Todd Sirras is Managing Director, Austin Vanbastelaer is Principal, and Justin Beck is a Senior Consultant at Semler Brossy LLC. This post is based on a Semler Brossy memorandum by Mr. Sirras, Mr. Vanbastelaer, Mr. Beck, Kyle McCarthy, Nathan Grantz, and Anish Tamhaney. Related research from the Program on Corporate Governance includes Executive Compensation as an Agency Problem and Pay without Performance: The Unfulfilled Promise of Executive Compensation both by Lucian A. Bebchuk and Jesse M. Fried; The Growth of Executive Pay by Lucian A. Bebchuk and Yaniv Grinstein; The CEO Pay Slice (discussed on the Forum here) by Lucian A. Bebchuk, Martijn Cremers, and Urs Peyer; and Paying for Long-Term Performance (discussed on the Forum here) by Lucian A. Bebchuk and Jesse M. Fried.

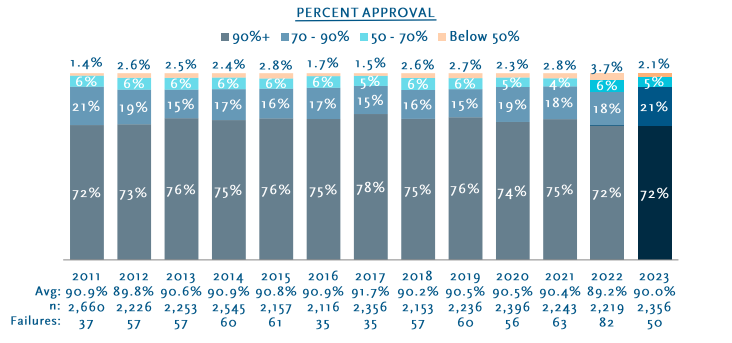

BREAKDOWN OF SAY ON PAY VOTE RESULTS

50 Russell 3000 companies (2.1%) failed Say on Pay in 2023, 12 of which are in the S&P 500 (2.5%). Four companies failed since our last report on September 28th (bolded on page 3). The 2023 failure rate was 160 basis points lower than the 2022 failure rate.

SAY ON PAY OBSERVATIONS

- The Russell 3000 average vote result was 90.0% in 2023, 80 basis points higher than in 2022 (89.2%); the S&P 500 average vote result was 88.7% in 2023, 150 basis points higher than in 2022 (87.2%)

- The failure rates for the Russell 3000 and S&P 500 in 2023 were lower than the failure rates in 2022: the Russell 3000 was 160 basis points lower at 2.1% and the S&P 500 was 220 basis points lower at 2.5%

- The average Russell 3000 vote result in 2023 was 130 basis points higher than the average S&P 500 vote result; this spread was closer than we observed in the previous two years

COMPARISON OF RUSSELL 3000 AND S&P 500

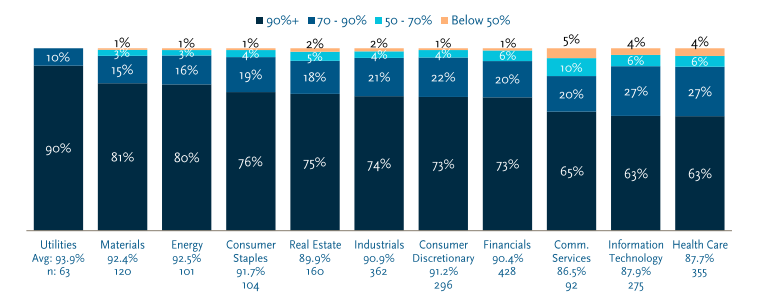

RUSSELL 3000 SAY ON PAY VOTE RESULTS BY GICS SECTOR

ISS RECOMMENDATION RATE OBSERVATIONS

- 12.8% of Russell 3000 companies and 9.6% of S&P 500 received an ISS “Against” recommendation in 2023

- The ISS “Against” recommendation rate was 120 basis points lower for the Russell 3000 and 310 basis points lower for the S&P 500 in 2023 compared to 2022

- The ISS “Against” recommendation rate for the Russell 3000 was 280 basis points higher than the rate for the S&P 500 in 2023, 150 basis points lower than the spread we observed in 2022

ISS “AGAINST” RECOMMENDATION RATE

AVERAGE RUSSELL 3000 VOTE RESULT AFTER ISS “FOR” OR “AGAINST” RECOMMENDATION

The average vote result for Russell 3000 companies that received an ISS “Against” was 26 percentage points lower than those that received an ISS “For” in 2023.

LIKELIHOOD OF A LOW SAY ON PAY VOTE

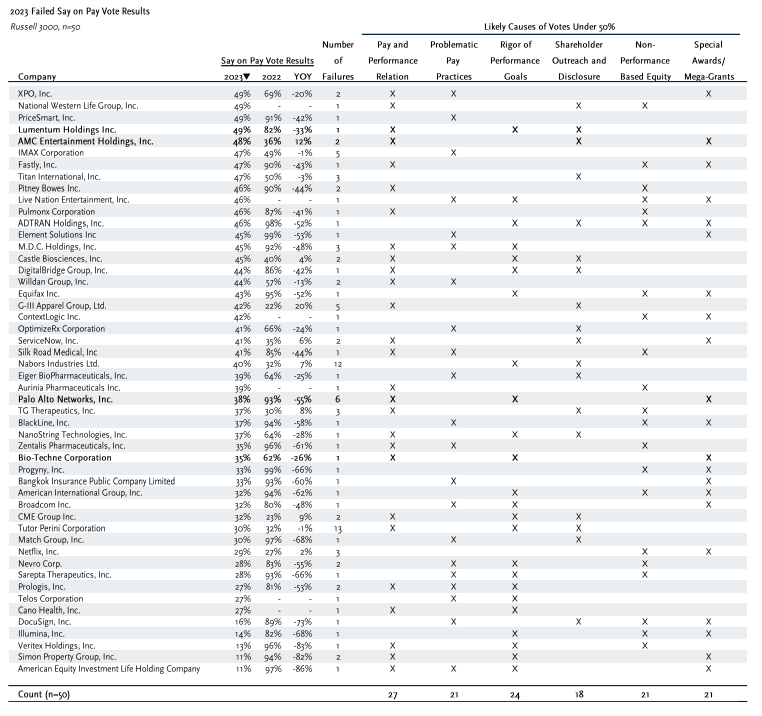

LIKELY CAUSES OF SAY ON PAY VOTES UNDER 50% IN 2023

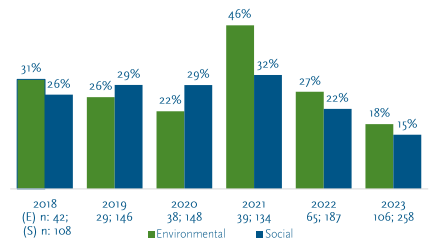

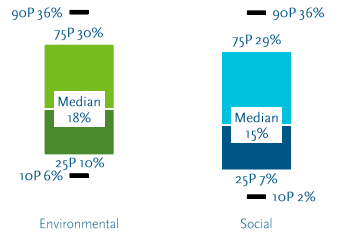

- Shareholders voted on 258 social proposals and 106 environmental proposals in 2023

- Median vote support was 15% for social proposals and 18% for environmental proposals

- Five social proposals (2%) and two environmental proposals (2%) received greater than 50% support in 2023

- Median support decreased by seven percentage points for social proposals in 2023 when compared to 2022 year-end average support, and nine percentage points for environmental proposals; while there was a surge of proposals in 2023, the vote outcomes continued the downward trend first observed in 2022

ENVIRONMENTAL & SOCIAL PROPOSALS MEDIAN VOTE RESULTS

ENVIRONMENTAL & SOCIAL PROPOSALS VOTE RESULT DISTRIBUTIONS

SPOTLIGHT: STRIDE

A shareholder submitted a proposal requesting that Stride increase its disclosures on its lobbying expenses and related policies.

The proposal received 49% vote support

- The proponent stated that since 2018, Stride has increased its public lobbying ten-fold, not including lobbying done at the state or local level

- The proponent contended that lobbying activities could create regulatory, reputational, and legal risks for the Company, especially as it is involved with the controversial American Legislative Council, which several prominent companies have left

- The board opposed the proposal, arguing that current disclosure complies with all applicable laws, and that additional disclosure would put them at a competitive disadvantage

- The board further argued that their ability to provide educational services is dependent on state and local laws, and consequently they have to be an active participant in the political process

- ISS supported the proposal, noting that the Company’s disclosures lack detail, do not indicate the Company’s stance on issues, and are time-consuming to compile

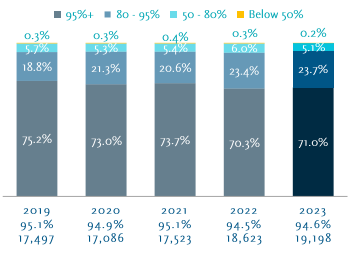

DIRECTOR ELECTION OBSERVATIONS

- Average vote support for Director nominees of 94.6% in 2023 was 10 basis points higher than the average vote support in 2022

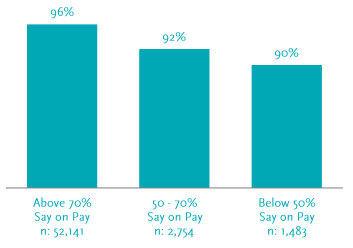

- Over the past five years, average Director election vote support at companies that received a Say on Pay vote below 50% in the prior year was six percentage points lower than at companies that received above 70% support

- Average vote support for female Director nominees was 80 basis points higher than average support for male nominees, which was lower than the spread observed last year

BREAKDOWN OF DIRECTOR ELECTION RESULTS

AVERAGE DIRECTOR ELECTION RESULTS IN YEAR FOLLOWING SAY ON PAY (2019-2023)

AVERAGE DIRECTOR ELECTION RESULTS BY GENDER

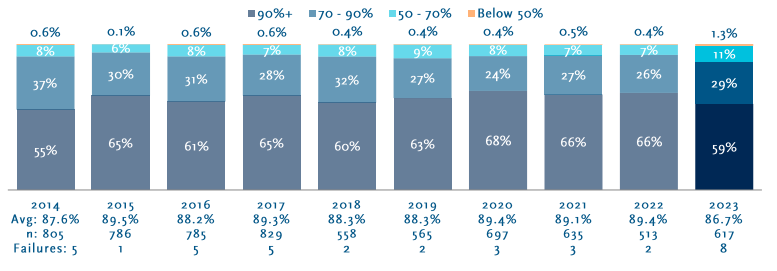

- Average vote support for equity proposals in 2023 (86.7%) was 270 basis points below the average vote support last year (89-4%)

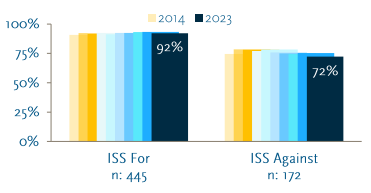

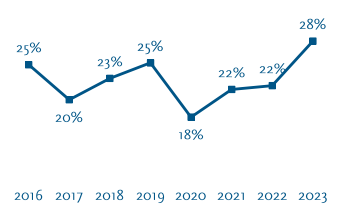

- The equity proposal failure rate (1.3%) and ISS “Against” recommendation rate (28%) in 2203 were the highest observed over the last ten years

- Average support for equity proposals that received an ISS “Against” recommendation in 2023 (72%) was 300 basis points below the average vote support observed in for companies that received and ISS “Against” in 2022 (75%)

BREAKDOWN OF EQUITY PLAN PROPOSAL VOTES

AVERAGE VOTE RESULT AFTER ISS “FOR” OR “AGAINST” RECOMMENDATION

The average vote result for companies that received an ISS “Against” was 20 percentage points lower than those that received an ISS “For” in 2023.

ISS “AGAINST” RECOMMENDATION RATE

Print

Print