Tami Groswald Ozery is Assistant Professor at the Hebrew University of Jerusalem, Israel. This post is based on her book, Law and Political Economy in China. Related research from the Program on Corporate Governance includes The Elusive Quest for Global Governance Standards (discussed on the Forum here) by Lucian A. Bebchuk and Assaf Hamdani.

![]() Scholars have long regarded certain attributes of corporate governance, particularly legal protections of private ownership, as prerequisites for financial development, deep capital markets and economic growth. Yet, the development of the Chinese market challenges many of the underlying assumptions of this “law matters” thesis. For decades, China achieved substantial growth and developed markets while preserving market control, state ownership, and relatively weak legal institutions. Informal means and functional substitutes provided investors with credible assurances that filled in some of the voids of law by incentivizing growth and governing markets.

Scholars have long regarded certain attributes of corporate governance, particularly legal protections of private ownership, as prerequisites for financial development, deep capital markets and economic growth. Yet, the development of the Chinese market challenges many of the underlying assumptions of this “law matters” thesis. For decades, China achieved substantial growth and developed markets while preserving market control, state ownership, and relatively weak legal institutions. Informal means and functional substitutes provided investors with credible assurances that filled in some of the voids of law by incentivizing growth and governing markets.

The enduring efficacy of these functional substitutes has left its observers puzzled and resulted in a broad intellectual and popular disregard for the role of law in China’s economic rise. Laws and legal institutions are often portrayed as window dressing or as a marginal governing tool at best. Corporate governance institutions are similarly dismissed as a political mirage. The tightening of market controls in China in recent years and the rising presence of political institutions in firms (discussed, here), in conjunction with China’s economic slowdown, further reinforce the widespread skepticism about the importance of law in China’s socialist market economy.

In my newly released book, “Law and Political Economy in China: the Role of Law in Corporate Governance and Market Growth” (Cambridge University Press, 2023), I call to reevaluate this approach. The role of law in the Chinese market, I argue, has been wrongly undervalued.

Laws and legal constructs, including China’s corporate governance framework, have in fact been instrumental to China’s market rise. To understand exactly how, and leave behind the discounting fallacy, one needs to replace a unipolar focus on rights protection, as the sole aspired function of legal reforms, with a more integrated approach of law and political economy. Indeed, when one looks only at the economic functions of law (i.e., investor protection), a disregard for the role of law in supporting China’s growth becomes almost inevitable. Instead, the book offers a new analytical framework through which to address China’s development puzzle and reassess the role of corporate legal reforms in supporting growth.

The new framework takes account of the dual functions of law – economic and political – and analyzes the relationship between formal law and market development from the vantage point of political power dynamics. It considers the political functions that corporate legal reforms provide for the local polity and examines how law, politics, and the economy entwine in China’s quest to create markets.

In doing so, the book combines questions from law & development, political economy, and corporate governance. It joins existing efforts to understand changes in corporate law, organizational ownership, and the rise of the public firm through political economy analysis (e.g., Bebchuk & Roe, 1999; Pargendler, 2020; Perotti & von-Thadden, 2006; Pistor, 1997; Rajan & Zingales, 2003; Roe, 2006). A law & political economy framework is especially fitting for comparative corporate governance inquiries, as it provides a much-needed context for understanding the determinants, goals, and limits of corporate legal reform in the given market.

In the case of China, the analysis shows that laws and legal constructs play a significant role in allocating economic authority within the Chinese party-state system itself ¾ i.e., between and within the different hierarchies of the state (central and local authorities), and between the “state” and the Chinese Communist Party (CCP). Throughout the different stages of China’s market development, legal reforms, including corporate legal reforms, were taken to secure desired shifts in China’s political-economic equilibrium. An orchestrated use of law to reconfigure the political-economic reality, in turn, incentivized market participants (both economic and political) to develop and deploy various growth-promoting mechanisms in firms and the market at large.

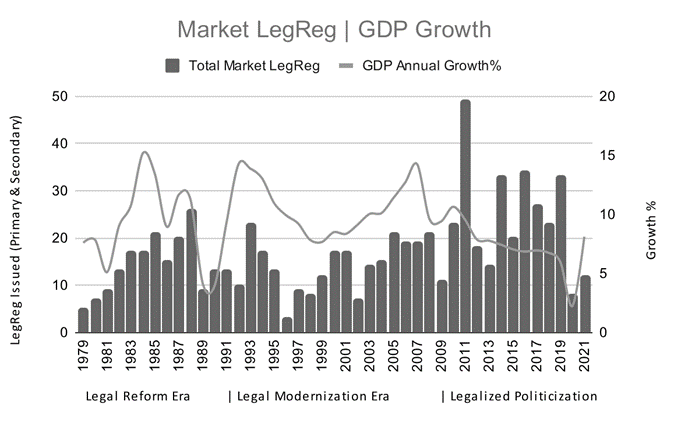

In the early 1980s, calculated limited law-making by the central government left the authority to govern markets with local government bodies. This, by design, had given local governments much room for experimentation, which led to various managerial growth-supporting schemes. As markets grew, so did opportunities for abuse. Local protectionism and dwindling central state coffers eventually pushed the Chinese party-state to recentralize authority and re-assert central state control over the market. New institutional and legal reforms were set in motion throughout the following two decades, and a course of profound change in ownership organization and market governance ensued. In this process, industrial and financial corporate groups were formed, leading to the emergence of China’s state capitalism in the early 2000s as one of the prominent attributes of China’s economic model. This was an era of substantial growth and activism in market-related rulemaking as China increasingly integrated into the world economy (Figure 2.1). Notwithstanding, recentralization under state capitalism failed to resolve the plights of the prior era. Quite the contrary, existing market infirmities intensified, while additional externalities were created.

Figure 2.1 Market rulemaking activism (legislation and regulation) vs. GDP growth

Uncontrollable corporate behemoths, both state and private national champions, emerged (Milhaupt & Lin, 2013). The deadweight of state assets only grew stronger under state capitalism. Asset stripping, self-dealing, and many of the illnesses of controlled ownership appeared in the market in full force, alongside more idiosyncratic problems such as local protectionism, rent-seeking, and corruption. Enmeshed within local interests and China’s crony capitalist elite, state officials and government authorities, including the People’s Courts system, were captured. In short, the state was found to be too weak to handle the mounting problems. The aftermath of the Global Financial crisis exposed the magnitude of these ailments, which by then threatened not only social stability and China’s growth prospect but also the legitimacy of its state-led model and of the Chinese Communist Party itself. Thus, at the turn of the era, the party-state decided that further change in the political-economic equilibrium was needed. Perhaps contrary to the expectations of external observers, the chosen remedy has been the further politicization of markets.

Once again, legal reforms were called upon as China ushered in a new era of “Legalized Politicization”, in which the legal system, including corporate reforms, was utilized to establish the CCP’s direct agency in the market. Indeed, from the perspective of the Chinese party-state, a legalized politicization of markets is needed to remedy the perils of the past and cope with the expected economic and governance challenges of the future. In its vision, such a system is the most fitting to support further (albeit more stable, thus more limited) market growth. Such dynamics of law & political economy reflect that law, politics, and economic outcomes in China interact in a reciprocal manner, creating an interdependent and course-correcting process that gives support to a market that thrives beyond expectations.

The book starts by laying the ground for using law & political economy as the desired analytical framework to reassess the role of law in corporate development and market growth (Part I). The book then proceeds with two levels of analysis: a market development macro level (Part II), and the rise of the public firm and corporate governance as a micro-level case study (Part III). Beyond supporting the analytical framework, the case study analysis demonstrates that the dynamics of law & political economy have real market effects on the environment within which firms operate – at times impeding, yet at times supporting economic activity, development, and growth.

At the macro level (Part II, Chapters 3-5), the book tracks the evolving use of law during China’s market reforms from the late 1970s until the present, identifying two intertwined functions of law – economic and political – and showing how these two functions of law developed side by side, each supporting the other. By uncovering the dual functionality of law, the book shows how the law translates and secures political–economic shifts in an iterative process that shapes the incentives of political actors to support market economic activity. Chapter by chapter, the legal configurations of political-power dynamics are examined. A three-stage shift in the allocation of market governance authorities within the Chinese party-state’s system has unfolded:

Chapter 3 examines the role of law during the Early Reform Era (Dec. 1978–1991), when the party-state vested economic decision-making authorities with its local governments, giving them a relatively free rein to experiment with and administer economic activity by limiting law-making by central level authorities. Chapter 4 moves on to examine the subsequent Legal Modernization Era (ca. 1992–2009) – a golden age for legal reformers in China. During this era, market governance authorities were reconfigured and recentralized with the central state through a massive project of national-level institutional and legal reforms. This reconfiguration of powers via the legal system also set the foundation for what is known today as “China’s state capitalism”. Chapter 5 examines the current era, labeled the “Legalized Politicization Era” (2010–present). During this era, the consequences of state capitalism forced a new political-economic reconfiguration. Here too, laws and legal constructs were employed for this purpose, this time in two directions: intensifying the presence of the regulatory state in the market on the one hand, while vesting substantial market governance powers with the Chinese Communist Party directly, on the other.

Indeed, in recent years, the direct market capacities of the Communist Party (whereby the CCP operates in the market directly, not in the shadows of state institutions) have been bolstered and enshrined through the use of legal measures. Thus, perhaps strikingly, the significance of legal constructs in China is only growing even while the market becomes more politicized.

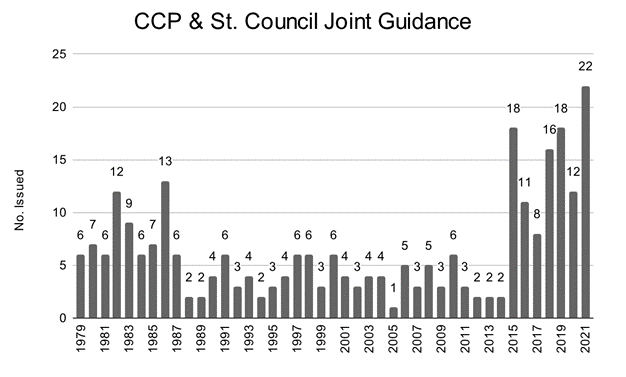

For example, de jure Chinese law does not prescribe the Chinese Communist Party any legislative or regulatory rule-making authority. Moreover, economic authority to govern markets has been formally and effectively vested with the Chinese State Council (the executive government) since the early 1980s. And yet, in recent years, the CCP’s capacity as a direct market regulator has taken hold. As is seen below (Figure 5.4) and elaborated in the book, the number of market-related rules to which the CCP joined as a formal rule maker (de facto regulator) has risen significantly in the past several years.

Figure 5.4 Number of newly issued market-related CCP and St. Council Joint Guidance rules per year

A qualitative analysis of such rules further supports that the CCP is expanding its direct governing capacity over public and private market participants.

Beyond establishing direct regulatory capacity over markets, the Party also stepped into the governance of firms. Here too, the change was done overtly through an institutional change in China’s corporate governance. Political institutions, such as corporate Party committees and newly legalized external monitoring political bodies, now bolster and at times replace some of the functions of traditional corporate governance mechanisms in Chinese firms (Groswald Ozery, 2022). This also means that the Chinese Communist Party itself, beyond any traditional shareholder role that the state may have, has become a legal corporate constituent with unique interests and a distinct corporate capacity to convey, direct, and monitor the ways such interests will be pursued. Furthermore, unlike the state’s shareholding capacity, the Party’s corporate governance capacities are not regulated and are not subject to any transparent corporate procedures (or other) checks and balances established in law.

The politicization of corporate governance is further developed in Part III (Chapters 6-9), which delves deep into China’s corporate and capital market evolution as a case study. Here, the law & political economy framework is used to explain changes in organizational ownership and the rise of the public firm throughout China’s development trajectory. Special attention is given to examining the creation and efficacy of corporate governance institutions (both conventional and idiosyncratic):

Chapter 6 focuses on the emergence of the public firm in China and looks at how the legal framework that governed firms during early market stages was shaped by and helped secure the political-economy dynamics of that time. Chapter 7 moves on to examine the corporate governance institutions that developed during the legal modernization era in support of China’s state capitalism. The chapter provides a thorough analysis of traditional, conventional, corporate governance mechanisms, both internal and external to the firm, showing how China’s facially convergent, shareholder-empowering framework diverges in practice. The Chapter illuminates the political functions of corporate and securities laws, showing how they supported the reconsolidation of powers and the shift toward state capitalism, and analyzing the implications for investors. The chapter also offers comparative insights drawn from corporate governance systems in concentrated ownership markets worldwide.

Chapter 8 looks at the politicization of corporate governance during the current era, which I argue has come in response to the obstructions of prior-era state capitalism. The Chapter examines how the CCP advances its corporate governance capacities and its roles in governing markets more broadly, through the use of law. This Chapter digs deep into the different functions of the corporate Party committee as an internal monitoring and decision-making body in China-domiciled firms. Additionally, it discusses various political, now legalized, institutions that operate outside firms and take part in corporate governance by monitoring corporate insiders, detecting, and deterring corporate fraud and corruption. Chapter 9 considers the potential benefits and costs of using such a politicized corporate governance system as a functional alternative in the Chinese market.

Taken together, Part III illuminates how political power dynamics motivated changes in corporate governance and organization, and how such changes operated to reallocate and secure political-economic power shifts. These iterative dynamics, in turn, mobilized market participants to employ various growth-promoting mechanisms in firms. The dual functionality of law in China, and of its corporate governance specifically, therefore, supported market development on multiple levels notwithstanding its slow-to-evolve, and at times limited, investor-protection functions.

Understanding the internal political functions of corporate legal reforms in China provides comprehensive and complex reasoning for the rise of the public firm and explains the shape of China’s corporate governance today and how it came to form. Moreover, in taking an interdisciplinary analytical approach that weaves together law and development theories, corporate governance analysis, and expertise in China’s political economy, the book offers new insights into the relationship between law, economic development, and politics in contemporary China. It sheds new comparative light on a long-standing debate about the role of law in economic development and about the possible varieties of growth-supporting governance mechanisms.

The book can be accessed via Cambridge Core, here.

Print

Print