Kei Okamura is a Portfolio Manager at Neuberger Berman. This post is based on his Neuberger Berman memorandum. Related research from the Program on Corporate Governance includes The Agency Problems of Institutional Investors (discussed on the Forum here) by Lucian Bebchuk, Alma Cohen, Scott Hirst; Index Funds and the Future of Corporate Governance: Theory, Evidence and Policy (discussed on the Forum here) and The Specter of the Giant Three (discussed on the Forum here) both by Lucian Bebchuk and Scott Hirst; and The Limits of Portfolio Primacy (discussed on the Forum here) by Roberto Tallarita.

Reforms could continue to drive performance, particularly in a small to mid cap space that is ripe for engagement-driven capital efficiency gains.

The long-overlooked Japanese equity market’s resilient performance in the first half of 2023 caught many global investors off guard, driven by a healthy economy, monetary policy normalization, favorable geopolitical conditions and, importantly, unprecedented regulatory reforms. Now, we believe this performance strength is likely to continue, particularly in the small to mid cap space where companies show potential to benefit from constructive engagement.

In this white paper, we explore our market views, and provide case studies and takeaways for global investors considering constructive discourse with Japanese management.

The long-overlooked Japanese equity market’s resilient performance in the first half of 2023 caught many global investors off guard. A combination of a healthy macro economy, monetary policy normalization and favorable geopolitical conditions acted as a catalyst in the initial phase of the rally. However, of particular surprise to many investors was the unprecedented regulatory reforms targeting Japanese companies’ capital mismanagement. We believe this helped drive the Topix and Nikkei 225 benchmarks to test multidecade highs on the back of foreign investor inflow levels not seen since the heyday of Abenomics in the mid-2010s.

Is this surge in performance complete? We believe the answer is no, and that Japanese equities are well positioned to rerate further due to the government-led reforms. Upside potential appears particularly evident within the under-researched small to mid cap (SMID)[1] market, which we believe has more potential to improve capital efficiency than large-cap peers. Moreover, our long experience with SMID companies suggest that the rerating opportunity could be amplified through constructive engagement.

In this white paper, we explore our market views, and provide several case studies and takeaways for global investors considering constructive discourse with Japanese management in the future.

The Market That Cried ‘Reform’

Japan is often compared with the boy who cried wolf. In the early 2000s, then-Prime Minister Junichiro Koizumi called for “privatization reforms,” and in early 2010s, late-Prime Minister Shinzo Abe introduced “corporate governance reforms.” Both times, global investors flocked to Japanese equities in the hope that state-driven initiatives would reignite Japan’s dormant economy and rerate its undervalued stock market, and both times, Japanese equities saw an initial burst of market exuberance, but failed to maintain that momentum, with shares reverting to undervalued levels. This sense of disappointment contributed to skepticism from global investors and their underweight in Japan equities for much of the past decade.[2]

We believe the market regime is changing. At the end of 2021, we argued in our white paper, “Japan’s Coming Wave of Reform,” that over the subsequent 12 to 24 months, Japanese companies would embark on a historic overhaul of corporate governance, capital management and sustainability practices that would be critical to long-term growth, while serving as a new catalyst for Japanese equities. In 2023, we have begun to see this scenario play out and even exceed our expectations. In particular, we have been encouraged by the depth and breadth of the government’s push to improve corporate value by specifically addressing Japan’s “Achilles’ heel” of widespread capital mismanagement.

The Tokyo Bourse Charges Ahead

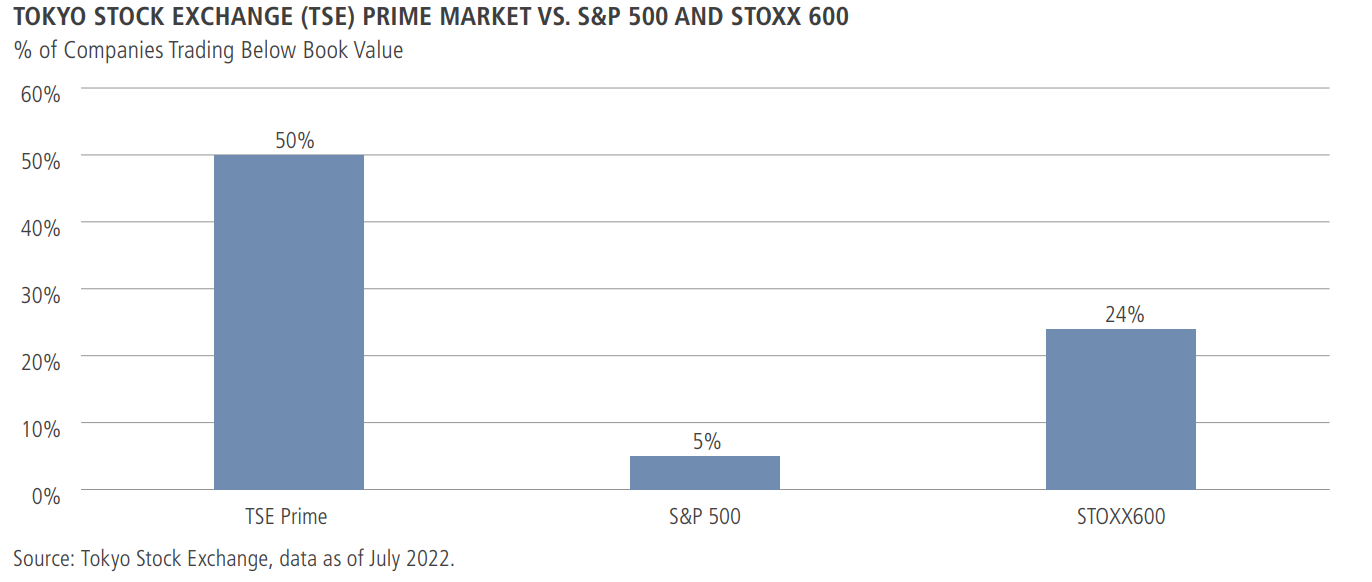

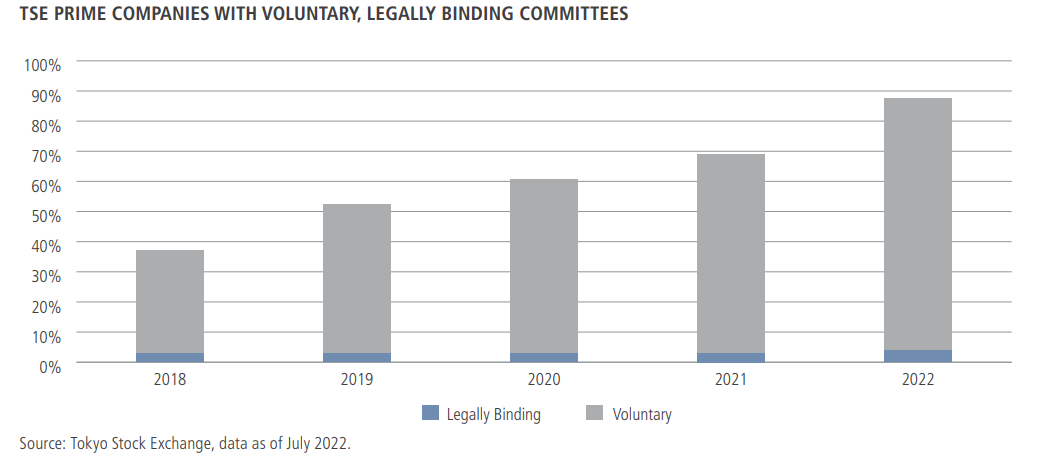

The first wave of capital management reform came from the Tokyo Stock Exchange (TSE) at the end of 2022 after the bourse undertook its biggest structural overhaul since its founding in 1847 by consolidating its four cash equity markets of TSE First, Second, Mothers and JASDAQ into TSE Prime, Standard and Growth. The goal of this historic shakeup was to make Japan’s equity market more attractive and accessible to global investors. The bourse placed strong emphasis on the coveted TSE Prime Market, which would cater to “companies with large market capitalization, [are] investable to many institutional investors, [have] a high quality of corporate governance, and [are committed] to sustainable growth through constructive dialogue with investors.”[3] To limit the number of companies, the TSE established new listing rules regarding liquidity, business performance and corporate governance. On governance, it is worth noting that the bourse-mandated companies be either in compliance with the fundamental principles of the Corporate Governance Code or provide an explanation in the event of noncompliance. In the 2021 revised CG Code, key updates such as one third board independence and establishment of voluntary nominations and compensation committees were, in our view, steps in the right direction to raise board effectiveness. On the other hand, it is worth noting that Japanese corporate governance is still far from the gold standard, in our view, as the portion of firms with majority board independence and a U.S.-style three-committee structure with legally binding committees remains at less than 10%.[4]

The TSE’s reform was initially received with mixed reviews from investors. The most often cited disappointment was the TSE’s decision to not set hard deadlines for when companies had to comply with the new guidelines. In our view, this provision likely resulted in 239 or 13% of 1,839 companies being granted a listing on the coveted TSE Prime Section even though they did not meet the new listing rules.[5] After criticism from investors, the TSE amended its rule and, at the end of 2022, announced a new schedule to push companies to comply with listing rules. First, all companies in noncompliance would be given until March 2025 to meet the guidelines. Second, if the subject firm were not in compliance by March 2025, it would be given a one-year improvement period. Third, if the company failed to meet the requirements within this period, it would be designated among the “Securities under Supervision/Securities to be Delisted” and would be delisted from the market, typically within six months. (TSE Prime companies would have the choice to relist in the TSE Standard Market or delist.[6] ) As a result, as of August 2023, 105 TSE Prime companies announced that they would move to the TSE Standard Market.[7] We believe that the TSE’s tougher position on companies in noncompliance was instrumental in prompting Japanese corporate managements to discuss the responsibilities of a publicly listed entity and the importance of improving corporate value over the long term.

That said, what came next took the market by surprise. In March 2023, just months after the hard deadline for listing requirements was established, the TSE sent a guideline to more than 3,000 TSE Prime and Standard constituents, seeking corporate managements’ disclosure as to how they planned to raise their capital return (as measured by return on equity [ROE] and return on invested capital [ROIC], among others) sustainably above their weighted average cost of capital (WACC) with a strong emphasis on companies trading below book value to make such disclosures.

We believe the TSE’s decision was pivotal for several reasons. First, the guideline singled out capital mismanagement as a core issue for undervalued Japanese companies, which represents a clear evolution from previous reforms focusing primarily on corporate governance. Second, the bourse highlighted share price and cost of capital as key performance indicators (KPIs) that companies should consider in making important management decisions, which we often find is missing from many boardroom discussions. Finally, it’s worth noting that the TSE directive sent a clear signal for management to engage with shareholders, domestic and foreign, on these topics, which we believe could pave the way for more companies to pursue corporate value creation for the sake of all minority shareholders.

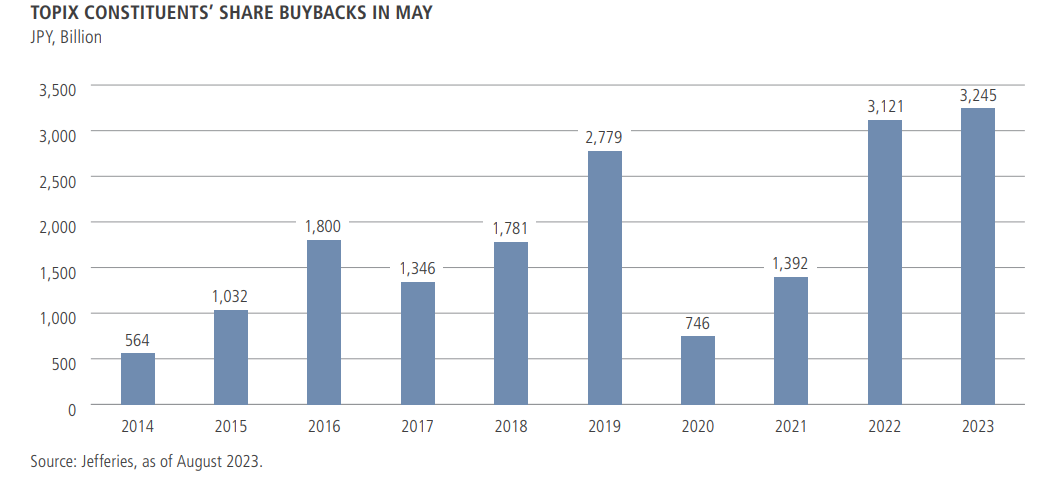

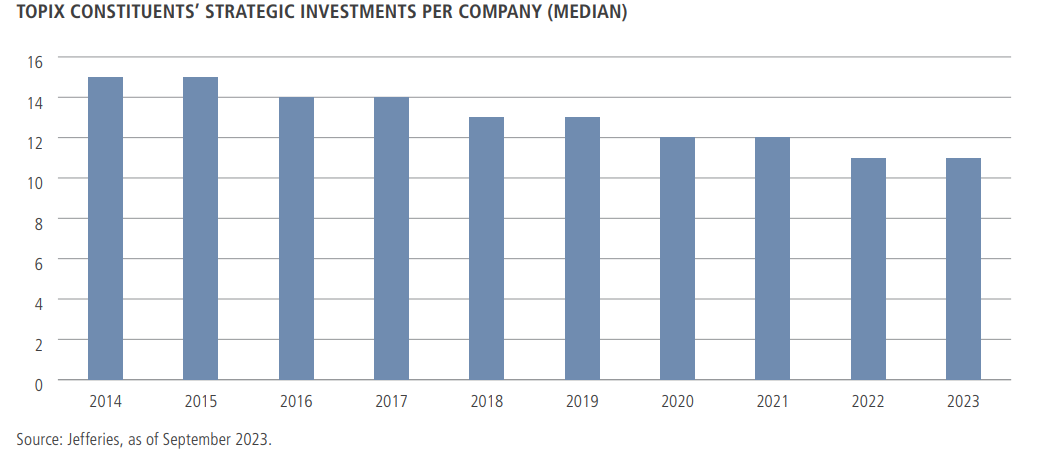

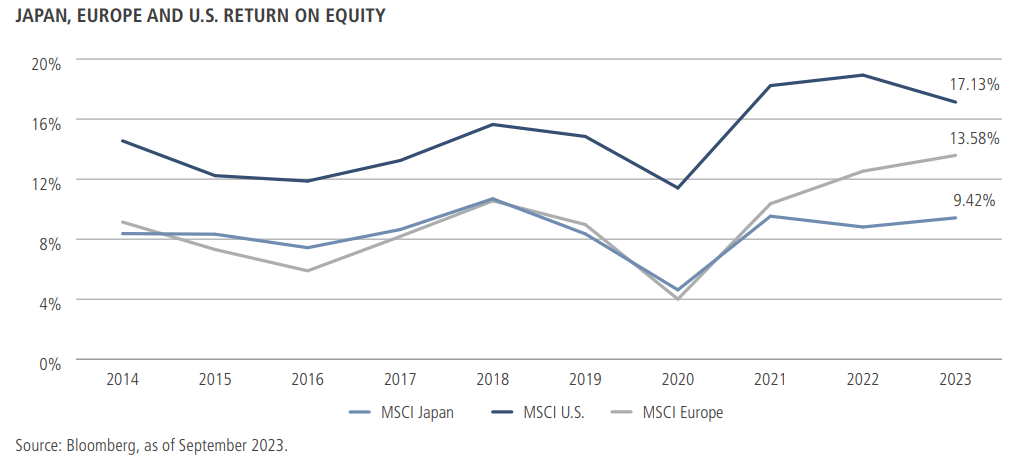

The TSE’s March 2023 announcement, dubbed the “Price-to-Book (PBR) Guideline,” had an almost immediate effect on companies especially those listed on the TSE Prime Market. First, they began to undertake share repurchases at record levels, resulting in May 2023 (which is the fiscal year-end reporting period when companies typically announce such measures) seeing the highest buybacks on record.[8] In addition, Japanese companies’ strategic investments, including cross-shareholdings among key clients, group firms and business partners, also continued to fall in the fiscal year ending March 2023, dropping 6% year-on-year, to the lowest level reported since companies were mandated to disclose such investments in 2010.[9] We believe this is a crucial step for many companies contending with low valuations as Japan’s ROE continues to lag overseas peers due to overcapitalized balance sheets.

The Government’s Grand Plan

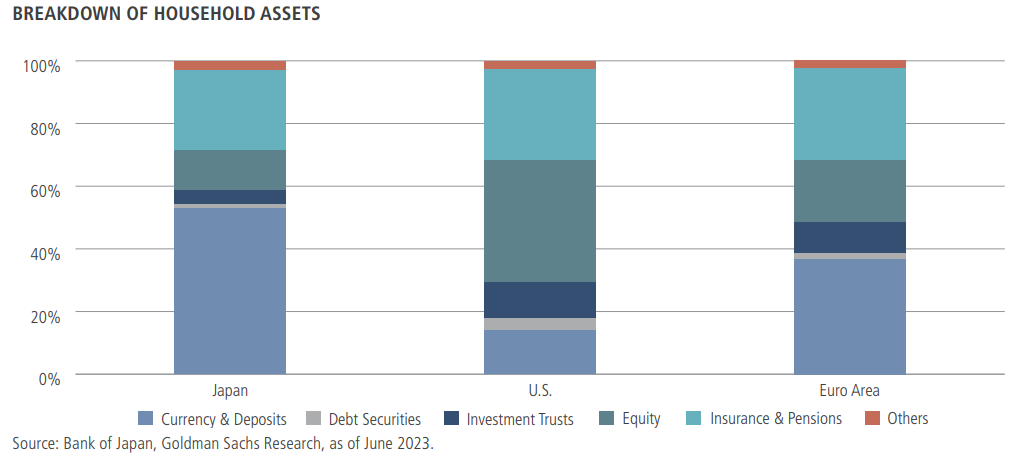

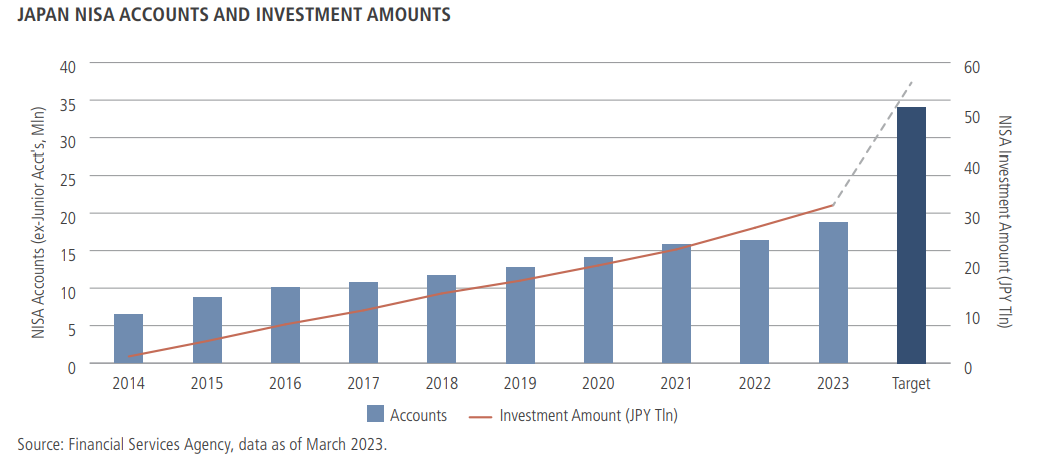

We believe the TSE-led reforms are the first of many government-led initiatives to come that will be intended to boost Japanese corporate value, all of which could support further rerating of Japanese equities over the mid to long term. Motivation behind the corporate reforms comes from Prime Minister Fumio Kishida’s “Doubling Asset-Based Income Plan.” Announced in November 2022, this grand plan targets the 2,000 trillion yen (US$14 trillion as of September 2023) in household financial wealth that is currently majority-held in cash and cash equivalents, in hopes of moving it into higher-return assets. To do so, the government will start in 2024 by overhauling the existing Nippon Individual Savings Account (NISA) scheme that offers tax exemptions to retail investors. Under a new framework, individual investors will have higher investment limits and greater tax emptions, while the duration of the investments would no longer be limited. The plan seeks to double the number of NISA accounts from 17 to 34 million and the aggregate investment amount from JPY 28 to 56 trillion in the next five years.[10] We believe the new scheme could act as a strong incentive for Japanese retail investors to shift their wealth into riskier assets like Japanese stocks, especially given emerging inflation trends. According to one researcher, a 1% shift in Japanese household assets into Japanese equities could create US$150 billion in new buying power, which would roughly translate into seven times the average daily turnover of the Topix index.[11] For this reason, the Japanese government is intent on fixing corporate Japan’s capital mismanagement to spark a rerating of the equity market and potentially boost personal wealth.

The Coming Wave of Capital Efficiency Reform

The government’s grand scheme has kicked off a coordinated response from regulators to boost companies’ capital efficiency, starting with the TSE’s “PBR Guideline.” Among other notable regulatory actions is the Ministry of Economy, Trade and Industry’s (METI) revamped “Guidelines for Corporate Takeovers,” announced in August 2023, which place a stronger emphasis on corporate boardrooms to objectively consider all takeover offers in the interest of corporate value maximization. We believe the guidelines could be instrumental to push board directors to play a more proactive role in discussing divestitures and acquisitions for the enhancement of corporate value. Further, we believe the new policy could help to remove outdated traditions that considered unsolicited domestic-to domestic takeovers as taboo. It’s worth noting that, around the same time as the METI Guidelines were finalized, precision equipment maker Nidec announced a US$118 million hostile takeover of machine tool maker Takisawa that was eventually approved by the latter’s board. Nidec’s CEO commented that the revised METI Guidelines were pivotal for the deal’s success.[12]

In addition, the Financial Services Agency (FSA) published the “Corporate Governance Action Program” in April 2023, outlining a set of recommendations to encourage companies to achieve sustainable growth. The program not only endorses the TSE’s PBR Guideline, but also includes new initiatives such as recommendations to companies to improve transparency of boardroom compensation and nomination committees and the role they play in addressing key management issues such as incentivization schemes, as well as succession planning. We believe more board director involvement in aligning the interests of management and shareholders through a comprehensive remuneration scheme linked to mid- to long-term KPIs, and holding top management accountable through succession plans, would encourage companies to address more fundamental issues that could help unlock corporate value. In addition, the program seeks to promote investor engagement with companies to address these issues. To do so, the FSA committed to resolving the legal issues surrounding the “act of making important suggestions” and “joint holders” as part of the large shareholding reporting rule.[13] Under the revisions, which are currently being debated within the Financial Services Council, the FSA will aim to clear any misapprehension investors may have as to rules on what circumstances would constitute acting in concert, and making significant proposals to company management in group settings, which we believe would be pivotal for investors’ collaborative engagement to become common practice in Japan. On that front, we believe the Asian Corporate Governance Association’s (ACGA) investor-led collaborative engagements with leading Japanese companies offer a useful template for other investors to consider in their future such endeavors. ACGA was also one of several major collaborative engagement groups in Japan cited by the annual survey of listed companies, conducted by Japan’s Government Pension Investment Fund (GPIF).[14]

Japan’s Overlooked SMID Market

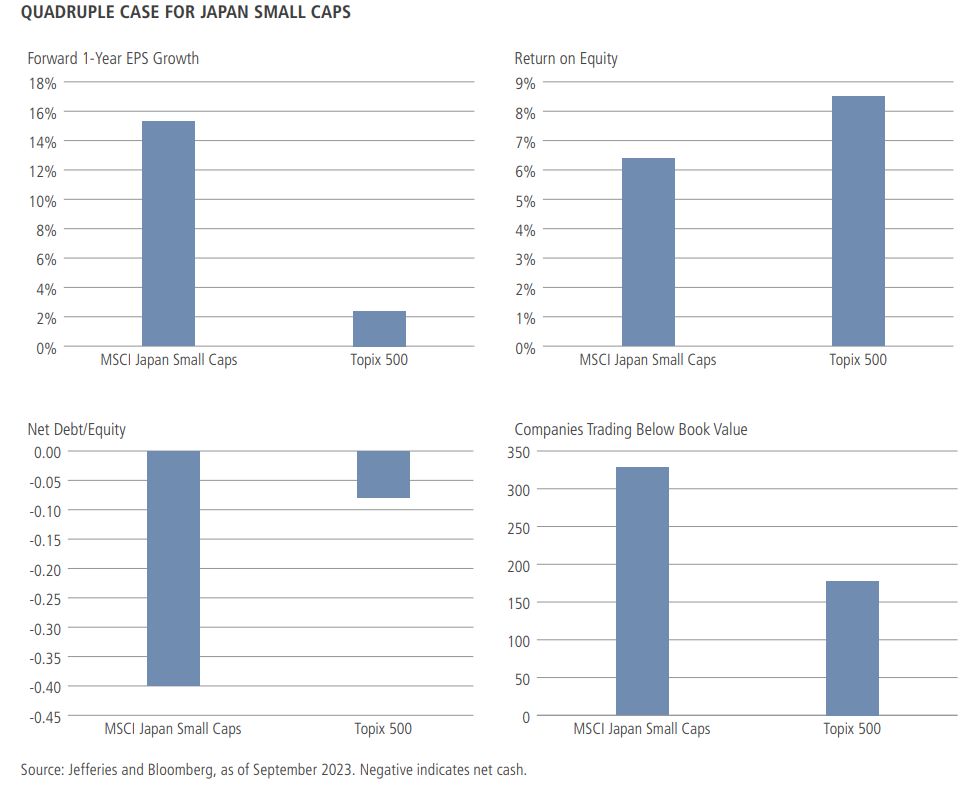

We believe Japan is finally emerging from its so-called lost decades, led by a progressive government committed to unlocking corporate value over the long term. While this could clearly benefit many Japanese equities, our view is that the bigger rerating potential for equity valuations lies in the overlooked and under-researched small- to midsize capitalization (SMID) market consisting of companies with valuations under US$10 billion. We believe this market is home to a plethora of high-quality businesses with strong fundamentals and attractive growth potential—qualities that have helped to support the group’s superior earnings growth relative to large-cap peers.[15] However, what makes this market unique is that despite the strong growth profile, ROE has consistently remained inferior, and we attribute this to companies’ relatively high capital surplus led by cash and cash equivalents. This has resulted in many companies trading at lower valuations than large caps, with nearly 40% of the MSCI Japan Small Cap benchmark trading below book value.[16]

Unlocking Value Through Engagement

Given this backdrop, we strongly believe the Japanese SMID market poses a unique opportunity to discover high-quality companies at discounted valuations with strong upside potential for a rerating through capital efficiency improvements. To achieve that goal, we believe it’s critical, first, to selectively choose companies run by progressive management willing to increase corporate value for all minority shareholders, and second, to conduct constructive engagement. In terms of stock selection, we believe the Japanese SMID market is home to many globally competitive businesses with attractive growth potential, but that key risks lie in management quality when decision-makers are not receptive to engagement and/or not willing to address financially material issues, which often results in “value traps.” To avoid such companies, we believe bottom-up fundamental analysis, combined with on-the-ground due diligence meetings, is vital, often involving multiple visits with not just the target company but also its peers, suppliers and sometimes its parent company to formulate an objective view of the engagement potential.

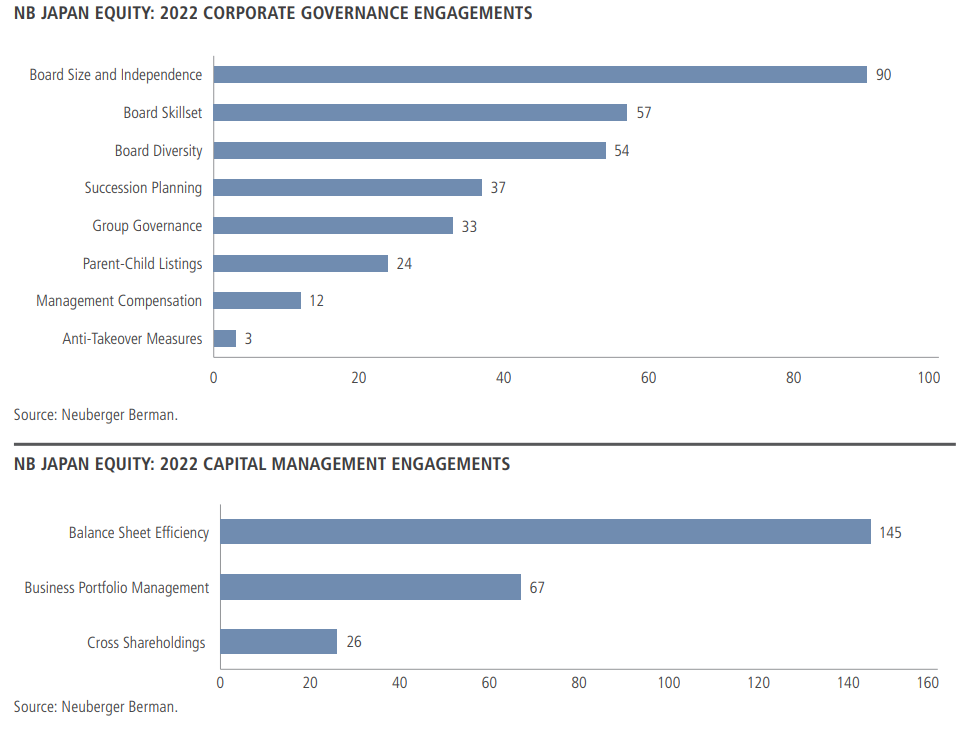

Based on our experience, a friendly and constructive approach to engagement that establishes a mutually beneficial relationship with companies can often yield the most sustainable outcomes. We believe that this is particularly the case on the issue of capital management. During 2022, the Neuberger Berman Japan Equities Team conducted over 200 meetings on this topic, making it the second most commonly discussed topic after corporate governance. Within capital management, the team’s discussions centered on improving balance-sheet efficiency to raise capital returns. When engaging on the topic, we believe it is critical for investors to have a robust strategy focusing on action, disclosure and governance, and to have a well-defined objective (i.e., a target valuation multiple) and a roadmap to achieve that goal over the short (less than a year) to mid term (one to three years) with interim KPIs. (Read our 2021 white paper, Japan’s Coming Wave of Reform, for more details on our approach to engagement and “milestone framework.”)

In the short term, we find that engagement milestones can be focused primarily on corporate actions such as reductions in cross shareholdings, repurchasing stock and raising dividends. We believe that such initiatives can be quick and effective ways to address low capital efficiency. However, we do not think such actions alone can sustain a fundamental rerating over the mid to long term. Over the mid term, we seek to conduct a “deeper-dive” engagement to integrate effective capital management into the business strategy, along with quantitative KPIs and effective investor communication. Here, we believe it is vital for investors to share their expectations as to what action points and disclosures are considered desirable from a mid- to long-term investment standpoint. At the same time, investors should proactively share best practice examples, typically from domestic peer groups. (It’s useful to ask management what companies they benchmark to.) A typical milestone from an action standpoint may be the complete divestiture of cross-shareholdings, unprofitable businesses, land assets and parent-subsidiary lending schemes whose proceeds can be used to reinvest in the business and/or raise shareholder returns. With respect to disclosure, we believe a high-priority KPI should be the announcement of a capital allocation policy that outlines how the company intends to grow the business, leveraging shareholder capital with respect to reinvestment (capital investment, R&D, M&A), cash on hand and shareholder returns. Finally, we believe a strong corporate governance framework is vital to successfully address this issue. Therefore, our engagement on capital management also extends to corporate governance agendas such as board skillset and management remuneration. On the former, we have found that many Japanese companies lack CFOs with actual capital planning and markets experience. Although firms claim that this skillset is represented in the skills matrix under “finance and accounting,” it is most often the case that the relevant director has accounting, but not corporate finance experience, which we do not see as interchangeable. On the latter, we understand the growing importance of aligning the interests of management and shareholders, and therefore look for companies to integrate their mid term capital efficiency targets into management compensation plans.

In our view, a successful corporate engagement will ultimately depend on the investor’s relationship with the company and whether senior management trusts the portfolio manager to be a sounding board in its decision-making process. Hence, in the initial round of meetings, investors may be asked to go beyond mere discussion and to present specific recommendations on how to improve corporate value, as you might find with a management consultant. This may involve a “teardown” of existing mid term strategies, balance sheet analysis, and cash flow modeling.

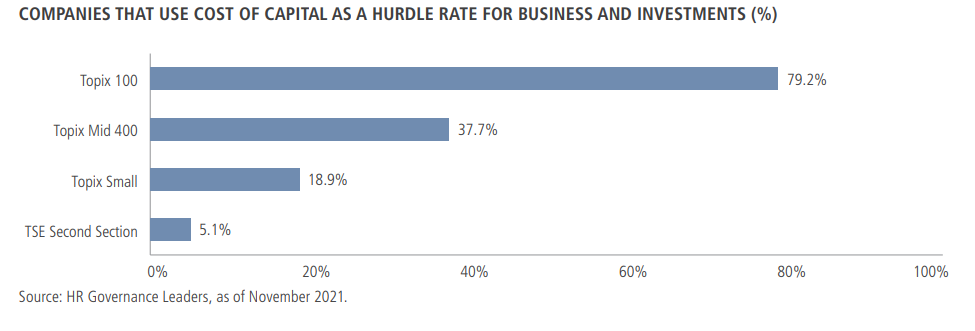

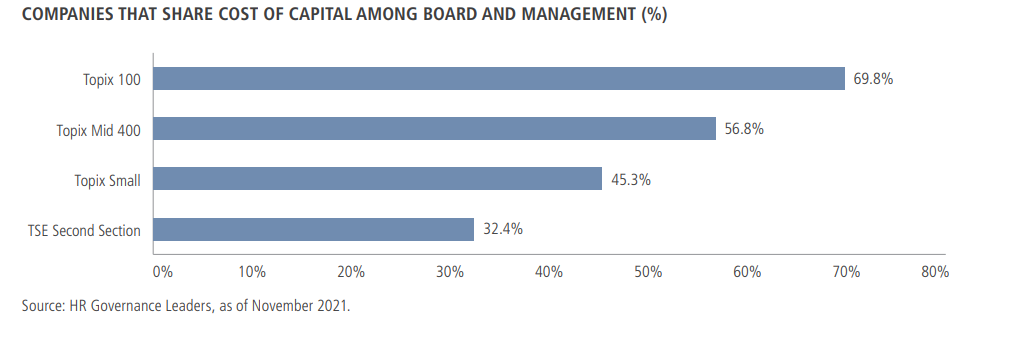

Ultimately, we do not believe this type of deep engagement is for every shareholder. However, in a unique market like Japanese SMIDs, where management access is favorable, the presence of other engaged investors is limited, the disclosure level is relatively low and valuations are often discounted to peers, we believe the potential for engagement to enhance corporate value can be substantial. As a case in point, according to a 2021 survey of Japanese companies, nearly 80% of large-cap company respondents (defined as Topix 100 constituents) indicated that the concept of cost of capital is used for business and investment evaluation, while two-thirds said that they shared the metric among board directors and management.

However, the ratio of respondents fell substantially for mid- and smaller-cap companies, indicating that there is a considerable divide in the level of awareness of basic capital management concepts like cost of capital among smaller firms. This is a point where we believe investors’ financial analysis vis-à-vis peers can provide significant value-add to investee companies. Further, many institutional investors in Japanese equities, especially among passive strategies, have traditionally focused their engagement efforts with large-cap companies as opposed to SMID due to economic (i.e., large position size) and resourcing (i.e., lack of engagement personnel) reasons.[17] We believe this blind spot creates an attractive opportunity for active long-term investors to seek constructive engagement with progressive smaller companies. And considering that the government’s coordinated capital management reforms have helped to raise the sense of urgency among management and have accelerated timelines for many companies to act, we believe the payback period for engagement wins has been shortened while prospects for more fundamental reforms that move the needle for the share price look increasingly attractive.

1We typically define small to mid cap (SMID) companies as those with a market capitalization under US$10bn at the time of purchase.(go back)

2Tokyo Stock Exchange, MSCI data as of end 2022, compiled by SMBC Nikko Securities.(go back)

3Tokyo Stock Exchange, “Overview of the Market Structure Review: Outline of the New Market Segments,” February 21, 2020.(go back)

4Tokyo Stock Exchange, “How Listed Companies Have Addressed Japan’s Corporate Governance Code,” July 14, 2022.(go back)

5Tokyo Stock Exchange data, as of July 2022.(go back)

6Tokyo Stock Exchange, “TSE’s Future Actions in Response to the Summary of Discussions of the Follow-up Council,” January 25, 2023(go back)

7Tokyo Stock Exchange data, as of August 2023.(go back)

8Jefferies Securities data, as of August 2023.(go back)

9Nikkei Newspaper data, as of September 2023.(go back)

10Cabinet Office, Doubling Asset-Based Income Plan. All references are as of November 2022.(go back)

11Goldman Sachs research data, as of May 2023.(go back)

12Reuters News, “Nidec’s Acquisitive CEO hails new Japan rules aimed at making takeovers easier,” July 24, 2023.(go back)

13Financial Services Agency, “Action Program for Accelerating Corporate Governance Reform: From Form to Substance,” April 2023.(go back)

14Government Pension Investment Fund, Report of the 8th Survey of Listed Companies Regarding Institutional Investors’ Stewardship Activities, May 2023.(go back)

15 Jefferies data as of May 2023 in reference to MSCI Japan Small Cap Index (JPY) cumulative total returns (%) relative to MSCI Japan Index (JPY) between December 1999 to December 2022.(go back)

16 Bloomberg data, as of September 2023.(go back)

17 Financial Services Agency, Progress Report 2023 for Enhancing Asset Management Business in Japan, June 2023.(go back)

Print

Print