George Cowlrick is a Product Manager at AQTION. This post is based on an AQTION study by Mr. Cowlrick, Ali Saribas, and Andrew Brady. Related research from the Program on Corporate Governance includes Big Three Power, and Why it Matters (discussed on the Forum here), Index Funds and the Future of Corporate Governance: Theory, Evidence and Policy (discussed on the Forum here), and The Specter of the Giant Three (discussed on the Forum here) all by Lucian A. Bebchuk and Scott Hirst; The Agency Problems of Institutional Investors (discussed on the Forum here) by Lucian A. Bebchuk, Alma Cohen, and Scott Hirst; and The Limits of Portfolio Primacy (discussed on the Forum here) by Roberto Tallarita.

i. Introduction

AQTION, a subsidiary of SquareWell Partners, published its inaugural study – ‘Stewardship in AQTION’ – which details how the world’s largest 65 asset managers and owners steward their portfolio companies and how they incorporate extra-financial considerations into their investment decision-making processes.

The study finds that investors are continuing to vocalize their expectations on extra-financial topics with a growing level of transparency and the low barriers to implement “activist” tactics by investors, such as commenting to media, suggests that pressure will remain on corporate boards to be pro-active in responding to investor demands, and to present a compelling “equity story” that incorporates mega-trend sustainability topics, but crucially, that is grounded in a robust governance structure.

This article leverages the findings from the ‘Stewardship in AQTION’ study where we further analyzed the similarities and differences between the stewardship practices of US and European investors (46 investors in total – 25 US investors, and 21 European investors). We excluded Sovereign Wealth Funds, Canadian, Japanese, and Korean investors from the initial study.

The review demonstrates a high level of congruence between the two groups, however, there remain several differences worth highlighting:

- Decision-Makers: European investors involve more the portfolio/fund manager in the final voting decisions at general meetings when compared to their US-peers which demonstrate a slightly higher reliance on the recommendations of their selected proxy advisors.

- Principles vs Pragmatism: Divergences on select governance topics have also emerged; for example, while US investors evaluate the combination of Chair/CEO roles on a case-by-case basis, European investors suggest a more dogmatic approach by communicating a strict preference for an independent Chair.

- Sustainability Agenda: European investors have, proportionally, supported/endorsed more environmental and social initiatives than their US-peers. While climate initiatives appear to be more broadly supported, European investors appear to be taking the lead in supporting initiatives relating to biodiversity and social topics.

- Activism: US investors are more transparent in disclosing their approach to evaluating proposals made by activists than their European peers. European investors, on the other hand, have been more vocal than their US peers in publicly communicating their concerns with specific portfolio companies and exhibiting a more “active” stewardship approach.

ii. Stewardship Practices

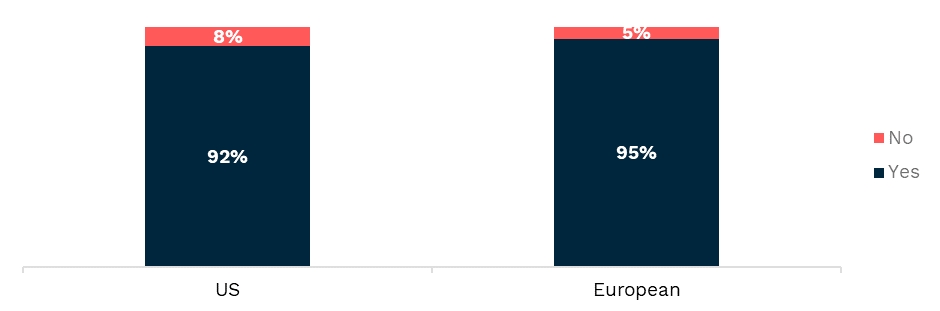

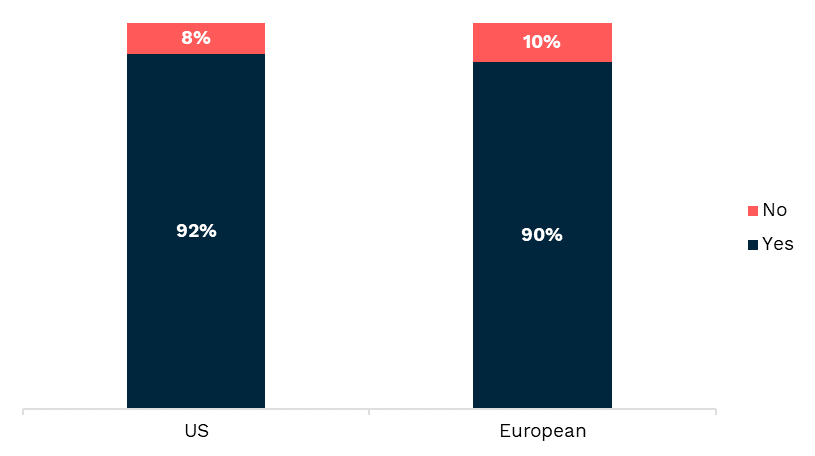

In recent years the world’s largest investors formed dedicated teams to oversee discussions with portfolio companies on “ESG” issues. These teams often also make decisions on how to vote their shares at general meetings. Forty-three of the 46 (roughly 93%) investors across both regions have established dedicated stewardship teams responsible for implementing their voting guidelines and engaging with companies on a wide range of topics (Figure 1).

Figure 1. Percentage of US and European Investors with a Dedicated Stewardship Team

Decision-Makers

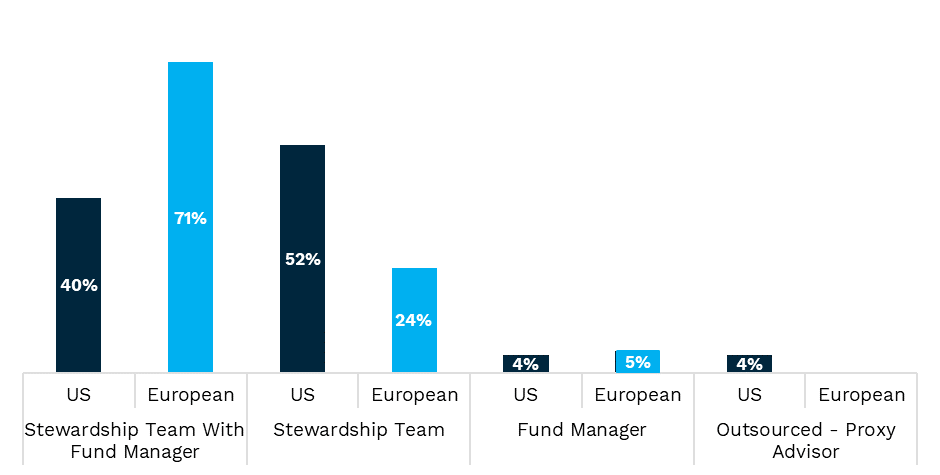

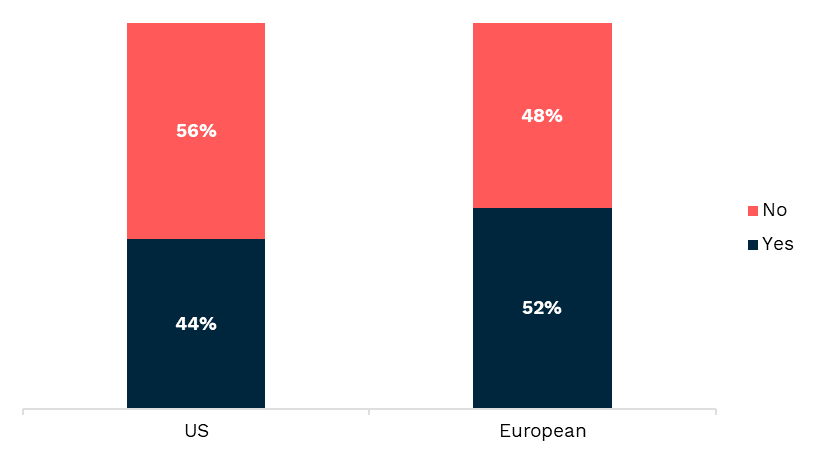

AQTION analysed the decision-making process at investors when evaluating a company’s general meeting agenda and instructing their final voting decision. The findings uncovered that all of the 43 investors (out of 46) that have a stewardship team will designate them either as the standalone decision-maker or as a joint decision-maker with the portfolio/fund manager. Interestingly, AQTION notes that European investors favour stewardship teams to make decisions with the input of the fund manager significantly more than the US group (Figure 2) bridging a bit the gap between “values” and “value”.

Figure 2. The Percentage Split between Decision-Makers Amongst US and European Investors

Reliance on Proxy Advisor(s)

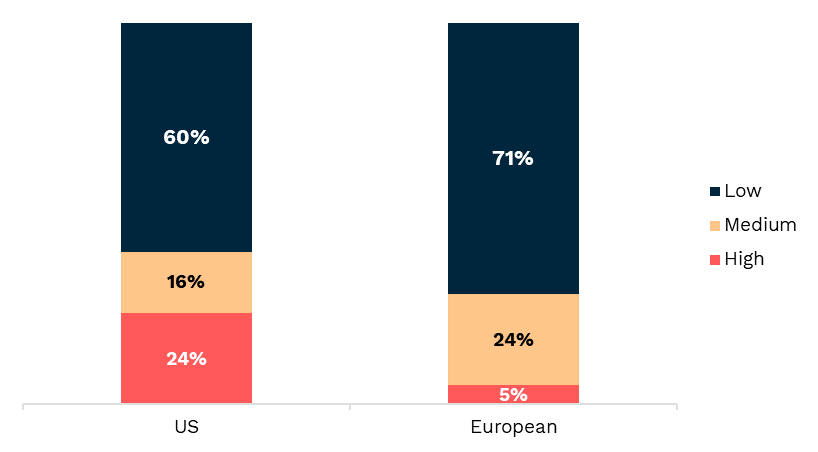

Even if investors receive recommendations from proxy advisors, most of those reviewed in the study have their own internal voting guidelines which will inform their final voting decisions. In fact, AQTION notes that both US and European investor groups broadly exhibit a “low” reliance on their primary proxy advisor (some investors use more than one proxy advisor), showing a preference to draw conclusions based on proprietary voting guidelines (Figure 3).

These findings, for the most part, support the position made by ISS’s CEO in a 2018 letter to the Securities and Exchange Commission (“SEC”) in the US which explained that 85% of ISS’s top 100 clients used a custom proxy voting policy – meaning that they did not rely on ISS’s standard research recommendations but have ISS’s custom research team apply investors’ own voting guidelines.

Figure 3. Reliance on Proxy Advisors’ Recommendations Between US and European Investors

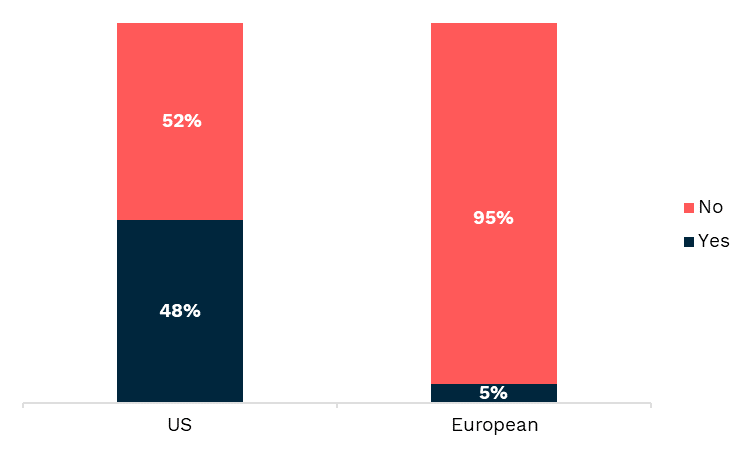

Disclosure of Voting Guidelines

AQTION identified that while 100% of the investors from both the US and European disclose their voting guidelines (Figure 4), there is some inconsistency that can be seen between the two when looking to see if they disclose country-specific voting guidelines. Forty-eight percent of US investors disclose a country-specific voting policy, whereas only 5% of the European investors do so (Figure 4). This stark contrast indicates that regional differences are, in general, more systematically considered amongst investors in the US while European investors encourage one set of standards to be considered by companies globally.

Figure 4. The Percentage of Investors Between the US and Europe that Disclose Regional/Country-specific Voting Guidelines

iii. Expectations on “ESG” Topics

Given the growing focus on “ESG” topics amongst investors, AQTION analyzed potentially differing views between the US and European on select “ESG” topics including.

Views on Governance Topics

AQTION reviewed whether there were differences between US and European investors when it comes to governance sensitivities. For the purposes of this article, AQTION focused on investors’ preference on two topics: (a) Chair/CEO; and (b) “ESG” criteria in pay.

(a) Chair/CEO

The combination of the Chair and CEO roles remains a divisive topic amongst investors. AQTION notes that 43 of the 46 investors provide insight on their position regarding the combination of the Chair and CEO roles in their voting policy. More specifically:

- 17 investors communicate that they will systematically vote AGAINST the (re)election of a combined Chair-CEO. For example, Legal & General Investment Management state that “Since 2020, we have been taking a stronger stance on combined roles and now vote against the election or re-election of any individual holding such a combined role. We believe that a separation of the roles of board chair and CEO is positive for culture, board discussions, remuneration policy and shareholder rights.”[1]

- 25 investors communicate that they will evaluate such positions on a case-by-case basis whereby they will consider mitigating factors such as the overall independence of the board or its key committees, the presence of a Lead Independent Director, and whether the combination of roles is temporary. For example, Neuberger Berman states that “We recognize that there are instances in which it may be appropriate to combine the CEO and Chairperson roles, including a current strong lead independent director, strong performance and governance provisions.”[2]

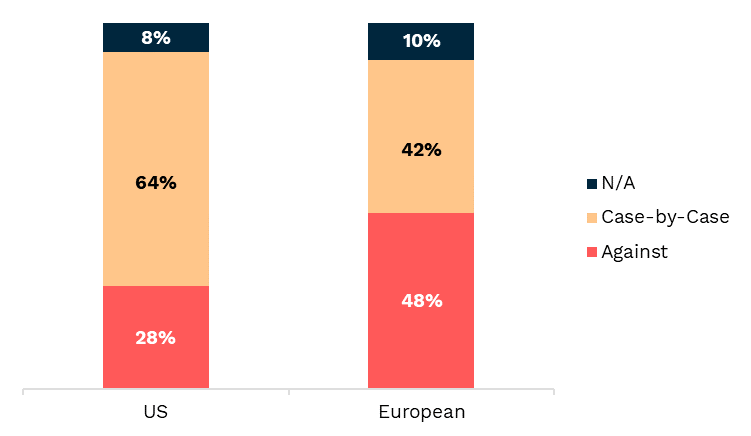

The split between US and European investors show that European investors have a stronger preference for having an independent Chair while US investors prefer to evaluate this on a case-by-case basis (Figure 5).

Figure 5. How US and European Investors View Combined Chair/CEO Roles

(b) “ESG” Criteria in Pay

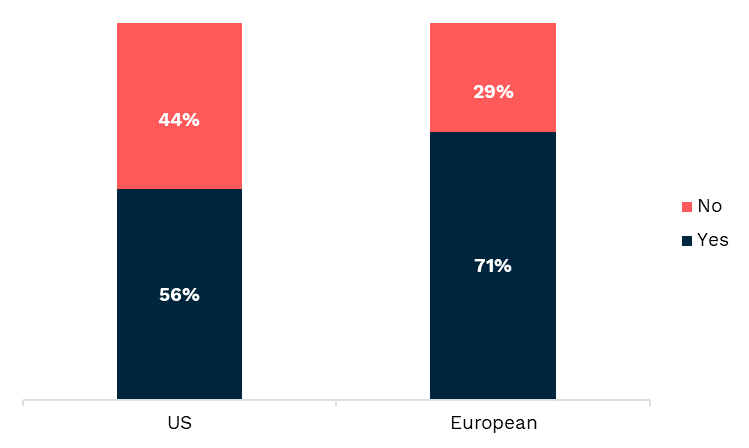

Not all investors expect companies to incorporate “ESG” criteria in executive pay packages. AQTION notes that only 29 investors of the 46 analysed communicate a public position on this topic. Maybe not surprisingly, European investors communicate more on this topic than their US peers (Figure 6). Investors that disclose on the topic, however, highlight that such performance criteria should be material, quantifiable, transparent, and sufficiently challenging. Some investors, however, communicate a clear position that they expect portfolio companies in certain sectors to include climate-related criteria (such as AXA Investment Managers and DWS Investment).

Figure 6. The Percentage of Investors from the US and Europe that Communicate a Public Position on “ESG” Criteria in Pay

Views on Environmental & Social Topics

Like governance topics, investors are increasingly communicating their expectations on key environmental and social topics. AQTION notes that 35 of the 46 investors have communicated their expectations on key environmental and social topics with the European investors being slightly more transparent than US investors (Figure 7).

Figure 7. The Percentage of Investors in the US and Europe that Communicate Expectations on Environmental & Social Topics

For the purposes of this article, AQTION focused on the level of transparency by investors on the topic of biodiversity given its growing importance. To this end, AQTION notes that 22 of the 46 investors have published their expectations on biodiversity with both constituents being equally transparent on this topic (Figure 8). While some investors mentioned projects they were participating in order to protect their investments from nature-related risks and what the economic consequences of biodiversity loss could entail, others provide guidance as to how companies should address biodiversity risks.

Figure 8. The Percentage of Investors in the US and Europe that Published Expectations on Biodiversity

iv. Engagement Efforts and Transparency

While investors’ expectations on “ESG” topics tend to be intentionally vague to allow for flexibility in evaluating nuanced situations, more and more investors are now disclosing their stewardship efforts which provide more granular insight as to how they evaluate specific situations and/or practices.

AQTION notes that 42 of the 46 investors publish stewardship reports, which not only sheds light onto their position on certain topics but also what they may be focusing on in their engagements with portfolio companies. Both US and European contingents publish stewardship reports in (near) equal weightings (Figure 9).

Figure 9. The Percentage of Investors in the US and Europe that Publish Stewardship Reports

Vote Rationales

Aside from stewardship reports, 22 of the 46 investors publicly disclose their vote rationales. Vanguard[3] and BlackRock[4] also publish detailed insights on their voting position in certain high-profile situations, although to a lesser extent when compared to previous years. These insights are published likely to control the narrative in the media as to how they steward their assets, but also to serve as a guide as to their position on certain topics to other portfolio companies that may be faced with a similar issue. Again, there is little variation between the US and European subsets, with European investors being slightly more transparent with their voting positions compared to their US counterparts (Figure 10).

Figure 10. The Percentage of Investors in the US and Europe that Discloses Vote Rationales

v. Participation in Initiatives

AQTION notes the emergence in recent years of numerous collaborative initiatives aimed at standardising “ESG” information as well as encouraging portfolio companies to progress on topics deemed material in meeting global challenges.

Climate Action 100+ (“CA100+”) and the Institutional Investors Group on Climate Change (“IIGCC”) are investor coalitions tasked with encouraging companies in key sectors to take concrete steps in tackling climate change with 37 of the 46 investors supporting both initiatives. The Net Zero Asset Managers initiative (“NZAM”), on the other hand, an international group of asset managers committed to supporting the goal of net zero greenhouse gas emissions by 2050, has seen less take-up with only 30 of the 46 analysed supporting this initiative. Notably, all three climate initiatives (CA100+, IIGCC, and NZAM) has seen a much stronger endorsement by European investors (Table 1).

On the standardization of “ESG” disclosures, AQTION notes that 41 of the 46 investors have publicly supported the Task Force on Climate-related Financial Disclosures (TCFD) – which is going to be incorporated and overseen by the International Sustainability Standards Board (ISSB) going forward. However, only 15 of the 46 investors have officially supported the CDP Science-Based Targets (SBTi) campaign[5] which encourages the adoption of science-based emission targets. Of these 15 investors in support of CDP, only two are from the US, demonstrating a disparity of alignment in supporting the initiative amongst European and US investors (Table 1).

The Task Force on Nature-related Financial Disclosures (TNFD) released its recommendations in September 2023. Like the TCFD, the TNFD aims to develop and deliver a risk management and disclosure framework for companies to report and act on evolving nature-related risks. The TNFD already has 26 supporters among the 46 investors studied, highlighting growing interest of investors to access comparable and robust data on biodiversity. Interestingly, where there is relative congruence between US and European investors in supporting TNFD (48% vs 67%, respectively), support for a comparable initiative, Nature Action 100 (“NA100+”) shows a stark contrast. AQTION found that just 4% of investors in the US subset were in support of the initiative compared to 62% of European investors (Table 1).

Table 1. The Percentage of Investors in the US and Europe that Support Key Environmental and Social Initiatives

| Category | Initiative | Investor Region | Support |

| Climate | Climate Action 100+ |

US |

68% (17/25) |

|

Europe |

95% (20/21) |

||

| Institutional Investors Group on Climate Change (IIGCC) |

US |

68% (17/25) |

|

|

Europe |

95% (20/21) |

||

| Net Zero Asset Managers |

US |

52% (13/25) |

|

|

Europe |

81% (17/21) |

||

| CDP Science-Based Targets Campaign |

US |

8% (2/25) |

|

|

Europe |

62% (13/21) |

||

| Task Force on Climate-related Financial Disclosures (TCFD) |

US |

88% (22/25) |

|

|

Europe |

91% (19/21) |

||

| Biodiversity | The Taskforce on Nature-related Financial Disclosures (TNFD) |

US |

48% (12/25) |

|

Europe |

67% (14/21) |

||

| Nature Action 100 |

US |

4% (1/25) |

|

|

Europe |

62% (13/21) |

||

| Social | The Workforce Disclosure Initiative (WDI) |

US |

12% (3/25) |

|

Europe |

19% (4/21) |

||

| Advance (UN PRI) |

US |

24% (6/25) |

|

|

Europe |

62% (13/21) |

vi. Activism

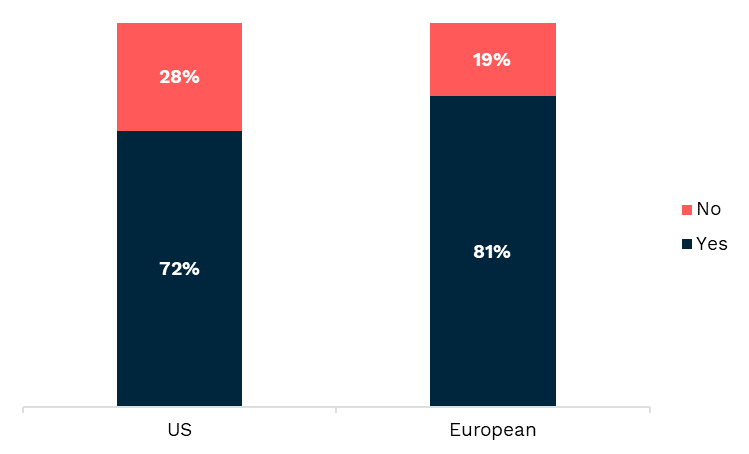

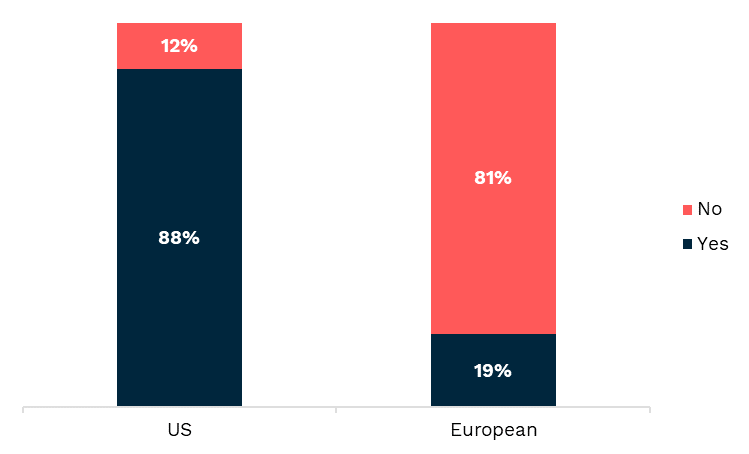

Activism has become increasingly more accepted by investors and perceived as a useful market force. AQTION notes that 26 of the 46 investors include their approach to evaluating contested situations within their voting guidelines, with contested board elections being the most common area they clarify their approach. Interestingly, there is a significant difference in disclosure levels between the US and European subset. Where 88% of US investors disclose their approach to contested situations in their voting guidelines, just 19% of the European investors do so (Figure 11).

Figure 11. The Percentage of Investors in the US and Europe that Disclose their Approach to Evaluating Contested Situations

Public Discontent

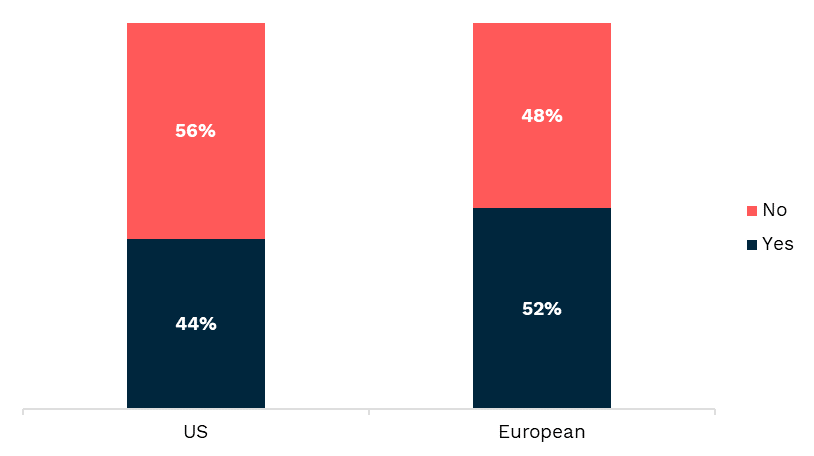

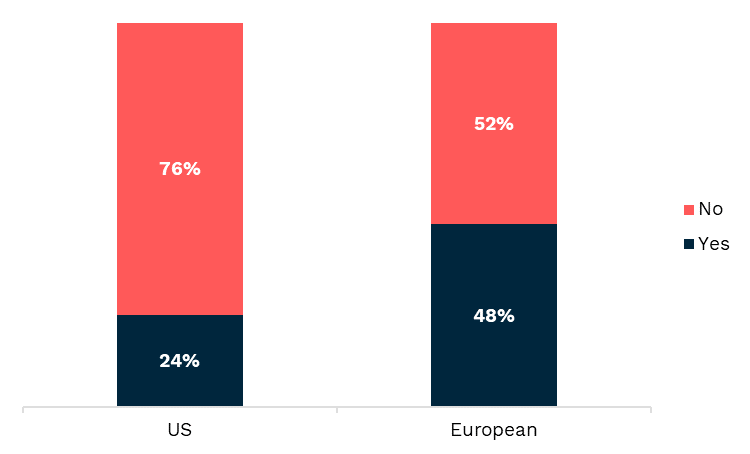

No longer limited to hedge funds, activism can come from any investor targeting companies of all sectors and sizes. Registration of public discontent is a process whereby an investor publicly voices their concern with a portfolio company, typically issuing a press release or media commentary, following the exhaustion of private engagement. For example, Legal & General Investment Management (“LGIM”) publicly indicated its intention to vote AGAINST the re-appointment of EMS-Chemie’s Chairman Bernhard Merki ahead of the 2023 general meeting due to concerns over climate risk management[6]. AQTION notes that such practice is becoming increasingly prevalent in recent years where 16 of the 46 investors have registered public discontent against portfolio companies in the past three (3) years. Interestingly, registration of public discontent is twice as frequent amongst the European investors compared to the US (Figure 12).

Figure 12. The Percentage of Investors in the US and Europe that Have Registered Public Discontent in the Past 3 Years

Endnotes

1Global corporate governance and responsible investment principles (2022)

2Governance and Proxy Voting Guidelines

3

4BlackRock – Vote Bulletin: ExxonMobil Corporation (2023) https://www.blackrock.com/corporate/literature/ press-release/vote-bulletin-exxon-may-2023.pdf(go back)

5The CDP Science-Based Targets (SBT) Campaign | CDP (2022) https://www.cdp.net/en/investor/ engage-with-companies/cdp-science-basedtargets-campaign(go back)

6LGIM’s voting intentions for 2023 (2023).

Print

Print