Joe Ucuzoglu is Global CEO and Jennifer Steinmann is Global Sustainability & Climate Practice Leader at Deloitte Touche Tohmatsu Limited. This post is based on their Deloitte memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita; Does Enlightened Shareholder Value add Value (discussed on the Forum here) by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita; How Twitter Pushed Stakeholders Under The Bus (discussed on the Forum here) by Lucian A. Bebchuk, Kobi Kastiel, and Anna Toniolo; and Corporate Purpose and Corporate Competition (discussed on the Forum here) by Mark J. Roe.

Climate remains a top priority despite many pressing issues

Climate change is now an enduring part of the business agenda

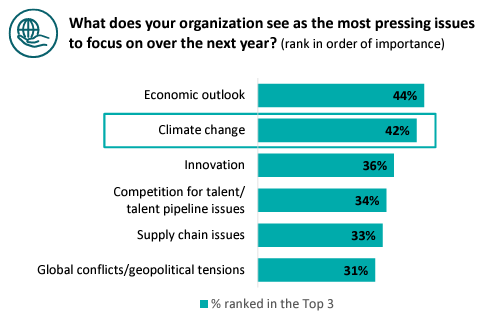

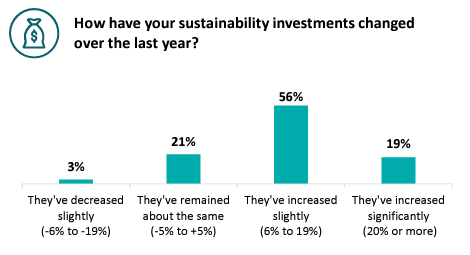

- Instead of retrenching amid inflation, geopolitical crises, and an energy crunch, CxOs indicate they’ve accelerated their sustainability efforts over the last year. When asked to rank the issues most pressing to their organizations, 42% of CxOs rated climate change as a “top three issue” with only economic outlook ranking higher.

- The importance of climate change is also seen in organizations’ investments over the past year: 75% say their organizations have increased their sustainability investments, nearly 20% of whom say they’ve increased investments “significantly.”

- Countries most likely to have increased investments “significantly”: the UAE (34%); Brazil (31%); Italy (29%).

- Only 3% say they’ve decreased sustainability investments over the past year. The most common reasons for a decrease were concern over an economic downturn and the effects of the Russia-Ukraine conflict.

Almost every organization has felt the impacts of climate change

Climate change is affecting companies in myriad ways

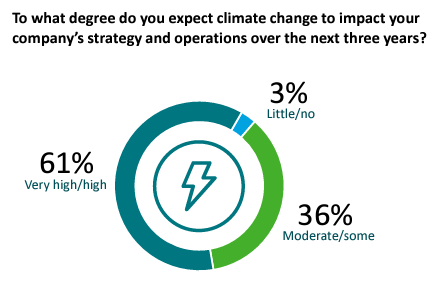

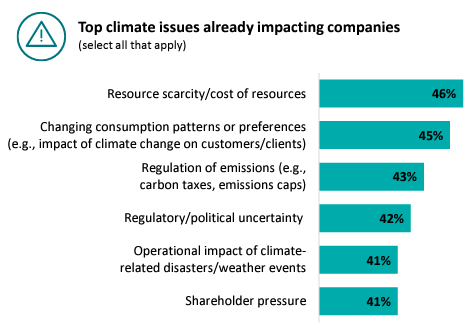

- Almost all respondents indicated climate change has impacted their organizations over the past year. In a year where the Russia-Ukraine conflict has caused supply chain disruption and resource issues, CxOs also identified climate change as a driver of high costs and resource scarcity. Organizations are also contending with changes in consumer demand, regulations, political uncertainty, and operational impacts related to climate disasters and weather events.

- Resource scarcity is most keenly felt in the UAE (64%), Germany (58%), and France (55%). However, it is less of an issue in the Americas region, where it ranked fifth.

- Shareholder pressure was the top issue cited by the largest companies surveyed (those with 50,000+ employees).

- Additionally, around a third of CxOs said climate change is negatively affecting their employees’ physical (37%) and mental (32%) health. Employee physical health was especially a concern in Asia-Pacific (APAC) countries where 44% of CxOs cited this as a current issue.

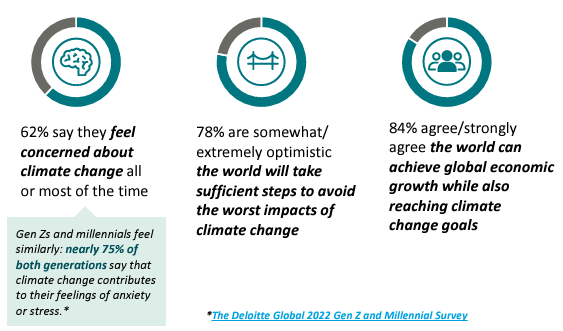

CxOs are worried about climate change but optimistic about climate action

Concern around climate change

- 78% are somewhat or extremely optimistic that the world will take sufficient steps to avoid the worst impacts of climate change. Despite this optimism, 62% say they feel concerned about climate change all or most of the time.

- 20% of respondents say they feel concerned about climate change “all of the time.” This highly concerned group is more likely than the average respondent to indicate that their organizations have already been impacted by climate issues, they are feeling much more pressure from their stakeholder groups, and they are much more likely to have been personally impacted by a climate event over the past year.

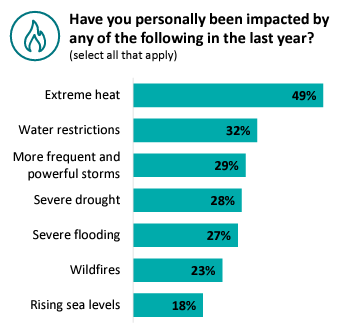

- 82% of executives say they’ve been personally impacted by climate events in some way, with extreme heat the most frequently-cited issue. This number jumps to 95% for the highly concerned group.

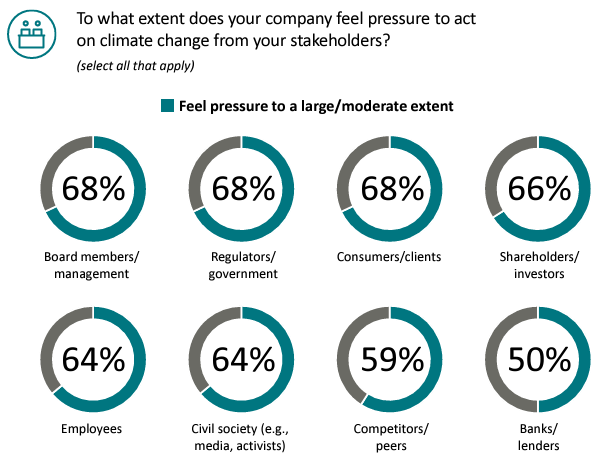

Companies feel broad pressure from stakeholder groups

Pressure from all sides

- Companies are feeling a moderate-to-large degree of pressure to act on climate change from many different stakeholder groups—from the board/management to customers to employees.

- Employees have become an increasingly influential group: More than half of CxOs said employee activism on climate matters has led their organizations to increase sustainability actions over the last year—and 24% said employee activism led to a “significant” increase.

- Regulation is also influential: 65% of CxOs said the changing regulatory environment has led their organizations to increase climate action over the last year

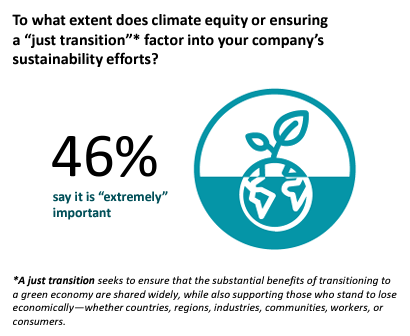

Many organizations express concern about a “just transition,” but focus is uneven among countries

Uneven concern

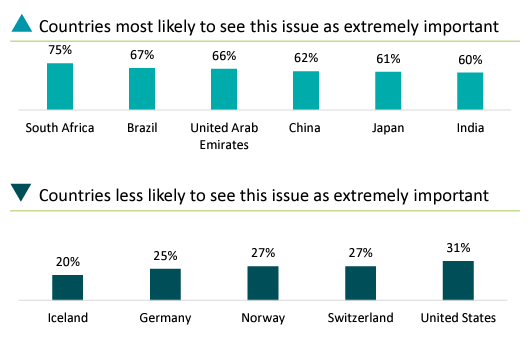

- 46% of CxOssay that ensuring a “just transition” is “extremely important” to their organizations. The view of its importance differs greatly by region and country:

- APAC is especially focused on a “just transition” with 57% of APAC CxOs saying, “it’s extremely important.” Countries most likely to see this issues as extremely important: South Africa (75%), Brazil (67%), the UAE (66%), China (62%), Japan (61%), and India (60%). Additionally, 76% of the “highly concerned group” of CxOs (referenced on page 8) are especially focused on a “just transition.”

- The countries least likely to see it as “extremely important”: Iceland (20%), Germany (25%), Norway (27%), Switzerland (27%),and the US (31%).

While organizations are acting, they’re struggling to move the needle

Over a third of organizations haven’t implemented more than one of five “needle-moving” sustainability actions

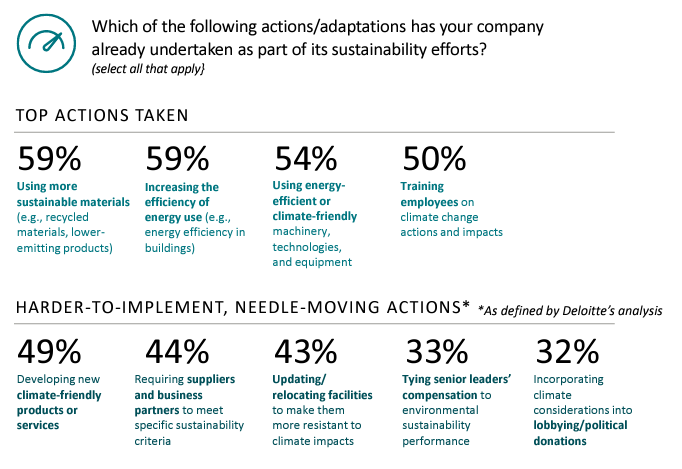

- Companies are less likely to implement actions that demonstrate they have embedded climate considerations into their cultures and have the senior leader buy-in and influence to effect meaningful transformation. For example, 21% of CxOs indicate their organizations have no plans to tie senior leader compensation to environmental sustainability performance and 30% say they have no plans to lobby government for climate initiatives.

- However, companies are acting: they are using more sustainable materials, increasing energy efficiency, training employees, and developing new climate-friendly products.

- They are also ramping up climate adaptation efforts: 43% are updating or relocating facilities to make them more resistant; 40% are purchasing insurance coverage against extreme weather risks; 36% are offering financial assistance to employees who have been impacted by extreme weather.

CxOs struggle to adopt initiatives with longer-term financial benefits

Difficulty linking more tangible financial opportunities to climate initiatives

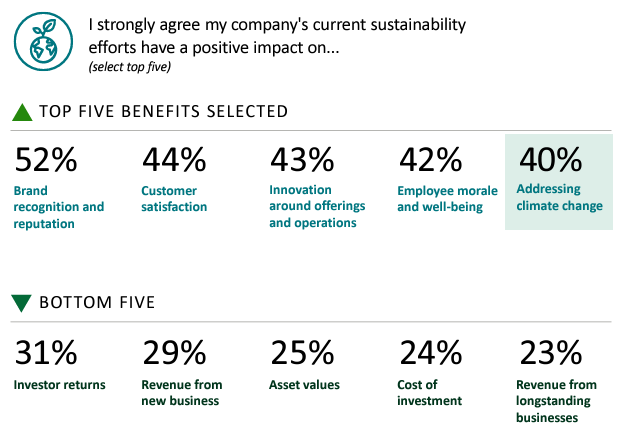

Like last year, CxOs chose brand recognition and reputation, customer satisfaction, and employee morale and well-being as three of the four top benefits of their companies’ sustainability efforts, suggesting many CxOs see climate actions as a way to benefit stakeholder relationships.

- Overall, 40% believe their organizations’ sustainability efforts will meaningfully address climate change.

- Leaders in APAC rank this slightly higher at 42% (a top-three benefit), but this benefit falls to 6th place in Europe, Middle East, and Africa (EMEA) and 8th in the Americas.

- The lowest-ranked benefits (all financial) suggest CxOs continue to struggle to define the longer-term financial opportunities that sustainability measures offer.

Several obstacles to climate action remain

Barriers to action and impact

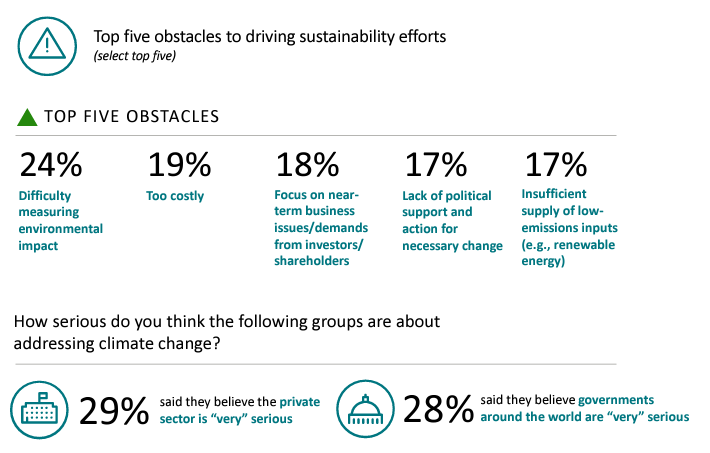

- Nearly a quarter of CxOs said the difficulty of measuring their organizations’ environmental impact was a top barrier and nearly one-fifth cited cost and focus on near-term issues as barriers.

- Although 19% of CxOs indicate cost is a barrier to action, 91% also said they agree or strongly agree that “my company can continue to grow while reducing greenhouse gas emissions.”

- There is also skepticism around the seriousness of the private sector and governments to address climate change, which could perhaps be an indicator of concerns around greenwashing.

- Deloitte’s 2022 Climate Check survey found that 66% of leaders agree that greenwashing has become a serious problem in their industries.

Recommendations for organizations

Our 2023 survey shows that CxOsbelieve that both their organizations and the global economy can continue to grow while reaching climate goals and reducing greenhouse gas emissions. So, how can they help close the gap between ambition and impact, break through the barriers to greater action, and start to balance the near-term costs of climate initiatives with the long-term benefits? Here’s how they can get started:

Embed climate goals into the business’ overall strategy and purpose: Often what impedes action isn’t lack of intention; it’s the choices and tensions that CxOs and boards must navigate to clearly define their organizations’ stance on climate action. By developing a holistic view of their sustainability goals, then integrating that view into their enterprise purpose and strategy, CxOs can reduce or eliminate stakeholder dissonance—and help ensure leaders focus on strategically-aligned climate action.

Build trust by taking credible climate actions: Our survey uncovered skepticism about private sector and government commitments to address climate change. Organizations can fight against such distrust by ensuring the data they report is relevant and reliable. Third parties like The Science Based Targets initiative and CDP offer guidance and widely recognized frameworks to set and measure credible climate action. Additionally, organizations should support policy interventions and enforcement mechanisms to eliminate greenwashing and fraud.

Empower the board: As stewards of their organizations, boards can play a vital role in guiding businesses toward a more sustainable future by ensuring that long-term views are captured in management decision-making. However, boards must know the right questions to ask—and where to push to find robust solutions. Deloitte, in association with the World Economic Forum and Climate Governance Initiative, has prepared guides with key insights from chairs leading climate action. These guides consider how key stakeholder groups are responding to a climate-driven future, help chairs understand the decarbonization road map, and how to realize value through a “just transition.”

Encourage stakeholder action: Organizations can’t drive change solely on their own; part of leading is enabling and influencing their stakeholders to act. For example, business leaders can collaborate with local and national governments in support of climate initiatives (something only 32% are currently doing, according to our survey) and work with their suppliers and business partners to meet specific sustainability criteria (something only 44% are doing). Leaders should also harness their employees’ passion by offering climate trainings and involving them in their organization’s sustainability work.

Consider the long-term opportunity: Nineteen percent of those surveyed cited the cost of climate initiatives as a barrier to increased action; yet, research from Deloitte has found that climate inaction could cost the global economy US$178 trillion over the next 50 years. On the other hand, it could gain US$43 trillion over the same period by rapidly accelerating the transition to net-zero. Although investing in the necessary change today may cause temporary financial discomfort, effective investments will pay off in the long run, especially as demand for sustainable products and services increases.

Invest in today’s (and tomorrow’s) technologies: Climate technology—whether it’s electrification, sustainable aviation fuel, or carbon capture—plays a vital role. But understanding which technologies to invest in, how to find them, and how to deploy them effectively can be daunting, especially when each industry, geography, and organization requires its own path forward. GreenSpaceTech by Deloitte is uniquely positioned to tackle this challenge by helping businesses scan, assess, and connect to innovators and emerging and existing climate tech globally, and formulate effective strategies to apply those cutting-edge solutions.

Collaborate to drive systems-level change: The pace of transformation needed requires a coordinated approach between sectors and industries and throughout supply chains and regions. One company can only do so much when the necessary infrastructure (e.g., electric charging stations, renewable energy) is in low or uneven supply. System-wide engagement with industry peers committing to accountability can help drive rapid behavioral change. Government, business, and society must work together to achieve their shared sustainability objectives.

Methodology

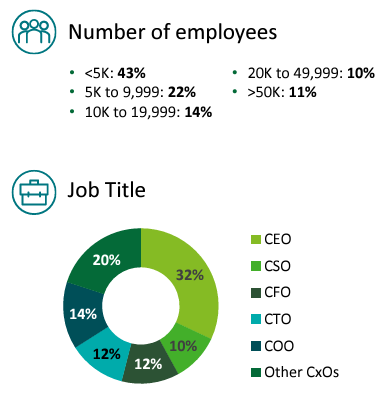

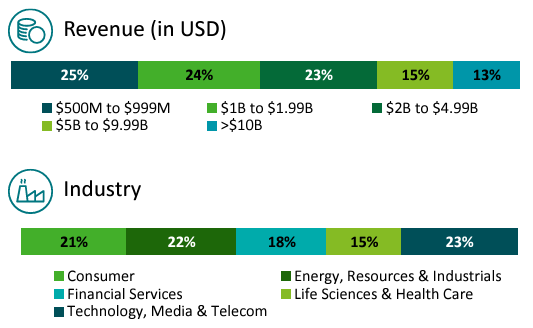

The report is based on a survey of 2,016 C-level executives. The survey, conducted by KS&R Inc. and Deloitte, during September and October 2022, polled respondents from 24 countries: 48% from Europe/Middle East/South Africa; 28% from the Americas; 24% from Asia-Pacific.* All major industry sectors were represented in our sample. Additionally, KS&R and Deloitte conducted select, one-on-one interviews with global industry leaders.

*Countries polled: Australia, Brazil, Canada, China, Denmark, Finland, France, Germany, Iceland, India, Italy, Japan, Mexico, The Netherlands, Norway, Qatar, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, the United Arab Emirates, the United Kingdom, and the United States.

The full report is available to read here.

Print

Print