, charters that reflect a conventional, simple Series A capital structure—that is, a charter that authorizes only a single class of common stock and a single series of “Series A Preferred Stock”—fell from 86% of sample charters in 2004 to just 5% of 2022 charters.

Overall, these findings indicate that as of 2023, when a startup conducts a Series A financing, it is highly likely to be done using the NVCA forms. However, it is also unlikely to be a startup’s first round of venture capital finance.

Print

Print