Lindsey Stewart is Director of Investment Stewardship Research at Morningstar, Inc. This post is based on a Morningstar memorandum by Mr. Stewart and River Meng.

Key Takeaways

Manager Exits Grab Headlines Ahead of Proxy Season

- Five US asset managers recently decided to exit or amend their participation in the Climate Action 100+ engagement initiative. The initiative has faced accusations of collusive behavior, which it denies.

- Invesco, JPMorgan, Pimco, and State Street have left the initiative. BlackRock has restricted its participation to its non-US business.

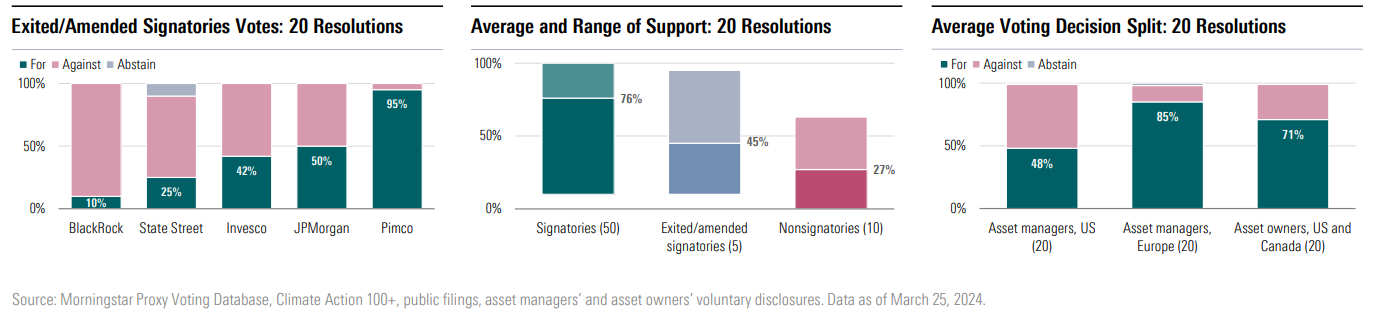

- The five exited or amended signatories’ support for 20 climate-related resolutions flagged by CA100+ averaged 45%, with a range of 10% to 95%.

Proxy-Voting Records Show No Evidence of Collusion

- Proxy-voting records for the 20 flagged resolutions in 2023 suggest a wide range of voting approaches among CA100+ signatories, not collusion.

- The 50 CA100+ signatories we reviewed supported an average 76% of the resolutions. Support by 10 nonsignatories averaged 27%.

- The 35 asset manager signatories supported an average 74% of the resolutions, ranging from 10% to 100%. Average support by five nonsignatory asset managers in the US stood much lower, at 11%.

Further Evidence of Managers’ US-Europe Divide

- The average voting profile of the five exited or amended signatories is very similar to that of other US managers. The 20 US managers we reviewed supported an average 48% of the 20 resolutions.

- In contrast, 20 European managers we reviewed supported an average 85% of the 20 resolutions.

- Twenty public pension asset owners in the US and Canada averaged 71% support for the proposals. Even among five nonsignatory asset owners, only two supported less than 60% of the 20 resolutions.

Analysis of Flagged Resolutions

Climate Action 100+ flagged 20 shareholder resolutions for signatories’ consideration in 2023. We assess the voting results.

Climate Action 100+ Flagged Resolutions: A Wide Range of Results in 2023

In its own words, Climate Action 100+ signatories “work with the companies in which we invest to encourage them to work towards the global goal of halving GHG emissions by 2030 and delivering net zero GHG emissions by 2050.” The initiative focuses on prompting companies to implement corporate governance changes, reduce GHG emissions across the value chain, and provide enhanced corporate disclosures.

Each year, CA100+ flags a number of shareholder resolutions and management proposals for investors to consider when voting at company shareholder meetings. In 2023, the initiative flagged 20 shareholder resolutions at 15 companies: 10 listed in North America, four in Europe, and one in Asia. The chart opposite shows adjusted shareholder support[1] for each resolution.

There was a relatively wide range of support for these proposals. Two of the resolutions featured on our list of well-supported key ESG resolutions with more than 40% adjusted support: a request at Berkshire Hathaway for a report on climate transition risks and opportunities, and one at Paccar requesting transparency on climate-related lobbying activities. Support for 18 other resolutions ranged from 16% to 36%. The most successful of these was a request at Exxon Mobil for disclosures on methane emissions. Requests for disclosure on greenhouse gas reduction targets formed the largest category, with eight such proposals in 2023. Two proposals on Just Transition—focused on achieving fairer social outcomes of climate transition—achieved less than 20% adjusted support.

Comparing Support for Flagged Resolutions

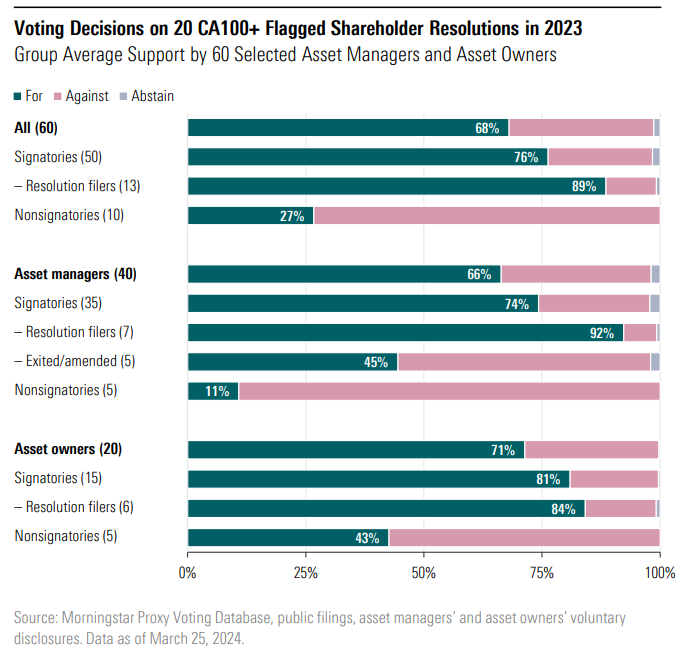

For this research paper, we analyzed the publicly disclosed voting results of 60 institutional investors for the CA100+ flagged shareholder resolutions in 2023. The group is a mix of 40 US and European asset managers (20 of each) and 20 US and Canadian public pension asset owners. Fifty of the group were CA100+ signatories during the period (including the five recently exited/amended signatories); 10 are nonsignatories.

The charts below show, unsurprisingly, that the signatories showed much higher support for the 20 proposals than the nonsignatories (76% versus 27% on average, respectively). Only one resolution—a request for scope 3 greenhouse gas targets at Shell—was supported by less than half of the signatories. But four of the five most successful resolutions were supported by at least 40% of the nonsignatories.

Comparison of Voting Records

A wide range of signatory voting decisions on flagged resolutions suggests an absence of collusive voting behavior.

Differences in Perspective Between Asset Managers and Asset Owners

On average, the asset owners in our selection showed higher support for the flagged resolutions than the asset managers. Across the entire group, support by the asset owners stood at 71% on average, compared with 66% for the asset managers. (A full record of voting decisions can be found in the Appendix.)

This trend still holds if we separate CA100+ signatories from nonsignatories. For signatories, 15 asset owners showed 81% support on average, compared with 74% for 35 asset managers. Among nonsignatories, the gap is much wider: There was average support of 43% by five asset owners, compared with 11% support by five asset managers (Capital Group, Dimensional, Fidelity, T. Rowe Price, and Vanguard).

We identified 13 institutions that have filed or co-filed flagged resolutions: seven asset managers and six asset owners. As could be expected, these institutions showed very high support (89%) for the 20 flagged resolutions in 2023.

Average support for the flagged resolutions by the five firms who exited or amended their participation in CA100+ stood at 45%; close to the average support level we observed for nonsignatory asset owners. However, the range of support by the five firms is wide, from 10% for BlackRock up to 95% for Pimco.

Overall, the wide range of voting support by signatories and by the five exited and amended firms suggests that accusations of collusion by signatories are wide of the mark.

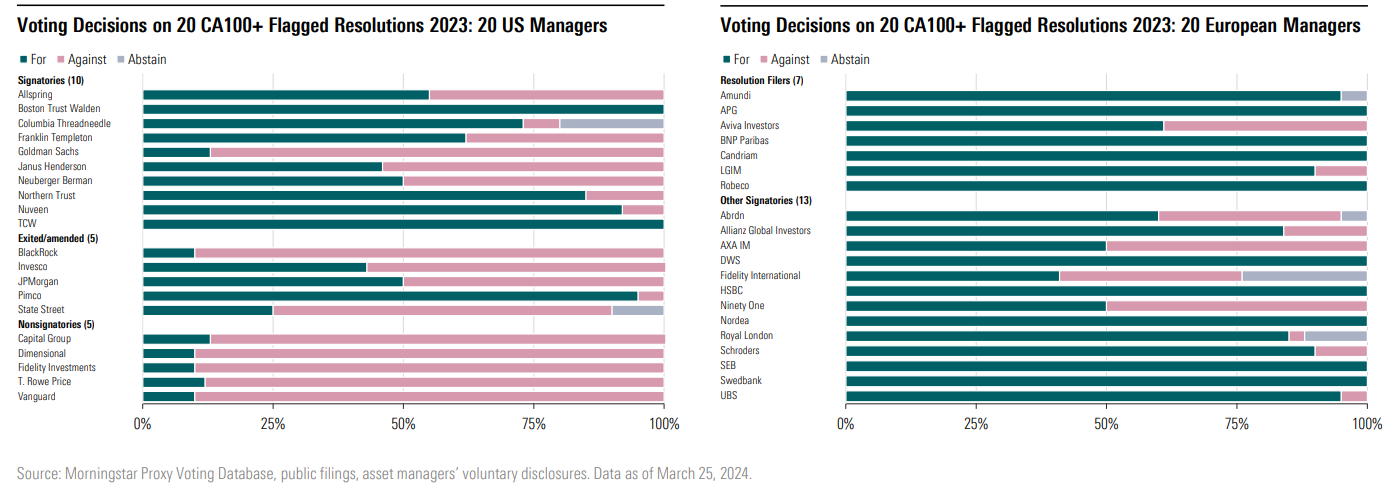

Comparing Asset Manager Voting Records

Looking at each asset manager’s support for CA100+ flagged resolutions in 2023, we again see a divide between US and European firms. The 20 US managers supported an average 48% of the 20 resolutions. The 20 European managers we reviewed supported 85% of the 20 resolutions. BlackRock and State Street, the largest of the five exited/ amended CA100+ firms, both supported no more than 25% of the 20 resolutions.

This places them closer to the US nonsignatory firms than to most of the other signatories on proxy votes. Support from Invesco and JPMorgan stood between 40% and 50%. Among the signatories, Goldman Sachs’ support for the 20 resolutions (13%) stands out for being over 25 percentage points lower than any of the other signatories we reviewed.

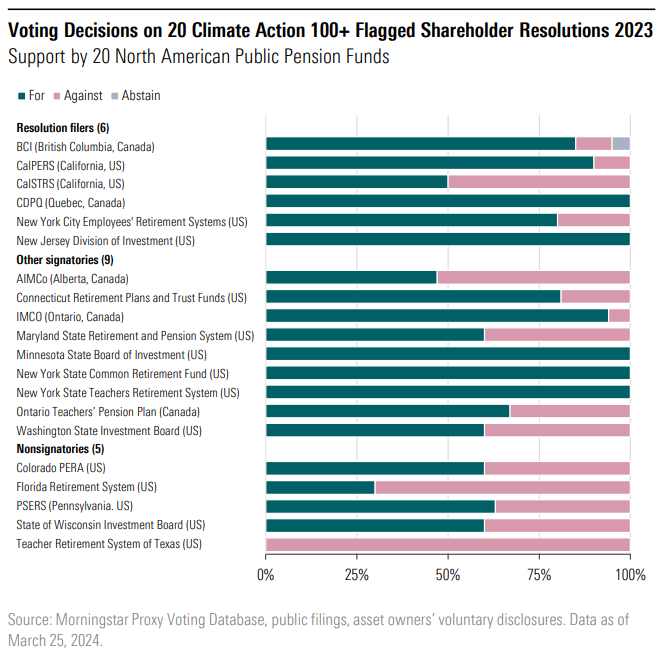

Comparing Asset Owner Voting Records

Among asset owner signatories, there is also a wide range of voting results on the flagged resolutions.

Average support among the 15 asset owner signatories we reviewed stood at 81%. Five of the asset owners—in Minnesota, New Jersey, New York, and Quebec—supported all the resolutions they voted on. Among the six asset owner signatories that have filed flagged resolutions, all except one supported at least 80% of the proposals. CalSTRS opted to support only half of the flagged proposals in 2023, deciding not to back several requests on GHG reduction targets and asset retirement obligations.

AIMCo—based in Alberta, home to much of Canada’s oil and gas industry—stands out as the only asset owner signatory we studied that supported less than half (47%) of the flagged proposals it voted on.

Notably, average support among the five nonsignatory asset owners we reviewed is lower but still significant, with average support of 43%. The average is lowered somewhat by the 100% opposition from the Teacher Retirement System of Texas (which is located in a state known to oppose pro-climate investor initiatives). Three other nonsignatory asset owners—in Colorado, Pennsylvania, and Wisconsin—supported at least 60% of the proposals they voted on.

Print

Print