Subodh Mishra is Global Head of Communications at Institutional Shareholder Services (ISS) Inc. This post is based on an ISS Corporate Solutions memorandum by Jun Frank, Global Head of Compensation & Governance Advisory; Stephan Stegmueller, Head of Compensation & Governance Advisory, EMEA and APAC; Yan Xu, Senior Adviser, EMEA; and Fredrik Lundin, Senior Sustainability Solutions Product Manager at ISS-Corporate. Related research from the Program on Corporate Governance includes Paying for long-term performance (discussed on the Forum here) by Lucian A. Bebchuk and Jesse M. Fried; Share Repurchases, Equity Issuances, and the Optimal Design of Executive Pay (discussed on the Forum here) by Jesse M. Fried; and The Perils and Questionable Promise of ESG-Based Compensation (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita.

Sustainability and Executive Pay Under Spotlight

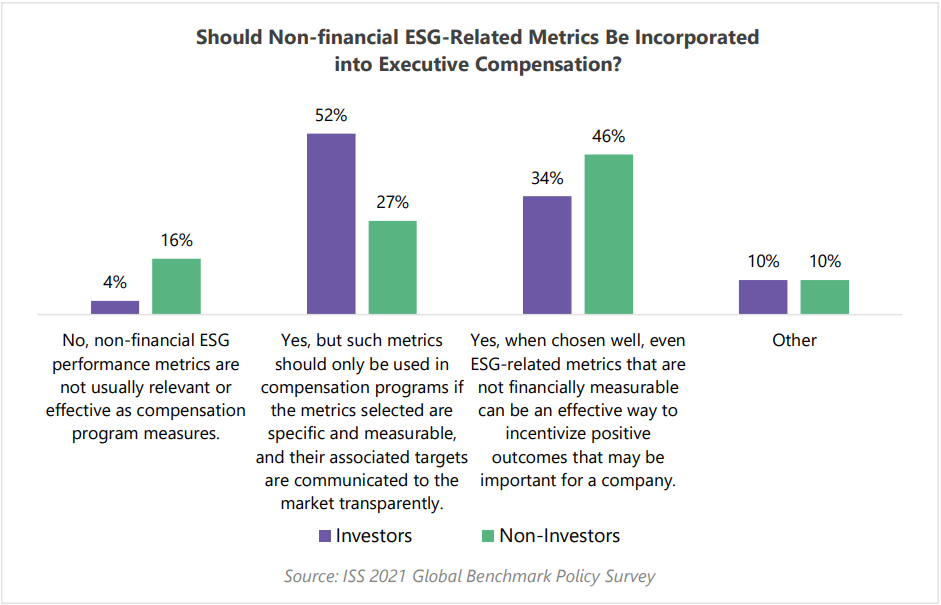

Compensation programs traditionally were designed to encourage higher earnings, business growth, and stock price performance, and only a fraction of companies incorporated environmental or social considerations in their executive pay program. However, market expectations have evolved in recent years, reflecting the growing integration of environmental and social considerations into investment as well as business decisions. An overwhelming majority of investors and non-investor respondents to Institutional Shareholder Services’ 2021 Global Benchmark Policy Survey agreed that non-financial Environmental, Social, and Governance (ESG)-related metrics should be incorporated into executive compensation.

Recent regulatory developments reflect this focus on linking executive pay to sustainability strategy. The EU Corporate Sustainability Directive’s (CSRD) European Sustainability Reporting Standards and the International Sustainability Standards Boards (ISSB) IFRS Sustainability Disclosures Standards would require companies to disclose the link between sustainability targets and executive compensation in some detail. These frameworks ensure that investors and other stakeholders understand the relevant risks and opportunities associated with sustainability-related issues. The CSRD also includes what is known as double materiality which requires companies to not only consider how they are affected by sustainability risks, but how they are impacting wider society, through their social, environmental, and economic footprints. These frameworks do not require companies to develop sustainability-related incentive schemes but when those schemes do exist, they require companies to demonstrate the materiality of the metrics being used, their alignment with sustainability performance, and their impact on pay decisions.

CSRD ESRS 2 – GOV 3 Integration of Sustainability-Related Performance in Incentive Schemes

- description of the key characteristics of the incentive schemes;

- whether performance is being assessed against specific sustainability-related targets and/or impacts, and if so, which ones;

- whether and how sustainability-related performance metrics are being considered as performance benchmarks or included in remuneration policies;

- the proportion of variable remuneration dependent on sustainability-related targets and/or impacts

IFRS Sustainability Disclosures Standards

S1 […] how the body and its committees oversee the setting of targets related to significant sustainability-related risks and opportunities, and monitor progress towards them […], including whether and how related performance metrics are included in remuneration policies

S2 […] (i) the percentage of executive management remuneration recognized in the current period that is linked to climate-related considerations; and (ii) a description of how climate-related considerations are factored into executive remuneration

Sustainability-Linked Metrics in Executive Compensation Continue to Gain Traction

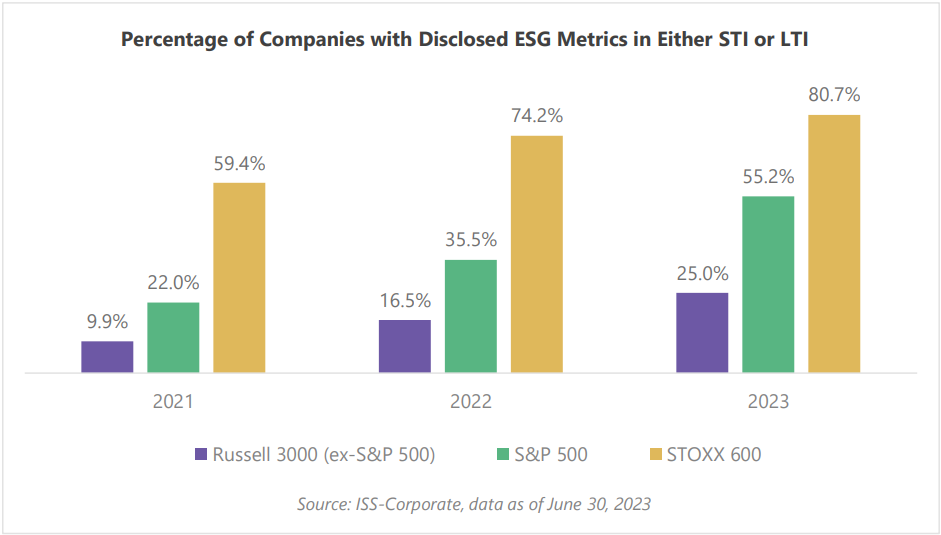

The integration of ESG factors into compensation continues to spread in both STI and LTI. In 2021, 22% of S&P 500 and 9.9% of Russell 3000 companies included ESG metrics in either their STI or LTI. That increased to 55.2% and 25%, respectively, as of June 30, 2023. Over the same period, ESG metric usage has increased by more than 20 percentage points in Europe, with more than 80% of companies in the STOXX 600 incorporating ESG metrics in pay as of June 30, 2023. Although the ESG metric adoption in the U.S. is less common than in Europe, it is steadily spreading and is starting to become the standard practice in the U.S. It remains to be seen whether the use of ESG metrics will continue to spread at the brisk pace we have seen in the past. As investors’ demand for ESG integration increases, the trend may continue, but rising political sensitivity around ESG in the U.S. may lead some companies to reconsider ESG metric adoption.

These figures probably underreport the number of companies that include ESG metrics in their executive compensation program. Only those that clearly disclosed ESG metrics that are sufficiently distinct from other metrics are counted as having an “ESG metric” in this analysis. Many companies may include ESG metrics in their executive compensation programs, but do not necessarily disclose the details. For example, ESG metrics often appear as a bullet point in a laundry list of individual performance objectives without sufficient detail regarding what they measure and what the targets are, if any. These typically are categorized as an “individual performance” metric as opposed to an “ESG” metric. Nonetheless, the data indicates that an overwhelming majority of STOXX 600 companies and a majority of S&P 500 companies have sufficiently distinct ESG metrics in either their STI or LTI.

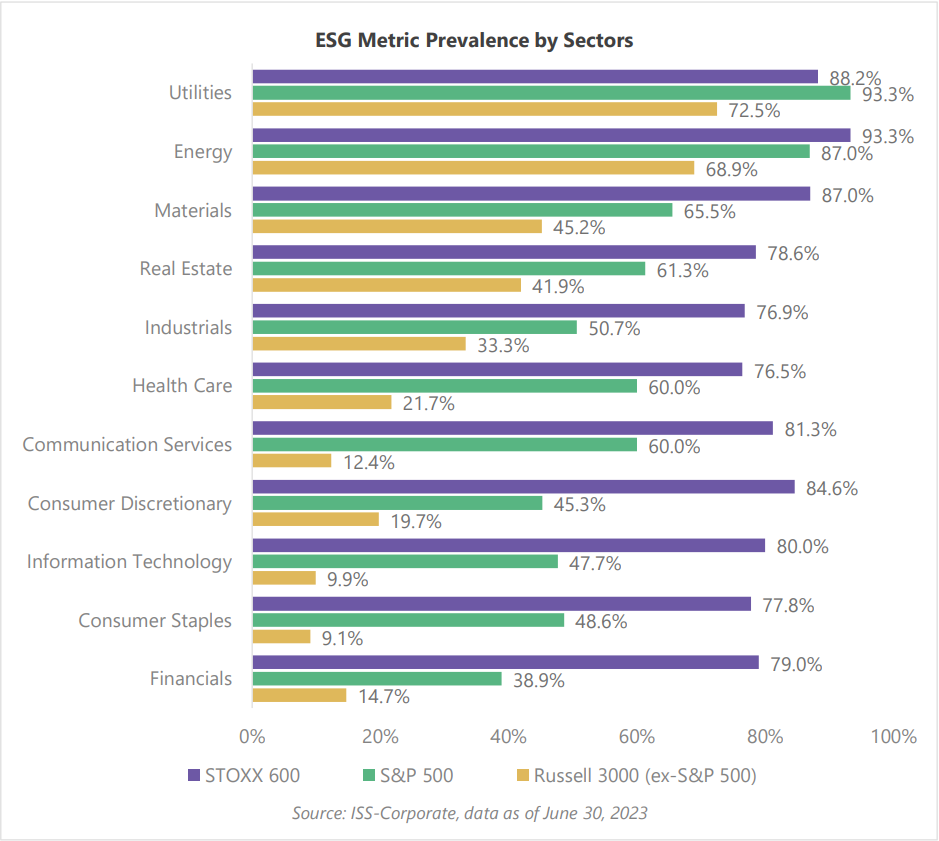

Sectors With Greater Environmental and Social Impacts Lead the Trend

Historically, companies in the Utilities, Energy, and Materials have been at the forefront when it comes to embracing ESG metrics. These industries have a substantial environmental footprint and carry significant social responsibilities. As a result, many investors and board members believe ESG factors should play a crucial role in determining the performance, valuation, and long-term viability of companies in these industries. It is also worth noting that the S&P 500 Utility sector outpaces the STOXX 600 sector and represents the only sector to do so with 93.3% (up from 75% in June 30, 2021[1]) of companies incorporating some type of ESG metric.

The IT sector within the S&P 500 saw remarkable growth in the adoption of ESG metrics, surging from 5.4% in June 2021 to 47.7% in June 2023. The S&P 500 financial sector also saw ESG metric adoption climb from 9.2% to 38.9% over the same period. Despite that growth, the Financials sector still has the lowest rate of ESG metric adoption in the S&P 500. Within the STOXX 600, the Healthcare sector had the lowest adoption rate at 76.5%, yet this was significantly higher compared with 60% among S&P 500 Healthcare companies.

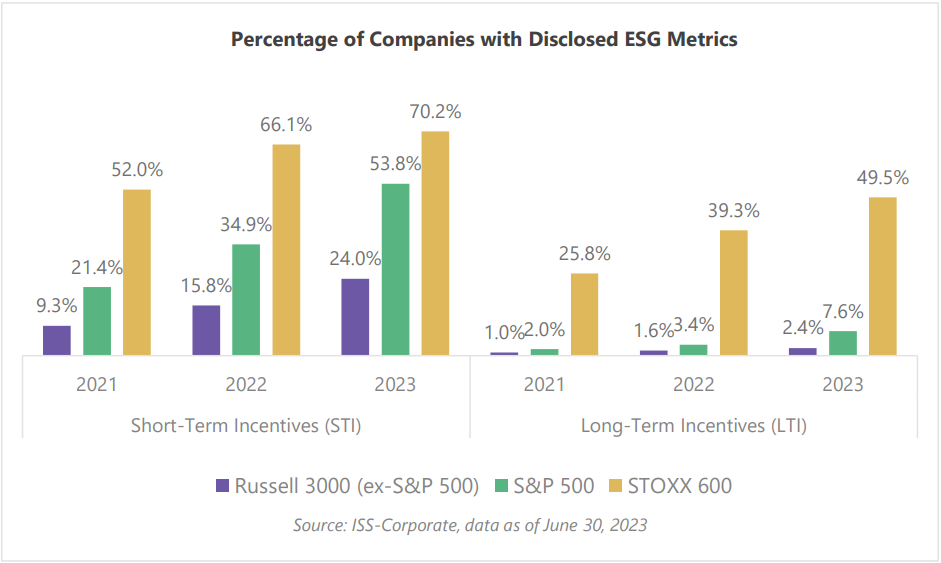

ESG Metric Horizon Remains Largely Short -Term but Long-Term Metrics are Increasing

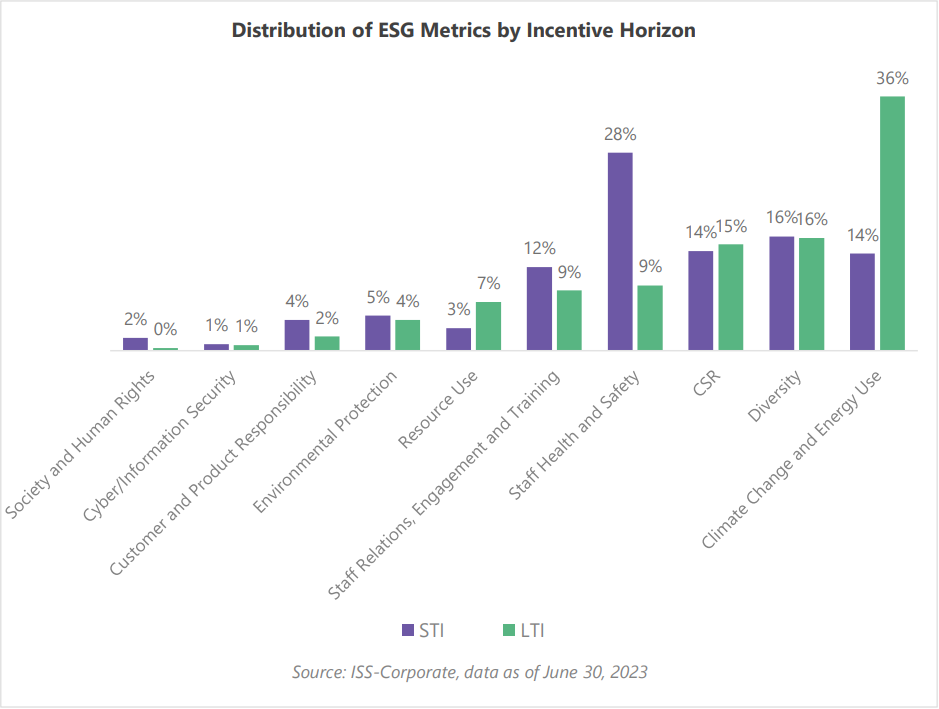

The inclusion of ESG metrics in STI or LTI depends on several factors, including specific objectives and time horizons. Despite the long-term nature of many ESG challenges, the STI plan continues to be the preferred choice for all companies regardless of geographical location. This preference can be partially attributed to the visibility it offers in seamlessly integrating sustainability into everyday operations, promoting employee engagement, and demonstrating a firm commitment to responsible business practices. Shorter-term ESG goal setting also helps companies lay the foundation for their longer-term ESG goals while giving them the ability to change metrics as their circumstances evolve.

It is worth noting that ESG metric adoption in the LTI almost doubled since 2021 on the STOXX 600 and now stands at close to 50%. By contrast, just 7.6% of S&P 500 companies and 2.4% of the remainder of Russell 3000 companies use these metrics in their LTI. The shift may be slower in the U.S. due at least in part to the accounting complexity associated with performance-based equity incentives.[2] Regardless of the reasons, companies in the U.S seem to have taken a cautious approach when it comes to implementing ESG metrics in these plan types.

Short-Term Incentives are usually linked to annual financial goals. Including ESG metrics in STIs is thought to facilitate immediate action and create a sense of urgency around sustainability and responsible practices. This approach can encourage behavioral change and achieve short-term ESG objectives such as employee welfare-based or client-driven metrics in the form of client retention or employee satisfaction. Often investors expect that the selected metrics to be relevant, measurable, and aligned with the company’s overall strategy.

Long-Term Incentives are typically based on a multi-year (commonly three years) performance period. Including ESG metrics in LTIs is thought to facilitate the alignment of long-term strategic objectives with sustainable practices. This approach can incentivize executives to consider the long-term ESG impacts of their decisions. However, it is important to select appropriate ESG metrics that reflect the company’s long-term sustainability objectives and are measurable over the specified period.

In practice, many companies, particularly in Europe, adopt a combination of both STIs and LTIs to incorporate ESG metrics into their compensation plans. Many companies believe that this approach allows for a balanced focus on short-term performance and long-term sustainability.

Environmental Metrics Gaining Popularity

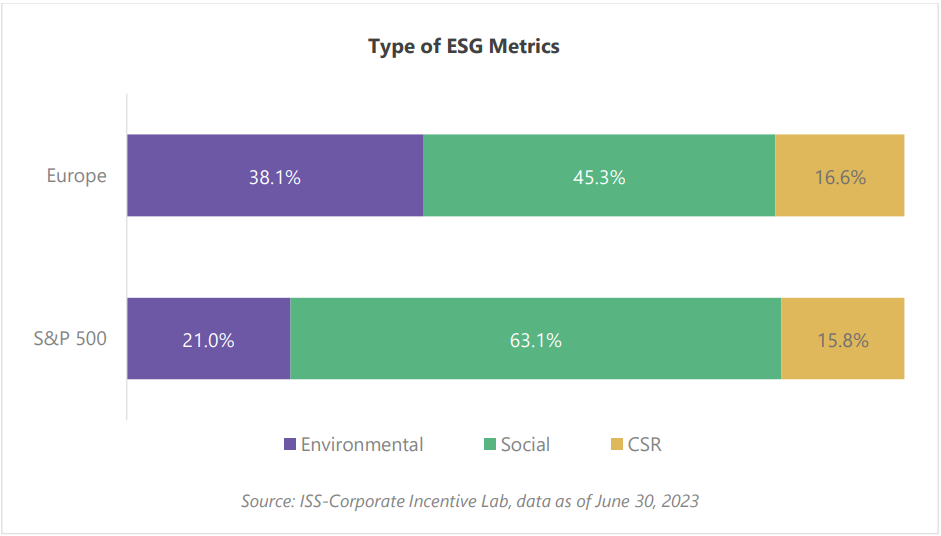

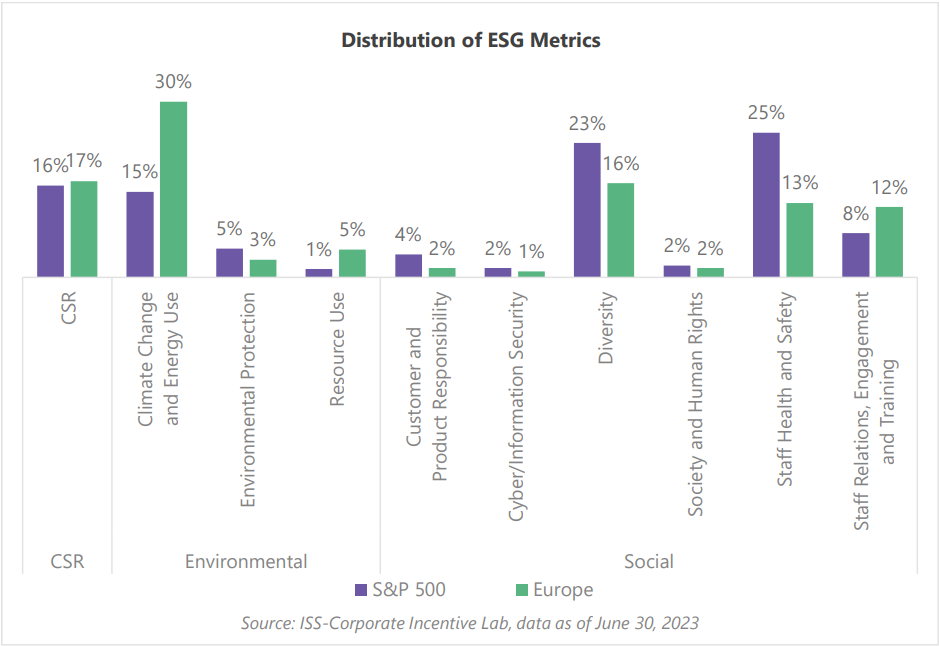

Social metrics in compensation plans evaluate a company’s human capital management practices, its impact on society, and its commitment to ethical business practices. These continue to comprise the most common ESG metric class, accounting for 63.1% of all ESG metrics in the S&P 500 vs, 45.3% in Europe[3] . However, these metrics represent a smaller share of the total than they did in 2021 when they accounted for 77.7% of all ESG metrics among U.S. companies and 53.9% among European firms[4].

The reduced dominance of Social metrics since 2021 is due to a shift in focus towards environmental metrics, reflecting increasing recognition of ecological concerns such as resource conservation, carbon emissions reduction, and green innovation. European companies have a higher rate of adoption, at 38.1% compared with 21% by S&P 500 firms. The most common ESG metric in Europe is Climate Change and Energy Use whereas in the U.S., Staff Health and Safety is the most prevalent.

Differences in regulatory, cultural and market factors may also account for the lower prevalence of environmental metrics in compensation plans at S&P 500 companies compared with their European peers. While regulatory implementation has been slower in the U.S., this could change significantly as CSRD takes hold in the next two years. The rules will apply to non-EU companies with at least one subsidiary in the EU and an annual net turnover of more than EUR150 million. In addition, CSRD requires companies to use European Sustainability Reporting Standards (ESRS) when reporting their ESG information for public disclosure. This may accelerate inclusion of Environmental metrics in compensation plans for S&P 500 constituents.

The Corporate Social Responsibility (CSR) metric is a catch-all term for ESG metrics that don’t fit into any other ESG categories. These often cover multiple topics or encompass a broad concept related to ESG, such as to promote a culture of responsible business conduct throughout the organization. This metric category often evaluates how an organization addresses issues such as community involvement, ethical labor practices, and environmental stewardship. It often uses a scorecard approach or relies on the board’s evaluation of the overall sustainability practice and progress. Including CSR metrics in compensation plans is driven in many cases by the desire to evaluate the company’s social and environmental impacts holistically. In 2021, 9.5% of all ESG metrics among U.S. companies were of this type compared with 16% in Europe. In 2023, this has increased to 15.8% for the S&P 500 compared with a modest increase in prevalence to 16.6% in Europe.

Key Principles of Effective (ESG) Incentives

When evaluating potential ESG metrics, a company should take a holistic approach and refrain from looking at these distinct metric classes in isolation. Sustainability-related performance metrics differ from traditional incentive measurements because they are not financial measures and are relatively new in concept. However, just as with any financial or operational performance metrics, sustainability performance metrics should follow the same basic principles of effective incentive metrics:

| Measure What Matters |

|

| Embed in (Sustainability) Strategy |

|

| Objective and Measurable |

|

| Incentivize Superior Performance |

|

| Appropriately Reward Performance |

|

Depending on maturity of the company’s sustainability program, it can be a major challenge for companies to integrate ESG metrics into executive incentives and apply these principles of effective incentives. What environmental or social factors are material to the organization may not be readily apparent. Companies may not have an established sustainability strategy that can guide the compensation metric. Furthermore, most ESG metrics are relatively new, unfamiliar to many companies and have a limited track record. That can limit a company’s ability to set appropriate targets.

Before incorporating sustainability-linked metrics into executive incentive programs, companies should first conduct a materiality analysis to identify the most salient issues impacting and impacted by the company’s business. As CSRD highlights, many investors expect companies to consider not only financial materiality of sustainability risks to their business but also the impacts their business has on the broader society and environment. To do so, companies should proactively engage with key stakeholders, not just shareholders, and establish long-term strategic goals to address these material issues. The process of establishing sustainability goals is a cycle of engagement with key stakeholders, identifying most material issues, developing strategy and roadmap, setting goals and objectives, and measuring, tracking, assessing and reporting the organization’s impact and progress.

Determining the time horizon of ESG metrics can be a challenge as well. Many ESG factors are long-term in nature and investors may expect companies to establish long-term goals. At the same time, establishing short-term goals and encouraging executives to reach short- to mid-term strategic goals can be effective in facilitating long-term sustainable value creation. When deciding whether to include ESG metrics in STIs, LTIs, or both, it is important for companies to carefully consider their specific ESG objectives, industry context, and stakeholder expectations. They should also refrain from making these goals too easily attainable and resist the temptation of selecting “softball” goals that are too easily attainable.

When integrating ESG metrics, companies must also find the right balance between ESG metrics and financial, operational, and shareholder return performance metrics. Sometimes there can be a tradeoff or conflicting demands between shorter-term financial goals and the longer-term sustainability objectives. These different metric classes should ultimately align with overall business strategy and holistically measure the company’s performance to incentivize long-term shareholder value creation.

ESG Metric Transparency is Mixed

Many companies also face challenges communicating the metrics and compensation outcomes to the market. There often is a tension between the demand for greater transparency and a need for withholding potentially sensitive information. Investors have a strong preference for clear disclosure of metrics and targets, and limited disclosure on ESG metrics could cast doubt on the appropriateness of their use, even if the company had gone through considerable length to carefully establish effective metrics.

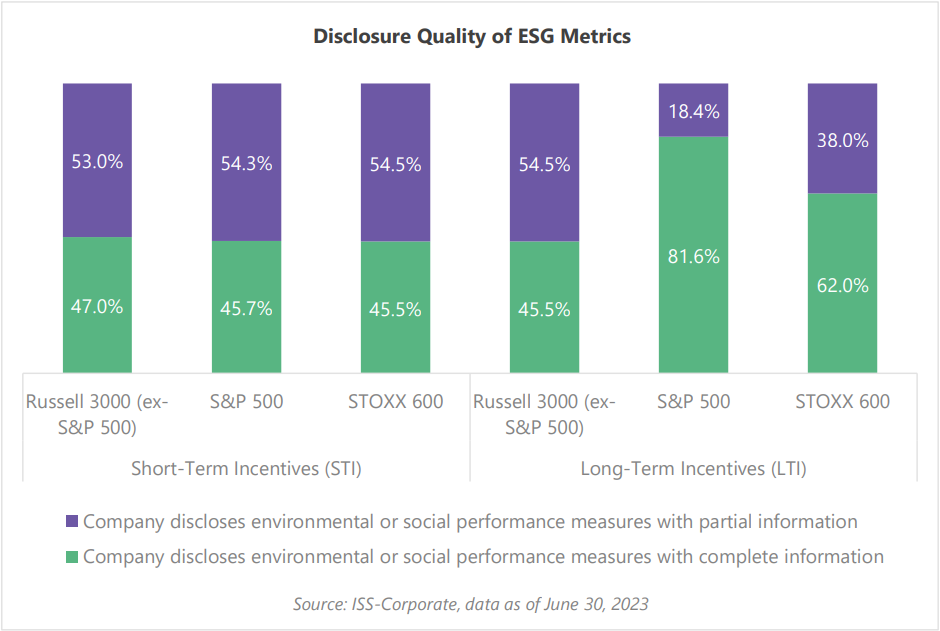

The level of specificity companies provide regarding their ESG metrics differs significantly. In both the U.S. and Europe, more than half of companies with ESG metrics in STI provide only limited disclosure regarding the metric and its target or use qualitative ESG metrics without clearly defined goals. However, the quality of disclosure generally is higher when ESG metrics are incorporated into LTI. This could be attributable in part to accounting considerations. It is also often the case that companies that are incorporating ESG into LTI already have an established process of measuring and reporting ESG KPIs. Further, Climate Change and Energy Use are by far the most common LTI metric used. These metrics measure GHG emissions reduction or renewable energy use, and many companies today have mid- to long-term goals under their sustainability strategy which they can tie to their compensation metric goals.

Companies must weigh internal and external demands in determining how much to disclose. Regardless of the level of disclosure, a robust narrative should demonstrate alignment between sustainability metrics and the company’s sustainability strategy as well as pay and performance, both financial and ESG.

Effective ESG Metrics and Effective Communication

Establishing effective ESG compensation metrics requires a robust sustainability management program and close collaboration between the organization’s compensation and sustainability managers. A well-functioning sustainability strategy should be integrated into the broader corporate strategy and there should be a clear understanding at the board and compensation committee levels over how incentives tie into the overall strategy. Compensation committees should also be well versed on the relevant data and information for key sustainability performance indicators. This may involve benchmarking key ESG KPIs and sustainability performance against peers and routinely reporting them to the compensation committee. Compensation committee members may also need to develop a level of sustainability literacy to be able to establish and oversee effective incentive programs.

It is important to keep in mind that with CSRD and IFRS sustainability disclosure standards, many firms will be required to disclose detailed information regarding sustainability-linked metrics in executive incentives. More companies are likely to start disclosing ESG compensation metrics and many will be required to enhance their transparency. Those that provide limited transparency will probably see increased investor scrutiny over their compensation program and sustainability strategy. With enhanced transparency, investors will have access to the information they need to assess the appropriateness of ESG metrics and their alignment with the overall strategy and company performance. As the investor expectation and regulatory frameworks evolve, it will become increasingly relevant for companies to contextualize their sustainability-linked incentives.

Endnotes

1“Incentivizing What Matters: Designing Meaningful ESG Metrics for Executive Compensation,” Jun Frank and Justin Chicoine, October 2021.(go back)

2Under Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 718, Compensation—Stock Compensation, if the metric goals are too subjective or cannot be measured formulaically, accounting grant date may not be able to be determined at the time of the grant of awards. This can have implications on how the awards are recognized their impact on income statement.(go back)

3Source: ISS-Corporate Incentive Lab, Data as of June 30, 2023. Incentive Lab covers over 2,200 U.S. companies including S&P 1500 and 400+ European companies.(go back)

4“Incentivizing What Matters: Designing Meaningful ESG Metrics for Executive Compensation,” Jun Frank and Justin Chicoine, October 2021.(go back)

Print

Print