Joyce Chen is Associate Editor and Courtney Yu is Director of Research at Equilar, Inc. This post was prepared for the Forum by Ms. Chen and Mr. Yu.

The 2024 proxy season is in full swing, as public companies are in the process of submitting their proxy statements (DEF14A) to the Securities and Exchange Commission (SEC) ahead of annual shareholder meetings. The proxy statement features detailed information on pressing matters related to executive compensation and corporate governance. This analysis focuses on 2024 proxy statements submitted by 163 Equilar 500 companies (the 500 largest U.S. public companies based on revenue) through March 15, 2024 and offers early trends in executive compensation and Pay Versus Performance (PvP) disclosures.

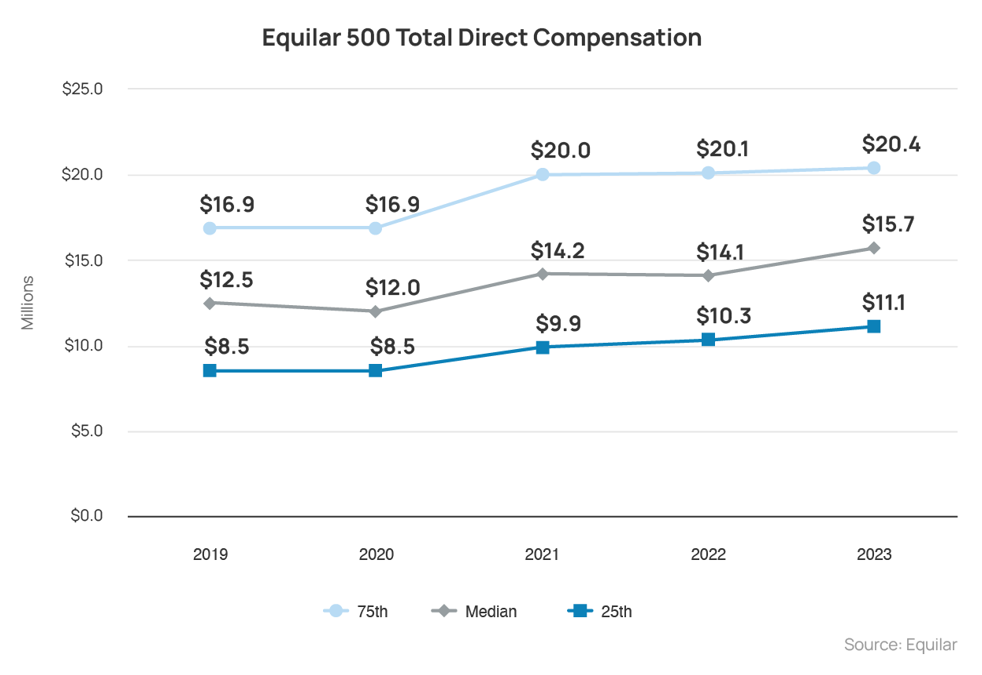

Post-Pandemic CEO Pay Surge Persists

The early results reveal that Equilar 500 CEO pay jumped in 2023. Among the sample of companies in the study, compensation for CEOs reached $15.7 million in 2023, which would mark an 11.3% increase from 2022. This surge in CEO compensation can be partly attributed to the complex changes and effects brought about by the COVID-19 pandemic. The pandemic reshaped businesses, prompting companies to navigate through unprecedented challenges such as remote work arrangements, supply chain disruptions and shifts in consumer behavior. CEOs were tasked with leading their organizations through these turbulent times. As a result, boards may have rewarded CEOs for their leadership and performance during these trying circumstances, contributing to the notable increase in median CEO pay observed going into 2021.

Starting from 2021, this upward trend gained significant momentum, and the momentum has persisted into 2023, with median CEO compensation continuing its upward trajectory among the 165 Equilar 500 CEOs included in the study. This increase of 11.3% from 2022 to 2023 underscores the ongoing emphasis on rewarding executive leadership in the face of evolving challenges and opportunities.

Figure 1: Median CEO Compensation (Equilar 500)

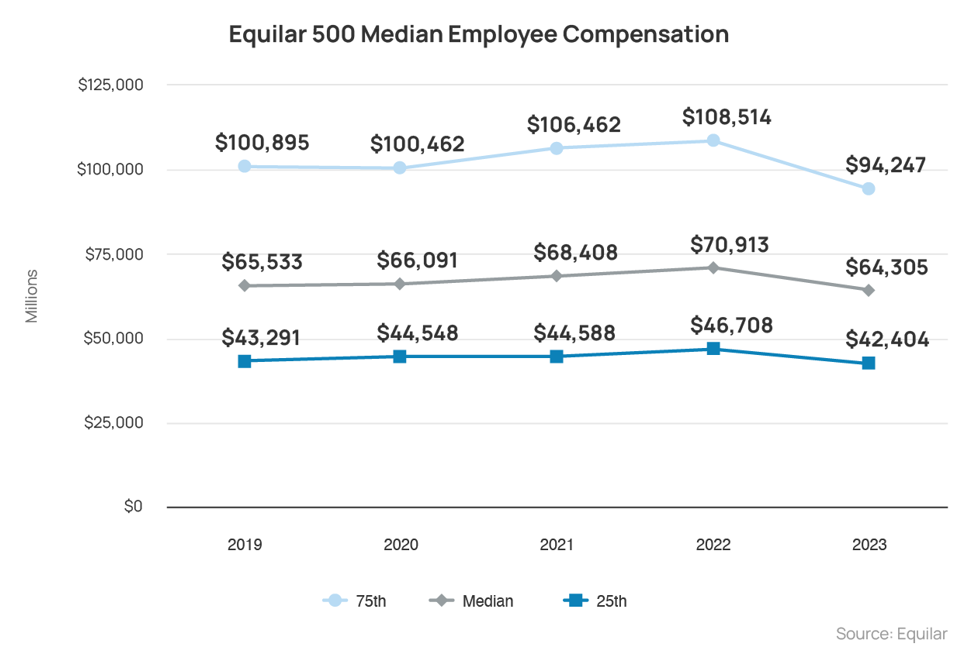

While CEOs are awarded lucrative compensation packages and bonuses tied to performance metrics, employees, especially those at the lower end of the pay scale, may experience stagnant wages, reduced benefits or limited opportunities for advancement.

The 9.3% decrease in compensation among median employees highlights the disproportionate impact on rank-and-file workers. This segment often comprises mid-level managers, professionals and skilled workers who may face salary reductions or limited bonus payouts as companies adjust their cost structures or prioritize profitability amidst economic uncertainties.

Figure 2: Median Employee Compensation (Equilar 500)

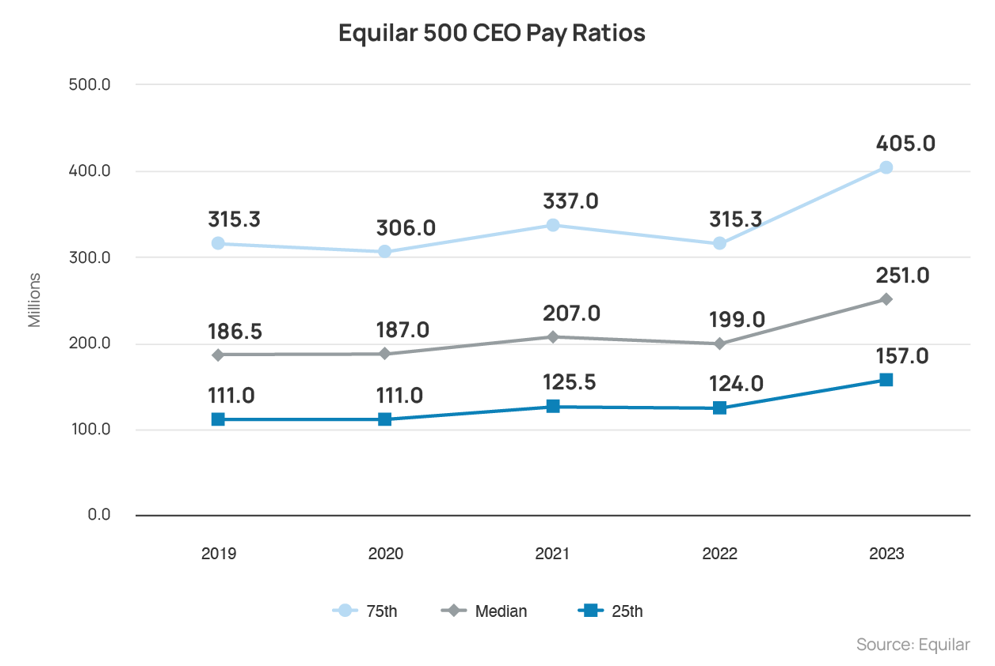

The decline in compensation among median employees, along with the rise in median compensation among CEOs, results in an uptick in the Equilar 500 CEO Pay Ratio for 2023. While the median pay ratio held relatively steady from 2019 to 2022, it increased significantly by 26.1% in 2023, reaching a ratio of 251:1. Overall, this marks a 34.6% jump compared to the initial 186.5:1 ratio observed at the outset of this study. This increase in the CEO Pay Ratio is significant as it marks a growing disparity between the compensation of top executives and that of the average employees within the company.

However, it is important to note that the largest component of CEO pay comes in the form of stock awards, the value of which is not realized until a future date. On the other hand, the median employee is paid primarily a salary and bonus, which poses challenges when comparing the growth of CEO pay to that of the median employee.

Figure 3: CEO Pay Ratios (Equilar 500)

CEO Compensation for Women Declines

Pay inequality is evident not only in the disparities between employees and executives but also in the discrepancies between men and women at the chief executive level. Over the period from 2019 to 2022, Equilar 500 CEO compensation by gender generally trended upward for both men and women, albeit with occasional setbacks. However, the early results for 2023 show a significant drop in compensation for women, with female CEOs earning $11.6 million compared to their male counterparts’ $16.3 million. This highlights a 26.1% drop for women and a 17.3% increase for men. Overall, 7.9% (13) of the 165 CEOs in this study are women.

Figure 4: Median CEO Compensation by Gender (Equilar 500)

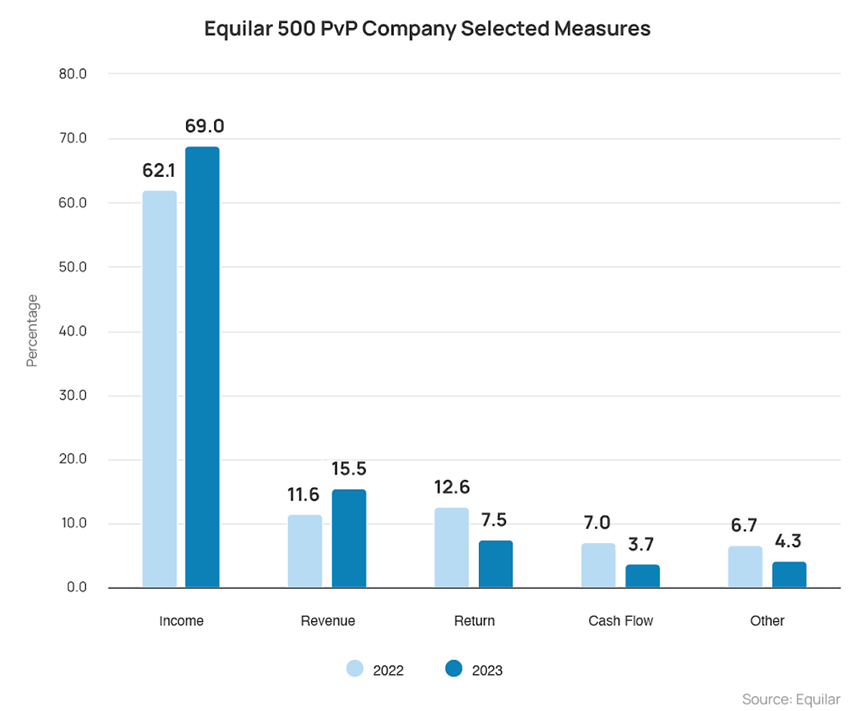

Income Remains Most Prevalent CSM in PvP Disclosures

As the second year of PvP disclosures continues, it has become apparent that income will remain the most common company selected measure (CSM) chosen by companies. Between 2022 and 2023, there was an 11.1% increase in the number of companies utilizing income as their chosen metric category. Following income, revenue emerged as the next common metric, with its usage increasing from 11.6% to 15.5%, marking a 33.6% rise. Conversely, both return and cash flow witnessed a decline in usage thus far, dropping by 40.5% and 47.1%, respectively.

Figure 5: PvP Company Selected Measures (Equilar 500)

The insights uncovered from this analysis provide a preliminary glimpse into CEO compensation and PvP disclosure trends across Equilar 500 companies. As the 2024 proxy season progresses, further data from 2023 will offer a more comprehensive view of evolving trends and the trajectory of the CEO compensation landscape.

Print

Print