Merel Spierings is Senior Researcher at The Conference Board ESG Center in New York. This post relates to a report authored by Ms. Spierings and based on disclosure data from Shareholder Voting Trends in the Russell 3000 and S&P 500: Live Dashboard, a live online dashboard published by The Conference Board and ESG data analytics firm ESGAUGE, in collaboration with Russell Reynolds Associates and The Rutgers Center for Corporate Law and Governance. Related research from the Program on Corporate Governance includes Social Responsibility Resolutions (discussed on the Forum here) by Scott Hirst; and Stockholder Politics by Roberto Tallarita.

The 2023 proxy season was marked by a record number of shareholder proposals, declining support for proposals, and shareholder proposal fatigue among companies and institutional investors. This report provides guidance on how companies can approach offseason engagement with investors and prepare for the challenges of the 2024 proxy season.

Shareholder Proposals

Overview

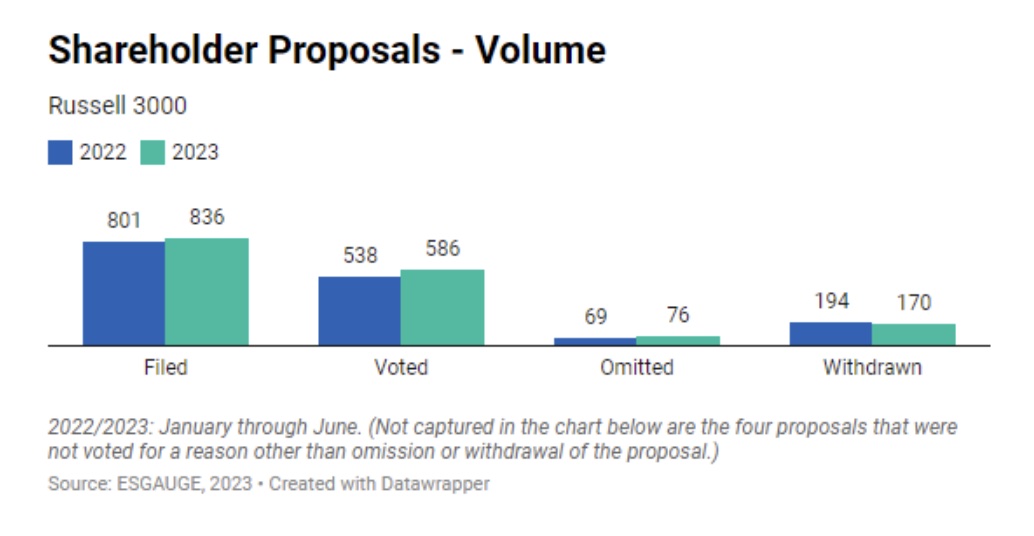

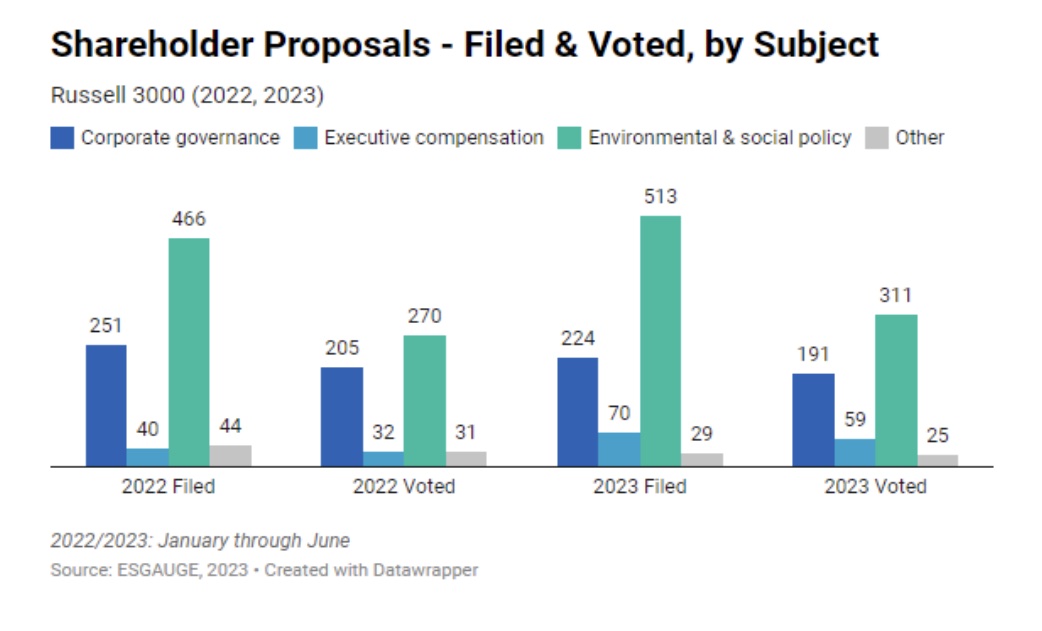

In 2023, the volume of shareholder proposals increased yet again. In the first half of 2023, shareholders filed 836 proposals at Russell 3000 companies, compared to 801 in the first half of 2022. That’s more than the 792 proposals filed in all of 2021. Additionally, a larger percentage of proposals went to a vote in the 2023 proxy season (70% compared to 67% in 2022) and a smaller share was withdrawn (20% in 2023 compared to 24% in 2022), indicating that proponents became less willing to negotiate with companies.

With an increase of 47 shareholder proposals, environmental and social (E&S) policy saw the sharpest rise in volume, but we also saw 30 more proposals on executive compensation. While governance proposals declined by 27, they were most likely to come to a vote (85%). Furthermore, E&S proposals saw the highest withdrawal levels, at 31% compared to 36% in 2022, but were least likely to be omitted (8%).

While receiving no-action relief has gotten more difficult since the SEC’s November 2021 Staff Legal Bulletin and companies are finding it harder to predict the outcome of their no-action requests, they should not give up on this process. SEC staff may have rejected many requests in the 2023 proxy season, but in addition to receiving relief on technical grounds, companies found some success with arguments that the proposal was overly prescriptive and inappropriately limited the discretion of the board.

The vast majority of governance shareholder proposals (77%) and executive compensation proposals (76%) are filed by individuals. By contrast, only 12% of E&S proposals are filed by individuals.

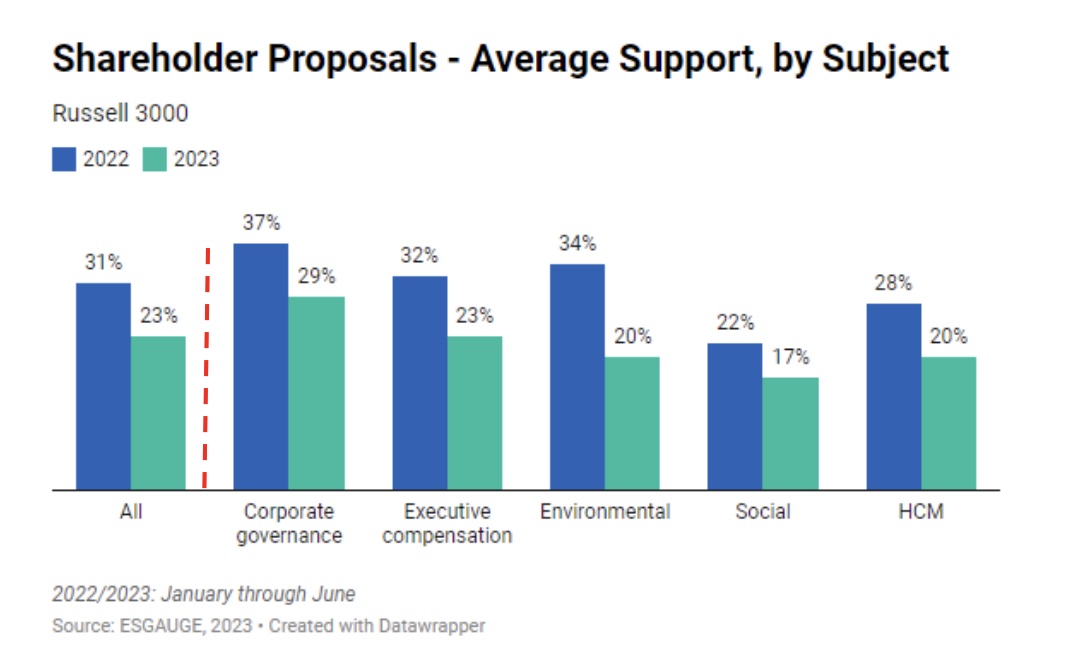

While the number of shareholder proposals increased in 2023, average support dropped dramatically, from 31% in the first half of 2022 to 23% in the first half of 2023. Continuing the trend we saw in 2022, support fell in every category: governance, executive compensation, environmental, social, and human capital management (HCM).

The sharp decline in support for shareholder proposals across the board this year may be due to various reasons:

- Institutional investors continue to be more discerning about their approach to shareholder proposals after being criticized for being too ESG oriented and are giving companies more latitude with respect to E&S issues. Whereas in previous years some major institutional investors may have been sending a message to companies across the board by virtually giving “blanket support” to proposals on certain issues (such as climate change), they are now taking a more balanced, company-focused approach amid scrutiny and conflicting pressures.

- As they were last year, many proposals are still of lesser quality, overreaching, or not relevant to the company’s core business, making investors reluctant to support them.

- Companies have responded to investor concerns by improving their disclosures. Many companies have stronger ESG records than ever before.

- Investors are more willing to listen to companies’ explanations of the cost-benefit analysis of shareholder proposals, as they recognize that the costs and resources it takes to review and implement a proposal may very well outweigh the benefits.

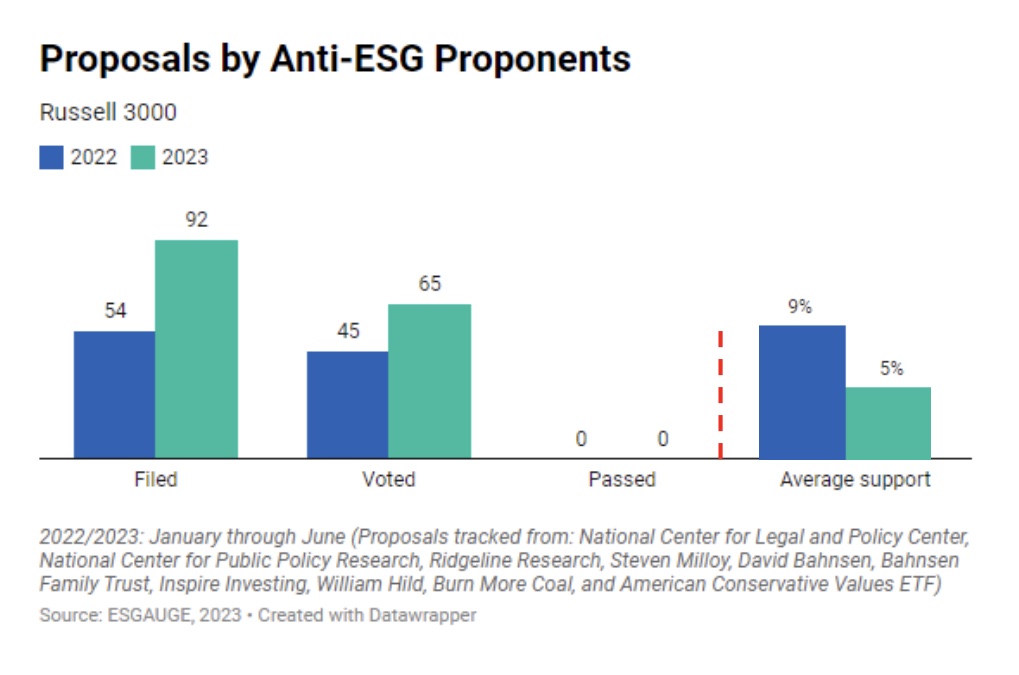

- The number of proposals filed by anti-ESG groups has increased significantly, and those proposals received low levels of support.

- The increase in volume in shareholder proposals has not been met with an increase in resources on the investor side to deal with these proposals (e.g., to assess the validity of each proposal and whether to support it) and has led to “shareholder proposal fatigue” among institutional investors.

The proliferation of shareholder proposals is also leading to fatigue among companies. The shareholder proposal process is taking up more resources than ever before, whether in negotiating with proponents, seeking no-action letters from the SEC, or developing a comprehensive response to be included in the proxy statement. Companies are also tired of being used as pawns in the political debate, especially in cases where the proponent is merely seeking publicity or the proposal is asking for something other than the proponent is actually trying to accomplish (e.g., the request is to issue a report, but the proponent in fact wants the company to take concrete action on a certain issue).

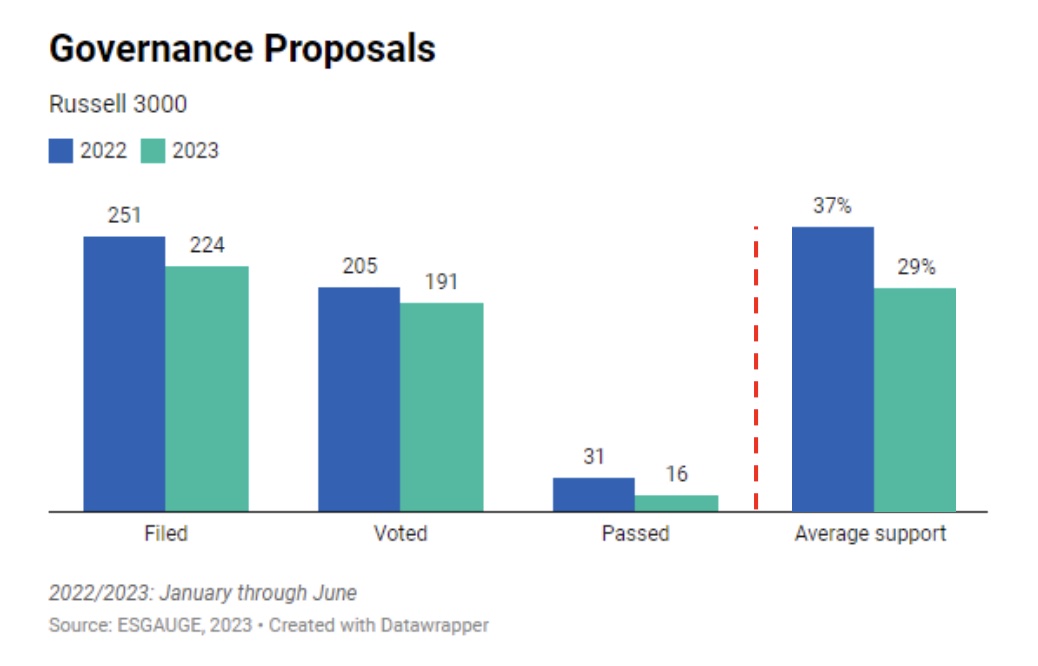

Governance proposals

While average support for governance proposals declined in 2023, such proposals continued to outperform those in other categories. And although fewer governance proposals passed in the 2023 proxy season compared with a year earlier (16 versus 31), more such proposals received majority support compared with E&S or executive compensation proposals—both in relative and absolute terms.

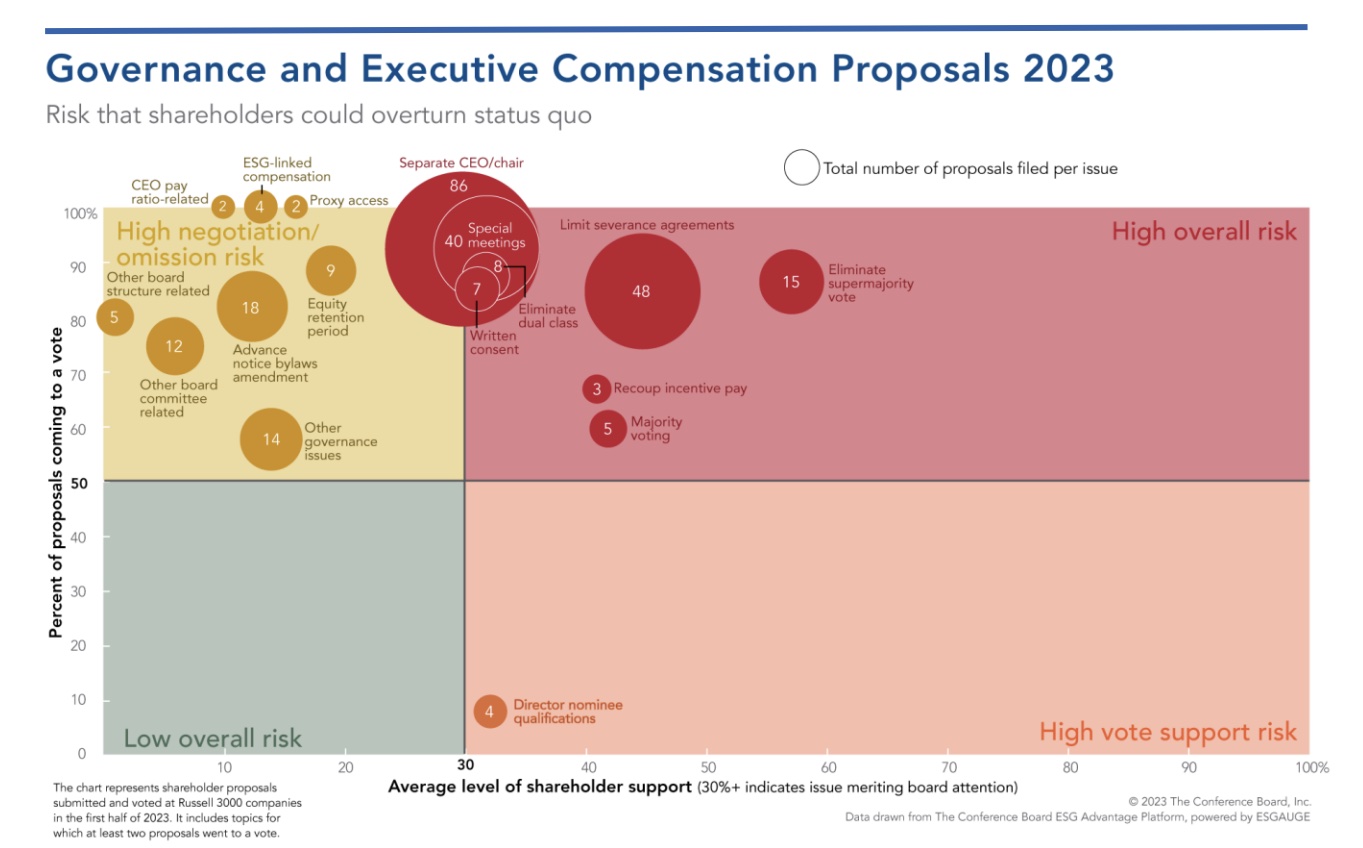

We saw an increase in volume and support for proposals on CEO/board chair separation but a decline in the number of and support for proposals on the ability to call special shareholder meetings. The number of proposals on CEO/board chair separation almost doubled, from 47 proposals in the first half of 2022 to 86 proposals in the first half of 2023, and with almost all proposals (92%) coming to a vote. Average support for such proposals increased slightly as well, from 28% in 2022 to 30% in 2023—but none passed. Further, after the number of proposals on special shareholder meeting rights increased from 37 in 2021 to 110 in the 2022 proxy season, it fell to 40 proposals this year. Average support for those proposals decreased as well, from 36% in 2022 to 32% in 2023.

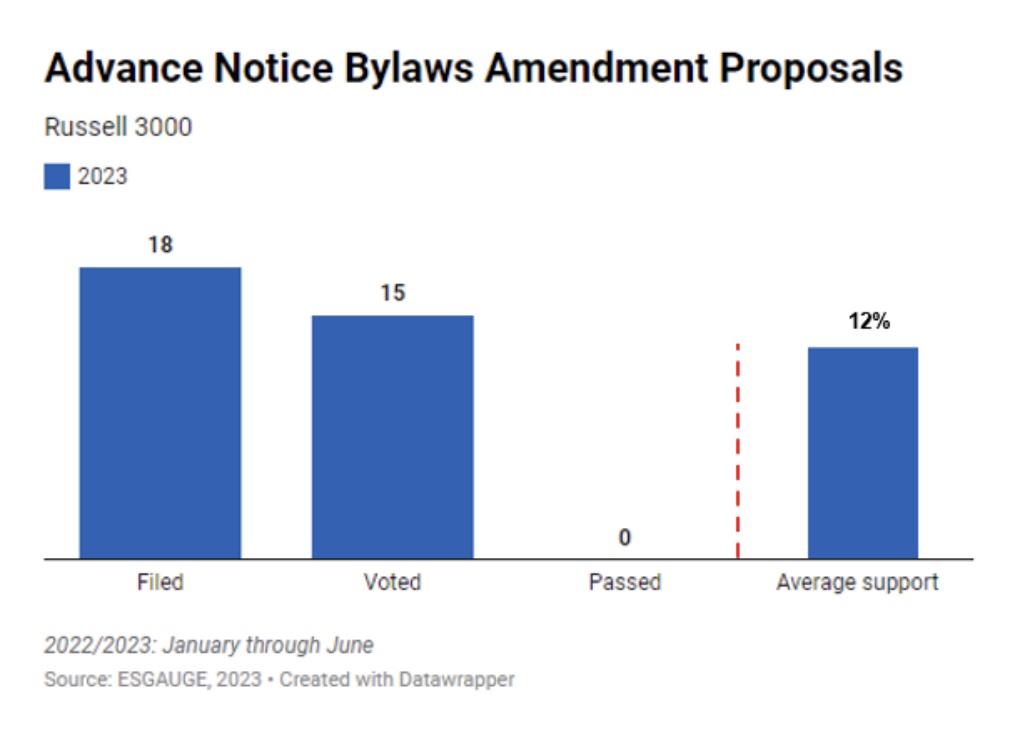

Some emerging governance topics garnered only low double-digit support, in part because they were deemed too prescriptive. A new proposal requiring shareholder approval of advance notice bylaw amendments averaged only 12%, despite increased scrutiny of companies that are updating their bylaws in light of the SEC’s universal proxy rule. Investors seem to agree that these proposals go too far in limiting the company’s ability to put reasonable provisions in place.

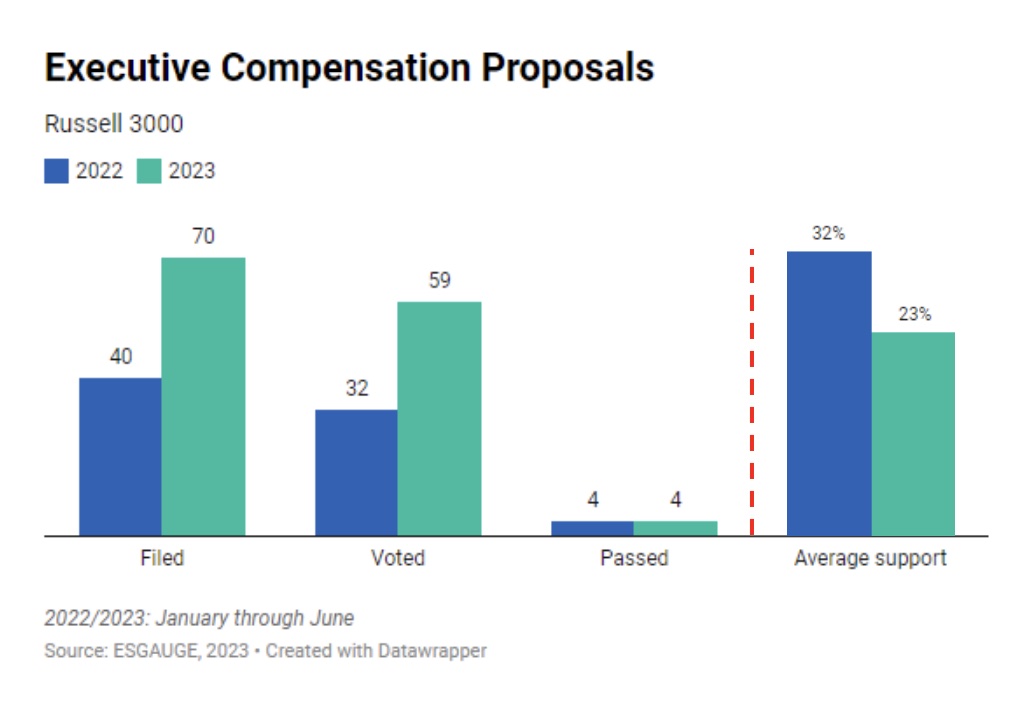

Executive compensation proposals

Shareholder proposals on executive compensation saw a significant increase in the 2023 proxy season, but average support dropped considerably, from 32% in 2022 to 23% in 2023. After governance proposals, these proposals were most likely to come to a vote (84%) and least likely to be withdrawn (4%).

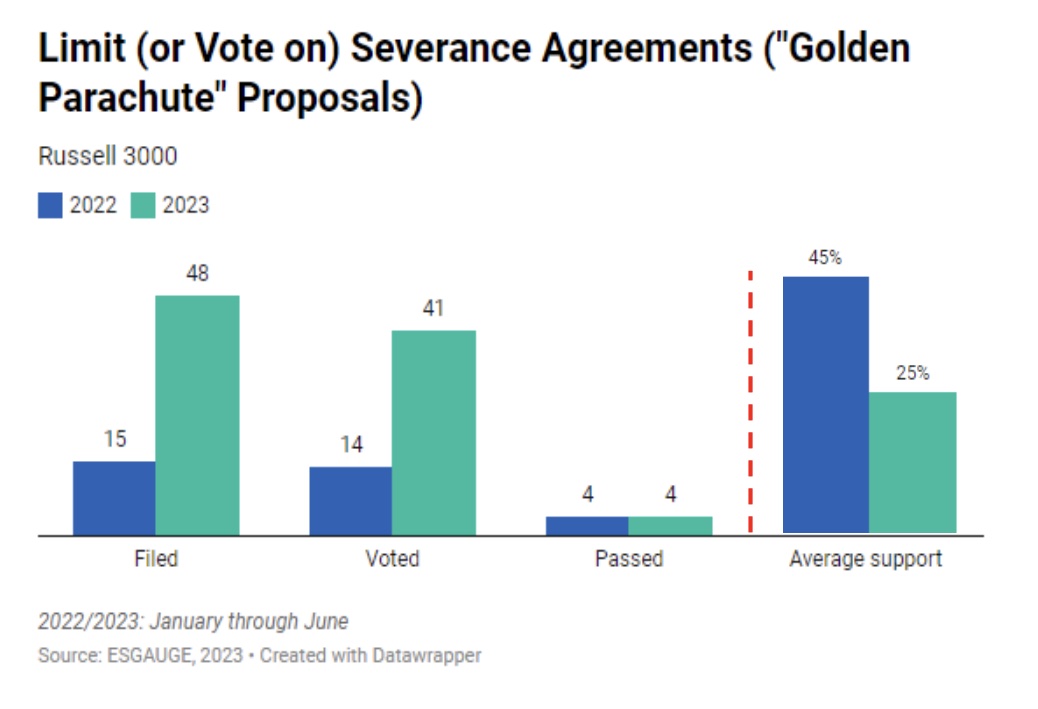

The significant rise in the number of proposals targeting severance arrangements drove the increase in compensation-related proposals. Support for such proposals dropped sharply, however, from 45% in the first half of 2022 to 25% in the first half of 2023, as companies had already implemented the proposal in some form.

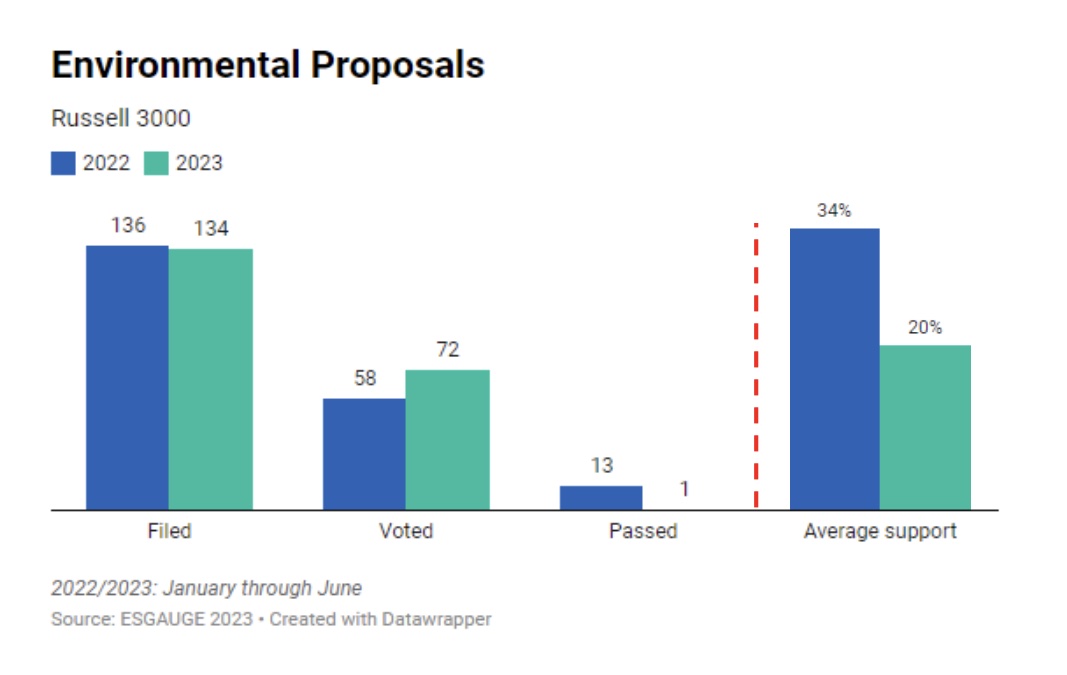

Environmental proposals

Shareholders filed fewer environmental proposals in 2023, and while more of such proposals went to a vote compared to 2022, the 14-percentage-point drop in the support for environmental proposals was the sharpest among all topics. At the same time, environmental proposals garnered slightly higher average support (20.2%) than HCM proposals (19.9%) and social proposals (17%).

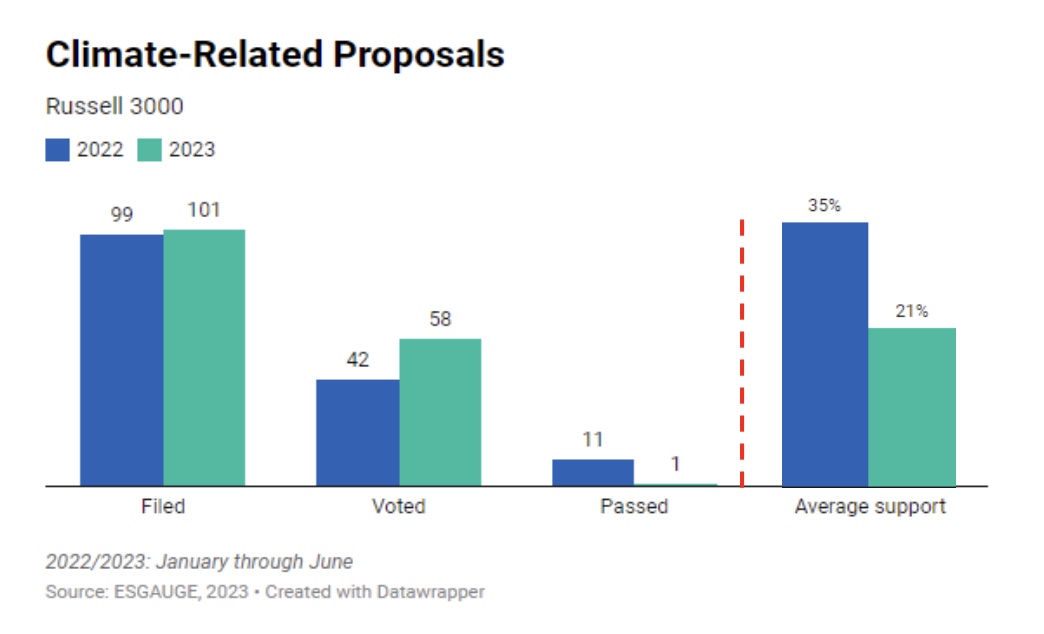

Climate-related shareholder proposals continue to dominate environmental proposals, but support has declined dramatically, from 35% in 2022 to 21% in 2023. Major institutional investors viewed some climate-related proposals as overly prescriptive, such as those submitted at financial companies that called for a time-bound phaseout of their services to companies engaging in new fossil fuel exploration and development. By contrast, a new climate-related proposal requesting a transition plan that describes how the company intends to align its activities with its GHG emission reduction targets has fared relatively well. The five proposals that came to a vote in the first half of 2023 received over 31% average support. And as our discussion with in-house corporate governance professionals revealed, this area may continue to garner support. Indeed, the transition to renewable energy for many companies is urgent, complex, and expensive. But while, according to our C-Suite Outlook 2023, 49% of surveyed CEOs globally say the transition to renewable energy will be significantly positive for their organizations, accelerating the shift to renewable energy sources is not a high internal focus priority for most—globally it ranks 24th on a list of 27 internal priorities.

Another area for scrutiny might be companies’ changing GHG emission reduction targets. Some companies are adjusting their emission reduction targets because their original goals were too ambitious, but this may draw attention from proponents next year.

During this year’s offseason, companies should focus on their core business strategy. Indeed, a company’s strategy serves as its North Star that creates longterm value for its shareholders and other stakeholders. Companies should also be in listening mode to understand how investors’ sentiment on ESG is evolving.

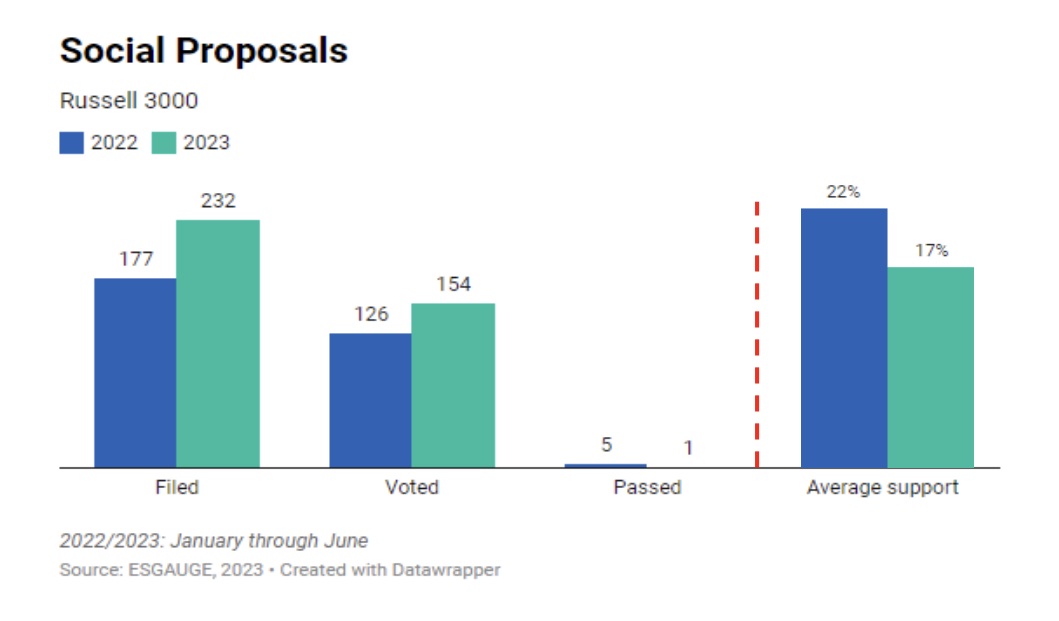

Social proposals

The number of social proposals grew considerably in 2023; compared to the other E&S areas (environmental and HCM), these proposals came to a vote most frequently—both in absolute and relative terms. The 5-percentage-point decline in average support for this category was the smallest among all areas (environmental, HCM, governance, and executive compensation).

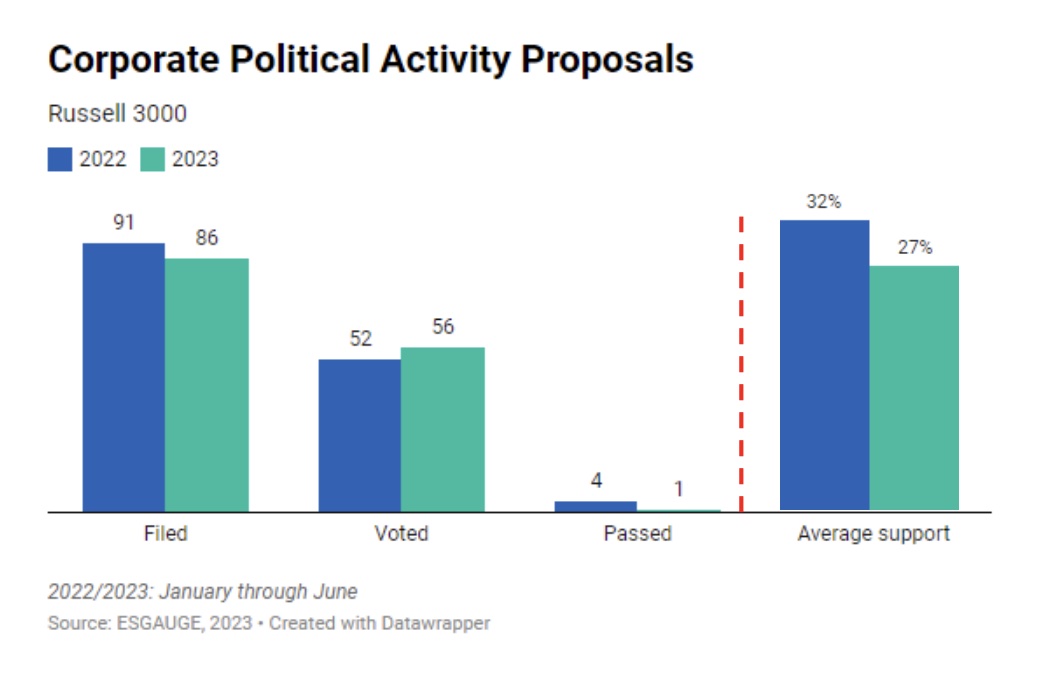

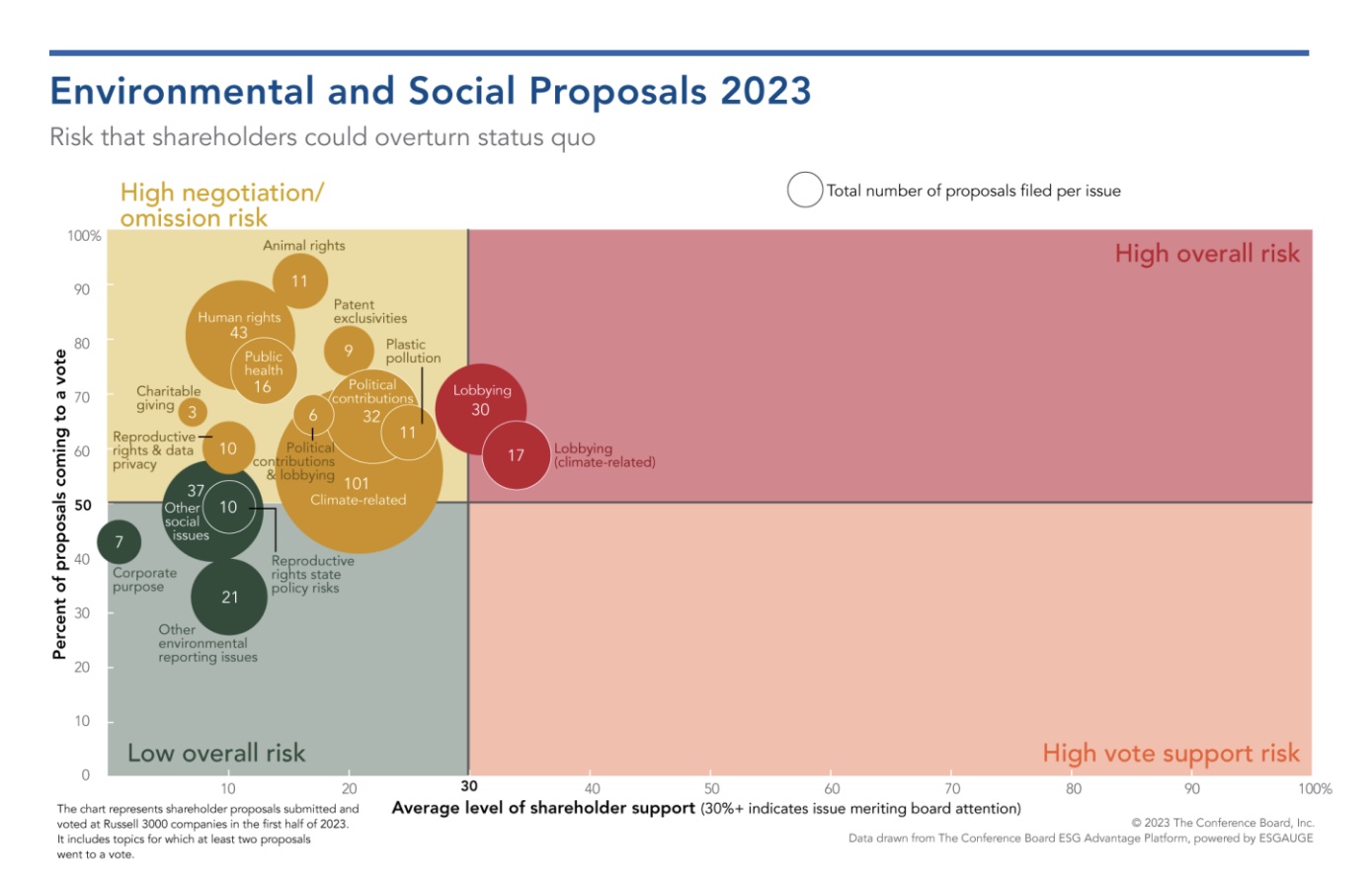

Shareholder proposals on corporate political activity generally performed worse in 2023, but this may change next proxy season with 2024 being a federal election year. The most common proposal was on political contributions, with 32 proposals filed and 21 voted. Next were proposals on traditional lobbying, with 30 filed and 20 voted. Seventeen proposals on climate-related lobbying were filed and 10 voted; these proposals received the highest level of average support (34%) among all E&S (including HCM) topics, indicating that investors still hold companies accountable for matching their climate-related statements and commitments with consistent action on the policy front.

Whatever the company discloses about the shareholder proposal or underlying issue in general will be closely scrutinized, by both pro- and anti-ESG proponents, and potentially by the press, and may open the door to litigation. This scrutiny increases pressure on companies not only to ensure that there’s a link between the company’s ESG and sustainability goals and the core business strategy, but also that anyone who speaks about ESG topics—in documents and/or verbally—does so consistently. The proxy statement can serve as the core playbook, so it may be helpful to involve departments that aren’t usually part of the proxy review (such as corporate citizenship) in this process, as they can add depth and perspective.

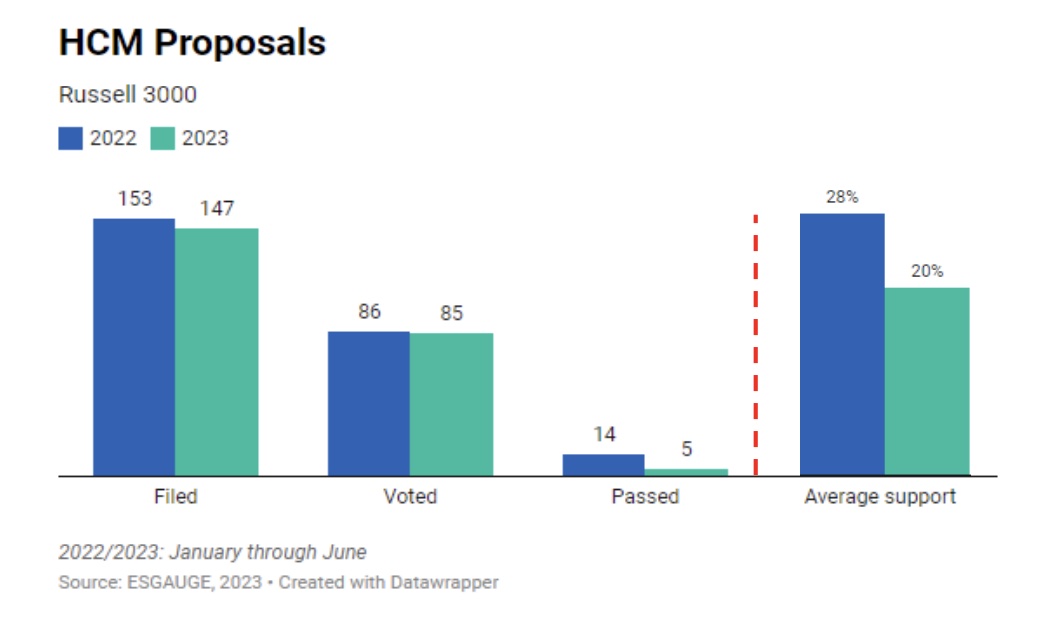

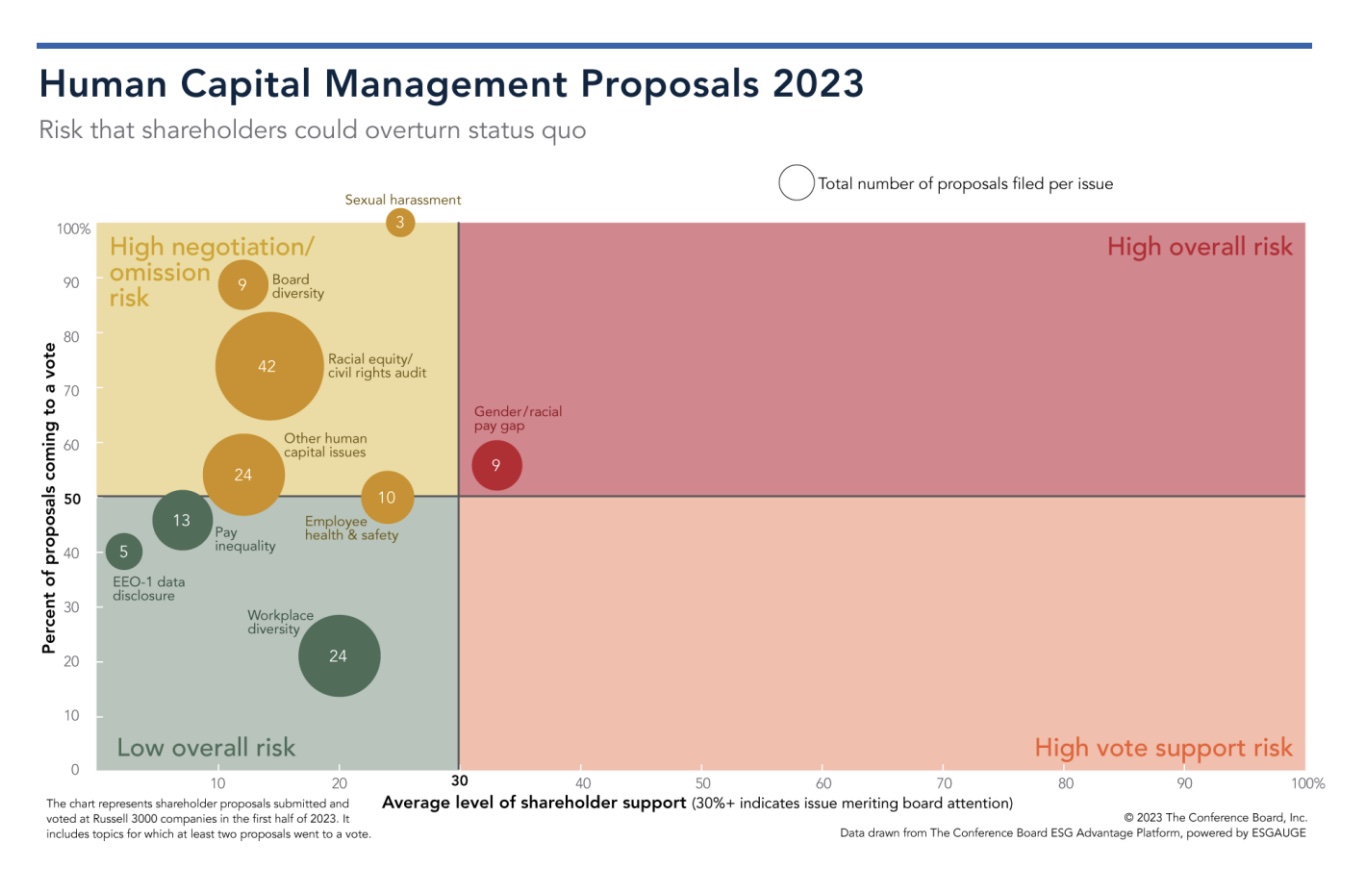

HCM proposals

Despite an intensified focus on HCM, fewer such proposals were filed and voted on this year, and as with every other category, average support declined, from 28% in 2022 to 20% in 2023. Yet, in terms of receiving majority support, this category was more successful than E&S proposals: whereas one environmental and one social proposal passed, five HCM proposals did so on topics ranging from workplace diversity to employee health & safety, sexual harassment, gender pay gap, and worker rights.

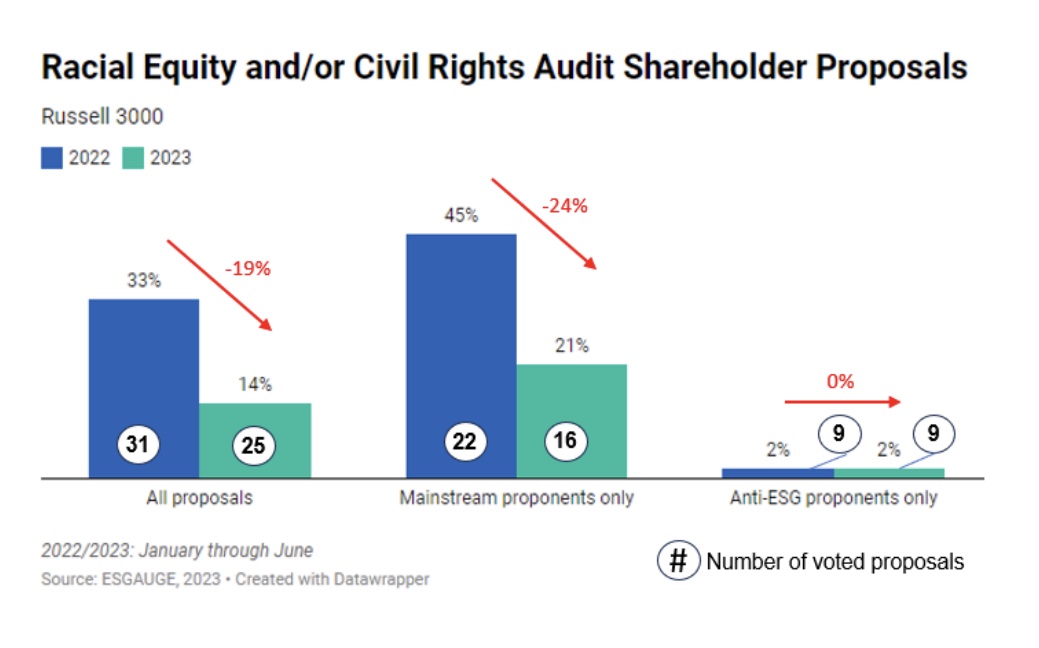

After two successful years, average support for racial equity and/or civil rights audits has dropped dramatically, reflecting that investors find the benefits of these proposals to be limited. In 2021, in the wake of the death of George Floyd, nine such proposals received 32% average support, and in the 2022 proxy season, 31 proposals received 33% average support. But in the first half of 2023, the number of voted proposals dropped and average support fell 19 percentage points to 14%. Interestingly, this decline in support is not due to the growing percentage of (consistently poorly performing) shareholder proposals on the topic from anti-ESG groups. In fact, when excluding such proposals, the decline in support for “mainstream” racial equity and civil rights audit proposals is even more pronounced, falling 24 percentage points from 45% in 2022 to 21% in 2023.

As the decline in support suggests, one of the best arguments against a shareholder proposal calling for an audit is to be able to explain what the company is already doing to evaluate and address discrimination, whether in the employee base or more broadly among its affected stakeholders. Additionally, companies should not hesitate to mention the proponent’s name in the proxy statement and describe what the negotiation process looked like. This attention to detail will eliminate confusion when there are dueling proposals on similar issues from groups at opposite ends of the spectrum. Investors also consider whether the company has tried to reach a negotiated withdrawal.

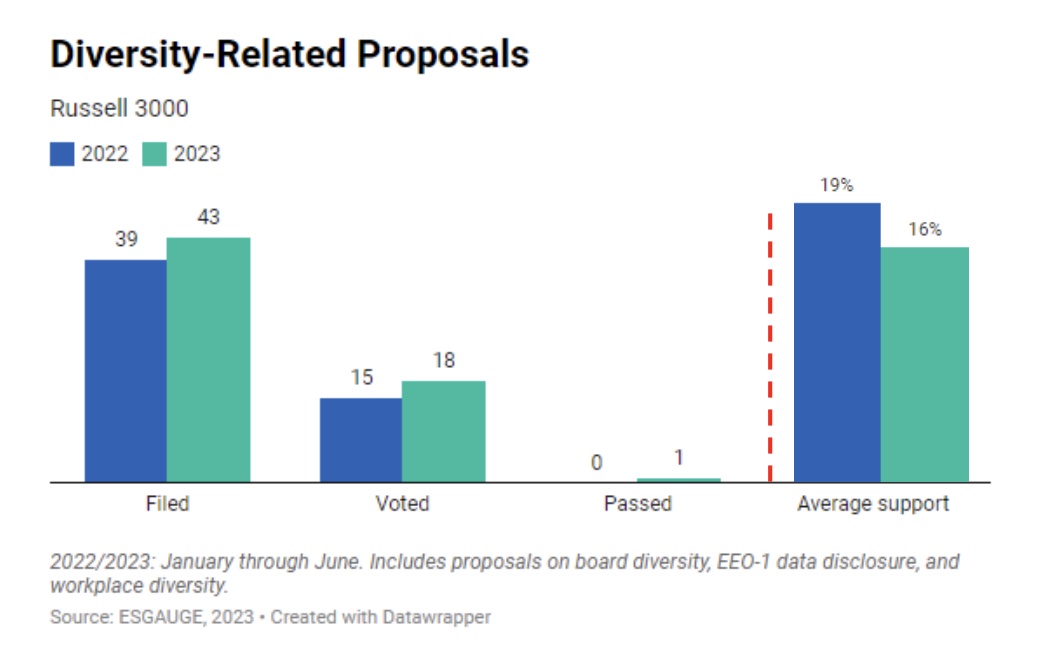

Support for other diversity-related proposals declined as well, but only modestly, especially compared to other topics. Average support for diversity-related proposals, which include topics such as board diversity, EEO-1 data disclosure, and workplace diversity, dropped 3 percentage points, from 19% in the first half of 2022 to 16% this year. One proposal on workplace diversity passed.

Proposals by anti-ESG proponents

There was a significant increase in shareholder proposals from anti-ESG groups in the 2023 proxy season, but those proposals continue to perform poorly. These proponents continue to challenge companies on their DEI policies (they filed 18 racial equity audit and other diversity-related proposals in the first half of 2023, compared to 12 last year). But they have expanded their focus: in 2023, they submitted 19 proposals addressing human rights, compared to only three last year. They also filed six climate-related proposals, compared to none last year. Conversely, they submitted fewer proposals on topics such as charitable giving (12 in 2022 versus one this year) and political spending (five last year versus one this year). Finally, the only topic where they got traction this year was on CEO/board chair separation, a traditional governance topic. Their nine proposals received an average support of 21%.

Companies should expect anti-ESG groups’ efforts to be even more carefully orchestrated and sophisticated next year. These groups are well funded and often work together. In fact, speaking with one of them means speaking with all of them, as oral and written communications even from lower-level employees may become public and quoted verbatim.

Management Proposals

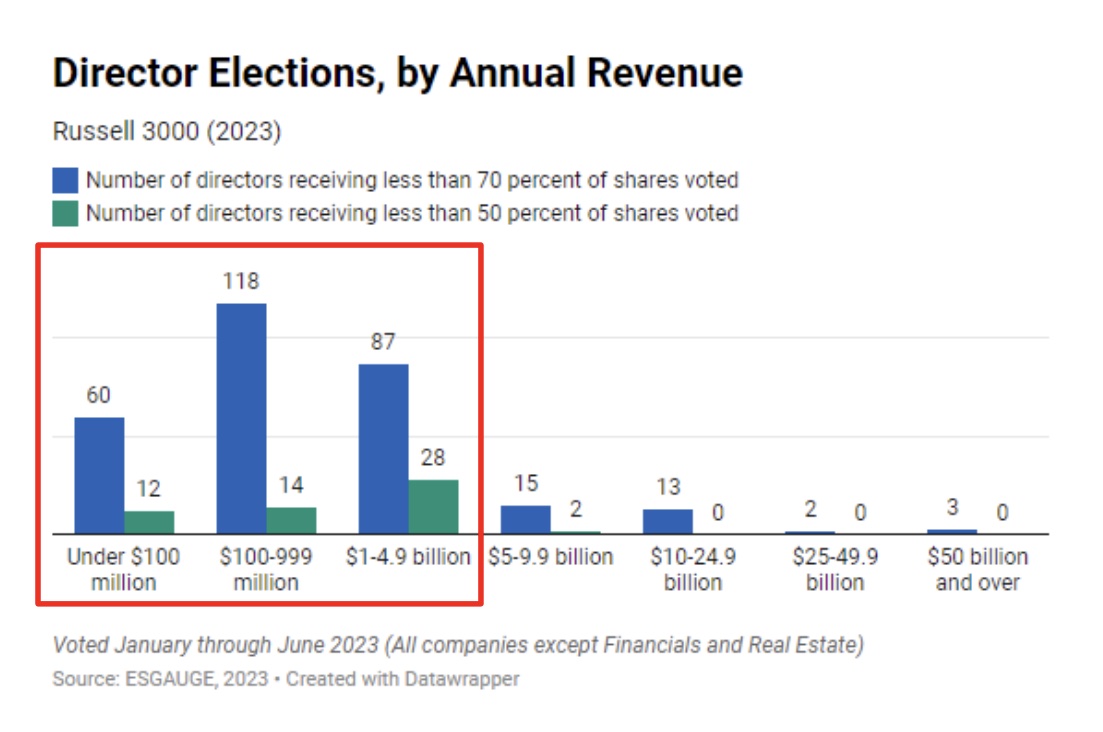

Director elections

Average support for directors remained unchanged compared to last year. Both in the first half of 2022 and 2023, directors received an average support of 94%. Moreover, virtually all directors who failed to receive majority support continue to serve on the board at companies with annual revenues under $5 billion. And the vast majority of directors who received less than 70% support serve on the board of those companies as well.

In preparation for the 2024 proxy season, companies should carefully review their directors’ qualifications as well as the disclosures on those qualifications— especially for directors who received lower levels of support this year. Disclosures should describe the unique and valuable perspectives each individual director brings to the discussion. (For example, a director may have been active in an adjacent industry, and it may not be apparent to investors why that business perspective is valuable.)

With ESG backlash gaining momentum, boards should consider whether they could be facing a proxy contest based on the argument that they are favoring certain backgrounds, skills, and experiences—including functional ESG expertise—at the expense of core business competencies, such as strategic and industry experience. The advent of the universal proxy card has not caused a significant uptick in proxy contests this year, but that may change as we head into an election year. Indeed, first-time activists may use the universal proxy—a relatively low-cost effort—to put forward directors with relevant business backgrounds. The ease with which a proxy contest can be instigated makes it all the more important for companies to explain why they have the right board composition.

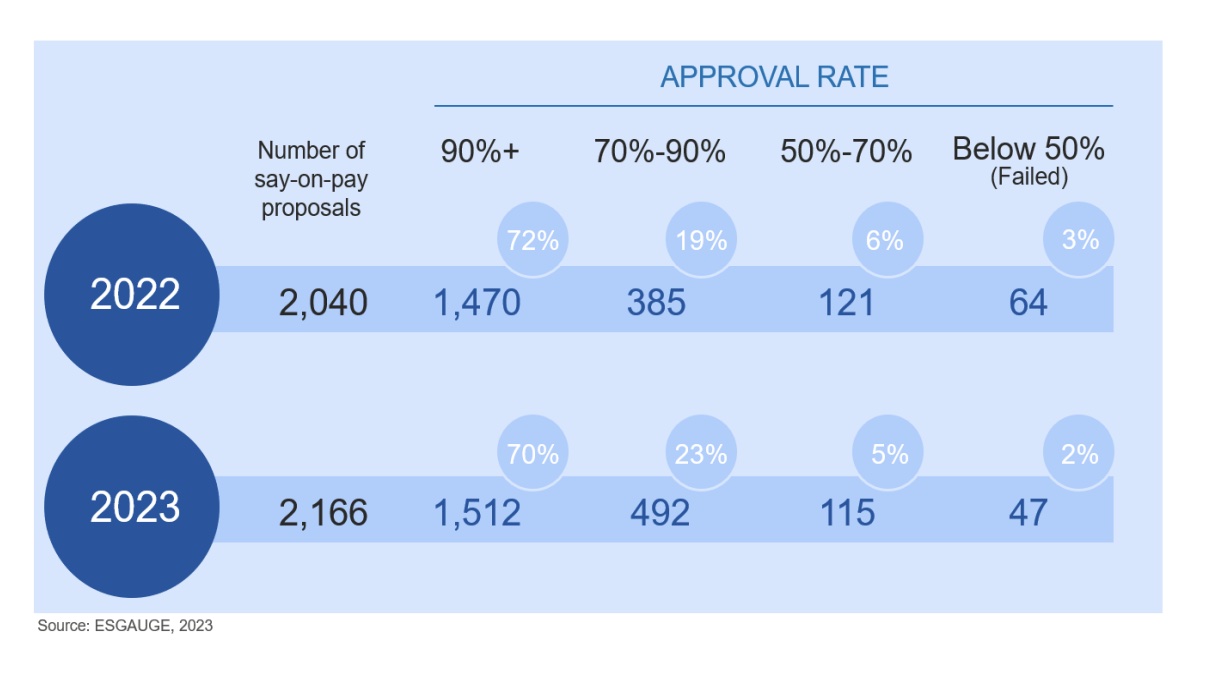

Say-on-pay votes

While average support for say-on-pay proposals went up slightly in 2023 compared to 2022 (from 89% to 90%), more of such votes ended up in the 70–90% average support range. In the first half of 2023, 70% of say-on-pay proposals received at least 90% support, compared to 72% a year earlier. By contrast, this year, 23% of such proposals ended up in the 70–90% average support range, versus 19% in 2022. On the upside, fewer proposals—both in relative and absolute terms—failed to receive majority support altogether.

Companies may want to take a fresh look at how they describe their executive compensation program and decisions. Instead of relying on proxy advisors, investors are increasingly voting according to their own voting guidelines and perspectives on executive compensation. With more players in the game—who may not necessarily be compensation experts—companies will want to make sure their disclosures around executive compensation are concise, understandable, and easily accessible, and that they highlight themes important to their investors (e.g., pay for performance and the determination of severance pay).

Companies should carefully review proxy advisors’ peer group analyses for errors. This year, ISS reversed a negative recommendation when it came to light that it had used incorrect and outdated peer data.

Conclusion—What’s Ahead in 2024

- After a proxy season marked by a record number of shareholder proposals, companies should be prepared for even more proposals next year that call out companies for failing to match words with action or address areas that may merit more board attention.

- Despite an 8-percentage-point decline in average support for shareholder proposals, companies should prepare for more politically motivated ones during the next proxy season and while heading into a federal election year. These proposals may not focus on corporate political activity itself but will likely address hot-button topics such as diversity, equity & inclusion (DEI) and climate, which have been a growing focus of anti-ESG shareholder proponent groups.

- While average support for “E” shareholder proposals dropped more than it did for “S” and “G” topics, mainstream investors may still endorse proposals calling for renewable energy transition plans or targeting companies that have extended their GHG emission goals. Proposals requesting a transition plan that describes how the company intends to align its activities with its GHG emission reduction targets received over 30% average support this year, suggesting that companies should consider adopting and disclosing such a plan; and if the company has decided to extend its GHG target dates, it will need to provide a full rationale for doing so.

- In their engagement with shareholders, companies should highlight their governance of the issues addressed in shareholder proposals. While major institutional investors are less inclined to support shareholder proposals “to send a message” to companies, they nonetheless want to be sure the board is paying attention to the risks and opportunities associated with ESG topics.

- At a time of ESG backlash and shareholder proposal fatigue, companies should be in listening mode during offseason engagement with shareholders and focus on their core business strategy. As investor sentiment on ESG is evolving, it will be critical to focus conversations with investors on how the company is providing long-term value for its shareholders and other stakeholders.

- Companies worried about a potential shareholder proposal may wish to engage with the proxy advisors as well as their major institutional investors early on in the offseason. Early engagement provides the opportunity not only to get the advisors’ and investors’ input on how they will evaluate the proposal, but also to educate them on the company’s position, which might be beneficial when the advisors make their recommendation.

- Companies may still be able to receive no-action relief from the SEC on the grounds of micromanagement. While the SEC has granted far fewer no-action requests since its November 2021 Staff Legal Bulletin, companies are still finding some success with arguments that the proposal is overly prescriptive and inappropriately limits the discretion of the board.

- Companies should take a fresh look at their disclosures on their directors’ qualifications. Companies should consider supplementing the traditional skills matrix and mandated disclosures on directors’ backgrounds to provide more context and detail on how individual directors add value to the board in light of the company’s business strategy.

Methodology and Access to Live DataFindings are based on a comprehensive review of shareholder proposals submitted at Russell 3000 companies between January 1, 2023, and June 30, 2023, as well as a webcast (held in July) and a Chatham House Rule discussion with leading governance professionals (held in June). The data and figures in this report represent shareholder proposals submitted and voted at Russell 3000 companies in the first half of 2022 and 2023, also referred to as the 2022 and 2023 proxy seasons. About 90 percent of shareholder meetings take place in the first half of the year, and this cutoff point allows easy comparisons with prior-year shareholder voting benchmarking reports. The research is conducted by The Conference Board and ESG data analytics firm ESGAUGE, in collaboration with leadership advisory and search firm Russell Reynolds Associates, and Rutgers Center for Corporate Law and Governance. To access the Shareholder Voting Live Dashboard and visualize trends by market index, GICS business sectors and company size groups, visit: |

Print

Print