Joseph Yaffe, Page Griffin, and Shalom Huber are Partners at Skadden, Arps, Slate, Meagher & Flom LLP. This post is based on a Skadden memorandum by Mr. Yaffe, Mr. Griffin, Mr. Huber, Regina Olshan, Erica Schohn, and Joseph Penko.

Incorporate Lessons Learned From the 2023 Say-on-Pay Votes and Compensation Disclosures

Companies should consider their recent annual say-on-pay votes and best practices for disclosure when designing their compensation programs and communicating about those programs to shareholders. This year, companies should understand key say-on-pay trends, including overall 2023 say-on-pay results, factors driving say-on-pay failure (i.e., those say-on-pay votes that achieved less than 50% shareholder approval), say-on-golden-parachute results and results of equity plan proposals, as well as recent guidance from the proxy advisory firms Institutional Shareholder Services (ISS) and Glass Lewis.

Overall Results of 2023 Say-on-Pay Votes

Below is a summary of the results of the 2023 say-on-pay votes from Semler Brossy’s annual survey[1] and trends over the last 12 years since the SEC adopted its say-on-pay rules. Overall, say-on-pay approval results at Russell 3000 companies surveyed in 2023 were generally the same or slightly more favorable than those in 2022.

- Approximately 97.9% and 96.3% of Russell 3000 companies in 2023 and 2022, respectively, received at least majority support on their say-on-pay votes, with approximately 90% receiving above 70% support in 2022 and 93% receiving above 70% support in 2023. This demonstrates slightly increased say-on-pay support in 2023 compared with 2022.

- To date thus far in 2023, approximately 87.5% of Russell 3000 companies and 90.5% of S&P 500 companies have received “For” recommendations by ISS, a slight increase from the 86% and 87.3% “For” recommendations averages in 2022.

- Russell 3000 companies received an average vote result of 90% approval in 2023, which is slightly higher than the average vote result of 89.2% approval in 2022.

- The average vote result exceeded 90% approval in 2023 across multiple industry sectors, including utilities, materials, energy, consumer staples, industrials, financials and consumer discretionary. The percentage of Russell 3000 companies receiving more than 90% support is 71%, which is slightly lower than the 72% of companies receiving greater than 90% support at this time last year.

- The communication services sector featured the lowest level of average support, at 86.3%, compared with other industry sectors.

- As of September 2023, approximately 2.1% of say-on-pay votes in 2023 for Russell 3000 companies failed, which is below the 3.7% failure rate for 2022.

- Approximately 13% of Russell 3000 companies and 15% of S&P 500 companies surveyed have failed to receive majority support for a say-on-pay vote at least once since 2011.

- 39% of S&P 500 companies and 32% of Russell 3000 companies surveyed have received less than 70% support in a say-on-pay vote at least once since 2011.

Factors Driving Say-on-Pay Failure

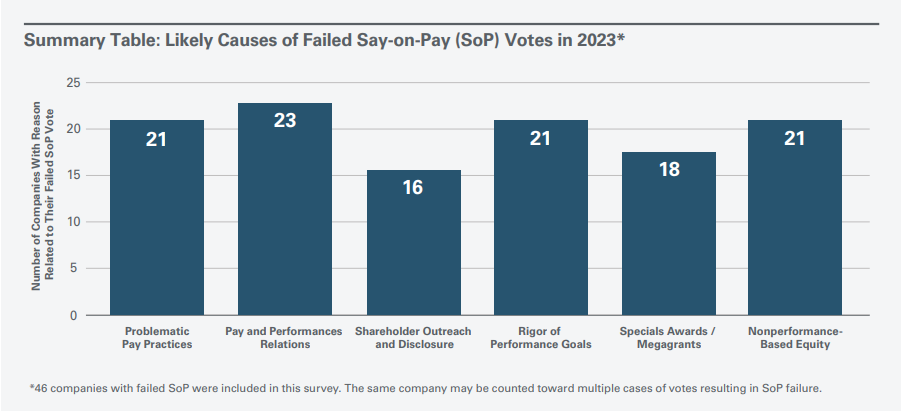

Overall, the most common factors voters used to reject say-on-pay proposals were pay and performance relation, problematic pay practices, rigor of performance goals, shareholder outreach and disclosure, nonperformance-based equity and special awards, as summarized in the chart below.[2]

Consistent with 2022 results, pay and performance relation was among the leading causes of say-on-pay failure for 2023. Notably, though voters issues with problematic pay practices significantly decreased from 38 instances in 2022 to 21 instances in 2023, the issue was still a top cause of SoP rejections in 2023. Also, the tally shows that rigor of performance goals and nonperformance-based equity have slightly outpaced special awards as leading causes of say-on-pay failure.

ISS Guidance

When evaluating pay practices, the focus of proxy advisory firms tends to center on whether a company’s practices are contrary to a performance-based pay philosophy. In December of each year, ISS publishes FAQs to help shareholders and companies understand changes to ISS compensation-related methodologies. In December 2022, ISS published its most recent general United States Compensation Policies FAQ,[3] which included the following key updates:

- ISS indicated that there are no changes to the three primary quantitative pay-for-performance screens (Relative Degree of Alignment (RDA), Multiple of Median (MOM) and Pay-TSR Alignment (PTA)) for 2023. For meetings on or after February 1, 2023, companies should observe updates to the methodology for the Financial Performance Assessment (FPA) measure and the “Eligible for FPA Adjustment” thresholds.[4]

- ISS noted that the potential FPA adjustments may affect companies’ overall quantitative concern level, causing certain high-concern companies with strong FPA performance to become medium concerns and certain medium-concern companies with poor FPA performance to become high concerns. ISS research indicates that the updated FPA methodology will impact the overall quantitative concern level for less than 9.5% of all companies subject to the quantitative pay-for-performance screen.

- ISS highlighted some of the key factors it typically considers in conducting the qualitative review of the pay-for-performance analysis. ISS noted that a company should fully disclose in its proxy statement the following factors if the company wants to be eligible to receive any mitigating weight:

- The ratio of performance to time-based incentive awards.

- The overall ratio of performance-based compensation to fixed or discretionary pay.

- The transparency and clarity of disclosure.

- The complexity of the pay program.

- Any risks associated with the pay program design.

- The emphasis of objective and transparent metrics.

- The rigor of performance goals.

- The application of compensation committee discretion.

- The magnitude of pay opportunities.

- Benchmarking practices of the company’s peer group.

- Financial/operational results, both absolute and relative to peers, including clear disclosure in the proxy of any adjustments made for incentive plan purposes.

- Special circumstances such as CEO and executive turnovers or unusual grant practices (e.g., biannual awards, special one-time grants).

- Recent changes to the pay program and/or any forward-looking commitments.

- Realizable and realized pay compared to granted pay.

- Any other factors deemed relevant.

- ISS indicated that a temporarily increased pay package for an incoming executive is generally acceptable when an executive transition occurs, but compensation levels will be expected to normalize after the transition. ISS added that the presence of inducement awards and make-whole awards could mitigate concerns regarding pay magnitude if a review of the award structure and disclosure reveals positive features. ISS suggests inducement awards should be predominantly performance-based and structured with shareholder-friendly guardrails such as limitations on award vesting in the event of a termination. For make-whole awards, ISS noted it does not expect performance criteria to be attached, but suggests companies disclose that the new grant is economically equivalent to forfeited compensation opportunities from the executive’s prior employment and make clear what portion of awards are attributable to inducement/ sign-on awards versus those that are strictly make-whole awards.

- ISS described how it evaluates modifier metrics for incentive pay programs based on an assessment of the modifier metric’s mechanics, including its applicable goals, the achieved performance level and impact on payouts (as well as the limitations that the modifier metric has on payouts). ISS indicated that modifier metrics that allow for a significant increase in a payout or do not disclose the percentage by which a payout can be increased may be viewed negatively, as will modifier metrics that overemphasize committee discretion.

- ISS highlighted problematic practices that carry significant weight and are most likely to result in adverse vote recommendations, including the following (which largely aligns with problematic practices noted in prior years):

- Repricing or replacing of underwater stock options/SARs held by named executive officers (NEOs) or directors without prior shareholder approval (including cash buyouts and voluntary surrender of underwater options).

- Excessive or extraordinary perquisites or tax gross-ups.

- New or materially amended agreements that provide for (i) excessive termination or change-in-control severance payments (generally exceeding three times [base salary plus average/ target/most recent bonus]); (ii) change-in-control severance payments without involuntary job loss or substantial diminution of duties (“single” or “modified single” triggers) or in connection with a problematic good-reason definition; (iii) problematic good-reason termination definitions that present windfall risks, such as definitions triggered by potential performance failures; (iv) change-in-control excise tax gross-up entitlements (including “modified” gross-ups); (v) multiyear guaranteed awards or increases that are not at risk due to rigorous performance conditions; or (vi) a liberal change-in-control definition combined with any single-trigger change-in-control benefits.

- Insufficient executive compensation disclosure by externally managed issuers (EMIs) so that a reasonable assessment of pay programs and practices applicable to the EMI’s executives is not possible.

- Severance payments made when the termination is not clearly disclosed as involuntary (for example, a termination without cause or resignation for good reason).

- Any other provision or practice deemed to be egregious and to present a significant risk to investors.

- ISS clarified that it may consider new disclosures required by the SEC’s “pay-versus-performance” rule finalized in August 2022 — particularly for companies that exhibit a quantitative pay-for-performance misalignment. However, ISS indicated that the new disclosures are not expected to replace prior disclosure expectations regarding incentive pay.

- Now that companies are in a position to return to pre-COVID incentive program structures, ISS will negatively view any midyear changes to annual incentive metrics, performance targets and/or measurement periods, or programs that heavily emphasize discretionary or subjective criteria. Additionally, ISS stated that changes to long-term incentive cycles or shifts to predominantly time-vesting incentives or short-term measurement periods will also generally be viewed negatively.

- Relatedly, ISS indicated that it will negatively view one-time awards or other significant increases in executive pay opportunities used to replace foregone compensation due to caps on executive compensation for companies receiving financial assistance under the CARES Act.

ISS is expected to release a full set of updated compensation FAQs in December 2023, which will provide robust guidance for 2024.

Glass Lewis Guidance

Glass Lewis published its 2024 policy guidelines for the United States in November 2023, which included the following compensation updates in effect for the 2024 proxy season:[5]

- Glass Lewis indicated that in addition to meeting the new Dodd-Frank Act clawback requirements, effective clawback policies should provide companies the power to recoup incentive compensation when there is evidence of problematic decisions or actions, such as:

- Material misconduct.

- A material reputational failure.

- A material risk management failure.

- A material operational failure where incentive payments have not already reflected the consequences.

Glass Lewis recommends that clawback policies provide the power to recoup regardless of whether the executive’s employment was terminated with or without cause. If the company decides to refrain from recouping compensation, the company should provide a rationale and disclose alternative measures it instead pursued, such as the exercise of negative discretion on future payments.

- Companies are expected to provide clear disclosure in the Compensation Discussion and Analysis section of their proxy statements of their executive share ownership requirements and how various outstanding equity awards are treated when determining an executive’s level of ownership. Glass Lewis noted that it is inappropriate to count unearned performance-based full value awards and/or unexercised stock options in determining an executive’s level of share ownership.

- Regarding proposals seeking approval for individual equity awards, Glass Lewis will positively view in its holistic analysis provisions that require a vote of abstention (often called a “non-vote”) from a shareholder if the shareholder is also the recipient of the proposed grant — especially where a vote from the recipient of the proposed grant would materially influence the passage of the proposal.

Glass Lewis also clarified the following in its 2024 policy guidelines:

- Pay-for-Performance: Glass Lewis may use the pay-versus-performance disclosure as part of its supplemental quantitative assessments supporting the primary pay-for-performance grade; however, the pay-versus-performance disclosure does not impact the pay-for-performance methodology and there has been no change to the methodology.

- Non-GAAP to GAAP Reconciliation Disclosure: Glass Lewis emphasized the need for companies to thoroughly disclose the use of non-GAAP measures in incentive programs to help shareholders reconcile the difference between non-GAAP results used for incentive payout determinations and reported GAAP results. Where significant adjustments materially impact incentive pay outcomes, lack of such disclosure may be a factor in Glass Lewis’ say-on-pay recommendation.

- Company Responsiveness to Say-on-Pay: Glass Lewis clarified that its calculation of say-on-pay opposition includes votes cast as either “Against” and/or “Abstain,” with opposition of 20% or higher treated as significant.

Recommended Next Steps

Overall, proxy advisory firms, institutional investors, the news media, activist shareholders and other stakeholders continue to shine a spotlight on companies’ executive compensation programs. This year’s proxy season provides an opportunity for companies to clearly disclose the link between pay and performance and efforts to engage with shareholders about executive compensation. As always, these disclosures should explain the company’s rationale for selecting particular performance measures for performance-based pay and the mix of short-term and long-term incentives. Companies should also carefully disclose the rationale for any increases in executive compensation, emphasizing their link to specific individual and company performance.

In the year following a say-on-pay vote, proxy firms conduct a thorough review of companies where say-on-pay approval votes fell below a certain threshold: 70% for ISS and 80% for Glass Lewis. ISS’ FAQ explains that this review involves investigating the following:

- The breadth, frequency and disclosure of the compensation committee’s stakeholder engagement efforts.

- Disclosure of specific feedback received from investors who voted against the proposal.

- Actions taken to address the low level of support.

- Other recent compensation actions.

- Whether the issues raised were recurring.

- The company’s ownership structure.

- Whether the proposal’s support level was less than 50%.

Attending to these factors should elicit the most robust stakeholder engagement efforts and disclosures.

Looking ahead to 2024, companies that received say-on-pay results below the ISS and Glass Lewis review thresholds should consider enhancing disclosures of their shareholder engagement efforts in 2023 and the specific actions they took to address potential shareholder concerns. Companies that fail to conduct sufficient shareholder engagement efforts and to make these disclosures may receive negative voting recommendations from proxy advisory firms on say-on-pay proposals and compensation committee member reelection.

Recommended actions for such companies include the following:

- Assess results of the most recent say-on-pay vote. As part of this analysis, identify which shareholders were likely the dissenting shareholders and why.

- Engage key company stakeholders by soliciting and documenting their perspectives on the company’s compensation practices. Analyze stakeholder feedback, determine recommended next steps and discuss findings with relevant internal stakeholders, such as the compensation committee and the board of directors.

- Review ISS and Glass Lewis company-specific reports and guidance to determine the reason for their vote recommendations in 2023. Carefully consider how shareholders and proxy advisory firms will react to planned compensation decisions for the remainder of the current fiscal year and recalibrate as necessary. For example, consider compensation for new hires, leadership transitions and any special one-time grants or other arrangements.

- Determine and document which changes the company will make to the its compensation policies in response to shareholder feedback.

- Disclose specific shareholder engagement efforts and results in the 2024 proxy statement. Such disclosures should include information about the shareholders engaged, such as the number of them, their level of ownership in the company and how the company engaged them. This disclosure should also reflect actions taken in response to shareholder concerns, such as a company’s decision to offer more robust disclosures or to adjust certain compensation practices.

Companies that have not changed their compensation plans or programs in response to major shareholder concerns should consider disclosing (i) a brief description of those concerns, (ii) a statement that the concerns were reviewed and considered and (iii) an explanation of why changes were not made.

Say-on-Golden-Parachute Proposal Results

Say-on-golden-parachute votes historically have received lower support than annual say-on-pay votes. In 2023, average support for golden parachute proposals decreased slightly from 72% in 2022 to 71% in 2023.[6] ISS’ negative vote recommendations dropped to 32% in 2023 from 41% in 2022. Companies should beware of including single-trigger benefits (e.g., automatic and accelerated vesting of equity upon a change in control without a corresponding termination of employment) in their parachute proposals given that stakeholders cite single-trigger vesting and tax gross-ups as primary concerns. Companies have historically also cited excessive cash payouts and performance awards vesting at maximum value as significant concerns.

The failure rate for say-on-golden-parachute proposals was at an all-time high in 2023 at 32% (up from 26% in 2022).

Equity Plan Proposal Results

Average support for equity plan proposals decreased in 2023:

- 1.4% of equity plan proposals at Russell 3000 companies received less than a majority vote in 2023 through September 2023, as opposed to below 1% in previous years (0.4% in 2022).[7]

- Average support for 2023 equity plan proposals as of September 2023 was 86.7%, which was below the 89.6% average support for equity plan proposals observed in September 2022.[8]

Most companies garner strong support from shareholders for equity plan proposals, regardless of the say-on-pay results. However, the strength of such equity plan support decreased in 2023:

- As of September 2023, Russell 3000 companies receiving an “Against” recommendation still received 72% support for equity plan proposals.[9]

- As of September 2023, the ISS “Against” recommendation rate was 28% (up from 22% in 2022).

The threshold number of points to receive a favorable equity plan proposal recommendation from ISS increased:

- From 57 points to 59 points for the S&P 500 model.

- From 55 points to 57 points for the Russell 3000 model.

- From 53 points to 55 points for all other Equity Plan Scorecard (EPSC) models.[10]

- Other than the burn rate factor update, ISS did not make changes to the factors, weightings or passing scores for any of the EPSC models.

Although ISS has not changed how it assesses a company’s clawback policy for EPSC purposes, it clarified that, to receive points, the clawback policy should authorize recovery upon a financial restatement and cover both time- and performance-based equity compensation for all NEOs. A company will not receive credit for a clawback policy that adheres to the minimum requirements of the SEC’s finalized clawback rules under the Dodd-Frank Act because the final rules generally exempt time-vesting equity from compensation that must be covered by the policy.

ISS changed how it calculates common shares outstanding (CSO) and market capitalization for shareholder value transfer (SVT) purposes in economic proposals (e.g., mergers, acquisitions or financing transactions). ISS evaluates where the implementation of the equity plan proposal is contingent on the consummation of the economic transaction and analyzes the equity plan proposal on a post-transaction basis, including the common shares issuable upon the economic transaction in the CSO and market cap. For purposes of satisfying NYSE or NASDAQ “20% rule” requirements, the shares issuable will only be included in CSO and market cap if the company discloses that the shares will be issued upon shareholder approval of the proposal.

ISS also changed how it considers a company’s burn rate in evaluating stock plans. For meetings before February 1, 2023, ISS used a three-year adjusted average burn rate — as a percentage of weighted average common shares outstanding — as a measure of the company’s typical annual equity-based grant rate. ISS compares this rate to a benchmark for the company’s industry/ index. A company’s three-year adjusted burn rate relative to that benchmark is a factor in the EPSC.[11] For meetings on or after February 1, 2023, the EPSC burn rate factor instead uses “Value-Adjusted Burn Rate” (VABR), with benchmarks calculated as the greater of:

- An industry-specific threshold based on three-year burn rates within the company’s Global Industry Classification Standard (GICS) group (segmented into S&P 500, Russell 3000 index (less the S&P 500) and non-Russell 3000 index companies).

- A de minimis threshold established separately for each of the S&P 500, the Russell 3000 index less the S&P 500, and the non-Russell 3000 index segments.

ISS noted that the VABR seeks to better approximate companies’ equity grant rates through compensation plans by using more accurate measures for the value of equity-based awards. A company’s annual VABR is calculated as follows:

Annual Value – Adjusted Burn Rate = ((# of options * option’s dollar value using a Black-Scholes model) + (# of full-value awards * stock price)) / (weighted average common shares * stock price).

On March 17, 2023, the S&P Dow Jones Indices and Morgan Stanley Capital International (MSCI), Inc. effectuated changes to the GICS structure.

- ISS indicated that for purposes of the EPSC, the GICS changes went into effect for shareholder meetings occurring on or after September 1, 2023.

- ISS also clarified that if a company’s Index membership or GICS classification has changed within the last three years, the burn rate benchmarks under the newer classification will apply.

Other Proxy Advisory Firm Takeaways

Each year, companies should consider whether to update the compensation benchmarking peers included in ISS’ database. ISS uses these company-selected peers when it determines the peer group it will use for evaluating a company’s compensation programs. This year, ISS will accept these updates from November 20, 2023, to December 5, 2023.[12]

Prepare for 2024 Pay Ratio Disclosures

2024 marks the seventh year that SEC rules will require companies to disclose their pay ratios, which compare the annual total compensation of the median company employee to the annual total compensation of the CEO.[13] One key item companies must consider annually when preparing the mandatory pay ratio disclosures is whether the same median employee may be used again for the upcoming year, and, if not, what new factors to consider when identifying the median employee.

Determining Whether To Use the Same Median Employee

Under Regulation S-K Item 402(u), a company only needs to perform median employee calculations once every three years, unless it had a change in the employee population or compensation arrangements that could significantly affect the pay ratio. This requires companies to assess annually whether their workforce compositions or compensation arrangements have materially changed.

When selecting a median employee for pay ratio disclosures about compensation in fiscal year 2023, companies should consider the following:

- If a company has been using the same median employee for three years, the company will need to perform median employee calculations for fiscal year 2023.

- Other companies that were originally planning to feature the same median employee as last year should not do so if their employee populations or employee compensation arrangements significantly changed in the past year.

- Companies should carefully consider how to incorporate furloughed employees, if applicable, in the median employee pool.[14]

- Companies should consider how headcount changes may impact their abilities to exclude certain non-U.S. employees from their pay ratio calculations under the commonly relied upon de minimis exception in Item 402(u)(4)(ii): Companies should evaluate whether non-U.S. employees in the aggregate and by jurisdiction, newly constitute or no longer constitute more than 5% of the company’s total employees.

- If a company’s non-U.S. employees account for 5% or less of its total employees, the company may either exclude all non-U.S. employees or include all non-U.S. employees when identifying its median employee.

- Alternatively, if over 5% of a company’s total employees are non-U.S. employees, the company may exclude up to 5% of its total employees who are non-U.S. employees; provided that the company excludes all non-U.S. employees in a particular jurisdiction if it excludes any employees in that jurisdiction, and employees excluded under Item 402(u)’s data privacy exception count toward this limit.

- Non-U.S. jurisdictions with employees that exceed 5% of a company’s total employees may not be excluded from the pay ratio calculation under the de minimis exception, although they may be permitted to be excluded under the data privacy exception.

Even if a company uses the same median employee in its proxy statement filed in 2024 as the company used in 2023, it must disclose that it is using the same median employee and briefly describe the basis for its reasonable belief that no change occurred that would significantly affect the pay ratio.

To determine whether a material change occurred, companies should continue to evaluate the following factors:

- How has workforce composition evolved over the past year?

- Review hiring, retention and promotion rates.

- Consider the applicability of exceptions under the pay ratio rules:

- Determine whether to incorporate employees from recent acquisitions or business combinations into the consistently applied compensation measure (CACM). For example, for the fiscal year in which a business combination or acquisition becomes effective, a company may exclude individuals that become its employees as the result of the business combination or acquisition, as long as the company discloses the approximate number of employees it is omitting and identifies the acquired business it is excluding.

- Determine whether the de minimis exception applies within the context of the company’s 2023 workforce composition. As described above, under this exception, non-U.S. employees may be disregarded if the excluded employees account for less than 5% of the company’s total employees or if a country’s data privacy laws make a company’s reasonable efforts insufficient to comply with Item 402(u).

- Analyze how the workforce used for the CACM is distributed across the pay scale and how the distribution has changed since last year.

- How have compensation policies changed in the past year compared to the workforce composition? For example, an across-the-board bonus that benefits all employees may not materially change the pay ratio, while material special commissions limited to a company’s sales team could do so.

- Have the median employee’s circumstances changed since last year? Consider changes to the employee’s title and job responsibilities alongside any changes to the structure and amount of the employee’s compensation, factoring in the company’s broader workforce composition. Additionally, if the median employee’s employment was terminated, companies must identify a new median employee.

Although the SEC provides companies with substantial flexibility in calculating their pay ratios, to satisfy the SEC staff and engage with investors, employees and other stakeholders, companies should continue to diligently document and disclose their pay ratio methodology, analyses and rationale.

Plan for the Second Year of Pay-Versus-Performance Disclosures

In August 2022, the SEC adopted final rules requiring public companies to disclose the relationship between the executive compensation actually paid to the company’s NEOs and the company’s financial performance. Companies were required to incorporate these items into proxy or information statements that include executive compensation disclosure for fiscal years ending on or after December 16, 2022, meaning that calendar-year companies needed to include this disclosure for the first time in their proxy statements filed in 2023. Companies should now prepare for the second year of PvP disclosure by drawing on lessons learned during the 2023 proxy season.

Overview

Item 402(v) of Regulation S-K contains the PvP disclosure requirements, which consist of three key components: (i) a PvP table that includes metrics from the previous five fiscal years such as CEO and NEO “compensation actually paid” (CAP), cumulative total shareholder return (TSR) for the company and its peer groups, financial performance measures and the company’s net income; (ii) a tabular list of important financial measures that the company selected to link CAP to the performance metrics; and (iii) a description of the relationship between CAP and the company’s performance metrics.

Specifically, the PvP table requires disclosure of:

- The total compensation of the CEO and the average total compensation of the other NEOs, using the information required to be reported in the Summary Compensation Table.

- The compensation “actually paid” to the CEO and the average total compensation “actually paid” to the other NEOs, calculated in accordance with Item 402(v), along with footnote disclosure of any amounts deducted and added to total compensation of the NEOs to determine the amount of compensation “actually paid.”

- The TSR of both the company and its peer group.

- The company’s net income (under GAAP).

- A financial performance measure selected by the company that in the company’s assessment represents the single most important financial measure that it used for the most recent fiscal year to link the company’s performance to compensation actually paid to the company’s NEOs.

Listing of Important Financial Measures: Companies also must provide an unranked tabular list of at least three and up to seven financial performance measures (the “tabular list”) that in each company’s assessment represent the most important financial performance measures the company used for the most recent fiscal year to link CAP for the company’s CEO and other NEOs to the company’s performance. A company may include nonfinancial performance measures in this list if those measures are among the most important performance measures used by the company to link CAP to performance and the company has disclosed at least three financial performance measures (or fewer, if the company uses fewer than three).

Description of the Relationship Between Pay Versus Performance: Using values reflected in the PvP table, a company is required to describe: (i) the relationship between (a) the CAP to the CEO and the average total CAP to the other NEOs and (b) the company’s TSR, its net income and the company-selected measure (CSM); (ii) how the company’s TSR relates to the TSR of its peer group; and (iii) the relationship between (a) the CAP to the CEO and the average total CAP to the other NEOs and (b) any supplemental measures voluntarily included in the PvP table. Companies can describe these relationships either through a narrative discussion, a graphical presentation or a combination of both.

Supplemental Disclosures

A company may supplement the disclosure by providing PvP disclosure (in tabular format or otherwise) based on other compensation measures such as “realized pay” or “realizable pay” if the company believes such supplemental disclosures provide useful information about the relationship between the compensation paid and the company’s financial performance. The supplemental disclosure, however, may not be misleading or presented more prominently than the required PvP disclosure. In practice, such supplemental disclosures were not common in the first year of PvP disclosure.

Covered Issuers

- All reporting companies that file proxies or information statements that require executive compensation disclosure are required to comply with this rule.

- Smaller reporting companies are subject to scaled disclosure requirements, including a three-year period subject to a phase-in period for the first applicable filing in which disclosure for only the two most recently completed fiscal years is required. Smaller reporting companies are not required to provide the peer group TSR or a CSM in the PvP table, or include a tabular list.

- Emerging growth companies (EGCs), foreign private issuers and registered investment companies (other than business development companies) are entirely exempt from the disclosure requirements.

- A newly public company is required to include PvP disclosure only for the years in which the company was a reporting company pursuant to Section 13(a) or Section 15(d) of the Exchange Act.

Time Period

Companies are required to disclose the applicable information for their five most recently completed fiscal years (with three years required in the first year of PvP disclosure, and adding another year of disclosure in each of the two subsequent annual filings). Therefore, in 2024, calendar-year public companies will generally include data for four fiscal years in their PvP tables.

Applicable Filings

- The PvP disclosure is required in any proxy or information statement that is required to include executive compensation disclosure, including those regarding the election of directors.

- The disclosure is not required in annual reports on Form 10-K, Securities Act registration statements or Exchange Act registration statements (e.g., registration statements on Form S-1 for IPO companies).

PvP Lessons Learned From the 2023 Proxy Season

In 2023, the SEC released three sets of Compliance & Disclosure Interpretations relating to the PvP disclosure rules. These C&DIs provide helpful clarification and additional guidance:[15]

- Prior-year equity awards granted to a first-time NEO must be included in CAP adjustments.

- Disclosure of CAP adjustments on an aggregate basis is not permitted.

- Footnote disclosure of CAP adjustments generally is required only for the most recent fiscal year, except for first-time PvP disclosure, or if it is material to an investor’s understanding of the information reported in the PvP table for the most recent fiscal year.

- If an award provides for retirement eligibility as the sole vesting condition, then this condition would be considered satisfied (i.e., the award would be counted as vested) for calculation of CAP in the year that the holder becomes retirement eligible. However, if retirement eligibility is not the sole vesting condition, other substantive conditions must also be considered in determining when an award has vested. Examples of such substantive conditions include market conditions or a condition that results in vesting upon the earlier of the holder’s actual retirement or the satisfaction of the required period of service.

- Notably, a September 2023 CD&I suggested that time-based awards that vest upon retirement should be counted as vested upon a holder’s attainment of retirement eligibility for purposes of calculating CAP, but a November 2023 C&DI appeared to reverse that position, so that unvested time-based awards that vest upon retirement should be counted as “unvested” until the time-based condition is satisfied or a holder’s retirement actually occurs.

Identifying Peer Groups

- Companies may use the peer groups that they disclose in the Compensation Discussion and Analysis (CD&A) portion of their proxy statements as long as such peer groups were, even without formal benchmarking, “actually used to help determine executive pay.”

- If a company uses the same peer group in its CD&A for 2020 and 2021 but uses a different CD&A peer group for 2022, then the company should present the peer group TSR for each year in the PvP table using the peer group disclosed in the CD&A for the corresponding year.

- If a company uses more than one published industry or line-of-business index for purposes of Item 201(e)(1)(ii) (i.e., its Form 10-K peer group), the company may choose which index to use for PvP disclosure and should footnote disclosure of the chosen index.

- Companies may not use a broad-based equity index as a peer group.

- The market capitalization-based weighting required under Item 402(v)(2)(iv) only applies when the company is not using a published line of business or industry as its peer group.

- If a company that uses a peer group other than a published industry or line-of-business index adds or removes companies in the peer group, the company is required to footnote the changes and compare its cumulative TSR against both the updated peer group and the peer group used in the immediately preceding fiscal year.

- Such comparison is not required if:

- An entity is omitted solely due to no longer being in the same line of business or industry.

- The changes in the composition of the peer index/group occur per preestablished objective criteria.

- Such comparison is not required if:

- The description of, and bases for, the change must still be disclosed, including the names of the companies deleted from the new index/peer group.

Identifying the CSM

- A CSM may be derived from or similar to net income or company TSR.

- Multiyear measurement periods are not permitted for the CSM. The use of a company’s stock price as its CSM is limited: The company may not use its stock price as the CSM if the company did not use that price to directly link CAP to performance during the most recent fiscal year. However, stock price may be used as the CSM if, for example, the company’s stock price is a market condition applicable to a performance-based equity award that was outstanding during the most recent fiscal year, or the stock price is used to determine the size of a bonus pool for the most recent fiscal year.

- A company may use its CSM as the financial performance measure used to determine a bonus pool.

Additional Guidance

- Companies may aggregate multiple overlapping principal executive officers for purposes of the relationship disclosure, to the extent the presentation will not be misleading to investors.

- When multiple individuals served as the principal financial officer during a single covered fiscal year, they are counted separately for purposes of calculating the average compensation amounts paid to NEOs (excluding the principal executive officer).

- A company may include the required GAAP reconciliation and other information in an annex to the proxy statement, provided the company includes a prominent cross-reference to such annex. Or, if the non-GAAP financial measures are the same as those included in the Form 10-K that is incorporating by reference the proxy statement’s Item 402 disclosure as part of its Part III information, the company may comply with Regulation G and Item 10(e) by providing a prominent cross-reference to the pages in the Form 10-K containing the required GAAP reconciliation and other information.

- Awards granted in fiscal years prior to an equity restructuring, such as a spin-off, that are retained by the holder must be included in the calculation of CAP.

- For outstanding stock awards and option awards, the calculations required by Item 402(v)(2)(iii)(C)(1) of Regulation S-K should be determined based on the change in fair value from the end of the prior fiscal year. The fair value of these awards should not be determined based on other dates, such as the date of the company’s initial public offering.

- Market conditions should be considered in determining whether the vesting conditions of share-based awards have been met (i.e., until the market condition is satisfied, companies must include in CAP any changes in fair value of any awards subject to market conditions). Similarly, companies must deduct the amount of the fair value at the end of the prior fiscal year for awards that fail to meet the market condition during the covered fiscal year if that failure results in forfeiture of the award.

- Awards that remain outstanding and have not yet vested, because, for example, performance or market conditions were not met in an eligible year, are not considered to have failed to meet the applicable vesting conditions for the purpose of Item 402(v)(2)(iii)(C)(1)(v).

- If an award with a performance condition requires certification by others (such as the compensation committee) that the level of performance was attained, then whether or not the award is considered vested if certification occurs after year-end depends on whether the certification is considered an additional substantive vesting condition (for example, where an employee does not vest in the award unless and until the employee remains employed through the date such certification occurs).

- Companies may use a valuation technique that differs from the one used to determine the grant date fair value of option or other equity-based awards that are classified as equity in the financial statements as long as the valuation technique would be permitted under the Accounting Standards Codification (ASC) of the Financial Accounting Standards Board (FASB) (Topic 718), including that the method meets the criteria for a valuation technique and the fair-value measurement objective. If the technique differs materially, then disclosure about the change in valuation technique from the grant date and the reason for the change is required.

- The fair value of stock awards and option awards must be computed using a methodology and assumptions consistent with FASB ASC Topic 718, and it is never acceptable to value awards as of the end of a covered fiscal year based on methods not prescribed by GAAP.

- A company is not required to disclose detailed quantitative or qualitative performance conditions for its awards under Item 402(v)(4) (i.e., footnote disclosure of assumptions made in the valuation that differs materially from those disclosed as of the grant date of such equity award) to the extent such information would be subject to the confidentiality protections of Instruction 4 to Item 402(b) of Regulation S-K. However, the company must provide as much information responsive to the Item 402(v) (4) requirement as possible without disclosing the confidential information, such as a range of outcomes or discussion of how a performance condition impacted the awards’ fair value. The company should also discuss how the material difference in the assumptions affects how difficult it will be for the executive or how likely it will be for the company to achieve undisclosed target levels or other factors.

- Dividends (including dividend equivalents) not already reflected in the fair value of stock awards or included in another component of total compensation must be included in the CAP calculation.

Transitional Relief

- The SEC will not object if a company that loses its classification as a smaller reporting company as of January 1, 2024, continues to include scaled disclosure under Item 402(v)(8) in its definitive information or proxy statement filed within 120 days after its 2023 fiscal year-end from which the company’s Form 10-K will forward incorporate the disclosure required by Part III of Form 10-K. The PvP disclosure must cover fiscal years 2021, 2022 and 2023.

- If a company loses its emerging growth company status, for example, as of December 31, 2024, the company will be required to provide PvP disclosure in its proxy statement filed in 2025. However, any such initial PvP disclosure may be provided for three years instead of five, with one additional year added in each of the two subsequent annual filings (i.e., the company may take advantage of the transitional relief provided by Instruction 1 to Item 402(v)).

Disclosure Errors

SEC comment letters released in 2023 revealed the following key common mistakes in initial PvP disclosures:

- Failing to describe the relationship between (a) CAP and (b) TSR, net income and the CSM.

- Failing to include the tabular list.

- Including multiple CSMs or failing to include the CSM in the tabular list.

- Failing to provide a GAAP reconciliation for non-GAAP CSMs.

- Using a TSR peer group that does not match either the industry group in the company’s 10-K performance graph or the compensation peer group disclosed in the CD&A.

- Failing to include or identify all NEOs who served each year.

- Using partial-year compensation (e.g., only including compensation for the time served as an NEO during a given year).

- Valuing awards that vest during the year based on a year-over-year change, rather than valuing them as of the date of vesting.

Preparing for 2024 PvP Disclosure

In addition to reviewing the company’s approach to PvP disclosure in the prior year and SEC guidance and comment letters released in 2023, a company should generally consider the following as it prepares for the second year of PvP disclosure:

- Companies will need to include four years of data in their PvP tables (including the three years previously disclosed and data for the most recently completed fiscal year).

- Based on newly released guidance (as described above), a company should review any applicable equity award agreements with retirement vesting language to ensure whether any changes to the CAP amounts disclosed last year in the PvP table may be necessary, and to confirm that the upcoming PvP disclosure appropriately reflects CAP adjustments for equity awards with retirement vesting conditions.

- A company should update its CSM as needed by evaluating the single most important financial performance measure (not otherwise included in the table) that the company used in the most recently completed fiscal year to link CAP to the company’s performance.

- A company should consider its tabular list of financial performance measures and update as needed to reflect the most important financial measures (including the CSM) the company used for the most recent fiscal year to link CAP to company performance.

- If a company will use a different peer group in its second-year PvP disclosure, the company must explain the reason for the change in a footnote and provide comparison information with respect to both the old and the new peer groups.

- Footnote disclosure of CAP adjustments will only be required for the most recent fiscal year (if the company included CAP adjustments for three years in its first-year disclosure).

Implement Clawback Policy and Comply With Clawback Policy Listing Standards

With the December 1, 2023, deadline for listed companies to adopt Dodd-Frank Act-compliant clawback policies in the rearview mirror, many compensation committee members have checked “adopt a Dodd-Frank Act-compliant clawback policy” off their to-do lists and are breathing a collective sigh of relief. However, now is not the time to forget about the clawback policy until an event triggers its application. Instead, listed companies should factor the clawback action items below into their agendas.

Background

Most listed companies have adopted clawback policies that meet the stock exchanges’ new listing standards issued in response to the SEC’s final rules implementing the incentive-based compensation recovery (clawback) provisions of the Dodd-Frank Act.[16]

The final SEC rules, which were adopted on October 26, 2022, directed the stock exchanges to establish listing standards requiring companies to develop and implement policies providing for the recovery of erroneously awarded incentive-based compensation received by current or former executive officers (as defined under Rule 16a-1(f) under Section 16 of the Securities Exchange Act of 1934 (Exchange Act)) and to satisfy related disclosure obligations, even if there was no misconduct or failure of oversight on the part of an individual executive officer.[17] The Dodd-Frank Act’s clawback rules, together with the final SEC clawback rules and the stock exchanges’ compensation recovery policy listing standards, are referred to collectively herein as “the Dodd-Frank clawback rules.”

Listed companies have a range of clawback policies in practice, from garden-variety Dodd-Frank Act-compliant policies to policies that permit recovery in circumstances absent an accounting restatement. Unless otherwise noted, the term “clawback policy” in this section refers to a Dodd-Frank Act-compliant policy.

Short-Term Action Items

- Confirm clawback policy adoption on the New York Stock Exchange’s Listing Manager, if applicable. Companies listed on the New York Stock Exchange are required to confirm, via Listing Manager, either (i) their adoption of a clawback policy by December 1, 2023, or (ii) their reliance on an applicable exemption.

- File the clawback policy as an annual report exhibit and ensure the annual report cover page is updated. The Dodd-Frank clawback rules require listed companies to file their clawback policies as exhibits to their annual reports on Form 10-K, 20-F or 40-F, as applicable. Companies can also consider whether to voluntarily file any stand-alone supplemental clawback policies that exceed the Dodd-Frank clawback rules’ requirements.

Additionally, listed companies should indicate by checkboxes on the cover pages of their annual reports whether the financial statements included in the filings reflect a correction of an error to previously issued financial statements and whether any of those error corrections are restatements requiring a recovery analysis of incentive-based compensation under their clawback policies. The new disclosure on the cover page of the Form 10-K, 20-F or 40-F must be tagged in interactive block text tag format using eXtensible Business Reporting Language (XBRL).

- Obtain written acknowledgement of the clawback policy from executive officers, to the extent not previously obtained. While executive officers at listed companies will be subject to their company’s clawback policy regardless of whether they acknowledge and agree in writing to be bound by the policy, obtaining each executive officer’s written acknowledgement that they knowingly, voluntarily and irrevocably consent to the clawback policy is a best practice to raise executive officer awareness of the policy, mitigate litigation risk and position the company to promptly recover compensation from executive officers, should the need arise. Such written acknowledgement often takes the form of a stand-alone clawback policy acknowledgement form. Alternatively or as a supplement to a stand-alone clawback policy acknowledgement form, companies may feature a clawback policy acknowledgement provision in compensatory agreements, such as equity award agreements, bonus agreements, employment agreements or offer letters.

Medium-Term Action Items

- Determine which executive officer compensation is incentive-based compensation. The Dodd-Frank clawback rules apply to “incentive-based compensation,” which is “any compensation that is granted, earned, or vested based wholly or in part upon the attainment of any financial reporting measure.”[18] Before an accounting restatement clouds the horizon, listed companies would be wise to reflect on which of their executive officer compensation arrangements are incentive-based compensation.

- Certainly, annual performance-based bonuses set based on achievement of financial reporting measures fall into this category, as do many equity awards that vest based on achievement of performance conditions, such as performance-based restricted stock units that vest based on financial reporting measures such as total stockholder return (TSR). However, other types of executive officer compensation may feature incentive-based compensation more implicitly as an underlying variable, leading aspects of the it to be incentive-based compensation. For example, if a company’s executive officer severance plan provides a pro rata bonus for the year of termination of employment that is paid based on actual company performance which is payable when bonuses are normally paid to actively employed executives, that element of severance could potentially be recoverable as erroneously awarded incentive-based compensation.

- For companies that have a variety of ad hoc compensation arrangements with their executive officers, the importance of taking inventory of which arrangements would be incentive-based compensation is heightened. Such preparation can be crucial to positioning companies with complex and varying compensation arrangements to meet the requirement of recovering erroneously award incentive-based compensation “reasonably promptly” if their clawback policies are triggered.

- Taken together with proxy statement reporting requirements and the challenges of administering executive compensation programs with many ad hoc executive compensation arrangements, the Dodd-Frank clawback rules offer one more compelling reason to simplify and standardize a company’s executive compensation program.

- Reflect on the rationale for and documentation of forms of executive compensation. Considering the “incentive-based compensation” definition in the context of the SEC’s final clawback rule confirms that time-based equity awards, bonuses and other forms of compensation that do not contain performance metrics can fall into the category of “incentive-based compensation” if they are granted in consideration of attainment of a past financial reporting measure. For example, if, in recognition of outstanding revenue performance during 2023, a company granted cash bonuses in 2024 that vest solely based on time-vesting criteria over the next three years, those bonuses would be incentive-based compensation. Therefore, companies should be aware that if they are documenting the rationale for executive compensation as based on prior financial reporting measure performance (whether implicitly or explicitly) in compensation committee resolutions, the Compensation Discussion & Analysis sections of their proxy statements, their executive offer letters or otherwise, that rationale could bring compensation under the umbrella of incentive-based compensation that would have otherwise been excluded from clawback policies, and that could meaningfully increase the scope of recoverable compensation if a clawback policy is triggered.

- Reinforce the importance of an open line of communication between your accounting, finance, HR and legal functions. If an accounting restatement occurs, various functions, such as accounting, finance, HR and legal, along with the company’s audit committee and compensation committee, will need to work hand-in-hand to determine whether, and the extent to which, the accounting restatement triggers application of the clawback policy and the process for compensation recovery, if applicable.

Clawback policies are typically thought to fall in the realm of the HR and legal functions, but accounting and finance functions play crucial roles in identifying whether an event has occurred that has triggered the application of the clawback policy and how much compensation to recover. These functions should be made aware that an accounting restatement could trigger application of the clawback policy and that they have the obligation to alert the other functions if an accounting restatement due to the listed company’s material noncompliance with any financial reporting requirement under the securities laws has occurred. In short, companies should ensure that their accounting, finance, HR and legal functions are all knowledgeable about their clawback policy’s requirements and that they are aware of their interdependencies if an accounting restatement occurs.

Long-Term/As-Needed Action Items

- If stock price or TSR is an input to incentive-based compensation, consider which advisor(s) to engage. The Dodd-Frank clawback rules do not prescribe how to determine the amount of incentive-based compensation to recover if the underlying financial performance metric is stock price or TSR. Determining how an accounting restatement impacts stock price and TSR may entail technical expertise, specialized knowledge and significant assumptions. Moreover, under Item 402(1)(i)(C) of Regulation S-K, if recovery was triggered under the clawback policy for a given fiscal year, the company would be required to disclose an explanation of the methodology it used to determine how much incentive-based compensation related to stock price or TSR to recover, and the company must maintain and provide documentation of the determination in accordance with the listing standard.

Given the complexity of the analysis and that aspects of the analysis will be disclosed externally, companies that have incentive-based compensation tied to stock price or TSR that experience an accounting restatement triggering the clawback policy should consider engaging a third-party valuation expert to assist.

- Determine the means of recovering erroneously awarded incentive-based compensation. Once erroneously awarded incentive-based compensation has been quantified, companies will need to assess how they intend to recover it, such as the means and timing of recovery, as well as how they plan to communicate any repayment obligation to their executive officers. Listed companies should keep in mind that certain states, such as California, have laws that generally prohibit the recovery of wages that have already been paid.[19] While the Dodd-Frank clawback rules are currently expected to preempt conflicting state law, litigation activity in the coming years may definitively confirm whether the Dodd-Frank clawback rules preempt state law and indicate which means of recovery mitigate legal risk.

- If the clawback policy is triggered, consider the tax consequences to the company and executive officers. The Dodd-Frank clawback rules require recovery of erroneously awarded incentive-based compensation on a pre-tax basis. Therefore, if its clawback policy is triggered, a company will need to carefully assess how much of that compensation is or was properly deductible, and may be required to refund the Internal Revenue Service for deductions taken in previous years. Similarly, executive officers should work closely with tax advisors to determine how their taxes are impacted by the clawback policy’s application, including whether any offset is available under Section 1341 of the Internal Revenue Code of 1986 or otherwise, especially to the extent that the offset relates to erroneously awarded incentive-based compensation that was paid in a prior tax year.

The final SEC rules noted “that the extent to which a tax system allows current adjustments for tax paid in prior periods under assumptions that later prove incorrect is a matter of tax policy outside the scope of this rulemaking … [but in] any event, we believe any resulting tax burden should be borne by executive officers, not the issuer and its shareholders.”[20] Open questions concerning how compensation recovered under clawback policies should be taxed are expected to be answered in the coming years as companies begin implementing their clawback policies.

- Disclose how the clawback policy has been applied during or after the last completed fiscal year. The following disclosure requirements generally apply under Item 402(w) of Regulation S-K (or analogous disclosure provisions in the forms applicable to foreign private issuers and listed funds), and the disclosure must be tagged in XBRL. Such disclosure applies in proxy or information statements that call for Item 402 disclosure or the listed company’s annual report on Form 10–K (if not incorporated by reference from the proxy statement):

- If during or after the last completed fiscal year the listed company was required to prepare a restatement that required recovery of erroneously awarded incentive-based compensation under the company’s clawback policy, or there was an outstanding balance as of fiscal year-end of erroneously awarded incentive-based compensation to be recovered from a previous application of the policy, the listed company is required to disclose:

- The date it was required to prepare the restatement.

- The aggregate dollar amount of erroneously awarded incentive-based compensation, including an analysis of how the amount was calculated (with enhanced disclosure if the financial reporting measure related to stock price or TSR).

- The aggregate dollar amount of erroneously awarded incentive-based compensation that remains outstanding at the end of the last completed fiscal year; provided that alternative disclosure would be required if the aggregate dollar amount of erroneously awarded incentive-based compensation had not yet been determined.

- If recovery would be impracticable in accordance with the narrow exceptions in the Dodd-Frank clawback rules, companies are required to briefly disclose why recovery was not pursued and the amount of recovery foregone for each current and former named executive officer and for all other current and former executive officers as a group.

- For each current and former named executive officer from whom, as of the end of the last completed fiscal year, erroneously awarded incentive-based compensation had been outstanding for 180 days or longer since the date the listed company determined the amount owed, the dollar amount of outstanding erroneously awarded incentive-based compensation due from each such individual should be disclosed.

- If the company was required to prepare a restatement during or after its last completed fiscal year and concluded that recovery of erroneously awarded incentive-based compensation was not required under the clawback policy, the company is required to briefly disclose the reasoning behind that conclusion.

- Any recoupment of compensation must be reflected in the Summary Compensation Table by subtracting the amount recovered from the amounts reported in that table for that year and quantifying the amount recovered in a footnote.

- If during or after the last completed fiscal year the listed company was required to prepare a restatement that required recovery of erroneously awarded incentive-based compensation under the company’s clawback policy, or there was an outstanding balance as of fiscal year-end of erroneously awarded incentive-based compensation to be recovered from a previous application of the policy, the listed company is required to disclose:

- Consider whether to amend or supplement the clawback policy. Compensation committees (or boards of directors, if applicable) should consider at least annually whether the clawback policy should be updated in response to proxy advisory firm guidance, other clawback rules and other factors that arise in the coming years as the Dodd-Frank clawback rules are implemented.

- For example, Glass Lewis’ United States 2024 Benchmark Policy Guidelines published in November 2023 expressed a strong preference for clawback policies that permit recovery in circumstances that extend beyond the Dodd-Frank clawback rules’ requirements. Specifically, Glass Lewis stated that recovery policies should permit companies to recover variable incentive payments (whether time-based or performance-based) “when there is evidence of problematic decisions or actions, such as material misconduct, a material reputational failure, material risk management failure, or a material operational failure, the consequences of which have not already been reflected in incentive payments and where recovery is warranted” and regardless of whether the executive officer was terminated with or without cause.[21]

- Glass Lewis also expects robust disclosure about a company’s decision not to pursue recovery under a clawback policy, and, if applicable, how the company has corrected the disconnect between executive pay outcomes and negative impacts of their actions on the company.[22] The absence of such enhanced disclosure could affect Glass Lewis’ overall say-on-pay recommendation.[23]

- Similarly, ISS only awards equity plan scorecard points for the clawback policy factor if a company’s clawback policy authorizes recovery upon a financial restatement of all or most equity based compensation for named executive officers, including time-based and performance-based equity awards.[24] ISS’ explicit inclusion of time-based awards extends beyond the Dodd-Frank clawback rules’ requirements.

- The impact of the U.S. Department of Justice’s Criminal Division’s three-year Pilot Program Regarding Compensation Incentives and Clawbacks (Pilot Program) remains to be seen. Under the Pilot Program, where a criminal resolution is warranted, public and private companies may qualify for reduced fines if they have implemented a compensation recovery program that permits recovery from employees who engaged in misconduct in connection with the conduct under investigation, or others who both had supervisory authority and knew of, or were willfully blind to, the misconduct.[25]

- Chief executive officers (CEOs) and chief financial officers (CFOs) remain subject to the clawback provisions of the Sarbanes-Oxley Act of 2002 (SOX), which provide that if a company is required to prepare an accounting restatement because of “misconduct,” the CEO and CFO are required to reimburse the company for any incentive or equity-based compensation and profits from selling company securities received during the year following issuance of the inaccurate financial statements. If the Dodd-Frank clawback policy and SOX cover the same recoverable compensation, the CEO or CFO are not subject to duplicative reimbursement. Recovery under the Dodd-Frank clawback will not preclude recovery under SOX to the extent any applicable amounts have not been reimbursed to the listed company.

While 2023 was the year of clawback policy adoption, 2024 will be the year of clawback policy implementation. As clawback policies are implemented, prevailing recoupment practices and answers to open questions about the Dodd-Frank clawback rules are expected to emerge, shaping companies’ approaches to implementing their clawback policies.

Prepare for New Option Grant Practice Disclosures

On December 14, 2022, the SEC adopted a new disclosure requirement under Regulation S-K Item 402(x). Under new Regulation S-K Item 402(x), issuers (including smaller reporting companies and EGCs) will be required to disclose on Form 10-K or in the annual meeting proxy statement the issuer’s policies and practices regarding the timing of awards of options in relation to the disclosure of material nonpublic information. Issuers will need to discuss:

- How the timing of awards is decided.

- How material nonpublic information is considered, if at all, when determining the timing and terms of awards.

- Whether disclosure of material nonpublic information is timed to affect the value of such awards.

Issuers will also need to disclose in a new table any options granted in the last completed fiscal year to NEOs that were granted within four business days before or one business day after the (i) filing of a periodic report on Form 10-Q or 10-K, or (ii) filing or furnishing of a current report on Form 8-K that contains material nonpublic information (other than disclosure of a material new option award grant under Form 8-K Item 5.02(e)). The table should provide the following:

- Each award (including the grantee’s name, the number of securities underlying the award, the date of the grant, the grant-date fair value and the option’s exercise price).

- The percentage change in closing market price of the securities underlying each award on the trading day before and after disclosure of the material nonpublic information.

These disclosure requirements will be effective for the proxy filing that covers the first full fiscal year beginning on or after April 1, 2023 (or October 1, 2023, for smaller reporting companies).

This focus on equity grant timing includes an accounting aspect as well. In November 2022, the SEC issued Staff Accounting Bulletin No. 120 (SAB 120), which addresses how companies should recognize and disclose the cost of providing “spring-loaded” equity awards to executives for purposes of Accounting Standards Codification 718.

A “spring-loaded award” is one made prior to (and proximate to) the company’s disclosure of positive and previously material nonpublic information. Under SAB 120, a company that grants an equity award while in possession of positive material nonpublic information should consider whether adjustments to the following are appropriate when determining the fair-value-based measure of the award for purposes of ASC 718:

- The current price of the underlying share; or

- The expected volatility of the price of the underlying share for the expected term of the share-based payment award. Significantly, SAB 120 applies to all equity awards and not just awards of options.

Taken together, the new 402(x) disclosure requirements and SAB 120 indicate that committees should be aware of the timing of equity grants and the public disclosure context in which the grants are made. While focus most often falls on the interplay of grant timing and disclosure of material nonpublic information in the context of stock options and positive disclosure, a company that grants full-value awards that are sized based on a market value for the underlying shares — and makes such a grant in advance of the public announcement of material nonpublic information — should at a minimum have a record of considering whether those awards were sized appropriately given the potential impact of the announcement on the award value.

Whether companies will react to this focus by adopting policies of fixed timing of grants or through other means (such making grants only during open trading windows) remains to be seen. In anticipation of potential expanded scrutiny of the interplay between material nonpublic information and equity awards, some companies are also timing vesting and settlement of their equity awards to occur during open trading windows.

Evaluate Hart-Scott-Rodino Act Implications on Executive Compensation

Officers and directors who hold at least $111.4 million[26] in voting securities in their companies should consider the need to make Hart-Scott-Rodino (HSR) filings whenever they increase their holdings through an acquisition of voting securities. A company’s annual preparation of its beneficial ownership table provides a regular opportunity to assess whether any of its officers or directors may be approaching an HSR filing threshold. HSR counsel can advise when exemptions are available to obviate the need to file notifications.

For HSR purposes, an “acquisition” is the receipt of new voting securities whether formally (technically) purchased or not. An acquisition is considered to occur only when the officer or director obtains beneficial ownership of the shares (i.e., receives the present right to vote for the board of directors). Therefore, acquisitions may include, without limitation:

- Grants of fully vested shares as a component of compensation.

- The vesting or settlement of restricted stock units and performance-based restricted stock units.

- The exercise of stock options.

- Open market purchases of shares.

- The conversion of convertible nonvoting securities into voting shares.

However, an officer or director would not be deemed to “acquire” shares underlying restricted stock units or performance-based restricted stock units that have not vested or shares underlying stock options that have not yet been exercised.

Generally, an “acquisition” can trigger a filing obligation. For example, an annual grant of voting securities pursuant to an officer or director’s long-term incentive plan can require HSR Act filings to be completed in advance of the grant, even if the value of the granted shares does not exceed a filing threshold and if the total percentage amount to be held after closing of the grant does not significantly increase the person’s aggregate holdings.[27] By contrast, a filing requirement is not triggered solely by an increase in the value of an officer’s existing holdings from $110 million to $112 million, for example, as a result of share price appreciation. However, if such officer subsequently wanted to exercise a stock option to acquire more stock, an HSR obligation could be triggered because the value of the officer’s current holdings already exceeds the filing threshold.

The need for a filing is triggered whenever — after the acquisition of voting securities — the aggregate value of an officer or director’s holdings of voting securities in the company exceeds an HSR filing threshold (the lowest of which is currently $111.4 million). Current holdings plus the proposed acquisition are considered to determine whether a threshold has been met or crossed.

There are also higher HSR reporting thresholds and, if an acquisition of voting securities causes an officer’s or director’s holdings to exceed those thresholds, additional notifications are required. The next two adjusted filing levels are currently $222.7 million or higher and $1.1137 billion or higher.[28]

If an HSR filing is required, both the individual and the company would need to make a filing and wait 30 days before completing the triggering acquisition. The filer has one year from the time of clearance to cross the applicable acquisition threshold and may make additional acquisitions for five years after the end of the waiting period with no further HSR filings, provided that the filer does not acquire sufficient shares to cross the next HSR threshold above the level for which the notification was filed.

The Federal Trade Commission and the Department of Justice have historically followed an informal “one free bite at the apple” enforcement practice in response to certain missed HSR filings, meaning that, if an officer or director inadvertently fails to make a required HSR filing, that person should notify the agencies and submit a corrective filing detailing his or her previous acquisitions and explaining the missed filing and how he or she plans to track and meet filing obligations in the future. This one “free bite” may address all prior missed filings that occurred before the corrective filing.

However, the Federal Trade Commission and the Department of Justice have otherwise pursued enforcement actions and may impose material civil penalties of up to $50,120 per day[29] for each day of noncompliance if an executive officer or director subsequently fails to make a required HSR filing, even if such failure was truly inadvertent.[30] Therefore, officers and directors who have made corrective filings should be especially vigilant and consult HSR counsel regularly before a potential “acquisition” event is expected to occur.

The full report can be downloaded here.

Endnotes

1See Semler Brossy’s report “2023 Say on Pay & Proxy Results” (Sept. 28, 2023). See also Semler Brossy’s report “2022 Say on Pay & Proxy Results” (Jan. 12, 2023). Unless otherwise noted, Semler Brossy’s report is the source of pay ratio, say-on-pay and equity plan proposal statistics in this guide.(go back)

2See Semler Brossy’s report “2023 Say on Pay & Proxy Results” (Sept. 28, 2023).(go back)

3See ISS’ FAQ “United States Compensation Policies” (Dec. 16, 2022).(go back)

4For more information, see ISS’ “Pay-for-Performance Mechanics” white paper.(go back)

5See Glass Lewis’ 2024 Benchmark Policy Guidelines – United States

(Nov. 16, 2023).(go back)

6See Willis Towers Watson’s report “U.S. Executive Pay Votes” (Oct. 2023).(go back)

7See Semler Brossy’s report “2023 Say on Pay & Proxy Results” (Sept. 28, 2023).(go back)

8See Semler Brossy’s report “2022 Say on Pay & Proxy Results” (Sept. 29, 2022).(go back)

9See Semler Brossy’s report “2023 Say on Pay & Proxy Results” (Sept. 28, 2023).(go back)

10See ISS’ FAQ “United States Equity Compensation Plans” (Dec. 11, 2023).(go back)

11ISS lists the burn rate benchmarks applicable for meetings on or after February 1, 2023, in the Appendix section of its FAQ; see id.(go back)

12See ISS’ “Company Peer Group Feedback” (2023).(go back)

13Emerging growth companies, smaller reporting companies and foreign private issuers are exempt from the pay ratio disclosure requirement. Transition periods are also available for newly public companies.(go back)