Matt DiGuiseppe is Managing Director, Maria Castañón Moats is Leader, and Paul DeNicola is Principal at the Governance Insights Center, PricewaterhouseCoopers LLP. This post is based on their PwC memorandum.

As we gear up for the 2024 proxy season, it’s important to temper our expectations for any major surprises. The trends we’ve seen in recent years are likely to continue, effectively establishing the past couple of years as the new normal. Shareholder proposal support is likely to remain subdued. Activist campaigns for board seats will likely end in settlements. Voting outcomes will remain predictable because guidelines have not changed significantly. On the handful of new mandated disclosures, shareholders will likely be observing and digesting them to figure out what strategic insights they can gain. And, after years of tumult, the market is settling on the new baseline for environmental, social and corporate governance expectations against which boards and management teams can measure themselves.

Shareholder proposals trends

As we approach the 2024 proxy season, it appears that shareholder proposal support may remain depressed compared to the peak we witnessed in 2021. Several factors are contributing to this trend, and understanding them can help guide you as the results come in.

Proposals remain too prescriptive

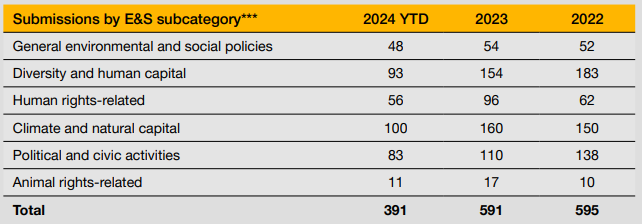

One significant driver is the continued preference of proposal filers to seek specific action and address specific topics related to environmental and social issues. Large institutional investors generally view these targeted proposals less favorably than broader policy-based proposals, and thus are likely to vote against them. But that does not preclude shareholders from raising the broader issues that matter to their investment process during engagement. For example, an investor might vote against a shareholder proposal asking the company to reduce its methane emissions but still express concerns during engagement that the company isn’t managing climate risk well. That same shareholder might even vote against one or more directors to express their concerns with climate risk management.

Potential for increased no-action relief

Another factor to consider is the continued evolution of the no-action process, which companies use to exclude shareholder proposals that don’t conform to the SEC’s rules. There has been a 30% increase in the number of no-action requests submitted to the SEC compared to this time last year. Additionally, a higher percentage of companies seem to be getting relief through this process after a low point in 2021, meaning more proposals are being determined to not conform to the rules. This is an interesting development considering recent attempts by companies to challenge the SEC’s role as arbiter of the rules in court. While companies have always had this option — including the option to appeal the SEC’s decisions — they rarely chose this path. It is worth monitoring whether the uptick in no-action relief granted decreases the likelihood of companies using the courts instead of the traditional process.

“Anti-ESG” proposal support remains low

Another reason we believe that support for shareholder proposals will remain low is that support for “anti-ESG” proposals will likely remain well below 10% if the early season trends continue. This highlights an important distinction between the attention-grabbing headlines suggesting that investors and companies are pulling back from using ESG in their communications and the actions they are taking.

On the one hand, many company leaders are reassessing their sustainability disclosures to avoid regulatory scrutiny or political criticism. Some companies have rebranded corporate reports and committees and removed ESG from executive titles and sections of their websites. In addition, we have seen a drastic drop in use of the term “ESG” on earnings calls, and investors have reduced or removed mentions of ESG from their voting guidelines. But it appears that change in the language used by both companies and investors has not translated into a change in actions taken. Despite all these changes, investors do not appear to be using their vote to signal that companies should back off from their environmental and social efforts. As we noted in our 2024 governance trends, a board can address this market dynamic by leaning into the environmental and social issues most material to its strategy and understanding how they are linked to financial results.

SEC climate rule

For the past three years, proposals related to climate and natural capital have topped the environmental and social proposal category. In early March, the SEC finalized its rule, The Enhancement and Standardization of Climate-Related Disclosures for Investors. Companies will need to comply with the rule’s disclosure requirements over the coming years. In cases where there are additional disclosures on the horizon, investors are frequently less likely to support proposals addressing the topic until they have seen how companies have complied. As such, support for climate-related shareholder proposals may be well below historical averages. Our In brief: SEC adopts climate-related disclosure rules and What boards need to know about the SEC’s climate-related disclosure rules have more information on the new SEC rule and compliance dates.

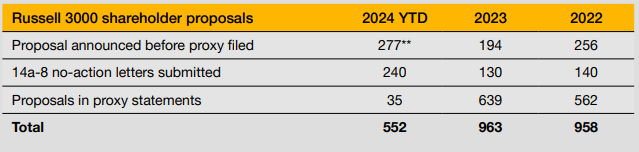

Shareholder proposals by the numbers

Before proxy statements are filed, we can gain preliminary insights into which proposals may be

included on the corporate ballot through the tracking of 14a-8 no-action requests to the SEC

and voluntary disclosures made by shareholder proponents. We expect the number of proposals

to decrease from last year’s peak: At this time last year, observers were tracking 100 more

proposals than now.[*]

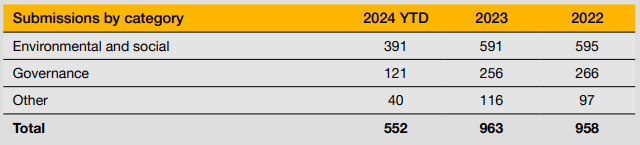

The following data shows how proposals break down by category. Based on our observations to date, the number of proposals will likely be below last year’s peak. There are several shareholders that do not announce where they have filed proposals ahead of time, so we will not know the final makeup until after proxy season.

Hedge fund activism

It is crucial for boards to be aware of the evolving landscape of shareholder activism. Behind the scenes, there is significant capital deployed and a flurry of activity, with settlement emerging as the easiest path due to the uncertainty surrounding universal proxy. However, what is particularly intriguing is the unusually quiet nature of discussions between companies and activists.

Many companies have adopted notice periods to deal with universal proxy, which require investors to state that they intend to nominate an alternative slate of directors. This period is typically between 90 and 120 days before the previous annual meeting’s anniversary date, generally in the first three months of the year. One might expect notice periods to lead to more public campaigns, but companies seem to prefer settling matters quietly, even after receiving notice from activists. While this may seem like a convenient solution, in the past it has raised concerns among investors who worry that quick and quiet settlements may not align with their long-term interests.

To address these concerns, boards and management should consider embracing transparency about agreements and strategic considerations post settlement. By openly communicating with shareholders and providing insights into the decision-making process, companies can build trust and demonstrate their commitment to long-term value creation.

Overall, we anticipate that there will be a slightly higher number of proxy contests than last year. As we highlighted in our 2024 governance trends, the introduction of universal proxy does not guarantee that management will lose one or more seats in every contest that goes to a vote. Therefore, it is essential for boards to closely monitor these contests and identify winning strategies that align with their companies’ goals and values.

Boards of directors may face both challenges and opportunities in the 2024 proxy season. By embracing transparency, actively engaging with shareholders and carefully analyzing the outcomes of proxy contests, they can navigate the evolving landscape of shareholder activism and promote the long-term success of their organizations.

Evolution of voting guidelines

Each year, we eagerly await changes to voting guidelines from influential entities such as ISS, Glass Lewis and the largest investors. However, this year’s dearth of headline changes could lead one to question whether investor focus on stewardship is waning. We believe the focus is not changing, but the methods may be. Rather than the prescriptive investor voting guidelines we saw a few years ago, recently investors have adjusted their guidelines to take a more principles-based approach (meaning their existing guidelines provide enough flexibility to address novel issues as they come up).

The consistency in investor voting guidelines this year may also portend significant governance advances. In the past, shareholder proposal proponents have used the relative predictability of large investors’ voting patterns to achieve major changes to governance standards, such as majority voting and annual director elections. This is often referred to as the “elusive market solution.” Looking ahead to this season, a market solution for today’s issues appears closer to reality in some areas than others. There have already been a couple of governance proposals that have passed this year, indicating that market expectations are emerging in the governance space. On the contrary, we have not seen shareholder proposals align with voting guidelines on environmental and social issues generally. However, as we navigate the upcoming proxy season, market-based solutions on which shareholders agree may emerge.

There was one significant update to the Glass Lewis guidelines of which boards should be aware; it relates to ESG oversight. Specifically, Glass Lewis may recommend voting against board members at Russell 1000 companies if board oversight of the environmental and social issues most important to the company is not codified in committee charters or other governing documents. Further, for S&P 500 companies with significant climate risks, Glass Lewis will be looking for disclosures aligned with the Taskforce on Climate-related Financial Disclosures. More information on the board oversight of ESG/sustainability can be found in our guide.

New disclosures

Over the past decade, the proxy statement has evolved from a legalese-driven disclosure to a blend between a legal filing and a broader communications tool. Most of that evolution has been voluntary, as companies seek to address shareholder expectations for enhanced transparency. More recently, they have also faced new required disclosures on pay for performance, cyber risk governance and clawback policies. Investors are still digesting the information, and it will likely be discussed in engagement activities.

This will be the second year that companies will be required to publish an SEC-mandated pay for performance table. Last year, most organizations focused on compliance, and investors reviewed the new material with curiosity. We can look to the evolution of the Compensation Discussion & Analysis section of the proxy as a guide for how this disclosure will shape discussion of executive compensation. One can expect disclosure that aligns with the explicit requirements of the rule in the near term while investors work out any expanded expectations and figure out how, if at all, they will incorporate it into their voting decisions.

Similarly, investors will be examining how companies respond to the clawback rules that the SEC adopted in late 2022. The rules call for a public company to adopt a policy that addresses clawing back erroneously awarded compensation following a restatement. The rules do not address what to do when an executive’s actions negatively impacts the company or other scenarios in which the board might want to claw back previous awards. Investors have long sought clawback policies that are more fulsome than required by the SEC rule, so companies should be prepared to continue engaging on this topic.

Finally, the SEC approved new cybersecurity disclosure rules this past summer, including timely disclosure of material incidents in a Form 8-K. The rules also include a description of the company’s policies and procedures for the identification, assessment, and management of cyber risks and their governance processes. This includes the board’s oversight of cyber risks and how the board is informed about cyber risks. Investors are used to looking in the proxy for this information, but the SEC rule requires disclosure in the Form 10-K. As we have observed with the other new disclosures, investors are likely to start with monitoring the filings for comparability and consistency to determine best practices. However, the focus on cybersecurity may cause investors to increase their inquiries into how the board oversees cyber-related risks.

Endnotes

*Data from Proxy Analytics as of February 29, 2024(go back)

**Some of the 277 proposals tracked will be withdrawn based on engagement activities before the annual meeting. The rest will appear in proxy statements.(go back)

***Categories are based on PwC analysis of data provided by Proxy Analytics(go back)

Print

Print