John Galloway is Global Head of Investment Stewardship at Vanguard, Inc. This post is based on a publication by Vanguard Investment Stewardship.

Vanguard’s Investment Stewardship Program

Vanguard’s Investment Stewardship program has a clear mandate to safeguard and promote long-term shareholder returns on behalf of the Vanguard-advised funds and their investors. We carry out this mandate by promoting governance practices that are associated with long-term investment returns at the companies in which the funds invest. When portfolio companies held by the funds generate shareholder returns over the long term, Vanguard-advised funds generate returns for their investors.

The Vanguard-advised funds

Vanguard-advised funds are primarily index funds managed by Vanguard’s Equity Index Group; these funds track specific benchmark indexes constructed by independent third parties.[1] This structure means that managers of index funds do not make active decisions about where to allocate investors’ capital. As a result, Vanguard-advised equity index funds are built to track specific benchmark indexes, follow tightly prescribed strategies, and adhere to well-articulated and publicly disclosed policies.[2]

Vanguard’s equity index funds are long-term investors in numerous public companies around the world. A small portion of Vanguard-advised funds is managed by Vanguard’s Quantitative Equity Group using proprietary quantitative models to select a broadly diversified portfolio of securities aligned with a fund’s investment objective.[3]

What we do

All aspects of Vanguard’s Investment Stewardship program are focused on safeguarding and promoting long-term investment returns with the goal of giving investors in Vanguard-advised funds the best chance for investment success. We do this by:

Engaging with portfolio company directors and executives to learn about each company’s corporate governance practices and to share our perspectives on corporate governance practices associated with long-term investment returns.

Voting proxies at portfolio company shareholder meetings based on each fund’s proxy voting policies.

Promoting governance practices associated with long-term investment returns through our published materials and participation in industry events.

On behalf of Vanguard-advised funds, we seek to understand how portfolio company boards—which are elected to serve on behalf of all shareholders, including Vanguard-advised funds—effectively carry out their responsibilities. We examine how each board is composed to provide for the long-term success of their company, how it consults with management on strategy and oversees material risks, how it aligns executive incentives with shareholder interests, and how it safeguards the rights of shareholders.

Our four pillars

The Vanguard-advised funds’ portfolio construction process is inherently passive—the equity index funds seek to track benchmarks determined by unaffiliated index providers. Our approach to investment stewardship operates in that context. Accordingly, with respect to companies held by Vanguard-advised funds, we do not seek to dictate strategy or operations, nor do we submit shareholder proposals or nominate board members. We believe that the precise strategies and tactics for maximizing long-term investment returns should be decided by a company’s board of directors and management team. Similarly, Vanguard does not use investment stewardship activities to pursue public policy objectives. We believe that setting public policy, including policy on environmental and social matters, is appropriately the responsibility of elected officials.

Our analysis of companies’ corporate governance practices is centered on four pillars of good corporate governance:

Board composition and effectiveness

Good governance begins with a company’s board of directors. Our primary focus is on understanding to what extent the individuals who serve as board members are appropriately independent, capable, and experienced.

Board oversight of strategy and risk

Boards should be meaningfully involved in the formation and oversight of strategy and have ongoing oversight of material risks to their company. We work to understand how boards of directors are involved in strategy formation, oversee company strategy, and identify and govern material risks to shareholders’ long-term returns.

Executive pay (compensation or remuneration)

Sound pay programs linked to relative performance drive long-term shareholder returns. We look for companies to provide clear disclosure about their compensation practices, the board’s oversight of those practices, and how the practices are aligned with shareholders’ long-term returns.

Shareholder rights

We believe that governance structures should allow shareholders to effectively exercise their foundational rights. Shareholder rights enable a company’s owners to use their voice and their vote—in proportion to their economic ownership of a company’s shares—to effect and approve changes in corporate governance practices.

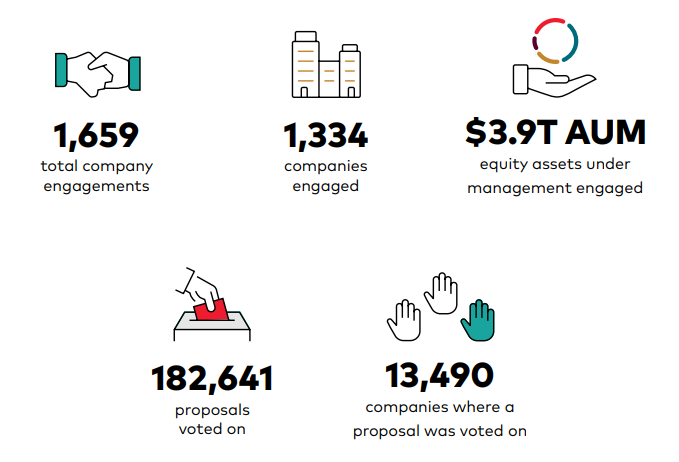

Investment Stewardship activity at a glance

In 2023, our team of more than 60 investment stewardship professionals engaged with 1,334 companies in 31 different markets representing 69% of the Vanguard-advised funds’ total assets under management (AUM).

Regional roundup

In this section, we highlight notable corporate governance topics and trends Vanguard’s Investment Stewardship team observed in various regions around the world in 2023.

We provide this report, and other publications and briefs, to give investors in Vanguard-advised funds and other market participants an understanding of the engagement and proxy voting activities we conduct on behalf of Vanguard-advised funds.

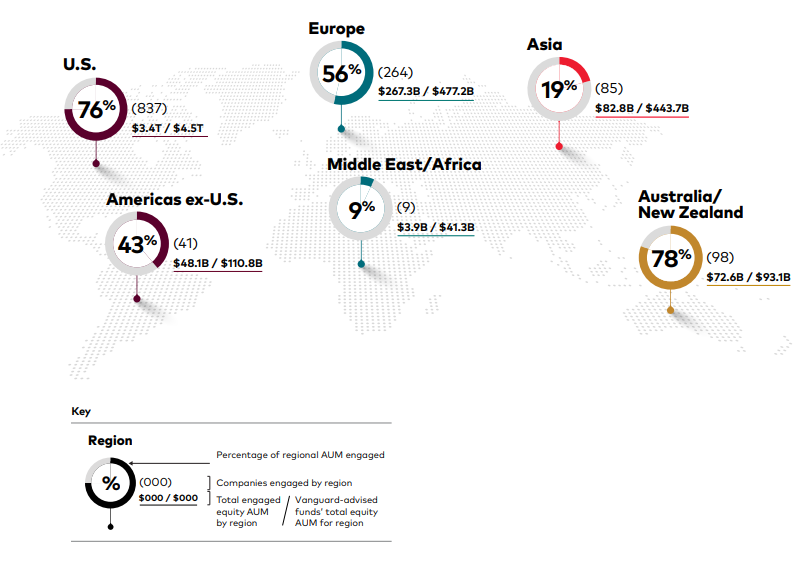

Regional engagement figures for 2023

The following figures represent the Vanguard Investment Stewardship’s team global engagement activities on behalf of the Vanguard-advised funds, in 2023.[4]

Americas

During the 2023 proxy year in the Americas (U.S., Canada, and Latin America), we engaged with portfolio company directors and executives on topics including board and committee leadership refreshment, their onboarding processes for new directors, and their oversight of material risks. We saw many U.S. boards implement new or revised practices in response to the universal proxy card, including, for example, increased disclosure of board skills matrices, director capacity and commitment policies, and board effectiveness assessments. Certain U.S. and Canadian shareholders continued to express interest in how boards are managing material environmental and social risks; this was reflected in the increased number of shareholder proposals submitted on environmental and social topics. In Latin America, many of our conversations were centered on issues of board independence, risk oversight, and disclosure.

In 2023, we engaged with 878 companies across the Americas on a range of governance and risk oversight topics, and the funds voted on over 47,000 proposals at nearly 4,800 portfolio companies across the region. In addition to direct company engagements, the Investment Stewardship team also regularly attended industry events across the U.S. to promote corporate governance practices associated with long-term investment returns and to share our perspectives and approach.

Board composition and effectiveness

In our engagements with leaders of U.S. and Canadian companies, we frequently discussed the evolution of boards’ composition over time and boards’ self-evaluation processes.

We saw many companies implement practices and enhance disclosure related to their board skills matrices, director capacity and commitment policies, and board effectiveness assessments. We shared with companies our perspective that these changes and their related disclosures give shareholders greater visibility into board operations and a better understanding of how boards fulfill their oversight role.

Across the Americas, independence was a primary factor in instances where the funds did not support a director’s election. When we observe a lack of sufficient board independence and/or have concerns related to key committee independence, the funds may not support the election of certain directors.

In addition, in the U.S. and Canada, the funds did not support compensation committee members in instances where issuers had not appropriately responded to significant concerns with executive compensation expressed through the prior year’s Say on Pay vote. While we have seen U.S. and Canadian company disclosures on board composition improve in recent years, we observed continued opportunities for Latin American companies to enhance timely disclosure of director nominees and their backgrounds, especially with regard to independence. The funds voted against a number of directors in Latin American markets for this reason.

Board oversight of strategy and risk

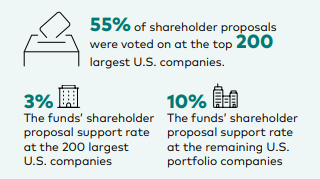

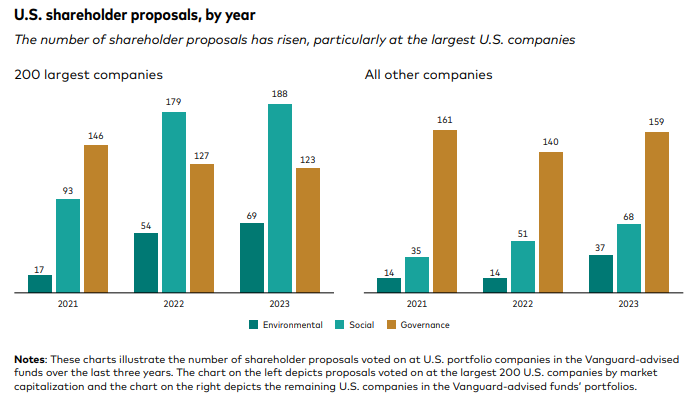

At U.S. public companies, the number of shareholder proposals related to environmental and social matters rose by approximately 21% in 2023. This increase continued a trend attributable, in part, to changes the Securities and Exchange Commission made in 2022 to guidance regarding issuers’ ability to exclude proposals from their ballots.[5] As part of our process for evaluating shareholder proposals, we discussed with company directors how their respective boards undertake prioritization exercises to identify, define, and mitigate material risks to their companies, in areas such as cybersecurity, operations, human capital management, and the post-pandemic supply chain.

We observed that shareholder proposals are primarily submitted at the largest U.S. issuers, which generally have more developed governance practices and greater resources dedicated to relevant disclosure than smaller issuers. Through our case-by-case analysis of each shareholder proposal, we observed, in many instances, evidence of appropriate risk oversight, board governance, and disclosures, which frequently led to the funds voting against the shareholder proposal in question.

Executive pay (compensation)

We continued to observe the use of one-time awards by certain U.S. companies as a part of their compensation programs. This practice increased during the COVID-19 pandemic and has remained above pre-pandemic levels, even as the business environment has stabilized for many issuers. In many of our engagements related to this practice, directors cited retention concerns and recruitment challenges as their rationale.

The funds supported over 96% of advisory votes on executive compensation (Say on Pay) in the U.S. and Canada, primarily due to companies’ ability to clearly articulate, through disclosure and/or engagement, the need for such awards, as well as the expected alignment of the awards with the long-term performance of the company.

Shareholder rights

We observed that many U.S. companies, in response to legal and regulatory changes, unilaterally amended company bylaw provisions to limit executives’ liability, require specific jurisdictions for litigation, and/or adopt advance notice provisions impacting shareholders’ ability to bring proposals and director nominations to votes at company meetings of shareholders. In these cases, we reviewed the impact these changes had on shareholder rights and engaged with companies to understand their rationale for adopting the provisions. In instances where we determined that the provisions were unduly onerous and/or otherwise alienated shareholder rights, the funds voted against relevant members of the board’s governance committee to express concern.

Endnotes

1For the year ended December 31, 2023, index equity portfolios advised by Vanguard represented 99% of the Vanguard-advised equity funds’ total assets under management.(go back)

2Vanguard-advised equity index funds are constructed using either a full replication or sampling approach. Under a full replication approach, a fund buys and holds the securities in the fund’s benchmark index in proportion to each security’s weighting in the fund’s benchmark index. Under a sampling approach, a fund buys and holds a representative sample of securities in the index that approximates the full index in terms of key characteristics.(go back)

3In aggregate, as of December 31, 2023, the funds managed in whole or in part by Vanguard’s Quantitative Equity Group represented approximately 1% of the Vanguard-advised funds’ equity assets under management.(go back)

4Data presented are for the 12-month period ended December 31, 2023. Numbers and percentages reflect rounding.(go back)

5See www.sec.gov/corpfin/staff-legal-bulletin-14l-shareholder-proposals.(go back)

Print

Print