Lindsey Stewart is Director of Investment Stewardship Research at Morningstar, Inc. This post is based on his Morningstar memorandum. Related research from the Program on Corporate Governance includes The Agency Problems of Institutional Investors (discussed on the Forum here) by Lucian Bebchuk, Alma Cohen, and Scott Hirst; Index Funds and the Future of Corporate Governance: Theory, Evidence, and Policy (discussed on the forum here) and The Specter of the Giant Three (discussed on the Forum here), both by Lucian Bebchuk and Scott Hirst; and The Limits of Portfolio Primacy (discussed on the Forum here) by Roberto Tallarita.

Key Takeaways

BlackRock, Vanguard, and State Street Have a Significant Impact on Voting Outcomes

- Overall, there were fewer key resolutions in 2023 partly because of the Big

- BlackRock and Vanguard sharply reduced their support for key resolutions in State Street’s support increased.

- Given their weight in the market, we look at how excluding the Big Three’s votes affects support for environmental and social (E&S)

More Key Resolutions if We Exclude the Big Three

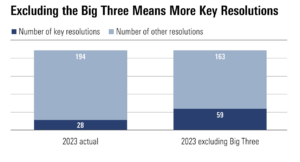

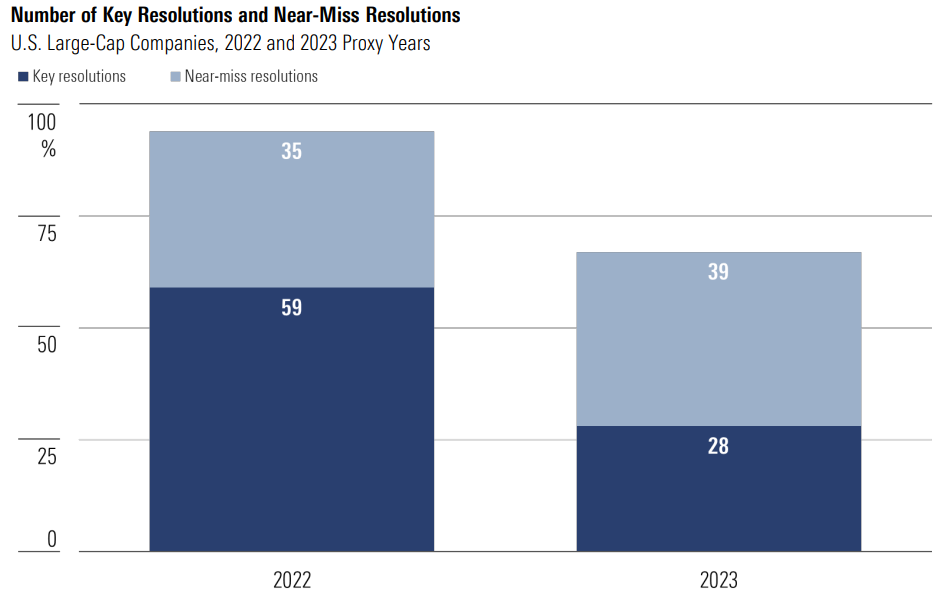

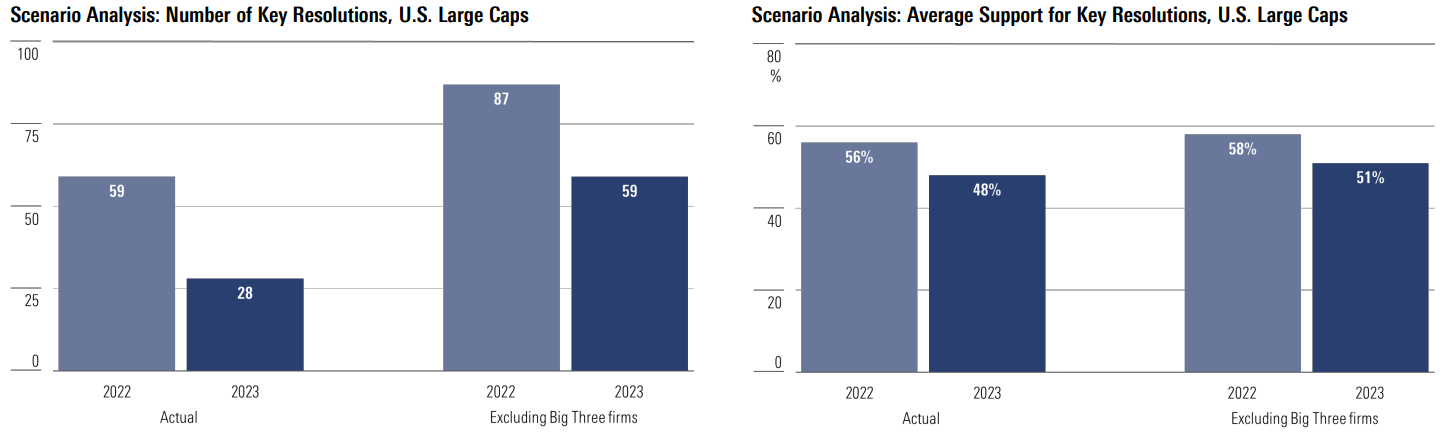

- Among S. large caps, we estimate there would have been 59 instead of 28 key resolutions in 2023 if the Big Three hadn’t voted—more than double.

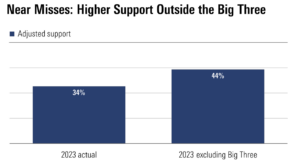

- Adjusted support for near-miss resolutions in 2023 was 34%, but this rises to 44% if we exclude the Big

- Several resolutions would have achieved majority adjusted support, including proposals on lobbying, climate, and workplace issues at Apple, Boeing, Chevron, and IBM.

- This would have sent a clearer signal to companies on which E&S issues are important to

How We Categorize E&S Shareholder Resolutions

|

Source: Morningstar proxy-voting database, Morningstar Direct, asset managers’ stewardship disclosures, SEC filings. Data as of Sept. 29, 2023.

Note: Charts show data for proxy years ended June 30 for resolutions at S&P 100 constituents as of June 30, 2023.

Analyzing Key Resolutions

Overall, the Big Three’s voting decisions lowered the average level of support for key resolutions. BlackRock and Vanguard had the largest effect.

Large-Cap Proxy-Voting Trends Broadly Represent the U.S. Market Overall

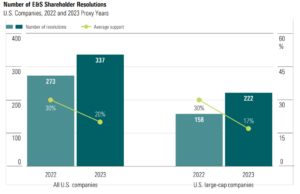

Our September research paper on proxy-voting trends posed the question of how much of the decline in support for E&S shareholder resolutions is due to lower support from large asset managers. To answer this, we looked at proxy-voting trends over the last two proxy years for U.S. large-cap [1] companies. It’s clear from the data that the trends seen among U.S. large caps are broadly representative of the wider U.S. market.

As the chart opposite shows, the number of E&S resolutions voted on at U.S. large-cap companies increased by 64 in 2023 compared with 2022. The size of the increase for the U.S. market as a whole is identical. Shareholder support for E&S shareholder resolutions stood at an average 30% in the 2022 proxy year for the U.S. market and the large caps. Average support fell to 20% in the U.S market in 2023, while the average for resolutions at large-cap companies fell to 17%. The steeper fall is mostly attributable to the higher representation among large-cap companies of resolutions filed at firms with large insider shareholdings and multiple-class share schemes.

Source: Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Sept. 29, 2023. Note: Chart shows data for proxy years ended June 30.

Large-Cap Key Resolutions: Adjusted Support Reveals Identical Trends to the Wider Market

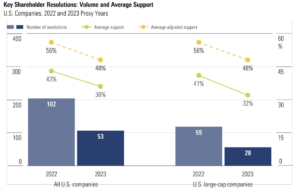

We also observed a similar steeper fall in average support for key resolutions at large-cap companies compared with the market overall, as shown by the green lines on the chart opposite.

If we adjust calculated shareholder support to exclude the effects of insider shareholdings and multiple-class share schemes, we observe identical trends for large caps and the U.S. market as a whole (yellow lines).

In both cases, the number of key resolutions roughly halved between 2022 and 2023.

Source: Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Sept. 29, 2023. Note: Chart shows data for proxy years ended June 30.

Support Among Big Three Firms Diverges—More So Among Large Caps

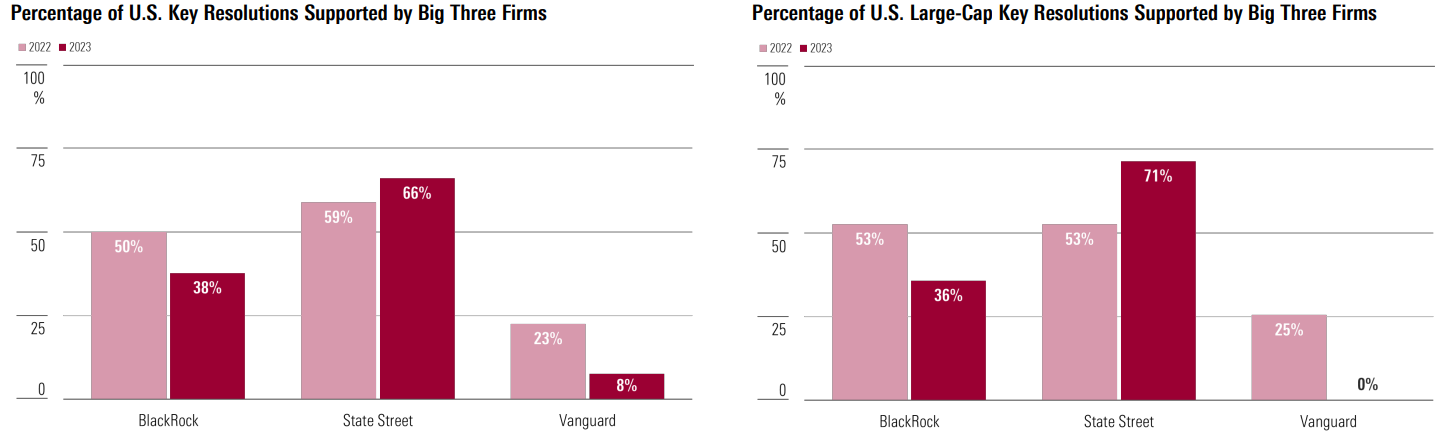

Overall, BlackRock and Vanguard decreased their support for key resolutions. State Street’s support increased. BlackRock supported 38% of key resolutions in the 2023 proxy year, down from 50% in 2022. Vanguard supported only 8% of key resolutions in 2023, down from 23% in 2022. State Street bucked the wider trend by increasing its backing for key shareholder resolutions to 66% from 59%.

Among the large-cap companies, BlackRock’s support for key resolutions was broadly similar to that for the U.S. market overall in both years. State Street’s support for large cap key resolutions was slightly higher than the wider market in 2023. Vanguard, on the other hand, supported none of the large-cap key resolutions, although it backed 8% of key resolutions overall.

Source: Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Sept. 29, 2023. Note: Chart shows data for proxy years ended June 30.

Disaggregating the Effects of Voting Decisions for Key Resolutions

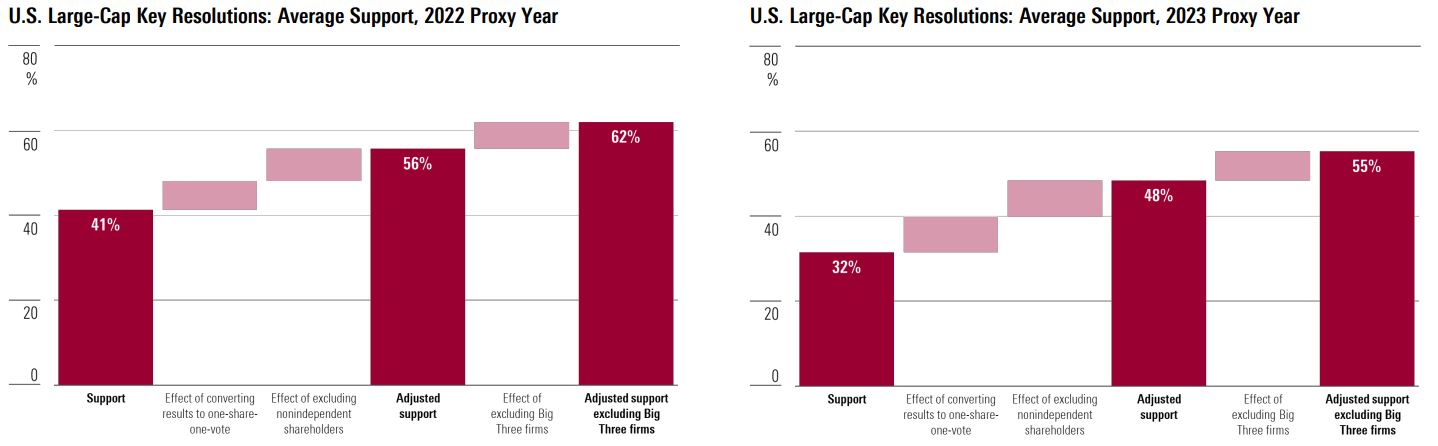

Based on shareholding data from proxy statements and SEC 13-F filings, we can roughly quantify the effects of adjustments to shareholder support. We can also estimate how adjusted support for each key resolution would change if the Big Three’s votes were excluded. In each of the last two proxy years, the effect of converting voting results to a one-share-one-vote basis, and of excluding votes “Against” by insider shareholders, stood at around 7 to 8 percentage points each on average. However, it’s noteworthy that average adjusted support for key resolutions would have been around another 6 to 7 percentage points higher each year if we exclude the Big Three’s voting decisions.

Source: Morningstar proxy-voting database, Morningstar Direct, asset managers’ stewardship disclosures, SEC filings. Data as of Sept. 29, 2023. Note: Chart shows data for proxy years ended June 30.

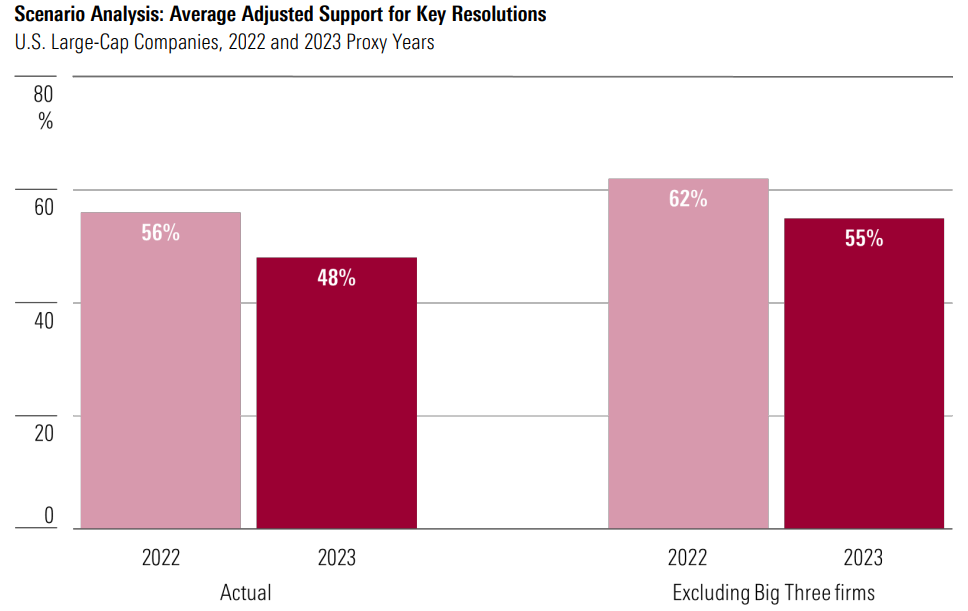

Independent Shareholders Other Than the Big Three Showed Higher Support for Key Resolutions

As a result, average adjusted support for key resolutions by shareholders other than the Big Three stood at 55% in the 2023 proxy year, compared with an actual result of 48%. In 2022, the respective figures are 62% and 56%.

Because State Street increased its support for key resolutions in 2023, this damping effect of the Big Three’s votes must be primarily attributable to BlackRock’s and Vanguard’s voting decisions.

Source: Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Sept. 29, 2023. Note: Chart shows data for proxy years ended June 30.

Analyzing Near-Miss Resolutions

Resolutions that didn’t quite achieve the key threshold of 40% adjusted support reveal greater divergence in managers’ voting decisions.

‘Near Misses’ Reveal Important Clues

Average adjusted support for confirmed key resolutions rises considerably above 50% in both the 2022 and 2023 proxy years if we exclude the Big Three’s votes. This indicates that looking at key resolutions alone doesn’t tell the whole story.

In both years, several proposals would have been key resolutions if the Big Three (particularly BlackRock and Vanguard) hadn’t voted against them. These resolutions must exist in the zone below 40% adjusted support but above 30%. In this study, we called these resolutions “near misses.” We calculate that there were 35 near-miss resolutions in the 2022 proxy year and 39 in the 2023 proxy year.

The number of potential key resolutions below the 30% adjusted support threshold is either zero or very small. Our calculations show that the Big Three account for just over one fourth of the independent shareholding of the large cap companies included in this study, on average. This arithmetic suggests that a resolution with less than 30% adjusted support is unlikely to have gained the support of 40% of independent shareholders excluding the Big Three.

Source: Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Sept. 29, 2023. Note: Chart shows data for proxy years ended June 30.

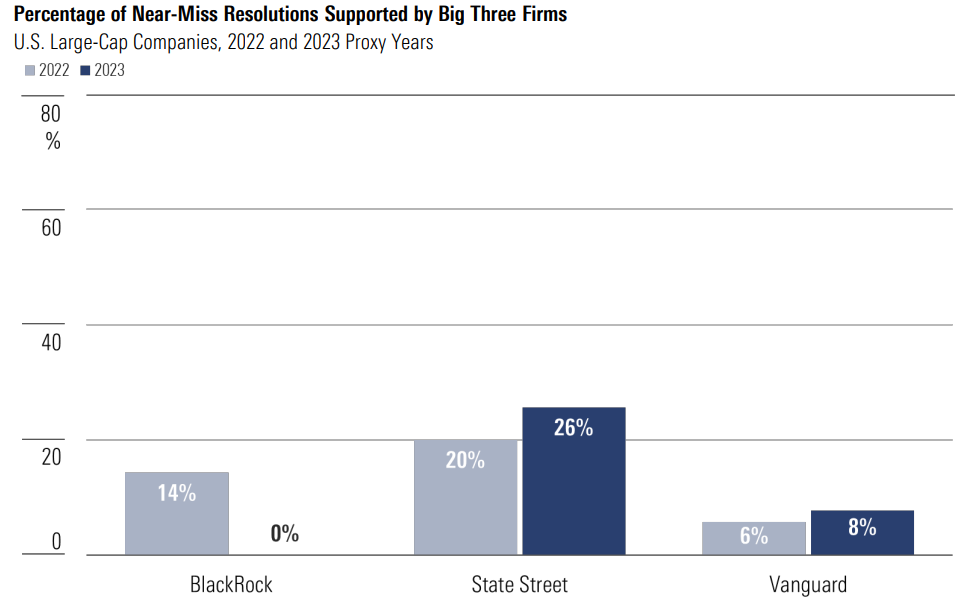

Big Three Support for Near-Miss Resolutions Diverges Further From the Wider Market

Even after accounting for their much lower average level of support, the Big Three firms are much less likely to vote in favor of near-miss resolutions. On average, near-miss resolutions at U.S. large-cap companies were supported by over one third of independent shareholders (36% in the 2022 proxy year, 34% in 2023).

At the U.S. large-cap companies, both BlackRock and Vanguard supported only five (7%) out of 74 near-miss resolutions in the last two proxy years. BlackRock supported no near-miss resolutions in 2023, while Vanguard voted “For” two in 2022 and three in 2023.

State Street’s support for near-miss resolutions considerably is higher than for the other Big Three firms. But the firm still decided not to back three fourths of these resolutions at U.S. large-cap companies over the last two proxy years.

State Street voted “For” 17 (23%) of the 74 resolutions: seven in the 2022 proxy year and 10 in 2023. The firm abstained on 10 of the 74 resolutions (four in the 2022 proxy year, six in 2023).

Source: Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Sept. 29, 2023. Note: Chart shows data representing voting decisions made by the majority of each firm’s funds for proxy years ended June 30.

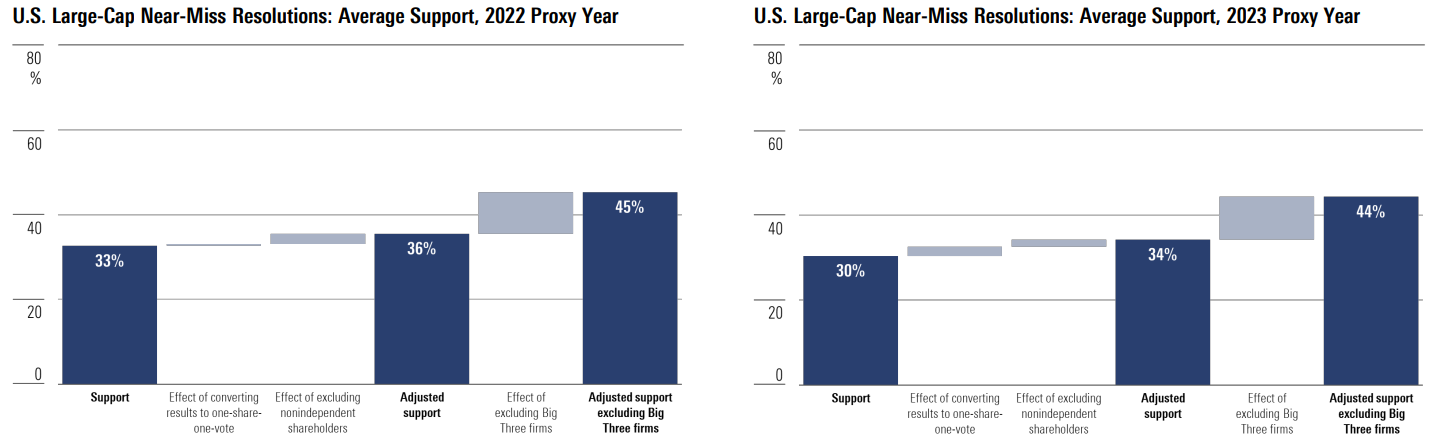

Disaggregating the Effects of Voting Decisions for Near-Miss Resolutions

Adjusting for multiple-class share schemes and insider shareholdings has a much smaller effect for near-miss resolutions than for key resolutions. This adjustment accounts for only 3 to 4 percentage points among near-miss resolutions on average, compared with 15 to 16 percentage points for key resolutions. However, the effect of the Big Three’s lower support for near-miss resolutions is larger than for key resolutions.

Excluding the Big Three’s votes adds 9 to 10 percentage points to adjusted support on average in both years, compared with 6 to 7 percentage points for key resolutions. The exclusion would lift the average well clear of the 40% threshold, suggesting that there are several proposals among the near-misses that had key resolution-level support among shareholders outside the Big Three.

Source: Morningstar proxy-voting database, Morningstar Direct, asset managers’ stewardship disclosures, SEC filings. Data as of Sept. 29, 2023. Note: Chart shows data for proxy years ended June 30.

Quantifying Support Outside the Big Three

Most near-miss resolutions would have been key resolutions based on their support from shareholders other than the Big Three.

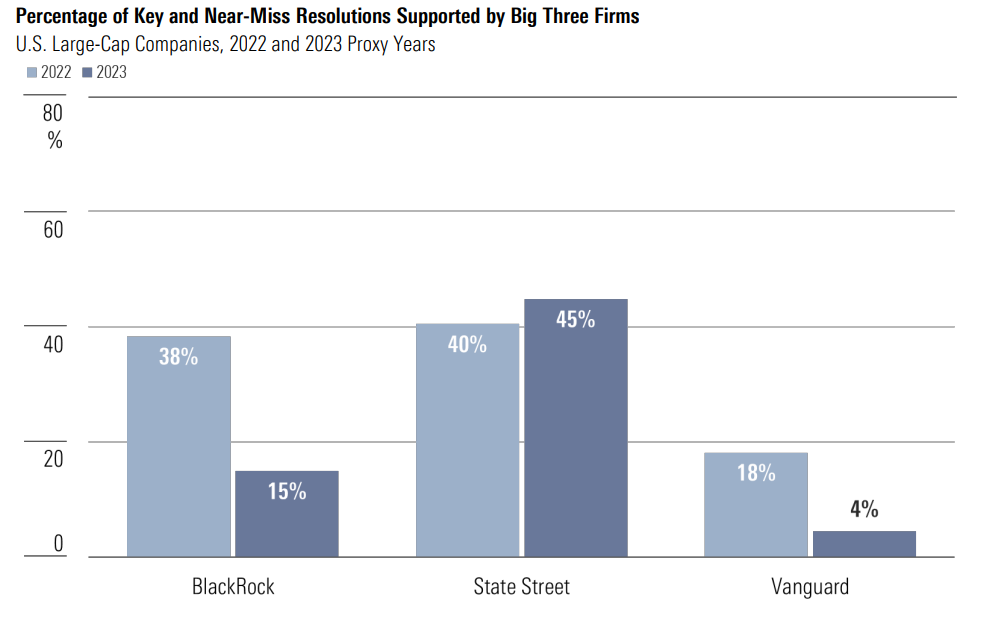

Aggregate Effect of Big Three Voting Decisions on Key and Near-Miss Resolutions Is Negative

If we combine the key and near-miss resolutions into one group (containing all E&S shareholder resolutions at U.S. large caps with at least 30% adjusted support), the average adjusted support for those 161 resolutions is 45%: 48% for the 94 resolutions in the 2022 proxy year and 40% for the 67 resolutions in 2023. We see on the chart opposite that only State Street supports a percentage of key and near-miss resolutions broadly in line with those averages.

BlackRock’s support was close to the average in 2022 but fell away sharply in 2023. Vanguard’s support for these resolutions was low in 2022 anyway but also declined considerably in 2023. These two firms have roughly double State Street’s voting power on the resolutions we analyzed, so their declining support for key and near-miss resolutions has a larger effect on the marketwide average.

Source: Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Sept. 29, 2023. Note: Chart shows data representing voting decisions made by the majority of each firm’s funds for proxy years ended June 30.

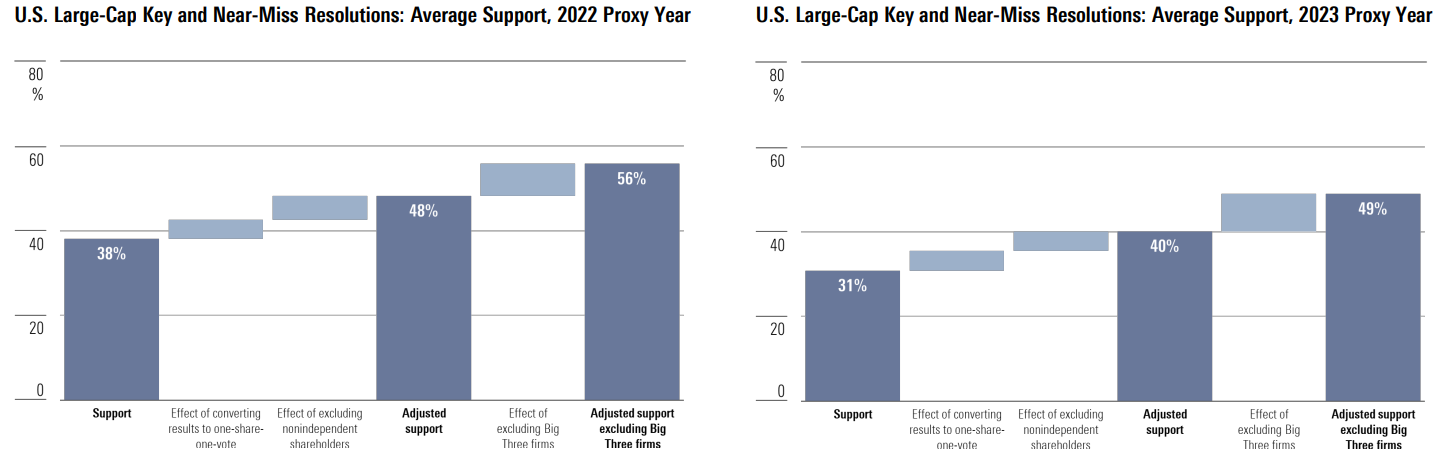

Disaggregating the Effects of Voting Decisions for Key and Near-Miss Resolutions

Overall, we see that for these resolutions, independent shareholders outside the Big Three show support around 8 to 9 percentage points higher than the market as a whole. Adjusted support excluding the Big Three is 49% in the 2023 proxy year and 56% in 2022. Comparable figures including the Big Three are 40% and 48%, respectively.

The size of the increase in average support caused by excluding the Big Three’s votes suggests that most near-miss resolutions would have been key resolutions based only on votes from outside the Big Three.

Source: Morningstar proxy-voting database, Morningstar Direct, asset managers’ stewardship disclosures, SEC filings. Data as of Sept. 29, 2023. Note: Chart shows data for proxy years ended June 30.

Excluding the Big Three, There Would Be Around 30 Additional Key Resolutions in Each Year

Splitting out these effects by individual resolution, we see that around 30 near-miss resolutions would have been key resolutions counting only votes cast by independent shareholders other than the Big Three firms. (That is, 31 out of 39 near miss resolutions in the 2023 proxy year and 28 out of 35 in 2022.) We identify each of these resolutions in Appendix 3.

Even after including these additional key resolutions, the average support for key resolutions among independent shareholders outside the Big Three changes little. The average for the 2022 proxy year would be around 2 percentage points higher at 58%. Similarly, the average for the 2023 proxy year would be around 3 percentage points higher at 51%.

Source: Morningstar proxy-voting database, Morningstar Direct, asset managers’ stewardship disclosures, SEC filings. Data as of Sept. 29, 2023. Note: Chart shows data for proxy years ended June 30.

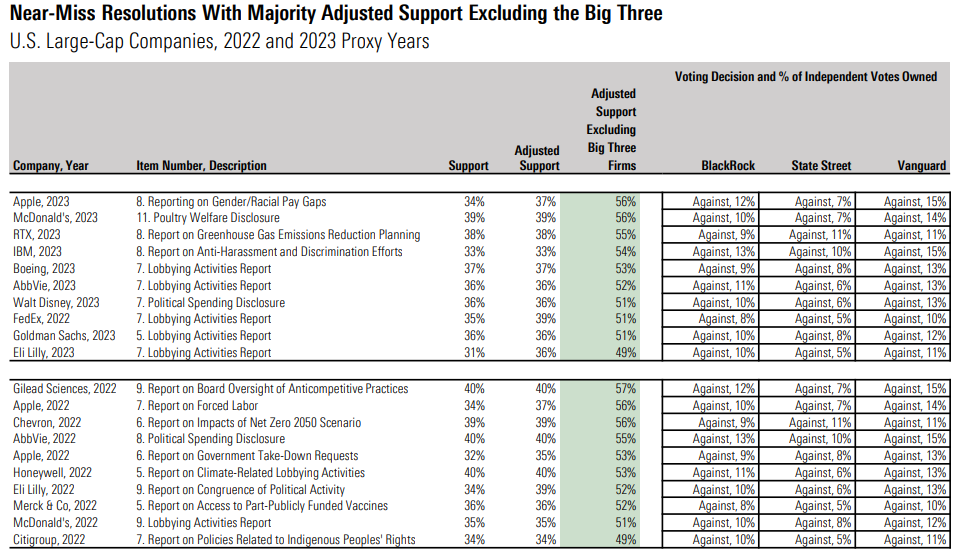

Several Near-Miss Resolutions Gained Majority Independent Shareholder Support Outside the Big Three

The tables opposite show near-miss resolutions with the highest support from independent shareholders outside the Big Three in the last two proxy years.

In both years, nine out of the top 10 such resolutions gained majority support among independent shareholders other than BlackRock, State Street, and Vanguard. Each of the three firms voted “Against” all 20 of these resolutions. In aggregate, the three firms held an average 30% of the independently owned shares at the companies in question.

Most of these resolutions relate to social topics. Proposals relating to political influence and activity were most common, particularly in 2023. Labor issues also featured: Resolutions requesting information on human rights risks and pay gaps at Apple and antiharassment and discrimination efforts at IBM are examples. However, climate-related matters also featured in the list in the form of proposals at Chevron and Honeywell in 2022 and RTX (formerly Raytheon) in 2023.

Source: Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Sept. 29, 2023. Note: Chart shows data representing voting decisions made by the majority of each firm’s funds for proxy years ended June 30.

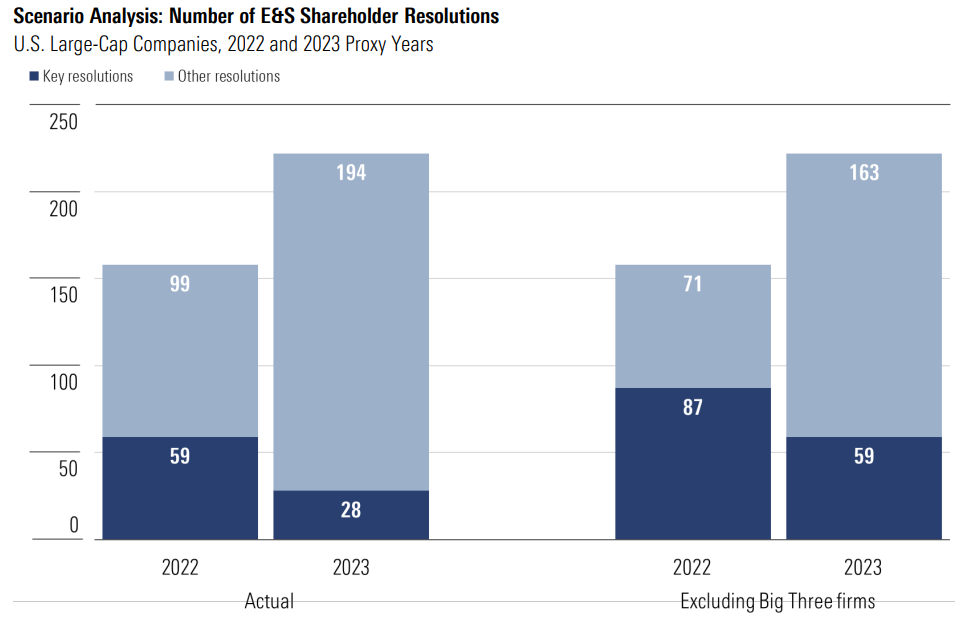

Conclusion: More Than One Thing Can Be True

It’s clear that there would have been many more key resolutions in the 2022 and 2023 proxy years if it weren’t for the damping effect of the Big Three’s voting decisions taken in aggregate. This does indicate that for resolutions with at least 30% adjusted support, perceptions of resolution quality among the Big Three (BlackRock and Vanguard in particular) have fallen below that of other independent shareholders in the U.S. market. Assuming large-cap trends apply to the whole U.S. market, there would have been around 90 key resolutions in 2023 instead of 53, excluding the Big Three’s votes.

However, as the chart opposite shows, whether you include or exclude the Big Three’s votes, the number of resolutions that do not achieve key-resolution status roughly doubled between 2022 and 2023: either an actual increase from 99 resolutions to 194, or an increase from 71 resolutions to 163 in the scenario excluding the Big Three. In both cases, the number of key resolutions as a percentage of the total falls by around 25 percentage points in the 2023 proxy year compared with 2022.

Source: Morningstar proxy-voting database, asset managers’ stewardship disclosures, SEC filings. Data as of Sept. 29, 2023. Note: Chart shows data representing voting decisions made by the majority of each firm’s funds for proxy years ended June 30.

1“U.S. large-cap” refers to S&P 100 constituents as of June 30, 2023.(go back)

Print

Print