Meaghan Kelly, David Blass, and Michael Osnato are Partners at Simpson Thacher & Bartlett LLP. This post is based on a Simpson Thacher memorandum by Ms. Kelly, Mr. Blass, Mr. Osnato, Nicholas Goldin, Michael Wolitzer, and Marc Berger.

Introduction

The end of September marked the close of the 2023 fiscal year for the United States Securities and Exchange Commission (the “SEC”). In remarks last week, SEC Director of Enforcement, Gurbir Grewal, noted that, “[w]hile we have not yet released our 2023 fiscal year-end numbers, I can give you a sneak preview: we had another incredibly productive year on behalf of the investing public.”[1] Focusing on private funds, Director Grewal stated earlier this year that private funds were a “substantive priority area” for the Division of Enforcement—and that has certainly been borne out in the 2023 docket.[2]

I. Examinations & Enforcement

In this guide, we discuss the following topics from recent examinations and enforcement actions: (i) the calculation of management fees in the post-commitment period; (ii) allocation of expenses; (iii) the amended Marketing Rule; (iv) the Custody Rule; and (v) off-channel communications. The first four topics were specifically identified as priorities for the Division of Examinations in connection with its release this month of its 2024 Examination Priorities.

MANAGEMENT FEES

The topic of the calculation of management fees is a perennial focus area for both the Division of Examinations and the Division of Enforcement. A distinct focus that has recently emerged in examinations, and evidenced through enforcement actions, is on the calculation of management fees in the post-commitment period, where fees are often calculated on the basis of invested capital or invested cost. In this regard, the SEC is focused on whether invested capital is being valued and calculated in line with fund governing documents, specifically in connection with write-downs, write-offs and permanent impairments that would otherwise require firms to stop or reduce collecting fees. The Staff’s concern, as reflected in settled enforcement actions, active enforcement sweeps and ongoing exams, is that firms may be reluctant to recognize reductions in the value of invested capital, particularly with respect to distressed assets, in order to maintain management fee streams. Increasingly, the Staff is framing this decision on the part of the sponsor as giving rise to conflicts of interest that require granular disclosure of the factors and subjectivity used in determining valuations, with the implicit presumption that the valuation process is per se conflicted. This is reflective of the Staff’s increasing use of aggressive conflicts of interest theories rooted in a fiduciary’s duty of care and the implicit view that routine exercises of managerial discretion (like the valuing of an asset) are presumptively tainted by conflicts of interest.

With respect to the Division of Examinations, the 2024 Examination Priorities indicated that the Division would place a specific focus on “calculation and allocation of private fund fees and expenses (both fund-level and investment-level), including valuation of illiquid assets, the calculation of post-commitment period management fees, adequacy of disclosures, and potential offsetting of such fees and expenses.”[3] Similar articulations of this management fee focus have appeared in prior Exam Priorities[4] and Risk Alerts.[5]

![]() A typical examination scoping request on this topic is:

A typical examination scoping request on this topic is:

Management Fee Calculations. A listing of any partial realizations, portfolio company write-downs and portfolio company write-offs during the Examination Period. For each Private Fund, provide a description of how you treated each type for purposes of any adjustments to the management fee calculation.

This issue came into sharp focus this year in the SEC’s settlement with Insight Venture Management LLC (d/b/a Insight Partners).[6] While the SEC has settled prior cases related to the interplay of valuations with management fees with exempt reporting advisers (“ERAs”) in 2020 and 2022,[7] this year’s settlement marked the first with a registered investment adviser (“RIA”) on this topic. The Insight Partners settlement, which arose out of an examination, focused on two allegations related to permanent impairments and management fees: Insight (i) charged excess management fees as a result of taking permanent impairments at the holistic investment level instead of at the actual investment/security level in contravention of relevant fund documents; and (ii) failed to disclose certain conflicts of interest in connection with determining permanent impairments, employing what the SEC said were “subjective” and “difficult to satisfy” criteria.

With respect to the alleged undisclosed conflict, the SEC concluded that Insight’s four-factor test for determining permanent impairments,[8] as well as Insight’s authority under the partnership agreements to reverse permanent impairments, created a conflict of interest by virtue of the adviser making permanent impairment determinations. The SEC charged Insight with violations of Sections 206(2), and 206(4) of the Adviser’s Act, as well as Rules 206(4)-7 and 206(4)-8, thereunder, and ordered Insight to disgorge approximately $865,000, which the firm had previously reimbursed and the SEC thus deemed satisfied, and pay a civil monetary penalty of $1.5 million. The disgorgement ordered and deemed satisfied was separate and in addition to a prior $3.8 million reimbursement that Insight had paid resulting from new (and more “objective”) impairment criteria that it applied to fees associated with four portfolio companies.

In announcing the settlement, the leadership of the Enforcement Division’s Asset Management Unit put a spotlight on fee calculation and disclosure, stating, “Investment advisers must accurately calculate their fees in accordance with fund documents. Moreover, when advisers employ fee calculation policies that create conflicts of interest, including permanent impairment policies, they must disclose those conflicts just like all other material conflicts.”[9] Notably, the penalty in the Insight Partners settlement of $1.5 million far exceeded the $175,000 in penalties imposed on the ERAs in the 2020 and 2022 settlements referenced above.

Looking ahead, we expect the Exam and Enforcement staff (including on the basis of currently active sweeps), to aggressively scrutinize firms for perceived bias (and hence conflicts) in their valuation process, particularly with respect to the valuation of assets maintained at lower valuations for successive periods where such valuations can have an effect on firm compensation.

ALLOCATION OF EXPENSES

The topic of allocation of expenses is likewise a perennial focus area for both the Division of Examinations and the Division of Enforcement—with respect to the allocation of expenses between the adviser and funds/portfolio companies, and with respect to the allocation of expenses among an adviser’s different funds and/or portfolio companies.

In terms of categories of expenses tested in examinations, we have seen continued focus on, among others, expenses related to travel (including private air travel), meals, entertainment, broken deal expenses, affiliated service providers and consultants or similar professionals providing services to portfolio companies (including where such professionals also have roles at, or provide services to, the adviser).

One noteworthy enforcement settlement was announced late in the fiscal year with American Infrastructure Funds, LLC (“AIM”), an RIA to private funds focused on investments in infrastructure and real property.[10] In the AIM settlement, the SEC found that the charging of certain expenses amounted to one of “three distinct breaches of fiduciary duties” at issue.[11] Specifically, the SEC found that AIM caused certain funds to inappropriately incur $1.3 million in expenses for a deal those funds later abandoned. AIM had initially refunded the amount to the funds, but AIM subsequently re-charged the funds for those expenses while the investment was under consideration by a new fund managed by one of AIM’s co-managing members (and thus an affiliated adviser). The SEC found this allocation had the “practical effect” of the older funds providing an undisclosed loan to the new fund for approximately six months, thus constituting a conflict of interest. Explicitly invoking the RIA’s duty of care, the Order found that AIM “failed to undertake a process to determine whether the allocation of expenses was in the best interest” of the older funds. Notably, AIM appeared to have consulted with the older funds’ limited partner advisory committee (“LPAC”) about the transaction after the fact; however, the SEC found that to be insufficient as AIM’s “disclosures to the LPAC were misleading because they failed to adequately disclose the conflicts of interest or AIM’s failure to consider whether the transaction was in the [the older funds’] best interests.” After SEC Staff raised the issue, the AIM-affiliated adviser paid interest to the older funds on the $1.3 million loan. The SEC charged AIM with violations of Sections 206(2), and 206(4) of the Adviser’s Act, as well as Rules 206(4)-7 and 206(4)-8, thereunder. The SEC ordered AIM to pay $373,368 in disgorgement, $72,092 in prejudgment interest, and a $1.2 million civil penalty.

Notably, the 2024 Examination Priorities highlight the Staff’s intention to assess adherence to contractual requirements related to LPACs, including contractual notification and consent processes.[12] This focus also appeared in an SEC Risk Alert published in January 2022.[13] It is important to stress that the Staff—in both the examination and investigative setting—closely reviews firm engagement with the LPAC(s) with respect to potentially conflicted transactions to determine if it deems disclosures to be transparent and fulsome, as it did in the AIM case. We expect that consultations with LPAC(s) about conflicted issues will increasingly draw scrutiny— not only the form and timing of the consultation but also the substance of the disclosures.

In addition, the new Private Fund Adviser Rules, discussed further below, impose new prohibitions, and restrictions and requirements, on charging and disclosing certain types of expenses, which are expected to present new compliance and operational challenges and may provide additional new avenues of scrutiny for SEC examinations once effective.[14]

AMENDED MARKETING RULE

Both the Division of Examinations and the Division of Enforcement are laser-focused on compliance with the amended Marketing Rule, whose compliance date was no later than November 4, 2022.

As confirmed in a recent Risk Alert,[15] it is routine for Examinations to test compliance with new rules and not uncommon for Enforcement Staff—as described below—to join policing efforts. Coupled with the Division of Examinations repeated pronouncements on its plans to focus on the amended Marketing Rule,[16] it is no surprise that Examinations Staff—both in Marketing Rule-specific initiatives as well as in routine examinations—have been testing compliance with the amended Marketing Rule. Looking ahead, we expect that the Division of Examinations may issue a Risk Alert next year with observations from their examination findings related to compliance with the amended Marketing Rule.

The SEC has also been testing compliance with the amended Marketing Rule through enforcement tools. At the close of the SEC’s fiscal year—just short of the one-year anniversary of the compliance date of the amended Marketing Rule—the Enforcement Division announced ten settlements related to the Marketing Rule, all of which related to hypothetical performance. While the settlements did not involve advisers to private funds, they are still reflective of the Staff’s willingness to use enforcement tools to pursue violations of a rule that the Staff believes that firms should be in full compliance with given, in the SEC’s view, the extended implementation period prior to the rule’s effectiveness.

In the first Marketing Rule settlement, the SEC found that Titan Global Capital Management USA LLC (“Titan”), a New York-based FinTech investment adviser to retail investors, used hypothetical performance metrics in advertisements that were disseminated to a mass audience on its website in violation of hypothetical performance requirements of the amended Marketing Rule that an adviser, “[adopt] and [implement] policies and procedures reasonably designed to ensure that the hypothetical performance is relevant to the likely financial situation and investment objectives of the intended audience of the advertisement.”[17] The SEC charged Titan with violations of Sections 206(2) and 206(4) of the Adviser’s Act, as well as Rules 206(4)-1 and 206(4)-7, thereunder. The SEC ordered Titan to pay $192,454 in disgorgement, $7,598 in prejudgment interest, and a civil monetary penalty of $850,000. In announcing the settlement, the SEC included a headline in its press release that, “[t]hese charges mark the first violation of the SEC’s amended marketing rule.”[18]

Less than three weeks later, in September 2023, the SEC announced similar settled charges against nine RIAs.[19] The SEC found that the firms advertised hypothetical performance to the general public on their websites without adopting and/or implementing policies and procedures required by the amended Marketing Rule. The SEC found that the firms charged had advertised hypothetical performance without having adopted such policies and procedures. Settling anti-fraud charges (Section 206(4) of the Advisers Act) and violations of the performance section of the Marketing Rule (Rule 206(4)-1(d)), the firms paid civil penalties ranging from $50,000 to $175,000 each, for a total of $850,000 in combined penalties. Notably, the Orders specifically stated that the compliance date was eighteen months after the Marketing Rule’s adoption, intimating the Commission’s view that firms had ample time to come into compliance.

In announcing the settled charges with the nine RIAs, Director Grewal said that the SEC, “will remain vigilant and continue our ongoing sweep to ensure that investment advisers comply with the Marketing Rule, including the requirements for hypothetical performance advertisements.”[20] This signals continued enforcement of the hypothetical performance requirements, and additionally, may presage sweeps encompassing other aspects of the amended Marketing Rule.

While it is yet to be seen which specific provisions of the Marketing Rule the Division of Enforcement may focus on next, the Division of Examinations previewed in a Risk Alert in June 2023 that it would emphasize compliance with the Marketing Rule, including: testimonials and endorsements, third-party ratings, and marketing practices disclosures on Form ADV.[21] We expect that the Division of Enforcement may follow suit.

CUSTODY RULE

Examinations remain focused on custody requirements for advisers under the current Custody Rule, Rule 206(4)2. In its process-related Risk Alert[22] referenced above, the Division of Examinations included a dedicated section on Custody in its sample initial information request, confirming the Division’s persistent examination of this area. Underscoring its commitment, the SEC’s 2024 Examination Priorities highlight, “[c]ompliance with Adviser’s Act requirements regarding custody, including accurate Form ADV reporting, timely completion of private fund audits by a qualified auditor and the distribution of private fund audited financial statements.”[23]

The 2024 Examination Priorities dovetail with the Division of Enforcement’s Custody Rule enforcement efforts in FY 2023, where the Staff has shown its ability to leverage data to monitor for compliance with certain components of the Custody Rule. For example, in early September 2023, the Commission announced settled charges against five investment advisers for violations of the Custody Rule and for failing to timely update SEC disclosures, namely, updates to their Forms ADV.[24] Each of the firms was found to have failed to do one or more of the following: (i) have annual audits performed; (ii) deliver audited financials to investors in a timely manner; and/or (iii) ensure a qualified custodian maintained client assets. All five firms were charged with violating Section 206(4) of the Advisers Act, as well as Rule 206(4)-2, thereunder. The firms charged with failure to amend their Forms ADV also violated Section 204(a) of the Advisers Act and Rule 204-1(a) (provisions related to amending Form ADV). The firms paid civil monetary penalties of between $50,000 and $225,000. These settlements come a year after the Commission settled nine similar actions against advisers in the same sweep in September 2022.[25] These cases demonstrate the Commission’s ability to analyze large amounts of data and utilize sweeps to efficiently enforce the Custody Rule and other technical disclosure requirements.

Less than one month later, on September 28, the SEC charged four investment advisers owned by Osaic, Inc. with violations of the Custody Rule when they failed to obtain verification by an independent public accountant of client funds and securities of which they had custody.[26] The SEC found that the advisers violated the Custody Rule because each adviser used form agreements with a clearing agent that, as required by the clearing agent, permitted the clearing agent to accept, without inquiry or investigation, any instruction given by the adviser concerning the client’s accounts. Because the agreements gave the advisers this authority with respect to client funds and securities in the accounts, the advisers had custody of the assets. The advisers were charged with violating Section 206(4) of the Advisers Act and Rule 206(4)-2 thereunder (requiring RIAs that have custody of client funds or securities to have independent public accountants conduct a verification of those client funds and securities by actual examination at least once each calendar year). Each adviser paid a civil money penalty of $100,000, tracking the Custody Rule settlements reached in early September. We expect this type of focused enforcement activity to continue into the next fiscal year.

OFF-CHANNEL COMMUNICATIONS

As widely reported in the press, the SEC has expanded its focus on off-channel communications beyond broker dealers to registered investment advisers. This inquiry, which was initially confined to the broker-dealer community, and resulted in approximately $1.5 billion in penalties, has unquestionably become a signature enforcement priority of the Gensler SEC. One major question for 2024 and beyond is whether this effort touches off a broad wave of record-keeping enforcement sweeps and settlements involving RIAs.

In contrast to the statutory record-keeping requirements for written communications by broker-dealers, which effectively require the retention of all written communications about the business of the broker-dealer, the requirement to retain written communications applicable to RIAs is far more circumscribed; pursuant to Rule 204-2(a)(7) of the Investment Advisers Act, RIAs must generally retain all messages related to any investment recommendation or advice that was given or proposed, any receipt, disbursement, or delivery of funds or securities, or the placing or execution of any order to trade a security. In response to press reports of an enforcement sweep targeting record-keeping violations by RIAs, several major industry trade associations have publicly engaged with the SEC to urge adherence to the fundamentally different, and narrower, record-keeping obligations of RIAs.[27]

While the SEC has yet to announce the resolution of any matters involving solely violations of the record-keeping provisions applicable to RIAs, 2024 may bring at least some settlements, which, we expect, will provide the SEC with an opportunity to articulate a presumably broad view of the scope of RIA’s record-keeping obligations. In the meantime, private fund managers should ensure that they continue to enhance their policies and procedures applicable to off-channel communications and continue to educate and train investment professionals as to the importance of conducting advisory business on firm-approved communications channels.

SEC 2024 EXAMINATION PRIORITIES

On October 16, the Division of Examinations released its 2024 Examination Priorities, aligning the release of the priorities with the start of the SEC’s fiscal year in hope that it would “provide earlier insight to registrants, investors, and the marketplace of adjustments in our areas of focus year to year.”[28] As expected, the Examination Priorities lay out various focus areas for investment advisers, including particular priority areas for examinations of investment advisers to private funds.

The topics covered above—management fee calculation, expenses, compliance with the amended Marketing Rule, custody, and recordkeeping requirements (generally, but not with respect to electronic communications)—all explicitly appear in the Examination Priorities.

Additionally with respect to advisers to private funds, the Examination Priorities note a focus on ensuring adherence to contractual requirements regarding LPACs. Sponsors should carefully review fund governing documents for notice and consent obligations and monitor, document and test compliance with these requirements.

Also included in the Examination Priorities for advisers to private funds are (i) for both private equity and venture capital firms, adequate due diligence practices for investments in portfolio companies, including a focus on consistency with policies and disclosures on this topic; (ii) a focus on conflicts, controls, and disclosures related to the use affiliated service providers; and (iii) for the second consecutive year,[29] a priority on private funds managed side-by-side with registered investment companies.

Finally, the Examination Priorities include other topics, such as policies and procedures for reporting on Form PF (which was recently amended), compliance with the amended Marketing Rule—underscoring the Commission’s overall focus on ensuring compliance with (and enforcing) newly adopted rules—as well as cybersecurity, AI, and OFAC, among other areas.[30]

II. Rule-Making

Chair Gensler’s SEC has delivered on its promise to advance an active rulemaking agenda—including in the private funds space.[31] We highlight three of those rules below: the proposed new Safeguarding Rule (which would replace the existing Custody Rule), the adopted (but currently subject to litigation) Private Fund Adviser Rules, and the proposed rule on Conflicts of Interest Associated with the Use of Predictive Data Analytics by BrokerDealers and Investment Advisers.

SAFEGUARDING RULE PROPOSAL

In February 2023, the SEC proposed a new “Safeguarding Rule” to take the place of the existing Custody Rule.[32] At a high level, the new rule proposes challenging new obligations that would disrupt current custody arrangements and practices by private fund sponsors—especially given the Commission’s proposed compliance period of twelve months for large advisers (and eighteen months for smaller advisers).[33] The proposed rule would impose significant new burdens on sponsors, such as requirements that sponsors enter into new written agreements with each client’s qualified custodian and obtain several written assurances from that qualified custodian; new requirements and conditions related to privately offered securities exception; that qualified custodians have possession and control of assets; and broadening the types of advisory activities that would be deemed to confer custody to a sponsor. Comments were due on October 30, 2023, after an extension of the comment period; comments have been fairly negative in terms of market perspective and overall feasibility. It is not yet clear if or to what extent the proposed rules will be adopted.

PRIVATE FUND ADVISER RULES

All eyes are on the Fifth Circuit for the pending challenge[34] to the SEC’s authority to adopt the new Private Fund Adviser Rules.[35] At a high level, the challenge alleges that the SEC’s new rules “exceed the Commission’s statutory authority, were adopted without compliance with notice-and-comment requirements, and are otherwise arbitrary, capricious, an abuse of discretion, and contrary to law” under the Administrative Procedures Act (“APA”) and the SEC’s “heightened obligation to consider its rules’ effects on ‘efficiency, competition, and capital formation.’”[36] The court recently issued an expedited briefing schedule with briefing set to conclude on January 22, 2024. If the challenge is successful, in whole or in part, it may embolden similar challenges that could potentially curtail the SEC’s aggressive rulemaking streak.

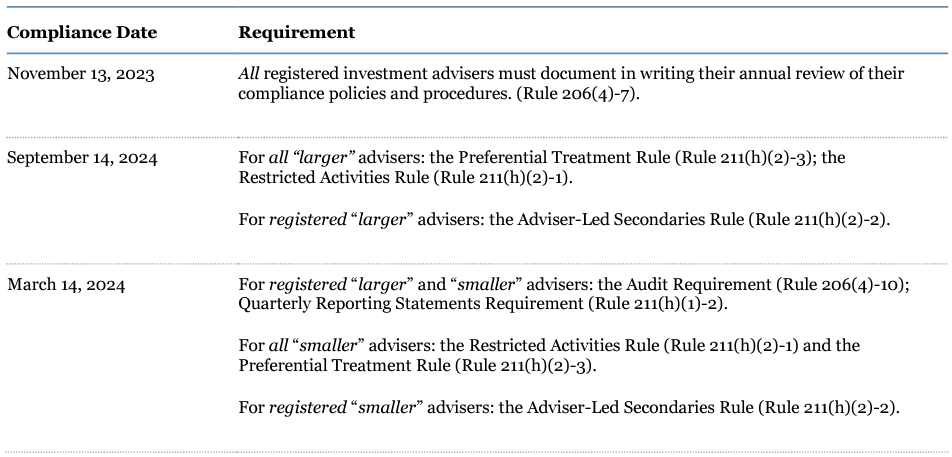

Barring any stay of the rule pending the outcome of the litigation, sponsors should begin to take steps to prepare to comply with the compliance dates, as set forth as follows, starting as early as November 2023:

One interesting aspect of the new rules is what was not implemented in the final rules as compared with the proposal. Specifically, the final rules removed the proposed rules’ prohibition on fees for unperformed services such as accelerated monitoring fees. While the absence of the provision in the final rule may signal the lack of such prohibition, the Adopting Release clearly asserts otherwise. The Adopting Release indicated that the prohibition on accelerated monitoring fees was not necessary to include in the new rules “because we believe this activity generally already runs contrary to an adviser’s obligations to its clients under the Federal fiduciary duty.”[37]

Indeed, the topic of accelerated monitoring fees was at issue in the AIM settlement discussed above.[38] There, the SEC found that AIM accelerated a portfolio company monitoring fee without timely disclosure to investors, and found that AIM thus breached its fiduciary duty.

PREDICTIVE DATA ANALYTICS PROPOSAL

In July 2023, Chair Gensler warned that, “[w]e at the SEC are technology neutral” but the “[s]ecurities laws . . . may be implicated depending upon how AI technology is used.”[39] Chair Gensler said that he asked SEC staff to make recommendations for rule proposals related to potential conflicts. As reflected in Chair Gensler’s recent speeches, the SEC is increasingly sounding the alarm about the impact of AI on financial markets[40] and has recently engaged, through its examinations program, in efforts to learn more about how large registered entities are using AI in their business. Given significant legislative uncertainty about how to regulate AI, we expect the SEC—similar to the path it has charted in the crypto sector—to stake out an expansive view of how its existing rulemaking abilities allows it to assert regulatory authority over AI.

One preview of this expansive view of the SEC’s ability to police the use of AI and enhanced technology are proposed new rules for registered investment advisers and broker dealers aimed at addressing purported conflicts of interest associated with such firms’ use of predictive data analytics and similar technologies.[41] The language of the proposed rule is remarkably broad, and touches virtually all aspects of a firm’s operations. We expect that industry comments on the rule will be substantial, predominantly negative, and, if the rule is adopted, likely subject to a litigation challenge under the APA.

Notwithstanding the emergence of SEC scrutiny and skepticism as to AI and similar technologies, many advisers are beginning to explore their use; although the regulatory landscape is evolving, some advisers are exploring the following options:

- Developing policies and procedures for the use of AI that address which personnel may use the technology, which applications may be used and for what purposes, and a means for tracking what uses have been reviewed and authorized;

- Considering if the use of AI implicates the sponsor’s existing policies concerning cybersecurity, data protection and privacy, protection of MNPI, recordkeeping, and conflicts of interest;

- Paying particular attention to confidentiality, including by avoiding entering into an AI application information about investors that is sensitive or subject to privacy protections, or information belonging to the sponsor that may contain trade secrets or be subject to attorney-client privilege or work product protections;

- Considering whether to disclose the use of AI in Form ADV Part 2A and in fund offering and governing documents (consistent with the above);

- Examining whether the use of AI poses an actual or potential conflict of interest, which could arise, for example, if the AI application is proprietary to the sponsor or one of its portfolio companies, or if the technology is designed or does in fact favor the sponsor at the expense of the client; and

- Considering—depending on the purpose for which the AI technology is used—whether the output thereof could constitute a record required to be kept or maintained under Rule 204-2 of the Adviser’s Act.

III. Looking Ahead to 2024

Taking stock of the last fiscal year, we expect 2024 to reflect enhanced scrutiny of the private funds industry, with an increasing risk of enforcement referrals in the examination context, an appetite to pursue enforcement actions for relatively minor violations and the risk of substantial penalties. More specifically:

- We expect continued examination and enforcement focus on the topics discussed above. With respect to management fees in particular, sponsors should expect close scrutiny on valuation practices and how such practices impact fees. On expenses, sponsors should ensure their expense allocation policies and practices are in line with their disclosures. Sponsors should exercise particular care with respect to non-pro rata expenses and to any allocation of expenses that the SEC may view as conflicted and without appropriate disclosure.

- We expect that the SEC will bring additional enforcement actions related to compliance with the amended Marketing Rule. Ensuring compliance with all aspects of the amended Marketing Rule will serve sponsors well.

As previewed, many are closely monitoring the Private Fund Adviser Rules litigation pending in the Fifth Circuit. In the meantime, sponsors should begin to plan how they will come into compliance with the new rules. For instance, sponsors should ensure adequate time and attention on how to operationalize quarterly reporting requirements. We expect prompt testing of compliance with the new rules post the compliance dates (pending any changes from litigation).

1 See Speech by Director Gurbir Grewal (Oct. 24, 2023); see also Speech by SEC Chair Gary Gensler (Oct. 25, 2023) (“We filed more than 780 actions, including more than 500 standalone cases. We obtained judgments and orders totaling $5 billion. Our work led to $930 million distributed to harmed investors”).(go back)

2 See Jessica Corso, SEC Enforcement Chief Warns of Private Fund Crackdown, Law360 (May 23, 2023); see also Q&A with Enforcement Director Gurbir Grewal at the Securities Enforcement Forum West (May 23, 2023) (available on YouTube).(go back)

3 See SEC 2024 Examination Priorities (Oct. 16, 2023) (emphasis added).(go back)

4 See SEC 2023 Examination Priorities (Feb. 7, 2023) (“. . .calculation and allocation of fees and expenses, including the calculation of postcommitment period management fees and the impact of valuation practices at private equity funds. . .”); SEC 2022 Examination Priorities (Mar. 30, 2022); SEC 2021 Examination Priorities (Mar. 3, 2021).(go back)

5 See SEC Risk Alert: Observations from Examinations of Private Fund Advisers (Jan. 27, 2022).(go back)

6 See In the Matter of Insight Partners (June 20, 2023); see also STB’s related client alert. (go back)

7 See In the Matter of Energy Innovation Capital Management, LLC, SEC Order (Sept. 2, 2022) (charging an ERA for (i) failure to make adjustments to its management fee calculations for individual portfolio company securities subject to write-downs; (ii) inaccurately calculating management fees based on aggregated invested capital at the portfolio company level instead of at the individual portfolio company security level; (iii) failing to begin the post-commitment management fee period at the correct date; and (iv) incorrectly including accrued but unpaid interest as part of the basis of the calculation of management fees for certain investments); see also In the Matter of EDG Management Company, LLC, SEC Order (Oct. 22, 2020) (charging an ERA for failure to adjust quarterly management fee calculations to account for write-downs).(go back)

8 The test outlined in this Insight order was where the investment was (i) written down 50% or more in value; (ii) valued below cost for six consecutive quarters; (iii) written down primarily due to operating results as opposed to due to market conditions or comparable transactions or companies (the latter suggesting an impairment was not permanent); and (iv) likely to need additional capital raised in the next twelve months.(go back)

9 See SEC Press Release (June 20, 2023).(go back)

11 Another alleged breach is discussed below in Section II. Rule-Making, in connection with accelerated monitoring fees. The third alleged breach is in connection with fund restructurings: “AIM transferred an asset owned by AIM-advised funds to a newly-formed private fund that AIM also advised without adequately disclosing its conflicts of interest, obtaining investor consent, or allowing investors to liquidate or exit their investment at the end of certain funds’ term.”(go back)

12 See SEC 2024 Examination Priorities (Oct. 16, 2023).(go back)

13 See SEC Risk Alert: Observations from Examinations of Private Fund Advisers (Jan. 27, 2022) (“Failure to obtain informed consent from Limited Partner Advisory Committees, Advisory Boards or Advisory Committees (collectively ‘LPACs’) required under fund disclosures”); see also SEC 2023 Examination Priorities (Feb. 7, 2023) (“Also, in the case of RIAs, examiners will review whether the conflicts of interest disclosures are sufficient such that a client can provide informed consent to the conflict, whether express or implied”).(go back)

14 We published a client alert in August 2023 on these and other requirements in new rules, which are described in more detail below. With respect to expenses, these include: restrictions on charging or allocating to a private fund regulatory, examination, or compliance fees unless such fees and expenses (including the dollar amounts thereof) are disclosed to investors within certain timeframes; a requirement to disclose and obtain consent from fund investors if the adviser charges and allocates to a private fund any fees or expenses associated with an investigation of the adviser (which are subject to certain legacy relief for funds in operation); a prohibition on charging or allocating fees or expenses related to an investigation that results or has resulted in a court or governmental authority-imposed sanction for violating the Advisers Act or the rules thereunder (and required reimbursement); and restrictions on charging certain non-pro rata fees and expenses related to investments, unless the manner of such allocation is disclosed to investors on a timely basis and an explanation of why such allocation is “fair and equitable” is provided in connection therewith.(go back)

15 See SEC Risk Alert: Investment Advisers: Assessing Risks, Scoping Examinations, and Requesting Documents (Sept. 6, 2023). (go back)

16 See SEC 2023 Examination Priorities (Feb. 7, 2023); SEC Risk Alert: Examinations Focused on Additional Areas of the Adviser Marketing Rule (June 8, 2023). In February 2021, we published a White Paper outlining the implications of the amended Marketing Rule for private fund sponsors.(go back)

18 See SEC Press Release (Aug. 21, 2023). (go back)

19 See SEC Press Release (Sept. 11, 2023). (go back)

20 See SEC Press Release (Sept. 11, 2023). (go back)

21 See SEC Risk Alert: Examinations Focused on Additional Areas of the Adviser Marketing Rule (June 8, 2023). (go back)

22 See SEC Risk Alert: Investment Advisers: Assessing Risks, Scoping Examinations, and Requesting Documents (Sept. 6, 2023). (go back)

23 See SEC 2024 Examination Priorities (Oct. 16, 2023). (go back)

24 See SEC Press Release (Sept. 5, 2023). (go back)

25 See SEC Press Release (Sept. 9, 2022). (go back)

26 See SEC Press Release (Sept. 28, 2023). (go back)

28 See SEC Press Release (Oct. 16, 2023). (go back)

29 See SEC 2023 Examination Priorities (Feb. 7, 2023). (go back)

30 See SEC 2024 Examination Priorities (Oct. 16, 2023). (go back)

31 We have written about the SEC’s rulemaking agenda for FY 2023. (go back)

32 See SEC Press Release (Feb. 15, 2023). (go back)

33 We published a client alert related to the SEC’s proposed new rule in February 2023. (go back)

34 See Petition for Review, Nat’l Assoc. of Private Fund Managers v. SEC, No. 23-60471 (5th Cir.) (Filed Sept. 1, 2023). (go back)

35 Rule 206(4)-10; Rule 211(h)(1)-2; Rule 211(h)(2)-1; Rule 211(h)(2)-2; Rule 211(h)(2)-3. (go back)

36 See Petition for Review, Nat’l Assoc. of Private Fund Managers v. SEC, No. 23-60471 (5th Cir.) (Filed Sept. 1, 2023). (go back)

37 See Private Fund Advisers; Documentation of Registered Investment Adviser Compliance Reviews Final Rule (Sept. 14, 2023). (go back)

39 See Speech by Chair Gary Gensler (July 17, 2023). (go back)

40 See Stefania Palma and Patrick Jenkins, Gary Gensler urges regulators to tame AI risks to financial stability, Financial Times (Oct. 15, 2023). (go back)

41 See SEC Press Release (July 26, 2023). (go back)

Print

Print