Lawrence A. Cunningham is Special Counsel in Mayer Brown’s New York office, and Carlos Juarez is a Project Administrator at Mayer Brown LLP and J.D. Candidate at Villanova University Charles Widger School of Law. This post is based on their Mayer Brown memorandum.

A REVIEW OF COMPENSATION SURVEYS

Historically, public company directors served without pay and with light workloads. Even after 1969, when Delaware law first authorized directors to set their own compensation, pay remained nominal. Directors generally kept a low profile, with a mandate often limited to advising or cheering on the chief executive.

All that has changed—gradually for several decades and more rapidly in recent years. Today, serving as a public company director entails increased demands on directors, along with related liability risks. Directors are expected to adhere to stringent independence standards; preside over both strategic direction and oversight of every possible risk; and be on call to respond to crises.

Compensation has risen accordingly. In 2022, average total director compensation for S&P 500 directors was $316,000, according to Spencer Stuart, up from $245,000 a decade earlier. In 2023, the figure increased by 2% to $321,220. The distribution of total annual director compensation among the S&P 500 is bell-shaped. At the high end, a dozen companies pay more than $400,000 — a couple of outliers at the very top ($1.1 million and $2.1 million) and two others above $500,000. At the low end, three outliers pay less than $200,000 — with one harkening back to the old days to pay a mere four digits ($3,160).

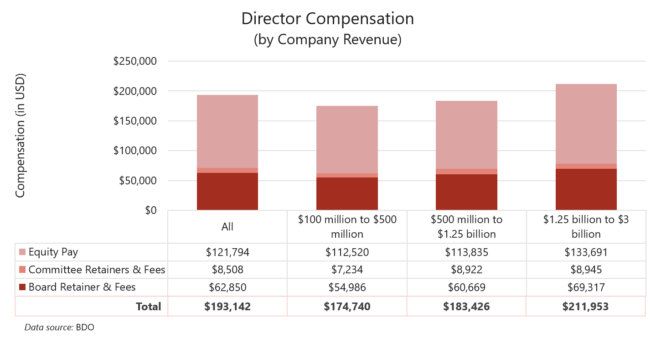

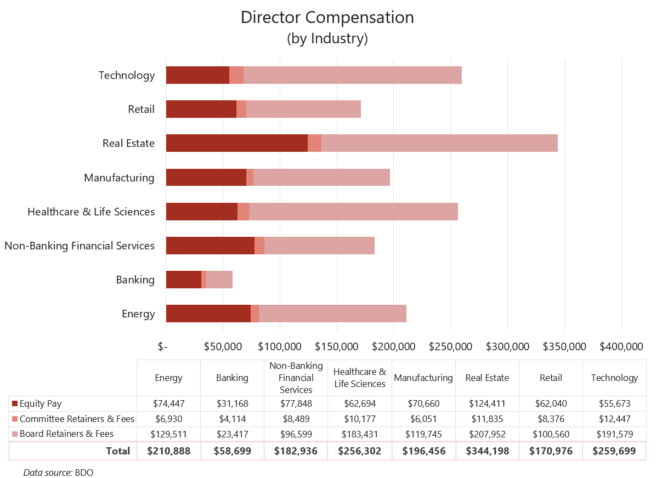

The form and amount of director compensation tends to vary with certain factors, including industry (regulated industries tend to pay least), company size (larger companies pay above average) and board size (logically reflecting relative work burdens). According to a recent survey of 600 middle-market companies by BDO (the “BDO Director Report”), for instance, directors in the real estate industry received average total compensation of nearly $350,000 while those in the banking sector received an average of approximately $55,000.

As to form, public company directors may be compensated in cash, including a board retainer, board meeting fees, committee retainers and fees, and often directors are awarded equity compensation in the form of full value stock awards and stock options. According to the BDO Director Report, board director pay increased 6.6% in 2023. On average, directors earned $193,142 in total compensation, including $62,850 in board retainers and fees, $8,508 in committee retainers and fees, and $121,784 in total equity pay. Equity made up 63% of director pay and consisted of 90% of full value stock awards and 10% stock options.

A study conducted by FW Cook (the “FW Cook Report”) took a closer look at the structure of director compensation and examined 300 US public companies equally divided among small-, mid-, and large-cap size segments (100 companies per segment) using companies’ proxy statements and/or annual reports filed with the SEC in the one-year period ending May 31, 2023. The FW Cook Report highlights a trend toward simplifying board compensation programs by eliminating meeting fees, with many companies opting to pay directors only a retainer. According to this study, compensation for boards, on average, was comprised of 38% cash compensation, 60% full value stock awards, and 2% stock options.

Retainers

With respect to cash compensation, the majority of companies have elected retainer-only compensation for their directors, with 84% of small-cap companies, 85% of mid-cap companies, and 90% of large-cap companies paying their directors retainer-only compensation. Median cash retainers for mid-cap companies increased to $85,000 in 2023 from $80,000 in 2022, while large-cap company retainers remained at $100,000 and small-cap company retainers stayed at $70,000.

Fees

Granting board meeting fees has fallen out of favor. The FW Cook Report reports only 3% of its total sample pays board meeting fees. Median small-cap board fees amounted to $1,500, while mid-cap companies paid $4,750 and large-cap companies paid $4,500.

Equity Vesting Practices

The FW Cook Report notes that across its total sample, about 94% of companies use short vesting provisions. For vesting periods of one year or less, 74% of small-cap companies had a one-year vesting period, while 20% had immediate vesting. Approximately 73% of mid-cap companies had one year vesting periods, 3% had a vesting period of less than one year, and 17% had immediate vesting. About 50% of large-cap companies had one-year vesting periods, 1% had a vesting period of less than one year, and 43% had immediate vesting.

Committee Member Compensation

Approximately 62% of the companies surveyed by the FW Cook Report pay directors for their service on committees through retainers and/or meeting fees. For audit committees, 53% of the surveyed companies awarded committee member retainers and 5% awarded committee member fees. The median retainer was $10,500 for audit committees and the median committee meeting fee paid was $1,500. Compensation committee member retainers were paid by 46% of the surveyed companies, while 5% paid meeting fees. The median retainer and fee paid for compensation committees was $10,000 and $1,500, respectively. Of the surveyed companies, 44% paid retainers for their nominating & governance committees and 5% paid meeting fees. The median retainer and fee paid for nominating & governance committees was $7,500 and $1,500, respectively.

Coda

The reported variation in the form and amount of public company director compensation probably reflects the diversity of public companies. True, the obligations and exposure of all directors have increased in recent years, but the degree almost certainly varies across industries, companies, and boards. That reality is ideally reflected in the resulting compensation practices at different companies.

Surveys Referenced

- Spencer Stuart, 2022 S&P 500 Compensation Snapshot (Sept. 2022), available at: https://www.spencerstuart.com/-/media/2022/september/compensationsnapshot/compensation_snapshot_final_9_07_22.pdf.

- Spencer Stuart, 2023 S&P 500 Compensation Snapshot (Aug. 2023), available at: https://www.spencerstuart.com/research-and-insight/sp-500-compensation-snapshot.

- BDO, The BDO 600: 2023 Study of Board Compensation Practices of 600 Mid-Market Public Companies (Oct. 2023), available at: https://insights.bdo.com/2023-BDO-600.html.

- FW Cook, 2023 Director Compensation Report (Oct. 2023), available at: https://www.fwcook.com/Publications-Events/Research/2023-Director-Compensation-Report/.

Print

Print