Edwin Hu is a Research Fellow at the NYU School of Law’s Institute for Corporate Governance & Finance, Nadya Malenko is a Professor of Finance at Boston College, and Jonathon Zytnick is an Associate Professor of Law at Georgetown University Law Center. This post is based on their recent paper.

Institutional investors play a crucial role in corporate governance, yet the process by which they arrive at voting decisions remains opaque. Our recent research opens the “black box” by highlighting the significant role of customized proxy voting advice in shaping shareholder voting behavior.

Traditionally, academic research and policy debates have centered around benchmark recommendations provided by proxy advisors like ISS and Glass Lewis. The dominance of these two firms has raised concerns about their influence over corporate governance. However, our study, using novel data from Glass Lewis, reveals that the majority of funds (around 80%) actually receive customized advice tailored to their specific needs.

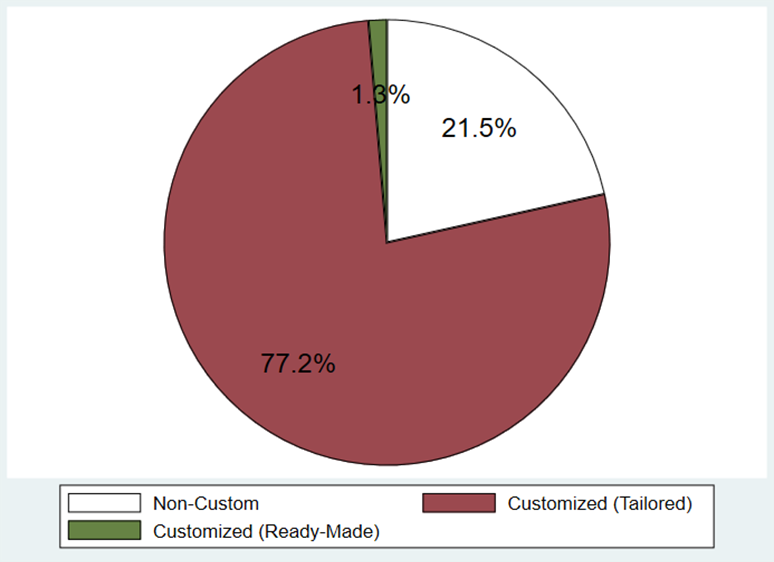

Specifically, we find that 77.2% of funds subscribe to custom recommendations that are tailored to their individual ideologies, and 1.3% of funds subscribe to “ready-made” custom policies designed by the proxy advisor—for example, an “ESG” or “Public Pension” policy. Only 21.5% of funds receive benchmark recommendations that most research and policymaking have focused on.

We argue that customization significantly impacts both the aggregation of preferences and the aggregation of information in voting outcomes. Our results suggest that proxy advice is a two-way street: investors do not merely follow the advice of proxy advisors, but rather actively shape the advice they receive.

The Two-Stage Decision-Making Process

Our research suggests that institutional investors follow a two-stage decision-making process when using proxy advisors:

Stage 1: Deciding Whether to Customize and Developing Custom Policies

Investors decide whether to customize and, if they do, collaborate with the proxy advisor to develop custom voting policies that reflect their unique ideologies. This could involve, for example, a greater emphasis on environmental and social (ES) issues than in the benchmark recommendations or adjustments to voting criteria for director elections. These custom policies shape the future recommendations they will receive from the proxy advisor.

Stage 2: Conducting Additional Research

Once actual proposals are announced and investors receive recommendations from the proxy advisor, they decide whether to conduct further research and potentially deviate from the proxy advisor’s recommendations.

Why Customize?

Our theoretical framework and empirical analysis identify two key motives for customization:

1. Expressing Ideologies:

Custom recommendations allow investors to align their votes with their specific ideologies, facilitating the aggregation of diverse preferences within the shareholder base. This is particularly relevant for investors with strong views on ES issues or other areas where their stance may deviate from the benchmark recommendations.

2. Allocating Attention:

By outsourcing the application of their voting policies to the proxy advisor, investors can reduce the time and resources required to analyze each individual proposal. This is especially beneficial for large shareholders or those with stakes in numerous companies, allowing them to exploit economies of scale and focus their attention on more critical matters.

Customization and Allocation of Attention

We assess how an investor’s decision to customize interacts with “Stage 2” of its decision-making process: whether to conduct additional research once a company’s proposals are revealed. We look at the extent to which investor votes deviate from proxy advisor benchmark recommendations and whether, and when, the investor manually submits its ballots as opposed to auto-submitting them. This variable is developed in a companion paper, Hu, Malenko, and Zytnick (2024), where we show that manual voting captures the fund’s attention to voting.

Our analysis reveals evidence of both substitution and complementarity effects of customization. On the one hand, customization incorporates the fund’s ideology and therefore reduces the fund’s need to pay attention to multiple proposals at once (substitution). On the other hand, it helps shareholders identify and focus their attention on the most important proposals, encouraging additional research on them (complementarity).

Substitution:

- Deviation from Benchmark: Customizers deviate from benchmark recommendations more frequently, while manually voting less frequently, than non-customizers within the same fund family. This suggests that customization allows funds to vote in line with their preferences without necessarily engaging in extensive research for every proposal.

- Ready-Made Customizers: Funds opting for “ready-made” custom policies exhibit lower manual voting rates than non-customizers. This indicates that they utilize these readily available policies to minimize voting costs while still expressing their ideology.

Complementarity:

- Attention to Important Proposals: Customizers exhibit greater sensitivity to the importance of proposals compared to non-customizers. They are more likely to manually vote in situations involving negative recommendations from proxy advisors, activist investors, or special meetings. This suggests that customization helps investors focus their attention and research efforts on proposals where their input is most impactful.

Implications for Policy and Future Research

Our findings have significant implications for ongoing policy debates surrounding institutional voting and proxy advisors. While concerns regarding potential overreliance on proxy advice and reduced shareholder deliberation are evergreen, our research suggests a more nuanced picture. In particular, we find that customization empowers investors to express their unique ideologies and allocate their attention more efficiently, leading to potentially more informed voting that accurately reflects institutional investors’ preferences. Therefore, attempts to limit investors’ use of proxy advisor services may have the unintended consequence of reducing informed voting. Our study is also the first to examine the use of ready-made customized policy packages, which we show allow for greater ideological expression with lower effort. Recent developments to increase investor representation, such as “pass-through” voting based on ready-made policies, are likely to increase the importance of such pre-packaged policies.

As the landscape of shareholder voting continues to evolve, understanding the role of custom proxy voting advice is essential for ensuring effective corporate governance and promoting shareholder democracy.

Print

Print