Jamie Smith is EY Americas Center for Board Matters Investor Outreach and Corporate Governance Director. This post is based on an EY memorandum by Ms. Smith and Kris Pederson.

In brief

- Investors want companies to prioritize talent strategy and climate-related business transformation to build resilience in a dynamic business environment.

- Investors seek increased director accountability and want to know how boards oversee material risks and stay up to speed on issues impacting the business.

- Responsible AI is an emerging engagement topic, and investors remain focused on material sustainability risks and opportunities for company business models.

As companies gear up for the 2024 proxy season, the EY Center for Board Matters has identified key areas of investor focus and shifts in the proxy landscape that could impact proxy voting results and shape engagement this year. These findings are based on conversations we had with governance specialists from institutional investors representing US$50 trillion in assets under management.

Based on our conversations with investor stewardship leaders, here are the developments we are watching heading into proxy season 2024.

- Business model resilience and operational refresh, including new workforce strategies, are areas that investors expect company leaders to prioritize as shifting labor dynamics, emerging technologies, climate disruption and the energy transition reshape the business environment.

- Board quality and effectiveness remain in focus. Investors may be more willing to vote against directors to signal their concerns in an increasingly complex shareholder proposal landscape.

- The bar for activists seeking change in the boardroom may be getting lower as investors acclimate to universal proxies.

- Investors want to understand how boards are building expertise and governing key topics such as climate-related risks and opportunities, strategic workforce matters, and the use of artificial intelligence (AI).

- Material sustainability risks and opportunities remain a top stewardship priority for investors even as environmental, social and governance (ESG) has become entangled in cultural and political debate. Investors seek to clarify their focus on financial materiality.

Investors we spoke with included individuals from asset managers (50% of all participants), public funds (23%), socially responsible investment managers (13%), labor funds (6%), faith-based investors (6%) and investor consultants (2%).

Chapter 1: Investors prioritize talent strategy and climate resiliency

Workforce development and business model resilience should be critical company focus areas, according to investors.

Investors believe workforce retention and development plus climate-related business transformation are critically important to long-term resilience. They recognize that companies are addressing urgent near-term challenges this year related to economic uncertainty, capital availability, geopolitical tensions and more, but expect them to maintain focus on long-term priorities while attending to these more immediate issues. Notably, the topics investors want companies to prioritize in 2024 differ from the topics boards will be prioritizing this year.

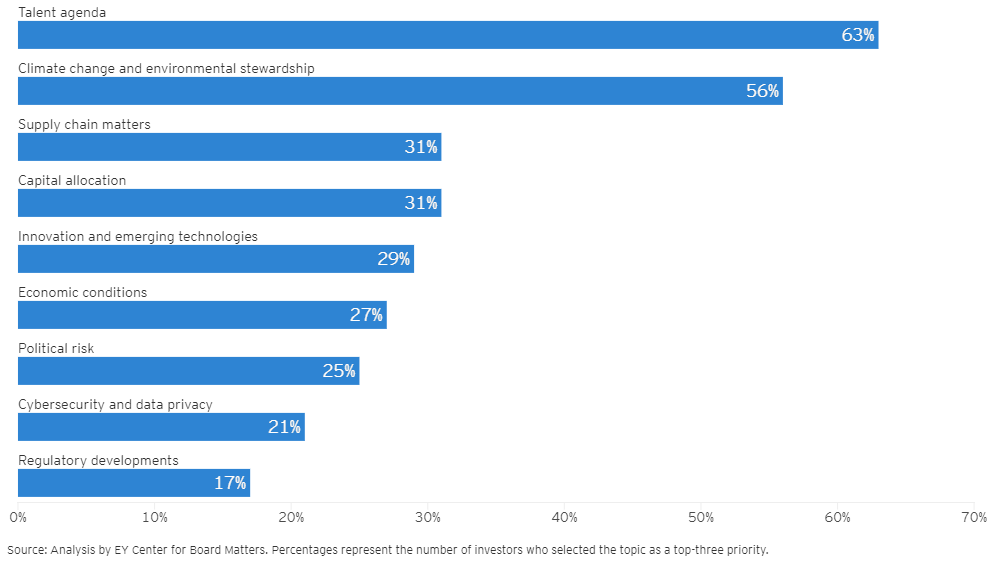

What investors want companies to prioritize in 2024

Investors want to understand how companies attract, retain and adapt their workforce

Nearly two-thirds of investors said they want companies to prioritize the talent agenda this year. These investors are particularly interested in how companies acquire and retain employees, including how they use compensation, flexibility, and training and development.

A few of these investors cited the recent strikes and collective bargaining efforts in various industries and suggested they are a signal that the paradigm of maximizing profits at the expense of worker satisfaction is being significantly challenged. They believe that these developments are creating higher stakes for companies in a tight labor market and a higher inflation environment and underscore the importance of company leaders being in touch with employee sentiment. Some investors also questioned whether companies have the right people with the right skills and training to execute on the investments the companies are making in digital transformation and innovation, including in AI.

Investors want companies to seize strategic opportunity in the energy transition and decarbonize

A majority (56%) of investors said they want companies to prioritize climate change and environmental stewardship this year. While this may come as a surprise to some who assume deceleration in investor interest in this issue amid a volatile economic environment, investor representatives we spoke with were clear that they continue to see alignment to longer-term growth for climate-impacted companies. Nearly half of these investors said they are most focused on how companies are innovating and adapting their business for a clean energy transition. They want to understand the capital expenditures behind those efforts and how companies are developing new products, services or business models that will help the company thrive in a low-carbon economy.

Investors are also focused on emissions reductions that they say will reduce systemic risk to the global economy and the long-term prospects of investors’ holdings. Additionally, they want to know how companies are managing the physical risks of climate change (e.g., critical industries with geographical concentrations in high climate risk areas, such as semiconductor manufacturers in water-stressed areas).

Investors and directors have different views on priority topics for 2024

Based on our survey of more than 350 directors across the Americas, boards will place top focus on economic conditions, capital allocation, and cybersecurity and data privacy for 2024. Those topics ranked highest among directors in terms of their importance to boards while the talent agenda and climate change and environmental stewardship – the top areas investors want companies to prioritize – ranked fifth and last, respectively.

This difference in prioritization may be explained in a number of ways. For example, directors may be thinking about the board’s time allocation vs. actual business activities, or prioritizing shorter-term areas, or they may think the company is progressing on its climate impact goals and therefore less board focus is needed now. Also, our conversations with asset managers were with individuals from investor stewardship teams, who may have different perspectives on priority topics than portfolio managers. While portfolio managers make investment decisions, stewardship teams make, or advise on, proxy voting decisions and regularly engage with portfolio companies as part of their fiduciary role. Those engagement dialogues tend to have a long-term focus, and that longer term lens informed their approach to this question.

Importantly, investors stressed the challenge of choosing priorities that are applicable to the thousands of companies held in their portfolios and emphasized that their answers would vary significantly depending on the company and what is most material for that business. Finally, these topics are interrelated so there may be common ground despite different prioritization. Still, boards should understand that even if climate change and environmental stewardship ranks low on their list of priorities for 2024, that may not be the case for their shareholders.

Key takeaways for boards

- Consider how the company’s talent strategy plus management of climate-related risks and opportunities position the company to thrive through the energy transition, the AI revolution, and the rise of new generations of employees and consumers.

- Challenge how company communications address investor areas of focus and give insight into how the company balances investments in long-term transformation with near-term efforts to shore up the balance sheet.

- Ensure investor engagement efforts include both portfolio managers and stewardship leaders to gain a full perspective of specific investor priorities.

Chapter 2: Directors under scrutiny as shareholder activism evolves

Investors are focused on board effectiveness and director qualifications.

Recent developments in the shareholder activism and proxy landscape point to increasing willingness by investors to hold directors accountable. Three items stand out. First, there has been a significant decrease in support for the re-election of certain board and committee leaders in recent years. Second, investor groups have begun signaling opposition to certain director and other management votes.[1] Finally, the impact of universal proxy rules continues to unfold, and we have seen the launch of the first proxy fight by investors who historically used shareholder proposals to push for change.[2] What we heard from investors underscores that boards should prepare for increasing scrutiny of board effectiveness and director qualifications, and potentially an increasing willingness to vote against directors.

Investors signal greater willingness to vote against directors

Investor discussions indicated different approaches for enforcing their points of view. A third (33%) of investors told us that in the current environment, all other things being equal, they are more likely to vote against specific directors than to vote for a related shareholder proposal if they have concerns about the board’s oversight of material risks and opportunities. These investors characterized director votes as more effective signals of concern when paired with direct communication to the company explaining the intention behind the vote. They indicated that voting in opposition of a specific director also conveys the seriousness with which they are approaching the issue and gives them more agency and flexibility to express their specific expectations on a timeline that they think is appropriate. Some investors also said that to support a shareholder proposal, the proposal would need to be precisely aligned with the investors’ position, and the motivation behind the proposal would need to be perceived as credible, which they said is less often the case in the current environment.

However, 29% of investors said that if they have concerns about the board’s oversight of material risks and opportunities, they are more likely to support a related shareholder proposal and view a vote against directors as an escalation tactic if the company is not responsive. Finally, many investors (38%) declined to choose one option over the other, explaining that they use both levers in tandem or in different ways (e.g., supporting a shareholder proposal related to topics that are still emerging and using the director vote related to well-established expectations) or prefer to focus on engagement to communicate concerns.

Importantly, investors noted that binary solutions, such as voting for or against a shareholder proposal or a director, are difficult given the nuance and complexity around these decisions. This makes engagement critical to understanding shareholders’ precise concerns, expectations and tactics.

The bar may be getting lower for activists making a case for change

Around three-quarters (73%) of investors told us that in considering how to vote on contested director elections, they start with determining whether there is a strategic case for change at the company and consider supporting dissident nominees only when that answer is yes. That aligns with what we heard from investors last year.

However, what is new this year is that a subset of these investors, 29% of investors overall, said that if presented with the right opportunity, they may be willing to support exceptional dissident nominees absent a strategic case for change. Or, put another way, they may consider the need for board refreshment a sufficient case for change. This is a notable shift from last year when more investors were adamant that they would resist supporting marginal change.

Investors said conditions that could contribute to such a decision include: an overly long-tenured board that lacks diversity or strategically relevant expertise; mediocre company performance relative to peers; a lack of investor responsiveness; or the investor having already planned to vote against certain of the company’s nominees based on their voting policies.

Further, an additional 17% of investors said they first and foremost consider the qualifications and experience of each nominee in a contested election and take the case for change as a given. The bottom line for boards is that through universal proxy rules, investors have more flexibility and choice in a contested election. As a result, the bar for the company to make its case may be getting higher, and the bar for activists to secure support may be getting lower.

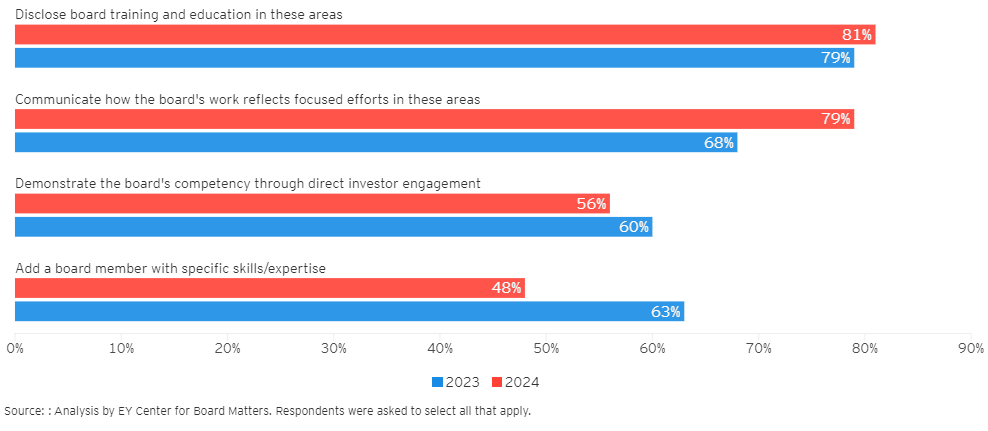

How should boards demonstrate their expertise in areas like cybersecurity and climate?

Disclosures about board training and oversight practices can demonstrate expertise

As investors evaluate how boards are staying fit for purpose, enhanced disclosures on board education and how the board is executing oversight may help companies. Eighty-one percent of investors told us that boards should disclose training and education to demonstrate their expertise in areas like emerging technology, cybersecurity and climate, vs. 48% who said boards should add a director with specific expertise. That compares with 79% and 63% of investors, respectively, regarding the same question last year, reflecting a sharp decline in investor support for single-issue or specialist board members.

While adding a director with specific expertise may make sense for some companies, investors are wary of the unintended consequences of boards filling seats with singular subject-matter experts and losing generalists with more operational experience. They also prioritize having the full board upskilled and value the objectivity and perspectives that an external expert can bring in educating the board.

Key takeaways for boards

- Oversee how the company’s investor engagement program is helping to identify and address investor concerns before they rise to the level of a vote against a director. Also, when engaging with an investor, management should determine if that investor is speaking on behalf of the firm or representing a minority of holdings under a specific investment strategy; some investment strategies (e.g., a net-zero strategy) may have different engagement priorities.

- Encourage enhanced disclosures that demonstrate the board’s engagement and education on priority topics for the business. Disclosures should make clear that the board is getting the training and external perspectives needed to help directors provide effective challenge to management’s approach. Disclosures should also tie individual directors’ qualifications to the board’s specific oversight needs now and moving forward.

Chapter 3: Investor stewardship focus areas expand

Investor stewardship approaches vary. Some investors take a thematic approach and set out topics of focus for the year, often more aligned with long-term matters, and others take a more bottom-up company-specific approach. The nature of those discussions also varies, with investors asking companies to take specific steps in some cases and adopting a less prescriptive approach in others. Highlighted here are the focus areas that came up the most in our conversations with investors.

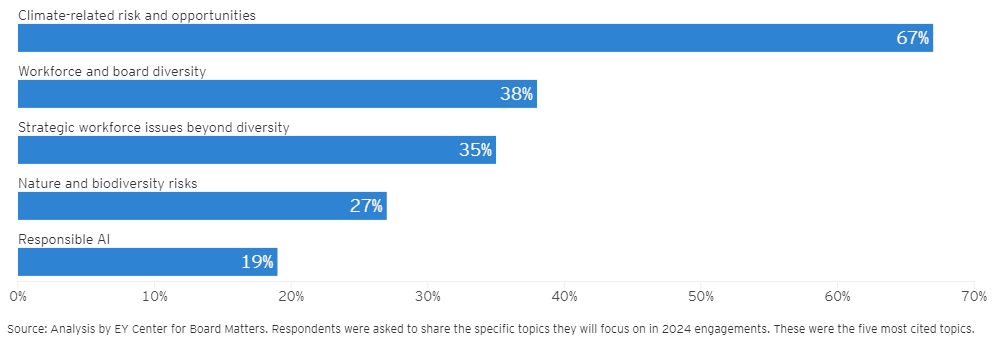

Topics investors will prioritize in their engagements with companies in 2024

Investors are fundamentally focused on how the board is executing oversight

One key theme is consistent across all the investor engagement priorities – investors want to understand how the board is governing material topics and executing its oversight responsibilities. Accordingly, investors will be asking questions such as:

- How are directors developing the competency needed to effectively oversee this matter?

- How are directors keeping pace with fast-evolving developments related to this topic?

- Who is the board hearing from on this topic, including from management and from external advisors and specialists?

- How often is the board discussing this topic?

- How are oversight responsibilities for this topic assigned at the committee level?

Investors are focused on five engagement topics

Our conversations revealed where investors plan to focus their engagement in 2024. While some topics were raised by a relatively small percentage of investors, in many cases these topics were still the focus of majority-supported shareholder proposals last year. These included employees’ freedom of association, workforce safety and wellbeing, company efforts to prevent harassment and discrimination, and climate lobbying.

1. Climate-related risks and opportunities, particularly for high emitting companies

Climate-related risks and opportunities was the most-cited investor engagement priority last year and remains so this year, with two-thirds of investors citing it as 2024 engagement focus. Many investors (31%) specified that they want companies to adopt science-based targets, which are validated by the Science Based Targets initiative and provide a defined path to reduce greenhouse gas emissions in line with the latest climate science. Where targets are in place, those investors seek climate transition plans that provide clarity on companies’ emissions reduction strategies. Some investors (8%) suggested they will seek disclosure on how companies’ political and lobbying efforts align to their climate commitments.

Investors are particularly focused on how companies will meet near-term emissions reduction targets, and some suggested that absent robust, company-specific explanations, they will hold companies accountable for not meeting those targets. They understand that operating environments change and some room for evolution is needed but said there are only so many times companies can change or miss targets without losing credibility. Investors want evidence that these are credible commitments, and perceived complacency may raise concern.

2. Workforce and board diversity

Thirty-eight percent of investors said they plan to engage companies on workforce or board diversity in 2024, making that the second-most-cited engagement topic this year, in line with last year. Regarding workforce diversity, 19% of investors suggested they will continue to encourage more companies to disclose EEO-1 data and information on the effectiveness of Diversity Equity and Inclusion (DEI) efforts. Racial equity audits, which seek an independent review of the racial impacts of company policies, practices, products and services, also remain on the agenda, with 8% of investors sharing that they will call for such audits or are currently assessing audit outcomes. A few investors (2%) suggested they will be asking companies about their efforts to prevent harassment and discrimination and their use of arbitration and nondisclosure agreements in the context of certain types of allegations such as harassment and discrimination.

In terms of board diversity, 13% of investors suggested they will rachet up pressure on outlier boards that lack gender, racial or ethnic diversity. Note, whether or not investors raised board diversity with us as an engagement priority, many investor proxy voting guidelines inherently keep the pressure on board diversification: Our review of the publicly available proxy voting guidelines of the world’s 20 largest asset managers (based on an external ranking study[3]) found that board diversity considerations are factored into 88% of those managers’ director voting policies.

3. Strategic workforce issues beyond diversity

Thirty-five percent of investors cited other human capital management topics as an engagement priority, which is in line with last year. Following a wave of labor strikes across different industries, there is growing investor focus on how companies are protecting employees’ rights to organize and collectively bargain and ensuring compliance with federal labor laws. Ten percent of investors suggested they will raise the topic in engagements this year, focusing on companies with allegations of labor rights violations.

CEO and management succession planning is another area receiving increased attention this year. Along with many cases of companies struggling with CEO successions, investors noted seeing significant senior management turnover recently (which complicates CEO succession planning as the internal talent pipeline is disrupted). Investors who raised this topic (6%) shared that they want assurance that companies are planning for longer-term and emergency CEO successions, and that boards are planning for related board leadership changes. A few investors raised strong concerns about former CEOs staying on the board beyond a temporary transition period.

Investors generally discussed wanting to know how companies are attracting the technology talent they need and upskilling and developing the workforce they have (particularly related to developments in AI), and a few raised concerns regarding the community impacts of workforce transformation. Additionally, 15% of investors suggested they will continue to engage companies on specific policies and practices related to living wage, paid sick leave, employee safety and wellbeing.

4. Nature and biodiversity risks

Around a quarter of investors (27%) cited risks and opportunities related to nature loss and biodiversity (i.e., the diversity within and among species, and of ecosystems) impacts as an engagement focus, up from 18% in 2023. These investors want companies in high-impact sectors to assess their nature-related dependencies as a step to addressing related material risks to the business (e.g., a beverage company’s reliance on fresh water, or a pharmaceutical company’s reliance on a specific raw material for a key product). While several developments are catalyzing action on in this space (e.g., the finalization of the Taskforce on Nature-related Financial Disclosures framework), nature-related business risks and opportunities continue to be an emerging issue; some investors may have specific requests and expectations[4] but others suggested that they will engage to listen and have introductory conversations.

5. Responsible AI

Responsible AI emerged as an engagement priority for the first time this year. While 19% of investors said AI, and particularly generative AI, will be an engagement focus this year, most investors said it will not be at this early stage. Still, even investors who do not plan to prioritize AI in their engagements said they still expect AI to be a subject of discussion and are considering related questions, such as asking how companies are using AI across the business; managing related impacts on labor and the workforce; identifying and mitigating risks, including related to human rights; adhering to responsible AI guidelines; and allocating capital to AI initiatives. Many investors suggested that they will approach AI-related discussions with high-level questions and a learning mindset, not defined expectations. By far the most-cited topic of interest regarding AI (42% of investors) was governance and the role of the board in overseeing AI risks and opportunities. Investors emphasized a particular interest in related board training and education, including from external experts, to build director competence.

Key takeaways for boards

- Ask management for high level insights on the engagement priorities of the company’s key shareholders, including not just portfolio managers but members of the investment stewardship teams. Ask about significant questions investors are raising, how management is responding, and whether shareholders’ expectations on those topics align to the shareholder’s proxy voting policies on director elections.

- Challenge how the company is communicating the board’s governance of investor topics of focus, including who the board is hearing from and how often (including both management and external advisors), and whether certain committees have related oversight responsibilities. Also consider having a director join key engagement discussions as appropriate to hear investor perspectives first-hand and demonstrate the board’s engagement.

Chapter 4: Investors clarify focus on material risks and opportunities

As ESG matures, investors underscore importance of financial materiality.

Investors suggest the political pushback against environmental, social and governance (ESG), including the introduction of federal and state-level anti-ESG legislation, has clarified, not deterred, investor interest in how companies are managing, and how boards are overseeing, material environmental and social-related risks and value drivers in their business models.

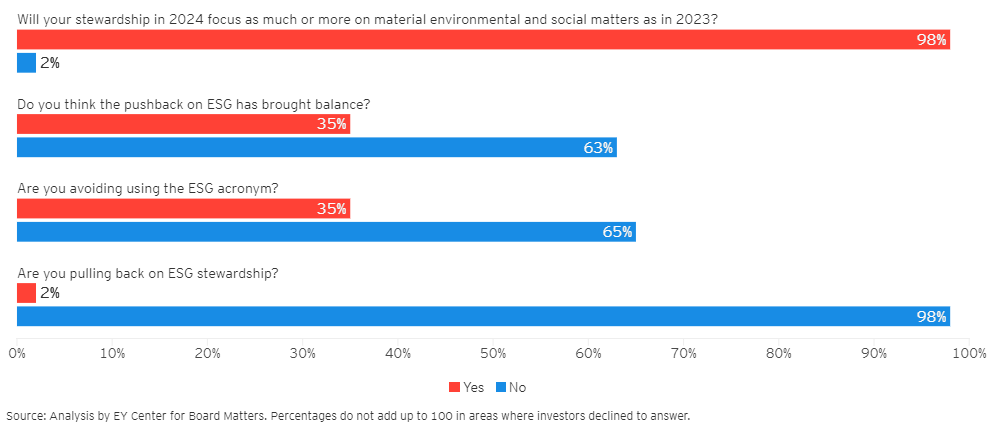

Nearly all investors stay the course regarding material risks with an environmental or social dimension.

Ninety-eight percent of investors said their stewardship in 2024 will focus as much or more on material environmental and social matters as last year. They said they approach these matters like any other material risk or opportunity and cannot afford to ignore material risk.

A few investors commented that a challenge in the current narrative is that there was lower support for environmental and social-focused shareholder proposals in 2023, which some observers have cited as evidence that investors are pulling back on ESG. The investors said that what gets lost in the noise is that there are multiple moving parts in their analysis of those proposals, and the same proposal voted under the same investor policy two years in a row may get a different result because the company has made progress during that time period. Investors said they remain focused on material risks to the long-term performance and value of their portfolio companies and are not raising or lowering the bar on expectations for how management teams and boards address these risks. More discussion and analysis is available in last year’s report, What directors need to know about the 2023 proxy season.

Investor perspectives on how ESG stewardship is evolving

Some investors are avoiding the ESG acronym in favor of more specific language

Around a third of investors said they are avoiding using the ESG acronym. In most cases these investors said they want to use more specific language and have more rigor and precision in their communications (e.g., material sustainability risks and opportunities in a company’s business model). They feel “ESG” is too broad, ill-defined and misunderstood. Around two-thirds of investors said they are not actively avoiding the acronym, but many of them indicated they are also trying to be more specific and precise in their communications to avoid misinterpretation.

Investors raised concerns that ESG’s politicization misconstrues material business risks

When asked whether the pushback on ESG has brought balance, about two-thirds of investors said no, stating their views that anti-ESG campaigns are often misinformed, politically motivated, polarizing, and distracting from underlying business risks. These investors said that the rhetoric ignores economic and fiduciary realities and creates risks to their holdings.

However, around a third of investors said the pushback on ESG has brought helpful balance in some respects. The most common positive sentiments shared were that the anti-ESG movement has exposed greenwashing, has driven investors and companies to be clearer in their communications and has forced a closer focus on financial materiality. Some investors characterized the anti-ESG movement as part of typical concept cycles, with the pendulum of public sentiment swinging from hyper-enthusiasm about innovative ideas back in the other direction before a new equilibrium is reached.

A few investors said that some legitimate arguments have been raised, including whether pursuing ESG objectives is always a “win-win” for business and the environment. They said there can be difficult trade-offs and unintended consequences involved in navigating ESG-related business and investment decisions – some of which are coming to the forefront as 2030 emissions reductions targets grow near. These investors said some good questions have also been raised about whether addressing corporate social and environmental practices belongs in the investment sphere or if policymakers need to address these issues. They view healthy debate on these points as a good thing.

Key takeaways for boards

- Understand how the company has identified the environmental and social factors that are material to the business, guide how those factors are integrated into strategy to drive value and oversee aligned investor communications.

- Realize that while in some cases the messaging may be tempered, investors are not pulling back on their stewardship related to material sustainability risks and opportunities.

- Encourage transparency around how the company is navigating difficult decisions and trade-offs related to sustainability goals and maintaining a focus on long-term value creation.

Going forward: Staying fit for purpose and securing investor trust

Both the business context and the proxy landscape continue to be dynamic, and investors are looking to boards to adapt accordingly. That includes business model review, oversight of workforce strategy and material risks, and opportunities to build resiliency for the long term. It also includes proactive board refreshment and ongoing board training aligned to the company’s evolving oversight needs. To help secure investor trust, boards can proactively address how they are executing oversight of material risks, seek education on priority topics for the business, rigorously evaluate the board’s effectiveness and succession planning, and encourage enhanced disclosures around these efforts. Finally, engagement of both stewardship leaders and portfolio managers is critical to secure a balanced view of investor priorities.

Questions for the board to consider

- How is the company adapting its business model and operations to thrive over the long term? How is the board overseeing and the company communicating those efforts?

- How is the company’s talent strategy supporting the overall strategy and positioning it to be an employer of choice for the next generation of talent? Do company leaders have a strong pulse on employee sentiment across all levels of the organization? How is the board gaining accurate insights into the employee experience across all levels?

- How is the company performing against its near-term climate goals? How is it transparently communicating that performance and any related challenges to stakeholders? Is the company demonstrating credibility around its climate commitments?

- How is the board gleaning insight into the topics its investors care about? Does the board understand how these views may impact investor votes on director elections? Are any directors hearing directly from key shareholders on their perspectives on the company’s governance?

- How do company communications address investor areas of focus? Do those communications effectively address how the board is building related competence and executing oversight? Is the board’s engagement in these areas well-communicated, and does that engagement involve getting external perspectives beyond management?

- How well does board composition align with the company’s strategy and key risk mitigation priorities? Do proxy disclosures make clear how individual director qualifications match the company’s specific oversight needs and how the full board is upskilling to keep pace with fast evolving topics that are material to the business

Summary

Investors want to understand how companies prioritize their people and adapt their business models for long-term success as they encounter emerging technologies, a changing climate and various other structural changes. Director accountability is essential as investors seek confidence that boards are effectively overseeing key risks and staying smart and current with fast-evolving oversight needs.

Endnotes

1“Proxy Season & Flagged Shareholder Votes,” Climate Action 100+, https://www.climateaction100.org/approach/proxy-season, accessed January 9, 2024.(go back)

2“Labor Group Plans Board Fight at Starbucks,” The Wall Street Journal, November 21, 2023.(go back)

3“Pensions and Investments Top Money Managers 2023.” Percentage based on the 17 asset managers whose proxy voting guidelines were publicly available.(go back)

4“Nature Action 100 releases investor expectations to support urgent corporate action on nature loss,” Nature Action 100, June 26, 2023(go back)

Print

Print