Subodh Mishra is Global Head of Communications at ISS STOXX. This post is based on an ISS-Corporate memorandum by Jun Frank.

Introduction

The 2024 proxy season opened with two explosive court cases: a landmark Delaware court ruling that

vacated Elon Musk’s pay and ExxonMobil’s court challenge to exclude a shareholder proposal on

greenhouse gas (GHG) emissions reduction from the proxy. These court cases highlight the emerging

tensions between corporates and their shareholders.

While calls for more robust governance and board accountability are growing, pressure against

Environmental & Social considerations is increasing. Both investors and issuers will need to navigate

these sometimes-competing trends carefully and evaluate the impact their actions may have on

various constituencies as issuers prepare their proxies and shareholders cast their votes. ISS-Corporate has examined key themes, trends, and notable shareholder proposals that are likely to

shape the discourse during the proxy season.

Key Takeaways

- The Delaware ruling on Musk’s pay and Exxon’s court challenge highlight two key themes of

the 2024 proxy season: a focus on board governance and increasing pressure against

Environmental & Social (E&S) agendas. - Shareholder proposals aiming to enhance board accountability increased significantly

between 2020 and 2023, and early data suggests momentum will continue in 2024. - Director election support continues to erode, particularly for senior board members

responsible for the company’s governance, a trend that is likely to accelerate. - Counter-ESG shareholder proposals increased in both volume and as a percentage of all

proposals submitted between 2020 and 2023. Early data indicates that the increase will

continue. - More and more asset managers are offering more choices to their fund investors in how the

votes are cast. As a result, votes cast by a single fund may represent a myriad of opinions and

policies.

Board Accountability in Focus

Shareholders Demanding Greater Board Independence

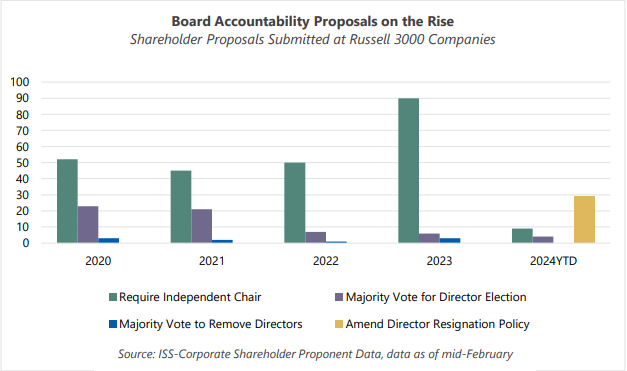

Shareholder proposals aimed at improving board independence and accountability have increased

dramatically, and there are early signs that the trend is set to continue. Proposals include those

seeking to require an independent board chair, to adopt a majority vote standard for director

elections, to allow for the removal of directors by a majority vote, and a new type of proposal to

amend director resignation policy to make director elections more consequential. There were nearly

100 such proposals submitted at Russell 3000 companies in 2023, up from 78 in 2020.

The increase in volume was driven largely by a surge in independent board chair proposals, while

majority vote proposals became less prevalent. Proposals on independent board chairs reached a

record high of 90 in 2023, up from 52 in 2020. Majority vote proposals dropped from 23 in 2020 to

just six during that period.

Based on shareholder proposals submitted so far, calls for greater board accountability are set to

increase. The 42 such proposals submitted represent 12.1% of the total submitted at Russell 3000

companies for 2024 shareholder meetings. These proposals represented 10.6% of all shareholder

proposals in 2023 compared with 9.8% in 2020.

Shareholder Proposals to Amend Director Resignation Policy

A novel type of proposal accounts for much of the increase in board accountability initiatives in 2024.

Carpenters Pension Funds have filed at least 29 proposals seeking to amend a company’s director

resignation policy and adopt a more consequential majority voting standard. The number of

proposals is second only to the 31 GHG emissions proposals made so far in the 2024 season.

Many U.S. companies have a director resignation policy that requires directors to submit their

resignation to the board if they fail to receive majority support from investors. However, the board

can reject those resignations in most cases. Some investors, including the Council of Institutional

Investors (CII), say that board-rejectable resignation policies lack “teeth” as they allow directors to

remain on the board despite failing to receive majority support.

These proposals to amend the resignation policy would force directors to submit an irrevocable but

conditional letter of resignation. That means the board must accept the resignation unless it presents

a compelling reason to reject it. If a director fails to receive a majority vote two years in row, that

director is dismissed automatically within 30 days. This approach is similar to so-called

“consequential” majority voting which forces immediate removal from the board following a failed

election, but is not as onerous as it gives boards some level of flexibility in its response to the first

failed election.

It remains to be seen how institutional investors and proxy advisors will respond to these novel

proposals on director resignation policy. Some may be attracted by the balance between making

shareholder votes more consequential while still giving the board a say in a director’s dismissal.

Director Election Showing Weakening Support

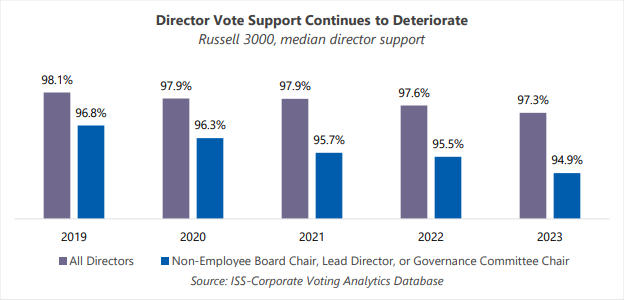

Amid this greater push for board accountability, shareholder support for sitting directors, especially

those most responsible for governance, has been declining steadily. Median support in director

elections declined to 97.3% in 2023 from 98.1% in 2019. More tellingly, the median support for non-employee board chairs, lead directors, and nominating & governance committee chairs have

declined at a much more dramatic rate, to 94.9% in 2023 from 96.8% in 2018. The gap between the

two has increased to 2.4 percentage points.

Non-employee board chairs, lead directors, and nominating & governance committee chairs typically

are the most senior board members who are responsible for the company’s governance practices.

When investors have concerns over the company’s governance or board oversight, they often voice

their concern by opposing these senior board members. A number of factors may be contributing to

negative votes, such as a lack of board independence or diversity, a preponderance of long-tenured

directors, the presence of material or immaterial related-party transactions, directors’ commitments

outside of the company, or even disclosure and handling of environmental and social considerations.

With board governance back in the spotlight and shareholder activists’ pushing for greater

accountability, the trend of deteriorating support is likely to grow, and directors who have historically

enjoyed strong backing may start to see their support decline, even when proxy advisors support

their election.

Board Accountability and Executive Pay

Special Equity Grants Triggering Shareholder Pushback

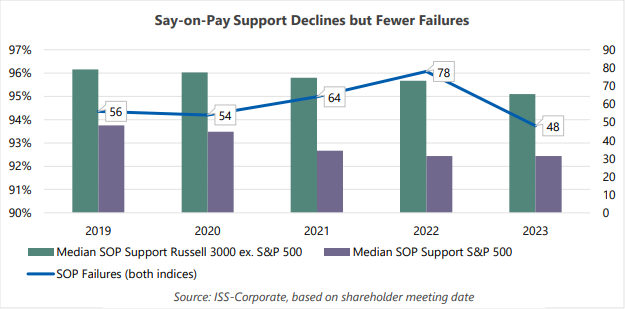

Median support for Say-on-Pay (SOP) proposals has also steadily dropped over the past several

years to 92.4% in 2023 for S&P 500. However, more companies were able to secure majority support

for their SOP proposals, compared to record-breaking SOP failures in 2021 and 2022.

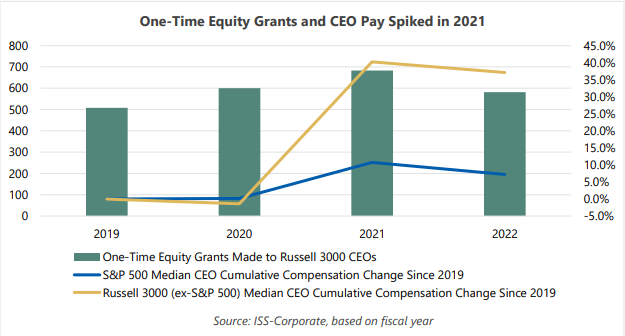

Many of the failures in 2021 and 2022 were driven by one-time discretionary compensation

arrangements in response to the Covid-19 pandemic and post-pandemic challenges in retaining,

recruiting, and incentivizing talent. Some of these, such as special equity awards to retain executives,

were met with significant opposition from shareholders. However, many compensation committees

responded to these concerns by conducting extensive shareholder outreach and proactively

addressing the underlying issues. Further, there were more than 100 fewer one-time equity grants[1] made during fiscal 2022 compared with the year earlier, and many CEOs saw their pay shrink as well. These actions likely demonstrated board responsiveness and accountability to shareholders, helping to reverse the trend of high SOP failures.

The volume of one-time equity grants for fiscal 2023 may further decline to pre-pandemic levels, and

SOP failures may stay steady. However, companies that did grant one-time equity awards could see

greater scrutiny during the 2024 proxy season, with investors questioning not just the quantum,

structure, and rationale for the grant, but also the process through which it was negotiated. Material

concerns over a company’s board and governance practices could cast doubt on the appropriateness

of the grant and vice versa.

Sustainability Proposal Support Recedes Under Pressure

The politicization of ESG principals in the U.S. and the Supreme Court’s landmark rulings against

affirmative action programs are expected to contribute to a growing challenge to the effectiveness

and purpose of integrating ESG principles in the company’s operations.

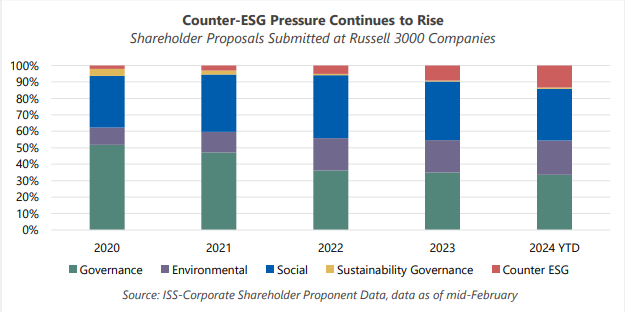

The number of shareholder proposals aiming to challenge the impact of incorporating ESG factors,

such as diversity and inclusion or climate change, on the company’s long-term shareholder value

(counter-ESG proposals[2]), almost doubled last year to 85 among Russell 3000 companies. Such proposals rose to more than 13% of the total submitted thus far for the 2024 shareholder meetings from just 2.1% in 2020.

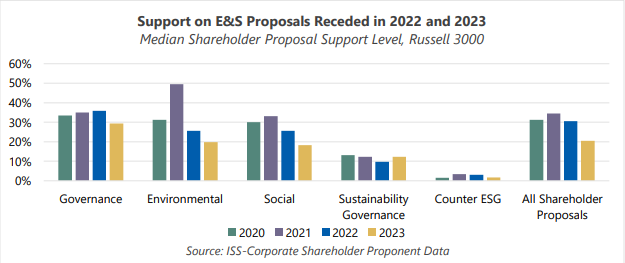

While counter-ESG proposals rarely receive significant backing, the counter-ESG movement appears

to be damping support level for shareholder proposals in general and those pushing for

environmental and social (E&S) initiatives in particular. Median support on counter-ESG proposals

trended around 2% to 3% between 2020 and 2023. By contrast, support for E&S proposals peaked in

2021 to nearly 50% for environmental proposals. That support, however, cratered in 2022 and 2023.

Pressure against ESG initiatives appears set to intensify as evidenced by an increase in share of

counter-ESG proposals, and support for E&S proposals likely will remain muted in the 2024 proxy

season.

Pass-Through Voting Offering More Voting Choices, Less Visibility to Voting Preferences

The expansion of pass-through voting could change how votes are cast by some of the largest asset

managers this proxy season. Three of the largest asset managers, BlackRock, Vanguard, and State

Street, have recently expanded programs to offer more voting choices to their fund investors,

including retail investors holding popular exchange traded funds (ETFs). Advocates of pass-through

voting, which allows fund investors greater ability to direct how votes are cast, say that it enables

increased individual investor participation in the proxy voting process. A more cynical view is that the

practice can shield large asset managers from criticism that they exert undue influence over

corporate issuers.

Regardless, the expansion of voting choices to popular ETFs means votes for trillions of dollars’

worth of assets under management could be impacted by individual fund investors’ preferences and

views. In these programs, fund investors are being offered an option to select a policy including the

asset managers’ standard proxy voting guideline as well as third-party policies offered by proxy

advisors such as ISS and Glass Lewis. Retail investors for the first time have the ability to cast votes

based on the ISS Benchmark Policy, ISS Catholic Faith-Based Policy, or ISS SRI Policy, among many

other choices being made available to them.

More voting choices could also mean less visibility for issuers. A fund could split its votes based on a

myriad of policies, whose perspectives and approaches may differ significantly. An issuer, believing a

fund holding significant shares would vote a certain way, may see some shares being voted

differently.

Most issuers pay little attention to policies and voting preferences beyond proxy advisors’

benchmark policies and top institutional investors’. However, as pass-through voting expands, issuers

may need to stay abreast of various policy options made available to the broader investor public in

order to understand voting behavior and its drivers.

Endnotes

1One-time equity grants here refer to any equity awards other than annual equity grants and new hire and promotion awards.(go back)

2Proposals are categorized into five categories based on the nature or intent of the proposal and the proponent’s stated objectives: Governance, Environmental, Social, Sustainability Governance, and Counter-ESG.(go back)

Print

Print