Subodh Mishra is Global Head of Communications at ISS STOXX. This post is based on an ISS-Corporate memorandum by Veronica Nikitas.

Key Takeaways

- Only about 15% of companies in the S&P 500 provide some disclosure in proxy statements about board oversight of AI.

- Disclosure of board oversight of AI and directors’ AI expertise is primarily found in the information technology sector, with 38% of companies providing some level of board oversight disclosure.

- 13% of S&P 500 companies have at least one director with AI-related expertise.

- As AI becomes a material factor for many companies, investors may start to demand that companies not only disclose relevant board skills and oversight responsibilities but also enhance disclosure on AI.

Introduction

Artificial intelligence (AI), the use of technology to execute or simulate processes that would otherwise require human intelligence, is quickly evolving. Companies have begun to use the rapidly expanding technology to help achieve efficiency, increase competitive advantages, and enhance engagement with stakeholders. Early adopters are implementing AI in a variety of ways, such as sales/marketing, product development, and legal.

However, while AI may provide unique opportunities for companies, there are significant risks and challenges surrounding its implementation. Mentions of AI are up by 77%,[1] and many companies are beginning to cite AI as a risk.[2] Given these circumstances, the White House has taken the first step in regulating this technology by issuing a sweeping executive order on AI on October 30.

Reflecting the rising importance of AI’s impact on businesses, some companies are recruiting directors with AI expertise and establishing board-level oversight. To assess how boards may evolve to manage and oversee this new area of potential risks and opportunities, ISS-Corporate examined S&P 500 company DEF 14As filed from September 2022 through September 2023 for mentions of board oversight and director skills related to AI.

Board Oversight of AI

Board oversight of AI can take on many forms as it has varying degrees of relation to a company’s overall business strategy. For the purposes of this evaluation, a company was determined to have oversight of AI if it disclosed in the proxy statement that: (1) the full board or a specific committee either has oversight responsibility of AI or AI was mentioned as one of the topics evaluated by the board or the committee during the year, (2) at least one director has expertise in the field of AI, or (3) the company has established an AI ethics board or a similar governing body tasked with overseeing AI-related topics. References to AI in business strategy or executive officer expertise were not included in the assessment process.

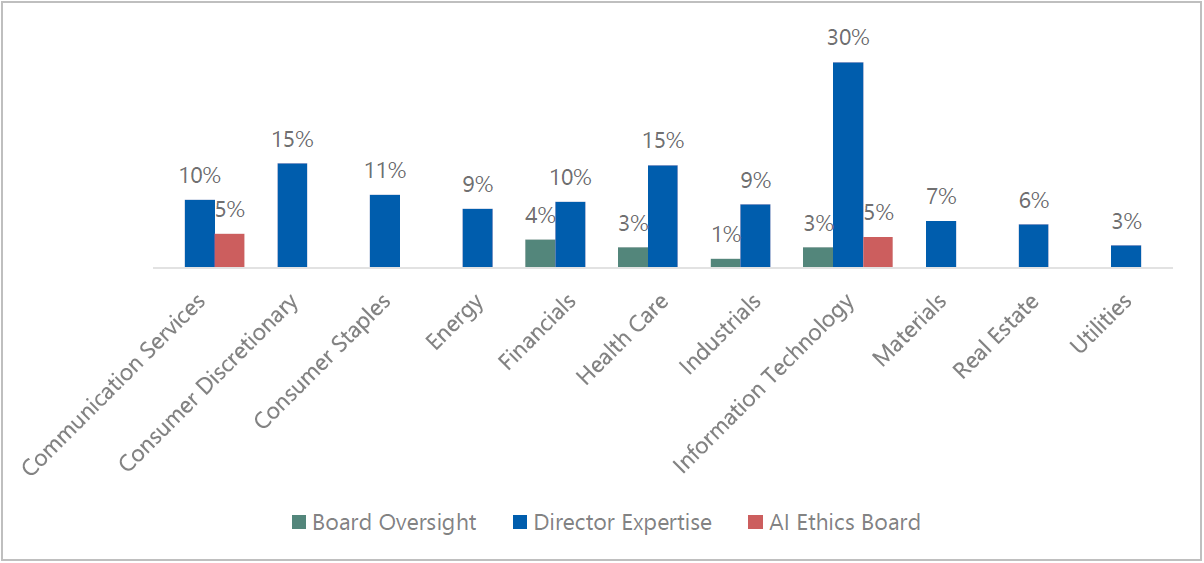

From September 2022 to September 2023, over 15% of the S&P 500 disclosed board oversight of AI, including specific committee oversight responsibility, director(s) with AI expertise, and/or an AI ethics board. Most disclosure of board AI oversight was concentrated in the Information Technology 2-digit GICS code, with 38% of companies disclosing some level of board oversight or expertise. The sector with the second most prevalent disclosure was Health Care, with 18% of companies providing disclosure. Communication Services and Consumer Discretionary sectors were tied for third, with 15%.

Source: ISS-Corporate Analysis

Given the business functions of these four sectors (i.e., Information Technology, Health Care, Communication Services and Consumer Discretionary), explicit disclosure of oversight responsibilities may become more prevalent in the coming years as AI gains adoption.

Director Expertise

The most common evidence of a board’s readiness to oversee AI-related risks and opportunities is found in the skills and experience of its board members, especially in industries where AI may have a greater impact. In the S&P 500, 13% of companies have at least one director with AI expertise on the board, compared with 1.6% with explicit board or committee oversight of AI and 0.8% with an AI ethics board.

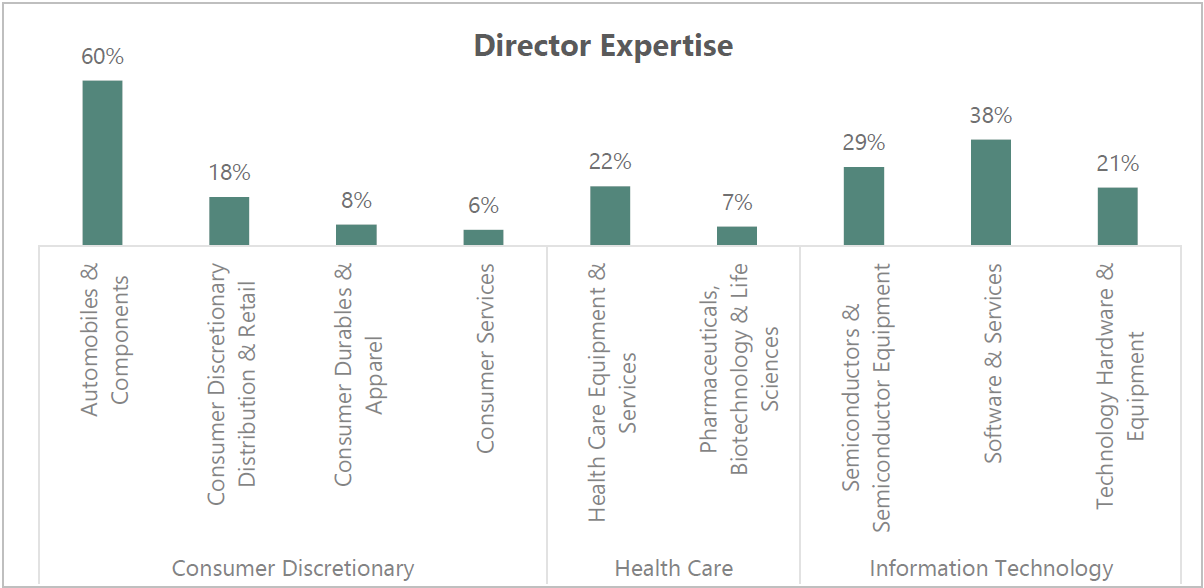

Not surprisingly, the Information Technology sector has the highest prevalence, with 30% of S&P 500 IT companies having at least one director with AI-related expertise. The Consumer Discretionary and Health Care sectors are tied for second place, with 15% of boards having at least one director with an AI background. Examining the prevalence among industry groups within these sectors, boards with AI experts are more concentrated in one specific industry within the Consumer Discretionary and Health Care sectors. By contrast, all industry groups within the Information Technology sector exhibit relatively high levels of boards with AI expertise.

Source: ISS-Corporate Analysis

For the purpose of this paper, a director was classified as having expertise in AI if any of the following apply:

- Current or past employment with companies in AI or relevant industry

- Current or past employment positions relevant to the AI industry

- Board membership with companies in AI or relevant industry

- Certification in AI

- Employment titles related to AI

Committee or Full Board Oversight

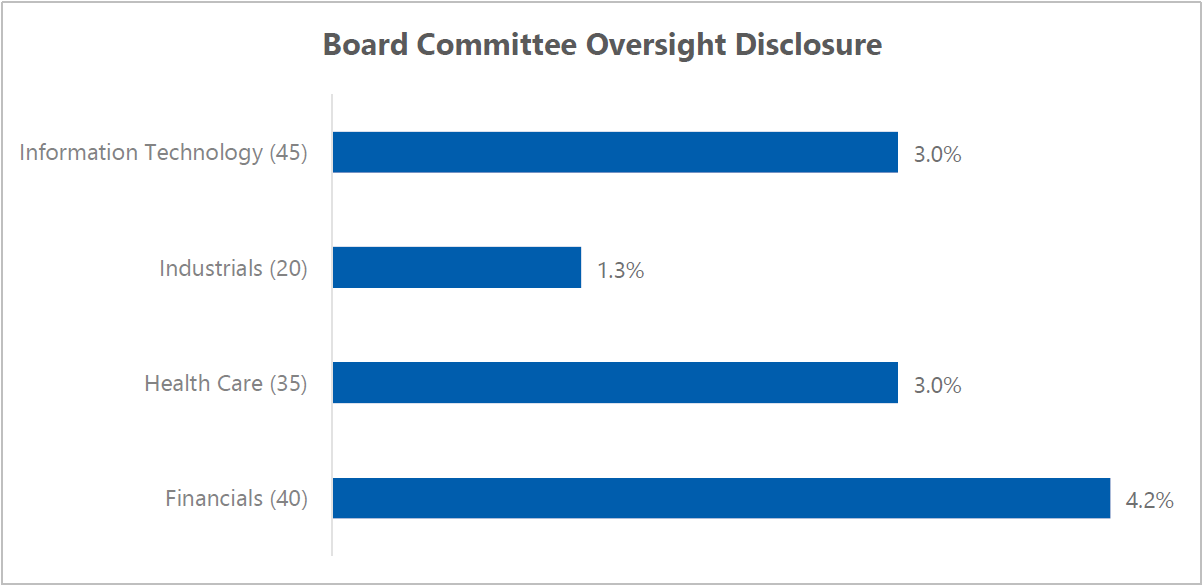

Explicit disclosure of full board or committee of AI oversight is still rare, with just 1.6% of the S&P 500 providing specific disclosure.

Source: ISS-Corporate Analysis

Among S&P 500 companies that disclose full board or specific committee-level oversight of AI, companies in the Financials sector show the highest prevalence at 4.2%. These companies describe AI oversight responsibility as falling under the full board as well as a specific committee such as audit technology.

When oversight responsibility for AI is delegated to a committee, an existing committee’s scope is typically expanded to oversee this new area. For example, some companies have recently added technology-related risks, such as cybersecurity, to the Audit Committee’s risk oversight responsibilities and have further expanded the scope to include AI-related risks. There are also companies that have a dedicated Technology Committee whose oversight responsibilities include a broad range of topics, including AI. Others are approaching AI in terms of environmental and social impacts and regulatory considerations, delegating oversight responsibility to a committee tasked with public policy matters and/or environmental and social risk oversight.

A handful of companies disclosed that the committee responsible for privacy oversight and risk management has been expanded to include AI-related risks and trends. Other companies included a discussion of non-financial regulatory risks, which include responsible AI use. Overall, most company disclosures regarding specific board committee oversight state that the board is responsible for constantly evaluating the competitive landscape and keeping pace with investments in the company’s business offerings and technology, which include AI.

AI Ethics and Review Board

Some companies have elected to designate the responsibility of AI to an ethics or review board comprised of multi-disciplinary teams. The presence of an AI ethics board, while not necessarily a board-level entity, indicates a systemic and organizational oversight mechanism relating to this emerging technology.

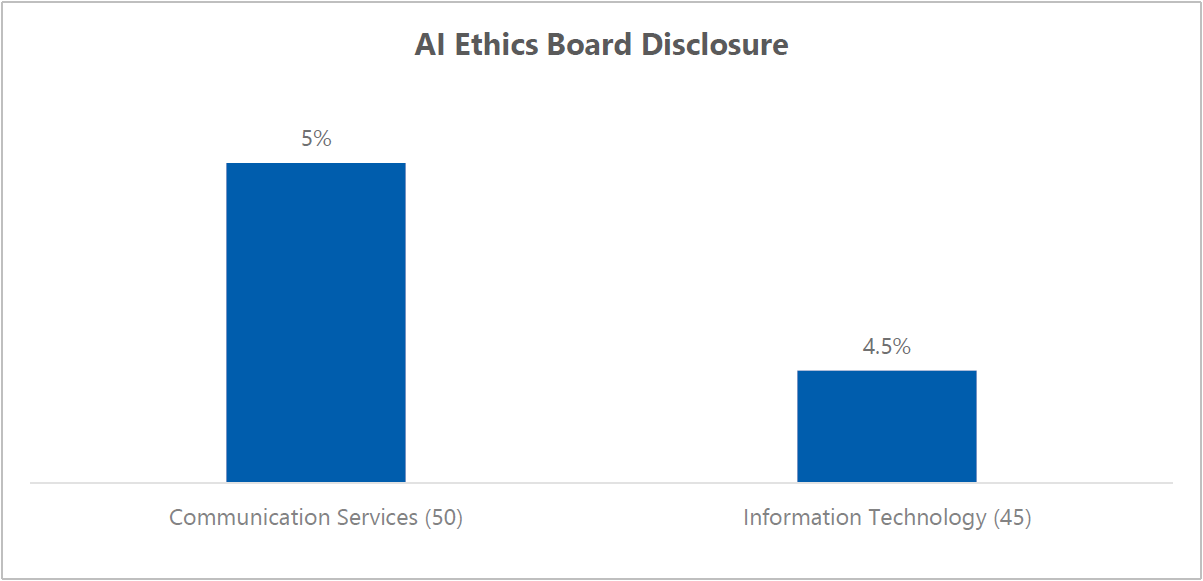

Disclosure of an AI ethics board was present in two sectors: Communication Services and Information technology. While Information Technology had the highest prevalence of disclosures for director expertise, Communication Services had a higher percentage, with 5% of companies in the sector providing some disclosure.

Source: ISS-Corporate Analysis

Among the companies that disclosed an AI ethics board, the common element was the presence of a multi-disciplinary group to ensure an ethical approach to AI. More specifically to Communication Services, disclosure for the AI ethics board was part of a risk assessment framework, similar to disclosures for board audit committees.

Regulatory Requirements and Investor Expectations

Although there are no clear guidelines or disclosure requirements relating to AI, frameworks on materiality offer guidance and a window into investor expectations:

SEC: Proxy statements addressing the election of directors must contain a discussion about the board’s role in the risk oversight of the company. However, the SEC has provided companies flexibility for the administration of risk oversight (e.g., whole board, separate committee, etc.).

Institutional Investors: Large institutional investors, such as BlackRock, Vanguard, and State Street, have varying policies on board oversight of material risks. Many investors believe that companies should have established processes for mitigating material risks, such as having proper oversight processes that can evolve in response to the evolution of corporate risk. However, voting policies do not specifically define corporate risk, much like the SEC, which allows for the natural evolution of material risks.

Conclusion

AI has the potential for significant value creation but could also pose significant risks for companies as well. As AI becomes a material factor, investors may begin to expect that companies, at least those in industries more heavily impacted by AI, start disclosing relevant board skills and oversight responsibilities. In fact, some investors have already submitted shareholder proposals demanding greater transparency on the use and impact of AI technology. As of this writing, at least four such proposals were submitted for 2024 shareholder meetings. It is too early to tell whether there will be any imminent material changes in disclosure requirements or institutional investors’ voting policies specifically relating to AI oversight. However, as the technology accelerates, institutional investors likely will expect companies to establish proper oversight processes to effectively manage and respond to evolving risks and opportunities related to AI, and the percentage of companies disclosing AI oversight is expected to accelerate as well.

Endnotes

1“AI Is the Hot Topic on Earnings Calls This Quarter,” Jennifer Ryan, May 5, 2023, Bloomberg L.P.(go back)

2According to a Weil, Goshal & Manges report, more than 100 companies in the S&P 500 include AI risk disclosure in their Form 10-Q/10-K.(go back)

Print

Print