Lara Aryani is a Partner and William Kim is an Associate at Shearman & Sterling LLP. This post is based on their Shearman memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita; How Much Do Investors Care about Social Responsibility? (discussed on the Forum here) by Scott Hirst, Kobi Kastiel, and Tamar Kricheli-Katz; Does Enlightened Shareholder Value Add Value? (discussed on the Forum here) by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita; and Companies Should Maximize Shareholder Welfare Not Market Value (discussed on the Forum here) by Oliver Hart and Luigi Zingales.

Over the last several years, companies, shareholders and regulators have focused increasing attention on three areas of investment risk: environmental, social and governance (ESG). While these risks are not strictly financial, investors have increasingly come to expect companies to address the ways in which these matters impact their businesses and the mitigation plans—if any—companies expect to adopt to manage these risks.

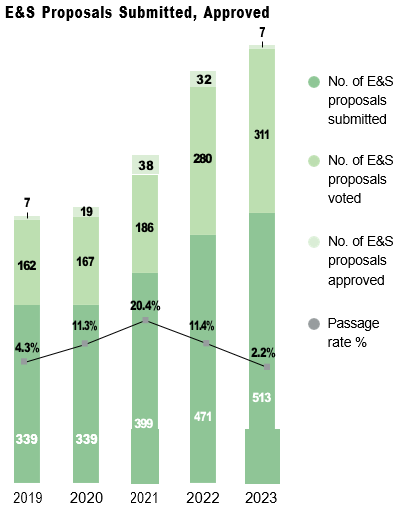

Environmental and social matters (E&S) in particular are in the crosshairs of a contentious debate on the role of politics in corporate boardrooms. Active political opposition to E&S corporate activities has emerged with condemnations from public figures like Elon Musk and Florida Governor Ron DeSantis and state legislatures introducing at least 165 “anti-ESG” bills in 37 states.[1] Following years of record-breaking shareholder support for E&S proposals, average shareholder support for E&S proposals declined steeply in 2022 and 2023.

Source: Broadridge, Broadridge ProxyPulse – 2023 Proxy Season Preview at 5, https://www.broadridge.com/report/2024-proxy-season-preview-and-2023-proxy-season-highlights.![]()

In the wake of declining passage rates and support rates for E&S shareholder proposals, various commentators have speculated on the “death” of ESG, the success of the “anti-ESG” movement and the fading interest of shareholders in the environmental and social risks that seemed to be so prominent in prior years.[2] However, a closer look at the data suggests a more nuanced explanation. It is likely that the rise of “anti-ESG” activism has had some chilling effect on the ESG activities of certain shareholders, some of whom may be revising fund materials or limiting their use of the term “ESG” in discussions with investors.[3] But the overall decline in shareholder support for E&S proposals is less likely due to a reversal in shareholder perspectives or policies on E&S matters and more likely the consequence, at least partially, of the high number of low quality E&S shareholder proposals that were submitted in the 2022 and 2023 proxy seasons relative to prior years.

Even at the height of shareholder support for E&S proposals, institutional investors warned that their support for E&S proposals was, like their support for any shareholder proposal, contingent on the proposals meeting certain criteria. For example, in 2021, Vanguard stated that its “funds are likely to vote in favor of shareholder proposals that call for reasonable enhancements to financially material DEI risk disclosures. However, the funds may not support such proposals where companies are already providing sufficient disclosures, or where a request is determined to be overly prescriptive.”[4] Similarly, in 2022, Blackrock warned that climate-related proposals were becoming increasingly prescriptive and that it was “not likely to support [such proposals] that, in [its] assessment, implicitly are intended to micromanage companies. This includes those that are unduly prescriptive and constraining on the decision-making of the board or management, call for changes to a company’s strategy or business model, or address matters that are not material to how a company delivers long-term shareholder value.”[5]

Proxy advisory firms ISS and Glass Lewis have echoed those sentiments, with Glass Lewis noting in 2021 and again in 2023 that it “believe[s] directors should monitor management’s performance in mitigating environmental and social risks…[and that] shareholders should use their influence to push for governance structures that protect shareholders and promote director accountability [in this regard]…However, we are not inclined to support proposals…seeking the implementation of prescriptive policies.”[6] ISS’s policy on E&S also is and has been generally supportive, particularly in respect of proposals “seeking greater transparency and/or adherence to internationally recognized standards and principles,” but at the same time it has cautioned against proposals that are overly prescriptive in nature.[7]

Years of record success for E&S proposals has likely emboldened their proponents, leading to a growth in the number of E&S proposal submissions and an expansion in the scope of their demands. Instead of carefully crafting and campaigning for resolutions that are targeted and tailored to a particular company, in 2023, certain proponents were more likely to mass produce generic proposals, or submit more aggressive and prescriptive proposals, in either case, failing to meet the parameters guiding shareholder voting of many institutional investors and also giving companies the ability to challenge the merits of the proposals in engagement meetings with institutional investors.

In spite of declining support for E&S proposals, the number of E&S shareholder proposal submissions has continued to enjoy record-breaking year-over-year growth, with the number of submissions increasing approximately 44% over the last five years.

Source: The Conference Board, Shareholder Voting Trends (2018- 2022) (September 27, 2022), at 14-23, https://www.conference-board.org/topics/shareholder-voting/trends-2022-brief-1-environmental-climate-proposals, and Proxy Season Review: Navigating ESG Backlash & Shareholder Proposal Fatigue (October 18, 2023), at 4, 9-10, https://www.conference-board.org/publications/2023-proxy-season-review-navigating-ESG-backlash-and-shareholder- proposal-fatigue.

*The data shown above covers companies constituent of the Russell 3000 index for the full year, except for 2023, in which the period considered was from January 1 through June 30.

Several investors noted that as the number of E&S proposals increased, their overall quality declined, with more prescriptive, non-targeted, or repetitive proposals having been submitted in the 2023 proxy season than ever before. Reiterating its statement from the 2022 proxy season,[8] BlackRock remarked that in the 2023 proxy season “there was an uptick in the number of such shareholder proposals that were overly prescriptive or unduly constraining on management decision-making. The number of single-issue proposals where the request made did not have economic merit also increased. Importantly, many proposals failed to recognize that companies had already substantively met their request”.[9] It also noted that many of the E&S proposals it declined to support in 2023 were “over- reaching, lacking economic merit, or simply redundant, [and] they were unlikely to help promote long-term shareholder value.”[10] Similarly, Vanguard said that “many shareholder proposals submitted during the 2023 proxy year went beyond requests for disclosure and instead sought specific actions from companies, including changes in company strategy or operations.”

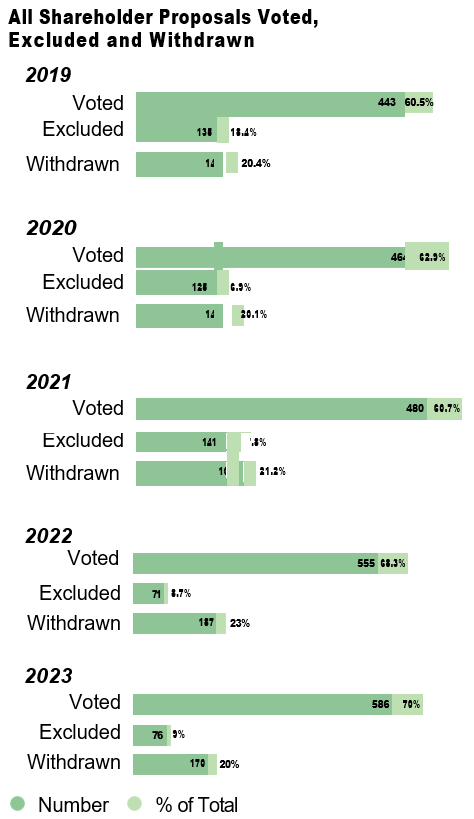

In 2023, there was also a notable increase in the number of shareholder proposals submitted and voted on and, correspondingly, a decrease in the number of proposals withdrawn. E&S proposals were the most likely to be withdrawn of all shareholder proposal types, with a withdrawal rate of 31% in 2023 compared to 36% in 2022 but the lowest exclusion rate of 8% in 2023.[11] While this could suggest that more companies are refusing to negotiate compromises with E&S proponents (and therefore, are allowing proposals to go to a vote), it could also reflect the impacts of the SEC’s revised 2021 guidance on Rule 14a-8,[12] which outlines the basis upon which a company can exclude a shareholder proposal from its proxy statement.

![]()

![]() Source: The Conference Board, Shareholder Voting Trends (2018- 2022) (September 27, 2022), at 12, https://www.conference-board.org/ topics/shareholder-voting/trends-2022-brief-1-environmental-climate-proposals, and Proxy Season Review: Navigating ESG Backlash & Shareholder Proposal Fatigue (October 18, 2023), at 3, https://www.conference-board.org/publications/2023-proxy-season-review-navigating-ESG-backlash-and-shareholder-proposal-fatigue.

Source: The Conference Board, Shareholder Voting Trends (2018- 2022) (September 27, 2022), at 12, https://www.conference-board.org/ topics/shareholder-voting/trends-2022-brief-1-environmental-climate-proposals, and Proxy Season Review: Navigating ESG Backlash & Shareholder Proposal Fatigue (October 18, 2023), at 3, https://www.conference-board.org/publications/2023-proxy-season-review-navigating-ESG-backlash-and-shareholder-proposal-fatigue.

*The data shown above covers companies constituent of the Russell 3000 index for the full year, except for 2023, in which the period considered was from January 1 through June 30.

2023 also saw a significant increase in the number of proposals submitted by “anti-ESG” proponents. None of these proposals passed, but they are categorized as E&S proposals for data tracking purposes, thus skewing data that purports to focus solely on the support of E&S-favorable proposals.

Source: Proxy Season Review: Navigating ESG Backlash & Shareholder Proposal Fatigue (October 18, 2023), at 15, https://www.conference-board.org/publications/2023-proxy-season-review- navigating-ESG-backlash-and-shareholder-proposal-fatigue.

Reflecting on its 2023 proxy voting record, Vanguard remarked, as have other institutional investors, that the significant decline in its support of E&S proposals does not reflect a change in its own policies, but rather a change in the quality and scope of the proposals submitted: “Despite changes in voting results, which are driven largely by the volume and substance of the proposals presented, our approach to evaluating shareholder proposals—including those on environmental and social matters—has been consistent over time. Our focus remains on identifying proposals that address financially material risks at a given company, supporting proposals that may fill gaps in the company’s current practices (while not intruding on company strategy and operations) and providing sufficient latitude to the company on implementation.”[13]

KEY TAKEAWAYS

- E&S continues to be a dominant focus of shareholder proposals—and the number of submissions continues to grow each year. The SEC’s apparently favorable disposition towards E&S proposals contributes to this growth.

- Large institutional investors have not changed their investment policies significantly in recent years, and they continue to remain supportive of high-quality E&S proposals that seek greater transparency on companies’ management of E&S risks. However, shareholders are reviewing the substance of proposals carefully and are less likely to support generic, poor quality or prescriptive proposals, even if related to E&S topics that they would otherwise support.

- Companies must continue to assess and manage their E&S risks, as well as their strategy for shareholder disclosure and engagement on E&S matters. While companies should expect that shareholders will remain focused on E&S matters, shareholder review and support for E&S proposals are careful and discerning. Companies should not be afraid to oppose E&S proposals that are truly generic, poor quality or overly prescriptive, as shareholders may agree with that assessment.

- Anti-ESG proponents are submitting an increasing number of shareholder proposals, and they appear to be supported by well-funded and organized groups. In spite of the low passage rate of anti-ESG proposals thus far, there is no sign that their number will decrease. Companies should expect these proponents to grow increasingly sophisticated, including in the ways in which they will spotlight corporate E&S activities that they oppose.

- Shareholders support proposals—and not proponents. Shareholders are discerning about aligning with the proponent of a proposal, but if a high-quality proposal is submitted by a proponent who has historically taken positions on E&S matters that directly conflict with a shareholders’ investment principles, some shareholders’ may nevertheless support the proposal if its end result (e.g., a request for additional disclosure) is supportable.[14]

Endnotes

1See Pleiades Strategy, “2023 Statehouse Report: Right-Wing Attacks on the Freedom to Invest Responsibly Falter in Legislatures,” https://www.pleiadesstrategy.com/state-house-report-bill-tracker-republican-anti-esg-attacks-on-freedom-to-invest-responsibly-earns-business-labor-and-environmental-opposition (June 2023); see also David Hood, “DeSantis Signs Sweeping Anti-ESG Bill Targeting Funds, Banks,” https://news.bloomberglaw.com/esg/desantis-signs-sweeping-anti-esg-bill-targeting-funds-banks (May 2, 2023).(go back)

2See Nicole Goodkind, “ESG Investing is Dying. That’s Not a Bad Thing,” https://www.cnn.com/2023/04/28/investing/premarket-stocks-trading (April 28, 2023); see also Jeff Green and Saijel Kishan, Support for ESG Shareholder Proposals Plummets Amid GOP Backlash,” https://www.bloomberg.com/news/articles/2023-06-09/support-for-esg-shareholder-proposals-plummets-amid-gop-backlash (June 9, 2023); see also Abigail Gampher, “Proxy Season Saw More ESG Proposals but Little Success,” https://news.bloomberglaw.com/bloomberg-law-analysis/analysis-proxy-season-saw-more-esg-proposals-but-little-success (July 12, 2023); see also Aswath Damodaran, “ESG is beyond redemption: may it RIP,” https://www.ft.com/content/d4082c75-3141-4a58-935b- 60a44c22897a?shareType=nongift (October 23, 2023).(go back)

3See Saijel Kishan, “ESG Investing Goes Quiet After Blistering Republican Attacks,” https://www.bloomberg.com/news/articles/2023-05-19/esg-investing-goes-quiet-after-republican-attacks (May 19, 2023).(go back)

4See Vanguard, “Vanguard Investment Stewardship Insights – Shareholder Proposals: Diversity, Equity and Inclusion,” https://corporate.vanguard.com/content/dam/corp/advocate/investment- stewardship/pdf/perspectives-and-commentary/INVDEIS_052021.pdf (May 2021).(go back)

5See BlackRock, “2022 Climate-Related Shareholder Proposals More Prescriptive than 2021,” https://www.blackrock.com/corporate/literature/publication/commentary-bis-approach-shareholder-proposals.pdf (May 2022).(go back)

6See Glass Lewis, “2023 Policy Guidelines,”https://www.glasslewis.com/wp-content/uploads/2022/11/ESG-Initiatives-Voting-Guidelines-2023-GL.pdf (November 30, 2022); see also Glass Lewis, “2021 Guidelines – an Overview of the Glass Lewis Approach to Proxy Advice,” https://www.glasslewis.com/wp-content/uploads/2020/11/ESG-Initiatives-Voting-Guidelines-GL.pdf?hsCtaTracking=c5fe11ce-e51d-449a-91fec00bfb8e16d0%7C80513084-8049-48f0-85bb-0e6864e24a9f (November 24, 2020).(go back)

7See ISS, “Sustainability Proxy Voting Guidelines,” https://www. issgovernance.com/file/policy/active/specialty/Sustainability-International-Voting-Guidelines.pdf (January 17, 2023).(go back)

8See BlackRock Investment Stewardship, “2022 Climate-Related Shareholder Proposals More Prescriptive Than 2021,” https://www.blackrock.com/corporate/literature/publication/commentary-bis-approach-shareholder-proposals.pdf (May 12, 2022).(go back)

9See BlackRock Investment Stewardship, “Overview of the 2022-23 Proxy Voting Year,” https://www.blackrock.com/corporate/literature/publication/2023-investment-stewardshipvoting-spotlight.pdf (August 23, 2023).(go back)

10See BlackRock Investment Stewardship, “Overview of the 2022-23 Proxy Voting Year,” https://www.blackrock.com/corporate/literature/publication/2023-investment-stewardship-voting-spotlight-summary.pdf (August 23, 2023).(go back)

11See The Conference Board, “Shareholder Voting Trends (2018- 2022),” https://www.conference-board.org/topics/shareholder-voting/proxy-trends-2022-executive-summary (September 27, 2022); see also “Proxy Season Review: Navigating ESG Backlash & Shareholder Proposal Fatigue,” https://www.conference-board.org/publications/2023-proxy-season-review-navigating-ESG-backlash-and-shareholder-proposal-fatigue (October 18, 2023).(go back)

12See U.S. Securities and Exchange Commission, “Shareholder Proposals: Staff Legal Bulletin No. 14L,” https://www.sec.gov/corpfin/ staff-legal-bulletin-14l-shareholder-proposals? (November 3, 2021).(go back)

13See Vanguard, “Vanguard Investment Stewardship – U.S. Regional Brief,” https://corporate.vanguard.com/content/dam/corp/advocate/ investment-stewardship/pdf/policies-and-reports/us_2023_ regional_brief.pdf (August 28, 2023).(go back)

14For example, in 2022, an anti-ESG proponent focused on forced labor in China submitted a proposal that received 36.8% support because it requested additional disclosure from Disney on the due diligence it undertakes to evaluate the human rights impact of its activities outside the United States. See Ruth Saldanha, “Forced Labor in China, Where Pro-ESG and Anti-ESG Groups Meet,” https://www.morningstar.com/sustainable-investing/forced-labor-china-where-pro-esg-anti-esg-groups-meet (April 14, 2022).(go back)

Print

Print