Subodh Mishra is Global Head of Communications at Institutional Shareholder Services (ISS) Inc. This post is based on an ISS Corporate Solutions memorandum by Alyce Lomax, Associate Vice President at ISS Corporate Solutions. Related research from the Program on Corporate Governance includes Golden Parachutes and the Wealth of Shareholders (discussed on the Forum here) by Lucian Bebchuk, Alma Cohen, and Charles C.Y. Wang.

A S H A R E H O L D E R P R O P O S A L T O W A T C H

Golden parachutes cushion corporate leaders from the financial risks of a sudden exit by promising substantial severance packages, particularly when there is a change in control. From the shareholder perspective, though, they are costly outlays that fail to pay for performance. With challenging macroeconomic factors and recession worries top of mind in the last several years, shareholders and corporate governance advocates are showing increased interest in curbing excessive CEO and executive financial windfalls upon termination.

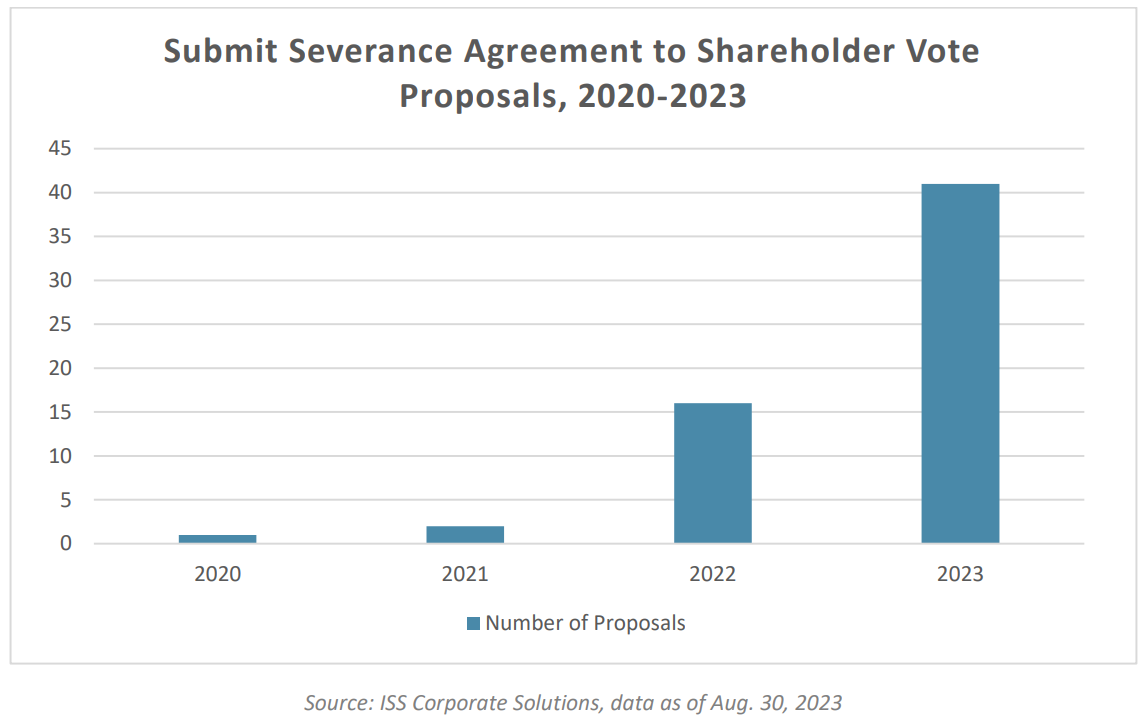

The third most prevalent shareholder proposal by count this year is Submit Severance Agreements (Change-in-Control) to a Shareholder Vote, ISS Corporate Solutions data shows. This type of proposal has been increasingly cropping up on companies’ proxy ballots and a handful have even won majority support. There could be more to come.

From January 2020 through August 2023, 61 proposals were filed on this topic within the Russell 3000 in the U.S., 41 of them in 2023 alone. Out of that, 15% have passed as of this writing. While the levels of proposals and support still represent just a fraction of publicly traded companies, the increased interest and glimmers of shareholder support make the topic well worth watching going forward. Macroeconomic factors could heighten urgency around reining in goodbye packages that fly outside of market norms as well.

G A U G I N G T H E C L I M A T E

The vast majority of “say on golden parachute” proposals have been submitted by well-known corporate governance activists John Chevedden and/or Kenneth Steiner. The common theme in their arguments is to encourage corporate managements to stay focused on business performance instead of being tempted to pursue a business combination that would not be well aligned, resulting in costly termination packages.

ISS research shows that while the median CEO golden parachute value reached $13.1 million in 2022, it has dropped 22% to $10.3 million in 2023. The resumption of an upward trajectory could galvanize future shareholder efforts to demand a vote on newly sweetened goodbye payouts even more.[1]

The last several years have been turbulent in the marketplace overall, from the advent of the COVID-19 pandemic to today. Although a much-predicted U.S. recession has not yet officially come to pass, if the Federal Reserve fails to achieve a “soft landing” there could be more difficult times ahead for companies and their shareholders and that can mean windfalls for any top executives who exit out of difficult situations. From the corporate management perspective, golden parachutes can be viewed as tools to prevent an exodus of top talent or head off the temptation for managers to resist a beneficial acquisition because it would result in a personal financial loss.

On the other hand, shareholders have their own perspective. Flagging profits (or burgeoning losses) and poor shareholder returns at public companies could contribute to higher CEO turnover as well as provide fertile ground for merger and acquisition (M&A) activity. When stronger companies opportunistically swoop in to buy beleaguered ones with depressed stock prices, the last thing shareholders want to see is outsized golden parachutes for departing executives who presided over situations where shareholder returns suffered. Given the possibility of such a scenario — after all, downturns and recessions are inevitable sooner or later — pushing for the shareholder right to vote on changes to severance might end up looking prescient.

S E T T I N G S T A N D A R D S

As much as corporate managers and boards may view these proposals as challenging, it’s important to emphasize that they are non-binding resolutions. Also, they do not seek to alter companies’ existing severance plans, but rather aim to put new or changed severance plans to a shareholder vote for ratification.

Going forward, it is not only worth monitoring the momentum around this proposal type, but also tracking how corporate boards respond when shareholders request this new spin on say on pay.

For example, 54% of Alaska Air Group shareholders passed one of these resolutions at the company’s annual meeting in May 2022. According to the company’s 2023 proxy statement Alaska Air’s non-executive board chair as well as the chairs of the Compensation and Leadership and Governance, Nominating, and Corporate Responsibility committees reached out to its top 25 institutional shareholders holding about half its stock for their perspectives on the proposal and ideas about implementation. Board members met with those who wanted to engage (this pool included 10 of its largest shareholders) and devised a policy that requires shareholder ratification for new or renewed severance agreements if the value of cash and equity exceeds 2.99 times the sum of executive salary and bonus. It’s interesting to note that Alaska Air chose to exclude change-incontrol severance, given golden parachutes’ association with change-in-control events. Still, the company’s actions can be viewed as mitigating the risk of severance that defies market norms. The company reported that the shareholders it engaged with did not express concern about its pay practices or its existing change-in-control agreements.[2]

In another case, 67% of Spirit AeroSystems Holdings’ shareholders voted in favor of say on golden parachutes in April 2022. As outlined in its 2023 proxy statement, the company not only reached out to shareholders representing 70% of outstanding shares for feedback, it also disclosed that it conducted a market survey on severance practices, discussed the topic with its compensation consultant, and approached peer companies that had received similar proposals. Although its ultimate policy didn’t exactly match the proposal, it did put in place the requirement that shareholders approve any cash severance in excess of 2.99 times the executive’s salary and target bonus. So, the final policy can also still be viewed as mitigating the risk of excessive severance.[3]

Finally, the policies and practices of proxy advisory firms and larger institutional shareholders like BlackRock, Vanguard and State Street are an important part of the landscape too.

Institutional Shareholder Services generally recommends that shareholders vote in favor of these proposals unless they require shareholder approval before entering into employment contracts.[4] Glass Lewis takes a similar stand, although it says it may recommend voting against such a proposal if the target company has already adopted a policy requiring shareholder approval for any cash severance payments that exceed 2.99 times the amount of the executive’s base salary plus bonus.[5]

As for large institutions, BlackRock says it may support shareholder proposals that request shareholder approval for golden parachute arrangements. Vanguard also says that its funds may vote in favor of such proposals as long as ratification after the fact is permitted. State Street has not yet specifically outlined a policy around this type of proposal in its voting guidelines.[6]

W A T C H I N G T H E S K I E S

Only time will tell whether this “say on golden parachute” push gains additional momentum or if other environmental, social, and governance issues will attract more shareholder attention during the next proxy season. Either way, attention on the topic now suggests that it is an important compensation and shareholder rights issue that is meant to ensure that corporate managements are properly and prudently incentivized to run successful companies for the long term — paid fairly for true performance, but not overcompensated for exit strategies. Both corporations and shareholders should stay informed on this important issue.

1https://insights.issgovernance.com/posts/2023-united-states-proxy-season-review-compensation/(go back)

2https://www.sec.gov/ix?doc=/Archives/edgar/data/766421/000095017023009765/alk-20230324.htm(go back)

3https://www.sec.gov/ix?doc=/Archives/edgar/data/1364885/000110465923032562/tm231793d2_def14a.htm(go back)

4https://www.issgovernance.com/file/policy/active/americas/US-Voting-Guidelines.pdf(go back)

5https://www.glasslewis.com/wp-content/uploads/2022/11/US-Voting-Guidelines-2023-GL.pdf?hsCtaTracking=45ff0e63-%207af7-4e28-ba3c-7985d01e390a%7C74c0265a-20b3-478c-846b-69784730ccbd;%20https://7114621.fs1.hubspotusercontentna1.net/hubfs/7114621/2023%20Reports/2023-Investment-Manager-Thematic-Voting-PolicyGL.pdf?hsCtaTracking=50cd5ea3-e164-4483-b853-fd20a03a5f1b%7C1cbdefda-605d-4de3-9b92-faab60b712f3(go back)

6https://www.blackrock.com/corporate/literature/fact-sheet/blk-responsible-investment-guidelines-us.pdf; https://corporate.vanguard.com/content/dam/corp/advocate/investment-stewardship/pdf/policies-andreports/us_proxy_voting_2023.pdf; https://www.ssga.com/library-content/pdfs/asr-library/proxy-voting-andengagement-guidelines-us-canada.pdf(go back)

Print

Print