Matthew Morreale, Elad Roisman, and Michael L. Arnold are Partners at Cravath, Swaine & Moore LLP. This post is based on a Cravath memorandum by Mr. Morreale, Mr. Roisman, Mr. Arnold, John W. White, and Kimberley S. Drexler.

Introduction

As we previously reported,[1] on March 6, 2024, the Securities and Exchange Commission (the “SEC” or the “Commission”) adopted (in a three-two vote) long-awaited climate-related disclosure rules for public companies (the “Final Rules”).[2] The Final Rules, although not as prescriptive as the rules that were proposed almost two years prior (the “Proposed Rules”),[3] contain broad-sweeping requirements that constitute a significant expansion of the amount of climate-related disclosure that public companies will have to make. Accordingly, the Final Rules will impose significant burdens in terms of the amount of time, resources and effort necessary for companies and their advisors to comply.

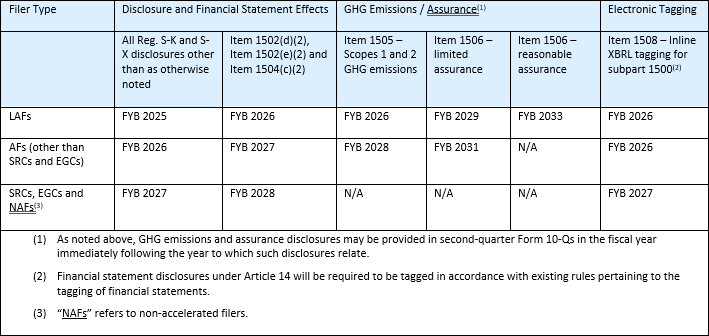

The Final Rules, which will become effective 60 days after publication in the Federal Register, apply to both domestic and most foreign private issuers (“FPIs”), regardless of industry sector, and to annual reports and registration statements.[4] As explained in Section 03 below, compliance obligations are phased in at different times depending on the requirement and the registrant’s filer status, with the first filing deadline occurring as early as March 2026 for large accelerated filers (“LAFs”), covering fiscal years beginning (“FYB”) in 2025.

Key Takeaways

- The Final Rules require disclosure about board and management governance of climate-related risks, material impacts of such risks, processes for managing such risks, transition plans used to manage material transition risks and climate-related targets or goals that materially affect the company’s business, among other related topics.

- We expect many companies will revisit their governance practices around these matters before the end of 2024 to ensure they are in a position to provide comprehensive disclosures in response to these requirements.

- The Final Rules do not require Scope 3 greenhouse gas (“GHG”) emissions disclosures for any registrants; however, they do require disclosure of Scope 1 and/or 2 GHG emissions metrics, if material, by accelerated filers (“AFs”) and LAFs on a phased-in basis starting in 2027 for LAFs (covering FYB 2026) and 2029 for AFs (covering FYB 2028).

- Disclosure of material Scope 1 and/or 2 GHG emissions metrics may be provided in registrants’ Form 10-Q for the second fiscal quarter of the fiscal year immediately following the year to which such metrics relate, giving them more time to prepare such disclosure.

- As with many of the disclosures in the Final Rules that are materiality-qualified, registrants should ensure they have appropriate controls, procedures and documentation regarding the materiality determination of their GHG emissions.

- As described further below, while the SEC has expressly incorporated a traditional definition of “materiality” derived from long-standing Supreme Court precedent, there are discussions in the Adopting Release that should guide how companies undertake materiality analyses under the Final Rules.

- Even if the registrant is confident these GHG emissions are not material, it appears that the SEC expects them to be tracked in order to make such a determination, and such tracking will need to be covered by disclosure controls and procedures maintained in accordance with the Sarbanes-Oxley Act of 2002 (“DCP”).

- Attestation reports regarding GHG emissions metrics will be required on a phased-in basis starting in 2030 for LAFs (covering FYB 2029) and 2032 for AFs (covering FYB 2031); the reports must be done at a limited assurance level, with a step up to reasonable assurance for LAFs four years later. Various requirements regarding the expertise and independence of attestation providers also apply.

- Companies should carefully monitor the development of the market for attestation services to understand what provider may be most suitable for them; but we expect that, since many companies will be in the market for the same service providers at the same time, costs may end up being more expensive than for current attestation services.

- The Final Rules also require registrants to disclose any climate-related target or goal set by the registrant—whether or not already publicly disclosed—that has materially affected or is reasonably likely to materially affect the registrant’s business, results of operations or financial condition, as well as provide annual updates on the progress made towards such target or goal.

- We expect this disclosure to be closely scrutinized by investors from year to year; companies may face related shareholder proposals and need to conduct heightened shareholder engagement with both traditional investors and activists if they are not disclosing sufficient progress towards their goals.

- There is no provision in the Final Rules that would allow companies to exclude targets or goals framed in terms of Scope 3 GHG emissions. This means that, while the Final Rules do not require the reporting of Scope 3 GHG emissions directly, some registrants may nonetheless need to report progress regarding a climate-related goal that includes their Scope 3 emissions (such as a net-zero goal), which would in turn require DCP coverage of such Scope 3 emissions, as well as potentially, in quantifying such progress, some level of disclosure of the Scope 3 emissions themselves.

- The Final Rules provide a safe harbor for forward-looking statements, but not “historical facts,” about transition plans, scenario analyses, use of internal carbon prices and targets and goals made pursuant to the new disclosure requirements.

- As described further below, companies should avoid putting too much reliance on this safe harbor as significant portions of the required disclosures on these topics will likely constitute historical facts that are outside the scope of the safe harbor.

- All registrants must disclose the aggregate amount of expenditures, losses, capitalized costs and charges incurred as a result of severe weather events and other “natural conditions” such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures and sea level rise, subject to certain minimum thresholds.

- Although the Regulation S-X provisions in the Final Rules are significantly easier to comply with than those in the Proposed Rules, the development and testing of accounting policies and internal control over financial reporting (“ICFR”) related to these requirements will likely represent one of the most immediate tasks for companies in responding to the Final Rules.

- Requirements are generally phased in by filer type, applying first to LAFs, then to AFs and finally to smaller reporting companies (“SRCs”) and emerging growth companies (“EGCs”). The Final Rules will apply to registration statements for initial public offerings.

- As anticipated, litigation challenging the Final Rules has already been filed, including by companies, trade groups, environmental groups and attorneys general from over a dozen states in the D.C., Second, Fifth, Eighth and Eleventh Circuits. The federal petitions were consolidated to the Eighth Circuit on March 21, 2024.

- Notwithstanding any uncertainty about the future of the Final Rules, companies should not wait to begin preparation for compliance, as some of the more time-consuming items described above will require significant time to implement and companies will not want to be caught unprepared if the Final Rules are upheld.

- We suggest that companies promptly start planning for compliance, including by taking the following key next steps: (1) establishing internal controls and procedures (including ICFR) in order to comply with the Regulation S-X requirements that will cover periods starting as early as January 1, 2025, for LAFs; (2) if they are AFs or LAFs, getting prepared to track Scope 1 and 2 GHG emissions, if they are not already, and assess the materiality of such emissions; (3) scoping and assessing materiality with respect to other climate-related matters under the Final Rules; (4) reviewing climate-related targets and goals; and (5) considering the interplay of the Final Rules with other applicable climate-related reporting obligations.

Compliance Dates

The Final Rules are subject to delayed and staggered compliance dates as shown below.

Endnotes

1See our client alert providing a high-level summary of the Final Rules (as defined above), available at: https://www.cravath.com/news/sec-adopts-climate-disclosure-rules-for-public-companies.html.(go back)

2See SEC Adopting Release, “The Enhancement and Standardization of Climate-Related Disclosures for Investors” (March 6, 2024), available at: https://www.sec.gov/rules/2022/03/enhancement-and-standardization-climate-related-disclosures-investors#33-11275 (the “Adopting Release”).(go back)

3See our memorandum summarizing the Proposed Rules, available at: https://www.cravath.com/news/sec-proposes-landmark-rules-to-enhance-and-standardize-climaterelated-disclosures.html.(go back)

4Although the Commission refers to “periodic reports” in the Adopting Release, quarterly reports will be impacted only in order to provide disclosure that would otherwise be required in annual reports on a delayed basis, as explained in Section 06 above. For additional information on the application of the Final Rules to FPIs, see Section 10 above.(go back)

Print

Print