Kris Pederson is Center for Board Matters Leader, Barton Edgerton is Center for Board Matters Corporate Governance Research Leader, and Jamie Smith is Center for Board Matters Investor Outreach and Corporate Governance Director at EY Americas. This post is based on their EY memorandum.

Dynamic global crises continue to challenge companies, with the escalation of conflict in the Middle East, the war in Ukraine, geopolitical complexities related to China, and an uneven global economy creating a sense of permanent crisis on a multitude of fronts.

At the same time, exceptional growth opportunities seem at hand. Generative AI (GenAI) represents a groundbreaking leap in technology with the potential to increase productivity and transform work, business models and society. Further, the continuing energy transition demands a reframing of business strategy to mitigate risks and thrive in a low-carbon economic future.

In this context of crisis and opportunity, directors are deepening their engagement. They are guiding companies to build resilience by considering multiple alternative scenarios and carefully balancing discipline and transformation.

To better understand directors’ priorities in 2024, we surveyed more than 350 corporate board members across the Americas, including Argentina, Brazil, Canada, Chile, Mexico and the US, who also represent a cross-section of sectors, public and private boards, and a variety of company sizes.

Based on the survey results and our direct engagement with more than a thousand key stakeholders (including boards, individual directors, C-suite executives and leading institutional investors), we have identified five top board priorities for directors as they navigate this challenging operating environment.

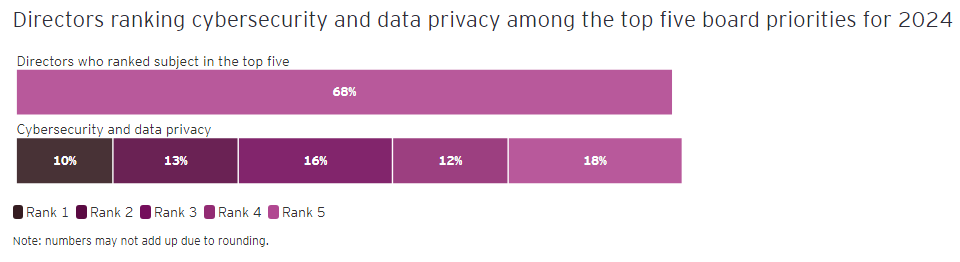

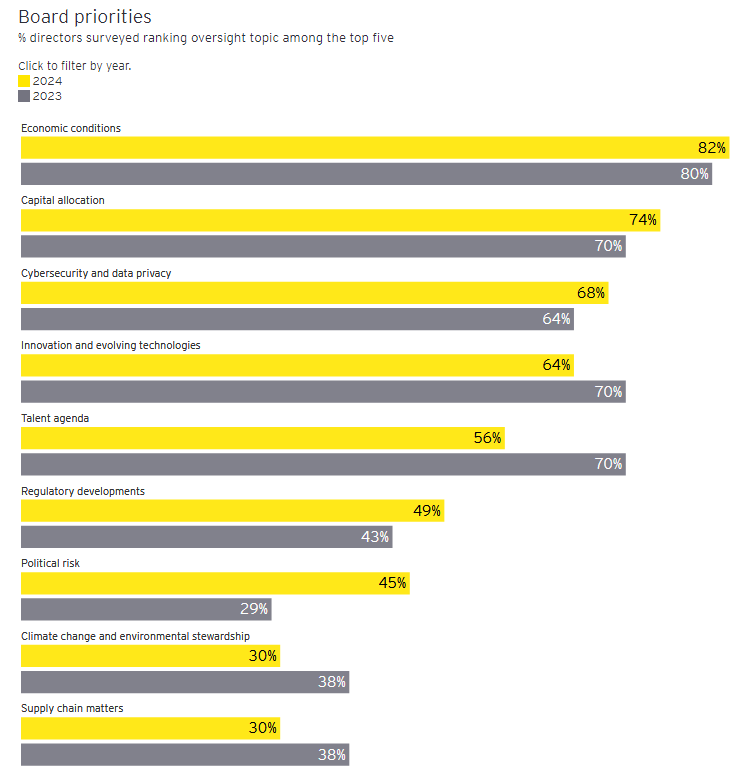

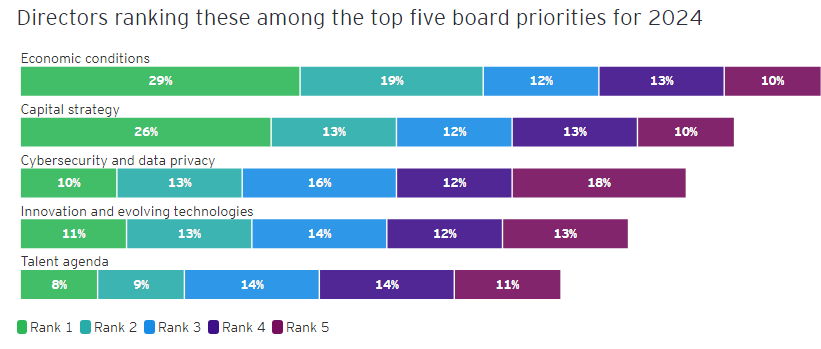

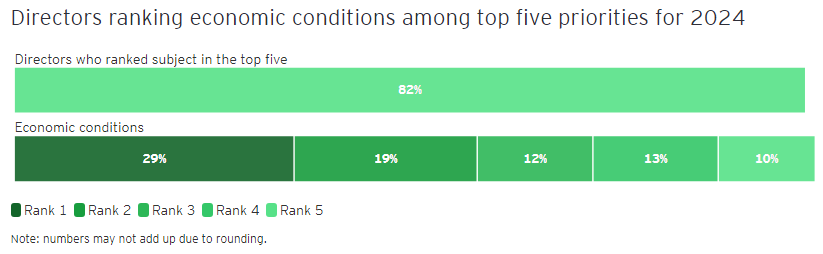

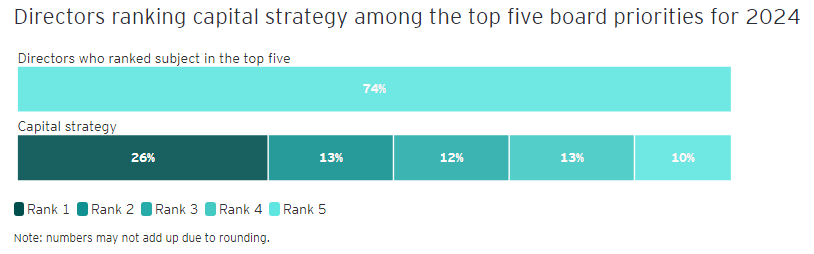

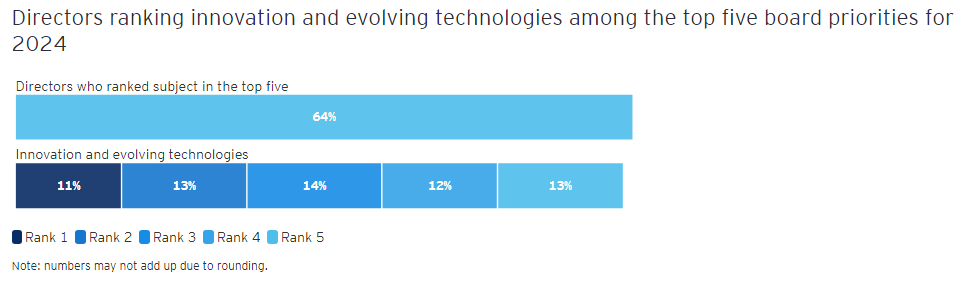

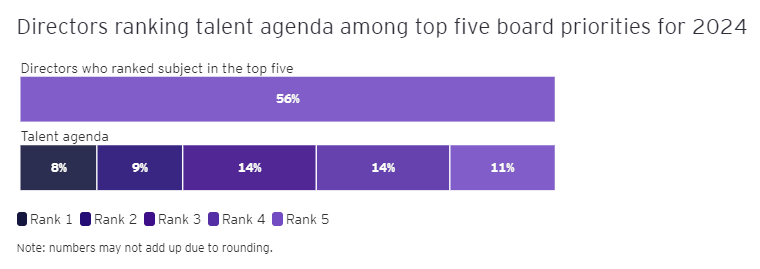

While the top five priorities remain the same as in 2023, there are significant shifts in emphasis this year. Cybersecurity and data privacy, capital allocation and economic conditions have grown in importance, but innovation and evolving technologies dropped slightly down the ranking, and the talent agenda dropped more. This is surprising with GenAI emerging as a disruptive force of unknown proportions that may have dramatic implications for business and operating models. Less surprising is that political risk experienced the largest jump in prioritization, against a backdrop of escalating geopolitical conflicts, increasing polarization and a charged election season ahead for several countries including the US and Mexico. Country-specific circumstances may be driving some of this change: Political risk ranked as the number two board priority for survey respondents in Chile, and the talent agenda ranked number eight, making that country a relative outlier.

Overall, 2024 board priorities relate to near-term issues (e.g., economic uncertainty and the cost of capital) as well as longer-term priorities (e.g., innovation and workforce development). A crucial role of the board this year will be guiding management in balancing what is urgent to address now with what is vital to invest in for the future.

Chapter 1: Stay agile amid continued economic uncertainty

Enhance oversight and flexibility as uncertain economic conditions persist.

Global economic activity remains subdued heading into 2024, with rising geopolitical tensions and tightening financial conditions as key risks. As the year begins, companies can expect slower business and consumer spending, along with softer labor market conditions and still-elevated costs.

Drivers of economic activity demand attention

Several drivers of economic activity will warrant greater attention from boards in this environment. These include:

- Cooling but persistent inflation: While global inflation will continue to moderate this year, the process will be gradual. Economic activity will continue to be constrained by price and cost fatigue, leading central banks to maintain a restrictive monetary policy stance. Directors are mindful of the risks. When asked about which economic factors they were most concerned about, 68% said inflation, rising costs and pricing power were top concerns.

- Interest rates likely to stay higher for longer: The end of the global monetary tightening cycle is near. Still, central bankers and investors are embracing the idea of higher interest rates lasting for a longer period. This could lead to slower economic growth for a more extended period, as the increased cost of borrowing limits restrain business executives in their investment and employment decisions.

- Labor market cooling: Though resilient, the labor market is likely to be affected by tightening financial conditions, elevated labor costs and softer demand. At the macro level, further hiring restraint, strategic resizing decisions, and continued moderation in nominal wage growth is expected. However, a severe employment pullback with broad-based layoffs and high unemployment is not expected.

Consumer spending expected to slow: Consumer spending momentum is likely to slow this year. An over-reliance on savings to finance purchases is not sustainable. Additionally, increasing pressure from elevated prices, higher interest rates, slowing income growth and, for the US, the restart of student loan repayments may further slow spending.

Economic conditions remain uncertain

Companies must navigate an ever-shifting landscape of geopolitical and economic uncertainty. To do so, they will need to build resilience and agility in their operations.

Upside risks to the economic outlook include continued labor market resilience, consumer spending strength and stronger productivity growth. Downside risks include an environment of higher inflation and weaker productivity growth that could prompt central bank officials to resume rate hikes, leading to a rapid tightening of financial conditions and making a recession more likely. Boards and management teams should exercise caution and be wary that signs of excessive demand could be seen as inflationary by policymakers and could lead to higher interest rates.

Further, alongside a host of challenging geopolitical conditions, conflict in the Middle East has emerged as a key downside risk to economic activity. Escalation of the conflict could significantly impact the global economy, with a spike in oil prices and a sharp tightening of financial conditions.

What boards should do in 2024

- Embrace agility and oversee flexible strategic planning that incorporates dynamic multi-scenario planning. Boards have an opportunity to guide management, pressure-test plans and assess multiple options for achieving strategic goals in the current operating environment. Directors should ask what economic, financial and customer demand scenarios have been considered and what the potential impacts are on financial performance, growth and strategy.

- Confirm how the board will receive timely updates about macroeconomic developments that could impact the company. The board is a strategic resource to the management team in preparing for different economic scenarios and thus needs timely and relevant information from experts beyond the management team to do this effectively. This information should directly inform scenario planning.

- Help management focus on the long term. This will be important as the company considers how to adapt to potential economic deceleration and various challenging geopolitical developments. For example, the board can oversee how productivity, training and efficiency gains can offset higher labor costs. The board can also encourage capital strategies that position the company to thrive as broader technology and sustainability trends continue to reshape the business environment.

Questions for the board to consider

- How is the company planning for a range of economic scenarios, including those in which geopolitical developments keep inflation elevated, and potentially rising, for longer?

- How often does the board ask leadership: What if we’re wrong? How is the company considering what it would do differently if a low-probability, high-impact scenario was to emerge?

- What is the company doing to stress-test its balance sheet and develop and test a crisis playbook that gives company leaders comfort in their ability to manage through even the worst-case scenario?

- How is the company developing a resilient strategy around pricing, capacity management and location, and distribution that is nimble enough to navigate a world where demand will ebb and flow more significantly than in the past few decades? How is scenario planning supporting that strategy?

- How is the company evaluating costs, investments and decisions in the context of its long-term strategy, especially regarding technology, talent and the energy transition?

Chapter 2: Balance discipline and transformation in capital strategy

Adapt strategic priorities to a slower-growth environment

A mantra for many leadership teams this year will be financial discipline. Growth at any cost has given way to investments that must show a clear path to profitability or value creation. Still, companies cannot afford to retrench.

A focus on financial discipline and profitability

Companies are entering the new year with a strong focus on capital conservation and cost cutting. Among directors who view capital allocation as a top priority in 2024, more than two-thirds are most concerned about capital availability. Globally, the appetite for mergers and acquisitions (M&A) has fallen to its lowest level since 2014, with only 35% of CEOs planning a business combination in the next 12 months, according to the October 2023 EY CEO pulse survey (via EY US). Further, acquisitions have become more about the fundamental value that the buyer can achieve through synergies, with revenue growth being secondary to the ability to drive cost effectiveness.

While the percentage of leaders planning M&A is higher for US CEOs (52%), the major focus is currently on joint ventures, strategic alliances and divestments. CEOs are seeking lower-risk ways to invest in innovative technologies, and are also looking to divest lagging assets, exit unprofitable markets and fund capital spending.

Despite reasons for optimism, geopolitical headwinds add uncertainty to the dealmaking market. Funding ongoing and future transformation will likely hinge on internal operational rationalization and cost-cutting initiatives rather than raising new capital.

Continue investing in long-term priorities with continued disruption on the horizon

Companies cannot afford to let financial caution prohibit necessary investments for long-term growth, such as those related to technology and sustainability. When it comes to GenAI, many companies are embracing the imperative to act now. One hundred percent of CEOs in the CEO survey (via EY US) said they are making or plan to make significant investments in GenAI, with the caveat that many remain uncertain about the direction the technology will take. This resonates with what we heard from CFOs (via EY US) during a roundtable in fall 2023. They said their companies have a number of GenAI experiments in flight but have yet to progress to defined projects with clear functional applications. Leaders challenge themselves to experiment and rethink processes instead of just plugging GenAI into existing systems. A good place to start is investing in data management and governance. Companies must have a solid data foundation to enable data analytics and artificial intelligence (AI) to drive future business growth and evolve the business model.

While sustainability is also material to long-term strength, leaders may be more susceptible to pausing those investments given current financial headwinds. The 2023 EY Global DNA of the CFO Survey found that while environmental, social and governance (ESG) and sustainability programs are among the top long-term investment priorities, they are also the most vulnerable to spending cuts to hit short-term earnings targets. Business leaders cannot afford to be short-sighted and will need to continue investing in sustainability but with an eye toward ROI and value creation. Capital strategies require a rigorous understanding of how markets will evolve and be driven by the energy transition, what that will mean for the business strategy, and what trade-offs need to be carefully navigated.

What boards should do in 2024

- Encourage accelerated investment for long-term growth and competitiveness. Boards must keep the long term in view for management so that companies do not miss out on innovations or avoid tough decisions that will be necessary to stay competitive in a future that will look very different from the past.

- Enable management to maximize profitability and position for business model transformation. Challenge how management is identifying opportunities for cost management, tracking the progress on investment decisions and considering how markets could evolve and impact the use of capital in existing and potential businesses. Probe how internal rationalization, cost cutting and divestitures can fund future transformation.

- Promote enhanced communication with investors about the company’s capital strategy. Capital allocation can be a key area of focus for activist investors, and a bear market leaves companies more exposed at a time when investors are less forgiving. In an environment of heightened shareholder activism, boards can help challenge whether companies are doing enough to communicate the company’s strategy narrative proactively with shareholders.

Questions for the board to consider

- How is the company optimizing its capital management and reducing direct and indirect costs through an era of continual change? How is it considering internal cost cutting as potential funding for ambitious transformation?

- How is the company investing to mitigate risk and create long-term growth opportunity despite multiple headwinds? Is it maintaining the right balance of innovation and capital strength?

- How is the board defining its role as stewards of investor capital? Does that role include positioning the business to thrive as the world evolves?

- How is the company’s capital investment strategy changing in areas such as digital and technology, people and skills, innovation and R&D, and sustainability? How are board committees coordinating their oversight of these matters?

- What types of transactions (e.g., M&A, divestment, new joint ventures or strategic alliances) is the company considering to achieve its strategic goals? Are those options explored at the board level or is the board presented only with management’s decision?

- How is the company’s investor engagement program keeping key shareholders informed of the company’s long-term value creation strategies and the board’s related expertise? Do disclosures describing the board’s composition demonstrate that, individually and collectively, the board is fit for purpose?

Chapter 3: Embrace cybersecurity and data privacy as strategic advantages

Broaden cybersecurity and data privacy beyond compliance

While cybersecurity and data privacy are perennial concerns for boards, they include a complex set of always-evolving drivers, and background knowledge that can quickly stale. 2023 saw a variety of different changes in the cybersecurity landscape, such as the quick adoption of new technologies, new geopolitical influences, new regulatory requirements and increasing nation-state bad actors.

Macro developments reinvigorate the focus on privacy and cyber

There are several reasons for renewed attention to cybersecurity and related concerns, including:

- New SEC disclosure rules: The new rules, which took effect mid-December 2023, require greater levels of transparency in cyber disclosures. This includes a four-day disclosure window for breaches determined to be material, enriched disclosures of the board’s role in oversight, and how risks from cyber threats may materially impact strategy or operations.

- Changing geopolitical threats: The war in Ukraine, conflict in the Middle East and US-China tensions may create conditions in which state actors seek to increase their cyber attacks on governments and industry, impacting operations and threatening data privacy.

- Rapid growth in AI and machine learning: Technologies such as GenAI create opportunities to enhance cyber defenses, but they also provide malicious actors with new capabilities to execute attacks more quickly.

- Cybercrime is increasing in volume and speed: Cybercrime is increasing across the globe and impacting organizations and their third-party networks.

Confronting a more complex cyber landscape

A more complicated environment will likely cause many organizations to mature their cybersecurity oversight through 2024. As part of this maturation, organizations may see a greater administrative burden to ensure compliance. Along with Brazil’s 2020 data protection regulations, many executives continue to prioritize data privacy. Further, a larger threat landscape that spans across an organization’s third-party network can become exceptionally complex when combined with new technology tools and techniques by which malicious actors can take advantage. Finally, although automation through AI and machine learning creates opportunities to better address many of these challenges, human error remains a prime factor in cybersecurity incidents – accounting for nearly 90%, according to several reports.

Outside of a focus on cybercrime, boards can help push management to take a more strategic approach to data privacy to build a trustworthy company by advancing the company’s privacy profile. In an era of quickly moving technology innovation, customers are increasingly aware of the privacy challenges and how their data is being used. Transparency and trust will be central to maintaining good relationships with customers, clients and regulators in an era when data misuse carries numerous risks (e.g., identity theft, brand and reputation damage, litigation, financial loss, and loss of consumer and business partner confidence). Most directors recognize this as a challenge needing a proactive response. More than half (56%) of directors who ranked cybersecurity and data privacy as a top concern in our survey cited readiness as a primary area of focus for 2024. Readiness includes breach response, recovery planning and simulations.

What boards should do in 2024

- Reconsider whether cybersecurity oversight is structured the right way. The new SEC disclosure rules may be a good opportunity for the board to reconsider whether it is structured appropriately to oversee cybersecurity in the years ahead. To do so, it may consider adding (or removing) a focused committee, concentrating or distributing cyber expertise throughout the board, changing the cadence of cyber discussions, or otherwise altering the board agenda.

- Participate in complex cyber threat tabletop exercises. These can be done either separately or with management, and complex cyber exercises can be incorporated into the board calendar. These scenarios should be varied and dynamic. Although it may be unlikely that a specific scenario will be replayed in real life, the simulation can develop the board’s muscles for dealing with a challenging crisis; pressure-test existing playbooks, discussing policy such as whether the company will pay ransoms; and uncover opportunities to improve processes and procedures.

- Maintain a wide variety of voices in the boardroom. In addition to members of the cybersecurity team, directors may seek a variety of voices, ranging from operators and internal audit to HR and strategy, to understand the company’s preparation that extends beyond threat and response to data privacy and ethical data usage. This can give insight into how the company’s cyber risk appetite is being applied and whether the cyber risk culture meets expectations. Further, complexity can be a barrier to effectively combating cyber threats. The board may ask management teams to consider how IT security systems can be simplified.

Questions for the board to consider

- How has management adapted the cyber response playbook to the threat environment that continues to evolve?

- Have appropriate and meaningful cybersecurity and data privacy metrics been identified and provided to the board on a regular basis, and have dollar amounts been assigned to these risks?

- What is the state of the organization’s cyber risk culture? How can the organization minimize employees’ susceptibility to online manipulation and deceit?

- What information has management provided to help the board assess which critical business assets and partners, including third parties and suppliers, are most vulnerable to cyber attacks?

- How does management evaluate and categorize identified cyber and data privacy incidents and determine which ones to escalate to the board?

- How does the organization use data to build and maintain trust with stakeholders, such as employees, customers, suppliers and investors?

- What controls are in place for ethical usage of technology to promote stakeholder trust and data privacy?

- Has the board participated with management in one of its cyber breach simulations in the last year? How rigorous was the testing?

- Has the company leveraged a third-party assessment to validate that the company’s cyber risk management program is meeting its objectives? If so, is the board having direct dialogue with the third party related to the scope of work and findings?

Chapter 4: Guide responsible and transformative innovation and technology

Enable the company to innovate in a way that is both revolutionary and ethical.

GenAI is only one of many emerging technologies that is already impacting business in expected and unexpected ways. Other technologies and innovations include the metaverse, Internet of Things, Web3, and quantum computing. These advancements will transform the work organizations do and the environment in which they operate.

Diverse factors drive increased oversight of innovation and emerging technology

The past year has seen enormous growth in the impact that GenAI and other emerging technologies are having on businesses. There are a number of considerations for boards to keep in mind as they oversee this fast-developing space, including:

- The rise of GenAI: The launch of ChatGPT, a GenAI chatbot, in November 2022 ushered in a wave of interest and uses of GenAI. Nearly every large technology company has a GenAI product or is working to integrate one into their platforms. The number of mentions of AI in Fortune 100 earnings calls increased fivefold in the 12 months following the ChatGPT launch.2 Additionally, a flood of venture capital (VC) investments has led to a doubling of funding to AI startups in the past year.3

- The need for speed: The rapid expansion of GenAI has led to a situation in which numerous organizations are under pressure to quickly integrate it into their business models, either as a pioneer or a fast follower. As with many emerging technologies, GenAI’s appeal puts pressure on management to take advantage of its potential for strategic advantage before their competitors do, or risk falling behind.

- Moving forward responsibly: A variety of stakeholders are creating pressure to create responsible AI policies within organizations. These include governments such as the US, UK and EU, as well as many corporations and AI leaders themselves. While there appears to be significant interest in regulating AI, organizations are not waiting for governments and are starting to create their own policies and procedures to ensure responsible development and address skepticism and concern from the public.

Overseeing operational and ethical risks

Innovation and emerging technology in general, and GenAI in particular, present companies with a broad spectrum of opportunities and risks. Some of the benefits of AI are clear (e.g., enhancing customer service, streamlining workflows and simplifying work processes). However, the potential risks can be more complex. Stories of AI hallucinations and careless employees uploading critical code to chatbots abound in the popular press and have been subject to litigation. Concerns related to misinformation, impacts on democracy, implicit bias, job displacement and human rights are all coming to the forefront, and business leaders need to be aware of these issues and take appropriate measures to mitigate them.

New technologies and innovations often bring unintended consequences, unknown unknowns, and risks that have yet to be realized or imagined. Even the most transformative technologies sometimes fail to live up to the hype from their biggest supporters, suggesting that healthy skepticism is warranted in many cases.

Perhaps the most meaningful innovations will come not from the isolated application of any single emerging technology but from how they work together. It’s possible that these technologies will have compounding and networking effects.

What boards should do in 2024

- Strengthen management accountability for responsible AI. Boards are in a strong position to make sure that management teams are creating responsible AI policies that effectively manage the risks and capitalize on the opportunities available for the enterprise while keeping the company’s values and purpose as a north star. It is not enough to require that policies are in place. Boards should go further to push management to ensure that employees adhere to such policies, that there is a mechanism to determine if they are not and that managers are quickly fixing problems.

- Embrace a range of perspectives and experiences in the boardroom. Directors with a wide variety of professional and lived experience are increasingly important to help drive innovation and govern emerging technology. This diversity enables the board to better identify nontraditional threats and encourage management teams to responsibly leverage new technologies and innovations. Further, a variety of perspectives from within the boardroom fosters an environment that facilities robust discussion, allowing key assumptions and conclusions in strategy, operations and other areas to undergo thorough pressure testing.

- Gain visibility into external trends and internal capabilities. An intentional approach to understanding the trends likely to impact the company over the long term is critical for a “future-back” approach to strategy. This strategy approach envisions possible future scenarios and then works backward to identify the strategic objectives in order to ensure the company is viable in that future. Further, working to understand the company’s internal capabilities by going beyond C-suite presentations through hands-on experience and R&D visits can help the board better evaluate how management is placing bets across the enterprise.

- Build agility into the decision-making process. The pace of innovation is fast and may only get faster. A traditional board meeting cadence – four to six full board and committee meetings a year – may be insufficient to support the needs of the company. Boards should work with their management teams to consider a more flexible trigger-based approach to strategic planning that entails a more consistent evaluation of the future. At the same time, boards may gain value by looking inward to consider the current structure for overseeing innovation and emerging technology. Confirming that the board’s structure remains fit for purpose is critical to making sure the board does its best to support innovation and emerging technology.

- Investigate innovation in the boardroom. The board may start to consider the ways in which innovations such as GenAI can improve its own work. GenAI may be able to support boards by summarizing large and complex board materials, more efficiently schedule time for board and committee meetings, and provide background and learning curriculum for new and emerging boardroom topics.

Questions for the board to consider

- What is the company’s path to value with GenAI and other technologies? How are the risks identified and managed?

- What policies has the company implemented to confirm that GenAI is used responsibly? How does management know they are working?

- How is the company’s innovation budget and program contributing to the creation of an informed strategic plan leveraging emerging technology?

- How is the board thinking about and redefining competitors or industry boundaries? Who might now be a competitor but wasn’t previously?

- How are responses to changing stakeholder demands, expectations and operational disruptions leading management teams to innovate?

- How are investments in innovation tracked and reported to the board? Is the board engaged in innovation discussions as part of the strategy-setting process?

- How is the board building a foundational understanding of evolving technologies, including learning through hands-on demonstration and experience?

- How will companies create an ecosystem in which AI and data protection coexist and create synergies to generate a better value proposition for users and customers?

Chapter 5: Enable a people-centric workforce strategy

Guide talent engagement and cultivation amid a rebalancing of power and a reimagining of work.

The talent landscape is constantly being disrupted by a combination of cyclical and structural forces. This has led to a divergence in perspectives between employers and employees.

Employees are guided by their perceived power in the labor market

The power dynamics in the labor market have experienced a slight shift back toward employers amid the recent economic downturn. However, the overall perception remains that employees maintain leverage since the COVID-19 pandemic.

In our recent Work Reimagined Survey, 31% of respondents indicated they believe employees hold the balance of power. Although this percentage has decreased from the previous year’s 36%, it remains elevated compared with pre-pandemic levels of 23%. Notably, high-profile strikes across industries, from Hollywood actors to auto and health care workers, have reinforced employees’ belief in their power and willingness to exercise it.

Despite this, there is a gap between how employers and employees are perceiving this “next normal.” Employers base their decisions on the realities of high inflation, an economic slowdown and weaker market demand. Employee decisions are largely influenced by their perceived power in the labor market and their willingness to change jobs to get what they want, which includes better total rewards packages amid high inflation and cost of living, better wellbeing, flexibility and skills.

Employers may be underestimating the fluidity of the labor market. While 57% of employers believe that a more challenging economic climate would reduce employees’ likelihood of seeking new jobs, the survey found that a significant 34% of employees expressed their willingness to leave their current jobs within the next 12 months. This highlights the importance of talent availability, acquisition and retention. For directors who view talent as a top priority in 2024, 77% said these topics were most important.

Employees and employers have divergent perspectives on key talent areas

Employees and employers also have divergent views on how companies are performing across many top employee focus areas, including wellbeing, flexibility, learning and skills. According to our survey, 80% of employers believe that their organization is equipped to adapt to change and build skills for evolving needs, but fewer (58%) employees do. Similarly, 76% of employers believe that their company’s leadership is in tune with the experience of the workforce and cares about employees as people, compared with 54% of employees. Tensions between employers and employees also persist in relation to hybrid and fully remote work models.

A people-centric approach helps companies achieve better talent outcomes

Embracing a people-first mindset enables organizations to bridge these gaps, cultivate trust, invigorate their workforce and ensure readiness for the future. While technology continues to reshape the talent landscape, it is evident that superior outcomes stem from workforce strategies rooted in human-centered approaches and inclusivity.

Organizations that prioritize their people exhibit remarkably heightened productivity and a thriving culture. These organizations foster an environment where employees feel trusted, empowered, connected, well-informed, and genuinely cared for by their leaders. They value diverse workforces and actively nurture skill development aligned with the evolving landscape of generative technology and workplace transformation.

What boards should do in 2024

- Seek a deeper view into employee sentiment and perspectives by hearing from employees more directly. Boards should actively engage with the chief human resources officer (CHRO) and seek direct input through tools such as pulse surveys and interactions with front-line employees. This approach enables boards to hear employees’ voices directly and fosters a culture of inclusivity and engagement.

- Guide management to put people first in workforce strategy and cultivate a culture of trust. This involves boards evaluating the leadership team and their incentives to energize and inspire employees, ultimately gaining their trust. Additionally, boards should oversee how management implements workforce re-skilling and training initiatives to prepare the workforce for future challenges, while actively involving employees as partners in that transformative journey.

- Enhance stakeholder communications around compensation committees’ oversight of human capital matters. With potential new SEC rules and heightened attention on high-profile strikes, stakeholders will scrutinize the board’s role in governing the talent agenda. Investors will seek to understand whether the compensation committee or full board has a meaningful impact on shaping a resilient talent strategy.

Questions for the board to consider

- How does the company’s talent strategy advance its overall strategy? What changes have been made to other elements of the business to advance the talent strategy?

- How is the company identifying and addressing employees’ chief areas of concern?

- How is the company’s leadership team earning trust with employees? Do the company’s employees feel connected, inspired and well-informed at work? Do they feel that leadership cares about them as people?

- How often is the board engaging directly with the CHRO or equivalent and what is the substance of those discussions? How is the board getting a direct line of sight into employee perspectives below the executive level?

- What human capital management metrics are the board or compensation committee reviewing? How do those metrics align with the long-term talent strategy, and what narrative is the company communicating to stakeholders about its talent agenda?

- How is the company providing support for career path and progression, including mentoring, learning and development programs, and updating organizational design to open opportunities for advancement? Are upskilling and retention central to the company’s talent strategy, including key areas such as technology and sustainability?

- How is the company making the use of AI compatible with talent development so that the company’s strategy can adapt quickly to the constantly changing business ecosystem?

- How is the company approaching in-office, fully remote or hybrid working models and maximizing the human experience of work in its talent strategy? How is the board getting insight into employee sentiment related to hybrid and remote working across different job functions, geography, age and gender?

Chapter 6: Keeping other focus areas on the board agenda

Balance top priorities with additional imperatives, being careful to not overwhelm the board agenda.

The board’s priorities for 2024 are not the only areas of risk and opportunity that boards will need to address this year. There are other business imperatives to consider in the year ahead.

Keeping pace with regulatory developments

Regulatory changes pose significant risks, and the pace of change is quickening, especially in election years in the US, Mexico and elsewhere. Companies can prepare in advance for anticipated changes, such as the expected rollout by the SEC of rulemaking governing disclosures. The SEC has finalized requirements for cybersecurity risk governance disclosures (via EY US), while disclosure rules on climate-related (via EY US) and other ESG matters (e.g., board diversity, human capital) still are pending. Boards also need to be aware that the global sustainability reporting landscape is shifting toward regulatory mandates that will impact many companies in the Americas, with examples like California’s (via EY US) climate disclosure laws, the European Union’s Corporate Sustainability Reporting Directive (via EY US), the International Sustainability Standards Board‘s first two disclosure standards, and Brazil’s mandating sustainability disclosures based on those standards. Policymakers are also urgently developing regulations for AI, and an evolving geopolitical landscape is driving a number of policies to which companies must adapt (e.g., US-China trade and investment restrictions). Boards can narrow management focus on relevant regulatory developments, oversee management’s actions and advocate for a harmonized global approach.

Guiding political considerations

Political risks jumped up the board agenda this year, driven by a dynamic geopolitical outlook as well as country-specific developments. Domestic and international political issues continue to pose significant risks to the operational and strategic objectives for many companies. Mexico and the US will hold presidential elections in 2024, the outcomes of which may lead to significant policy and regulatory changes domestically and impact each country’s relationship with others across the globe.

Active conflicts, such as the war in Ukraine and conflict in the Middle East, are likely to continue and will disrupt parts of global supply chains and the energy market. Further, many firms find that they must strike a delicate balance in the ways in which they support or speak out against domestic and global political events, as parts of their employee and customer bases may hold contrary beliefs. At the same time, we see two themes that are likely to dominate geopolitics. The first is a continued dispersion of geopolitical power, which is restructuring globalization into more regionalized blocs and alliances. Some of this is evident in the move some corporations have taken to nearshore supply chains closer to core markets. The second is policymakers’ prioritization of national security over pure economic considerations. This is evident in the move to more substantial industrial policy that boosts selected domestic industries or excludes international rivals. These themes are particularly relevant for multinational companies doing business in China and navigating related geopolitical complexities and restrictive investment and trade policies. Boards can guide management to proactively consider how political developments may affect growth opportunities, the supply chain, strategic options and stakeholder expectations.

Overseeing supply chains as strategic assets

Since the COVID-19 pandemic, supply chains have been increasingly viewed as strategic assets that companies can use to help achieve near-term and long-term strategic objectives. Many companies have initiated a shift away from viewing supply chains as a pure cost center to one of resiliency. Traditionally, parts of the supply chains have been viewed as discrete pillars – end customer, distribution, storage, and order management, for example. However, given the emerging strategic view of supply chains and the ability to digitally integrate end-to-end processes, many leading companies are starting to take a more holistic ecosystem approach to managing their supply chain, all while ensuring that supply can keep up with demand.

Boards can work with their management teams to govern an integrated supply chain approach from strategy to cost to resiliency. From this perspective, organizations may be able to take greater advantage of their supplier networks to help achieve strategic goals, improve resilience during crises and provide greater transparency to stakeholders.

Addressing climate change and environmental stewardship

With just six years to meet the Paris Agreement target of halving greenhouse gas emissions worldwide by 2030, swift action from companies will need to continue. Stakeholders, including investors, will closely monitor companies’ progress in meeting short-term emissions reduction targets and will also scrutinize their climate transition plans for evidence of tangible strategies. Investors are also looking beyond target setting and expect companies to transform for a new economy. This entails building resilience to different climate scenarios, conducting quantitative physical climate risk assessments and engaging in partnerships and investments to scale climate solutions. Stakeholders are also interested in how companies are identifying and addressing their dependencies and impact on biodiversity and nature.

Boards should build their competency around the material climate- and nature-related risks and opportunities across the organization’s value chain. They can challenge how these factors inform the company’s strategy and work toward integrating climate and nature considerations into decision-making processes.

Across these additional priorities, boards act as stewards of the long term and provide effective challenge to management.

Questions for the board to consider

- What systems and processes are in place to monitor international and domestic legislative and regulatory developments and keep the board informed as appropriate? How is management taking prudent action now to prepare for future regulation as appropriate?

- How is the company ensuring visibility across global supply chains and considering alternative suppliers to improve resilience to shortages or price volatility? Is it evaluating supplier relationships for potential geopolitical complications and exploring alternative networks tuned to the new geostrategic environment?

- Does the company view climate- and nature-related initiatives as a means of protecting and creating more value for the business? How is it exploring opportunities to transform its business portfolios while reducing emissions?

- How is the company engaging and supporting suppliers to influence emissions reduction through their supply chains? Has the company considered a strategic partnership or joint venture to help achieve its climate agenda?

Going forward in 2024: enhancing the board’s strategic value

In 2024, boards will need to enhance their strategic value by enabling resilience through discipline and transformation. They must guide management to balance short-term demands and long-term growth and support the organization as it confronts crisis and embraces opportunity.

While cyclical changes such as inflation and consumer spending require attention and may present tactical opportunities, it is structural changes such as the GenAI revolution, geopolitical fragmentation and the energy transition that are significantly impacting strategy and raising the stakes for businesses and society. Effective boards will provide valuable insights, effective challenge and leadership to enable companies to make agile decisions aligned with their values in this turbulent environment.

Summary

In 2024, high-performing boards will be a strategic asset as companies navigate ongoing economic and geopolitical headwinds and seize the transformation imperative around emerging technology. At the top of the agenda for boards will include economic conditions, capital strategy, cybersecurity, innovation and emerging technologies, and talent management. Boards will work together with management to balance short-term demands with long-term strategy and drive business model transformation.

Print

Print